Original title: The Hunger Games: USDH arc

Original author: Naruto 11.eth

Original translation: AididiaoJP, Foresight News

If you’ve been in crypto for even three months, you probably know what Hyperliquid is by now. If not, here’s the short version: it’s one of the most successful projects in the cryptocurrency space, generating the most revenue, has a loyal community, and is the future of decentralized finance.

Currently, all eyes are on Hyperliquid and USDH’s proposal.

What is USDH?

Essentially, it is a “Hyperliquid-first native stablecoin.”

There have been multiple proposals so far, and even WLFI wants to get involved. For the sake of brevity, we will skip the weaker ones.

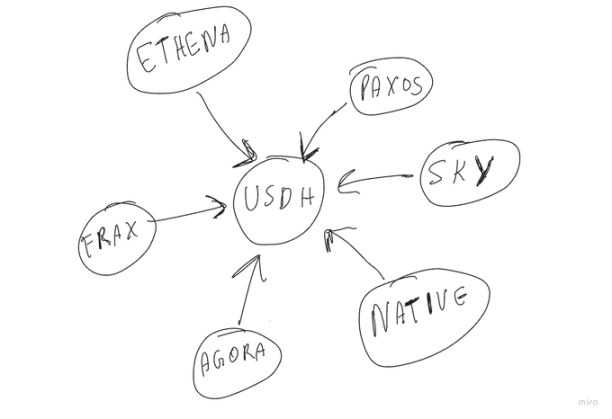

Here are the main contenders:

And the latest Polymarket data:

Native Markets

Native Markets: Co-founded by @fiege_max and his team, it received the most votes on Polymarket.

Some interesting ideas from Native Markets:

- USDH is built to comply with the GENIUS Act, manages institutional reserves through escrow, and is designed to be issuer-agnostic.

- Hyperliquid Foundation: 50% of reserve earnings flow directly and immutably to the Hyperliquid Foundation, while the other 50% is reinvested in USDH growth. This emulates past Hyperliquid precedents for fee sharing (HIP-3, deployer fees), community ownership, and long-term Hyperliquid alignment.

- Developed the CoreRouter smart contract, a first-of-its-kind smart contract for atomically minting USDH on HyperEVM and cross-chaining USDH to HyperCore.

In general, many people now support Native's proposal.

Ethena

Ethena: Just heard from @gdog97_ this morning that this is actually a very strong proposal, with many community members and external parties vouching for it. Ethena also has such a strong team and extensive experience handling stablecoin issuance. Here are some quick notes:

- USDH will initially be 100% backed by USDtb (custodied by Anchorage Digital Bank in compliance with the GENIUS Act) and indirectly backed by BlackRock BUIDL, emphasizing institutional, regulatory, and sufficient early liquidity.

- One thing I personally like about the proposal: USDtb's current supply is larger than the combined cumulative supply of all other pure Treasury-backed stablecoin issuers that have submitted applications to date. Including USDe, Ethena's product is approximately 10 times larger than all other such issuers combined, excluding Sky. To date, Ethena has minted and redeemed over $23 billion in tokenized USD assets without any security issues or downtime.

- Benefits to the community: A commitment to allocating no less than 95% of the net income from the USDH reserve to Hyperliquid (foundation + HYPE buyback; later, it can be shared with staked HYPE and validators through voting).

- Ethena will cover all transaction costs for migrating from USDC to USDH.

- Security is provided through an elected Hyperliquid group that has the power to freeze and reissue to avoid any type of serious damage or failure.

- Liquidity and microstructure advantages: Instant liquidity swaps between USDH, USDC, and USDT through Ethena market maker relationships and fee tiers; the goal is to have no liquidity disadvantage compared to USDT trading pairs on CEXs.

- GENIUS Act Advantages: Currently the only well-defined path to full GENIUS compliance is through the ADB; NYDFS and MTL paths can be slower and uncertain.

- A strong ecosystem showcase, I think: $13 billion USDDe balance sheet, the largest natural counterparty to perpetual contracts; $750 million to $150 million in incentives committed to the HIP-3 front end

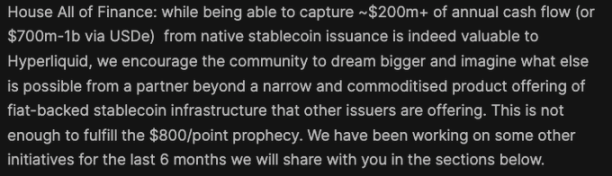

What really won everyone’s heart? The prediction that each point is worth $800 may be realized through Ethena.

Agora

Agora: I personally support the proposal by @withAUSD and @Nick_van_Eck. The stablecoin infrastructure provided by Agora for USDH is actually very good. Here are some key points:

- Reserves are managed by State Street ($49 trillion AUM) and VanEck ($130 billion AUM); the liquidity management bank (Cross River, Customers Bank) has institutional-grade allocations and early credibility.

- 100% of net proceeds return to Hyperliquid: all reserve earnings and buyback funds. Simple, maximized value accumulation.

- Hyperliquid preferred and neutral issuer: USDH is natively issued on Hyperliquid; Agora has no competing chains, brokerages, or exchanges (frictionless alignment).

- Comply with GENIUS Act requirements

- A strong distribution network: Rain + LayerZero + EtherFi. This brings new users and increased liquidity to Hyperliquid, particularly for crypto card usage.

- $10 million in initial liquidity on the first day.

My thoughts: @Nick_van_Eck and the rest of the team bring a ton of experience from both the traditional finance world and @vaneck_us itself, which is why I'm confident they can win the vote and make USDH great. I'm also a big fan of the @withAUSD team.

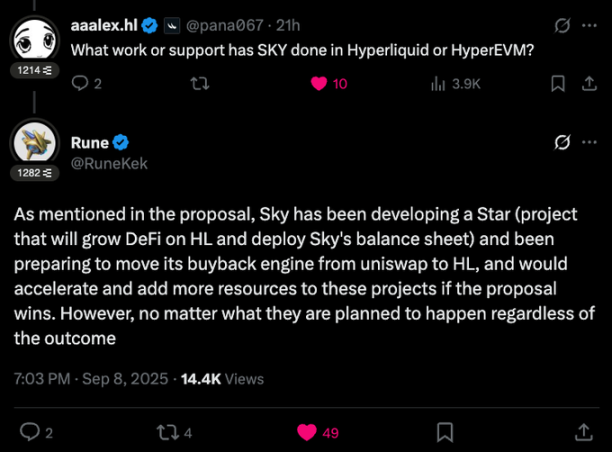

Sky

Sky (formerly MakerDAO): @SkyEcosystem and @RuneKek also put forward a great proposal. Everyone knows MakerDAO and its importance to the crypto ecosystem. Here are some things I learned:

- Sky is the 4th largest stablecoin project: 8 billion+ USDS, $13 billion in collateral, 7+ years of uptime, and no security incidents.

- But Sky also has a liquidity advantage: 2.2 billion USDC instant redemptions and seamless switching to USDH-margined perpetual contracts and spot trading pairs through the Pegged Stability Module (PSM). Sky has deployed its $8 billion+ balance sheet to Hyperliquid.

- Use LayerZero.

- All 4.85% USDH returns on Hyperliquid are used to buy back HYPE in the buyback fund. Optional sUSDS integration and instant access to Sky Savings Rate (currently 4.75%).

- A $25 million commitment to establish Hyperliquid Genesis Star, a DeFi incubator with token mining, similar to Spark (which has a TVL of $1.2 billion). Sky's annual $250 million+ in profit buybacks may be migrated to Hyperliquid, increasing liquidity and setting the standard for protocol buybacks.

- Most of the rest is the same. Comply with GENIUS requirements, risk management and transparency, real-time monitoring and long-term planning: USDH becomes its own “Sky Generated Asset”.

There was a tweet here that really resonated with me and I think Sky’s positioning was pretty good.

Frax Finance

Frax Finance: Here are some quick notes from the @fraxfinance team.

- Frax pledges to distribute 100% of treasury revenue to Hyperliquid. No commissions, tokens, or any other form of revenue sharing will be taken.

- In their updated proposal, they say they have a federally regulated U.S. bank (name not yet released) + GENIUS Act compliance

- Holds U.S. Treasury bonds through Blackrock, superstate, wisdomtree, etc.

- Frax Distribution: Connectivity across 20+ chains, but USDH remains native to Hyperliquid. Rewards flow programmatically and transparently on-chain; governance selects recipients.

- Community first.

Estimated economic impact: $55B in deposits + 4% annual interest on US Treasury bonds = $220M in annual revenue. All flows back to Hyperliquid:

- Increase HYPE staking income

- Repurchase Fund Repurchase

- Trader rebates or USDH holding rewards

Paxos

Paxos: The last good contender is @paxos. They submitted a V2 proposal for USDH, similar to $PYUSD.

Here are some brief points about Paxos and its proposals:

- Paxos promotes Hyperliquid globally.

- Distribution work: HYPE will be listed on PayPal and Venmo, and USDH will provide free fiat currency deposit and withdrawal channels.

- A commitment of $20 million in incentives was made, and Paypal pledged to invest $20 million in incentives in the Hype ecosystem.

- Checkout integrations: PayPal Checkout, Braintree, Venmo P2P, Hyperwallet mass payments, Xoom remittances (100+ countries)

Revised income structure of the aid fund:

- Starting with 20% allocated to the buyback fund (TVL < $1 billion), gradually increasing to 70% allocated to the assistance fund once USDH > $5 billion

- Axos charges 0% before $1 billion, capped at 5% after $5 billion, and the fee is held in the form of HYPE

- Governance voting is conducted on every major event and is supervised by the community

More important things:

- Users can even trade Hyperliquid liquidity without knowing it.

- As the asset issuer, Paxos introduced RWA into the HIP-3 perpetual contract.

- Paxos will build HyperEVM "Earn" product + tokenized HLP structured products for retail and institutional scale

Those are the 6 main proposals. While I like all of them, I would lean more towards Ethena because they have a strong, serious proposal, or Agora because they have those traditional finance relationships that can take Hyperliquid to the next level.

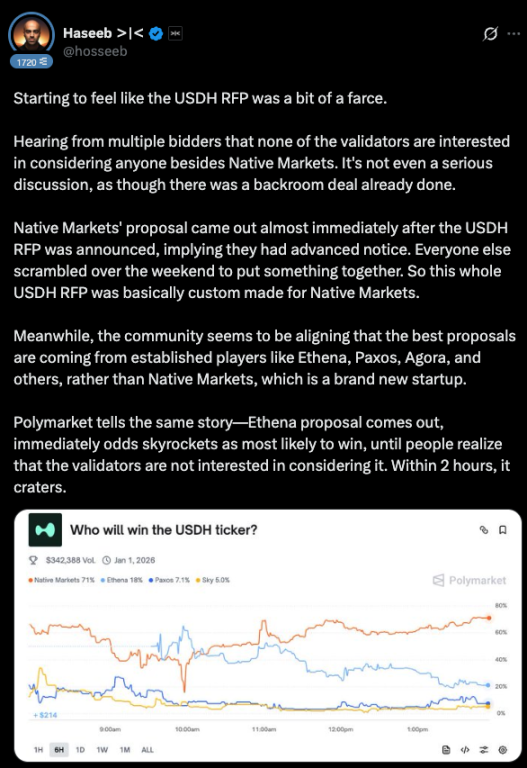

A lot of money was being placed on Native, and there were constant reports that the winner had been decided before the bidding even began, which does make sense if you consider how quickly Native was formed and how its proposal lacked real weight compared to agora or ethena.

I've spoken with multiple Hyperliquid members over the past four days and read their opinions on Twitter, and almost all of them say this is not the case. Validators haven't yet made a decision on any proposal, and it's impossible for a winner of any proposal to be chosen before then.

However, I personally think, and agree with @hosseeb, that there was some truth to this, or at least that was the initial expectation, and that the winner was somewhat predetermined. Regardless, this was actually great marketing for Hyperliquid and all the companies involved.

What will happen now? No one knows, we’ll soon see who wins. My money is on Ethena. What about you?

- 核心观点:Hyperliquid稳定币USDH提案竞争激烈。

- 关键要素:

- Native Markets提案获最多社区投票。

- Ethena拥有最大稳定币发行经验。

- Agora提供100%净收益回归。

- 市场影响:可能重塑DeFi稳定币格局。

- 时效性标注:短期影响。