Who controls USDH? The crypto war behind Hyperliquid's $5.6 billion treasury

- 核心观点:Hyperliquid社区投票决定数十亿美元稳定币收益归属。

- 关键要素:

- 9月14日验证者投票决定USDH控制权。

- 获胜方将掌控每年2.2亿美元收益流。

- 竞选者包括加密团队与机构巨头。

- 市场影响:重塑链上衍生品收益分配格局。

- 时效性标注:短期影响。

Original author: Tristero Research

Original translation: TechFlow

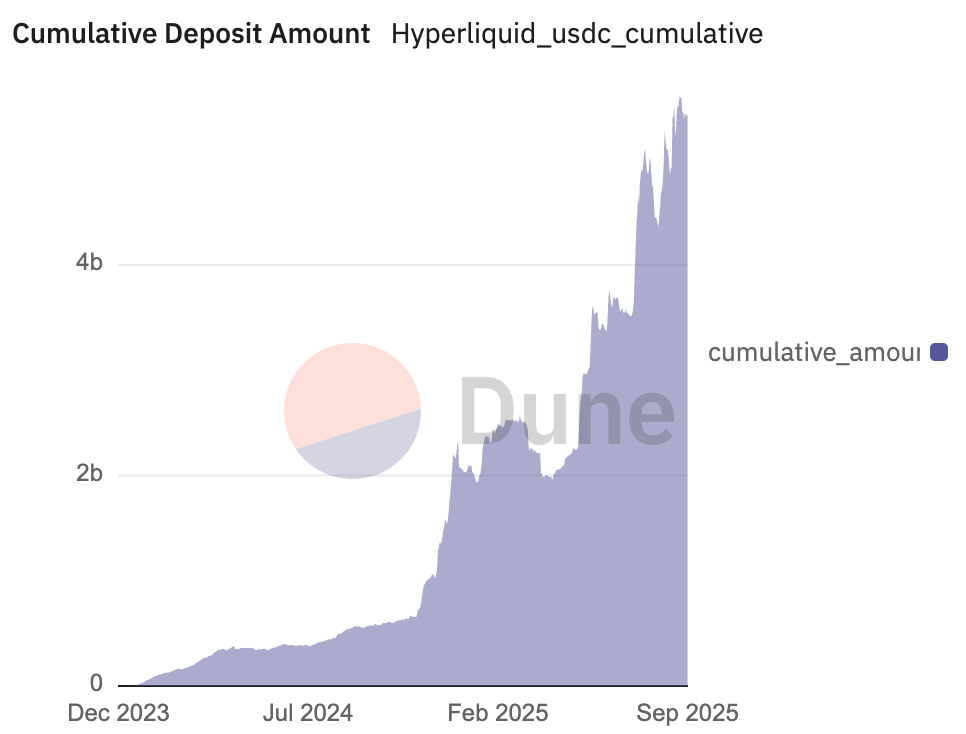

Hyperliquid is one of the fastest-growing perpetual swap exchanges in the DeFi space, locking up billions of dollars in capital. With a seamless user experience and a rapidly expanding user base, the exchange has become a leading platform for on-chain derivatives trading. Currently, its trading engine is powered by over $5.6 billion in stablecoins, the vast majority of which is Circle's USDC.

This capital has generated a significant income stream through the underlying reserve, but currently those returns have gone to external institutions. Now, the Hyperliquid community is working to reclaim them.

On September 14th, Hyperliquid faces a decisive battle. Its validators will conduct a crucial vote to determine who will hold the keys to USDH—the platform's first native stablecoin. This vote is about more than just the ownership of a single token; it's about control of a financial engine capable of reintroducing hundreds of millions of dollars in revenue back into the ecosystem. This process is similar to a multi-billion dollar request for quote (RFQ) or government bond auction, but it will be conducted transparently on-chain. By staking HYPE to secure the network, validators also serve as a "hiring committee," deciding who will mint USDH and how billions of dollars in revenue will be redistributed.

The difference between the contenders is stark – on one side are teams of crypto-native developers promising complete alliance, and on the other are institutional financial giants with deep pockets and established operational mechanisms.

Mature Model: $220 Million Annual Potential Opportunity

To understand the significance of this competition, we must first understand where capital flows are occurring. Currently, USDC reigns supreme among stablecoins. Its issuer, Circle, has quietly built its fortune by investing its reserves in US Treasuries and earning returns, generating $658 million in revenue in just one quarter. This is precisely the business model Hyperliquid aims to emulate.

By replacing third-party stablecoins with its native stablecoin, USDH, the platform can avoid value outflows and redirect capital flows inward. Based on existing balances, the USDH reserve alone could potentially generate $220 million in revenue annually. This marks Hyperliquid's transformation from a "tenant" to a "landlord"—no longer a client of external stablecoins, but rather a holder of its own financial infrastructure. For Circle, this competition is crucial: losing Hyperliquid's reserves could instantly reduce its revenue by as much as 10%, exposing its heavy reliance on interest income.

The only question facing the community is not whether to pursue this prize, but who to trust to make it happen.

However, Circle wasn't about to give up its position easily. Even before the USDH plan surfaced, Circle had already taken steps to solidify its position within Hyperliquid, announcing the launch of native USDC and CCTP V2 in late July. This upgrade promised seamless USDC transfers between supported blockchains, improving capital efficiency—no wrapper tokens or traditional cross-chain transactions. Circle also introduced its institutional-grade fiat on- and off-ramps through Circle Mint. The message was clear: as the listed issuer of USDC, Circle wasn't about to cede Hyperliquid's liquidity to a competitor.

Candidates: A Clash of Ideas

Several different visions surrounding USDH have emerged, each representing a different strategic path for Hyperliquid.

Following USDH's announcement, the Hyperliquid native team , Native Markets, quickly joined the race, proposing a GENIUS Act-compliant stablecoin specifically for the platform. Their plan included integrating a fiat gateway to streamline on- and off-ramps, and sharing revenue with the Hyperliquid Assistance Fund. The team included veterans like MC Lader, former president of Uniswap Labs, but some community members questioned the timing and funding of their proposal. The team positioned itself as the most local option—combining regulatory compliance, on-chain expertise, and a commitment to returning value to the ecosystem. The advantages were clear: a credible local project committed to regulatory compliance and close alignment with $HYPE. The disadvantages came from some community members who questioned the timing and the team's resources to deliver at scale.

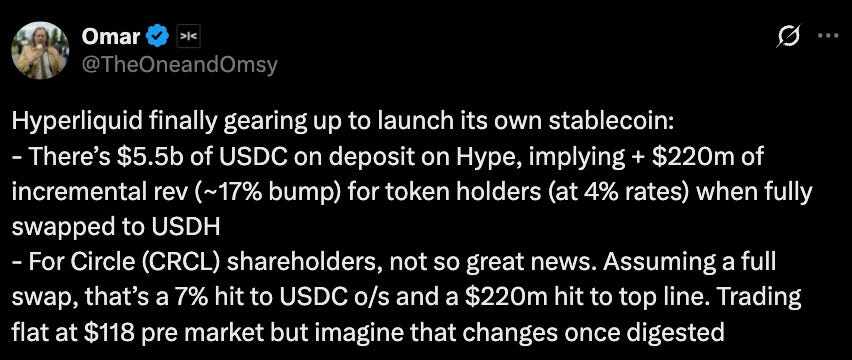

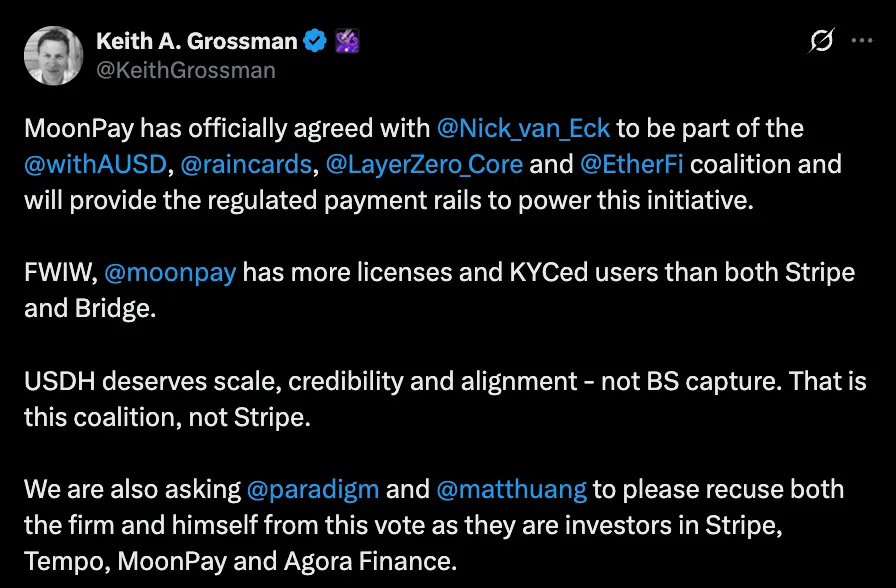

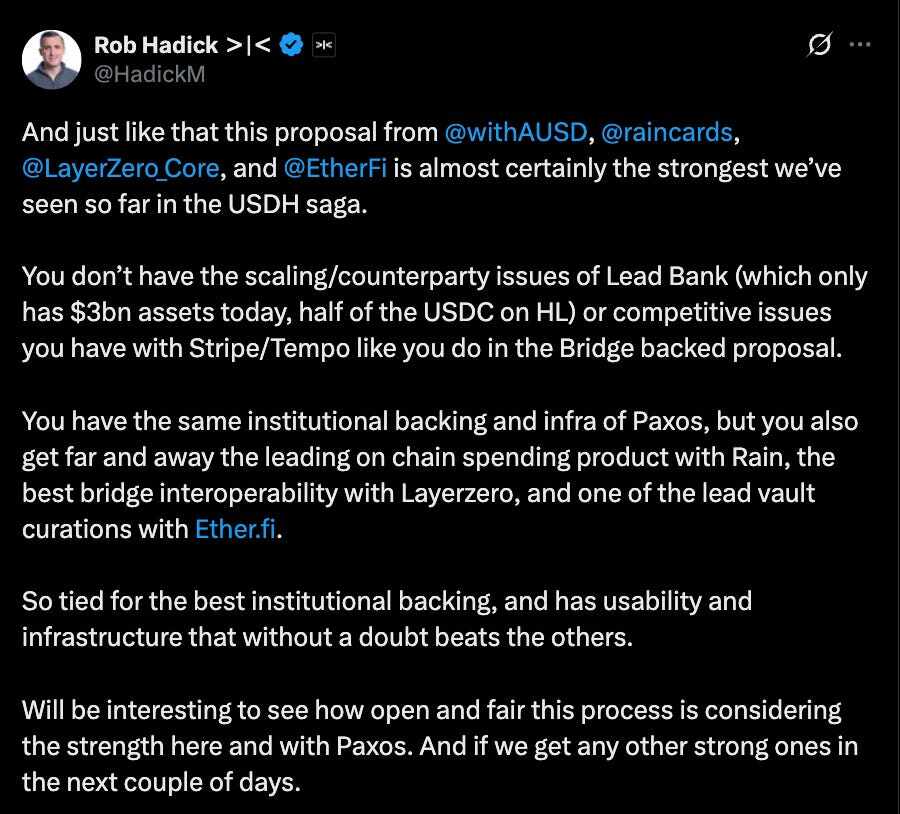

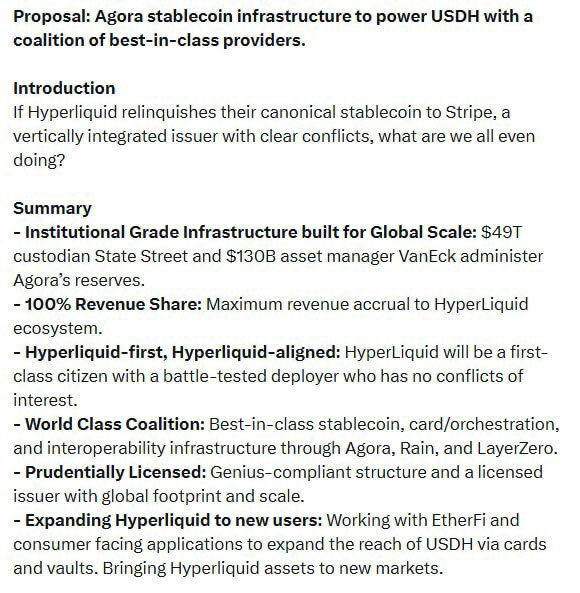

One proposal gaining significant momentum is Agora , a stablecoin infrastructure provider that has assembled a consortium of established partners. Agora is backed by MoonPay, a cryptocurrency deposit service provider with more licensed jurisdictions and KYC users than Stripe.

Rain , which provides seamless on-chain spending and card services; and LayerZero , which provides optimal cross-chain interoperability.

Backed by a recent $50 million round led by Paradigm, Agora emphasizes regulatory compliance through proof of reserves and positions itself as fully aligned with Hyperliquid's interests. Its reserves will be custodied by State Street, managed by VanEck, and proof of reserves provided by Chaos Labs. The team has also pledged to provide at least $10 million in initial liquidity through partners such as Cross River and Customers Bank. Its proposal offers a proven model backed by institutions and a core commitment: every dollar of net income from the USDH reserve will flow back into the Hyperliquid ecosystem. In practice, this means that the stablecoin's growth will directly translate into returns for HYPE holders. Its advantages lie in institutional credibility, capital backing, and distribution capabilities. However, reliance on banks and custodians could reintroduce the off-chain bottlenecks that USDH sought to avoid.

Stripe , through its $1.1 billion acquisition of Bridge , is proposing a proposal to establish USDH as the backbone of a global stablecoin payments network. Bridge's infrastructure already enables businesses to accept and settle stablecoin payments (such as USDC) with low fees and near-instantaneity in over 100 countries. The integration with Stripe brings regulatory credibility, a developer-friendly API stack, and seamless card/payment connectivity. The company also plans to launch its own fiat-backed stablecoin, USDB, within the Bridge ecosystem, aiming to circumvent external blockchain costs and create a defensive moat. The advantages are clear: Stripe's scale, brand, and distribution capabilities could bring USDH into mainstream commerce. However, the risk lies in strategic control: vertically integrated fintech companies with their own public blockchains (Tempo) and wallets (Privy) could ultimately control Hyperliquid's core currency layer.

Other contenders have chosen different paths. Paxos , a regulated trust company headquartered in New York, offers the most conservative option: compliance first. Paxos pledges to use 95% of interest earned on USDH reserves directly for HYPE repurchases. Paxos also promises to list HYPE on the networks it supports (including PayPal, Venmo, and MercadoLibre)—an institutional distribution channel that other contenders cannot match. Although the US regulatory environment has become more friendly under the Trump administration, Paxos remains the preferred choice for those who see durability and regulatory approval as the cornerstones of USDH's long-term legitimacy. Its weakness lies in its complete reliance on fiat currency custody, exposing it to US banking and regulatory risks—a vulnerability that led to the failure of BUSD.

In contrast, Frax Finance offers a DeFi-native solution. Born within the crypto ecosystem, Frax's proposal prioritizes on-chain mechanisms, deep community governance, and a revenue-sharing strategy that appeals to crypto purists. Their campaign is a bet on the future of USDH, a more decentralized, community-centric vision. Its design sees USDH backed 1:1 by frxUSD and treasury bonds managed by asset giants like BlackRock, with seamless convertibility into USDC, USDT, frxUSD, and fiat. Frax also promises to distribute 100% of its revenue directly to Hyperliquid users, with governance fully controlled by validators. Its strength lies in a proven, high-yield, community-driven model that aligns closely with crypto ideals. Its weakness lies in its reliance on frxUSD and off-chain treasury bonds, which may introduce external risks and limit its adoption relative to traditional fiat institutions.

Konelia , a smaller and lesser-known entrant in the USDH competition, submitted its bid through the same on-chain auction process as its larger competitors. Its proposal emphasized compliant issuance, reserve management, and ecosystem alignment tailored for Hyperliquid's high-performance Layer 1. Unlike top contenders, its proposal lacked public details and attracted limited community attention. Despite being officially recognized as a valid bidder, Konelia was viewed more as a peripheral player in the competition than a frontrunner. While its strengths lay in its formal qualifications and customized Layer 1 proposal, its lack of details, brand recognition, and community support put it at a disadvantage compared to its more well-capitalized competitors.

Finally, the xDFi team, comprised of DeFi veterans from SushiSwap and LayerZero, has proposed USDH, a fully crypto-collateralized, cross-chain stablecoin, covering 23 EVM chains from day one. Backed by assets such as ETH, BTC, USDC, and AVAX, balances will be natively synchronized between chains via the xD infrastructure, avoiding cross-chain and fragmentation. The design allocates 69% of revenue to $HYPE governance, 30% to validators, and 1% for protocol maintenance, making USDH community-owned and free from banks or custodians. Its appeal lies in its censorship-resistant, crypto-pure design, which deepens Hyperliquid's role as a liquidity hub. However, its risks lie in its reliance on volatile crypto collateral for stability and the lack of regulatory support for mainstream adoption.

Curve takes a different approach, positioning itself as a partner rather than a competitor. Based on its crvUSD LLAMMA mechanism, Curve proposes a dual stablecoin system: a regulated USDH backed by Paxos or Agora, and a decentralized dUSDH backed by HYPE and HLP but running on Curve's CDP infrastructure and governed by Hyperliquid. This setup unlocks looping, leverage, and yield strategies while creating a powerful flywheel for HYPE and HLP value. Curve points to crvUSD's resilience and stable peg in volatile markets, along with flexible licensing terms. It emphasizes that its CDP model has generated annual revenue of $2.5 million to $10 million at a scale of $100 million. Its strengths lie in its balanced "best of breed"—regulatory coverage with decentralized options. Its weaknesses lie in the potential for liquidity and brand damage from a split between the two tokens, as well as the reflexive risks of using Hyperliquid's own assets as collateral.

Decentralized authorization

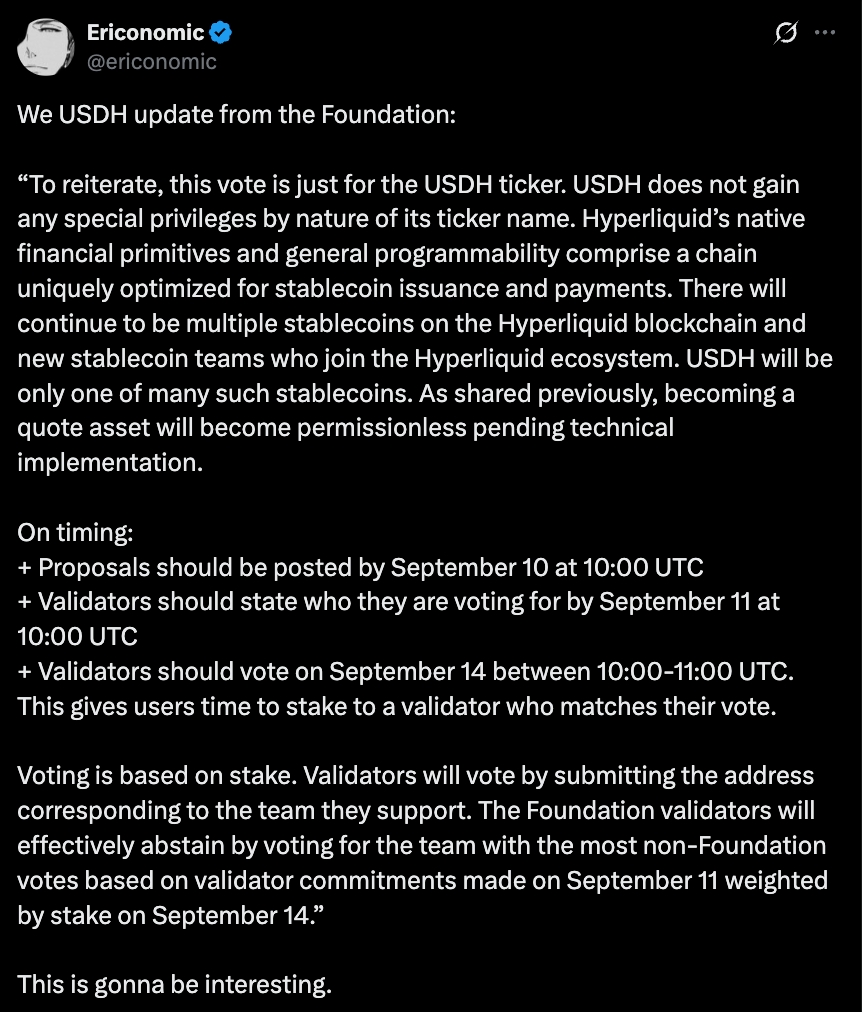

The final decision will be made by Hyperliquid’s validators through an on-chain vote. In an important move to ensure a fair and community-driven outcome, the Hyperliquid Foundation has announced that it will abstain from the vote.

By committing to support the majority opinion, the Foundation is choosing to let go – alleviating concerns about centralization and making it clear that decision-making rests entirely with stakeholders.

September 14th will be more than just a vote — it will be a test of how far DeFi governance has evolved, from a token fee-switch debate to the awarding of multi-billion dollar contracts decided by community vote.