Empty shell company + Trump = $30 billion, WLFI textbook-level operation

- 核心观点:特朗普家族借政治资源推动WLFI成为加密战略核心。

- 关键要素:

- 阿布扎比基金用USD 1投资币安20亿美元。

- 代币高度集中,家族控制超70%份额。

- 产品未完全落地,但资源整合迅速。

- 市场影响:可能重塑稳定币竞争格局与监管互动。

- 时效性标注:中期影响。

On September 1st, the official launch of the World Liberty Financial (WLFI) token drew the attention of the entire crypto market once again to the Trump family. In just six months, this project, originally considered a mere "Aave fork," has evolved from a fringe experiment into a core piece of the Trump family's crypto strategy.

The drama of this story lies in its context. Just a year ago, the market's perception of Trump's involvement in crypto was limited to jokes like "Trumpcoin." But when Trump returned to the White House, his family didn't stop at speculative NFTs or meme coins, but instead opted for financial infrastructure like stablecoins, lending, and Treasury assets. WLFI's positioning has therefore evolved from a simple lending protocol to a "DeFi super app" that attempts to integrate stablecoins, treasuries, trading, and payments.

This shift isn't just about the launch of a protocol; it's a landmark event, a fusion of politics and capital. Trump's son attended the conference in Hong Kong, becoming a star on the Asian Web 3 scene. Abu Dhabi's sovereign wealth fund completed a $2 billion investment in Binance using the WLFI stablecoin, USD 1. Crypto veterans like Justin Sun, DWF Labs, and Ryan Fang have all thrown their weight behind the project. The close integration of political and crypto resources has made WLFI's influence far beyond that of a typical DeFi project.

Why should we pay attention to WLFI? Because it reveals a brand new proposition: When the family of the US president personally steps in, will stablecoins be redefined? When capital, policy, and narrative are tied together, will the order of the crypto industry be rewritten?

Recently, BlockBeats and Web 3 101 co-produced a new podcast, featuring Liu Feng and dForce founder Mindao, exploring the complex dynamics behind the rise of WLFI, its practical logic, narrative techniques, and potential risks. The following insights are compiled from the podcast (listen to the podcast: " E 60 | Talking Again about Trump and WLFI: Are the President's Family and Friends Arriving to Reap the Fruits of the DeFi Revolution? ").

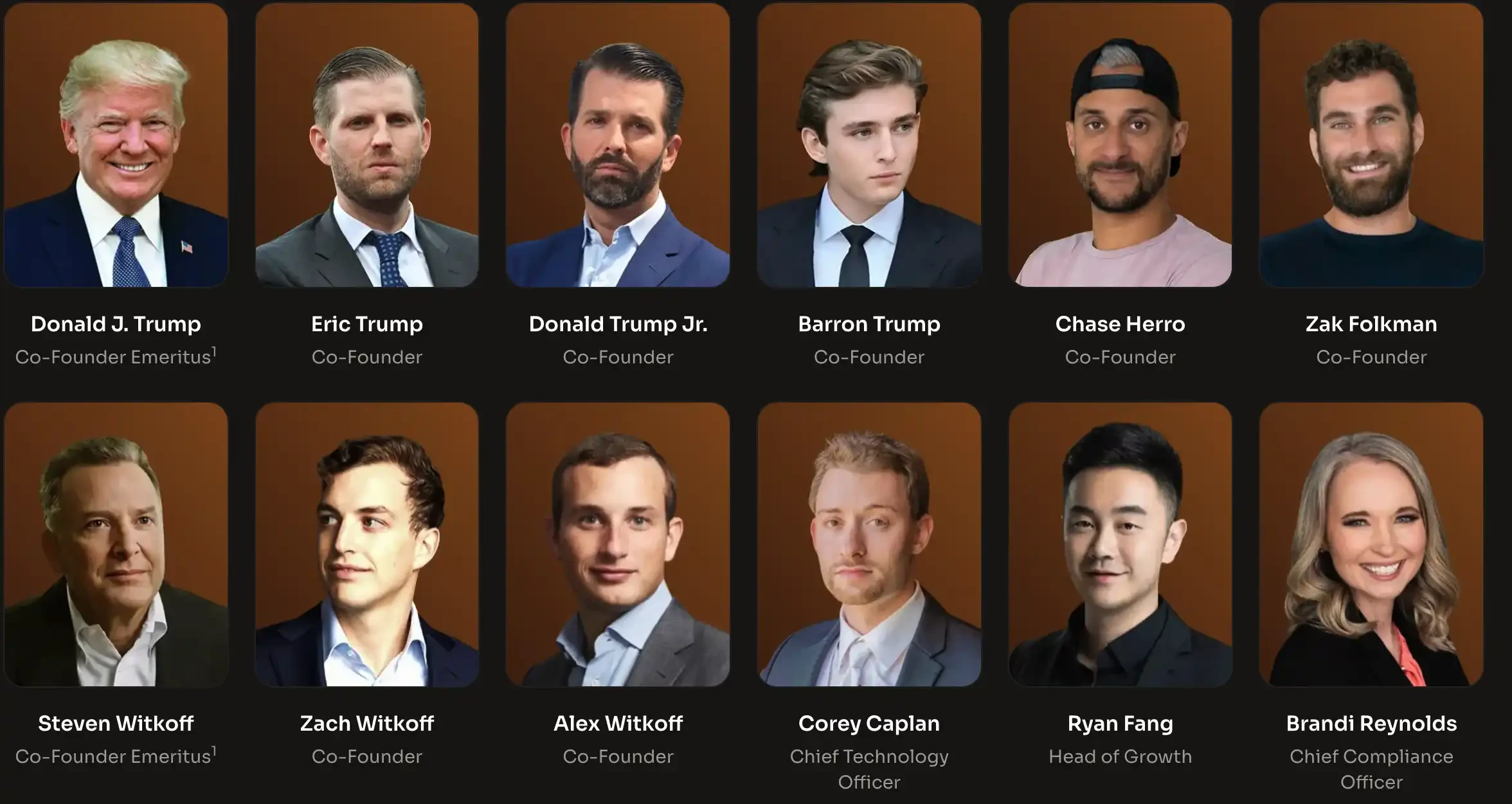

Panoramic layout of the Trump family

The Trump family's foray into the crypto world wasn't a spur-of-the-moment decision; it was driven by a clear strategic logic. World Liberty Financial (WLFI) was announced as early as October 2024, before Trump was re-elected. Market enthusiasm wasn't high at the time, and the ICO took some time to sell out. However, the project's positioning was already evident: the Trump family listed almost all of their members as "co-founders," demonstrating their deep commitment and ambition to the project.

From a holistic perspective, WLFI continues the Trump family's consistent approach to the crypto world—entering nearly every major sector: from the initial Trump meme coin to DeFi protocols, stablecoins, Bitcoin mining, and even Treasury companies, it essentially covers the entire crypto landscape. WLFI is the project that best embodies their ambition. Initially a simple fork of Aave, it has gradually evolved into a comprehensive DeFi super app, its ambition far exceeding initial expectations.

Now, it's not only preparing to launch a stablecoin, but also tying it to the DAT treasury model, making it the family's most practical flagship product in the crypto landscape. While the specific amount of tokens held by the family has not yet been disclosed, industry insiders generally believe that WLFI is similar to Trump Coin—besides the investor and ICO public offerings, the majority of the remaining shares remain firmly in the hands of the Trump family. In other words, despite the participation of some co-founders and external investors, true control remains concentrated in the hands of the Trump family and their closest allies.

What exactly is the relationship between WLFI and Trump and his family?

Although President Trump is listed as a co-founder of World Liberty Financial (WLFI), he is not directly involved in the project's day-to-day operations. According to information disclosed by the team, the core team is led by the Trump family and the Witkoff family, with over 40 years of experience in New York real estate. They are joined by several close allies, including Dolomite, and some longtime friends with experience in the crypto industry. In other words, the foundation of this project isn't a haphazard piece, but rather built on deep family ties and long-standing business connections.

As the team gradually expanded, WLFI's circle of friends quickly extended to the crypto world's native players, particularly the Chinese community. Ankr founder Ryan Fang, Paxos co-founder Rich Teo, and Scroll founder Sandy Peng all sided with the project early on. Rumors even circulated that the project initially planned to launch on Scroll, a Layer 2 blockchain developed by a Chinese team, but this plan subsequently faded from public view. More widely known are Justin Sun and the controversial market maker DWF Labs, both of whom have a close relationship with WLFI. DWF not only received token investment from the project but also immediately launched WLFI's stablecoin, USD 1, on its own platform, Falcon Finance.

To mobilize resources at a higher level, WLFI collaborated with Abu Dhabi's sovereign wealth fund, MGX. In March 2025, the fund invested $2 billion in Binance, with the funds settled using USD 1, the Trump family's stablecoin. This move caused USD 1's market capitalization to surge from $100 million to $2 billion in a remarkably short period of time, with over 90% of its reserves held directly on Binance. Since then, Binance has provided numerous applications for USD 1 on BNB Chain, ranging from liquidity management for meme coins to new IPO services. Exchanges like Huobi (HTX) followed suit, listing USD 1 immediately. Falcon Finance even incorporated USD 1 into its collateral system, allowing users to borrow and lend directly against USD 1.

This strategy had an immediate impact. Leveraging the Trump family's political and business influence, coupled with the resources of crypto OGs like Binance, DWF, and Justin Sun, USD 1 penetrated the entire crypto market's circulation network in just a few months. From top-tier exchanges to second- and third-tier platforms, USD 1 quickly adopted this emerging stablecoin. It can be said that WLFI, through this "family endorsement + global resource integration" model, transformed the once complex and difficult process of stablecoin promotion into a "fast track" driven by the joint efforts of resourceful players. This is one of the key reasons for WLFI's rapid rise to popularity.

How did WLFI quickly expand its ecosystem in just half a year?

Over the past six months, World Liberty Financial (WLFI) has delivered a performance that has been the envy of the entire DeFi industry. For most DeFi products, gaining user adoption and building effective ecosystem support often requires a long process: both exchanges must be willing to support them and other protocols must be willing to integrate them. This is especially true for the "hard-core" market of stablecoins, where gaining market share is a protracted battle. However, WLFI has fully expanded its market presence in just six months, a rare achievement in the fiercely competitive crypto world.

So, what exactly is WLFI? What is its product logic and development path? If we look back, WLFI began as a simple fork of Aave. Aave is one of the most classic lending protocols in the crypto world, allowing users to borrow stablecoins by pledging assets like Bitcoin and Ethereum. WLFI's starting point was almost a carbon copy of Aave's model, positioning itself as a standard DeFi lending project. However, as the project progressed, it gradually expanded into more ambitious directions, particularly the issuance of stablecoins. WLFI's stablecoin, USD 1, to some extent attempted to compete with mainstream stablecoins like USDT and USDC, becoming a key strategic fulcrum.

At the same time, WLFI has also crossed over into traditional financial markets, establishing Alt 5 Sigma Corporation, a US-listed cryptocurrency-to-equity company. They plan to use the WLFI token as a reserve asset, following a MicroStrategy-style flywheel approach. The team has even announced plans to enter the crypto payments market, incorporating nearly every trending topic into their blueprint. It can be said that WLFI has gradually evolved from a simple lending agreement to a platform that "issuing tokens while simultaneously updating the whitepaper." With each version update, its vision has become increasingly ambitious, moving towards becoming a "fully matrixed DeFi Super App": with a stablecoin, it can expand into interest-bearing products, treasury bond products, lending, arbitrage, and potentially even trading, derivatives, and other areas, building a "super app" that covers all areas of DeFi.

From an industrial perspective, other Trump family businesses are also interacting with WLFI. For example, Trump Media & Technology Group Corp. (DJT), Trump's multi-billion dollar media technology company, has begun exploring crypto payment integration. In the future, the family's cryptocurrency-backed companies are likely to integrate with WLFI's stablecoin and lending products, forming a closed loop between the family businesses and DeFi protocols. This "industry chain complementarity" not only provides WLFI with a landing page but also strengthens its ambitions in the financial ecosystem.

In its external narrative, the WLFI team consistently emphasizes its mission to "Bank the Unbanked"—to enable those without access to the traditional financial system to obtain financial services through DeFi and Web 3. This slogan is not new, practically a cliché in the crypto industry. However, a closer look at WLFI's actual progress reveals that its execution is far more complex than its slogan suggests.

Initially, WLFI was merely a replica of a lending protocol, but it quickly entered the stablecoin market. Its USD 1 stablecoin utilizes a centralized issuance model similar to USDT and USDC: users submit US dollars to the team, who then issues an equivalent amount of USD 1 on-chain. This model is not new, but with its robust resource and capital integration capabilities, the USD 1 stablecoin's size soared from $100 million to $2 billion in a matter of days, reshaping the market's perception of speed.

However, if you visit WLFI's official website today, you'll find that most products are still listed as "Coming Soon": from lending to exchanges, they're all still in the "launch soon" phase. In other words, much of WLFI's product portfolio hasn't yet been fully implemented. Meanwhile, its influence and narrative have already permeated the entire industry: its stablecoin has already launched, and its token has completed multiple rounds of sales, generating significant revenue for the project. It was listed on a top global exchange on September 1st.

This is the reality of WLFI—a DeFi project with a grand story and a broad vision, but its product is still in the making. Its model is more like "painting the pie first, then building momentum," using political resources and capital alliances to quickly convert the pie into real influence. While its concrete applications are currently limited, it has become a hot topic in the market thanks to the surge in USD 1 and the binding of family resources. In other words, WLFI may still be in the "blueprint stage of city building," but the shadow of this city is already eye-catching enough.

From DeFi protocols to stablecoins, is the concept of "Bank the Unbanked" just a slogan?

Many people assume the Trump family's foray into DeFi is merely a speculative venture capitalizing on a trending market. However, judging by the development path of World Liberty Financial (WLFI), this assessment is inaccurate. Trump has indeed dabbled in NFTs and meme coins in the past, but these were more short-term plays chasing market sentiment. WLFI, however, has a distinctly different positioning. It is the family's most strategically significant part of the crypto landscape, not only on a grand scale but also embodied by a sense of real-world pain and long-term considerations.

The reason can be traced back to the painful experience of being "debanked." After Trump's first term, hundreds of the family's bank accounts in the United States were closed overnight, and the real estate company lost basic account services with traditional financial giants like JPMorgan and Bank of America. Trump's son's eyes were filled with anger when he recalled this incident in an interview. Whether motivated by political retaliation or regulatory reasons, the "DeBank" incident taught the Trump family firsthand that the traditional financial system is unreliable for them. If Trump leaves office in 2028 and the Democrats return to power, similar crackdowns are highly likely to occur again. Traditional industries like real estate and media would be virtually defenseless in such a situation. However, if the family's core assets have shifted to the crypto world, the situation would be completely different. Therefore, the business they are engaged in is directly related to a painful past experience, and from the perspective of the Trump family, establishing WLFI is a very logical decision.

The history of cryptocurrency itself is a story of resistance against traditional banking. From China to the United States, and through regulatory crackdowns and policy blockades, crypto has risen amidst both expulsion and resistance, ultimately nurturing the current $4 trillion market and a comprehensive DeFi infrastructure. The Trump family, fully aware of this, began shifting their business focus to crypto. This was not only a defensive move, but also an offensive one: leveraging their time in office to push for legislation that would embed crypto finance into the US legal system, ensuring that the family's crypto empire would be institutionally protected even after a change of government.

From this perspective, WLFI isn't a spur-of-the-moment speculation, but rather a pragmatic and strategic decision. It not only frees the family's wealth from bank dependence but also creates a firewall against future uncertainties. More importantly, compared to simply investing in existing protocols like Aave, WLFI is a true entrepreneurial venture. The project's value lies not only in the token itself, but also in tying Trump's political influence to global crypto resources through stablecoins, lending, derivatives, and other businesses. The upper limit is much higher than simple investment.

How does Trump “cash in” on the influence of the US President?

If you truly understand the Trump family's thinking, you'll discover that World Liberty Financial (WLFI) isn't simply a crypto speculation, but a vast strategic game. Currently, they're leveraging Trump's influence as president of the United States to transform this political and social capital into a new way to monetize resources. The term "monetize" should be used in quotation marks, as the family may not necessarily agree with it. However, to the outside world, it's a path to capitalize on their influence.

The beauty of this approach is that it not only brings attention to the family but also attracts the support of the most powerful players in the crypto world. Leveraging the halo of the presidency, they first build influence in crypto, then leverage blockchain's censorship-resistant and government-interference-resistant properties to build a firewall against future business interests. This way, even after Trump leaves office, the family can maintain a sustainable moat.

Even more cleverly, the Trump family leverages its influence in the global market. Real estate and media businesses are highly dependent on localization and the banking system, while cryptocurrencies are decentralized and global, allowing them to capitalize on influence most effectively on a global scale. For example, 30% to 40% of attendees at Trump's private dinners were Chinese, and WLFI's supporters are highly concentrated in the Asian market—particularly offshore exchanges in Greater China. Cryptocurrency offers a global reach that is far more efficient than traditional real estate projects.

Behind this, Chinese OGs like Binance CEO CZ and Justin Sun played a key role. Currently, the primary use case for the WLFI stablecoin, USD 1, is on Binance and Huobi (HDX). Projects like ListaDAO, a staking protocol on the BNB chain, Plume Network, a Hong Kong-based RWA initiative, and StakeStone all have strong ties to Binance. Falcon Finance, backed by the Chinese-American DWF Labs, Ankr founder Ryan Fang, and Paxos founder Rich Teo are also deeply involved in the WLFI project. In other words, WLFI's global influence is being accelerated through the Asian crypto community.

Even more interesting is that last week, the CFTC announced a deadline for non-US exchanges to return to the US market. These major, previously offshore exchanges may leverage this compliance window to reenter the US market. For both Binance and OKX, establishing closer ties with the Trump family through this channel would not only facilitate legislation and access, but also potentially gain an advantage in US market competition.

Therefore, WLFI is not just a tool for the Trump family to monetize their influence; it is also a strategic pawn in their efforts to build a global network of allies. It serves both current political capital and a safe space for their post-presidential business ventures.

Is there any benefit for a trading platform to accept USD 1 even if it makes less money?

Why are so many crypto OGs backing World Liberty Financial (WLFI)? Rumors offer some clues. For example, some speculate that CZ's support for Trump stems in part from the hope of securing a future pardon. Justin Sun has also been asked a similar question in an interview: Is this support a form of "political cash"? Regardless of whether this is true or not, it certainly represents a lucrative deal for top offshore exchanges—investing capital in exchange for political resources often yields higher returns than purely commercial investments.

On the other hand, Trump, like Musk, possesses a powerful attention magnetism, practically a "traffic black hole." Whether it's his tokens, NFTs, or public statements, they instantly capture global attention. For exchanges, supporting such a project presents minimal risk: with the Trump family's backing, there's virtually no worry of a potential backlash or hack. For example, the USD 1 stablecoin, tied to Middle Eastern capital, is a brilliant deal for Binance. Since the investors are investing, the choice of stablecoin is largely irrelevant. Using a Trump family stablecoin not only eliminates the additional cost but also garners Trump's favor.

A more realistic consideration is the potential of the US market. Over the next three years, major exchanges like Binance and OKX are far more likely to return to the US market than to China. Closer ties with the Trump family could potentially facilitate compliance and legislation in the US market. While Coinbase was more cautious, it also immediately expressed support for Trump Coin upon its launch. Every exchange weighs the pros and cons of supporting the Trump family, but from both political and economic perspectives, it's a highly profitable proposition.

Regarding Binance's acceptance of nearly $2 billion in USD 1 stablecoins, the question often arises: Is this a good deal? On the surface, Binance is forgoing substantial profits. If this capital were deposited in USD or USDC, interest income alone could have reached $80 million to $100 million annually; and USDC also subsidizes distribution partners. Accepting the newly minted USD 1, however, means forgoing these profits. However, Binance may have gained even greater benefits:

First, this is a legally issued stablecoin, fully compliant with the US-regulated stablecoin framework, and has the potential to be mainstreamed alongside USDC and USDT. Speculation suggests that Binance may have a "back-to-back" agreement with the Trump family or a Middle Eastern fund, such as interest revenue sharing or liquidity subsidies, which prevents Binance from actually losing significant profits. Second, the funds are primarily directed by Middle Eastern funds, and Binance may not have the final say. As an ambassador to the Middle East and co-founder of WLFI, Steven Witkoff could very well have designated USD 1 as an investment vehicle, and Binance would naturally accept it. The logic here is clear: this is the result of a political and financial tie, not a purely commercial decision. Third, for Binance, USD 1 itself is a strategic option. Since BUSD was "stifled" by regulators, Binance has been lacking a stablecoin that is closely aligned with it and can be implemented in a compliant manner. While FDUSD exists, its prospects are uncertain. In contrast, USD 1 boasts the Trump family's endorsement and US regulatory compliance, and could even become Binance's "default stablecoin" in the future. If successful, this would forge a closer strategic alliance between the two parties.

In other words, WLFI's decision to secure greater support from Asian exchanges through a Middle Eastern consortium's investment in Binance, backing WLFI and USD 1, was a decisive one. It puts OGs on the side of potential power and lays the groundwork for a possible return to the US market. In this respect, WLFI resembles a two-way trade between the Trump family and crypto OGs: Trump trades influence for capital and support, while exchanges stake capital on future political protection and market opportunities.

What is the relationship between WLFI and World Liberty Financial? What is its token model?

WLFI is the governance token for the World Liberty Financial protocol, but its design differs from typical governance tokens. First, the token does not pay dividends and cannot be mapped to equity in the underlying company, effectively displacing the actual decision-making power in the hands of token holders. In other words, WLFI is more like a "pure governance token," but its true governance role remains questionable, as key protocol decisions remain the responsibility of the company itself, rather than driven by on-chain governance processes.

In terms of token distribution, WLFI appears highly concentrated. Trump himself reportedly holds over 15% of the tokens, while Justin Sun, due to his previous large purchases, controls approximately 3% of the circulating supply. Furthermore, a number of whales acquired significant stakes through both on- and off-exchange transactions. Overall, WLFI sold approximately 30% of its tokens during the ICO, with the remaining 70% held by the project. There is currently no public information regarding the distribution of these internal shares, the unlocking schedule, or future sales, leading to significant uncertainty regarding the potential for selling pressure on WLFI.

In terms of issuance design, WLFI also follows many typical practices of DeFi projects. For example, when the white paper was released in October 2024 and the pre-sale phase was still in progress, the token was set to non-transferable. This is a common tactic for circumventing regulations in the US market, and similar practices are also seen in projects like EigenLayer, with lock-up periods often lasting up to one year. Now, WLFI is gradually becoming eligible for transfer and listing. This is partly due to the clearer legislative environment in the US; partly due to the change in the SEC chairman and the shift to a more friendly regulatory stance, which has also cleared obstacles for the token's circulation and listing.

From a token economics perspective, WLFI, like many DeFi projects, possesses governance features, supporting on-chain voting and distribution mechanisms. Even during periods of non-transferability, holders can participate in governance votes. This arrangement is common among US projects and is seen as a protective design to mitigate regulatory pressure. Ultimately, however, whether WLFI truly delivers on governance value or is more of a "politically garbled bargaining chip" remains a focus of public attention.

What's the story behind the WLFI and Aave token distribution controversy? Are products with strong resources but no innovation always the market winners?

In October last year, WLFI used the narrative of "building a lending agreement based on Aave v 3" and put forward supporting proposals on the governance forums of WLFI itself and Aave: first, 20% of the fee income generated by the WLFI agreement in the future will be allocated to the Aave DAO treasury; second, 7% of the total number of WLFI tokens (then the base number was tens of billions) will be transferred to Aave for governance, liquidity incentives or promoting the decentralization process.

On August 23rd of this year, the Aave founder publicly confirmed the validity of the proposal. However, members of the WLFI team subsequently publicly denied the authenticity of the 7% quota. Chinese media outlets further sought confirmation from the WLFI team and were also told it was fake news. This infuriated the Aave founder, and community opinion plummeted. Based on the pre-market valuation at the time, the 7% allocation would have been worth billions of dollars, a factor that directly fueled the community's outrage.

In reality, there's a fundamental difference between proposals that merely undergo a "temperature check" and "binding" governance. The former is often a textual expression of intent; a "pass" vote doesn't equate to the binding force of "executable code." Without the contractual logic binding the proposal, the governance outcome could be overturned at any time by subsequent proposals.

In other words, without clauses that can be executed on the chain, the so-called "approval" is more like a non-binding memorandum of understanding (MOU), which is difficult to establish both in terms of law and agreement implementation. In addition, usually, project cooperation at the technical platform level (such as Spark and Aave) will not "give away" such a large proportion of tokens. Therefore, the "generosity" of the original proposal deviated from industry common sense, and there were some "ambiguous" judgment bases. Before verifying Aave's substantial contribution to WLFI, it is unusual to promise a "fixed ratio" of total token quota and long-term revenue sharing.

Back in the fourth quarter of 2024, WLFI was still facing questions about its lack of credibility and high valuation. Furthermore, the founding team had a history of hacker attacks, leading to suboptimal token sales. In this context, leveraging Aave's brand and security reputation to enhance its reputation was an understandable PR and marketing strategy: a fork combined with profit sharing/token transfer. This strategy mitigated the ethical concerns surrounding "copycat" while also mitigating security concerns.

However, in the months that followed, WLFI quickly gained momentum, shifting its strategic focus to a DeFi hub centered around the USD 1 stablecoin, with its original focus on a lending protocol taking a backseat. This shift in narrative naturally led to a renegotiation of the earlier static promise of a "fixed ratio," potentially evolving into dynamic incentives tied to actual usage and contribution, or dedicating a portion of the tokens to attract traffic to Aave-related markets.

Liu Feng quoted the interview between Laura Shin and Kyle Samani, the founder of Multicoin, in 2018. At that time, Kyle put forward a view that "in the world of Crypto, technology is not important. What is most important is how to go to market and how to operate." This view was questioned by many people at the time, but now, such things are happening more and more frequently.

Can USD 1 move from “exchange-driven liquidity” to “real user usage”?

First, the current outlook for stablecoins is not optimistic. From a Crypto Native perspective, with the exception of a few leading stablecoins (USDC and USDT), they are rarely used in daily life due to the lack of revenue accumulation. Even with an injection of approximately US$2 billion, USDE is unlikely to see natural retention. FDUSD is mostly used in strategic scenarios such as new listings on exchanges and is rarely used in normal times. This shows that "building up scale" does not mean "being needed by users."

In this context, USD 1 faces three hurdles: first, the double-edged effect of politics and banking channels. Political aura is conducive to the rapid organization of liquidity in offshore exchanges, but it may create resistance in the local financial system. Whether large US banks are willing to provide friendly clearing, settlement and custody remains uncertain. Some jurisdictions and institutions may even avoid sharing the stage due to political sensitivities (such as the example of Hong Kong officials choosing to avoid participating due to Eric Trump's visit to Hong Kong).

The second is the real bottleneck of channels and distribution. Currently, USD 1 mainly leverages the resources of overseas exchanges. Moving towards "real user use" requires connecting the embedded scenarios of banks, payments, e-commerce, and social/super apps. These are slow-moving variables that require heavy qualifications, risk control, and business negotiations. Without these, stablecoins can easily become "settlement chips between exchanges."

The third is the requirement for self-consistency between products and incentives. Crypto-native users generally dislike "group narratives" and value verifiable reliability and clear use cases. If USD 1 wants to break the strong inertia of USDT/USDC, it needs to form stable expectations in terms of reserve transparency/audit disclosure rhythm, multi-chain availability and bridging experience, wallet/custodian native integration, merchant fee and rebate structure, and convenient redemption in compliant regions. It also needs to transform early resource advantages into long-term incentives linked to "actual use" rather than one-time market-making subsidies.

But at the same time, WLFI's "resource pool" does have unique spillover value: by allowing the Trump family to form vital interests and policy drivers, it is expected to pave the way for broader on-chain innovation; the first step of USD 1, "increasing on-chain liquidity", has emerged, but the key to transitioning from "passive liquidity" to "active use" lies in whether it can continue to introduce high-quality applications and complete cross-domain distribution by leveraging the existing ecological list and appeal.

It's unlikely to challenge USDT/USDC's position in the short term. While USD 1 is currently serving as a universal settlement stablecoin across multiple exchanges, it lacks sufficient resources for bank inflows and outflows, pilot programs for payments, e-commerce, and payroll, and default support from mainstream wallets and custodians. Coupled with marginal changes in the US political landscape, this presents a double-edged sword, not necessarily a plus.