2 million ETH squeezed into the staking exit queue, what exactly happened?

- 核心观点:ETH解质押激增源于Kiln安全预防措施。

- 关键要素:

- Kiln因安全事件决定退出160万ETH质押。

- 解质押队列达204万ETH,提款延迟35天。

- 大部分ETH预计将重新质押而非抛售。

- 市场影响:短期流动性压力,但抛压有限。

- 时效性标注:短期影响。

Original | Odaily Planet Daily (@OdailyChina)

Author|Azuma (@azuma_eth)

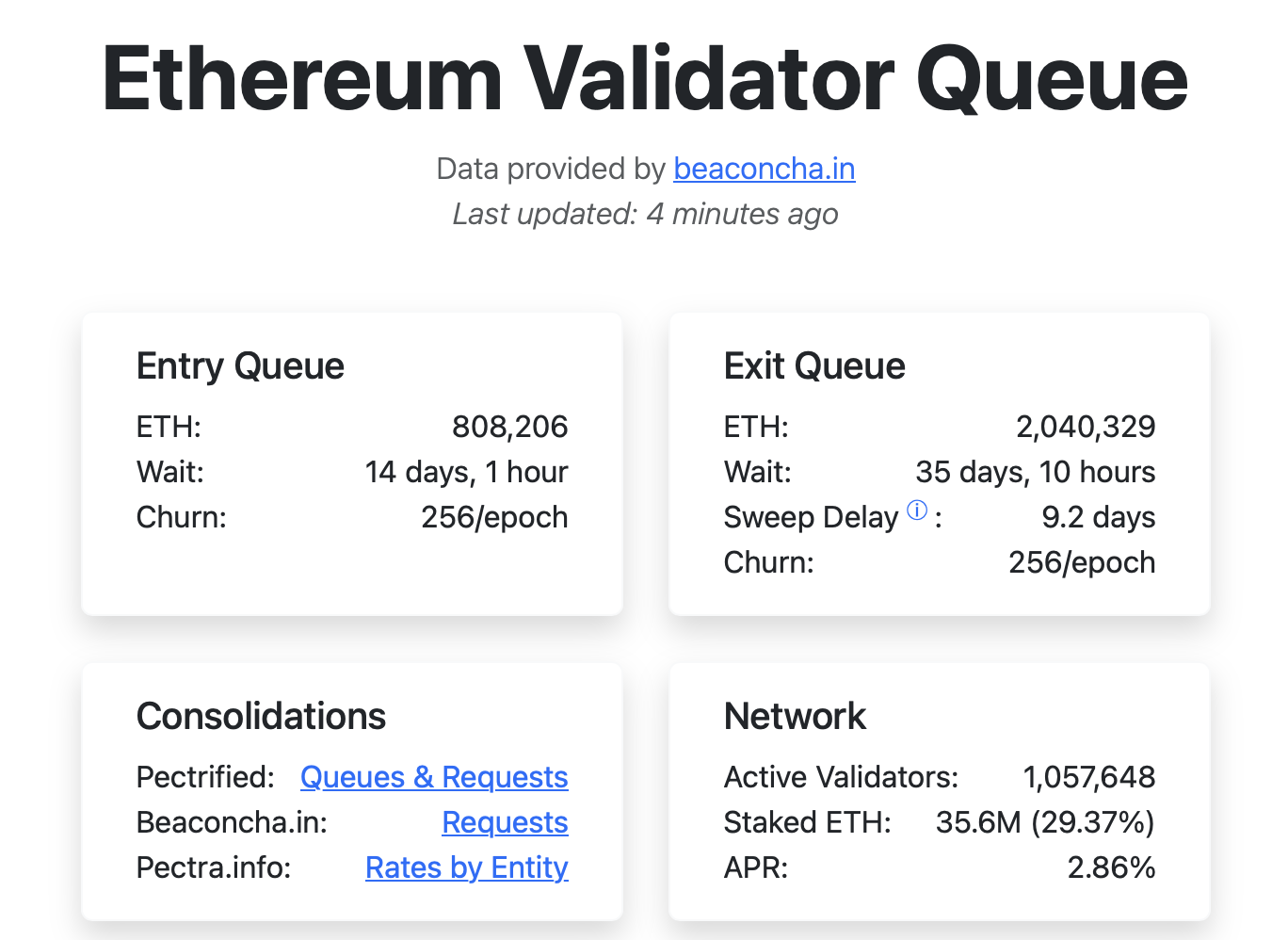

Data from the Ethereum staking tracking website Validator Queue shows that as of 4:00 PM Beijing time on September 10, the number of ETH waiting to be unstaked on the Ethereum network has skyrocketed to 2,040,329, almost doubling the historical peak of 1,058,531 ETH set on August 29. Withdrawal time has been significantly delayed to approximately 35 days and 10 hours. At the same time, the current number of ETH waiting in line for staking is temporarily reported at 808,206, and the waiting time in the access queue is approximately 14 days and 1 hour.

Such a sudden and concentrated unstaking of ETH is rare. Is this a sign of a major whale retreating? If so, the sell-off of millions of ETH would undoubtedly impact the entire cryptocurrency market. However, a comprehensive understanding of the market dynamics surrounding this event suggests there are underlying reasons for this, and ETH holders should not panic.

The incident stems from a security incident yesterday. On the evening of September 8th, SwissBorg, a Switzerland-based cryptocurrency platform, lost 192,600 SOL (worth approximately $41.3 million). SwissBorg later disclosed that the theft was caused by a breach in the API of a staking partner, allowing hackers to gain unauthorized access to the staking wallet and transfer the associated assets.

The hacked partner was later revealed to be the staking service provider Kiln , which subsequently issued a statement saying: “SwissBorg and Kiln are investigating an incident that may involve unauthorized access to a staking wallet. We learned of this incident early that day, September 8, 2025. The incident resulted in the abnormal transfer of SOL tokens from the wallet used for staking operations. Upon discovery, SwissBorg and Kiln immediately activated the incident response plan, curbed the related activities, and contacted our security partners. SwissBorg has suspended Solana staking transactions on the platform to ensure that other users are not affected.

So how does this relate to the centralized unstaking of ETH? The key reason is that Kiln isn’t a staking service provider focused solely on the Solana ecosystem; its staking services cover almost all PoS networks, including Ethereum.

This morning, Kiln officially announced that it will be withdrawing all ETH stakes in an orderly manner for security reasons. The main content of the announcement is as follows:

Following yesterday's announcement regarding the Solana incident involving SwissBorg, Kiln is taking additional precautions to safeguard the assets of all network clients. As part of this response, Kiln began an orderly exit of all of its Ethereum (ETH) validating nodes today. This exit process is a precautionary measure to ensure the continued integrity of staked assets.

This decision prioritizes the interests of customers and the broader industry, and was made through collaboration with key stakeholders and advice from leading security firms.

Customer assets remain secure at all times. The withdrawal process is expected to take 10 to 42 days (depending on the validator), after which the network will complete withdrawals within a scheduled 9-day period. Validators will continue to earn rewards during the withdrawal period. This delay is enforced by the protocol based on the number of validators exiting and cannot be altered by Kiln.

Withdrawals are automatically processed by the Ethereum protocol and will be returned directly to your wallet or the smart contract used in the wallet staking process, where they can be withdrawn.

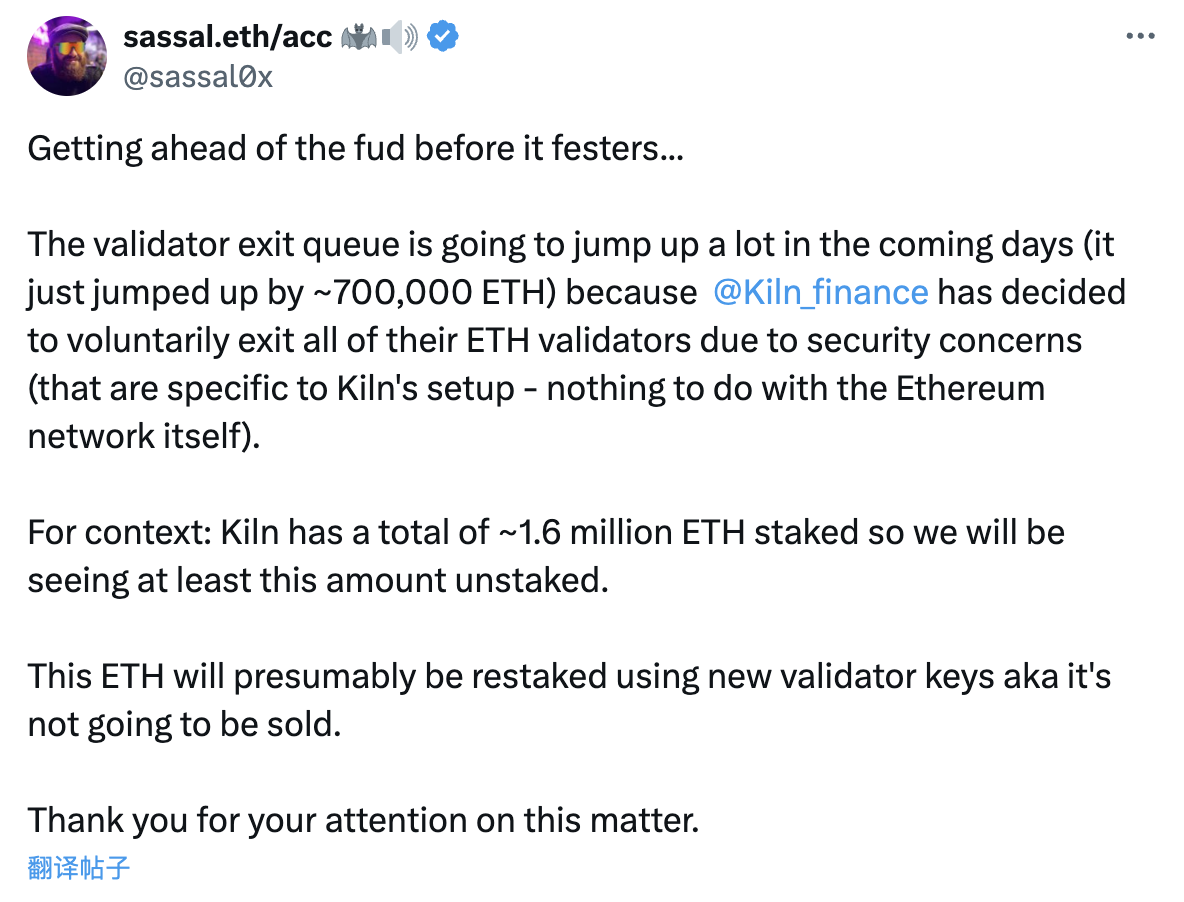

According to the disclosure of sassal.eth, a well-known Ethereum developer, Kiln has staked a total of about 1.6 million ETH, so the market may see a corresponding amount of ETH appear in the unstacking queue in a short period of time, but this does not mean that these ETH will be sold . Kiln may use a new verification node key to put these ETH back into stake.

In short, the surge in the number of ETH waiting to be unstaked today is essentially a risk-avoidance operation by Kiln. Most of these ETH belong to customers like SwissBorg who staked their ETH through Kiln's services. Although it is not ruled out that some customers will take this opportunity to sell, it is expected that most of the ETH will be staked again through Kiln (after risk elimination) or other staking solutions, so there is no need for the market to panic.