BitMine's lone effort to prop up the market: How long can it hold on after its stock price has plummeted by 80%?

- 核心观点:BitMine能否持续买入ETH成市场焦点。

- 关键要素:

- BitMine持仓356万ETH,浮亏30亿美元。

- ETF净流出,质押收益降至2.9%。

- 机构态度分裂,ARK加仓而Thiel减持。

- 市场影响:考验以太坊价格支撑与市场信心。

- 时效性标注:短期影响

Original author: Zhou, ChainCatcher

The crypto market continues its downturn, with Ethereum's price falling nearly 40% from its peak since November, and ETFs experiencing continuous net outflows. Amid this systemic retreat, BitMine, the largest Ethereum treasury firm, has come into focus. Peter Thiel's Founders Fund reduced its BMNR holdings by half, while Cathie Wood's ARK Invest and JPMorgan Chase have chosen to increase their positions against the trend.

The polarized attitude of capital has put BitMine's "5% alchemy" on the spot: 3.56 million ETH, 3 billion unrealized losses, and mNAV plummeting to 0.8. As one of the last bastions of Ethereum buying, how long can BitMine continue to buy? Is there a value mismatch? After the DAT flywheel stalls, who will take over the ETH?

1. BitMine 5% Alchemy: How long can the funds last?

BitMine, the second-largest cryptocurrency treasury company after MicroStrategy, had planned to purchase tokens equivalent to 5% of Ethereum's total supply in the future. On November 17, BitMine announced that its Ethereum holdings had reached 3.56 million, representing nearly 3% of the circulating supply , more than halfway to its long-term goal of 6 million. In addition, the company currently holds approximately $11.8 billion in crypto assets and cash, including 192 Bitcoins, $607 million in uncollateralized cash, and 13.7 million shares of Eightco Holdings .

Since launching its large-scale cryptocurrency hoarding program in July, BitMine has become a focus of the market. During that period, the company's stock price rose in tandem with the price of Ethereum, and the story of "increasing market capitalization through cryptocurrency" was seen by investors as a new model in the crypto space.

However, as the market cooled and liquidity tightened, market sentiment began to reverse. The drop in Ethereum's price made BitMine's aggressive buying pace seem even more risky; based on an average purchase price of $4,009, BitMine's unrealized losses were approaching $3 billion . Although Chairman Tom Lee repeatedly expressed his bullish view on Ethereum and stated that he would continue to add to his position at lower levels, investors' focus shifted from "how much more can be bought" to "how long can this hold out?"

BitMine currently has cash reserves of approximately $607 million, with the company's funding primarily coming from two sources.

First, there's the revenue from crypto assets . BitMine generates short-term cash flow through immersion-cooled Bitcoin mining and consulting services, while simultaneously pursuing long-term returns through Ethereum staking. The company stated that its ETH holdings will be staked, generating approximately $400 million in net proceeds.

Secondly, there's secondary market financing . The company launched its ATM (Available-to-Money) stock sale program, a mechanism that allows it to sell new shares at any time to raise cash without pre-setting a price or size. To date, the company has issued hundreds of millions of dollars worth of stock and attracted investment from numerous institutional investors, including well-known firms such as ARK, JPMorgan Chase, and Fidelity. Tom Lee stated that when institutions buy large amounts of BMNR, these funds will be used to purchase ETH.

By accumulating ETH and generating revenue, BitMine is attempting to reshape the logic of corporate capital allocation, but changes in the market environment are weakening the stability of this model.

In terms of stock price, BitMine (BMNR) is facing some pressure, having fallen about 80% from its July high. Its current market capitalization is about $9.2 billion, lower than its ETH holdings value of $10.6 billion (based on ETH at $3,000). Its mNAV has fallen to 0.86 , reflecting market concerns about the company's unrealized losses and the sustainability of its funding.

II. The final straw for ETH price: Three visible factors contributing to a widening gap in purchasing power and a decline in staking.

From a macro perspective, the Federal Reserve has released hawkish signals, reducing the probability of a rate cut in December. The overall cryptocurrency market is weak, and risk appetite has declined significantly.

Currently, ETH has dipped to $3,000, a drop of over 30% from its August high of $4,900. This correction has brought the market back to a key question: if the previous price support came from increased holdings by treasury firms and institutions, who will take over the buying now that the buying has subsided?

Among the visible market forces, the three main buying channels—ETFs, treasury companies, and on-chain funds—are showing divergence in different directions.

First, the inflow trend of funds into Ethereum-related ETFs has slowed significantly . Currently, the total holdings of these ETFs are approximately 6.3586 million ETH, representing 5.25% of the total supply. According to SoSoValue data, as of mid-November, the total net assets of Ethereum spot ETFs were approximately $18.76 billion. This month, net outflows have significantly exceeded inflows, with daily outflows reaching as high as $180 million. Compared to the period of continuous net inflows from July to August, the funding curve has shifted from a steady upward trend to a fluctuating downward trend.

This decline not only weakened the potential for large buyers but also reflects that market confidence has not yet fully recovered from the pace of the collapse. ETF investors typically represent medium- to long-term allocation funds, and their withdrawal means that incremental demand for Ethereum from traditional financial channels is slowing. When ETFs no longer provide upward momentum, they may instead amplify volatility in the short term.

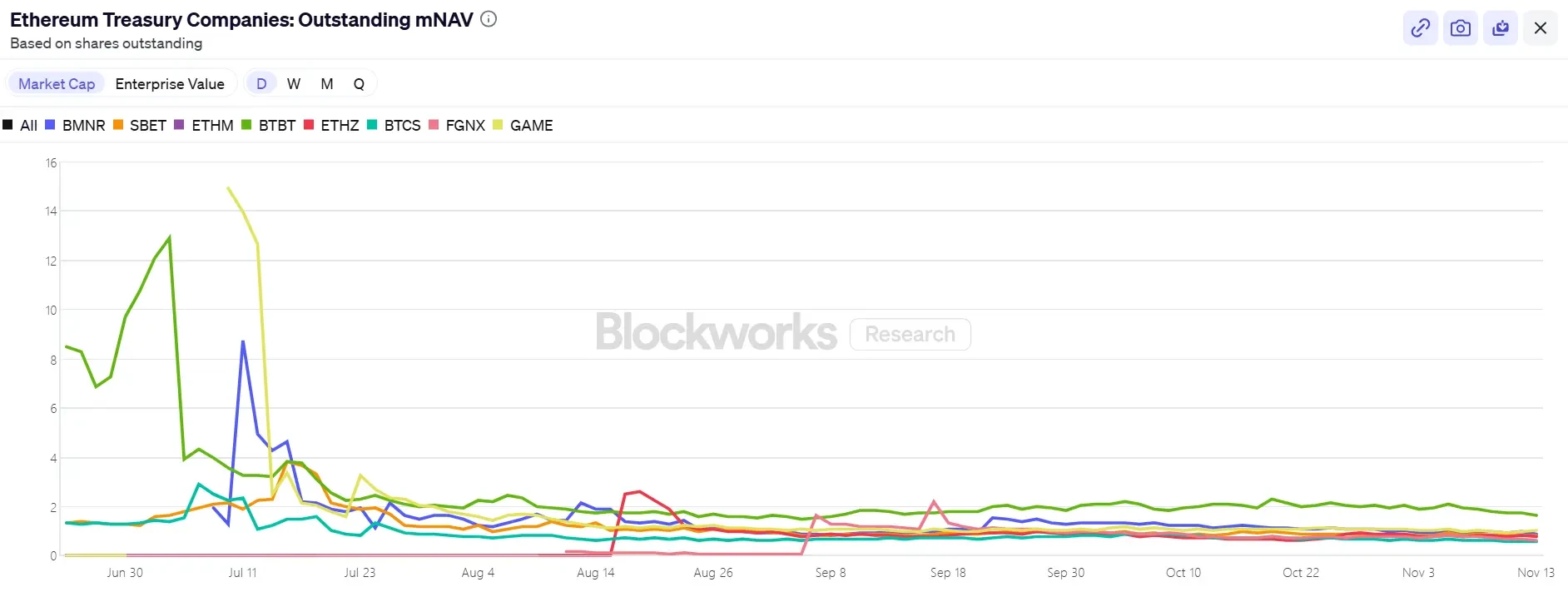

Secondly, the Digital Asset Treasury (DAT) sector has also entered a phase of differentiation . Currently, DAT's total Ethereum strategic reserves amount to 6.2393 million ETH, representing 5.15% of the total supply. The pace of accumulation has slowed significantly in recent months, with BitMine becoming almost the only major player still making large-scale purchases. In the past week, BitMine added another 67,021 ETH, continuing its buy-on-dips strategy. SharpLink, after purchasing 19,300 ETH on October 18th, has not made any further purchases, with a total cost of approximately $3,609, and is currently also experiencing a paper loss.

In contrast, some small and medium-sized financial companies are being forced to scale back. ETHZilla sold approximately 40,000 ETH at the end of October to buy back shares, attempting to narrow the discount and stabilize the stock price by selling some of its ETH.

This divergence signifies that the financial sector is shifting from widespread expansion to structural adjustment. Leading companies can still maintain buying power thanks to their capital and confidence, while small and medium-sized enterprises are facing liquidity constraints and debt repayment pressures. The market's baton is shifting from broad-based incremental buying to a few "lone wolves" who still possess capital advantages.

At the on-chain level , short-term funds are still dominated by whales and high-frequency addresses, but they do not constitute a force supporting prices. The recent liquidation of several long ETH investors has dampened trading confidence to some extent. According to Coinglass data, total open interest in ETH contracts has almost halved since its August high, and leveraged funds are rapidly shrinking, indicating a simultaneous cooling of liquidity and speculative fervor.

Furthermore, Ethereum ICO wallet addresses that had been dormant for over 10 years have recently been activated and are beginning to transfer funds out. Glassnode data reports that long-term holders (addresses held for more than 155 days) are currently selling approximately 45,000 ETH daily, equivalent to about $140 million . This is the highest level of selling since 2021, indicating a weakening of bullish momentum.

BitMEX co-founder Arthur Hayes recently wrote that while ETF inflows and DAT purchases have allowed Bitcoin to rise since April 9th due to the contraction in dollar liquidity, this momentum has ended. The basis is not sufficiently broad to encourage institutional investors to continue buying ETFs, and most DATs are trading at a discount to their current NAV, leading investors to avoid these derivative securities.

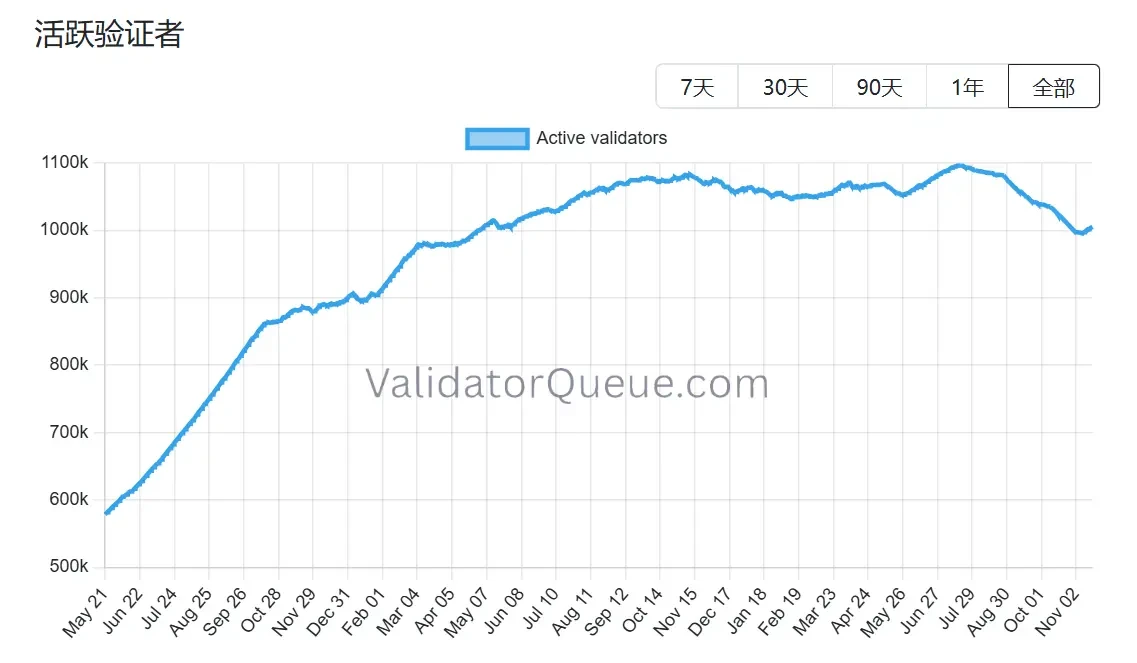

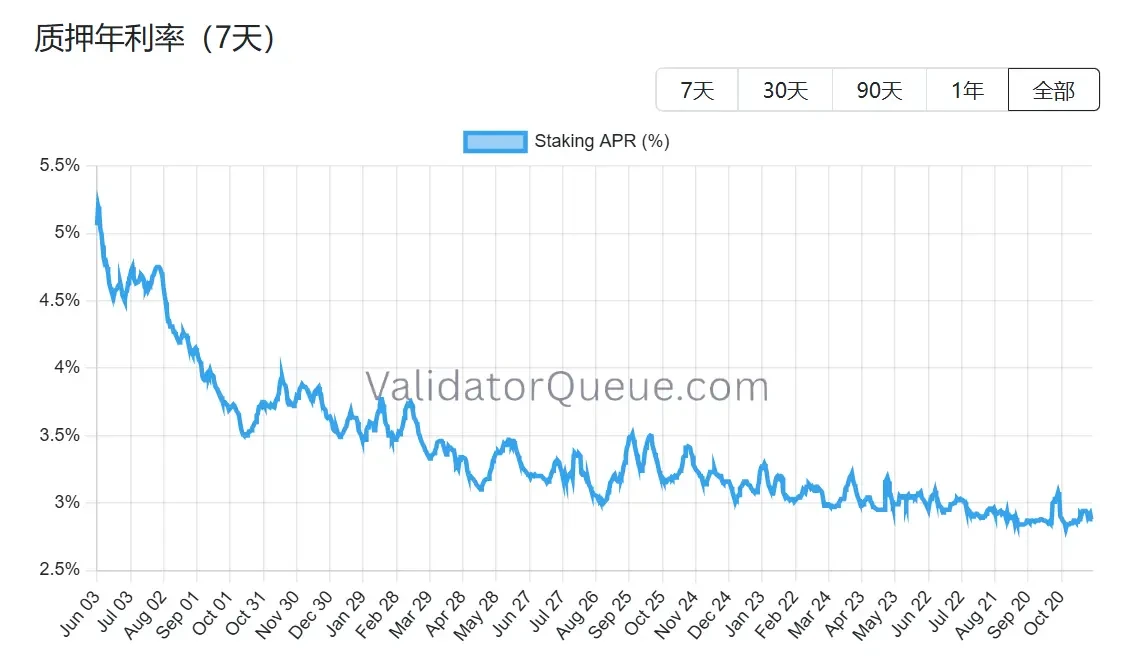

Ethereum is experiencing a similar decline, especially given the retreat of its staking ecosystem . Beaconchain data shows that Ethereum's daily active validators have decreased by approximately 10% since July, reaching their lowest level since April 2024. This is the first time such a significant drop has occurred since the network switched from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus mechanisms in September 2022.

The decline was mainly due to two factors:

The decline was mainly due to two factors:

First, the surge in Ethereum's price this year has led to an unprecedented number of validators leaving the queue, prompting staking operators to rush to cancel their staking in order to sell and profit.

Secondly, declining staking yields and rising borrowing costs have made leveraged staking unprofitable. Currently, Ethereum's annualized staking yield is approximately 2.9% APR, far below the all-time high of 8.6% reached in May 2023.

With all three main buying channels under pressure and the staking ecosystem receding, Ethereum's price support faces a structural test in the next phase. Although BitMine is still being bought, it is almost fighting alone. If even BitMine, the last pillar, cannot be bought, the market will lose more than just a stock or a wave of funds; it may lose the very foundation of the entire Ethereum narrative.

III. Does BitMine suffer from value mismatch?

Having discussed the funding chain and the retreat of buying interest, a more fundamental question emerges: Is the story of BitMine truly over? The current market pricing clearly doesn't fully grasp its structural differences.

Compared to MicroStrategy's approach, BitMine chose a completely different strategy from the outset. MicroStrategy heavily relied on raising funds in the secondary market through convertible bonds and preferred stock, incurring hundreds of millions of dollars in annual interest burdens, and its profitability depended on the unilateral rise of Bitcoin. Although BitMine diluted its equity through new share issuances, it had almost no interest-bearing debt. At the same time, its ETH holdings contributed approximately $400-500 million in staking income annually. This cash flow was relatively rigid, and its correlation with price fluctuations was far lower than that of Strategy's debt costs.

More importantly, this return is not the end. As one of the world's largest institutional ETH holders, BitMine can use its staked ETH for restaking (earning an extra 1-2%), operating node infrastructure, locking in fixed returns through yield tokenization (such as a certain return of around 3.5%), and even issuing institutional-grade ETH structured notes—operations that MicroStrategy's BTC holdings cannot achieve.

However, BitMine (BMNR) is currently trading at a discount of approximately 13% to its ETH holdings on the US stock market. While this discount isn't the most extreme within the DAT sector, it's significantly lower than the historical pricing average for similar assets. Bearish sentiment amplifies the visual impact of unrealized losses, to some extent obscuring the value of yield buffers and ecosystem options.

Recent institutional actions seem to have captured this discrepancy. On November 6th, ARK Invest added 215,000 shares ($8.06 million); JPMorgan Chase held 1.97 million shares at the end of the third quarter. This wasn't blind bottom-fishing, but rather based on an assessment of the long-term compound growth of the ETH ecosystem. Once the price of Ethereum stabilizes or rebounds moderately, the relative stability of returns may make BitMine's mNAV recovery path steeper than that of purely leveraged funds.

Whether a value mismatch truly exists is already clear; the remaining question is when the market will be willing to pay for scarcity. The current discount is both a risk and the starting point of divergence. As Tom Lee stated, the growing pains are short-term and will not change the ETH supercycle. Of course, it may also not change BitMine's core role in this cycle.