USDH voting in progress: "Predetermined script", "Boss chasing love", "Quitting at the peak of his career" take turns to play

- 核心观点:Hyperliquid稳定币USDH发行权竞标引发争议。

- 关键要素:

- Native Markets获超70%投票被疑内定。

- Ethena提出优厚条件后突然退出竞标。

- 验证者投票权集中引发社区质疑。

- 市场影响:暴露去中心化治理潜在操纵风险。

- 时效性标注:短期影响。

Original | Odaily Planet Daily ( @OdailyChina )

By Wenser ( @wenser 2010 )

The bidding for Hyperliquid's native stablecoin, USDH, is in full swing, but discussion within the crypto market and the Hyperliquid community has reached a new level. A Dragonfly partner called it a "pre-determined farce," while a member of the Hypurrscan team explicitly told Jan Van Eck they held 15% of the voting rights and wanted to hear his explanation. Ethena, after offering various favorable terms, abruptly withdrew from the bidding. The USDH bidding has become more heated and discussed than even Hyperliquid officials and community members could have imagined.

Although the voting deadline of September 14 has not yet arrived, the current drama already includes quite dramatic plots such as "predetermined script", "domineering boss pursuing love" and "retirement at the peak of one's career". Odaily Planet Daily will organize the recent USDH-related plots in this article for readers' reference.

For a brief summary, see "Hyperliquid's stablecoin USDH becomes a hot commodity in the industry, and giants start a fierce battle for distribution rights."

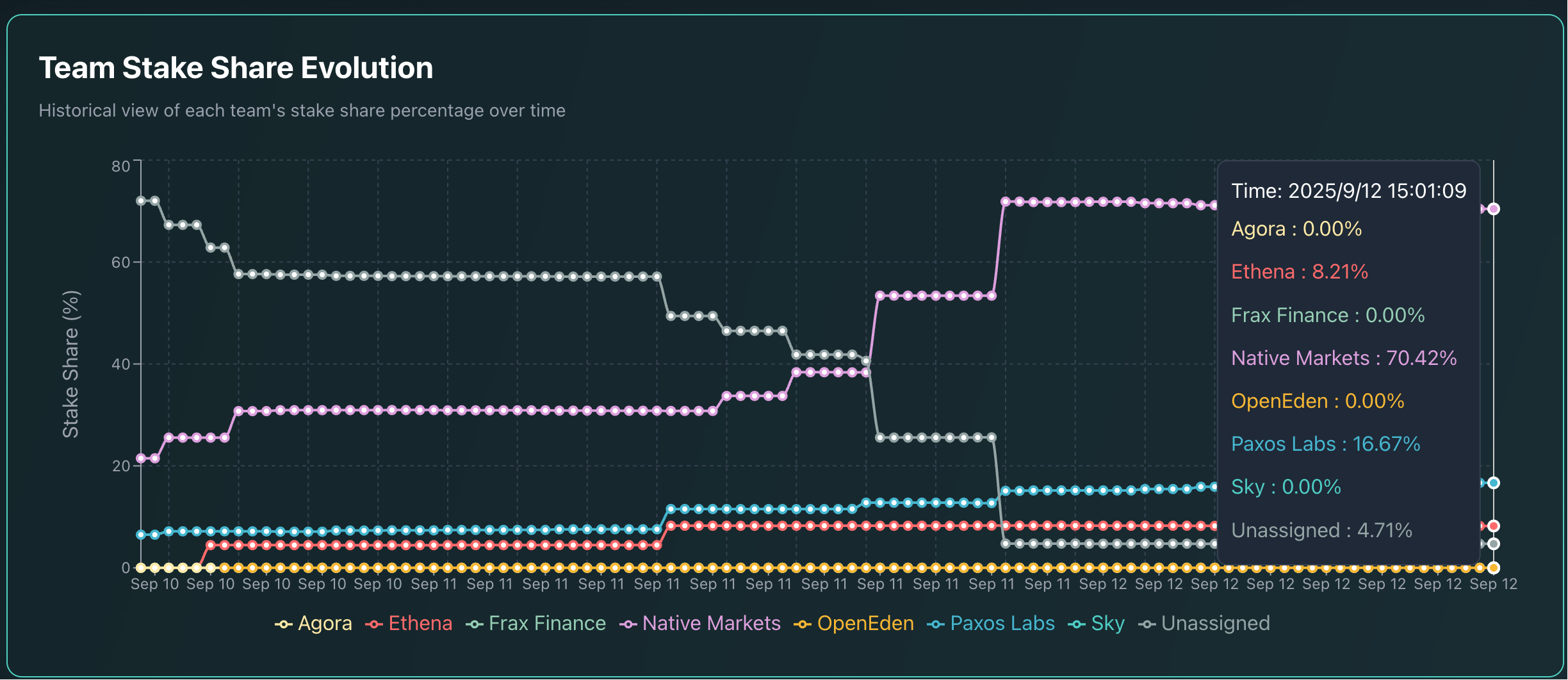

USDH voting in progress: Native Markets receives over 70% of validator votes, Paxos Labs comes in second

According to the USDHTracker website , as of 3:00 PM on September 12, the vote ratios of the major issuers in the USDH bidding were as follows:

- Native Markets: 70.42%

- Paxos Labs: 16.67%

- Ethena: 8.21%;

- Unallocated votes: 4.71%.

Issuers such as Agora, Frax Finance, OpenEden, and Sky all received 0 votes.

USDH validator voting interface information

Considering the information mentioned in previous community discussions that Native Markets submitted a bid proposal just one hour after Hyperliquid's official announcement, it's no wonder that Dragonfly Managing Partner Haseeb previously wrote , " It's starting to feel like the USDH RFP is a bit of a farce. I've heard from multiple bidders that no validator is interested in considering other issuers besides Native Markets. This wasn't even a serious discussion; it was as if a backroom deal had been reached. Native Markets' proposal appeared almost immediately after the USDH RFP was announced, suggesting they were notified in advance. Everyone else was scrambling to put things together all weekend. So the entire USDH RFP was basically tailor-made for Native Markets."

Meanwhile, the community seemed to be reaching a consensus that the best proposals came from established players like Ethena, Paxos, and Agora, rather than a brand-new startup like Native Markets. Polymarket told the same story—as soon as the Ethena proposal was announced, the odds immediately soared, making it the most likely option to win, until people realized validators weren't interested. Within two hours, the odds plummeted. Later, in the comments section, they added, "We've now heard from over half of the USDH bidders who agree with this and say they won't speak publicly because they think it's pointless and will only lead to criticism." Furthermore, another bidder told them, "For obvious reasons, I don't want to say this publicly, but count me in as someone who said, 'I was sure this was for Native Markets and they wanted to do a procedural governance vote, but underestimated the insane amount of competition it would face.'"

Of course, in response to Haseeb's remarks, Alex Svanevik, CEO of Nansen, which operates the largest HL validator together with Hypurr Collective, stood up to fight back, saying: "This is absolutely factually incorrect. Our team has invested a lot of energy in reviewing proposals and communicating with bidders to find the best alternative to HL. This week I have been receiving private messages and calls from USDH bidders, and we have always been the ones who actively contacted them. We even encouraged those hesitant players to advance their proposals to make the whole process more competitive."

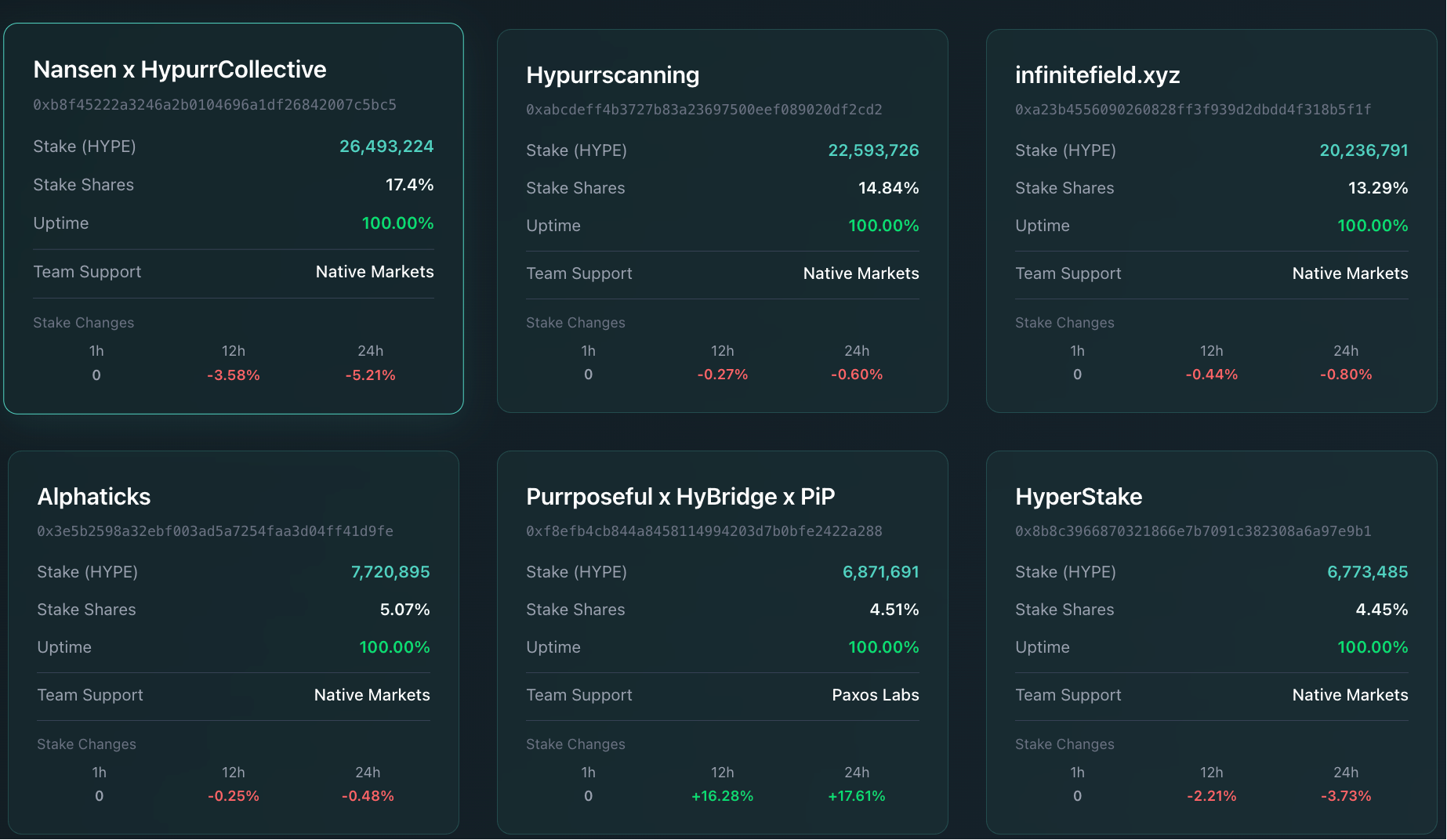

But in reality, Nansen has chosen to "vote with their feet." According to USDH voting data , Nansen and Hypurr Collective currently have approximately 26.5 million HYPE staked, accounting for 17.4% of the staked share, making them the validator with the highest voting share. The USDH issuer they support is Native Markets, a "Hyperliquid community native project." Despite Nansen's CEO's previous assertions, their voting share has fallen by 5.21% in the past 24 hours and 3.58% in the past 12 hours.

Some Hyperliquid validators’ USDH proposal voting information

USDH Proposal Interlude: Multi-millionaires' "!Rank" and "Meow" Moments

It is worth mentioning that two interesting things happened during the USDH proposal bidding process, some of which were even quite ridiculous.

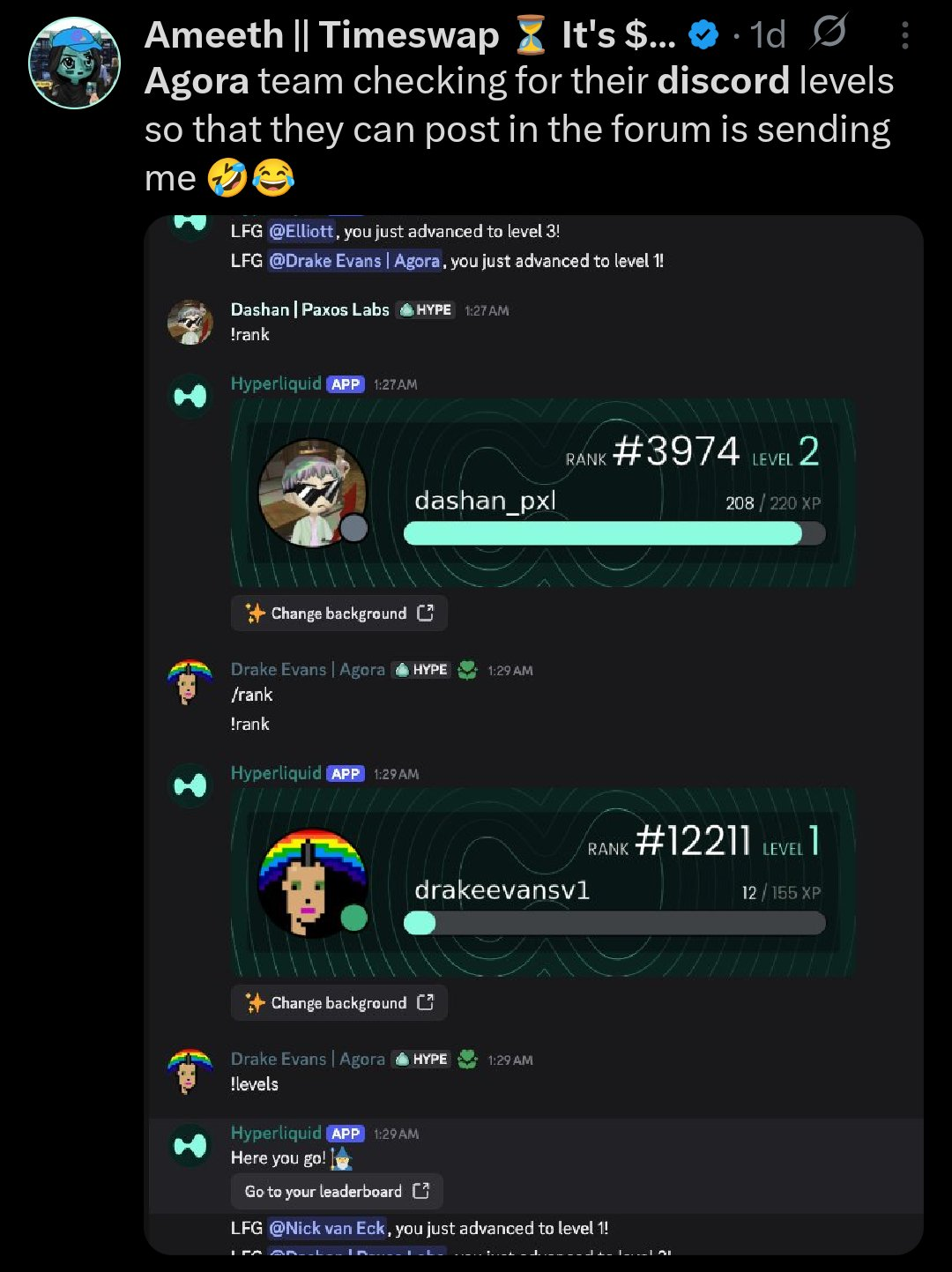

To show their sincerity, members of the Agora and Paxos teams were busy checking the community's speaking levels.

After Hyperliquid officially opened a USDH sub-channel for major issuers to submit proposals, team members from established issuers Paxos Labs and Agora frequently checked their speaking levels and community rankings on Discord to ensure they had a voice and to demonstrate their enthusiasm for speaking in the community.

It has to be said that the USDH bidding once again demonstrated the charm of the "auction mechanism". After all, behind it is a cash flow business with a scale of over US$5.6 billion and an annual profit of over US$200 million.

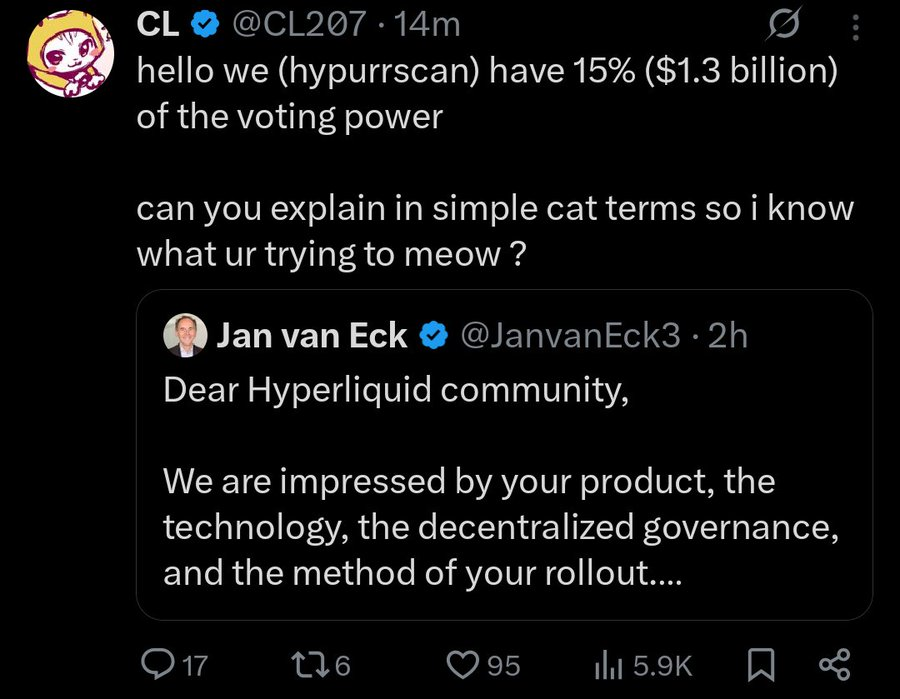

The head of the billionaire asset management giant Van Eck worked hard to show goodwill, prompting validators to ask for an explanation.

In addition to the publisher team members going out of their way to demonstrate their sincerity, Jan van Eck, CEO of asset management giant VanEck and the resource provider behind Agora, also made a rare statement on the X platform, directly addressing Hyperliquid community members and praising the platform, ecosystem, and community achievements.

Later, CL, the builder behind Hypurrscan, posted a blunt message: “We have 15% of the voting rights (worth $1.3 billion). Can you explain what you mean in simple terms?”

Of course, in the end, Syavel of the Hypurrscan team said : "After careful consideration, Hypurrscan voted for Native Markets as a validator. Among the many competitors, we believe that Native Markets is the only proposal that is truly led by Hyperliquid and is most aligned with Hyperliquid."

But anyway, as one person commented : “This is actually crazy! A bunch of Wall Street billionaires had to fight like rats with a bunch of cartoon characters to get their stablecoin approved.”

"Crypto tycoon's love": Paxos Labs and Ethena showed their utmost sincerity, but Ethena eventually withdrew

Now it seems that if the USDH code bidding is regarded as a "courtship ceremony" launched by major stablecoin issuers to the Hyperliquid platform, Native Markets led by Max Fiege is like a "childhood sweetheart" who has been through thick and thin with the Hyperliquid platform and has come to this day together, while major mature stablecoin issuers such as Paxos Labs and Ethena are more like "domineering presidents" who came here because of its reputation.

Paxos: Invites PayPal and Venmo to join the cooperative network and has the global legal issuance rights

In the USDH v2 proposal submitted by Paxos, as a veteran stablecoin issuer, it chose to leverage its strong "cooperative resource advantages" and "global layout advantages" -

1. Partnership with global payment giant PayPal - HYPE will be listed on PayPal/Venmo, offering free USDH deposits and withdrawals, $20 million in ecosystem incentives, and omnichannel payment integration with Checkout, Braintree, Venmo, Hyperwallet, and Xoom. Notably, PayPal and Venmo reach a combined user base of 400 million.

2. Redesigned reward mechanism - A clear AF-first (endowment foundation first) incentive structure. Paxos Labs only receives rewards when TVL milestones are achieved, with a cap of 5%. All fees are collected in the form of HYPE tokens, directly aligning with the interests of the community.

3. Global Expansion Plan - Paxos Labs will collaborate with Paxos, the only legally licensed global stablecoin issuer. Other bidders claim only to meet the GENIUS standard, but are unable to legally issue USDH in Europe. Their issuing entity holds only MTL. Paxos is the only issuer in the world capable of ensuring USDH can be fully compliantly scaled globally.

Ethena: I turned my heart to the bright moon, but the bright moon only shines on the ditch

Compared to Paxos, Ethena is a highly anticipated rising star in the stablecoin space, following Tether and Circle. The latest data shows that the issuance volume of its two major stablecoins, USDe and USDtb, has exceeded $15 billion (USDe with over 13.2 billion issued and USDtb with over 1.8 billion issued).

Previously, Ethena was also very serious about competing for the right to issue USDH. The core terms of its proposal included:

- USDH will initially be 100% backed by USDtb;

- Ethena has pledged to use at least 95% of the net revenue generated by the USDH reserve for the Hyperliquid community;

- If the Hyperliquid community wishes to revalue trading pairs currently denominated in USDC on core exchanges to USDH, Ethena will cover all transaction costs of migrating USDC to USDH;

- The Ethena Labs research team will submit a proposal to the Ethena Risk Committee to apply for USDH to be listed as a compliant endorsement asset of USDe, etc.

In other words, Ethena will not only cover the cost of migrating USDC to the Hyperliquid network, but will also share 95% of the revenue with the community. To put it in perspective, it's like a domineering CEO in a relationship not only giving you a share of your money but also covering the breakup settlement.

However, with the fresh results of the validator voting, even Ethena, the wealthy boss, could no longer continue its self-touching "courtship" - on the evening of September 11, Ethena founder Guy Young posted a message saying : After communicating with validators and delegators, due to the community's concerns about its non-local team identity and its compatibility with the Hyperliquid ecosystem, Ethena decided to withdraw from the USDH stablecoin issuance competition.

Of course, this does not mean Ethena's complete withdrawal from the Hyperliquid ecosystem stablecoin track. It emphasizes that there will be a series of follow-up plans, such as developing new products with the local Hyperliquid ecosystem team, including:

-hUSDe native synthetic USD,

-USDe has enabled savings and card spending products,

- Implemented hedging liquidity on Hyperliquid,

- and Ethena's uniquely enabled HIP-3 market-wide design space:

a) Trading collateral with rewards,

b) Modularized primary brokerage business,

c) Perpetual stock contracts.

In addition, it mentioned that "other corresponding stablecoin codes have already been prepared" and plans to launch new stablecoins in the future.

It is worth mentioning that in this long article about withdrawing from the USDH bidding, Guy Young used many playful words, and expressed ridicule towards the Native Markets team and Hyperliquid ecosystem validators in explicit or implicit ways.

As for who is right and who is wrong, and who will have the last laugh in the Hyperliquid ecosystem stablecoin war, everything will be verified by time.

Finally, according to Hyperliquid's official announcement, each validator node will indicate their voting intention and reasoning in the "Validator USDH Voting Statement." Official voting will begin at 18:00 UTC+8 on September 14th, and stakers must delegate their stake to a validator that aligns with their voting intentions before then. Official voting closes at 19:00 UTC+8. Once two-thirds of the votes have been cast, designated bidders will be able to bid for the USDH token symbol in the spot deployment gas auction.