When prediction markets encounter information explosion: Who is building the "Bloomberg Terminal" of the crypto world?

- 核心观点:预测市场聚合器需求激增。

- 关键要素:

- 多平台切换效率低下。

- 单日成交量达2.7亿美元。

- 聚合工具初显整合能力。

- 市场影响:提升交易效率,促生态成熟。

- 时效性标注:中期影响。

Original author: June, TechFlow

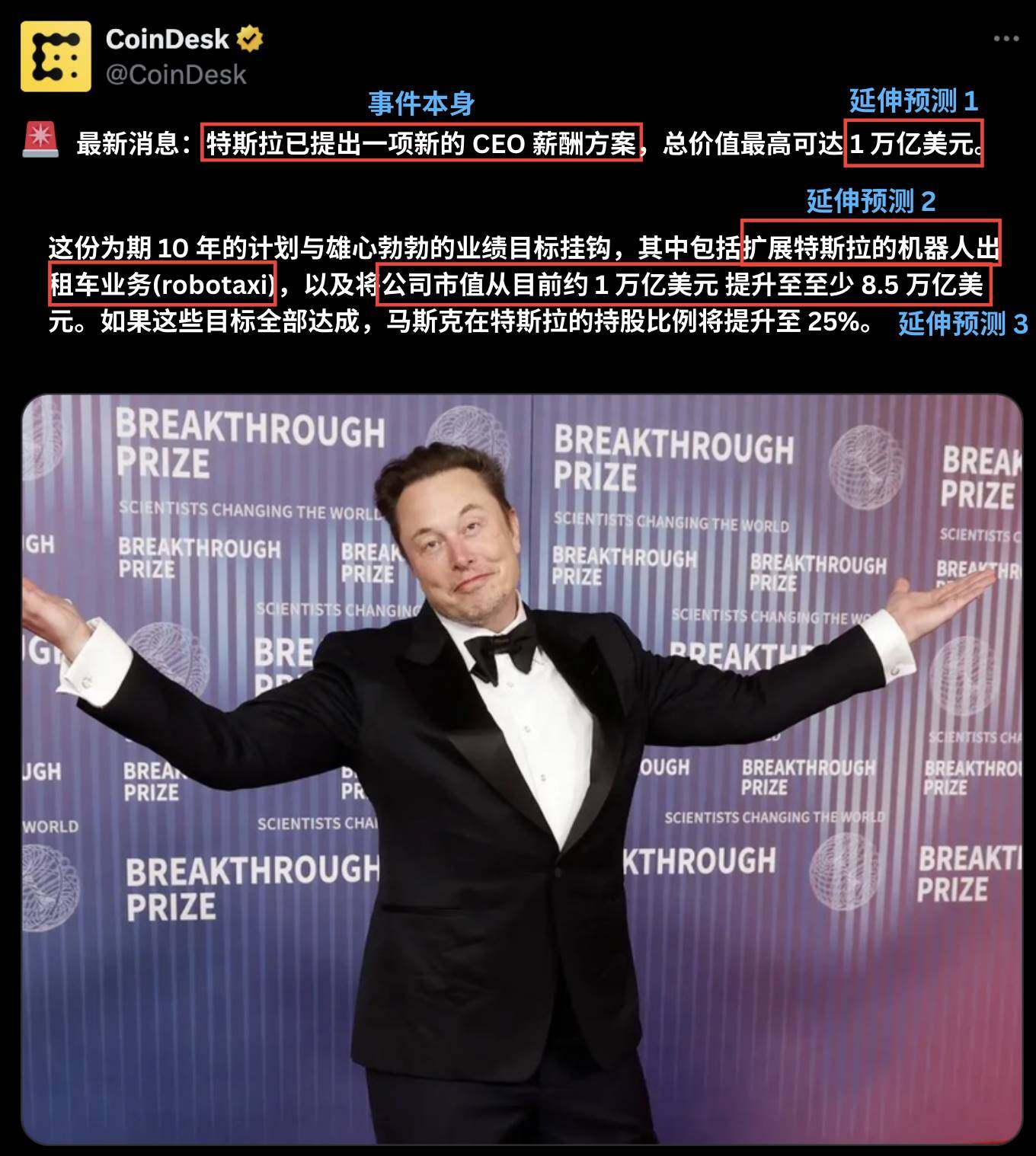

As soon as Musk's compensation plan was announced, traders' fingers were already flying on keyboards. But they were not looking to buy Tesla stock, but to search for relevant problems in the prediction market.

They believe this single piece of news can lead to a wide variety of predictions: Who will become the world's first trillionaire? When will Musk reach the trillion mark? How will Tesla's market capitalization trend this quarter? Which city will the Robotaxi roll out first?

This is the current daily routine for prediction market traders: behind a piece of news, there are often multiple themes and opportunities hidden on multiple prediction platforms.

However, the reality is that traders need to search for relevant markets on multiple platforms such as Polymarket, Kalshi, and Limitless, compare odds, and monitor price changes.

This incident alone demonstrates the shortcomings of the existing market.

If we can automatically match relevant prediction markets based on news content, trading efficiency will be greatly improved; conversely, if we can quickly grasp the key points and place accurate bets after the news is released, our winning rate will also be significantly improved.

The coexistence of multiple platforms has brought unprecedented challenges to traders: to find the best odds, they need to switch between multiple platforms; to capture arbitrage opportunities, they need to monitor the price differences between different platforms at the same time; and to obtain comprehensive information, they must continuously track the latest market news.

This fragmented information not only consumes time and energy, but also hinders traders from making optimal decisions.

Trading volume is catching up with Meme, but information noise is greater

Remember the Meme coin explosion a few years ago?

In 2024, the Pumpfun launch platform quickly rose to prominence.

At the time, new coins were being launched at a dizzying pace. Traders were quickly overwhelmed by such a vast and rapidly growing market, and manually tracking every new project became impractical. Amidst this chaos, trading bots and aggregators emerged. They helped users filter information, identify opportunities, and streamline the complex trading process.

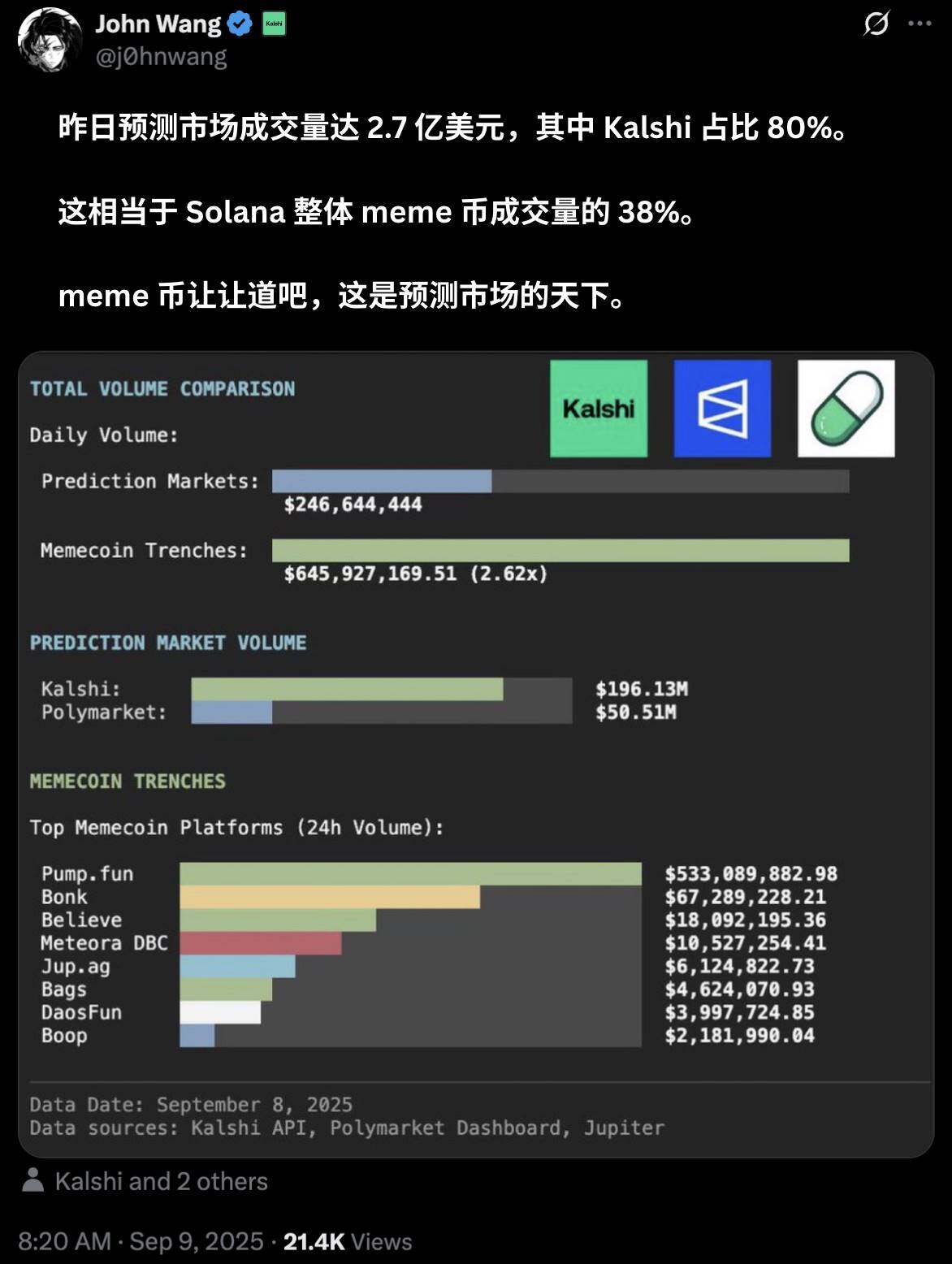

This phenomenon is now being repeated in the prediction market. On September 8th, the prediction market saw a single-day trading volume of $270 million, of which Kalshi alone accounted for 80%, equivalent to 38% of Solana's total meme coin trading volume. The prediction market is gaining momentum and has begun to attack the meme coin market.

As more and more prediction market platforms emerge, traders are once again faced with the problem of information overload.

Aggregation and automation tools become necessary when supply outstrips human processing capacity, a process that all rapidly growing crypto ecosystems go through.

At this moment, the prediction market is at this turning point.

Giants compete for supremacy, and many competitors compete for supremacy

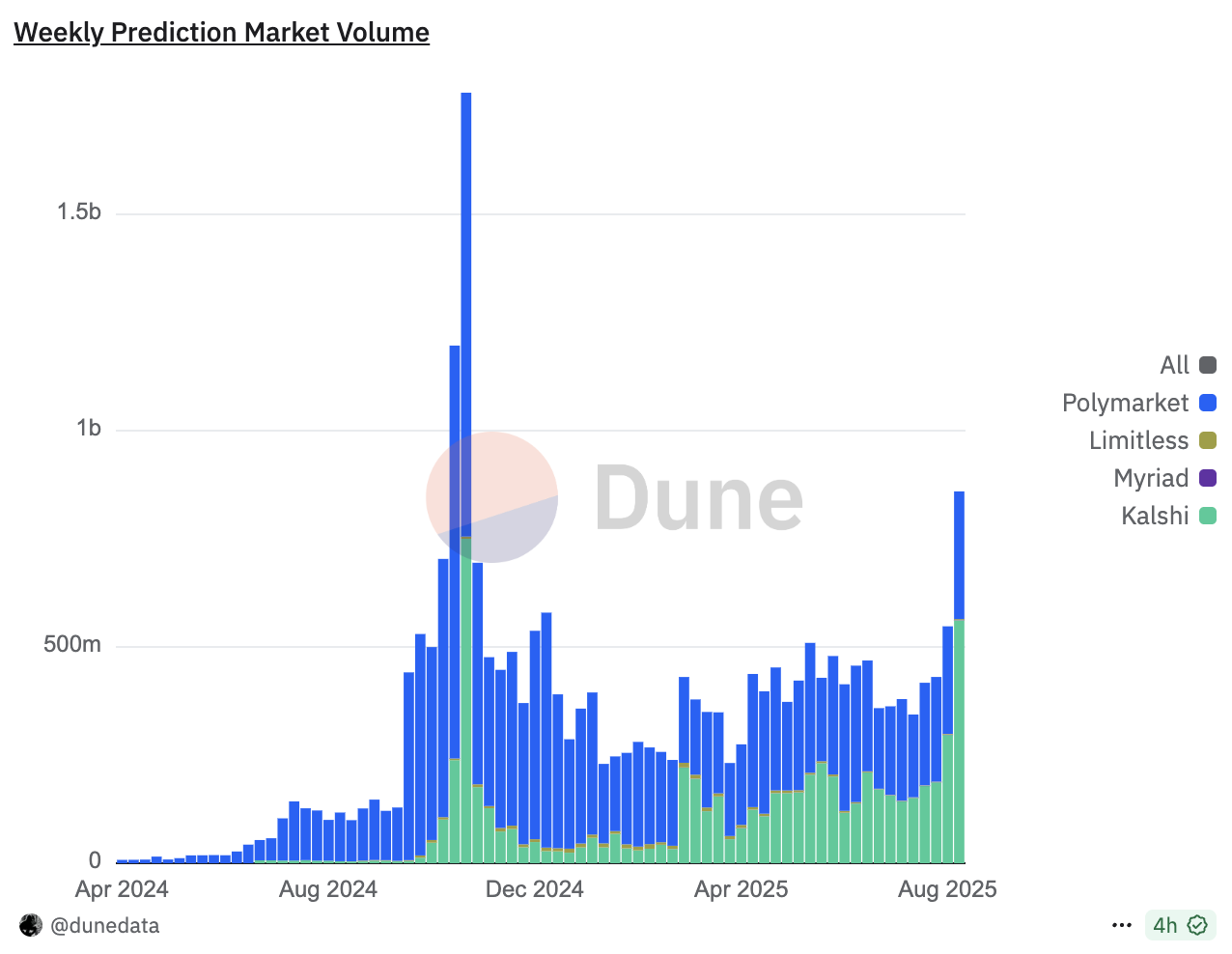

The popularity of the prediction market could actually be seen a few months ago.

In May of this year, the U.S. Commodity Futures Trading Commission (CFTC) withdrew its appeal against Kalshi. That same month, Kalshi began supporting cryptocurrency deposits, including USDC, RLUSD, SOL, BTC, WLD, and XRP, offering users an alternative to traditional funding methods. In June, Kalshi secured $185 million in Series C funding led by Paradigm, bringing its valuation to $2 billion and officially joining the ranks of unicorns.

Meanwhile, Polymarket reportedly raised approximately $200 million at a valuation exceeding $1 billion, garnering significant investment from both major players. However, Polymarket's journey into the US has been somewhat challenging. In 2022, the platform was fined $1.4 million by the CFTC for operating an unregistered binary options market and was forced to restrict access to US users.

Just as Polymarket gained fame for its accurate predictions of the 2024 US presidential election, the FBI suddenly raided its office eight days later and confiscated founder Coplan's computer and phone. The situation took a turn during the Trump administration. The judicial investigation abruptly ended, and Polymarket secured its return to the US through its acquisition of QCEX. On September 4th, the CFTC officially gave the green light.

The dual support of a loosened regulatory environment and capital boost has created an excellent environment for the explosion of the prediction market.

At this moment, the competitive landscape is also quietly shifting. Kalshi has been performing exceptionally well since recruiting renowned crypto influencer John Wang as its Head of Crypto. Since August 25th, its weekly trading volume has surpassed Polymarket, intensifying the competition between the two giants.

While giants are competing for supremacy, new competitors are already ready to move in: MyriadMarkets (founded by Farokh, the founder of Rug Radio and Decrypt Media), Truemarkets, HedgehogMarket, DriftProtocol and Limitless, etc.

The prediction market is rapidly reshaping, and these platforms are undoubtedly trying to get a piece of this booming market.

Just as the "Group Meme Dance" gave birth to tools such as the early Bananabot and the GMGN platform, and then to the later Axiom, the prediction market war is creating huge market demand for aggregators.

Aggregator prototypes emerge

The pain points mentioned at the beginning have given rise to a number of innovative solutions. Although most are still in the beta stage, they have already demonstrated great potential.

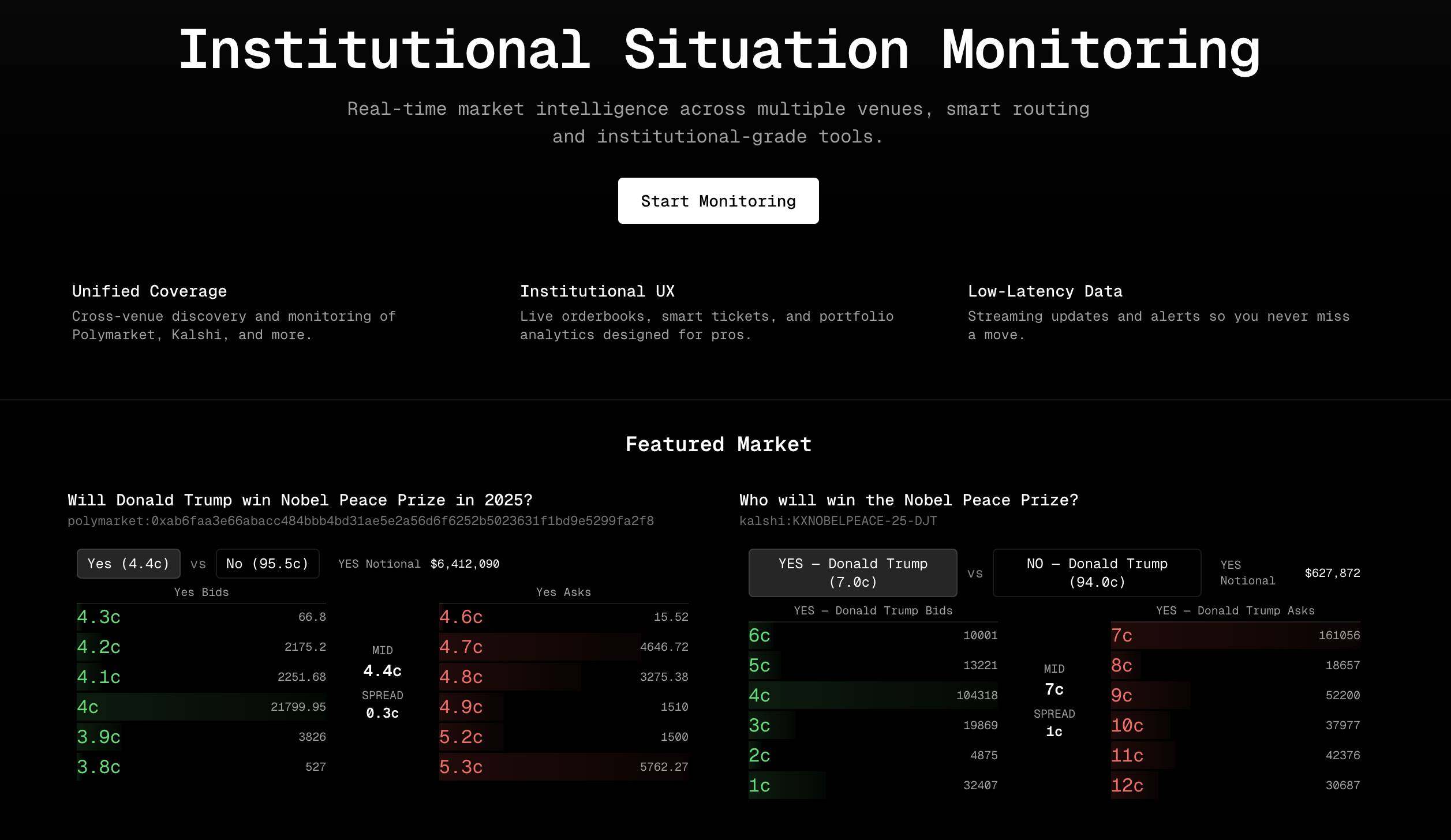

monitorthesituation.lol, developed by @rileyxcook , displays real-time order books across multiple platforms and automatically matches similar markets on Kalshi, Limitless, and Polymarket, allowing traders to spot price discrepancies at a glance.

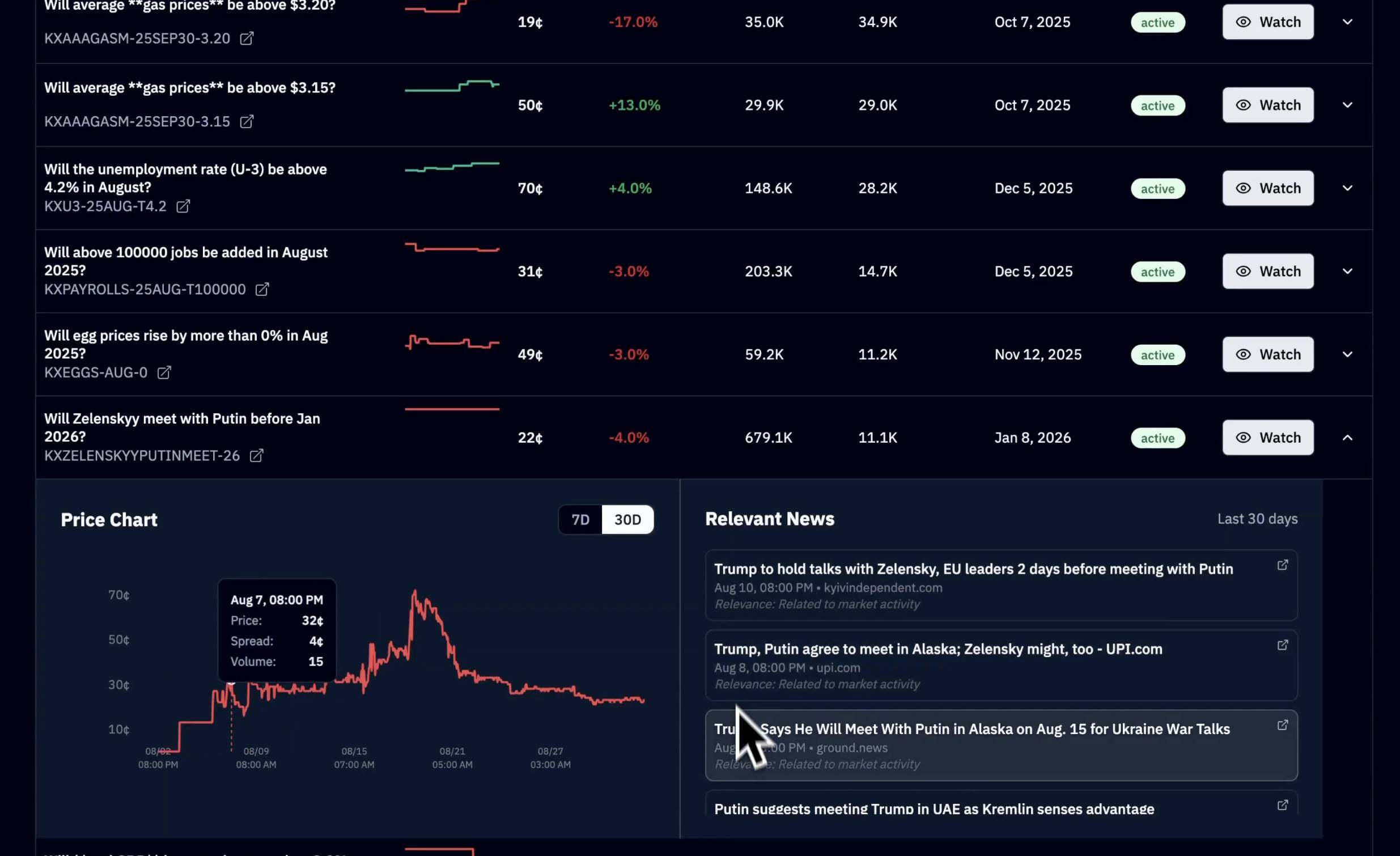

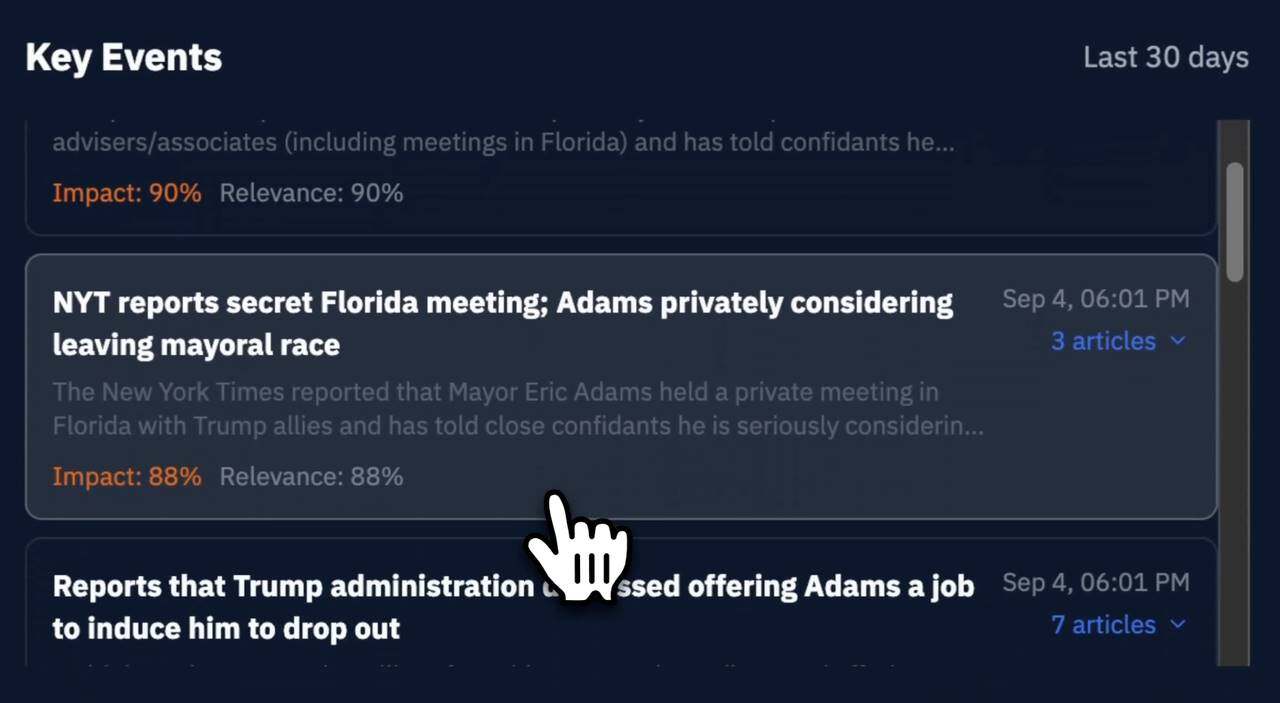

Verso Trading has built a smarter news engine that consolidates duplicate headlines into single events and provides impact and relevance scores. This allows users to see which news items are truly impacting the price of Kalshi contracts. The platform will also soon launch a low-latency, real-time alert feature that will notify users immediately when news or tweets are potentially market-moving.

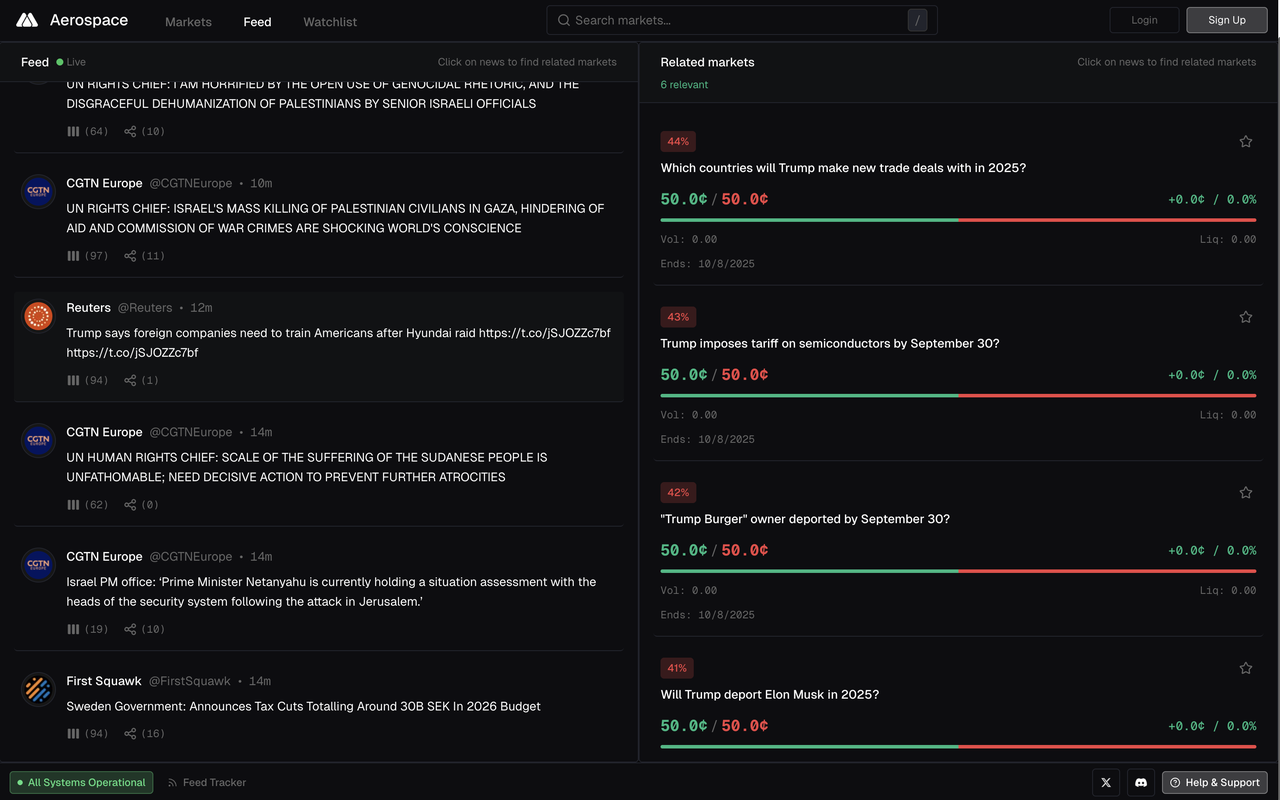

16-year-old engineer @agpkeleta created Aerospace, a prediction market trading platform equipped with a real-time news feed that accurately matches alpha information with relevant markets. This allows traders to quickly capitalize on market opportunities based on confirmed outcomes before the market resolves to "yes." Currently, the site only supports Polymarket, with Kalshi coming soon.

These tools all address the same core problem: integrating news information with relevant prediction markets into a unified platform to facilitate complex trading. While still in its early stages, these beta releases are already demonstrating the value proposition of aggregators.

Future Outlook: Greater Opportunities

When a gap appears in the market, opportunity arises.

The rise of prediction market aggregators is not accidental, but an inevitable result of the thriving ecosystem.

A thriving ecosystem requires diverse infrastructure support. We witnessed this pattern during the Meme coin boom last year. As core asset classes mature, tools, analytical platforms, and automated solutions surrounding them mushroom, ultimately forming a complete ecosystem.

Today’s prediction markets may be at the same tipping point.

As more and more platforms emerge and their user base expands, the demand for specialized tools will only grow stronger.

Aggregators may just be the beginning.

We're likely to see even more innovations, such as cross-platform arbitrage bots, AI-driven market analysis tools, and institutional-grade risk management systems. Prediction markets are no longer simply about "betting"; they're evolving into a complex trading ecosystem that requires specialized tools and in-depth analysis. Projects that can provide the core infrastructure during this transition are likely to become the most important components of this emerging ecosystem.

Bonus: Since we're predicting the market, why not let AI also predict the future? I asked the AI to boldly envision the future of this sector, and here's its response.

In the short term (6-12 months):

- The Aggregator Wars Are About to Begin

- Polymarket vs. Kalshi Upgrade: The two companies will launch more similar markets to compete directly, and users will see fierce price wars for the same event on different platforms.

- New platforms will "copy homework": madly copy popular markets, leading to serious homogeneity

Medium term (1-2 years):

- API integration becomes standard: Successful aggregators will force platforms to open better APIs, otherwise they will lose traffic

- Institutional players enter the market: Hedge funds and quantitative teams will begin to use prediction markets for arbitrage on a large scale, reducing the advantages of retail investors.

- Vertical segmentation emerges: prediction markets specializing in sports, politics, and cryptocurrencies will rise, and general platforms will begin to differentiate.

Long term (3-5 years):

- Platform reshuffle: only 2-3 mainstream platforms will remain, and the others will either be acquired or die.

- Aggregators become “super portals”: The most successful aggregators may launch their own marketplaces, becoming both channels and platforms.

- AI-driven predictions go mainstream: AI analyzes news and social media data to automatically place bets, while manual predictions become a niche hobby.

My boldest prediction: Future prediction market aggregators will be like today's brokerages, not only displaying prices but also offering leverage, options, portfolio investments, and other financial instruments. By then, prediction markets will have truly become a mature financial product.

Which prediction do you think is most likely to come true?