While cryptocurrency players are paying attention to Trump's health controversies and waiting for possible gambling opportunities, a coin called $CARDS has attracted the attention of players with its performance of rising nearly 10 times from September 2 to the present, with its market value once exceeding US$400 million.

$CARDS is the token of Collector Crypt, a physical Pokémon card trading platform on Solana. Collector Crypt announced the completion of a seed funding round in February 2023. The amount was undisclosed, with participation from GSR, Big Brain Holdings, FunFair Ventures, Genesis Block Ventures, Master Ventures Investment Management, StarLaunch, and Telos.

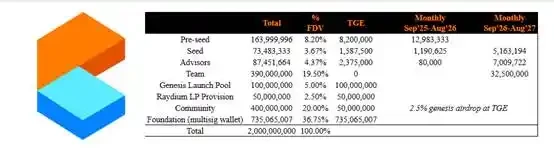

Despite completing its seed round two and a half years ago, $CARDS’ presale only launched last week. 5% of the token supply (100 million $CARDS) was allocated to the presale, ultimately raising 16,500 SOL (approximately $3.5 million USD) from 718 participants.

In addition, of the 20% of tokens allocated to the community, 2.5% are available for redemption alongside pre-sale tokens. According to the official tokenomics release, if tokens held by the project are not counted in the initial circulation (the project claims there are no current sales plans), the current circulating supply of $CARDS is approximately 212 million.

Based on market prices, the tokens unlocked during the pre-seed round, seed round, and TGE by advisors are currently worth approximately $1.67 million.

Officials say there are currently no plans to sell tokens

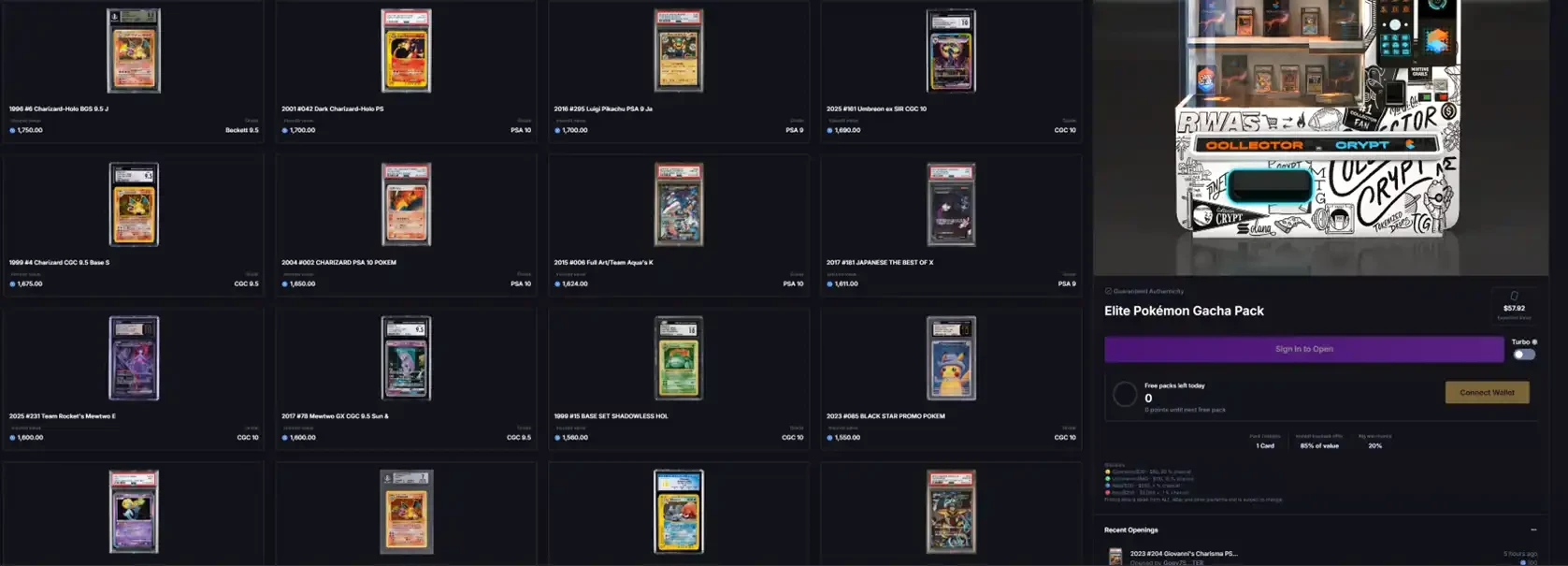

In fact, if we look at what the project itself does, Collector Crypt's on-chain trading of Pokémon cards is not that novel.

Courtyard.io on Polygon has also been running for over two years. Last month, Courtyard's monthly sales hit a new high of approximately $78.43 million. Since February of this year, Courtyard's monthly sales have exceeded $40 million.

Courtyard's rapid growth this year may be the reason for its significant funding. On July 28, Fortune reported that Courtyard had secured $30 million in Series A funding, led by Forerunner Ventures and joined by existing investors such as NEA and Y Combinator.

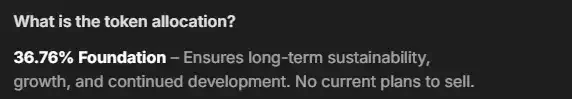

We reported on Courtyard in August 2023, when it first attracted the attention of a small number of NFT players. At that time, some NFT players had already obtained Pokémon cards through Courtyard and used them for collateral loans on the chain.

In addition to Collector Crypt and Courtyard, other encryption projects doing similar business include Beezie, Drip, Emporium and phygitals.

However, Collector Crypt is the only one of these projects to have issued a token, giving $CARDS an advantage. Of course, Collector Crypt itself is also quite strong. Last month, its monthly trading volume reached approximately $44 million, not far behind Courtyard.

You may wonder, is there really so much real demand for trading Pokémon cards on the chain?

The answer is no. Whether it's Collector Crypt or Courtyard, their actual money-making business is the gambling-style "blind box" business.

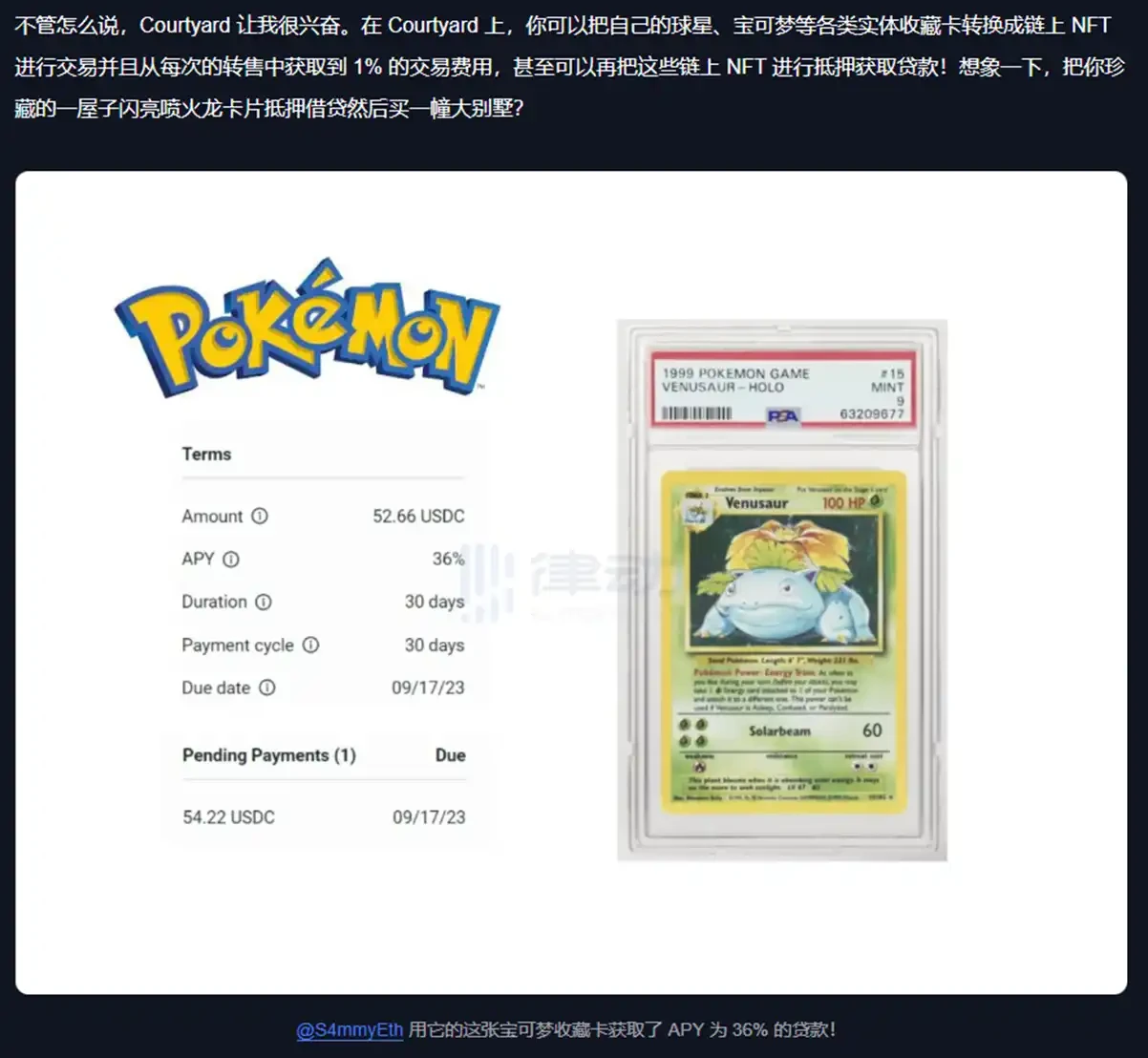

The picture above shows Collector Crypt's Pokémon card gacha machine system. For about $60, you have an 80% chance of winning a card worth $30-$60, a 15% chance of winning a card worth $60-$110, a 4% chance of winning a card worth $110-$250, and a 1% chance of winning a card worth $250-$2000.

What if you get a bad card? No problem, you can sell it back to the Collector Crypt at an 85% discount and keep drawing.

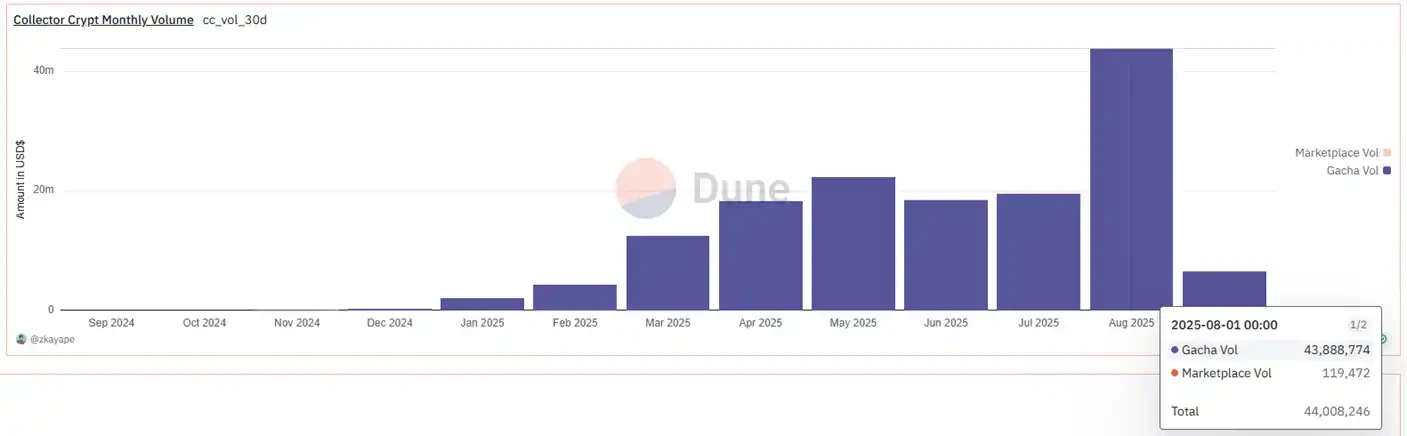

Collector Crypt's lottery system officially launched in January of this year, generating approximately $2 million in sales that month. This figure grew to $12.55 million in March, $22.31 million in May, and $43.89 million last month. Last month, the Collector Crypt card trading market only saw approximately $120,000 in sales.

On the Collector Crypt monthly total sales bar chart, the share from the card trading market is almost completely invisible.

While direct sweepstakes revenue data isn't available, Courtyard's previous interviews offer a glimpse into just how profitable the sweepstakes business is. In an interview with Fortune last month, Courtyard reported that it buys back sweepstakes cards from customers at 90% of their value and then resells them to customers in new sweepstakes packs, generating revenue. The same card is sold an average of eight times per month on the platform.

Despite this, it's still difficult to say that the $CARDS rally was a result of market-driven "price discovery." From the pre-sale until two days ago, the price of $CARDS was sluggish, and those who participated in the pre-sale even felt like they'd "lost again."

But the addition of Pow and Gake significantly changed the price trend. After they both tweeted about $CARDS, everyone started to believe it.

At this point, we can make a summary of $CARDS:

- The business narrative is not new, but the revenue is quite impressive, making it the absolute leader in this field on Solana.

- The demand is real, but it is not the demand for Pokémon card trading itself, but the gambling-style demand for "lottery", and the same is true for other projects in the same track.

- Other projects in the same field have not yet issued tokens, so there are currently no competing projects with the same concept on the market.

- The number of token holders is not large, and the current rise is more due to the "leading" orders.

There is real stuff, but it remains to be seen whether $CARDS can continue to maintain momentum after the sentiment-driven rally.

- 核心观点:$CARDS币短期暴涨源于博彩需求与喊单推动。

- 关键要素:

- 平台月抽奖收入达4389万美元。

- 同赛道项目暂未发币,无竞品。

- KOL喊单推动币价短期暴涨。

- 市场影响:或引发类似博彩概念代币炒作。

- 时效性标注:短期影响。