The public blockchain race has seen a new player join the fray. What is Upbit's intention in launching Giwa?

- 核心观点:Upbit推出Giwa链寻求业务转型。

- 关键要素:

- 基于OP Stack构建L2网络。

- 专注韩元稳定币和本地化体验。

- 应对交易所增长瓶颈和竞争。

- 市场影响:加剧交易所公链竞争,推动商业模式创新。

- 时效性标注:中期影响。

Original author: David, TechFlow

The public chain arms race has one more participant.

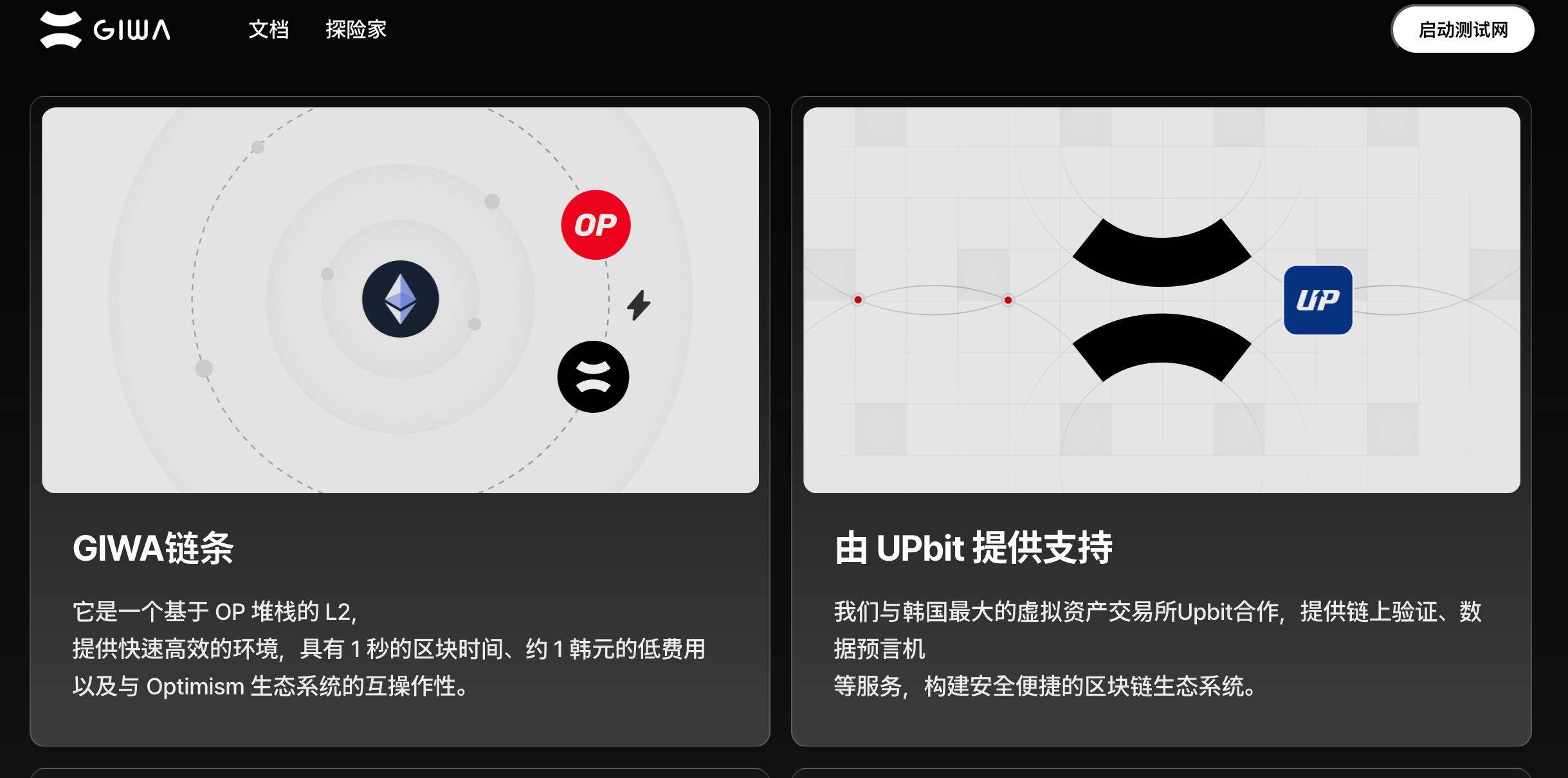

On September 9, South Korea’s largest crypto exchange Upbit officially launched Giwa, an Ethereum Layer 2 network built on the Optimism OP Stack, at the UDC 2025 conference in Seoul.

Before the official launch, there was only a mysterious countdown website stirring up market sentiment.

The name Giwa is also interesting. "Giwa" in Korean refers to the roof tiles of traditional Korean architecture. These tiles are interlocked layer by layer through a clever interlocking structure to form a fully functional roof structure.

The name Upbit was obviously not chosen casually. Modularity and interoperability, the core concepts of blockchain, are all hidden in the beautiful meaning of interlocking tiles.

It’s just that the reality may not be as beautiful as the name.

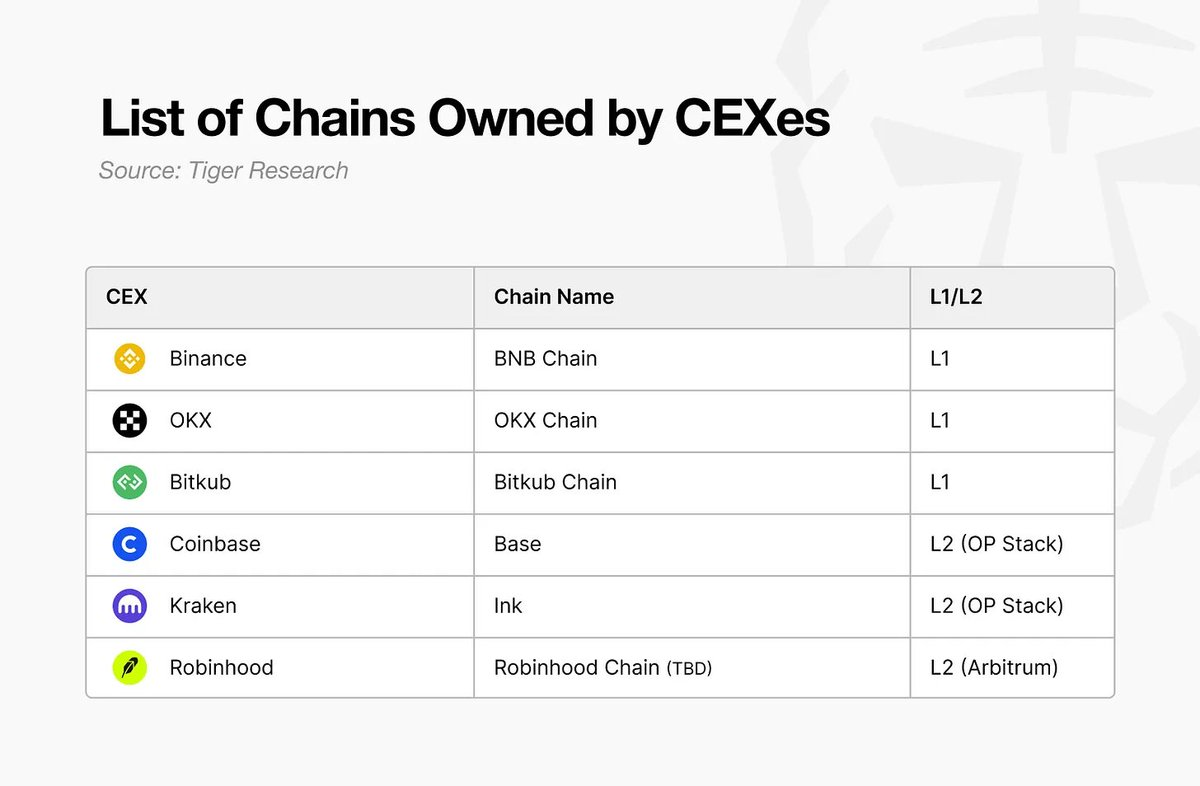

Upbit isn't early on the blockchain front among exchanges. Coinbase's Base, already a year old, boasts over $8 billion in total value, becoming a powerhouse for social and consumer applications. Binance's BNB Chain is a long-standing player, with a growing ecosystem of projects and CEX integrations. Even Kraken recently launched Ink, and Robinhood is promoting stock tokenization on Arbitrum.

Everyone understands one thing: if you rely solely on transaction fees to make a living, there is a ceiling.

(Image source: Tiger Research)

However, as a latecomer, Giwa also uses an open source technology stack. What might be its advantages and opportunities?

Giwa Preview: Same Origin as Base, but Different Path

There is actually not much hesitation in choosing OP Stack and Upbit.

There are only a few technical approaches for Layer 2: Optimistic Rollup, ZK Rollup, and some hybrid solutions. While ZK technology is attractive, its maturity is questionable. Arbitrum's technology stack is also impressive, but its ecosystem is relatively closed. OP Stack is open source, modular, and has the precedent of Coinbase's Base, making it a proven path.

The core of OP Stack is optimistic rollup, which first assumes that all transactions are honest and then challenges them if there are any problems.

This brings two advantages: transactions are executed first and verified later, which is fast; and the verification logic is simple and cost-effective. This is particularly suitable for trading platforms like Upbit, which have huge daily trading volumes.

What’s interesting is the comparison between Base and Giwa: with the same OP Stack, the two chains take completely different paths.

Backed by Coinbase's US user base, Base promotes "Onchain is the new Online" and targets consumer scenarios such as social networking, gaming, and NFTs. While these narratives have been lukewarm in the current cycle, the previous success of social products like Friend.tech on Base is largely due to Base's positioning. Low gas fees, a smooth user experience, and comprehensive developer tools are Base's three key strengths.

Giwa's approach is different. Upbit's users are primarily Korean, with different trading habits and regulatory environments. Korean users are more accustomed to the experience of centralized exchanges and, conversely, less receptive to DeFi. This requires Giwa to maintain decentralization while providing a user experience closer to that of a centralized exchange.

Judging from the information that has been revealed, Giwa may make a fuss in several directions:

First, native support for the Korean won stablecoin should be a top priority. If gas fees could be paid directly with the won stablecoin, the barrier to entry for Korean users would be much lower. This requires protocol-level modifications and regulatory collaboration, and cannot be solved by simply deploying a contract.

In July, news broke that Upbit’s parent company, Dunamu, had confirmed it would collaborate with Naver Pay to advance the Korean won stablecoin payment business, which appears to be part of a move to pave the way for Giwa.

Second, compliance features may be built into the chain. South Korea's regulatory requirements are strict, and KYC and AML are unavoidable. Rather than leaving it up to individual projects to implement these features, it would be better to provide standardized solutions at the chain level, such as on-chain identity systems and transaction monitoring mechanisms.

Finally, the focus of performance optimization may differ from that of Base. Base is optimized for high-frequency, small-value transactions, which are suitable for social scenarios. Giwa may be more concerned with the efficiency and security of large-value transactions, after all, transactions of hundreds of thousands of dollars are common on Upbit.

Furthermore, cross-chain bridges are a key issue. Users' assets are primarily held on Upbit's centralized ledger. How can they be safely and conveniently migrated to Giwa? Without this user experience, everything else is meaningless. Upbit may develop a dedicated bridge solution, perhaps even integrating it directly into the exchange interface, similar to Binance's approach.

Of course, these are all speculations based on the information currently available.

However, the choice of technology can reflect strategic intentions. Choosing OP Stack shows that Upbit wants to quickly launch and reduce risks, while leveraging the existing ecosystem integrated by its own CEX.

Transformation, or transformation?

Upbit’s blockchain development was more of a forced move than a proactive move.

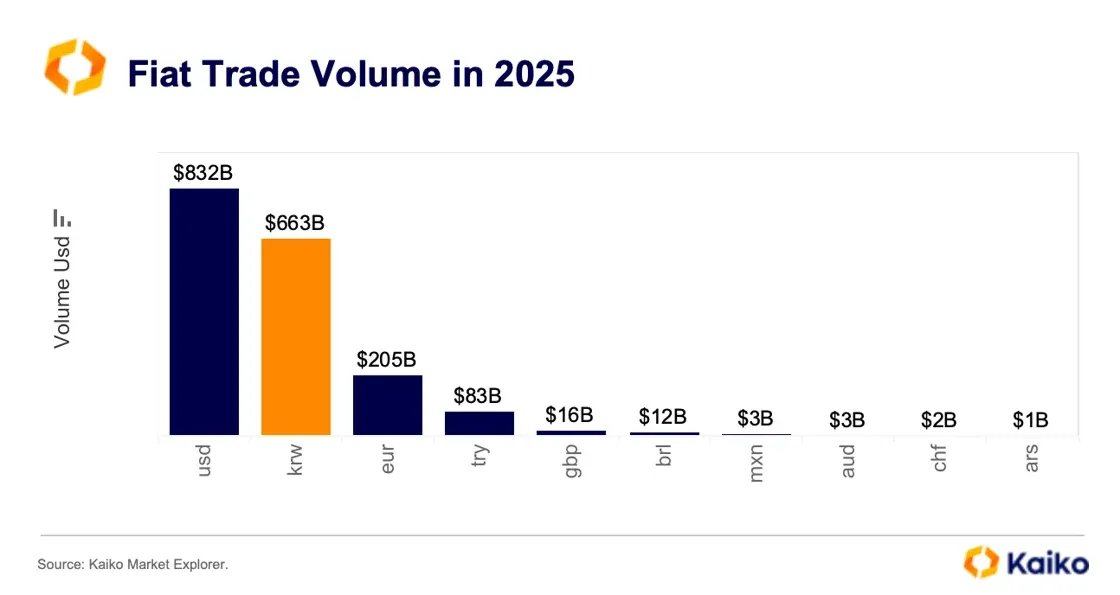

In 2025, Upbit seemed to be doing well. With an 80% market share in South Korea and daily trading volume regularly ranking among the top three globally, its growth curve had begun to flatten. South Korea was a small country, and almost everyone who could trade cryptocurrencies was already doing so. Where would new users come from?

This anxiety seems to have spread throughout the crypto industry over the past year or two. Exchanges around the world are searching for a second growth curve, and the answer is surprisingly consistent: building blockchains .

Coinbase's Base proved this approach feasible: not only could it collect gas fees, but more importantly, it controlled pricing power within the ecosystem. When popular apps like Friend.tech took off on Base, Coinbase profited not only from transaction fees but also from the spillover effects across the entire value chain.

More importantly, beyond its exchange business, Coinbase has extended its value chain through ecosystem development. The transformation from a "trading platform" to an "infrastructure provider" is essentially a diversification of its revenue model.

The unique characteristics of the Korean market make this transformation even more urgent. The "Kimchi Premium" appears to be a defensive factor for Korean exchanges, allowing the same Bitcoin to fetch a higher price, but in reality, it reflects the closed and inefficient nature of the market.

International arbitrageurs can't enter, and South Korean capital can't leave. Sooner or later, the isolation will be broken. Once international exchanges find a legal way to enter South Korea, Upbit's monopoly will be in jeopardy.

The Korean won stablecoin presents a window of opportunity. Following the collapse of Terra, the stablecoin vacuum in the Korean market remains unfilled. Koreans have a genuine need for local stablecoins: for cross-border remittances, risk hedging, and everyday payments. Public data also shows that South Korea's cross-border remittance market generates $15 billion in annual transactions.

(Image source: Tiger Research)

And this is exactly the problem: South Korea’s Virtual Asset User Protection Act stipulates that exchanges cannot trade tokens issued by themselves or their affiliates.

The company built a Giwa chain, allowing its partner Naver Pay to issue Korean won stablecoins on the chain, with Upbit providing the infrastructure. This circumvented regulation while maintaining control over the ecosystem.

In addition, seeking a position in the capital market and the relentless pressure from competitors are also important reasons for Upbit to accelerate its transformation.

Another South Korean exchange, Bithumb, is already preparing for an IPO in the second half of 2025, and Dunamu (Upbit's parent company) undoubtedly has similar plans. With the successive IPOs of numerous global crypto exchanges, the capital market may have grown tired of hearing about exchanges; the term "Web 3 infrastructure" sounds much more appealing.

Of course, building a blockchain also carries risks. Klaytn's failure is still fresh in our memory. Kakao, backed by a major conglomerate, ultimately failed to take off. Technology isn't the problem; the ecosystem is. Without applications and users, a blockchain is likely to be nothing more than an empty shell.

But for Upbit, the risk of not making this attempt may be greater than doing it.

Looking ahead to September 2025, blockchain development by exchanges has gone from being an "innovation" to a "standard feature." Coinbase has Base, Binance has BNB Chain, and now Upbit has Giwa.

The endgame of this arms race may not be who has the best blockchain, but who can first find a new business model. In this sense, the launch of Giwa is just the first step in Upbit's transformation. The real test has just begun.