WLFI Token Launch: Arbitrage Opportunities in Depth

- 核心观点:WLFI上线提供多种套利机会。

- 关键要素:

- CEX间价差套利。

- 现货-永续基差套利。

- 币股ALTS对冲套利。

- 市场影响:增加流动性,吸引套利资金。

- 时效性标注:短期影响。

WLFI, the Trump family's flagship project, which has been honed for six months, launches tonight at 8 PM, drawing worldwide attention. Some are betting on price fluctuations, while others are speculating on hot coins. Besides trading the market, are there more reliable ways to capitalize on this wave of hype? The answer is arbitrage. In this article, BlockBeats has compiled some practical arbitrage opportunities with WLFI:

Spread Arbitrage

1. Price arbitrage between CEXs

Since the matching rules, opening hours, buying density, handling fees and deposit and withdrawal arrangements of different trading platforms are inconsistent, there will be price differences for WLFI in a short period of time, and there will be arbitrage space.

For example, WLFI will open spot trading on Binance at 9 o'clock tonight, but withdrawals will be available at 9 o'clock tomorrow night. This means that before withdrawals are opened, funds can only "flow into Binance and be sold to on-site buyers" but cannot "flow out" for the time being. One-way flow will make on-site pricing more likely to be expensive.

The practical strategy is actually quite simple. First, select two or three controllable scenarios to form the "price triangle." These typically include a first-tier CEX (mostly Binance today, due to its high buy volume and public attention), a secondary CEX with withdrawal support (you can choose one with lower fees, as this allows for better profit preservation through multiple inbound and outbound transactions), and an on-chain observation post (such as Uniswap's WLFI pool, to determine the strength of marginal on-chain buying).

Open the market quotes and recent trades on both exchanges simultaneously and monitor the price difference of WLFI. Once you see that the price on Binance is significantly higher than the other exchange, and the net difference is still positive after accounting for taker fees, spreads, and possible slippage, you can buy and then sell on Binance.

The difficulty lies not in logic but in pace. Cross-exchange arbitrage is essentially a race against latency: deposit and withdrawal delays, risk control pop-ups, on-chain confirmations, and even your own click-confirm speed all determine whether or not you can pocket that 0.x% to 1.x% gross profit. Therefore, the safest approach is to first go through the entire process with a small amount, measuring the time and cost of each step, and then increasing the volume.

2. Triangular Arbitrage

Triangular arbitrage can be simply understood as an upgraded version of the previous "CEX price spread arbitrage," involving more on-chain paths and sometimes involving currency swaps between stablecoins. Therefore, there are more opportunities but also more friction.

The most common "sandwich spread" in a project's early days is: the BNB on-chain price is approximately equal to the Solana on-chain price, higher than the Ethereum mainnet price, and higher than the CEX on-chain price. Because BNB and Solana on-chains generally have smaller pools and more bots, prices are more easily driven up by a few orders. Ethereum has higher fees, fewer bots, and relatively conservative trading, resulting in lower prices. Centralized exchanges, controlled by market makers and often closed or capped, prevent price gaps from being immediately closed, resulting in the lowest spot price. Since WLFI is a multi-chain deployment, this flexibility also exists.

In addition, there may be slight decoupling or fee differences between the new stablecoin USD 1 and USDT/USDC, which will also amplify the loop benefits.

However, it should be noted that triangular arbitrage is more complicated than CEX arbitrage, and it is best for novices not to try it. The prerequisite is to be familiar with the cross-chain mechanism, cross-chain path, slippage and handling fees in advance.

3. Spot-Perpetual Basis/Funding Arbitrage

This "spot-perpetual basis/funding fee" arbitrage is also a common practice among market makers, market-neutral funds, quantitative arbitrageurs, and arbitrageurs. Retail investors can also engage in this, but due to their small size, high fees, and borrowing costs, the advantages are less pronounced.

The "profit" from this arbitrage comes from two fundamental sources: the first is the funding rate. When the perpetual price is higher than the spot price and the funding rate is positive, long positions must periodically pay "interest" to short positions. This involves a "spot long + perpetual short" trade, collecting this interest regularly. Conversely, when the funding rate is negative, a "sell spot + perpetual long" trade is executed, with short positions paying long positions. This leaves your net exposure close to zero, and the funding rate, like current account interest, is settled on a rolling basis over a certain period of time, feeding off the cash flow of the "sentiment premium/pessimism discount."

The second is basis reversion. During a launch or when sentiment fluctuates, perpetual swaps may experience a one-time premium or discount relative to the spot price. When sentiment cools and market making recovers, the perpetual swap will converge toward the spot/index price. Within a hedging structure, you can pocket this one-time gain from this narrowing spread. The combination of these two factors is a combination of "interest + reversion," which, after deducting borrowing costs, fees, and slippage, yields the net profit.

However, it is important to understand the various information on different trading platforms, such as liquidation mechanisms, slippage, fees, funding rate settlement times, and transaction depth, to prevent a short squeeze on XPL. Related reading: " Lighter's ETH and HL's XPL both experienced short squeezes. How can I avoid being liquidated by large investors? "

In addition, in the most common "spot long + perpetual short" strategy, you can also find some vaults with relatively high annualized returns, such as StakeStone and Lista DAO's vaults, which have an APY of 40%+ after subsidies.

4. Group LP+ Short Selling Hedge Arbitrage

Simply forming an LP isn't arbitrage; it's more like "trading directional risk for fees." However, if you add short selling as a hedge, leaving only a net profit curve of "fees - funding fees/borrowing interest - rebalancing costs," this is also a relatively effective hedging strategy.

The most common structure involves providing centralized liquidity on-chain (such as a WLFI/USDC or WLFI/ETH pool) while simultaneously shorting an equivalent notional value of WLFI perpetuals on an exchange. If perpetuals aren't available, you can borrow tokens in your margin account to sell spot, but this involves greater friction. The goal is to discourage speculation on price fluctuations and focus solely on the "more transactions, higher fees" side of things.

During execution, think of LPs as the "fee-based market-making range." First, choose a fee rate and price band you can stick to, such as a 0.3% or 1% fee tier for new coin futures, and set the range to a "medium width" close to the current price. After deployment, LP positions will be divided into WLFI spot and stablecoin. You use this WLFI "equivalent notional" to short perpetuals, initially aligning the USD values of the two legs. As the price fluctuates within the range, the on-chain leg collects turnover fees and pockets a small price difference through passive rebalancing; the short leg assumes the opposite direction, maintaining an overall neutral trend. If the funding fee is positive, you can earn additional interest on the short leg; if it is negative, you'll need to rely on a wider range, lower leverage, and less frequent re-hedging to maintain net returns.

The difference between this and basis arbitrage is that while basis arbitrage exploits the price differential between perpetual swaps and spot contracts and funding fees, this leverages on-chain transaction fees. The difference from pure LP lending is that the profits and losses of pure LP lending are largely determined by direction and impermanent loss.

WLFI Coin-Share ALTS and WLFI Hedge

ALT 5 Sigma (Nasdaq: ALTS) raised approximately $1.5 billion through a combination of a stock offering and private placement. A portion of the proceeds was directly exchanged for WLFI tokens, while the remainder was used to allocate WLFI in the secondary market, effectively establishing itself as a "treasury/proxy exposure" to WLFI. For more information on the WLFI token-stock, see " If You're Hesitant to Buy Tokens, Is There Still a Chance for WLFI Token-Stocks? "

Observe the increases in both ALTS and WLFI simultaneously. The logical approach is to go short on the stronger side and long on the weaker side, hedging and closing positions when the two sides return to normal. For example, WLFI may rise first due to the exchange and the narrative, while ALTS may be constrained by US stock trading hours or stagflation in borrowing costs, causing a price gap. This gap will close when US stocks open and funds replenish the ALTS proxy exposure.

If you use WLFI perpetual for hedging, you may also get funding fees, but the main income still comes from the price difference itself, not a unilateral direction.

This differs from the previous "basis/funding fee arbitrage" in that there's no "spot-perpetual" deterministic anchor. Instead, stocks are used as a proxy for WLFI. The logic is more similar to the old "BTC ↔ MSTR" approach, but the execution is difficult due to friction and timeframes. Crypto trading operates 24/7, and WLFI unlocks at 8:00 AM, but the Nasdaq opens at 9:30 AM. Buying or selling before this time constitutes pre-market trading, allowing for order placement and matching, but the matching rules differ from regular trading. Furthermore, one must be aware of the possibility of trading halts and circuit breakers.

WLFI Market Cap Bet on Polymarket

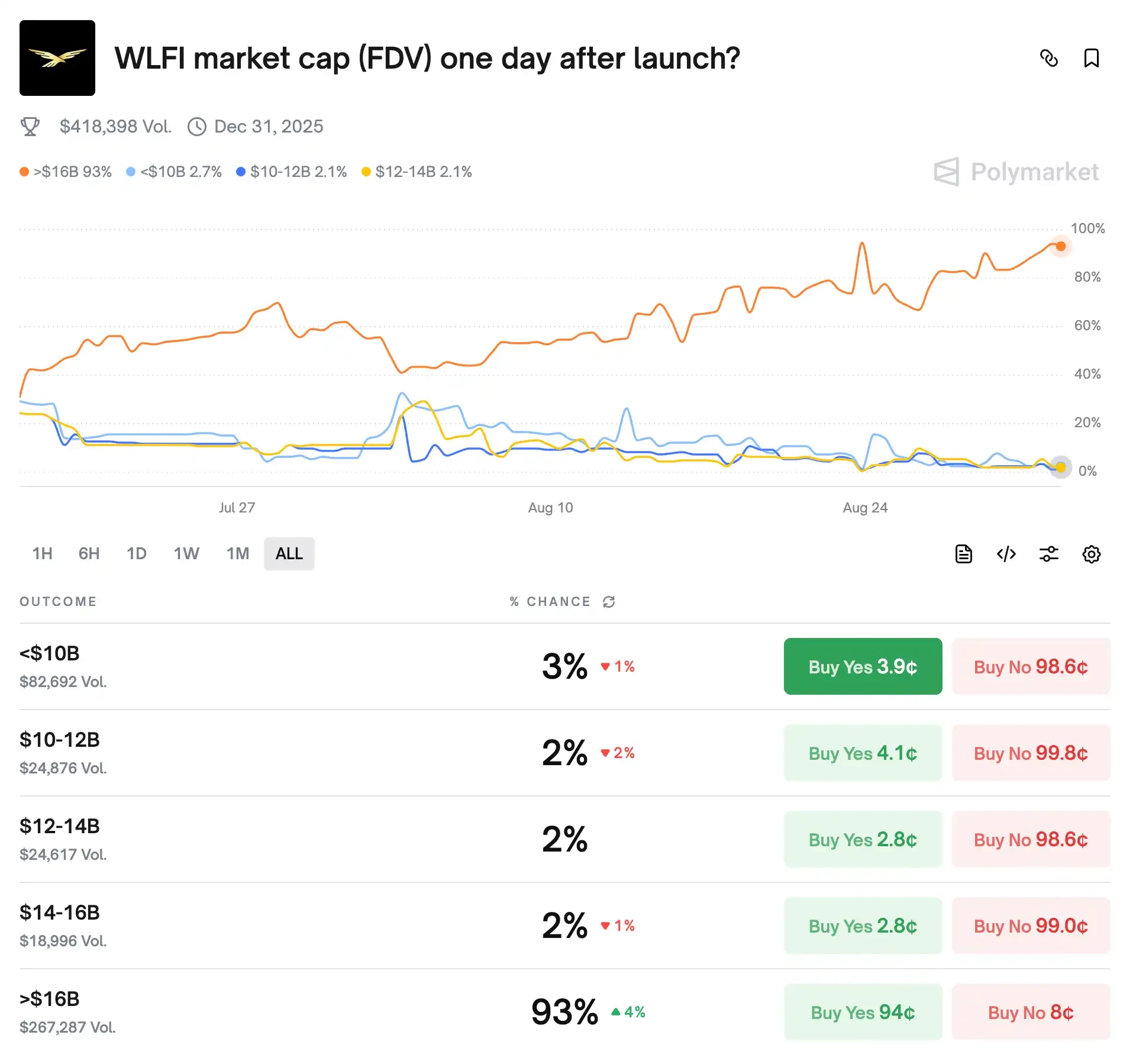

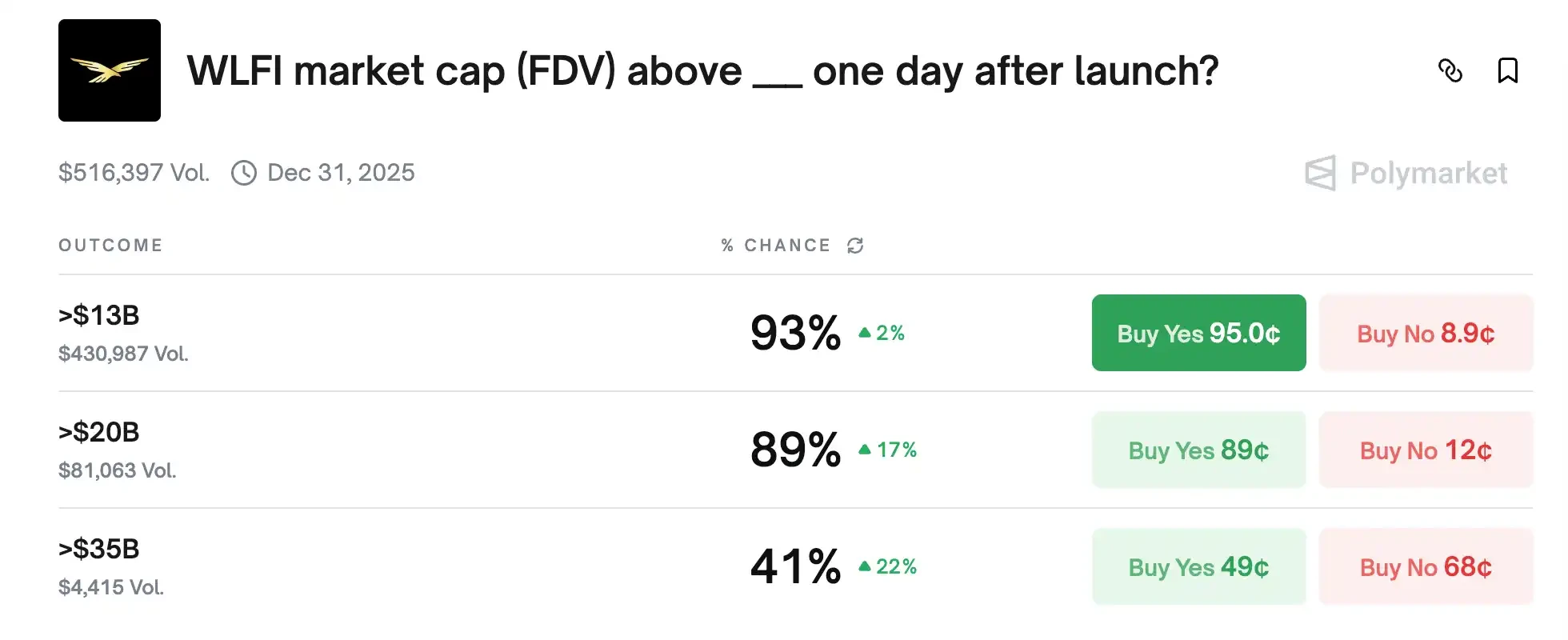

There are currently two bets on WLFI on Polymarket, both about the market capitalization of WLFI on the day of its launch, except that one is a tiered market (choose one of five: <$10 B, $10–12 B…, >$16 B), while the second is a threshold market (three binary judgments: >$13 B, >$20 B, >$35 B).

Because we're asking about the FDV of WLFI one day after its launch, the prices must be consistent: the sum of the five probabilities in the tier must equal 100%. Therefore, the price in the tier ">$16 B" must be consistent with the threshold P(>16 B).

At the same time, the sum of the prices in the complement of the tier (<$10 B, 10–12 B, 12–14 B, and 14–16 B) must equal the threshold of 1 − P(>16 B). If you find an imbalance between the two sides, for example, the price of ">$16 B" is very high, but the sum of the four tiers is also high, resulting in the sum of ">$16 B + the other four tiers" being significantly greater than 1, then sell on the expensive side or hedge with "No" while simultaneously buying up the cheaper side, creating a "must-win $1, cost < 1" basket. If the sum is less than 1, buy up both sides to lock in the difference.