RWA In-Depth Research Report: On-chain IPOs and Recombinations of Real-World Assets

- 核心观点:金融链上化是美国国家战略,RWA是核心抓手。

- 关键要素:

- 美元美债美股链上化扩张美元影响力。

- RWA提升清结算效率和资产可组合性。

- 产业链收敛为超级平台整合发行与分销。

- 市场影响:加速全球资本美元化,重塑金融生态。

- 时效性标注:长期影响。

Original Post by: Paolo & Andy @VDX

Original Source: VWIN Ventures

TL;DR:

- Big Picture: Why is the on-chain financialization a top-level national strategy and market trend in the United States ? RWA is a tool for "de-geographical export of global assets and competition for on-chain liquidity." The United States uses high-quality assets, open borders, and standard output to build a highway network for the free flow of global capital assets, pushing the dollar's pricing and clearing radius onto the open chain.

- The essence and core value creation of RWA: RWA is essentially the on-chain re-issuance of real-world assets, rewriting the "issuance-circulation-pricing-trading-clearing-settlement-combination" process. Its value comes from 1) efficient and reliable clearing and settlement, 2) open-ended fund and asset matching, and 3) asset composability. This improves enterprise capital efficiency and asset plasticity.

- Market structure: In the early stage, the competition is on-chain asset issuance, and in the next stage, it will be on channels + ecological integration: the current focus is on achieving compliant issuance + on-chain integration and running through leading models; as the issuance threshold drops, competition will shift to channel control and ecological collaboration (market making, subscription and redemption, mortgage, hedging, distribution) , with DeFi protocol integration, liquidity routing and scenario access being the core focus.

- Opportunities across different segments of the industry chain: The core links include " issuer - tokenization platform - distributor , " along with third-party service providers such as blockchain financial contracts, oracles, law firms, custodians, and auditors. In the future, the industry will converge into a "RWA Prime Broker" super-platform , integrating issuance, compliance, clearing and settlement, and distribution/liquidity.

- Issuers: In the short term, we focus on yield and liquidity , and prioritize strong consensus and differentiated underlying assets.

- Tokenized platforms: Value capture is relatively low, and they may be integrated by upstream and downstream platforms. They focus on compliance and neutrality.

- Distributors: They control the routing of funds and are expected to achieve scale, with a focus on capital acquisition and channel coverage.

Big Picture: Why is financial chain integration a top-level national strategy and market trend in the United States?

After studying Project Crypto, the Trump administration, and various policies and statements from SEC Chairman Paul Atkins, we believe that the on-chainization of finance may have risen to a de facto top-level US national strategy. The goal is to make the US dollar a "programmable settlement standard" for open blockchains, using stablecoins and RWAs as tools. The path involves legislative anchoring, on-chain integration of US dollar assets, and access to funding channels (traditional financial institutions, CEXs, and DeFi). The goal is to expand US dollar interest rates and regulations into the settlement gravity field for open blockchains. From the passage of the GENIUS Act stablecoin legislation in July to the accelerated entry of traditional asset management companies, exchanges, and banks, this chain is already in operation.

The United States's efforts to promote financial chain integration mainly include three aspects.

- Institutional levers: The issuance right is decentralized, and the pricing and anchoring rights are more market-oriented and centralized. The federal level establishes the licensing framework, reserve quality, disclosure frequency, and penetration standards for stablecoins/RWAs ; the control levers evolve from "authority control" to "market selection competition."

- Asset Grabber: Putting "US dollars, US bonds, and US stocks" on the chain and moving US dollar assets onto the chain will allow global DeFi/on-chain institutions to use US dollar interest rates as a "gravity field" ; mortgage and hedging will be available, and minting, redemption, and liquidation will be accelerated, attracting idle stablecoins and risky funds from around the world to flow into US dollar assets.

- Channel Focus: Standardize the “clearing and settlement pipeline” to the open chain

The packaged assets on the chain will be connected to traditional financial institutions (brokerage firms, stock exchanges), encrypted CEX and on-chain DEX/DeFi protocols to expand the reach of users and funds. At the same time, as the regulatory details of on-chain asset issuance are introduced, the regulatory logic will be gradually embedded into the protocol.

Long-term impact trends

- Impact on global finance and capital flows: The “gravitational field” of the US dollar expands, and the pricing power and asset anchoring power of the US dollar chain are strengthened.

- For other regions: liquidity is siphoned away, and “regulatory follow-up/defense” forces the upgrading of supervision and market infrastructure.

- For the crypto industry: The issuance of stablecoins has increased, and crypto assets have also risen, but there has been structural differentiation.

- Opportunities for RWA issuers/participants: RWA accesses the global capital highway network, reduces the cost of capital injection and financing, and financial legos release the liquidity of assets.

RWA Core Value Creation: Beyond Financing

- Essence = asset re-issuance + full process rewriting

- Value = clearing and settlement efficiency × distribution radius × composability.

RWA's value creation is closely centered around the core advantages of blockchain technology:

1. Efficient and reliable clearing and settlement: Reshaping the underlying architecture of enterprise operations

To B (Financial Institutions) – Achieve underlying infrastructure upgrades and more standardized/convenient asset issuance, solve trust, traceability, and transparency issues through blockchain technology, achieve more efficient clearing and settlement, and gradually transform the traditional financial system.

To Enterprises – Reduce intermediary agency wear and tear, simplify cross-border and over-the-counter processes, enhance reconciliation and penetration, and accelerate capital turnover

2. Open Finance: Breaking the Growth Ceiling

By allowing high-quality assets to enter the global clearing and settlement network, it helps to improve the difficulty of financing through existing channels, improves the matching efficiency between the capital side and the asset side, and significantly expands the issuance and distribution radius. The constraints of "difficult/expensive financing" are diluted by networked liquidity, greatly improving capital allocation efficiency and opening up new imagination space for corporate growth.

3. Composability: igniting business model innovation

Connecting off-chain assets with on-chain funds enables permissionless asset combination and leverage in a more efficient network. The on-chain allows for combinations such as "yield enhancement + hedging + re-staking," forming a new paradigm for asset operations.

Industrial Chain: How Enterprises Position and Participate

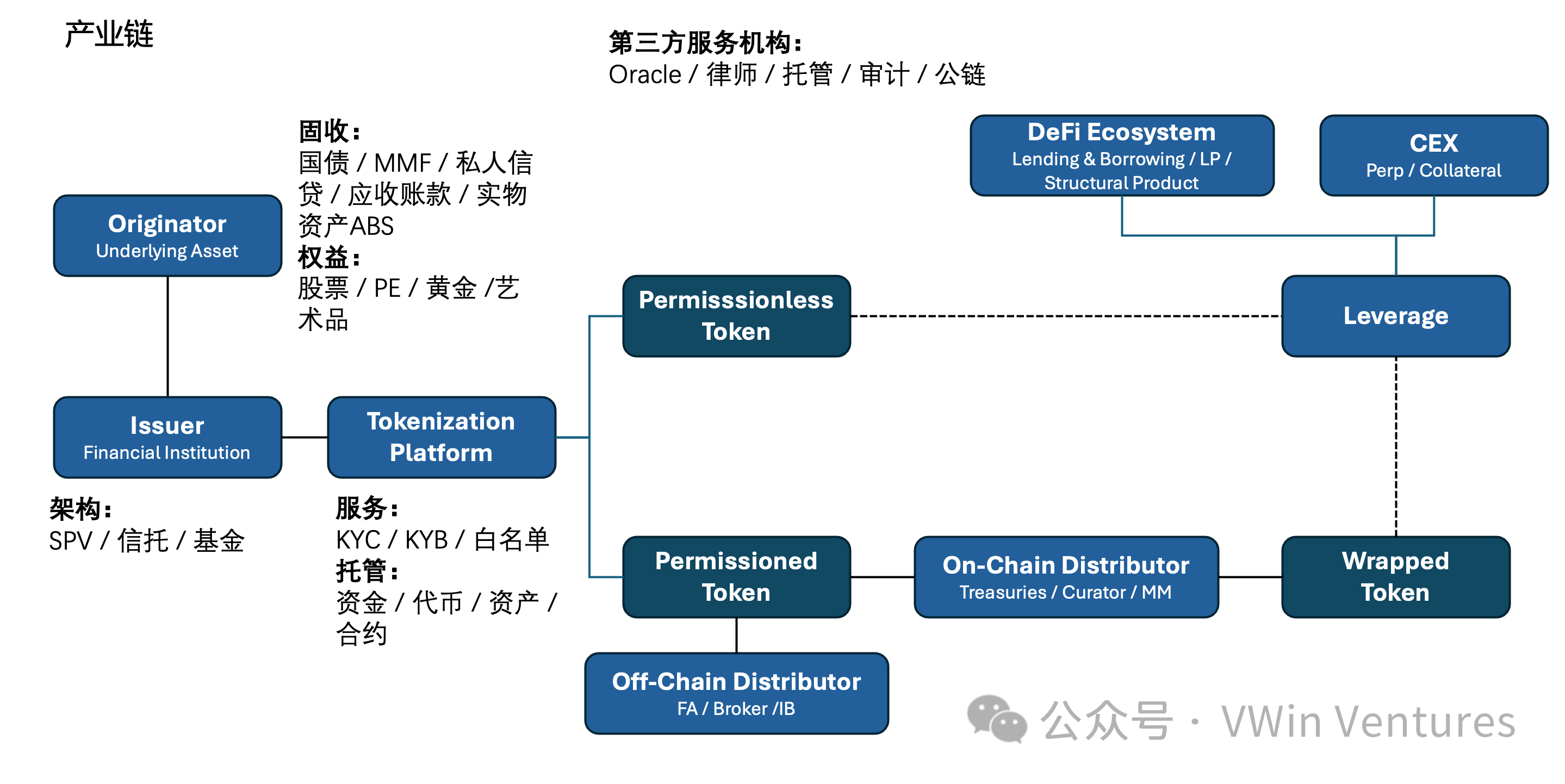

- Issuer - Tokenization platform - Distributor three-stage structure, with a neutral third party (oracle/custodian/law firm/audit) forming the foundation.

- The focus of competition shifted from "issuance capability" to "channel and ecosystem integration," and ultimately converged to RWA Prime Broker.

The core links of the RWA industry are asset issuers + tokenization technology platforms + distributors , plus third-party service agencies (oracle/lawyers/custodians/audits/on-chain contracts, etc.). After off-chain compliance issuance, they are expanded to blockchain native scenarios through on-chain packaging and redistribution.

- Positioning of the three ends of the industry chain: issuers connect compliance and high-quality asset supply, tokenization platforms provide neutral on-chain issuance infrastructure, and distributors integrate the ecosystem and control the capital entrance.

-Core concerns of enterprises: yield and liquidity for issuance, compliance and neutrality for platforms, and user acquisition and channel coverage for distribution.

- Competitive landscape: The issuance side is fragmented; the platform side is squeezed by upstream and downstream, but a third-party leading neutral platform will emerge; the distribution side is relatively concentrated (including the on-chain ecosystem and CEX).

- Current pain points: Lack of cross-border extension motivation on both the issuance and distribution ends; platform technology homogeneity and thin value capture.

- Evolution direction: The industry will converge into a "RWA Prime Broker" super platform, integrating issuance, compliance, clearing and settlement, and distribution/liquidity.

Market structure and breakthrough opportunities

- First movers enjoy the "traffic × valuation" dividend, and barriers quickly shift from licenses/issuance to cross-domain integration and operational capabilities.

- The capital side prefers high returns and high liquidity, and the asset side has an oversupply - under the mismatch, high-quality targets come first, and the long tail will spill over later.

The current market is in a phase of achieving compliant issuance and attempting ecosystem integration, with successful cases for leading assets. The market's early stages offer potential traffic and liquidity dividends. Companies that pioneer the RWA model of high-quality assets are poised to reap significant benefits. Early successes often command significant valuation premiums in the capital market. As the industry develops, asset issuance barriers gradually decrease, market dividends narrow, and competition shifts to deeper industry integration capabilities.

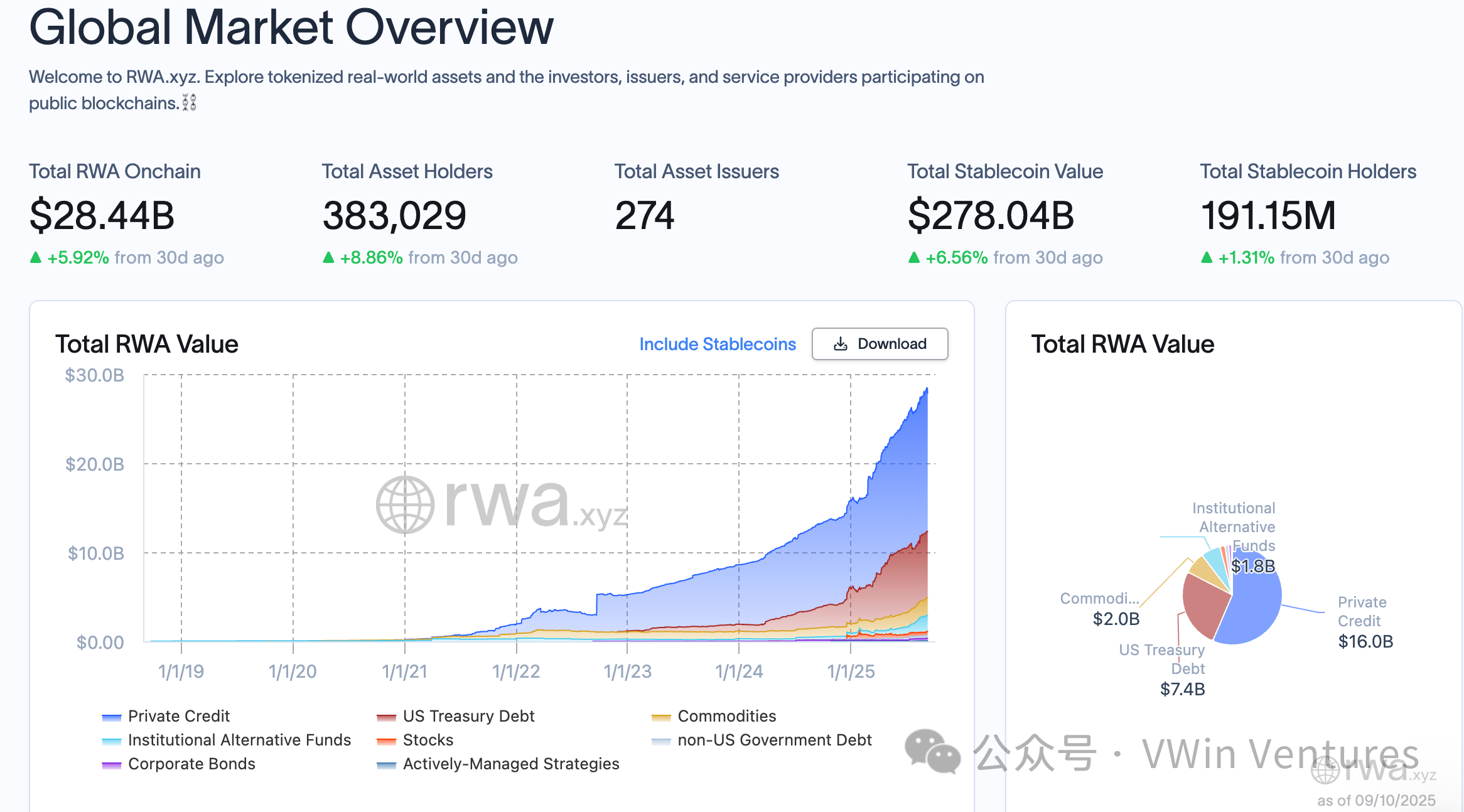

RWA underlying assets are mainly divided into two categories:

- Fixed income products (government bonds/MMF/private credit/accounts receivable/physical asset ABS, etc.) provide stable cash flow income

- Equity assets (stocks/PE/gold/artworks, etc.) provide volatility.

The market's development phase is aligning with the three core changes that RWA has brought to the industry: compliant issuance, open finance, and composability. From permissioned token issuance to permissionless wrappers and finally to the RWA ecosystem, mainstream markets around the world are gradually expanding beyond compliance to explore derivative scenarios.

Looking at the current development of the capital and asset sides of the market, although the volume of stablecoins on the capital side has shown accelerated growth, most on-chain native funds still prefer high returns and high odds on the chain, and the corresponding audience and capital side of RWA assets are relatively scarce; in contrast, the real-world asset side has a relatively excessive demand for on-chain financing.

Therefore, on the asset side, priority should be given to top-tier and differentiated assets, as well as asset value-added capabilities. Similarly, distribution channels should prioritize high-quality assets for capital. Market development also prioritizes mainstream assets with strong consensus and high liquidity. As capital scale gradually increases, this will gradually spill over to long-tail and alternative assets. Ultimately, in the blockchain-based stage, the distribution of asset categories and sizes will converge with the traditional financial market landscape.

Breakthrough opportunities in the industrial chain

Issuers rely on top assets to generate volume and create economies of scale or expand differentiated assets

- The market issuance threshold is gradually lowered, and long-term issuers are gradually extending to the downstream. Vertical tracks have the opportunity to form head issuers + bundled third-party service providers, combining distribution channels + brands to achieve stronger bargaining power.

- Long-term decentralization of on-chain investment banks (similar to the traditional financial sector where there are local top asset issuers), but regional top RWA Prime Brokers will be formed

The tokenization platform runs through the issuance channel, opens up the compliance and technical architecture, and is relatively neutral to third parties.

- Core capabilities lie in compliance, licenses, architecture reuse, and marginal cost reduction

- Long-term upstream integration or the emergence of third-party leading technology service providers such as Paxos

Distributors seize the capital side and open up the chain ecosystem

- Can be CEX or on-chain

- Long-term barrier strengthening and relative concentration of top players

On-chain ecological integration

RWA brings asset options with real cash flow, different risk preferences and yields to the entire on-chain ecosystem. At the same time, various on-chain infrastructures also provide additional empowerment for the underlying RWA assets.

Analyzing the transmission and combination mechanisms of different types of RWA assets on the chain, the most directly related infrastructure includes oracles, DEXs, and lending pools . Oracles, as the core infrastructure for mapping RWA assets on and off the chain, and DEXs, as liquidity aggregation centers, have become key upstream links in the RWA ecosystem.

Since equity and fixed-income RWA assets have different on-chain investor profiles, their impact mechanisms on on-chain infrastructure are also different: the target audience of equity RWA assets pursues volatility, and the core infrastructure is oriented around transactions, such as Perp Trading, revolving loan leverage, etc.; the target audience of fixed-income RWA assets pursues yield, and their secondary price volatility is small and the trading demand is low. The core infrastructure is oriented around yield, such as staking, income swaps (similar to Pendle), etc.

Key Case Analysis: Different Attempts at Compliance and On-Chain

- Path = Compliance Boundary × Depth of Ownership Confirmation × Distribution Radius Trade-off Function

- First, "ownership and pricing penetration", then "channel and market making orchestration" - clearly define equity/income rights and extreme rights confirmation paths, select neutral oracle/custody and issuance paths; simultaneously design CEX+DeFi distribution, market making/redemption/buyback and income components

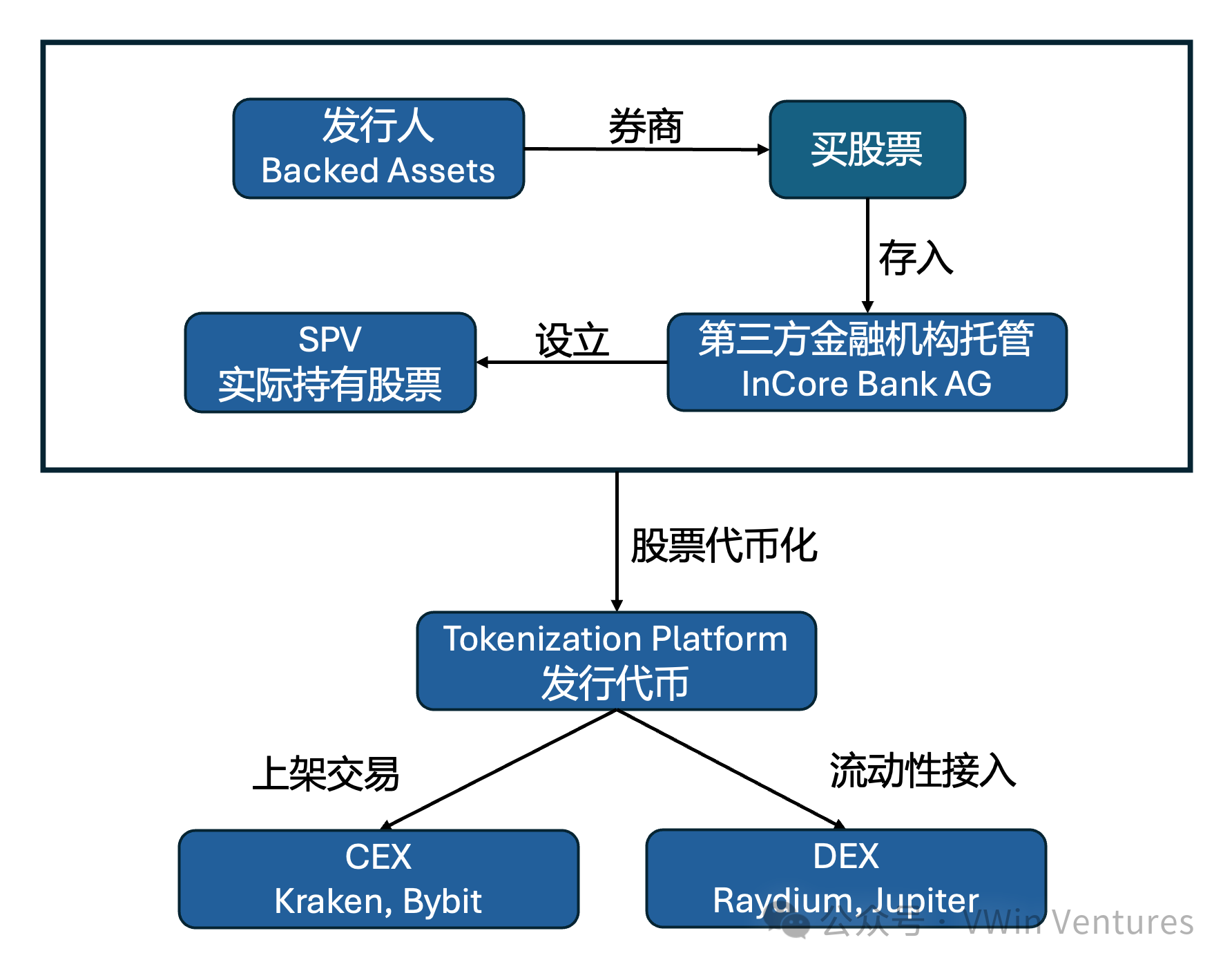

Equity: Stock Tokenization

There are currently three mainstream solutions on the market:

1. xStocks/Dinary offshore SPV shares are tokenized, using a B2B business model to connect to on-chain and off-chain exchanges. By weakening the underlying rights (such as voting rights) of the tokens, they avoid the risk of being identified as securities; they are issued in a relatively compliant manner as securities.

2. Robinhood uses CFDs to map stock price fluctuations. Tokens only anchor returns and do not correspond to underlying asset ownership. A native token has not yet been issued. It is rapidly gaining market share while awaiting regulatory approval.

3. StableStocks adopts a large account system. Users use stablecoins to subscribe and redeem tokens corresponding to securities trading within the brokerage firm, which is a to C business model.

Core user portraits are divided into three categories:

1. Reach new markets: Reach investors in third world countries or emerging markets who are unable to invest in your company due to restrictions on opening accounts with traditional brokerage firms

2. Provide new ways to play: On-chain investors can use DeFi lending or derivatives protocols to use the company's stock tokens to play higher-level leverage and hedging strategies, increasing the depth and breadth of stock trading

3. Empowering Traditional Stock Holders: Traditional long-term holders can enhance their returns through on-chain financial management (locking in the value of underlying stocks through options and providing liquidity through on-chain token mapping to earn excess returns).

xStocks US Stock On-Chain Architecture

Fixed Income: Tokenization of US Treasury Bonds

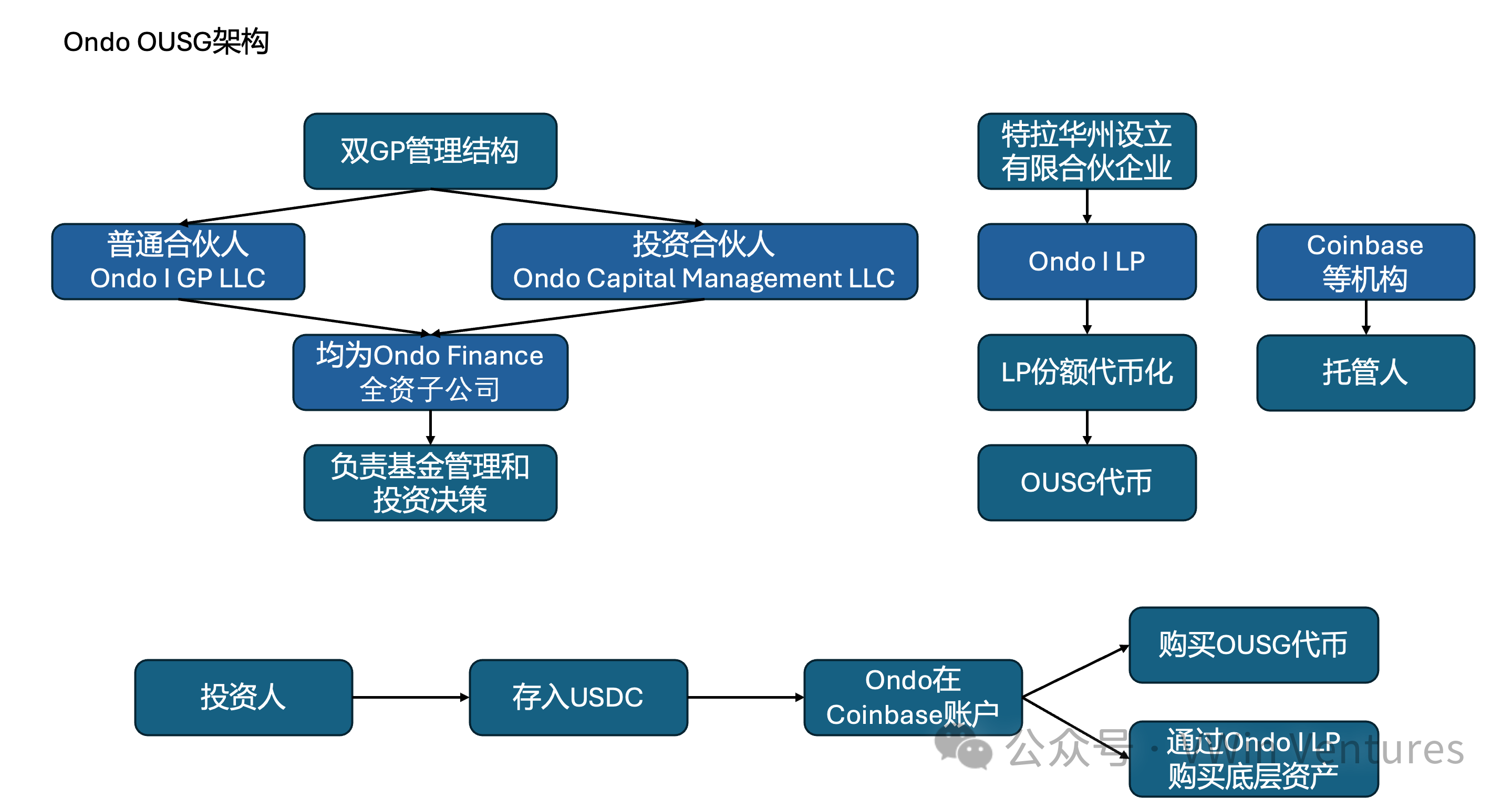

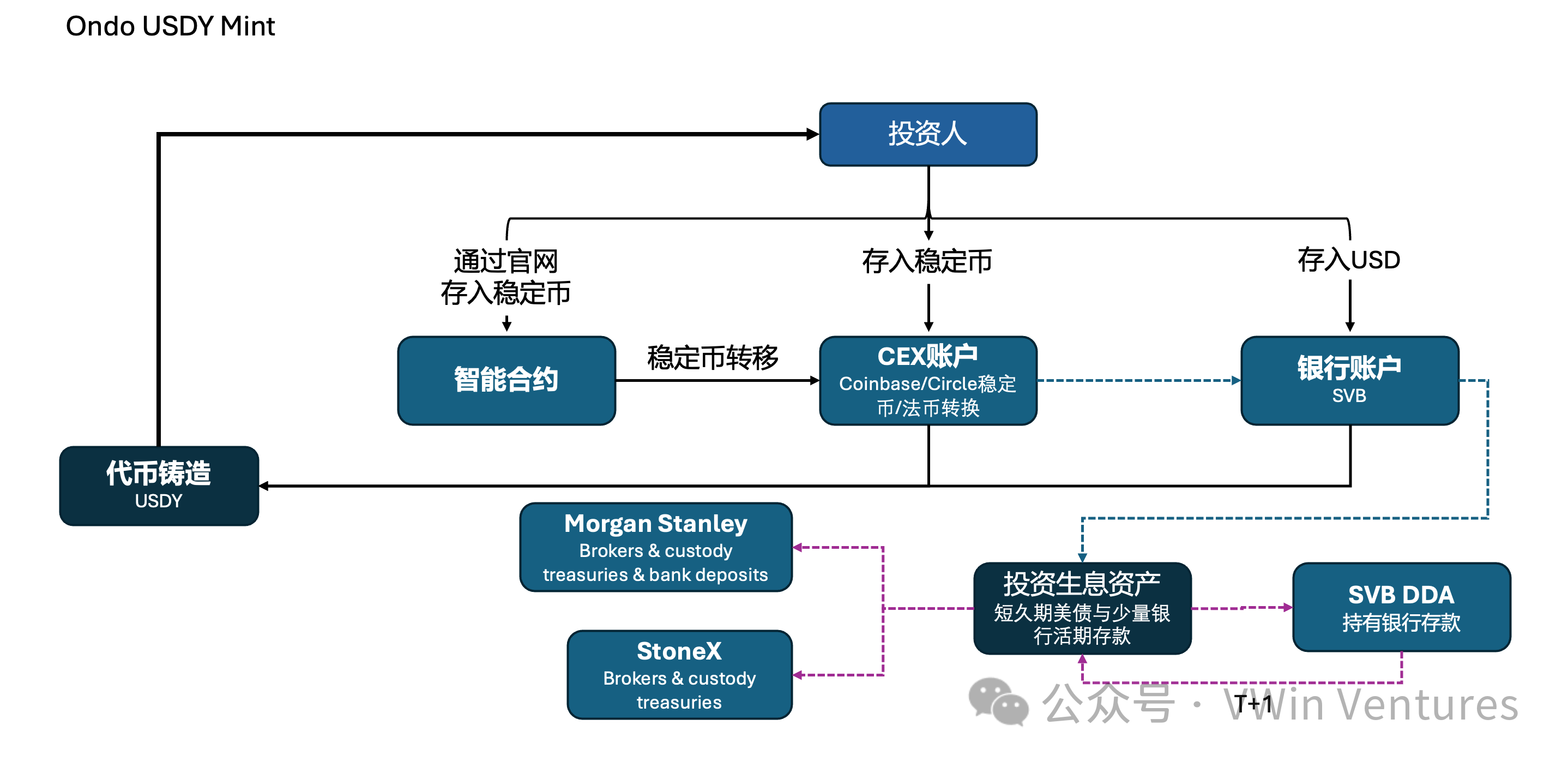

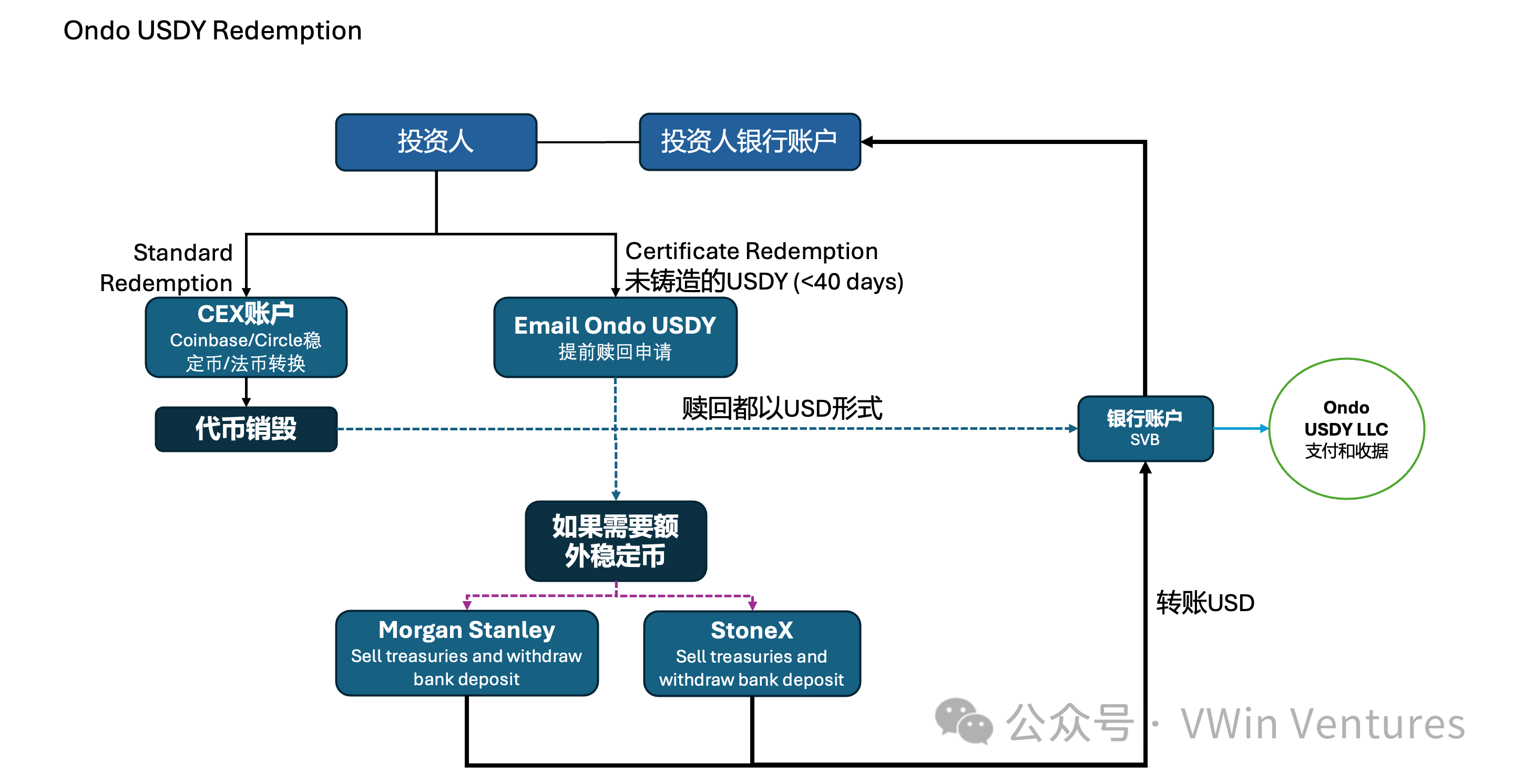

Ondo Finance uses two packaged tokens to deliver risk-free returns on underlying US Treasury bonds to global investors: OUSG (which lowers the threshold for US domestic investors through Reg-D) and USDY (which delivers to global investors through Reg-S).

Core user portrait:

1. Lowering the investment threshold: Opening up investments that were previously only accessible to institutions or high-net-worth individuals to a wider range of qualified investors worldwide

2. Empowering Idle Funds: Providing stablecoin yield enhancement to institutions and individuals around the world who hold large amounts of stablecoins (on-chain hedge funds, on-chain idle stablecoins)

3. Build a base for income: Become the foundation of the on-chain treasury investment portfolio

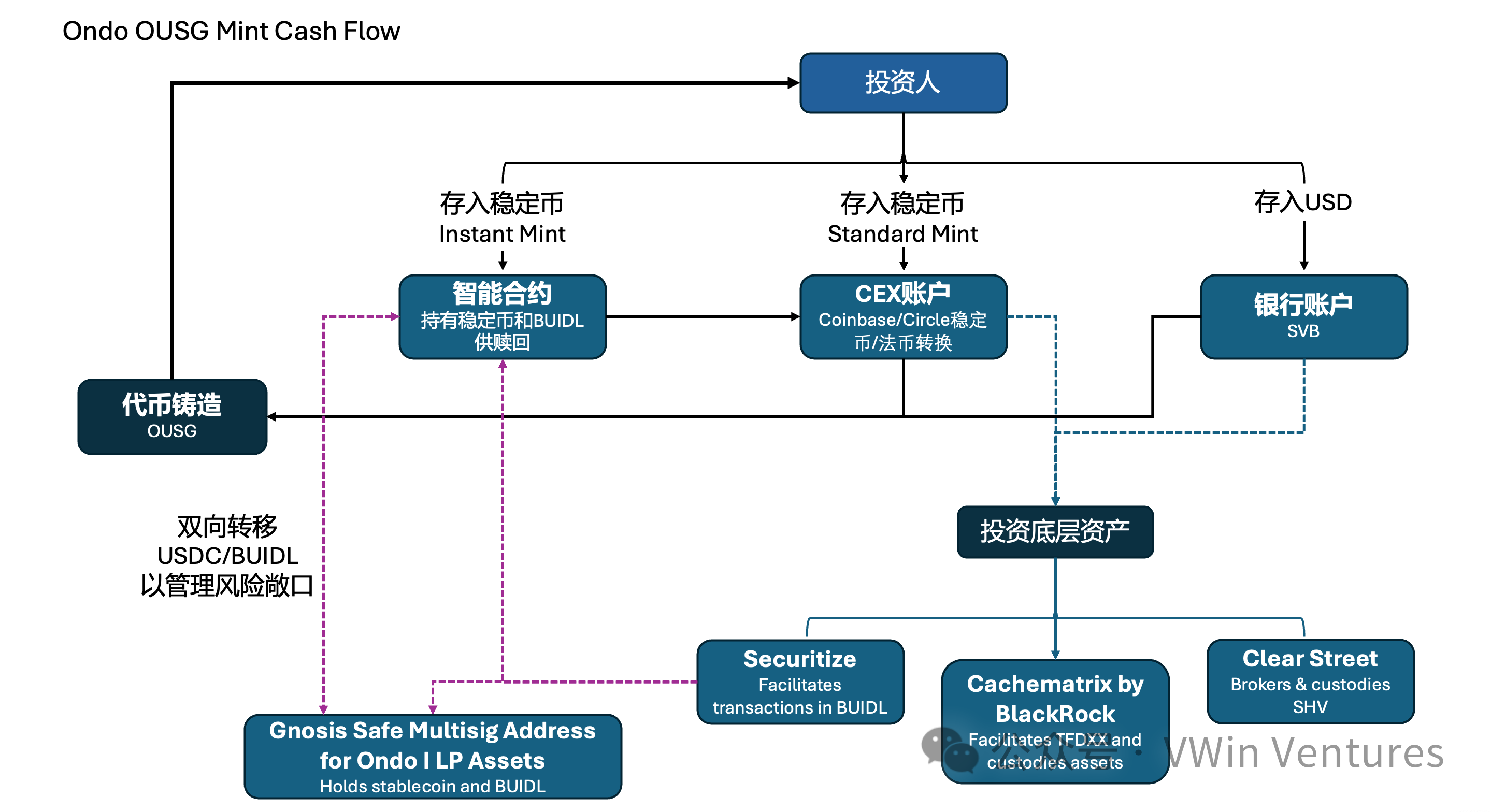

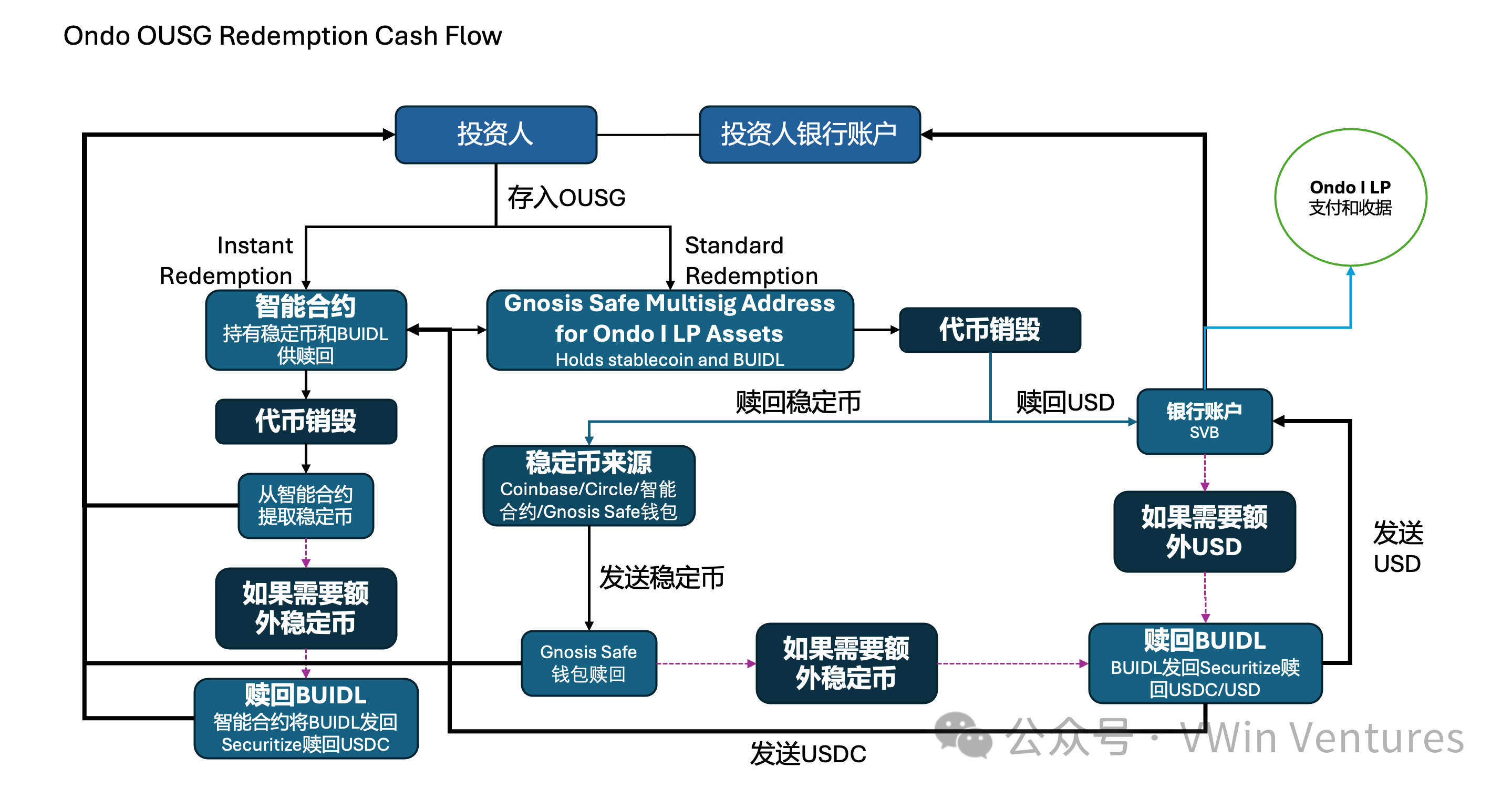

OUSG Architecture

OUSG Mint Cash Flow

OUSG Redemption Cash Flow

USDY Mint Cash Flow

USDY Redemption Cash Flow

Recommended Actions for RWA Participants

- Prioritize inventorying core assets: Identify assets with high internal consensus, easy standardization, easy penetration, strong cash flow, or high growth potential . For example, mainstream financial assets include high-credit corporate bonds, accounts receivable, gold ETFs, etc.; mainstream equity assets include equity in companies with high liquidity, high market demand, and high growth potential. Differentiated assets —segmented assets that can be amplified through brand and channel (such as specific ABS)—will serve as a breakthrough point in the second phase.

- Choosing an issuance path: Consider the target audience and channel, integrate leading compliance institutions in mainstream regions , or adopt a mature offshore approach such as an overseas SPV . Select a trusted third-party neutral platform (issuance, custody, oracle, lawyers, etc.) to ensure that the price/net value is strongly aligned with the underlying asset and that KYC/AML and information disclosure boundaries are clearly defined.

- Distribution and liquidity integration : Synchronize the layout of on-chain protocols and CEX channels, design market making/redemption/repurchase and yield enhancement components (such as staking and swaps); strive to connect to mainstream liquidity pools to avoid liquidity fragmentation.

- Identify risks: Legal penetration and investor suitability – ensure that equity/income rights are clearly defined, and that the path to title confirmation/liquidation in extreme scenarios is clear; Pricing and oracle risks: ensure that net asset value/price is strongly consistent with the underlying asset to avoid liquidity mismatches triggering bank runs; Operations and reputation – ensure that subscription/redemption/repurchase and market-making mechanisms are transparent and verifiable, and that information disclosure and audit frequency are acceptable to institutional investors.

Essentially, RWA is a "re-issuance" of your company's high-quality assets on a global blockchain, rewriting the entire process from issuance, circulation, pricing, and portfolio. Its core commercial value comes from a more efficient and reliable clearing and settlement system, a borderless open financial network, and disruptive permissionless portfolio capabilities.

Recommended actions for businesses:

Recommended actions for businesses:

- Attach great strategic importance to: View the integration of financial chains as a core strategy for the future competitiveness of enterprises, rather than a simple financing tool;

- Actively embrace this approach: Inventory the best-suited RWA assets internally, prioritize top-tier and differentiated assets, and successfully execute the first pilot case.

- Powerful alliances in cooperation: Select the best partners in compliance, technology and global distribution to seize the dividends of blue ocean market.