ERC-364 Explained: Why is it the most suitable token standard for RWA?

- Core point: ERC-3643 fills the compliance gap and promotes the tokenization of RWA.

- Key elements:

- Built-in identity verification and transaction limits.

- Reduce compliance costs and improve efficiency.

- Supports multiple assets such as securities and physical assets.

- Market impact: Accelerate the on-chain integration of traditional assets and enhance liquidity.

- Timeliness annotation: medium-term impact.

Original author: JAE, PANews

The "permissionless" and "anonymous" nature of the crypto world contrasts with the stringent "compliance" and "traceability" requirements of traditional finance (TradFi), creating a world of contrasting possibilities. This fundamental contradiction has been a hindrance to the large-scale tokenization of real-world assets (RWAs). Conventional token standards like ERC-20 and ERC-1400 have their own limitations, hindering the widespread adoption of RWA tokens like securities and physical assets.

Against this backdrop, ERC-3643, a token standard specifically developed to fill this "compliance gap," emerged. By embedding compliance logic directly into the token itself, it reshapes the technical components of on-chain finance and provides a "compliance engine" for RWA tokenization that ensures compliance while reducing costs and increasing efficiency. In this article, PANews introduces the features, advantages, and common use cases of the ERC-3643 standard.

ERC-3643: Token Standard for Compliant RWAs

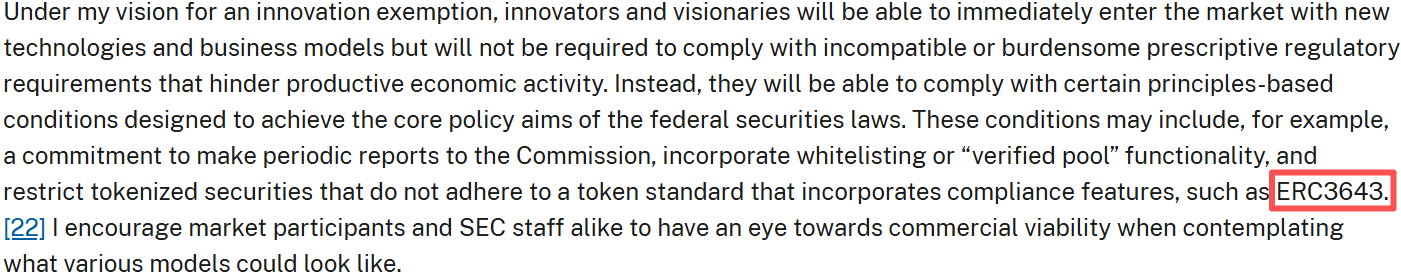

On July 31, 2025, SEC Chairman Paul Atkins delivered a speech titled "America's Leadership in the Digital Financial Revolution" and announced the launch of "Project Crypto." ERC-3643 was explicitly mentioned, becoming the only standard publicly cited in the speech. Atkins stated that when the SEC develops its innovative exemption framework, it will prioritize token standards with "built-in compliance." ERC-3643 integrates identity verification, permission control, and trading restrictions, directly meeting the Know Your Customer (KYC)/AML (anti-money laundering) and accredited investor requirements of the Securities Act.

ERC-3643 evolved from the T-REX (Token for Regulated EXchanges) protocol. It is a set of technical standards designed specifically for regulated assets that can enable the issuance, management, and transfer of "permissioned tokens."

Before the rise of RWA tokenization, ERC-20 was the most adopted token standard on Ethereum, prioritizing simplicity and interoperability, operating in a "trustless" environment, and allowing free and anonymous transfers between any wallets.

However, the inherent permissionlessness of ERC-20 makes it unsuitable for RWA tokenization. RWAs require regulatory compliance, including jurisdictional restrictions, identity verification (KYC/AML), and investor checks. ERC-20, on the other hand, grants holders personal sovereignty over their assets, allowing them to be managed, held, or transferred to other anonymous users, making it incompatible with regulatory compliance logic.

In contrast, ERC-3643 can be seen as a "compliant version" of ERC-20. While retaining compatibility, it also designs unique features such as token authentication, conditional transfers, and compliance reviews through smart contracts.

Another set of compliant token standards, ERC-1400, appeared earlier than ERC-3643. It is specifically aimed at security tokens and adds transfer restrictions and includes transaction regulatory documents.

ERC-3643 is also an upgraded version of ERC-1400. In terms of compliance management, ERC-3643 focuses more on dynamic global compliance. In terms of asset class support, ERC-3643 is compatible with a wider range of asset classes. In terms of technical efficiency and scalability, ERC-3643's storage mechanism is more efficient, helping to reduce gas fees, and it is easier to expand to add new features.

The evolution from ERC-20, ERC-1400, and ERC-3643 reflects the crypto industry's ongoing "token compliance arms race," with standards continually refined to meet increasingly complex regulations. ERC-20 exposed its limitations in tokenizing RWAs; ERC-1400 addressed the compliance requirements for security tokens; and ERC-3643 addressed the need for dynamic global compliance and compatibility across a wider range of asset classes. The historical evolution of token standards demonstrates the market's active development of solutions to bridge the gap between technological innovation and regulatory compliance, with ERC-3643 marking a significant milestone in this iterative process.

Reducing costs and increasing efficiency: ERC-3643 reshapes the RWA issuance process

The issuance cost of RWA has also catalyzed the crypto industry's demand for tokenization solutions, that is, reducing costs through technological means.

The core reason for the high issuance costs of RWAs lies in the conflict between trustless on-chain transactions and real-world regulatory compliance, which leads to reliance on intermediaries and ongoing compliance expenses. Traditional financial intermediaries such as brokerages ensure compliance through manual review, transaction monitoring, and offline processes, which are the main cost items of RWA projects.

In the face of this challenge, ERC-3643 provides a new approach to RWA tokenization, which is to reduce long-term compliance expenses and improve overall efficiency through automation and standardization.

Therefore, ERC-3643 may become a key technology connecting TradiFi and crypto assets. It introduces a paradigm shift, with its core mechanism summarized as: permissioned tokens + on-chain identity (ONCHAINID). The core of ERC-3643 lies in the fact that its tokens are not freely transferable. Each transfer requires mandatory verification of the sender and receiver's identity and qualifications at the protocol level, requiring both parties to meet the necessary on-chain compliance. This provides assets with the advantages of blockchain (such as instant settlement and programmability) without sacrificing regulatory oversight.

Developing "permissioned tokens" on-chain not only meets regulatory compliance requirements but also maintains the transparency and efficiency of distributed ledgers. While permissionless systems embody the ideal of pure decentralization, they are often incompatible with actual regulatory frameworks. ERC-3643 offers a hybrid model: the underlying public chain remains decentralized, providing transparency and consistency, but access to specific assets on the chain is controlled. This design allows accredited investors to participate in the broader crypto ecosystem, benefiting from ample liquidity while fulfilling necessary regulatory compliance obligations. This model may also become a key driver of blockchain integration into TradFi.

ONCHAINID, the decentralized identity (DID) framework built into ERC-3643, is a key module for achieving compliance. It ensures that only permitted users who meet predefined criteria can become token holders. Once investors complete KYC/AML verification off-chain, their identities are mapped on-chain and associated with specific wallet addresses. This system forms the foundation of "native compliance," preventing non-compliant entities from acquiring or holding tokens.

The ONCHAINID framework can also be associated with token smart contracts to represent the "identity" of assets, effectively acting as an "on-chain copy" of assets and adding any claims throughout the token's lifecycle. Its high transparency and immutable log entries enhance auditability and trust, reducing the trust risk of entrusting intermediaries.

The ONCHAINID contract is not tied to a specific token, meaning each user only needs to deploy it once, and their identity can be reused for multiple asset class issuances. Its reusability is a key design choice that significantly improves the investor user experience and accelerates the development of the ecosystem. In TradFi, each new investment vehicle typically has to go through the KYC/AML process again, which creates a cumbersome user experience for investors. By allowing a single verified ONCHAINID to be used in various issuances based on the same standards, ERC-3643 simplifies the investor onboarding process. This "verify once, reuse multiple times" model encourages investors to participate in a wider range of RWA issuances, thereby increasing the liquidity and market depth of the entire ecosystem.

Compliance logic is automatically enforced at the smart contract level. Transfers of ERC-3643 tokens must meet both investor and issuance rules to be processed. This effectively prevents tokens from flowing into unauthorized wallets. It also means that token issuers can set and update transfer rules at any time, such as whitelisting transactions, freezing designated accounts, or forcing transfers.

The value proposition of ERC-3643 lies in translating off-chain regulatory requirements into on-chain, automatically executed "compliance logic" through code, fundamentally transforming the compliance mechanism of RWAs. Traditional compliance processes are complex and costly, but ERC-3643 enables real-time, automated, and tamper-proof compliance checks by embedding compliance logic within token contracts. This not only reduces audit and legal costs in long-term operations, but also improves transparency and transaction efficiency.

From Traditional Assets to Emerging Assets: ERC-3643's Diverse Use Cases

As a compliant native token standard, ERC-3643 has a wide range of application scenarios, and its programmability can provide tokenization solutions for multiple asset classes.

Securities assets are the most mature and common application scenario for ERC-3643, applicable to the issuance and transfer of traditional financial instruments such as stocks, bonds, and funds. Through ERC-3643, issuers can embed governance rules such as dividend distribution and voting rights, along with on-chain compliance logic, into smart contracts, ensuring that only accredited investors can hold and trade tokens. For example, in 2023, ABN AMRO issued a €5 million green bond on Polygon using the ERC-3643 standard, directly demonstrating the feasibility of issuing regulated assets on public chains. Furthermore, ERC-3643 can also help reduce costs, improve liquidity and transparency, and expand the investor base.

ERC-3643 also makes it possible to bring physical assets onto the blockchain, enabling fractional ownership, automated asset management, and simplified physical asset trading. Physical assets primarily include real estate, commodities (such as precious metals, agricultural products, and crude oil), and art (such as collectibles and luxury goods). Through its "fractional ownership" feature, ERC-3643 divides high-value physical assets into smaller tokens and encodes transfer rules. This significantly lowers the investment threshold and provides greater liquidity. It also addresses the inherent challenges of identity verification and jurisdictional restrictions associated with physical assets. For example, Inveniam Capital Partners used ERC-3643 to tokenize $260 million worth of US commercial real estate, granting investors fractional ownership and secondary market access.

Furthermore, ERC-3643 is exploring applications in emerging asset classes. Carbon credits, as green assets, typically require strict traceability and trading management. ERC-3643 can be used to issue and manage carbon credit tokens, ensuring that their transactions adhere to specific compliance requirements. ERC-3643 will provide a transparent, traceable, and regulatory-compliant on-chain infrastructure for the global carbon market. ERC-3643 can also tokenize intellectual property, allowing creators and inventors to commercialize their works or rights. Smart contracts automatically distribute royalties or revenue to token holders, reducing significant labor costs and operational errors while ensuring fair and timely distribution of returns.

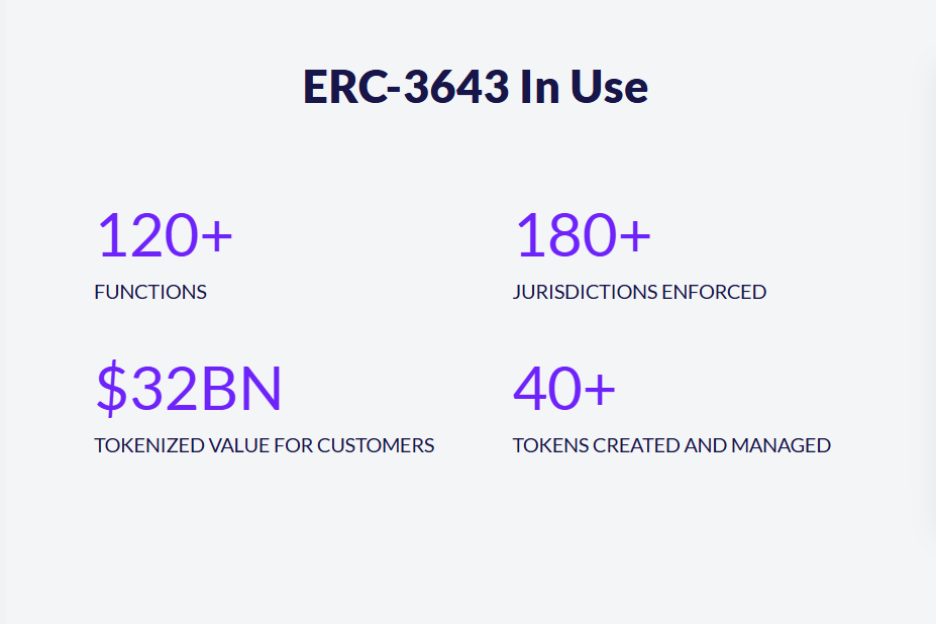

To date, ERC-3643 has demonstrated significant traction, supporting over 120 functions, complying with regulations in over 180 jurisdictions, tokenizing over $32 billion in assets, and creating and managing over 40 tokens, laying a solid foundation for mass adoption.