Behind the Hyperliquid craze: How to break the five major traps of Perp DEX?

- 核心观点:Perp DEX面临流动性假象等隐性问题。

- 关键要素:

- 成交量高但流动性指标被激励人为抬高。

- 订单簿模式需大量做市商补贴成本高。

- 黑箱清算缺乏透明度易被操纵。

- 市场影响:推动行业构建更稳健透明机制。

- 时效性标注:中期影响。

Original author: Rui

Original translation: Saoirse, Foresight News

Hyperliquid has ignited a frenzy in the perpetual contract decentralized exchange (Perp DEX) space, capturing 8.62% of centralized exchange (CEX) traffic. However, we must confront some of the underlying challenges in this space and build a framework to ensure a truly irreversible transition to decentralization.

TL;DR

- Liquidity Illusion: High volume does not equal good liquidity. Bid-ask spreads, slippage, and taker fees contribute to price impact and execution losses, but these metrics can be artificially inflated by incentive mechanisms.

- Hidden costs: The order book model requires a large number of market maker subsidies, and the liquidity providers (LPs) of automated market makers (AMMs) are difficult to scale. Both face economic challenges.

- Black box clearing: Prioritizing system security over user convenience, this requires open interest (OI) risk control, multi-source clearing mechanisms, and verifiable proof. However, the risks are particularly prominent in pre-market trading scenarios.

- Trading order sacrifice: There is a trade-off between prioritizing retail investors and high-frequency trading (HFT), which is essentially a choice between fairness and efficiency.

- Inefficient margin: A dynamic and efficient margin system needs to be built, integrating interest-bearing collateral, loan integration, and hedge identification capabilities to match the efficiency of centralized exchanges.

The illusion of liquidity

While trading volume is a common metric, it can be misleading when token incentives artificially generate fake trading. Even with the same trading volume figures, retail trading is more valuable than “speculative trading” because it is more stable and sustainable.

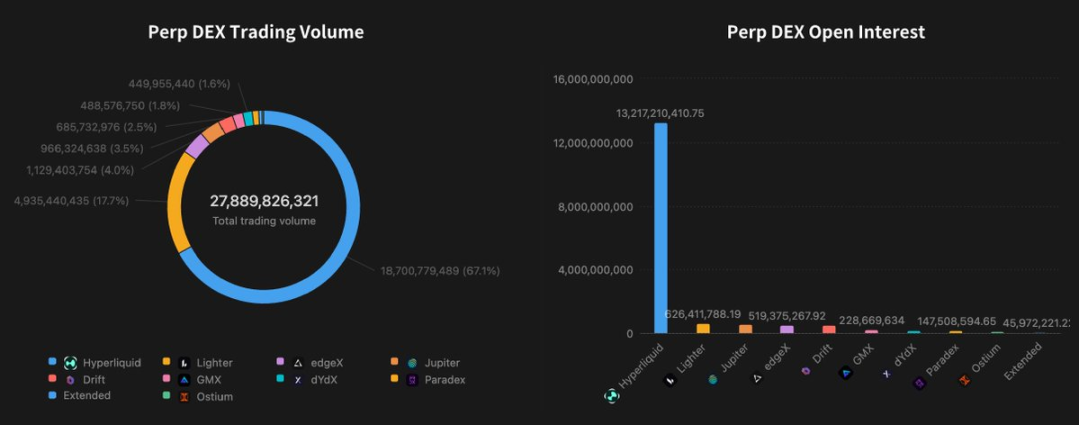

Perp DEX trading volume and open interest

The ratio of open interest to trading volume (OI-to-Volume) reflects true trading activity. Centralized exchanges without APIs typically exhibit a ratio of 1:2 or 1:3. Hyperliquid's hourly fees and order cancellation priority mechanism enable a high ratio of 1:1. Other decentralized exchanges that haven't yet issued a token often have lower ratios due to token incentives that encourage wash trading to inflate trading volume. Furthermore, fee revenue is crucial to platform sustainability, providing both incentives and a direct safety buffer.

Liquidity is the ultimate metric for platform usability. Narrow bid-ask spreads reduce market entry and exit costs, low slippage ensures stable pricing for large orders, and ample market depth protects against price volatility during trading. Comparative data shows that Hyperliquid excels in handling large positions exceeding $20 million, while edgeX is more retail-friendly, offering the deepest liquidity within 1 basis point (bps), the lowest slippage for most trades, and the narrowest spreads.

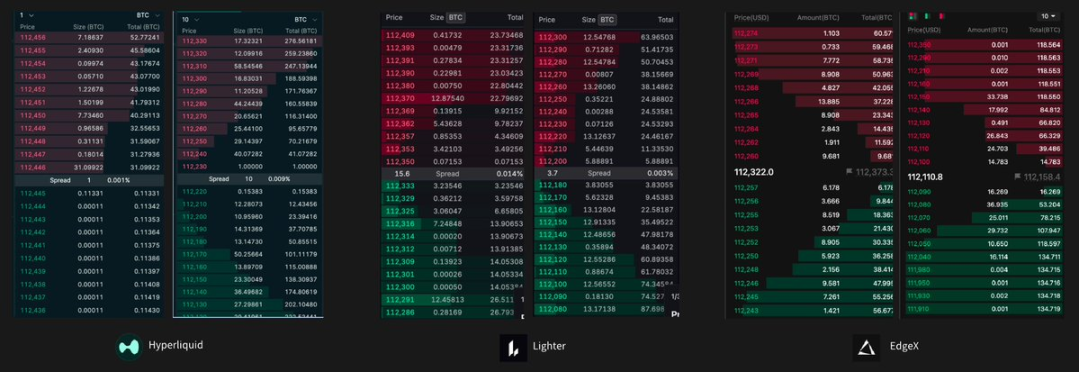

Order Book Comparison

Hidden costs

Liquidity is a typical "cold start problem": traders are reluctant to enter platforms with sparse orders, and market makers will also avoid platforms with insufficient liquidity.

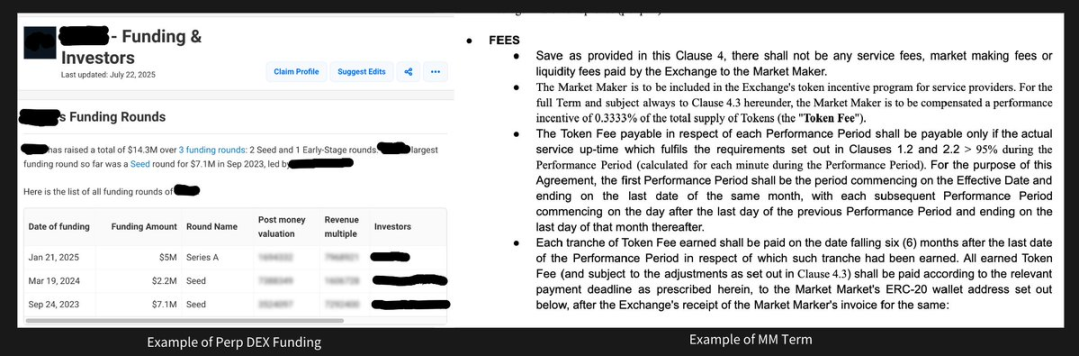

The order book model is more capital-efficient, but requires significant upfront capital investment for market making. Market makers often have demanding requirements: For example, even if a perpetual contract team charges a 0.035% handling fee, after paying 0.01% to the market maker and returning 0.01% to users, only 0.015% remains. If the team's monthly operating costs are $500,000, then daily taker trading volume would need to reach at least $111.1 million to break even. This simple calculation explains why most new entrants fail.

Perp DEX Funding and Market Maker Terms Example

The automated market maker (AMM) model lowers capital requirements through a pool of liquidity providers (LPs) and can achieve a "cold start" through incentive mechanisms (GMX and Ostium are typical examples). However, this model suffers from a significant market maker advantage and cannot support large-volume transactions. Hyperliquid, by shifting from an LP pool model to an order book model, has explored a more sustainable development path.

Black Box Liquidation

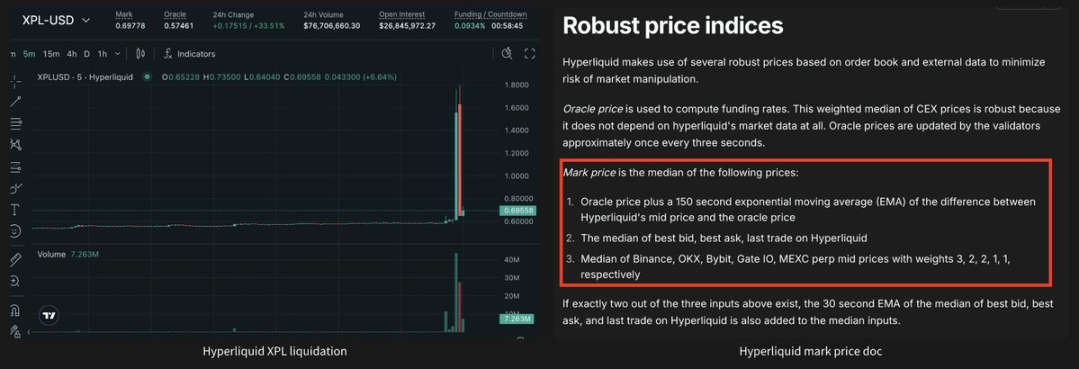

A single internal liquidation source is susceptible to manipulation. Take the Hyperliquid XPL incident on August 26, 2025, for example: a single investor drove the price of XPL from $0.60 to $1.80 in a matter of minutes, while prices on other platforms remained stable (centralized exchanges have circuit breakers in place to limit abnormal price fluctuations during pre-market trading). This ultimately led to the liquidation of 85% of short positions, resulting in losses of $25 million. While multiple sources of marked pricing offer advantages in most cases (increasing the cost of manipulation), and Hyperliquid has implemented this mechanism for most assets, pre-market trading presents unique challenges when platforms seek first-mover advantage but lack a reliable external pricing source.

Hyperliquid's XPL Event and Price Index

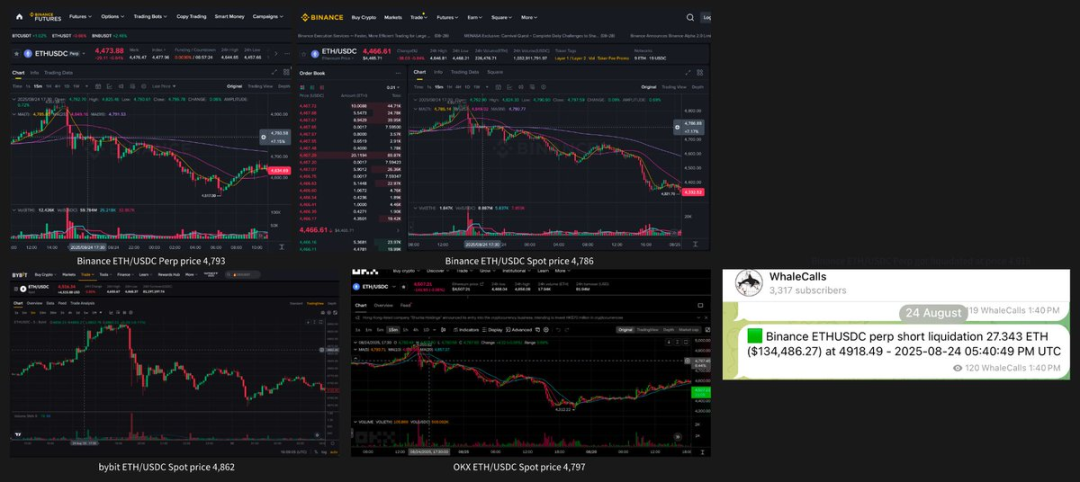

The liquidation process lacks transparency and verifiability. Binance claims to use the "median of three sources" for pricing, but on August 25, 2025, the ETH/USDC liquidation price was $4,918, while the observed price range at the time was $4,786-4,862, making the result difficult to interpret. The lack of timestamps makes liquidations on centralized exchanges both unpredictable and unverifiable. While Hyperliquid has achieved some improvements by bringing node oracle prices on-chain, its internal matching engine and centralized exchange API remain unverified.

Binance forced liquidation example

Free markets have their limitations. Hyperliquid initially adopted a trader-friendly model, allowing traders to open positions freely and retaining maintenance margin when liquidations were executed through the order book. However, in the "JELLY incident," the platform was forced to shut down the market and settle at a price favorable to itself, setting a worrying precedent. Despite the subsequent addition of orphan auto-deleveraging (ADL) and dynamic open interest (OI) caps, the XPL incident still exposed similar vulnerabilities.

Building a fair and robust clearing mechanism is inherently challenging. Hyperliquid has taken a bold step toward openness and efficiency, but this freedom can also create vulnerabilities—possibly allowing coordinated manipulators to gain an advantage over smaller traders. Imposing a volatility cap might be a more promising approach.

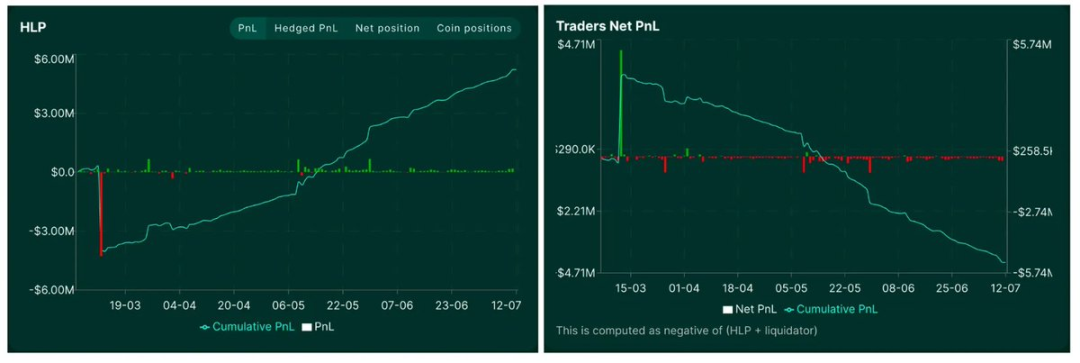

The HLP pool is still profitable because traders are losing money.

Transaction ordering sacrifice

The core trade-off in trade ordering lies between fairness and accessibility and efficiency and volume. Hyperliquid prioritizes fairness by implementing a "speed buffer" (a three-block mempool buffer plus order cancellation priority) to protect retail traders and small market makers from being exploited by sophisticated high-frequency trading (HFT). This mechanism fosters a more inclusive trading environment, allowing less experienced participants to offer narrow spreads without worrying about adverse selection. However, this protection comes at the cost of limiting the platform's overall liquidity and trading volume growth (compared to Binance) by hindering the natural "survival of the fittest" competition among market makers, which is crucial for driving true price discovery. As Enzo suggests, a "barbell strategy" may be able to meet the needs of both retail and HFT users.

Inefficient margin

Centralized exchanges offer greater margin flexibility because these margins are displayed as figures before users withdraw funds, without requiring actual funds to be held. Decentralized exchanges face greater challenges, as they cannot simply reduce margin requirements to increase flexibility. In addition to conventional cross-margin systems, optimization strategies can be implemented through the following:

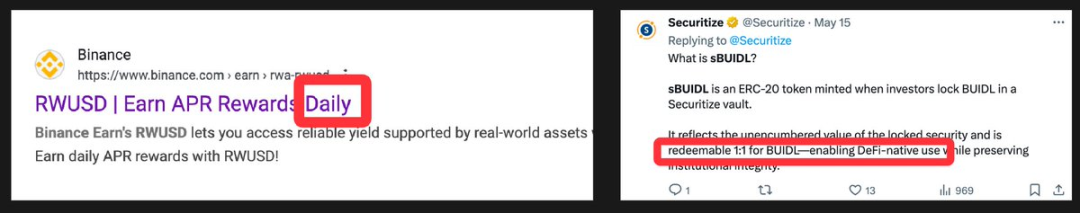

- Interest-earning positions: Short-term government bonds offer the lowest risk, but there are trade-offs. BlackRock's BUIDL product requires real-name verification (KYC), while other similar products with less restrictive regulations lack liquidity. The on-chain monthly yield reset mechanism introduces operational complexity, while Binance's daily annualized yield product, RWUSD, demonstrates the advantages of centralized exchanges. While interest-earning stablecoins have potential, they generally lack sufficient liquidity to support perpetual contract trading.

- Separating collateral and margin through lending: Borrowing USDC as margin using native assets as collateral can increase flexibility. For example, using 1 BTC as collateral, borrow USDC for trading margin. Drift's model allows assets such as SOL to be used as collateral based on the loan-to-value ratio (LTV), and all transactions are settled in USDC. However, there are significant differences in the risk systems of lending and perpetual contracts: in lending scenarios, failed liquidations will result in bad debts (because there is no automatic position reduction mechanism); in addition, there are very few participants willing to invest in insurance, resulting in bad debts ultimately being borne by the lender. Centralized exchanges can set risk limits and use profits to cover occasional losses, but this is difficult to achieve in the DeFi field because most liquidation proceeds belong to the liquidators and the protocol itself lacks risk buffer funds.

- Hedge Identification in Margin Systems: Smart margin systems should be able to identify "naturally hedged" positions to reduce margin requirements. For example, when using USDE as collateral while shorting Ethereum (ETH), the two positions are negatively correlated (ETH collateral + ETH short), meaning that bad debts may only occur if the perpetual contract decouples by more than 90%.

in conclusion

Obviously, the future Perp DEX needs to have a capital-efficient margin system, competitive spreads, extremely low slippage, and a strategically deployed incentive mechanism to build a sustainable development path.

However, there are still key trade-offs in this area, which ultimately depend on the market philosophy of the protocol: how the platform handles unlimited open contracts, how to accommodate large traders, how to balance the execution preferences of retail investors and high-frequency traders, and how to coordinate trader protection and system security - these subtle differences will greatly affect the platform's user base and usage scenarios.

"Decentralization" is often misunderstood in this space. Most Perp DEXs simply shift centralized risk from the "custody stage" to the more hidden "execution" and "liquidation" stages. High-quality protocols should be designed with core values in mind and consistently maintain robust market integrity. Currently, with the help of advanced infrastructure such as LayerZero and Monad, new design solutions are constantly emerging, heralding the arrival of a new generation of Perp DEXs.