Original author: Zhou, ChainCatcher

After nine months, the Federal Reserve once again pressed the interest rate cut button.

In the early morning of September 18, Beijing time, the FOMC lowered the target range of the federal funds rate by 25 basis points from 4.25%–4.50% to 4.00%–4.25%, marking the first interest rate cut in 2025.

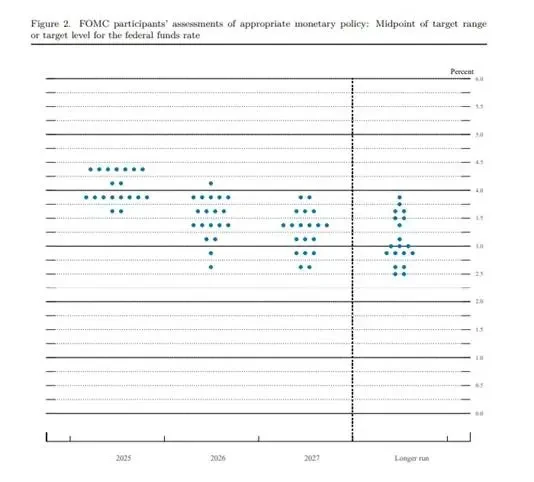

The latest dot plot shows that the median forecast of officials points to another 50 basis point cut this year. If the next two meetings each cut 25 basis points, the federal funds rate may fall into the range of 3.50%-3.75% by the end of the year.

Powell emphasized at the press conference that this action is a risk-management interest rate cut, the goal of which is to reduce the probability of failure in an environment where complex and two-way risks coexist; the 50 bp range has not received broad support and no quick action will be taken.

He added that the high inflation seen since April has shown signs of easing, linked to a cooling labor market and a slowdown in GDP growth. The recent rise in inflation has been driven more by factors like tariffs and appears more like a one-off shock, not enough to constitute evidence of sustained inflation.

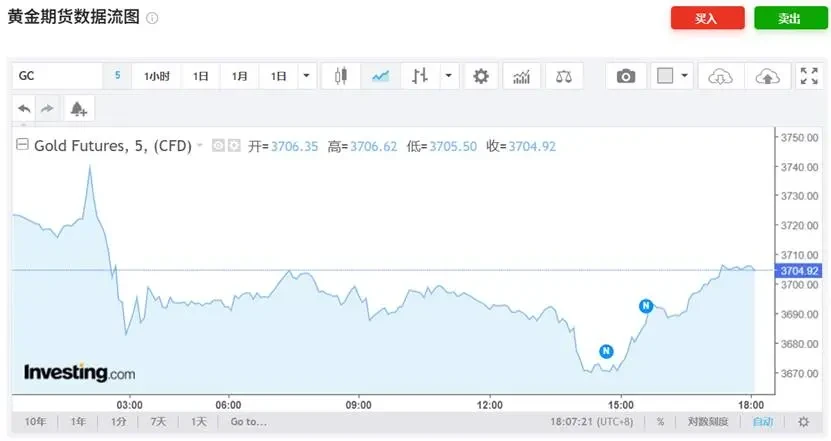

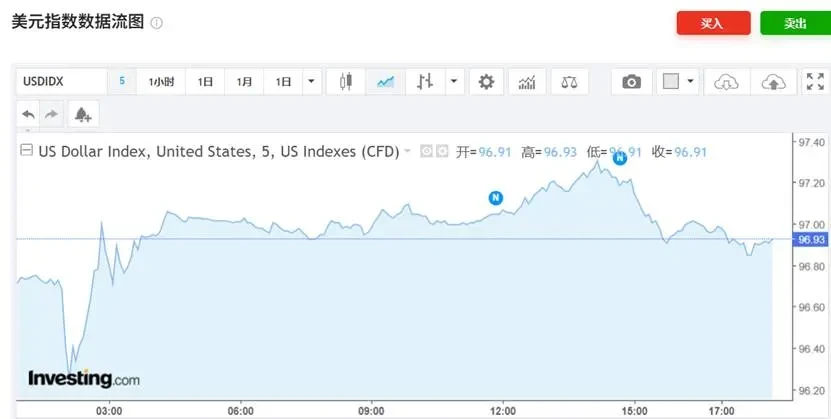

At the market level, the US dollar received support and gold came under short-term pressure; Wall Street growth stocks saw profit-taking after the previous surge, and the "Big Seven" stock basket closed lower, with the style shifting to lower-valuation sectors in the short term; the overall reaction of crypto assets was also relatively flat.

How do institutions interpret this interest rate cut?

As for domestic securities firms, Zheshang Securities believes that although there is still room for improvement in the dot plot, there is a possibility of a reversal of easing expectations, which mainly depends on the impact of the core momentum of the US economy and the stability of the unemployment rate.

CICC noted that the threshold for interest rate cuts is becoming increasingly high, with weak employment data and rising inflation limiting the scope for easing. The current US problem lies in rising costs, and excessive easing could exacerbate inflation and lead to a "quasi-stagflation" scenario. Minsheng Macroeconomics, however, stated that rate cuts are the beginning of the problem, with larger cuts potentially triggering inflationary risks, while insufficient cuts could create political risks.

There are also differing views among overseas institutions. Nick Timiraos, a "Federal Reserve mouthpiece," stated that this is the third time under Powell's leadership that the Fed has initiated rate cuts without facing a significant economic downturn. However, given the more thorny inflation situation and political factors (the White House's confrontational nature), the stakes in 2019 and 2024 will differ.

Olu Sonola, head of U.S. economic research at Fitch, said the Federal Reserve is now fully committed to supporting the labor market, clearly signaling a decisive and aggressive rate-cutting cycle starting in 2025. The message is clear: growth and employment are the top priorities, even if that means tolerating higher inflation in the short term.

Jean Boivin, head of the BlackRock Investment Institute, said the Fed's prospects for rate cuts are likely contingent on whether the labor market remains sufficiently slack. He noted that Powell's description of the Fed's latest rate cut as "risk management" in response to growing signs of labor market weakness likely means future policy actions will be highly data-dependent. Boivin believes further labor market weakness would justify further rate cuts from the Fed.

Barclays economists note that risks to the Federal Reserve's interest rate path are tilting toward delaying rate cuts. They wrote in a research note that this could occur if inflation data in early 2026 consistently show strong price increases, or if tariffs boost non-commodity prices amidst a moderate rise in unemployment. Conversely, if unemployment suddenly spikes, the FOMC could resort to more aggressive rate cuts. Barclays projects that the FOMC will maintain interest rates unchanged in 2026 until monthly inflation data show signs of slowing and provide confidence that inflation is returning to its 2% target.

Hu Yifan, Chief Investment Officer for Greater China and Head of Macroeconomics for Asia Pacific at UBS Wealth Management, stated that, looking ahead, under the baseline scenario, the Federal Reserve is expected to cut interest rates by a further 75 basis points by the first quarter of 2026. The Fed is expected to continue prioritizing labor market slack over the potential for a temporary rise in inflation. Under a downside scenario, if labor market slack proves more severe or persistent, the Fed could cut interest rates by 200-300 basis points, potentially as low as 1-1.5%.

What do institutions think about the financial market?

Gold futures fell as much as 1.1% in early trading on September 18th. The US dollar weakened initially following the announcement of the resolution, but quickly reversed course and rallied. Mitsubishi UFJ Financial Group analyst Soojin Kim said investors viewed the Fed's guidance as less dovish than expected. Chairman Powell emphasized the risk of tariff-driven inflation and indicated a "meet-by-meeting approach" to further rate cuts, pushing the dollar higher.

Francesco Pesole of ING, however, stated that Wednesday's Federal Reserve interest rate decision was generally negative for the US dollar, believing that lower funding costs would further depreciate the dollar. Furthermore, the euro/dollar (EUR/USD) pair retreated from its four-year high reached on Wednesday. Pesole also noted that the euro could resume its upward trend, and ING maintained its target of 1.2 against the US dollar in the fourth quarter.

George Goncalves, head of U.S. macro strategy at Mitsubishi UFJ, said the Fed's decision was its most dovish yet, adding another rate cut to the dot plot forecast. He noted that the Fed hasn't entered a sprint to cut rates, but rather has restarted the process due to weaker-than-expected job market performance. This explains the muted reaction in risk assets. The Fed is likely to cut rates by 25 basis points each in October and December, but a 50 basis point cut isn't necessarily positive for credit.

Kerry Craig, a strategist at JPMorgan Asset Management, said that US interest rate cuts could support emerging market assets, noting that the Fed's 25 basis point cut was in line with market expectations. He believes that lower interest rates could mean a weaker US dollar, which could boost the performance of emerging market equities and local currency debt. Furthermore, the reduced risk of a US recession means that credit markets will continue to be well supported.

Richard Flax, chief investment officer at European digital wealth management company Moneyfarm, said the Fed's rate cut could boost short-term market sentiment for risky assets, with the stock market expected to benefit. He noted that while the rate cut could provide moderate relief for U.S. households and businesses, the broader policy signal is one of caution rather than a shift to rapid easing.

Franklin Templeton portfolio manager Jack McIntyre stated that significant divergence in the Federal Reserve's policy views through 2026 could mean more volatility in financial markets next year. He noted that the current rate cut is a risk-management move, indicating the Fed is paying closer attention to labor market weakness. Investment strategist Larry Hatheway believes that while the market has priced in significant Fed easing, the challenge for investors is that the Fed is not yet willing to commit to the market's expected path of low interest rates.

The Bank of Japan has kept interest rates unchanged for five consecutive times

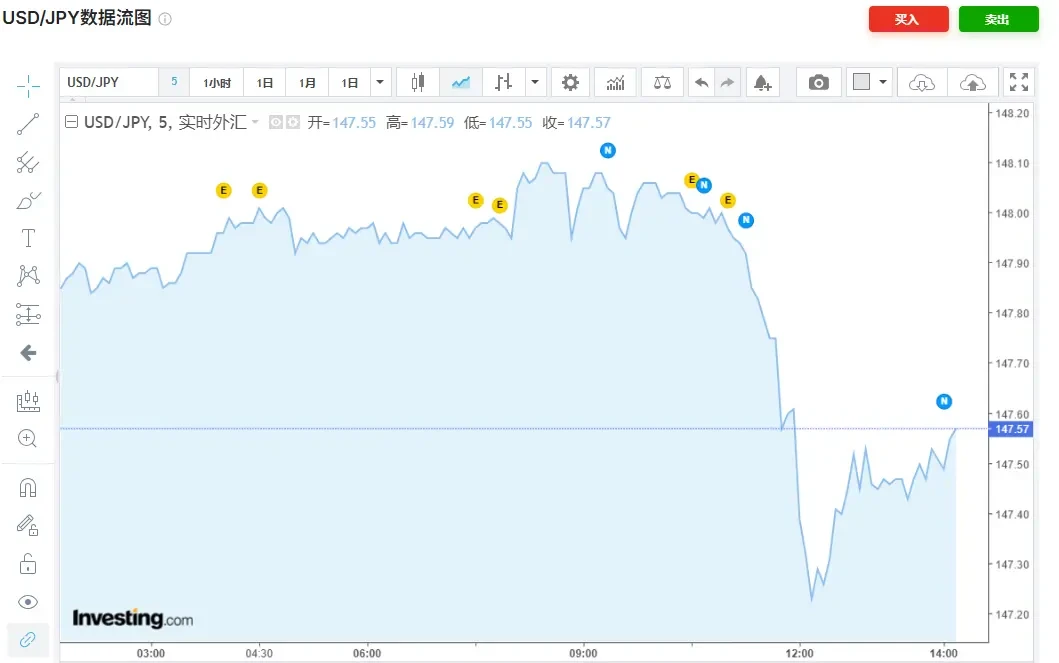

On September 19, the Bank of Japan held its monetary policy meeting with a vote of 7 to 2 to keep the policy interest rate unchanged at 0.50%, the fifth consecutive resolution to remain unchanged.

Two members (Hajime Takada and Naoki Tamura) advocated for a 25 basis point increase in short-term interest rates to 0.75%, citing increased upside risks and the need to bring interest rates closer to a neutral level. Meanwhile, the Bank of Japan announced plans to reduce its holdings of exchange-traded funds (ETFs), with plans to sell approximately 330 billion yen annually to further advance its policy normalization framework.

The price and growth backdrop justified the current rate cut. Japan's core inflation (excluding fresh food) was 2.7% in August, the lowest since November 2024 and the third consecutive month of decline. Overall inflation also fell to 2.7%.

The immediate market reaction was hawkish yet steady. USD/JPY briefly dipped to around 147 after the announcement, before fluctuating. The Nikkei 225 dipped 1.8% intraday, falling below 45,000 points, while the Topix index fell about 1% to 3126.14. On the bond market, Japan's benchmark 10-year government bond yield rose by about 3.5 basis points to 1.63% after the central bank announced plans to reduce its ETF holdings. Treasury bond futures plummeted 53 basis points to 136.03.

Institutional and trader interpretations are divided. Hiroaki Amemiya, investment director at Capital Group, stated that the Bank of Japan's decision to hold interest rates steady underscores its cautious stance amid slowing inflation and global uncertainty—prioritizing stability over premature tightening. By retaining policy flexibility, the Bank of Japan signals its readiness to respond to external fluctuations while continuing to assess the strength of Japan's economic recovery. The current strategy is more about supporting the early stages of a reflation cycle than reversing its course.

Hirofumi Suzuki, an analyst at Sumitomo Mitsui Banking Corporation, called the outcome unexpected. While the market generally expected the Bank of Japan to simply maintain its policy unchanged, the launch of the ETF sales program and the dissenting votes of two members (in favor of a 25 basis point rate hike) gave the meeting a hawkish tone. The timeline suggests that even with the LDP leadership election on October 4th, the Bank of Japan is signaling a steady pace of policy normalization. Another rate hike is expected in October.

Separately, Chris Weston of Pepperstone writes that the departure of Japanese Prime Minister Shigeru Ishiba has shifted the focus to his successor and what this might mean for political stability. Markets will weigh the extent of additional fiscal measures and budgets under the new leadership, and the extent of fiscal stimulus will be crucial in controlling the rise in long-term Japanese government bonds.

He said these developments could be seen as further reason to delay the Bank of Japan's next 25 basis point rate hike until 2026. This expectation is already priced into the market, with swap traders pricing in only a 12 basis point rate hike by December, which Weston noted is another reason why few are currently willing to hold the yen. He expects yen weakness in Asian markets to become widespread.

Market analysts say controversy is escalating over the vaguely defined indicator of underlying inflation, with some members advocating to downplay the term and focus more on overall inflation and wages, paving the way for another rate hike as early as October. DBS's economics team predicts that Japan's GDP growth in the second quarter will likely hover around 0% quarter-over-quarter. They forecast a modest 0.2% increase in the seasonally adjusted annualized rate, just enough to offset the first-quarter contraction. Export momentum weakened in the second quarter, impacted by declining exports to the US and weak overseas demand.

- 核心观点:美联储降息落地,日本央行维持利率不变。

- 关键要素:

- 美联储降息25基点至4.00%-4.25%。

- 日本央行维持0.50%利率不变。

- 机构对后续政策路径存在分歧。

- 市场影响:短期风险资产情绪获提振,但波动可能加大。

- 时效性标注:短期影响。