Seven Reasons to Be Optimistic About Hyperliquid: The Evolutionary Path from DEX to L1 Ecosystem

- 核心观点:Hyperliquid是挑战CEX霸权的顶级DEX。

- 关键要素:

- 年化收入13.7亿美元,99%用于回购。

- TVL加速增长,头部DeFi项目扩展至其生态。

- HYPE代币自推出上涨超10倍,空投激励持续。

- 市场影响:可能重塑去中心化交易市场格局。

- 时效性标注:中期影响。

Original author: Aylo

Original translation: Bernard, ChainCatcher

In the cryptocurrency space, there are only a handful of decentralized projects truly challenging the hegemony of centralized exchanges. Hyperliquid stands out as one of the most notable, achieving not only breakthroughs in product development but also demonstrating unique competitive advantages in its economic model and ecosystem development. Much like the Solana ecosystem's explosive growth at the end of 2023, the Hyperliquid ecosystem is in a similarly early stage of growth.

01 Hyperliquid embodies the true spirit of crypto

Hyperliquid started as a DEX with no KYC, zero gas fees, and a top-tier user experience, and gradually built its own L1 ecosystem. Its success stems from a series of "combination punches":

- Self-funded: No extractive private equity rounds, TGE is just a start, not a cash-out.

- Successful Airdrop: 30% of the total supply was distributed in the Genesis airdrop, and the HYPE token has increased over 10x since launch.

- Product first: Build products based on user needs first → attract long-term users → reward users with large amounts of airdrops → continue to expand by building an on-chain ecosystem.

- Future Incentives: 40% of the HYPE supply (worth billions of dollars) is reserved for future incentives, which may include another airdrop.

- Strong token economics: 99% of protocol fees are used to buy back HYPE

- Efficient and lean team: Hyperliquid's team consists of only 11 people, but the average revenue per employee exceeds $100 million.

Unlike most projects that vanished after their "mercenary mining" exploits, Hyperliquid has emerged even stronger since its airdrop. Its performance has soared across the board, and it's on its way to becoming the first DEX to truly compete with giants like Binance.

02 Hyperliquid is a cash cow, HYPE is seriously undervalued

Based on approximately $114 million in monthly fees, Hyperliquid currently generates approximately $1.37 billion in annualized revenue. Since 99% of revenue is used for HYPE buybacks, theoretically all circulating HYPE can be fully repurchased in less than 9 years—no other protocol in the crypto space has such a robust economic model.

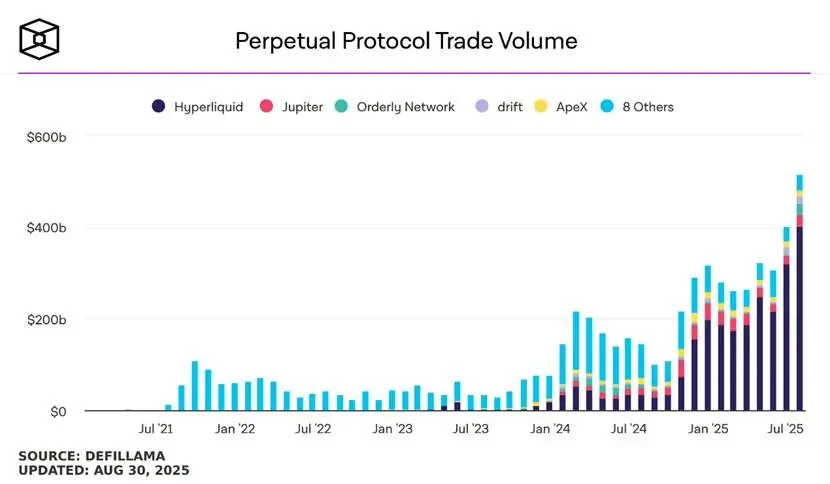

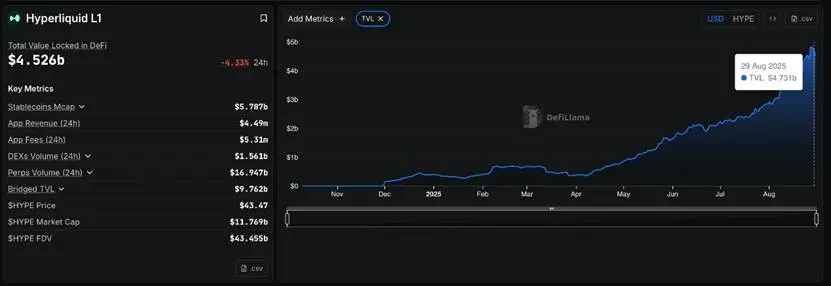

03 Hyperliquid ecosystem is growing rapidly

Hyperliquid’s TVL chart says it all – growth is accelerating.

Some of the leading players in DeFi (Ethena, EtherFi, Pendle, Morpho) are expanding into HyperEVM. The fact that these savvy teams are investing resources in this area is undoubtedly a strong signal that something is happening.

At the same time, Hyperliquid native projects such as Kinetiq and Liminal are also booming. The recent integration of Hyperliquid's native USDC has further cleared the way for ecological development.

04 HYPE is a powerful collateral asset

Like Ethereum's ETH, Solana's SOL, and BNB Chain's BNB, any Layer 1 platform needs a strong collateral token to thrive. Most Layer 1 platforms lack such a strong asset, limiting their DeFi growth. HyperEVM, on the other hand, possesses HYPE, one of the strongest assets in crypto.

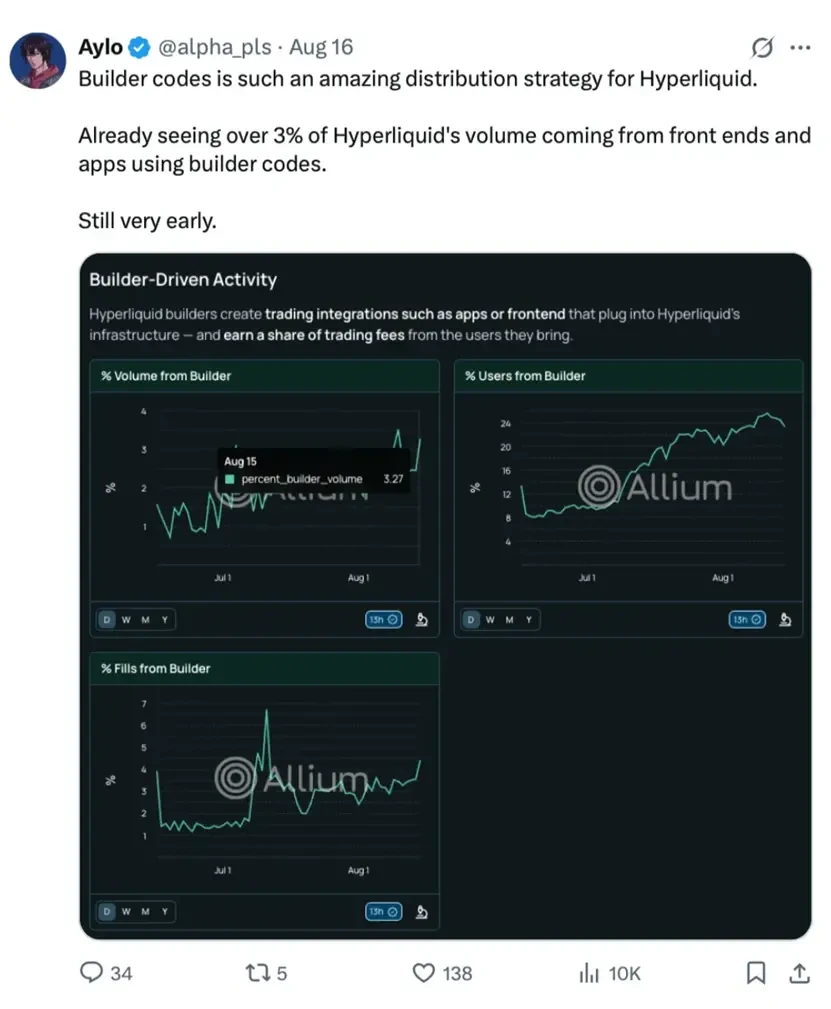

05 Builder Codes: A brilliant distribution strategy

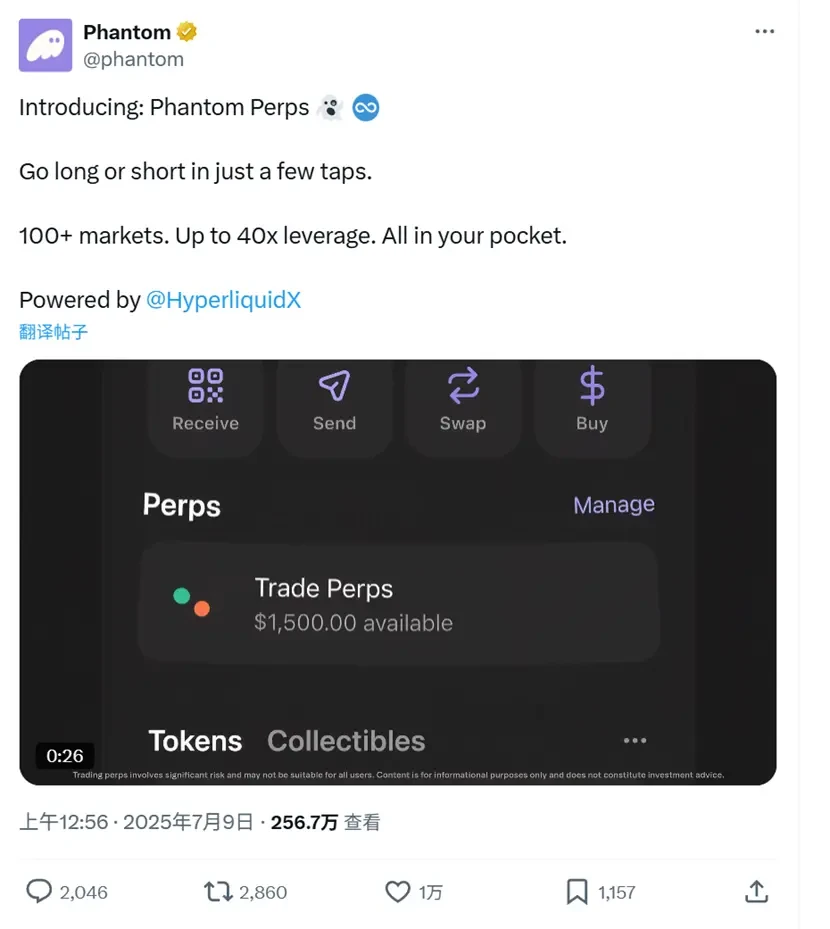

This mechanism allows developers to build trading applications using Hyperliquid infrastructure and earn a share of the fees from the transactions they guide, turning DeFi builders into Hyperliquid's distribution partners, creating a true win-win model.

For example, Phantom has launched perpetual contract trading through Hyperliquid, Rabby Wallet has also hinted at similar moves, and protocols such as Ranger Finance and Mass have also begun to utilize this mechanism.

06 HIP-3 is changing the rules of the game

Anyone can create a perpetual contract market by staking 1 million HYPE (approximately $42 million). Deployers can set parameters and earn up to 50% in fees.

Unlike Builder Codes distribution, HIP-3 involves product expansion. More markets → more users → more fees → more repurchases → stronger appeal, creating a positive cycle.

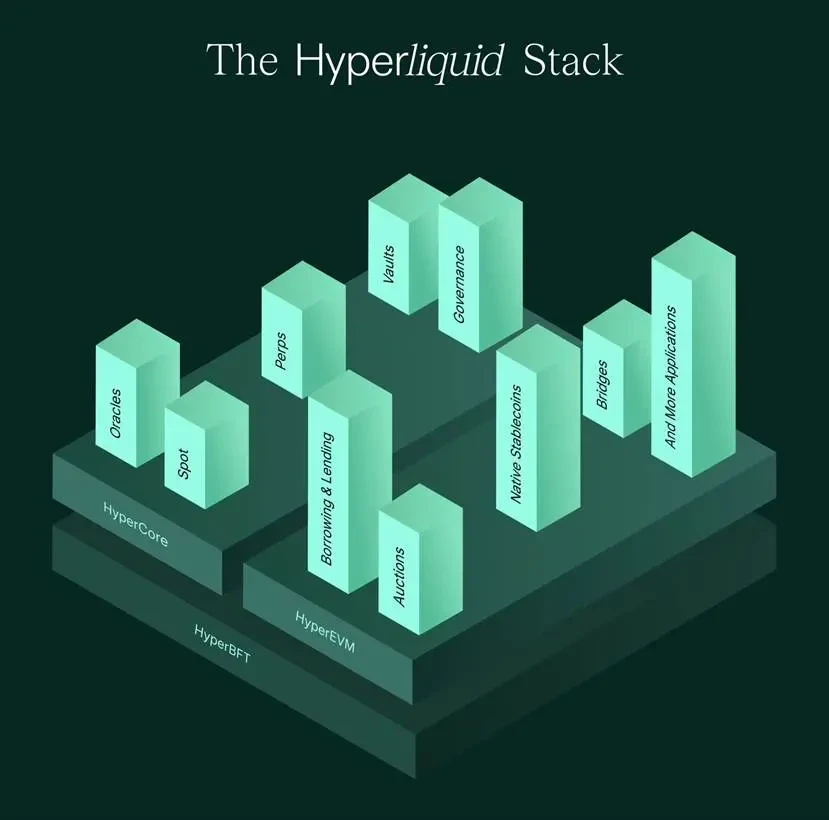

07 Synergy between Hyperliquid and HyperEVM

Hyperliquid and HyperEVM are not two different concepts, but two sides of the same coin. HyperEVM makes Hyperliquid programmable and composable with the rest of DeFi, while Hyperliquid provides liquidity and cash flow, and exchanges bring instant transaction volume, credibility, and revenue to the chain.

This creates a unique feedback loop: DeFi protocols on the Hyper EVM can access Hyperliquid’s deep liquidity and order book while using EVM smart contracts directly.