RWA Weekly Report | US Senate Democrats Announce Crypto Market Regulatory Framework; Tether to Launch USAT, a US-Based Stablecoin (September 10-16)

- 核心观点:RWA总市值首破300亿美元,市场加速扩张。

- 关键要素:

- RWA链上总价值周涨8.42%。

- 私人信贷占比56%,增长9.03%。

- 用户数连续六周正增长。

- 市场影响:推动资产上链和机构参与加速。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3)

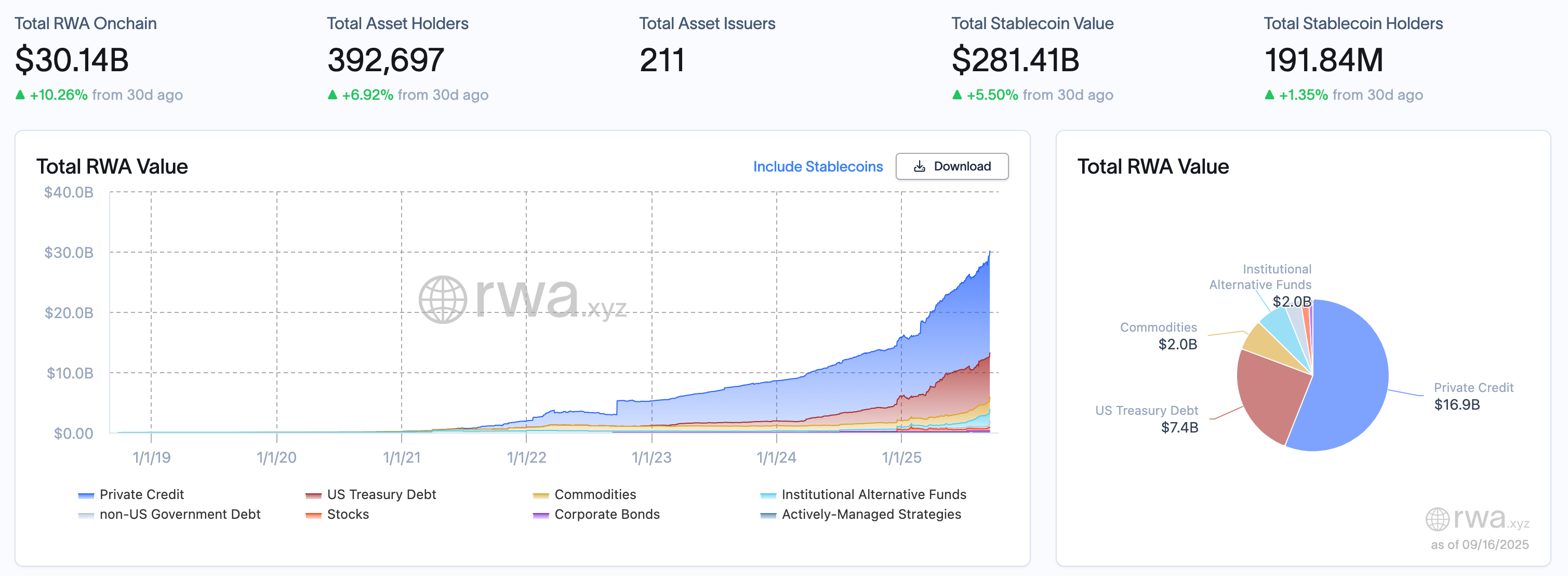

RWA Sector Market Performance

As of September 16, 2025, the total value of the RWA on-chain reached $30.14 billion, an increase of $2.34 billion, or 8.42%, from $27.80 billion on September 9. This marks the first time that the total market capitalization of RWA has exceeded $30 billion , continuing the market's previous growth trend and entering a new round of accelerated expansion. User engagement also increased, with the total number of asset holders increasing from 382,324 to 392,697, a weekly increase of 10,373, or 2.71%. This marks the sixth consecutive week of positive user growth. The number of asset issuers decreased from 274 to 211, a decrease of 63, or 22.99%. This data anomaly may be related to platform liquidation and adjustments to statistical rules. (This may be related to the weekend's controversy surrounding the RWA metric. For more information, see " A $12 Billion False Boom? The Battle Between Figure and DefiLlama Over "RWA Data Falsification". ") As of September 16, the total value of the stablecoin market reached $281.41 billion, an increase of $3.81 billion, or 1.37%, from $277.60 billion on September 9. The number of stablecoin holders remained essentially flat, rising slightly from 191 million to 191.84 million, an increase of approximately 8,400, a change of less than 0.03%, with minimal overall fluctuation.

From an asset management perspective, private credit remains the core of the RWA sector, accounting for approximately 56%. This week, it increased by $1.4 billion, or 9.03%, from $15.5 billion to $16.9 billion . U.S. Treasuries remained stable at $7.4 billion for the second consecutive week. Commodity assets remained stable at $2 billion, with no significant change. Institutional alternative funds saw a slight increase this week, from $180 million to $200 million, an increase of 11.1%, demonstrating continued institutional interest in non-standard assets. Other asset classes, such as equities, non-U.S. government debt, and corporate bonds, are relatively small in size and therefore have a limited impact on the overall structure.

What are the trends (compared to last week )?

Looking at overall market trends, the RWA market demonstrated a combination of growth in volume and a robust structure in the second week of September. On the one hand, the total market capitalization of RWAs surpassed $30 billion for the first time, with gains in both private credit and alternative funds providing strong support for the upward trend. On the other hand, the stablecoin market stabilized, with user activity remaining largely unchanged, indicating a more mature funding structure. The significant decline in the number of asset issuers may be a data anomaly, or it may reflect the platform's efforts to centralize or de-redundant project management.

Review of key events

Tether to Launch USAT, Appoints Bo Hines as CEO

According to official news, Tether officially launched USAT, a US dollar-backed stablecoin planned to be issued under the US regulatory framework, and appointed Bo Hines as the future CEO of Tether USAT.

USAT will strictly adhere to the regulatory standards of the US GENIUS Act and be backed by transparent reserves, aiming to provide businesses and institutions with a digital alternative to cash and traditional payment systems. The stablecoin will utilize Tether's Hadron technology platform, with federally regulated crypto bank Anchorage Digital serving as the compliant issuer and Cantor Fitzgerald serving as the designated reserve custodian.

Tether CEO Paolo Ardoino said the launch of USAT is a natural step to ensure the dollar maintains its dominance in the digital age. Bo Hines, formerly the executive director of the White House Crypto Council, has legal, business, and policy expertise.

U.S. Senate Democrats unveil crypto market regulatory framework, spurring bipartisan negotiations

On September 9th, 12 Democratic members of the US Senate proposed a seven-pillar regulatory framework for the crypto market structure, the most comprehensive proposal from within their party to date. The plan aims to strengthen investor protection, address regulatory gaps, and limit potential corruption, specifically targeting crypto projects involving Trump and his family. The core framework includes: granting the Commodity Futures Trading Commission (CFTC) new authority over the spot market for non-security tokens and establishing a mechanism for determining security tokens; imposing disclosure and compliance requirements on issuers, exchanges, and custodians; requiring digital asset platforms serving US users to register as financial institutions, subjecting them to the Bank Secrecy Act and anti-money laundering regulations; and proposing new oversight tools for potential illicit financial risks in DeFi. Furthermore, the plan prohibits stablecoin issuers from paying interest directly or indirectly and prohibits current officials and their families from issuing or profiting from crypto projects. This move lays the groundwork for negotiations with the Republican Clarity Act, but the two sides differ significantly on ethical provisions and DeFi regulation.

DigiFT, the institutional-grade tokenized real-world asset (RWA) exchange, today announced that its joint project with Chainlink, the industry-standard oracle platform, and UBS Tokenize, UBS’s in-house tokenization service, has been approved by Hong Kong Cyberport’s Blockchain and Digital Asset Pilot Funding Scheme.

DigiFT, Chainlink, and UBS are developing a regulated blockchain infrastructure designed to automate and streamline the distribution, settlement, and lifecycle management of tokenized products, reducing manual errors and saving costs. As part of the project, DigiFT is validating the infrastructure and providing business feedback to ensure the system meets the compliance, scalability, and interoperability requirements of Hong Kong financial institutions.

Yunfeng Financial Group announced the issuance of 191 million new shares through a top-up placement at a price of HK$6.10 per share, raising approximately HK$1.17 billion. This placement aims to expand the company's shareholder and capital base and increase market liquidity. The funds raised will primarily be used for system and infrastructure upgrades, talent recruitment, and related capital needs, including but not limited to the launch of comprehensive virtual asset trading and investment management services.

Earlier news reported that Yunfeng Financial used US$44 million to purchase 10,000 ETH as reserve assets, and has been approved by the Hong Kong Securities and Futures Commission to provide virtual asset trading services. The board of directors also appointed Mr. Liang Xinjun, co-founder and executive of Fosun International, as an independent non-executive director.

Ant Digital Technology announced the establishment of Ant Chain Credit

According to official news, Ant Digits and Longxin Technology Group jointly announced the establishment of "Ant Chain Trust". The company will carry out green asset management, dynamic rating pricing and other product services based on core technologies such as blockchain, IOT and AI, and build a full-chain service platform covering "asset chain-data aggregation-asset management-rating pricing".

Previously, Ant Digital released DT Tokenization Suite to help standardize and scale RWA development.

Figure announces IPO pricing at $25 per share

Figure Technology Solutions, the blockchain-native lending company led by SoFi co-founder Mike Cagney, announced the pricing of its initial public offering (IPO) on Wednesday evening: issuing 31,500,000 shares of Class A common stock.

The company priced the offering at $25 per share — higher than the $20 to $22 per share range disclosed earlier in the day in its S-1 filing with the U.S. Securities and Exchange Commission (SEC).

At the announced price, Figure plans to raise $787.5 million in its IPO (previously estimated at $693 million), valuing the company at approximately $5.3 billion (previously $4.7 billion). Upon completion of the offering, approximately 211.7 million shares of Class A and Class B common stock will be outstanding, excluding the underwriters' overallotment option.

The offering consisted of 23,506,605 shares of Class A common stock issued by Figure and 7,993,395 shares of Class A common stock sold by certain existing shareholders. This represents a change from the previously filed figures of 26,645,296 and 4,854,704 shares, respectively, reflecting a change in the offering structure. Figure will not receive any proceeds from the sales of shares by existing shareholders.

Gemini raised $425 million in its IPO, selling about 15.2 million shares at $28.

Bloomberg quoted people familiar with the matter as saying that cryptocurrency company Gemini Space Station Inc. (Gemini) raised $425 million through its initial public offering (IPO). Its issue price was higher than the recommended range and the issue size was reduced.

Gemini, led by the billionaire Winklevosses, sold about 15.2 million shares on Thursday at $28 apiece, after previously offering them at $24 to $26, according to people familiar with the matter who asked not to be identified because the information is private. Bloomberg News earlier reported that the company told investors on Thursday it planned to cap the base size of its IPO at $425 million, which was oversubscribed by double digits.

The prospectus indicates that Nasdaq has agreed to subscribe for $50 million worth of shares at the IPO price through a private placement. Gemini will reserve up to 10% of the IPO shares for long-term users, management and employees, and friends and family, and allocate up to 30% to retail investors who subscribe through proprietary investment platforms such as Robinhood Markets Inc., SoFi Technologies Inc., and Webull Corp.

China New City Group and EX.IO partner to launch commercial real estate RWA

China New Town Holdings Limited (1321.HK), a Hong Kong-listed company, and EX.IO, a licensed virtual asset trading platform in Hong Kong, today announced a strategic partnership to jointly issue RWAs that combine commercial real estate projects with digital assets.

The underlying assets of this offering consist of two components: high-quality domestic commercial real estate and mainstream crypto assets with significant growth potential. The commercial real estate is ZhongAn Times Square, located in Hangzhou, Zhejiang Province. The project has consistently maintained high occupancy rates and stable customer traffic, attracting a diverse network of high-quality tenants, and boasts outstanding asset quality and profitability. By adding mainstream crypto assets to the portfolio, the company will provide global investors with an asset allocation option that combines security with attractive returns.

China New City Group has reportedly transitioned to a digital asset management company. The group will leverage cutting-edge technologies such as blockchain, artificial intelligence, and the Internet of Things to digitally transform assets across sectors like real estate, green finance, and cross-border trade, ultimately building a new digital real estate ecosystem.

EX.IO, a licensed virtual asset trading platform invested by Sina's Huasheng Group, was licensed by the Hong Kong Securities and Futures Commission in December 2024. Its core team comes from international financial institutions such as Societe Generale, Morgan Stanley, and HSBC, and has both deep traditional financial experience and blockchain innovation capabilities.

Hot Project Dynamics

Ondo Finance (ONDO)

One sentence introduction:

Ondo Finance is a decentralized finance protocol focused on the tokenization of structured financial products and real-world assets. Its goal is to provide users with fixed-income products, such as tokenized U.S. Treasury bonds and other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, highly liquid assets while maintaining decentralized transparency and security. Its ONDO token is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application within the DeFi ecosystem.

Latest News:

On September 10th, Ondo Finance officially announced that Peter Curley has joined the company as Head of Global Regulatory Affairs. Curley brings decades of experience in financial policy, including stints as Senior Policy Advisor at Coinbase, Senior Advisor for Financial Institutions Policy at the U.S. Treasury Department, Deputy Director of the U.S. Securities and Exchange Commission, and Head of Strategy and Head of IPO Regulation at Hong Kong Exchanges and Clearing Limited.

On September 12th, according to on-chain data , Ondo Global Markets ranked first in the tokenized stock sector by total value locked (TVL), with $126.85 million, exceeding the combined value of all other platforms. xStocks and Dinari ranked second and third, with $48.66 million and $45.42 million, respectively.

MyStonks (STONKS)

One sentence introduction:

MyStonks is a community-driven DeFi platform focused on tokenizing and trading Reliable Warrants (RWAs) such as US stocks on-chain. Through a partnership with Fidelity, the platform offers 1:1 physical custody and token issuance. Users can mint stock tokens like AAPL.M and MSFT.M using stablecoins like USDC, USDT, and USD 1, and trade them 24/7 on the Base blockchain. All trading, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks is committed to bridging the gap between TradFi and DeFi, providing users with highly liquid, low-barrier-to-entry on-chain investment in US stocks, and building the "NASDAQ of the crypto world."

Latest News:

On September 12th, MyStonks announced that the "STONKS Token Staking and Airdrop Plan" passed a 98% approval rate in a community vote, officially launching the platform's token staking program. Staking will be open for 10 days, from September 12th to September 22nd, 2025, with a 180-day lock-up period. Users must connect their wallet, log in to their profile, and click the "Stake" button to complete the process. No additional deposit is required. Users who fail to participate after the expiration date will not be able to stake again.

On September 16th, the MyStonks platform officially launched Hong Kong stock futures trading . Users can trade directly with USDT/USDC using their wallet, with up to 20x leverage. This launch includes a number of high-quality Hong Kong stocks, including Guotai Junan International (1788.HK), BYD Co., Ltd. (1211.HK), Xiaomi Group (1810.HK), Mixue Group (2097.HK), Meituan (3690.HK), Tencent Holdings (700.HK), Pop Mart (9992.HK), JD.com (9618.HK), and SMIC (981.HK). These stocks cover a variety of sectors, including technology, automotive, retail, internet, and semiconductors, meeting users' diverse asset allocation needs.

Related links

Sort out the latest insights and market data for the RWA sector.

A $12 billion false boom? The dispute between Figure and DefiLlama over "RWA data falsification"

A standoff over RWA transparency and data standards has revealed a bigger fig leaf.

The New Landscape of Public Chains Driven by Stablecoins and RWA

The next chapter of the public chain will be written by platforms that can truly serve the real economy and reduce friction in the flow of value.

Blockchain has completely reshaped how assets are initiated, traded, and financed. This isn’t a fintech makeover of an old system, but rather a brand new capital market ecosystem.

RWA In-Depth Research Report: On-chain IPO and Recombination of Real-World Assets

Why is financial chain integration considered to be the top national strategy and market trend of the United States?