Lazy Money Management Guide | Linea Launches 1 Billion Token Liquidity Incentive; Jupiter Lend One-Click Revolving Loans Amplify Returns (September 3rd)

- 核心观点:Linea启动流动性激励计划吸引资金。

- 关键要素:

- Linea分发10亿代币激励流动性。

- Jupiter Lend上线提供稳定币借贷。

- Cap集成Pendle提升积分和收益。

- 市场影响:增加稳定币理财机会和收益。

- 时效性标注:短期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

This column aims to cover the current low-risk return strategies based on stablecoins (and their derivative tokens) in the market (Odaily Note: code risks can never be ruled out), to help users who hope to gradually expand their capital scale through U-based financial management to find more ideal interest-earning opportunities.

Previous records

New opportunities

Linea Launches Liquidity Incentive Program

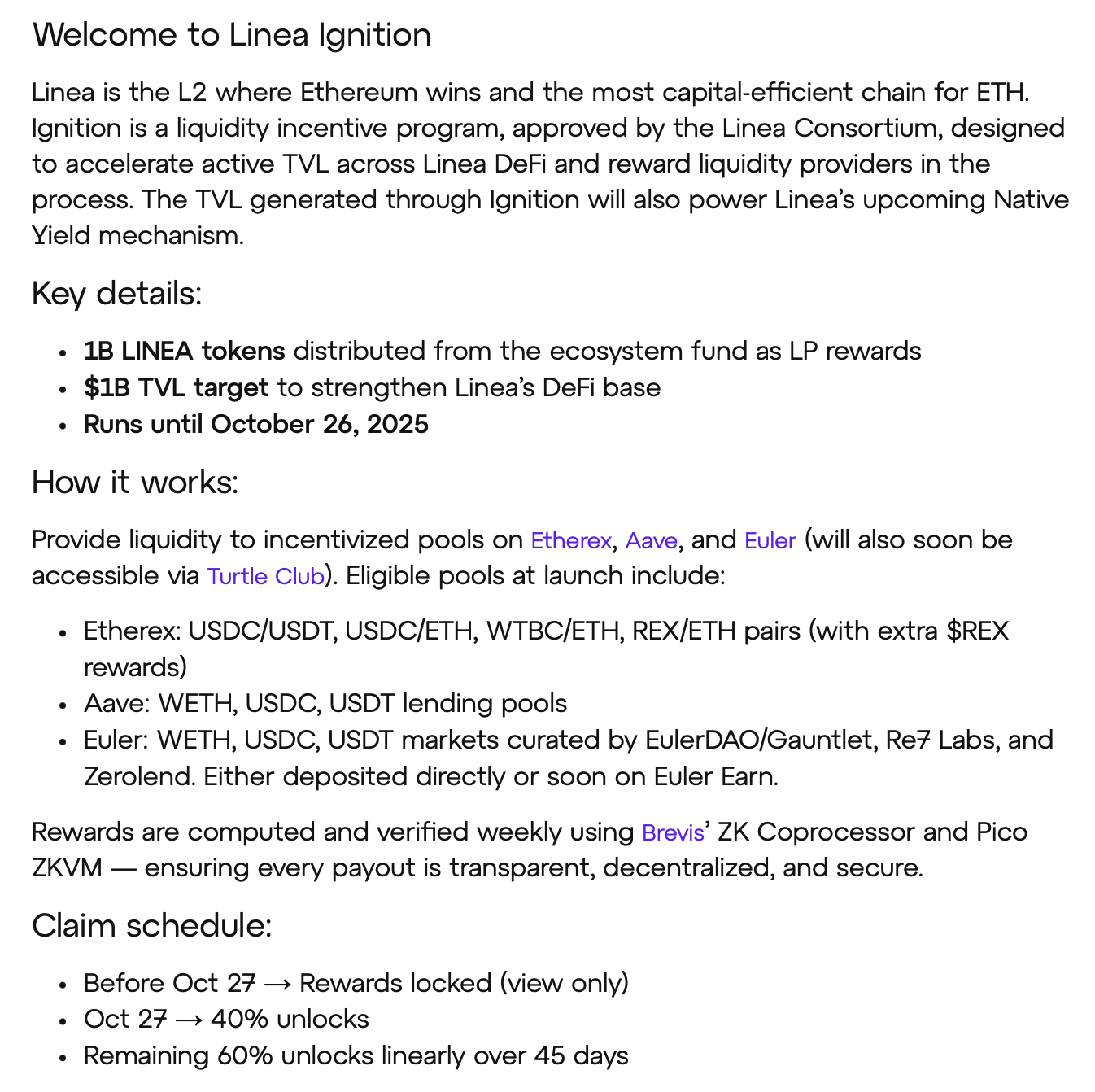

Last night, Linea officially announced that it will launch the liquidity incentive program Linea Ignition, planning to distribute 1 billion LINEA tokens as incentives to attract an additional $1 billion TVL for Linea.

The event will last until October 26, 2025. Eligible partnerships during the launch phase include Ethereum, Aave, and Euler (with Turtle Club expected to be added later). Participating liquidity pools include:

- Etherex: USDC/USDT, USDC/ETH, WTBC/ETH, REX/ETH trading pairs (including additional REX rewards)

- Aave: WETH, USDC, USDT lending pool;

- Euler: A WETH, USDC, USDT pool managed by EulerDAO/Gauntlet, Re7 Labs, and Zerolend. You can deposit directly or participate through Euler Earn (coming soon).

In terms of rewards, 40% of the incentive tokens will be unlocked on October 27, and the remaining 60% will be unlocked linearly within 45 days.

As of the time of writing, LINEA is currently trading at $0.033 in the Binance pre-market. Based on this static price, 1 billion tokens correspond to a total prize pool of approximately $33 million. Considering that the entire event cycle is not long, although the tokens have certain lock-up restrictions, the unlocking period is also very short, so it is still quite cost-effective to participate - it is recommended to deposit Aave without thinking, and you can consider taking out some revolving loans appropriately.

Jupiter Lend is now live

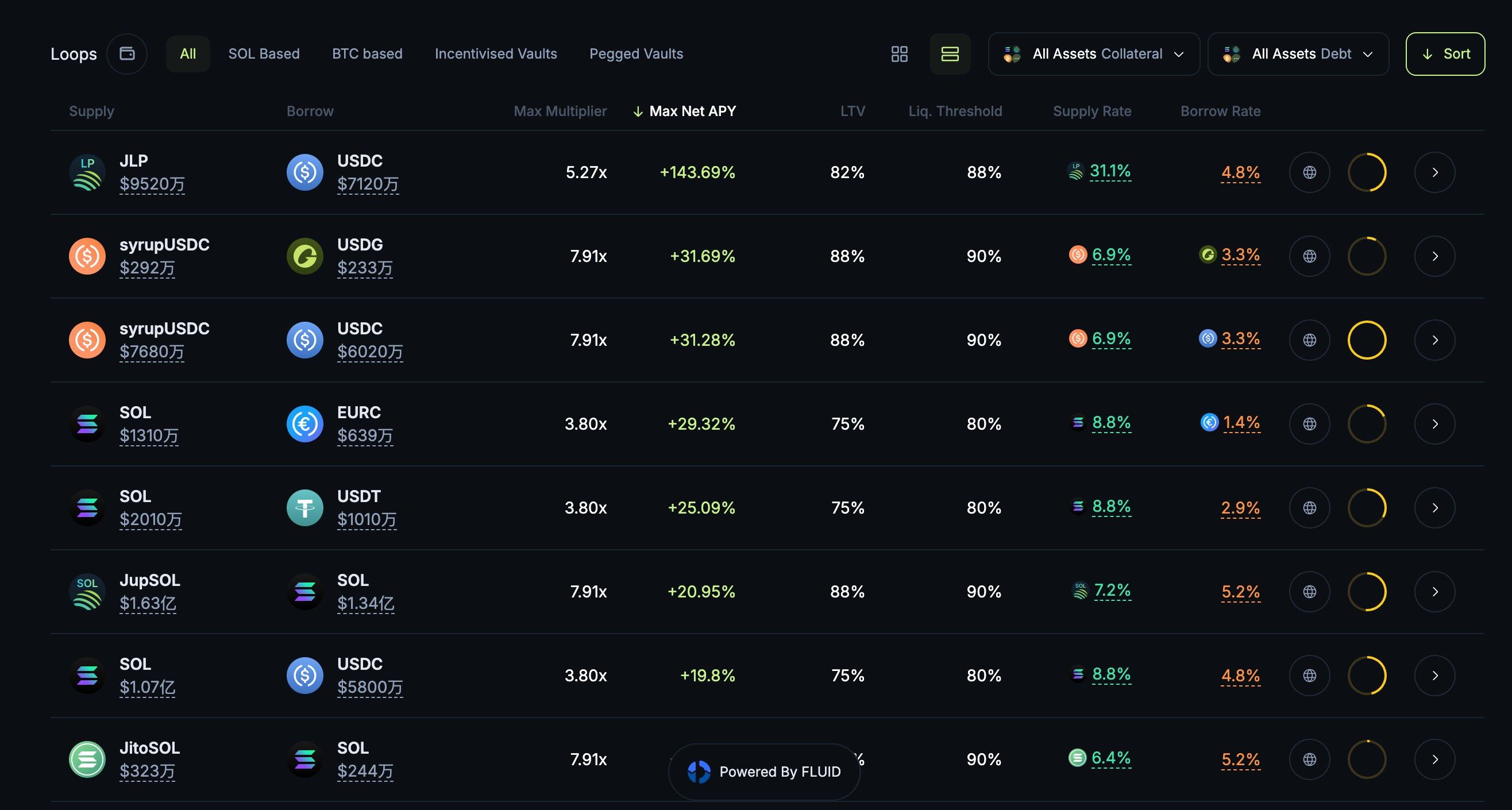

Jupiter Lend, a lending product launched in collaboration with Fluid, was officially launched last week and has quickly become one of the most popular lending protocols in the Solana ecosystem.

Currently, the annualized return of stablecoins such as USDC, USDT, and USDS deposited directly in Jupiter is generally slightly below 10%. Although this is not high, it has the advantage of the security endorsement of Jupiter and Fluid, and the rewards will be issued in the form of corresponding stablecoins (for Kamino, which has relatively high returns, part of the returns will be issued in the form of KMNO).

In addition, Jupiter Lend's built-in one-click revolving loan function (Multiply) is quite easy to use. Users with relevant operating experience can use some leverage to magnify the yield rate . The most recommended here is actually SOL holding users. The revolving loan risk of JupSOL/SOL is more controllable, and the income is relatively considerable among all SOL interest-bearing products.

Cap further integrates Pendle

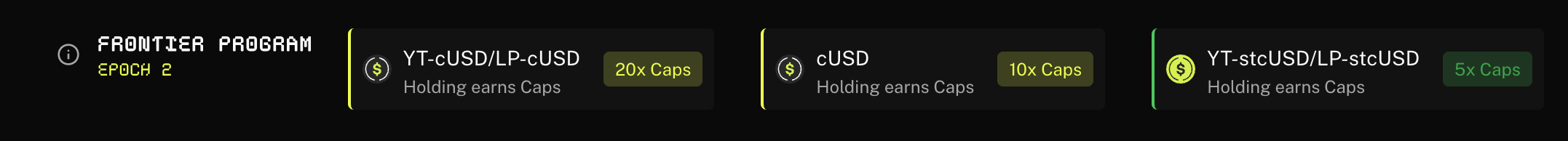

The interest-bearing stablecoin Cap mentioned last week has completed further integration with Pendle - previously only supporting the interest-bearing asset stcUSD, now it also supports the points asset cUSD.

Last week, when we recommended this, Cap was still in Epoch 1. Static cUSD holdings earned a 20x points bonus, but no annualized returns. This week, with the official launch of Epoch 2, the points multiplier for static cUSD holdings has been reduced to 10x, while still earning no annualized returns. However, LPs who choose to invest cUSD in Pendle will continue to earn a 20x points bonus and an 8.3% APY. There's no reason not to move.

Other protocols on the sidelines: USD.AI, Reflect

USD.AI also recommended it last week, but I never expected the project to progress so rapidly. First, it raised $13 million, then secured funding from Binance (YZi Labs), and then integrated with the popular stablecoin chain Plasma. As a result, the initial deposit limit quickly reached its limit. USD.AI has previously announced plans to expand the deposit limit for USDT. We recommend keeping an eye on this project and grabbing a spot as soon as possible.

Reflect announced this morning the completion of a $3.75 million seed round led by a16z Crypto's CSX Accelerator, with participation from Solana Ventures, Equilibrium, BigBrain Holdings, and Colosseum. Reflect plans to build a "software-as-stablecoin" infrastructure, enabling applications to issue interest-bearing USD stablecoins without locking up capital. The project is expected to launch on mainnet in early September, initially supporting USDC on Solana. We'll see how these yields perform then .