Lazy Money Management Guide | River Launches Limited-Time 40.8% APR Income Pool; Avantis LP Points Payout Tonight (September 9th)

- 核心观点:多个平台推出高收益稳定币理财机会。

- 关键要素:

- Avantis提供最高15.76%APR收益。

- Arbitrum启动4150万美元激励计划。

- River推出40.8%APR限时收益池。

- 市场影响:吸引资金参与DeFi稳定币理财。

- 时效性标注:短期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

This column aims to cover the current low-risk return strategies based on stablecoins (and their derivative tokens) in the market (Odaily Note: code risks can never be ruled out), to help users who hope to gradually expand their capital scale through U-based financial management to find more ideal interest-earning opportunities.

Previous records

Follow up on old mines

Avantis officially launches its coin offering and Season 3 launches simultaneously

Avantis, the leading derivatives trading platform in the Base ecosystem, which we recommended in June, will officially open its AVNT airdrop today. Users who made limited partner deposits at the time should be eligible to receive the airdrop. Several exchanges have officially announced their listing of AVNT, including Binance Alpha, which will open for trading at 9:00 PM, and Binance Futures, which will open at 11:00 PM.

At the same time as TGE, Avantis has also launched the points activity for Season 3, but the specific number of tokens that can be distributed this season has not yet been disclosed (Note: a total of 2.19% of AVNT was distributed to LPs of Season 1 and Season 2 in the initial airdrop).

Besides the potential airdrop income associated with points, Avantis LPs themselves offer a relatively impressive return. Avantis LPs are categorized into high-risk and low-risk tiers. High-risk LPs bear higher market-making losses (65%) but also receive higher fee income (35%). Low-risk LPs bear lower market-making losses (65%) but also receive lower fee income (35%). Currently, the base return for high-risk vaults is 4.37% APR, which can be increased to 15.76% with locked LPs. Low-risk LPs have a base return of 3.23% APR, which can be increased to 11.75% with locked LPs.

- Season 3 Portal: https://www.avantisfi.com

Resolv Season 2 is coming to an end

In addition to Avantis, another project that is about to make money is Resolv, which has already conducted a round of airdrops. The project's Season 2 points will start on May 9 and last until September 9. The total token distribution this quarter is determined to be 5.75% of the total supply, of which at least 4% will be used for the Season 2 points plan.

At present, Resolv has not officially announced the application time for Season 2 airdrop, so wait for the announcement.

New opportunities

Arbitrum Launches DRIP Incentive Program

Arbitrum announced a new incentive program called DRIP last week, which will provide a total of 80 million ARB (about US$41.5 million) for incentives. The program will be implemented in four seasons, and each season will provide incentives for a specific DeFi vertical field.

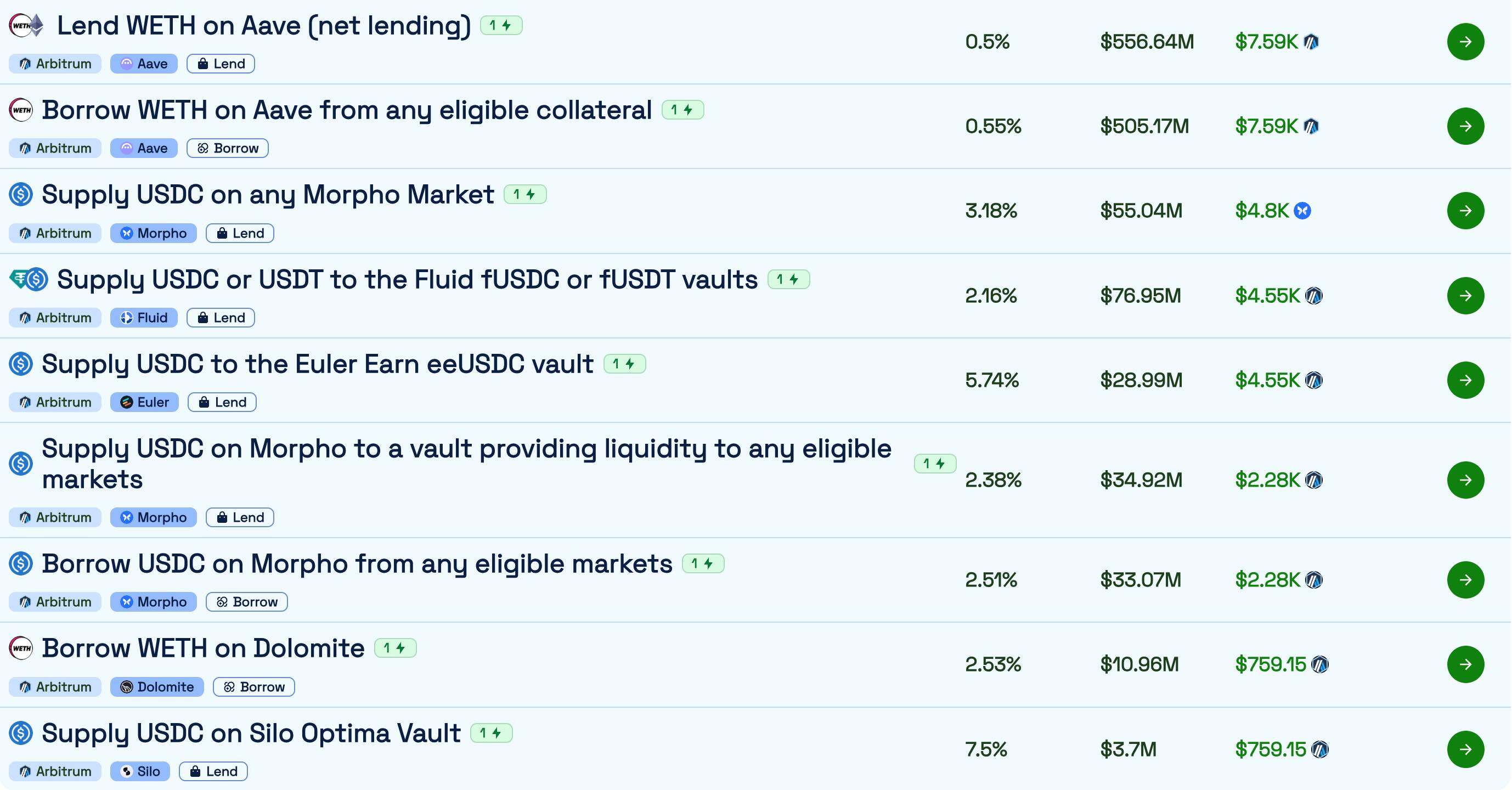

The first season of the DRIP program launched on September 3rd and is expected to run until January 20th of next year. It will provide approximately 24 million ARB (approximately $12.72 million) as incentives to drive the growth of revolving leverage within the ecosystem's lending market. Lending protocols currently included in the incentive include Aave, Fluid, Morpho, Euler, Dolomite, and Silo. The specific pools and incentives (including daily ARB incentives and corresponding APY increases) are shown in the figure below.

River launches 45-day limited 40% APR income pool

On September 8, the chain-abstract stablecoin protocol River announced that it would launch a new revenue pool, Smart Vault, at 22:00 Beijing time on September 10. The specific information of the pool is as follows:

- Deposit opening time: September 10, 22:00;

- Deposit cycle: 5 days;

- Supported assets: USDT;

- Total pool limit: 10 million USDT (first come, first served);

- Revenue cycle: 45 days;

- Lock-up period: 3 days;

- Total Annual Percentage Rate (APR): 40.8% — 16.8% in satUSD (guaranteed return); 24% in River PTs (based on $200 million in FDV, redeemable for RIVER tokens in the future) ;

Although the yield situation sounds exaggerated, considering that the pool is limited in time and amount, and most of the income comes from points (corresponding to future tokens), the actual interest cost paid by the protocol is not too high - if you do not mind the funds being locked, you can consider depositing an amount that your risk appetite can accept, and individuals will tend to participate (if they can grab a pit).