The B-side of Binance’s Alpha Model

- 核心观点:币安Alpha模式损害社区利益不可持续。

- 关键要素:

- 仅7%项目最终上线现货。

- 空投占比高达2.5-5%。

- 交易量存在人为操纵现象。

- 市场影响:助长投机风气破坏生态健康。

- 时效性标注:中期影响。

Originally from The Smart Ape

Editor's Note: Since the Binance Web3 Wallet launched on Binance Alpha, usage and transaction volume have skyrocketed, propelling Binance to the top of the wallet and decentralized exchange (DEX) market in just a few months. Consequently, many exchanges have begun to emulate Binance's model, including OKX Boost, Bitget Wallet Alpha, and Gate Alpha.

However, this model also has many disadvantages for the market and the community, including unfairness to the community, transaction manipulation, and lack of sustainability. The following summarizes the disadvantages of Binance Alpha products, and also reflects the adverse impact that such exchange products have on the market, leading the crypto market towards more unhealthy development.

In short, Binance Alpha is a section within the Binance Web3 Wallet where early-stage projects can be listed and trading becomes more convenient. Users can also earn Alpha Points by trading tokens already listed on Binance Alpha, which qualifies them for airdrops of newly listed tokens.

However, it is completely different from Binance spot or futures trading. Listing a token on Binance Alpha does not guarantee listing on Binance spot. Less than 7% of tokens listed on Alpha eventually become listed on spot trading.

So, since there is already a spot market, why did Binance launch Alpha? There are official reasons and unofficial reasons.

The official reason is that Binance Alpha is intended to be a discovery zone where users can trade very early-stage tokens directly from the Binance wallet. Compared to spot trading, Binance Alpha is positioned more as a "degen" platform, where projects must demonstrate stronger fundamentals and liquidity.

But the real reason could also be that Binance understands what its users want: to earn a profit. The truly important element of the entire product is the Alpha Points. They encourage users to use the Binance Wallet, generating more trading volume, and ultimately bringing in more users and revenue for Binance.

This also enables Binance to test a large number of projects without the reputational risk of a failed spot listing.

Injustice to the community

Most projects that launch on Binance Alpha end up alienating their own communities.

Imagine supporting a project from its early days, testing every new feature, providing continuous feedback, staying active on Discord, and helping newcomers learn.

When the TGE arrives, you expect your efforts to finally be rewarded accordingly. Instead, you see the token listed on Binance Alpha first, and before you even receive your community allocation, the project has already airdropped it to Alpha point miners.

These airdrop miners then dump their tokens, causing the price to plummet, leaving you with only scraps.

This is exactly the situation for most projects listed on Binance Alpha, and many people are frustrated by this.

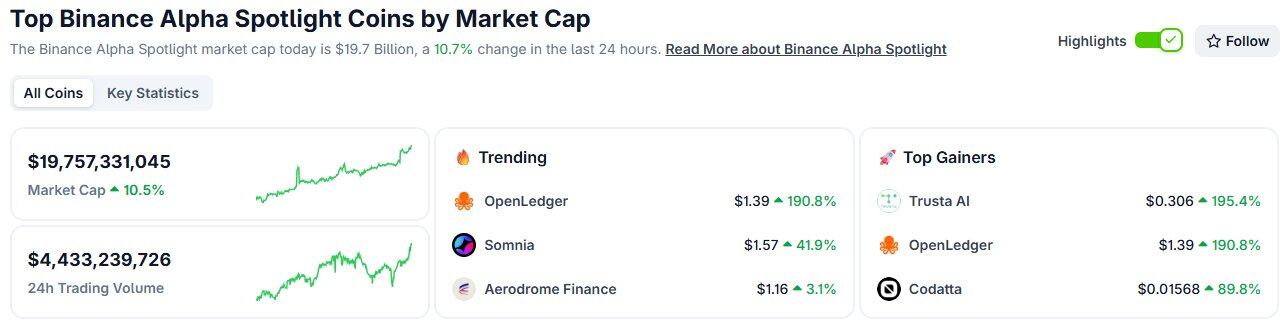

The plunge in the price of Alpha tokens after listing

Almost all tokens listed on the Binance Alpha platform fail to survive in the long term.

Tokens listed on Binance Alpha platform continue to fall after listing

Everyone wants to know what percentage of each project's tokens will be airdropped to Binance Alpha users. But Binance has never disclosed this information. They only reveal the amount of each airdrop and the required points threshold, but never the size of the total token pool.

Estimates of the percentage of tokens airdropped vary depending on the project, but typically range from 2.5% to 5% of the total supply, a high percentage given that these tokens are distributed to Binance users upon project launch, rather than to the actual community.

It’s no surprise then that these tokens were immediately dumped, causing the token price to plummet.

Recently, the MYX project airdropped tokens worth over $4,000 to Binance Alpha platform users. Considering that they were not the original community members, this amount of money is huge.

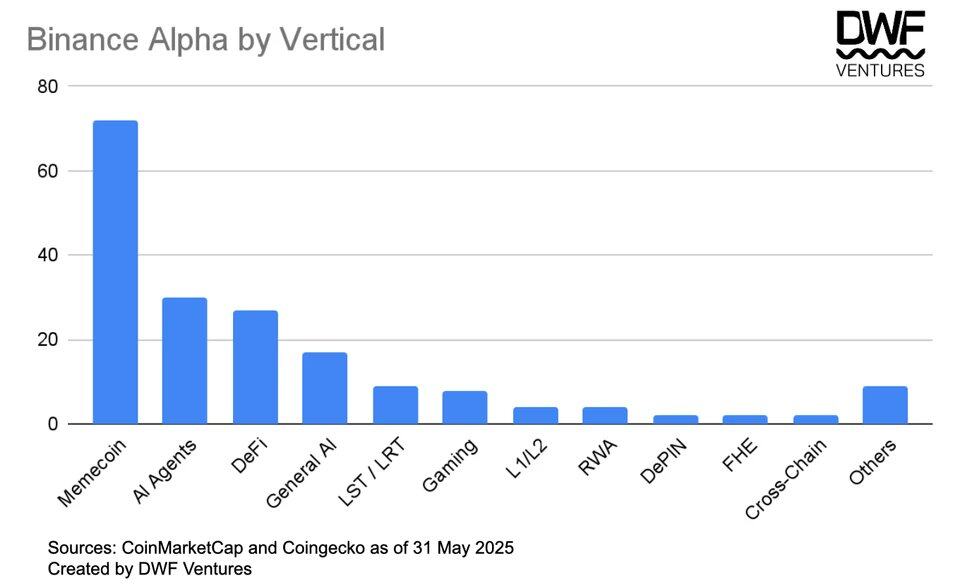

Trading volume manipulation

Listing on Binance Alpha is becoming a necessary step before listing on Binance Spot. This means that every project listed on Alpha is under immense pressure to demonstrate strong traction and secure quick entry into the spot market.

One of the main criteria that Binance looks at is trading volume.

So guess what happens? Project owners artificially inflate trading volume to boost their appeal. This can be done in a variety of ways: through wash trading, massive allocation of Alpha points, or by secretly driving up prices before selling.

The problem is that rather than building a loyal community, these projects primarily attract opportunistic “scammers,” which is not sustainable in the long term.

No sustainability

Some may argue that Binance Alpha has indeed inflated the prices of some project tokens. Binance Alpha creates scarcity and attention, which naturally attracts traders seeking early entry. Users farm Alpha points to qualify for airdrops, which requires them to increase trading volume, all of which increases project liquidity and market capitalization.

But none of this is sustainable. Most users aren't coming for the project itself; they're coming for the points. Once the points reward ends, activity will collapse.

Binance Alpha also didn’t offer any real product innovation. At its core, it was a showcase platform with an airdrop mechanism, so it struggled to sustain interest after the initial hype wore off.

Furthermore, tokens listed on Binance Alpha are already tradable directly on DEXs, often at lower prices. The only reason people use Alpha is for the airdrops.

This makes it difficult for any project to build lasting value by listing on Binance Alpha, and more and more communities have realized this.

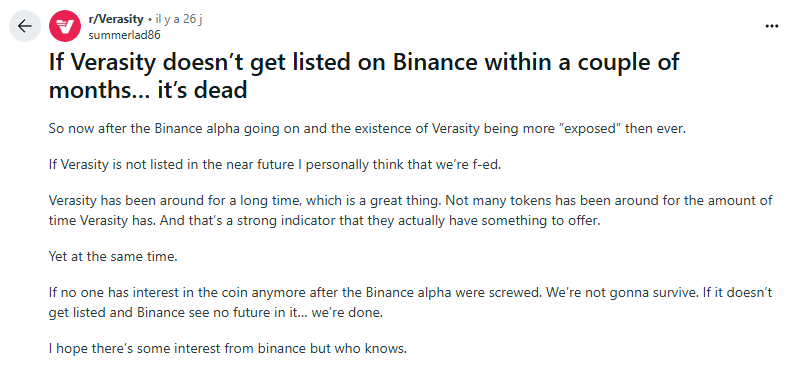

There is no guarantee of access to the spot market

There's another crucial point that many people seem to misunderstand: listing on Binance Alpha does not guarantee listing on Binance's spot trading platform. Many projects accept listing on Binance Alpha, essentially betraying the community for the chance to get listed on Binance, only to end up losing both the money and the service.

The Verasity team once said, “If they can’t list on Binance spot markets, they’re basically dead.” Apparently, the only reason they listed on Binance Alpha was to get listed on Binance spot markets.

Final Thoughts

But ultimately, whether to launch on Binance Alpha or other similar exchanges’ product markets is the choice of the project owner.

However, I don't think Binance Alpha is good for the long-term development of a project, as it usually means that the project has chosen short-term hype rather than working with the community. If a project is loyal to its community, it should slowly build and gradually build popularity and market hype over time.