NAKA's stock price plummeted 54% in one day. Is the market tired of DAT?

- 核心观点:KindlyMD股价暴跌,DAT策略遇冷。

- 关键要素:

- PIPE融资致股本稀释,股价腰斩。

- 比特币ETP资金流出,需求饱和。

- mNAV比率趋近1,估值溢价消失。

- 市场影响:DAT投资热情减退,市场趋于理性。

- 时效性标注:短期影响。

Original author: Chloe, ChainCatcher

On September 15th, KindlyMD (NAKA), a digital asset management (DAT) company, saw its share price plummet to $1.28, a 54% drop in the 24 hours prior to press time and a more than 90% drop in a month. The healthcare-turned-Bitcoin (BTC) asset manager is facing pressure from both its equity dilution plan and widespread investor fatigue with its digital asset treasury (DAT) strategy.

KindlyMD, originally listed on the Nasdaq, is an integrated medical technology company. Its transformation began with its merger with Bitcoin (BTC) asset Nakamoto Holdings. Its founder, David Bailey, served as a crypto policy advisor to former US President Trump and is very familiar with industry regulatory trends.

A month ago, KindlyMD announced plans to raise $540 million through a stock offering to expand its Bitcoin reserves. In mid-August, KindlyMD announced its first Bitcoin purchase, acquiring approximately 5,744 Bitcoins through a Nakamoto subsidiary for a total of approximately $679 million, with an average price of approximately $118,200 per coin. At the time, Bitcoin was trading around $110,000.

The stock peaked above $15 in mid-August and then began a steep decline that accelerated throughout September.

The company announced PIPE financing, and its stock price subsequently halved

"As these shares enter the market, the company expects stock price volatility to increase in the short term. For shareholders seeking short-term transactions, the company recommends exit." On September 12, David Bailey posted on social media that the company had submitted Form S 3 to register the shares sold in PIPE financing.

A PIPE financing is a method of raising capital by selling shares to private investors, typically at a discount to market price. After the S3 Form is registered, these shares become publicly traded. The introduction of a significant number of new shares (in this case, those in the PIPE financing) increases the supply of shares in the market. This can put downward pressure on stock prices, leading to volatility, if demand is not matched.

KindlyMD's move directly allows for a gradual issuance of shares at current market prices, raising significant investor concerns about equity dilution.

Is it related to the saturation signal of digital asset vaults (DAT)?

Grayscale's August report documented a softening of investor interest in digital asset treasuries (DATs), noting that Bitcoin exchange-traded products saw their first monthly net outflow since March, with redemptions reaching $755 million. The report measures supply and demand imbalances by comparing market capitalization to the value of the underlying crypto asset, known as "mNAV."

According to Grayscale, the mNAV ratio for major DAT companies has approached 1.0, indicating a balance between supply and demand, rather than the premium valuations these products previously commanded. This suggests that investors are no longer paying a premium for cryptocurrency exposure through public equity vehicles.

Grayscale's August 2025 report revealed a weakening of investor interest in digital asset treasuries (DATs). This was primarily due to Bitcoin exchange-traded products (ETPs) experiencing their first monthly net outflow since March in August, with redemptions reaching $755 million. This reflected a reduction in investor holdings and enthusiasm for Bitcoin spot ETPs. Meanwhile, ETH-related spot ETPs bucked the trend, attracting substantial inflows, with approximately $3.9 billion in net inflows in August, marking two consecutive months of net inflows. This demonstrates investors' preference for diversified asset allocation, particularly their growing confidence in Ethereum and its application areas (such as DeFi and smart contracts).

The "mNAV" mentioned in the report measures the supply-demand balance between a DAT's stock price and the market value of its crypto holdings. The mNAV (market NAV) ratio compares a company's market capitalization to the market value of its underlying crypto assets. When the ratio approaches 1.0, it indicates that the stock price is consistent with the actual value of its holdings, reflecting a balance between supply and demand. Grayscale noted that the mNAV ratios of most major DATs are approaching 1.0, indicating that the market is no longer willing to provide these companies with a premium valuation, meaning that investors are no longer paying the premium to gain cryptocurrency exposure through stock trading.

Therefore, the decline in investor enthusiasm, the outflow of funds from Bitcoin ETP, and the disappearance of the valuation premium of DAT companies reflect the saturation and rational return of the entire market's demand for such digital asset investment tools.

Despite signs of fatigue for Bitcoin DATs, altcoin DATs continue to emerge.

Is the altcoin DAT criticized for being confusing?

In terms of altcoin DAT, tokens such as Solana and Cronos have recently announced the establishment of new digital asset vaults, indicating that although investors' enthusiasm for overall DAT companies has declined, institutions are still continuing to launch related products.

As reported in August, Nasdaq-listed Mill City Ventures III may be raising an additional $500 million to fund its recently announced Sui Token DAT strategy. Galaxy Digital, on July 31st, noted that narrative-driven investing is driving the firm’s expansion beyond Bitcoin.

Cryptocurrencies such as ETH, Solana, XRP, BNB, and HyperLiquid are gradually gaining favor in corporate coffers alongside Bitcoin.

According to BitcoinTreasuries.NET, publicly traded companies hold approximately $117.91 billion worth of Bitcoin. Ethereum, another crypto asset, is gaining increasing attention, in part due to its ability to be staked and generate annualized returns, making it both a store of value and a source of income.

According to data from StrategicETHReserve, approximately 3.14% of Ethereum's total supply is held by publicly listed DATs. Galaxy Digital CEO Mike Novogratz suggested that DATs' interest in the broader crypto market may be contributing to Bitcoin's recent price consolidation. "Bitcoin is currently in a period of consolidation, in part because most DATs are starting to experiment with other tokens."

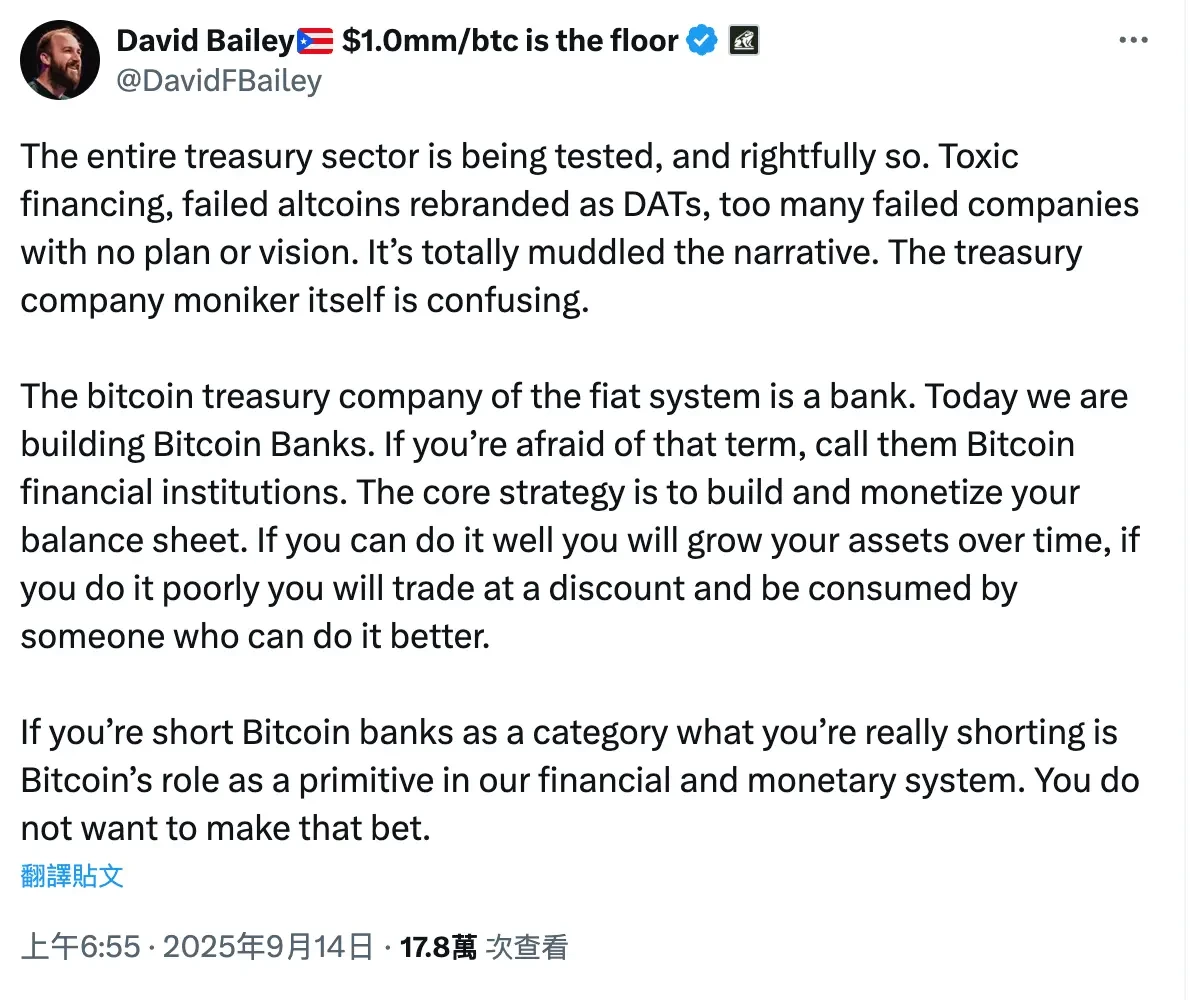

However, David Bailey criticized the term "digital asset treasury" as confusing, as more and more companies are holding assets other than Bitcoin on their balance sheets. "Many companies are adding underperforming altcoins to their balance sheets, which blurs the DAT narrative."

Image credit: X @DavidFBailey

Currently, altcoins are being heavily included in many companies' financial reports, raising market concerns about some digital asset companies (including some DATs and similar financial entities). With altcoins under scrutiny in treasury vaults, Bitcoin treasury vaults are now also facing questions.

Venture capital firm Breed said that only a few Bitcoin vault companies can stand the test of time and avoid falling into a "death spiral" of trading close to the net asset value.