Original author: Grayscale

Original translation: TechFlow

- Regulatory clarity for digital assets in the United States has been a long time in the making — and while the path forward is still unfolding, policymakers have made meaningful progress this year.

- The market's focus on favorable regulations may have contributed to Ethereum's outperformance. Ethereum is a leader in the blockchain finance market and therefore could benefit if regulatory clarity boosts the adoption of stablecoins, tokenized assets, and/or decentralized finance applications.

- Digital asset treasuries (DATs)—publicly listed companies that hold cryptocurrencies on their balance sheets—have proliferated in recent months, but investor demand may be reaching a saturation point. Valuation premiums for large-scale projects are compressing.

- Bitcoin prices briefly hit an all-time high of around $125,000, but ended the month lower. While August wasn’t as volatile as other months, pressure surrounding the Federal Reserve’s independence reminded investors why Bitcoin remains a popular currency.

In August 2025, the total cryptocurrency market capitalization stabilized at around $4 trillion, but there was significant sectoral volatility within the market. The crypto asset class encompasses a wide range of software technologies with distinct fundamental drivers, so token valuations don’t always move in sync.

While Bitcoin prices declined in August, Ethereum gained 16%. [1] The second-largest public blockchain by market capitalization appears to be benefiting from investor concern about regulatory changes, which could support the adoption of stablecoins, tokenized assets, and decentralized finance (DeFi) applications—areas in which Ethereum currently leads the industry.

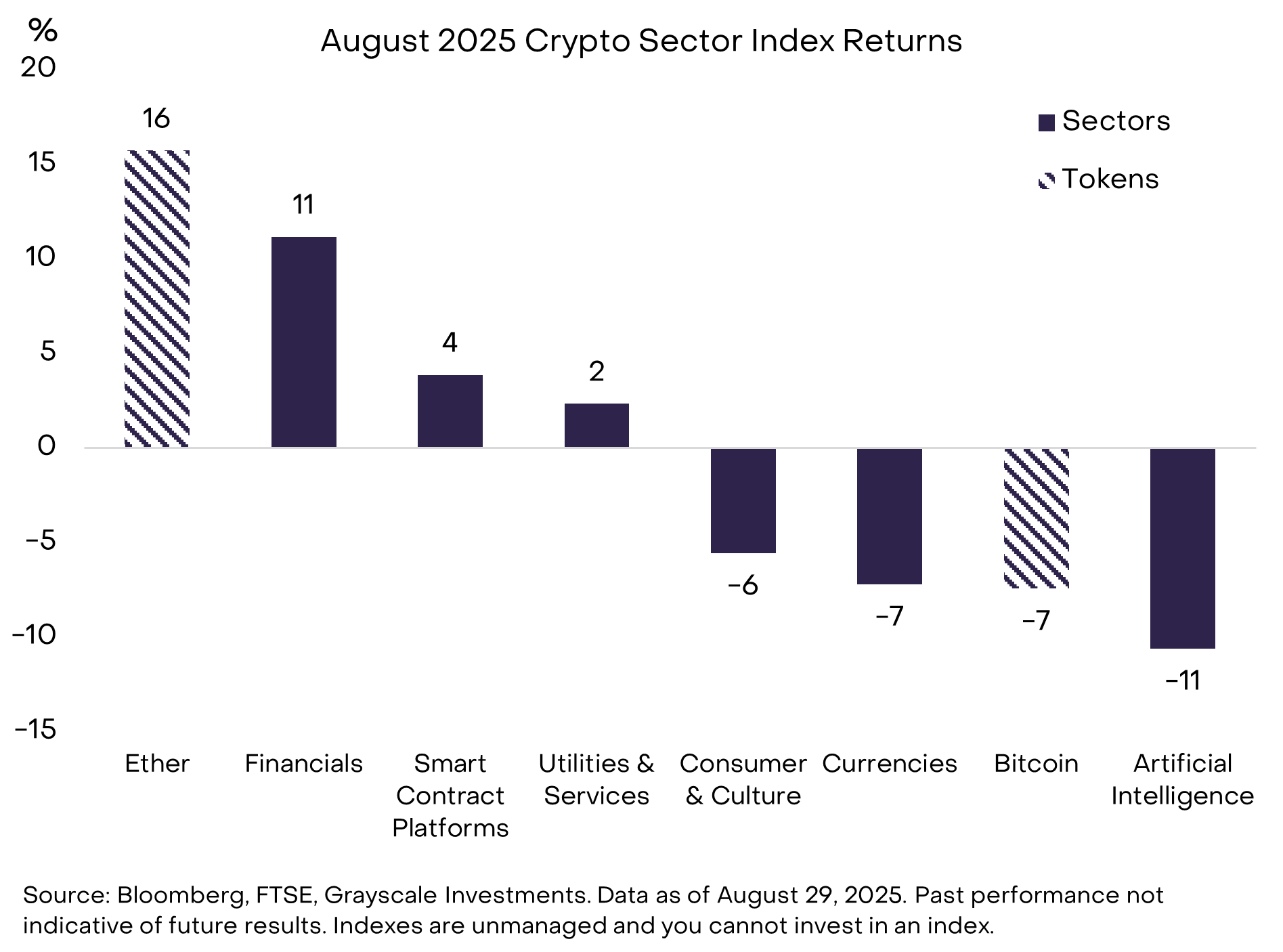

Figure 1: According to the Crypto Sectors framework (a digital asset classification and index product developed in partnership with FTSE/Russell), market sectors saw significant shifts in August. The Currency, Consumer & Culture, and Artificial Intelligence (AI) crypto sector indices all saw small declines, with the AI sector's weakness reflecting the underperformance of AI-related stocks in the public equity market. Meanwhile, the Financials, Smart Contract Platforms, and Utilities & Services sector indices saw gains during the month. While Bitcoin's price declined month-over-month, it reached a record high of approximately $125,000 in mid-August; Ethereum also hit a record high of nearly $5,000. [2]

Figure 1: Significant rotation into the crypto sector in August

The GENIUS Act and the Future

We believe that Ethereum’s recent outperformance is primarily due to improving fundamentals, most importantly the increased regulatory clarity for digital assets and blockchain technology in the United States. One of the most impactful policy changes this year was the passage of the GENIUS Act in July. This legislation provides a comprehensive regulatory framework for payment stablecoins in the US market (for background, see “Stablecoins and the Future of Payments” ). Ethereum is the leading stablecoin blockchain today (in terms of transaction volume and balances), and the passage of the GENIUS Act drove Ethereum’s price up nearly 50% in July , [3] and continued to push its price higher in August.

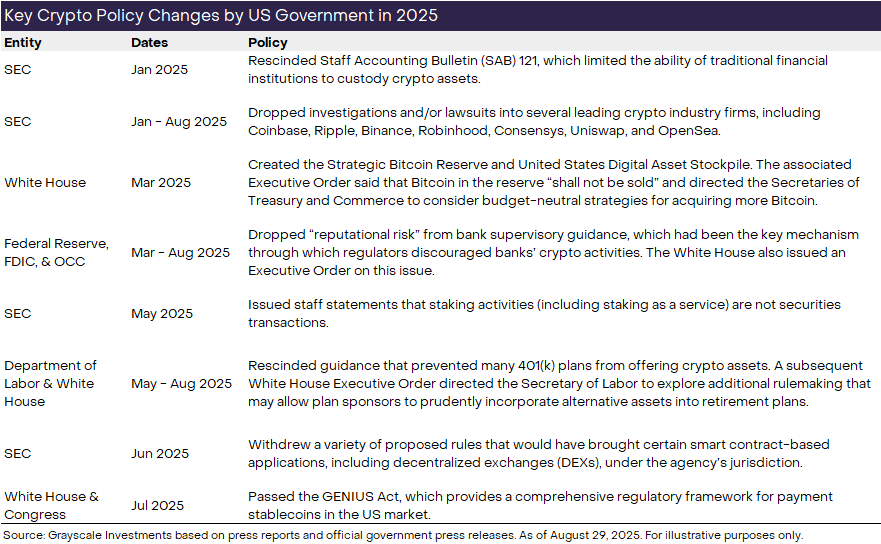

However, this year's US policy changes extend beyond stablecoins, encompassing a range of topics from crypto asset custody to banking regulatory guidance. Looking ahead, these changes are likely to further drive institutional investment into the crypto industry. Based on our observations, the most significant policy actions taken by the Trump administration and federal agencies in the digital asset sector are summarized in Figure 2. These policy changes, and the potential for more to come, are triggering a wave of institutional investment in the crypto industry (for more details, see "March 2025: The Institutional Chain Reaction" ).

Figure 2: Policy changes bring greater regulatory clarity to the crypto industry

In August of this year, Federal Reserve Board Governors Waller and Bowman both attended a blockchain conference in Jackson Hole, Wyoming, a scene that would have been unimaginable a few years ago. The conference was held immediately after the Federal Reserve’s annual Jackson Hole Economic Policy Conference. In their speeches, they emphasized that blockchain should be regarded as a financial technology innovation and that regulators need to find a balance between maintaining financial stability and creating space for the development of new technologies. [4]

As of September, the U.S. Senate Banking Committee plans to review crypto market structure legislation—regulations that would cover crypto market-related issues beyond stablecoins. The Senate effort builds on the CLARITY Act, which was passed by the House of Representatives with bipartisan support in July. Senate Banking Committee Chairman Scott said he expects the market structure legislation to also receive bipartisan support in the Senate. [5] However, there are still significant issues to be resolved. Industry groups are particularly concerned about ensuring that market structure legislation protects the interests of open source software developers and non-custodial service providers. This issue is likely to continue to spark debate among lawmakers in the coming months. (Notably, Grayscale was one of the signatories of a recent opinion letter submitted by industry groups to members of the Senate Banking and Agriculture Committees.)

Have you had enough of DAT?

In August, Bitcoin underperformed while Ethereum outperformed, a trend evident in fund flows across multiple trading platforms and products.

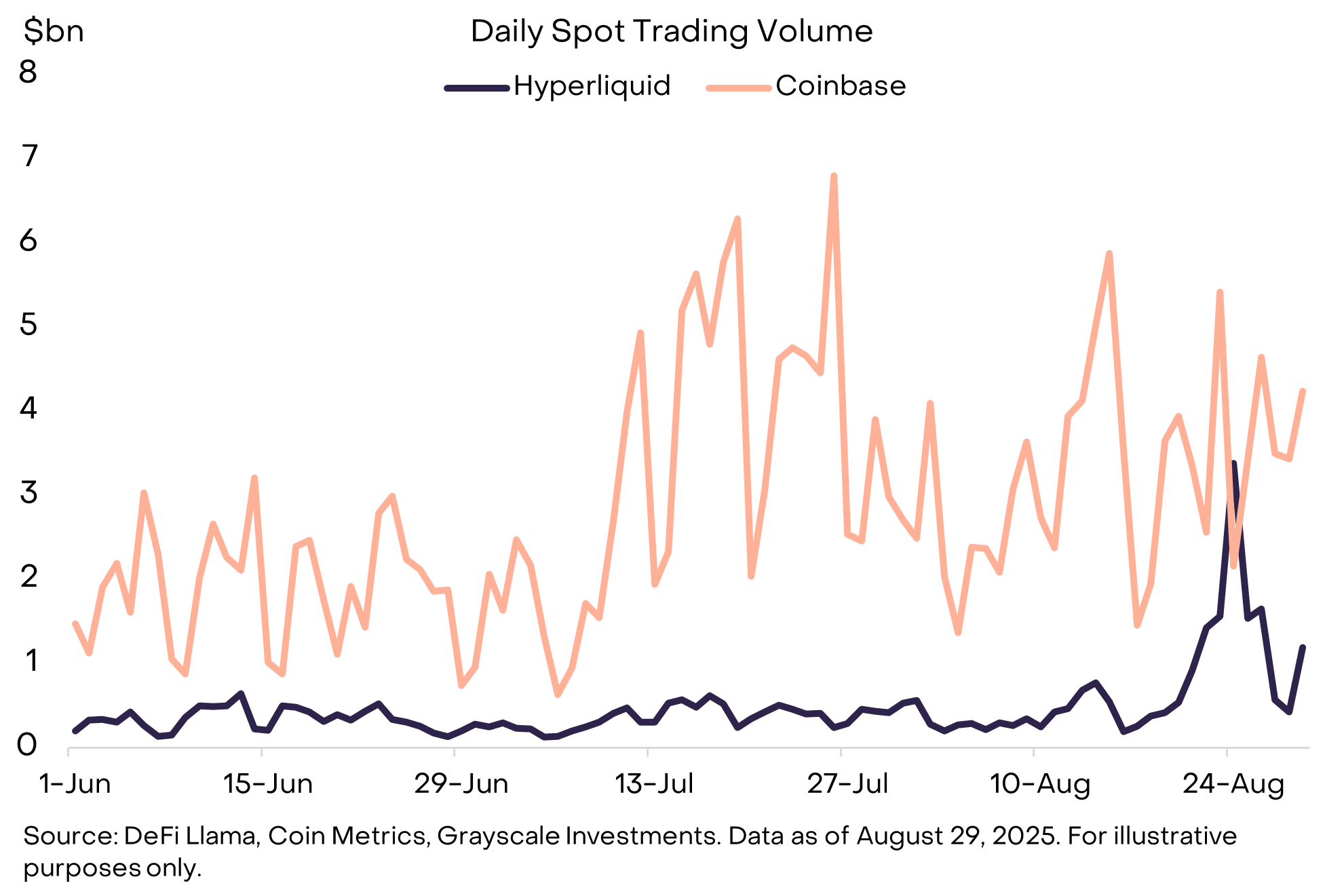

Part of the drama took place on Hyperliquid, a decentralized exchange (DEX) that offers spot trading and perpetual contracts ( for background, see “The Allure of DEXs: The Rise of Decentralized Exchanges ” ) . Starting on August 20th, a single Bitcoin “whale” (an investor holding a large amount of BTC) sold approximately $3.5 billion in BTC and immediately purchased approximately $3.4 billion in ETH. [6] While we cannot speculate on the investor’s motivations, the fact that this scale of risk transfer occurred on a DEX rather than a centralized exchange (CEX) is encouraging. In fact, on its highest trading day of the month, Hyperliquid’s spot trading volume briefly surpassed Coinbase’s spot trading volume (see Figure 3).

Figure 3: Hyperliquid spot trading volume surges

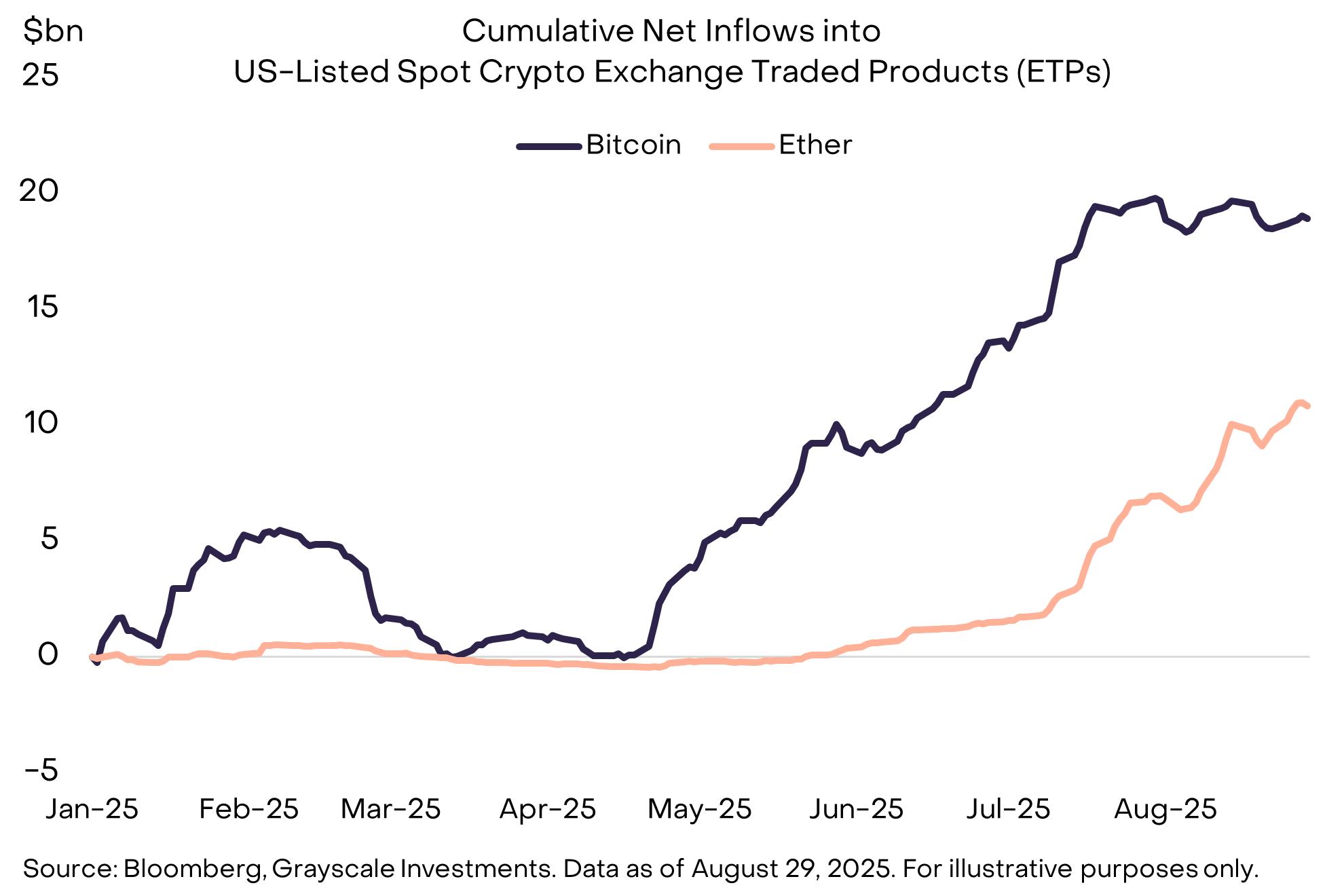

Similar ETH preferences were also reflected in net inflows into crypto exchange-traded products (ETPs) that month. US-listed spot Bitcoin ETPs saw net outflows of $755 million in August, the first such outflow since March. In contrast, US-listed spot Ethereum ETPs saw net inflows of $3.9 billion in August, a significant increase following the $5.4 billion inflows seen in July (see Figure 4). Following the surge in ETH net inflows over the past two months, both BTC and ETH ETPs currently hold over 5% of their respective tokens' circulating supply.

Figure 4: ETP net inflows shift to ETH

Bitcoin, Ethereum, and many other crypto assets have also been supported by purchases by digital asset treasuries (DATs) . DATs are publicly traded companies that hold crypto assets and provide equity investors with exposure to cryptocurrencies. Strategy (formerly MicroStrategy), the digital asset treasury with the largest Bitcoin holdings, purchased an additional 3,666 BTC (approximately $400 million) in August. Meanwhile, the two largest Ethereum treasuries purchased a combined 1.7 million ETH (approximately $7.2 billion). [7]

According to media reports, at least three new Solana DATs are in the works, including one funded by Pantera Capital and a consortium consisting of Galaxy Digital, Jump Crypto, and Multicoin Capital, with a total investment exceeding $1 billion. [8] Additionally, Trump Media & Technology Group announced plans to launch a DAT based on the CRO token, which is associated with Crypto.com and its Cronos blockchain. [9] Other recent DAT announcements have focused on Ethena’s ENA token, Story Protocol’s IP token, and Binance Smart Chain’s BNB token. [10]

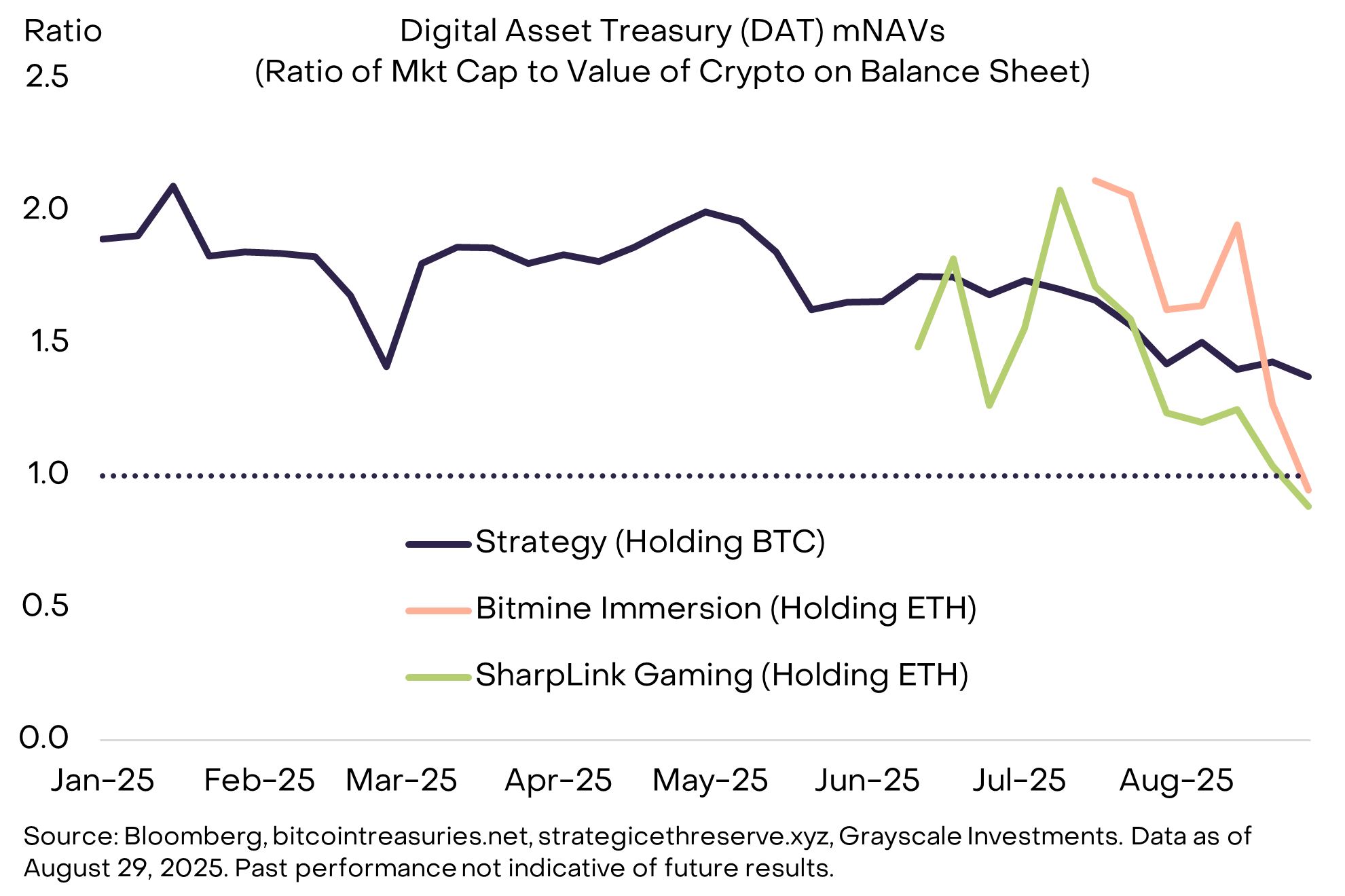

Despite promoters' continued offerings of these investment vehicles, price performance suggests that investor demand may be reaching saturation. Analysts often monitor "mNAV"—the ratio of a company's market capitalization to the value of its cryptoassets on its balance sheet—to gauge supply-demand imbalances. If there's excess demand for cryptoassets in the form of public equity instruments (i.e., insufficient DATs), mNAV can exceed 1.0; if there's an excess supply of cryptoassets in the form of public equity instruments (i.e., an oversupply of DATs), mNAV can fall below 1.0. Currently, the mNAV of several large projects appears to be approaching 1.0, suggesting that DAT supply and demand are balancing (see Figure 5).

Figure 5: DAT valuation premium is declining

Back to Basics: The Case for Bitcoin

As with all asset classes, public discussion of the crypto market often focuses on short-term issues such as regulatory changes, ETF flows, and DATs. However, taking a step back, it may be more important to reexamine Bitcoin's core investment rationale. Among the many assets in the crypto space, Bitcoin's significance lies in providing a monetary asset and peer-to-peer payment system based on clear and transparent rules, independent of any specific individual or institution. Recent threats to central bank independence have served as a further reminder of why many investors are so drawn to these assets.

For background, most modern economies utilize a "fiat" monetary system. This means the currency has no explicit backing (i.e., it's not pegged to any commodity or other currency) and its value is based entirely on trust. Throughout history, governments have repeatedly exploited this characteristic to achieve short-term goals (such as reelection). This can lead to inflation and erode trust in the fiat monetary system.

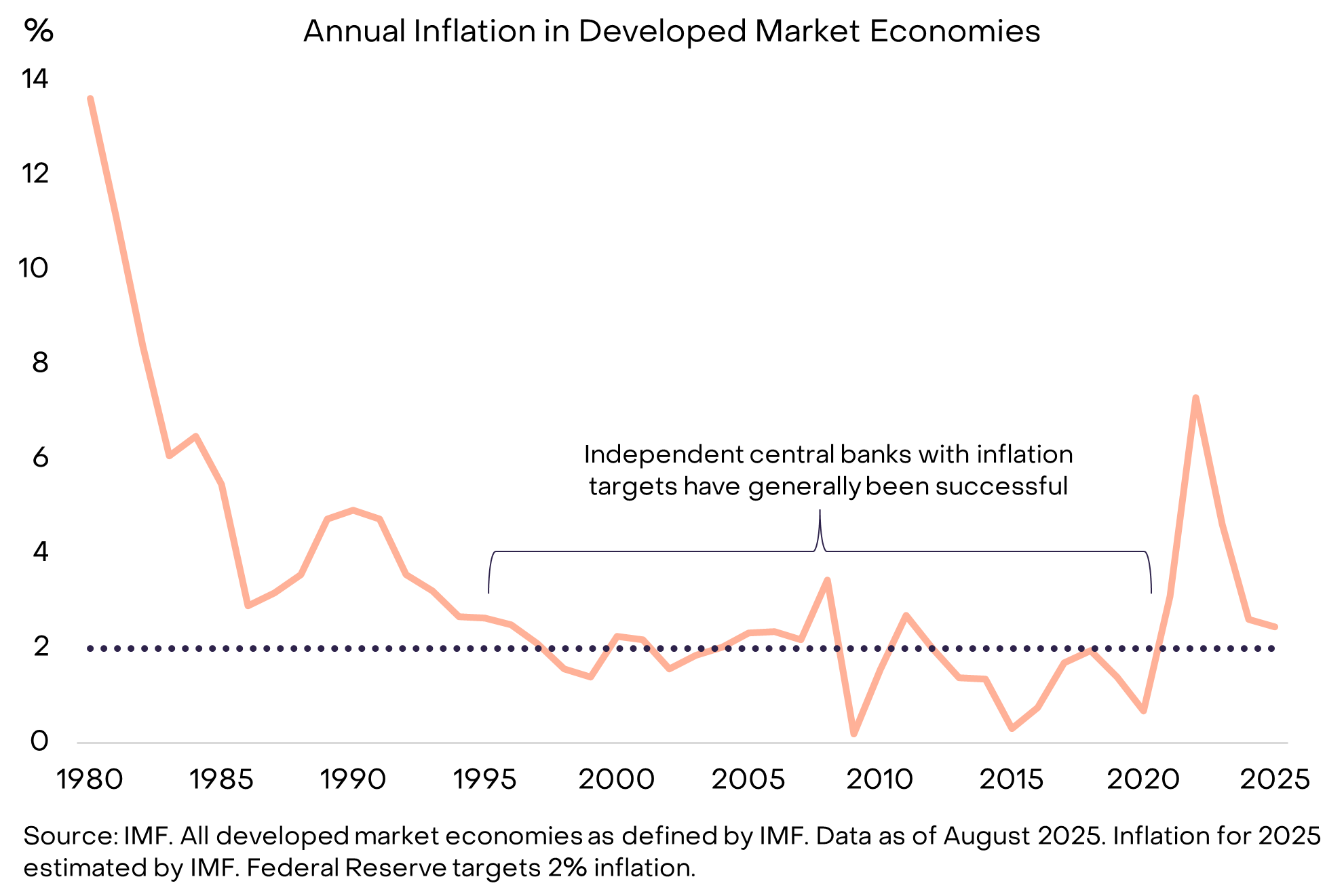

Therefore, for fiat currencies to work effectively, governments need to be able to fulfill their promises and not abuse the system. The approach taken by the United States and most developed market economies is to give central banks clear objectives (usually in the form of inflation targets) and operational independence . Elected officials typically exercise some oversight over central banks to ensure democratic accountability . With the exception of a brief post-COVID-19 spike in inflation, this system of clear objectives, operational independence, and democratic accountability has achieved low and stable inflation in major economies since the mid-1990s (Figure 6).

Figure 6: Independent Central Banks Achieve Low and Stable Inflation

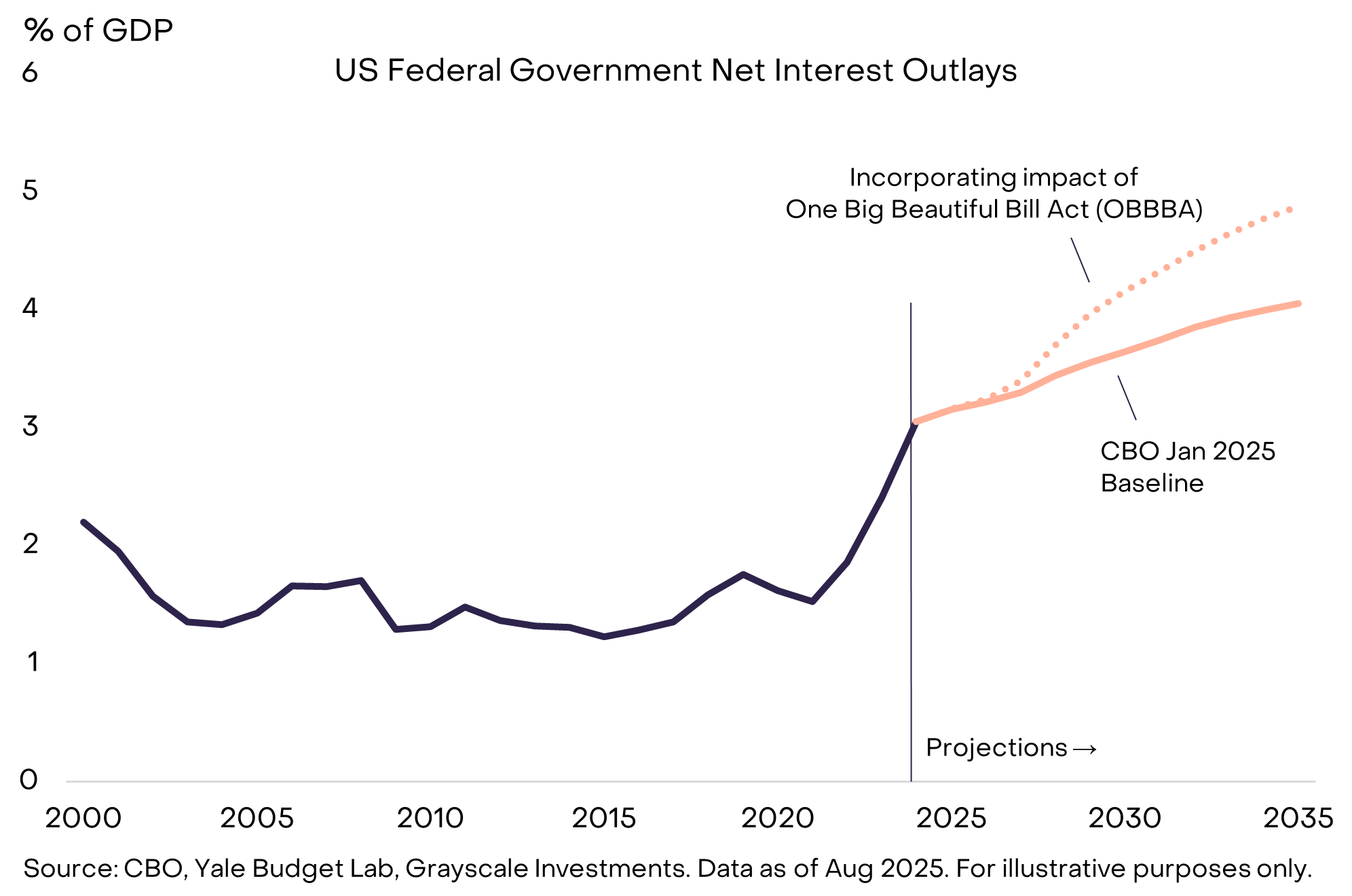

In the United States, this system is currently under strain, not fundamentally due to inflation but rather to deficits and interest payments. The US federal government's total debt currently stands at approximately $30 trillion, or 100% of GDP, the highest level since World War II, despite peacetime and low unemployment. As the Treasury refinances this debt at interest rates around 4%, interest payments continue to rise, diverting resources from other uses (see Figure 7).

Figure 7: Interest payments take up a larger share of the federal budget

The One Big Beautiful Bill Act (OBBBA), passed in July, will lock in high deficits for the next decade. Unless interest rates fall, this will mean higher interest payments and further squeeze other uses of government revenue. As a result, the White House has repeatedly pressured the Fed to lower interest rates and called for the resignation of Fed Chairman Powell. These threats to the Fed's independence escalated further in August with the removal of Lisa Cook, one of the six current members of the Fed's seven-member Board of Governors. [11] While this may benefit elected officials in the short term, the weakening of the Fed's independence increases the risk of high inflation and monetary weakness in the long term.

Bitcoin is a monetary system based on transparent rules and predictable supply growth. When investors lose confidence in the institutions that protect the fiat monetary system, they turn to more trustworthy alternatives. Unless policymakers take steps to strengthen the institutions that back fiat currencies and reassure investors about the promise of low and stable inflation over the long term, demand for Bitcoin is likely to continue to grow.

Index meaning:

- FTSE/Grayscale Crypto Sectors Total Market Index

- The index measures the price return performance of digital assets listed on major exchanges around the world, providing a reference for the overall trend of the crypto market.

- FTSE Grayscale Smart Contract Platforms CryptoSector Index

- The index is designed to assess the performance of crypto assets that support the development and deployment of smart contracts, which serve as the underlying platforms for self-executing contracts.

- FTSE Grayscale Utilities and Services CryptoSector Index

- The index focuses on measuring the performance of crypto assets designed to provide real-world applications and enterprise-level functionality.

- FTSE Grayscale Consumer and Culture CryptoSector Index

- The index assesses the performance of cryptoassets that support consumption-centric activities across a wide range of goods and services.

- FTSE Grayscale Currencies CryptoSector Index

- The index measures the performance of cryptoassets that fulfill one of three core functions: store of value, medium of exchange, and unit of account.

- FTSE Grayscale Financials CryptoSector Index

- The index specifically assesses the performance of crypto assets designed to provide financial transactions and services.

Source:

[1] Source: Bloomberg. Data as of August 29, 2025. Past performance is not indicative of future results.

[2] Source: Bloomberg. Bitcoin hit a new all-time high on August 14; Ethereum hit a new all-time high on August 24.

[3] Other organizations have recently announced Layer 1 blockchains targeting stablecoin use cases, including Circle (Arc), Stripe (Tempo), and Bitfinex (Plasma). Google also began promoting its Layer 1 GCUL in August. While Ethereum is currently the market leader, many blockchains will compete for a share of stablecoin transaction volume and associated fees.

[4] Source: Federal Reserve , Federal Reserve .

[5] Source: CoinTelegraph .

[6] Source: mempool.space, hypurrscan.io, etherscan.io, Grayscale Investments. Prices in USD as of August 29, 2025.

[7] Source: Bitcointreasuries.net, strategythreserve.xyz, Bloomberg, Grayscale Investments. Data as of August 29, 2025.

[8] Source: Unchained , CoinDesk .

[10] Source: CoinDesk , The Block , DL News .

[11] Source: The New York Times .

- 核心观点:监管利好推动以太坊领涨加密市场。

- 关键要素:

- 天才法案提供稳定币监管框架。

- 以太坊ETP净流入39亿美元。

- 比特币ETP出现7.55亿净流出。

- 市场影响:加速机构资金流入加密领域。

- 时效性标注:中期影响。