Korean Exchange Listing Guide: Data Decoding the Black Box of Korean Exchange Listings

- 核心观点:韩国交易所上币受市场与政策双重驱动。

- 关键要素:

- BTC价格与上币数量显著正相关。

- Coinone具桥梁效应,首发代币表现优。

- 本地化营销与KOL合作提升上币成功率。

- 市场影响:为项目方提供韩国市场进入策略参考。

- 时效性标注:中期影响。

This article is jointly published by Klein Labs and K1Rresearch

Overview of Research Methodology

This report analyzes the listing paths and market dynamics of South Korean exchanges, combining listing data from January 2024 to July 2025. Using a panel fixed-effects regression model, we quantify the impact of factors such as BTC price, Korean won-denominated trading volume, and policy window on the number of listings. Through statistical analysis and yield calculations, we reveal patterns in the three major exchanges' listing cadence, market preference, and token price performance, providing quantifiable insights for project developers in selecting listing timing, exchanges, and marketing strategies.

Key Highlights

1. South Korea leads the world in market size and activity

Since 2025, cryptocurrency trading volume denominated in the Korean won has consistently ranked second globally, second only to the US dollar market, and has long led altcoin trading, demonstrating high acceptance of new coins and ample liquidity. For project developers, this represents a high-potential, early adopter market.

2. Policy and market sentiment drive the pace of coin listings

Panel regression results show a significant positive correlation between the average monthly BTC price and the number of listed coins on exchanges, indicating that market enthusiasm has a direct impact on coin listing decisions. Furthermore, policy windows amplify this effect, demonstrating the combined influence of regulatory signals and market sentiment. For projects entering the Korean market, they should comprehensively consider market enthusiasm, investor attention, and policy timing, arranging their listing schedules appropriately to maximize project exposure while optimizing trading liquidity and achieve a strategic listing strategy.

3. The “Bridge Effect” of Token Listing and Market Diffusion Mechanism

From an overall perspective, both Bithumb and Coinone play a "bridging role" in the coin listing process, with some tokens listed on both exchanges before entering UPbit, which boasts greater trading volume. Coinone's listing performance is particularly impressive, achieving a secondary amplification of both price and trading volume. Projects can prioritize Coinone as a starting point before gradually expanding to larger exchanges, leveraging resources and attracting interest. All three exchanges belong to the DAXA Alliance, further enhancing the market diffusion of coin listings.

4. Listing platforms should be differentiated

Exchanges vary significantly in their user profiles, listing schedules, and market influence. Simply pursuing the largest platform is not the optimal strategy. Project developers should prioritize exchange type and listing sequence based on token characteristics, community structure, and marketing budget to maximize their return on investment.

5. Korean market promotion requires localization and multi-channel integration

An effective Korean market entry strategy relies not only on simple exchange listing applications but also includes Naver keyword optimization, local crypto forum discussion, offline event marketing, and KOL collaboration. Project owners should synchronize their listing schedule with localized marketing efforts to create a closed-loop conversion process from awareness to trading volume.

1. Introduction

South Korea is rising at an astonishing pace in the global cryptocurrency landscape. Since 2025, total cryptocurrency trading volume denominated in the Korean won has reached $663 billion, making it the second-largest cryptocurrency market in the world, second only to the US dollar. More notably, South Korea has long maintained a leading position in alternative cryptocurrency trading, boasting the highest trading volume in the world. A staggering 25.4% of the South Korean population actively participates in cryptocurrency trading, a level of participation that is exceptional globally. This enthusiasm has also given rise to the unique phenomenon of a "Kimchi premium."

At the same time, the South Korean government is actively reshaping its cryptocurrency regulatory framework, moving away from previously restrictive policies and toward a new phase that encourages innovation and market development. The recently launched cryptocurrency ETF roadmap and stablecoin development plan not only inject new institutional benefits into the market but also further consolidate South Korea's strategic position as a key crypto market in Asia and globally.

Against this backdrop, studying the potential of South Korea's cryptocurrency market not only provides project developers with practical strategies for listing on South Korean exchanges but also reveals the opportunities and risks of this unique market for investors. This report examines the listing paths and performance of South Korea's five major exchanges—UPbit, Bithumb, Coinone, Korbit, and GOPAX—and incorporates the latest data from 2024 to 2025, providing a more detailed and in-depth analysis to help readers fully understand the listing ecosystem and market logic of South Korean exchanges.

2. Preparation before listing: Marketing is not everything, but it is essential

Successful coin listings rely not only on the project's strength and technical prowess, but also on marketing and promotion. This is particularly true on Korean exchanges, where listing requirements are stringent and limited. Projects must demonstrate strength in technology, community, and market recognition. Below, we've compiled several key Korean marketing methods from the perspective of exchanges, analyzing their effectiveness in boosting project exposure, gaining user recognition, and attracting investment, offering valuable insights for successful coin listings:

2.1 KOL and Community Influence

High-quality local KOLs and community resources are essential for promoting and listing a cryptocurrency in the Korean market. Currently, there are several highly active Korean crypto communities with professional content production that have been deeply engaged in the market for a long time.

On Telegram, the KOL communities with a reach between 20,000 and 40,000 people and known for their professionalism and high-quality content include:

- MBM Creator Academy (@MBMweb 3)

- We Crypto Together (@WeCryptoTogether)

- Cobacknam Announcements (@cobacknamannounce)

- Yobeul's World (@yobeullyANN)

- Telegram Coin Rooms & Channels - CEN (@emperorcoin)

- Jammin 123 (@muijammin 123)

- Fire Ant CRYPTO (@fireantcrypto)

- Youth Passion Flavor House Co., Ltd. (@minchoisfuture)

These groups are all core OG communities established in the early days. They have both historical accumulation and influence, and also gather active players who are experienced and good at creating an atmosphere. They are very popular in South Korea.

And a group of communities with a stable membership of around 10,000. Although relatively small in scale, they have more accurate user profiles and higher stickiness, including:

- CRYPTO Sea (@crypt 0_sea)

- KOOB Crypto 3.0 (KOOB Crypto) (@kookookoob)

- Coin Boy's Crypto Story (@coinboys)

- Naback's coin life (@ysytop 2)

- Lee Dojin Metaverse Announcement (@leedojin 2)

Considering South Korea's population is only 50 million, tens of thousands of followers is already a significant number compared to English-speaking and social media communities. Unlike in English-speaking areas, the use of X is still a minority among Koreans (although there is a trend of some KOLs and users migrating to X). Most people still use Kakao and Telegram. Due to Kakao's relatively strict speech control, Telegram has a relatively high user base.

These KOL communities not only have a wide reach but also play a vital role in disseminating industry information and guiding market sentiment, providing a solid foundation for the project's implementation and growing visibility in South Korea. Furthermore, many KOLs not listed also possess considerable influence.

2.2 Media coverage and article promotion

During the promotion and listing process in the Korean market, highly influential authoritative media coverage that is in line with local investors’ preferences is also crucial. This can not only quickly establish the project’s credibility, but also effectively expand market awareness and participation.

CoinNess

CoinNess is South Korea's leading cryptocurrency media platform, specializing in real-time translation and distribution of international news. Its Live Feed service provides investors with the latest market updates. As South Korea's largest provider of institutional-grade crypto investment information, CoinNess has also partnered with Yonhap Infomax, South Korea's national news agency, to exclusively provide a real-time cryptocurrency news feed. (@coinnessgl)

Blockmedia

As South Korea's first blockchain-focused media outlet, Blockmedia has long focused on trends in both traditional finance and crypto markets, project developments, and regulatory developments. While its real-time coverage may be slightly inferior to CoinNess, it has earned a reputation within the industry for its high-quality content and in-depth analysis, covering a wide range of topics, including regulation, technology, and lifestyle. (@with_blockmedia)

TokenPost

TokenPost is South Korea's leading blockchain and cryptocurrency media outlet. As an official media partner, it frequently participates in government blockchain forums, the Asia Crypto Summit, and technical seminars. Its data platform and industry research division provide customized intelligence and in-depth analysis services to institutions and businesses, delivering both authoritative and professional services. (@tokenpost)

Bloomingbit

Bloomingbit is an authoritative crypto information platform under Han Keun Media Group, South Korea's most influential and credible comprehensive financial media group. It provides 24/7 blockchain and cryptocurrency news and market reports curated by industry experts. Bloomingbit's broad reach and professional interpretation capabilities have made it a key source of information for institutional investors. (@bloomingbit_io)

2.3 Professional consulting agencies and research platforms

Since some investors find it difficult to fully understand the structure and key points of a project, the listing and marketing of crypto projects rely on professional consulting agencies and research teams to help interpret the core value and market potential of the project and provide investors with in-depth analysis and decision-making support.

Despread

As a leading crypto data analysis platform, its in-depth market research and industry trend reports help project owners understand market dynamics, accurately assess competitiveness, and thus develop more targeted marketing strategies. (@DeSpreadTeam)

Xangle

With its powerful blockchain data analysis capabilities and transparent project review mechanism, it provides investors with authoritative risk assessment and decision-making support. It serves as an important information platform for the crypto industry. (@Xangle_official)

Tiger Research

Through in-depth research, GTM consulting, and strategic investments, Tiger Research not only provides insights into industry trends but also helps projects optimize their growth paths and market strategies, driving the long-term development of the Web 3 ecosystem. (@Tiger_Research_)

K 1 Research

With its advanced market analysis capabilities and strategic data-driven decision-making, it provides crypto projects and investors with in-depth market insights and trend forecasts. Through data analysis, it helps optimize investment decisions and risk assessments, contributing to the sustainable development of the crypto ecosystem. (@K1_Research)

2.4 Other methods

- SEO optimization: Based on the above methods, a more refined SEO layout can be carried out for the Korean market, especially on the Naver platform, which has the best effect. If the strategy is appropriate, it can not only significantly increase the project exposure, but also increase the success rate of coin listing.

- In-depth forum viral marketing: Combining community-based and viral forum marketing can effectively amplify discussion enthusiasm and user attention, achieving cross-industry penetration. For example, posting memes that align with Korean culture on popular local platforms like Coinpan often inspires users to spontaneously create and disseminate memes, generating sustained buzz.

- Offline activities: Offline activities are an important part of Korean project marketing. These activities include community learning groups, seminars, and information sessions with on-site token distribution. These activities can enhance user trust and brand stickiness, while also promoting interaction among community members and word-of-mouth communication.

- Event sponsorship: This includes both cryptocurrency and non-crypto events. Hackathons are the most common example of cryptocurrency event sponsorship. Among non-crypto event sponsorships, sports events, such as football, racing, and esports, are the most common. These sponsorships not only expose potential users to your project but also significantly enhance your brand influence.

- Kaito Marketing: Kaito Marketing is based on algorithms and data, providing rankings and indicator tools that allow project owners to monitor user participation and interaction effects in real time, achieving transparent and efficient targeted promotion. At the same time, the cost structure is more friendly to small and medium-sized projects, helping to increase community activity and accurately reach users. However, it is necessary to pay attention to the potential risk of excessive noise causing user disgust.

- Professional Marketing Plan: Introducing a professional third-party marketing agency to conduct comprehensive managed marketing, including brand positioning, community operations, content creation, and advertising, to increase exposure and user engagement.

3. Basic Information on Coins Listed on Korean Exchanges

3.1 Market Share

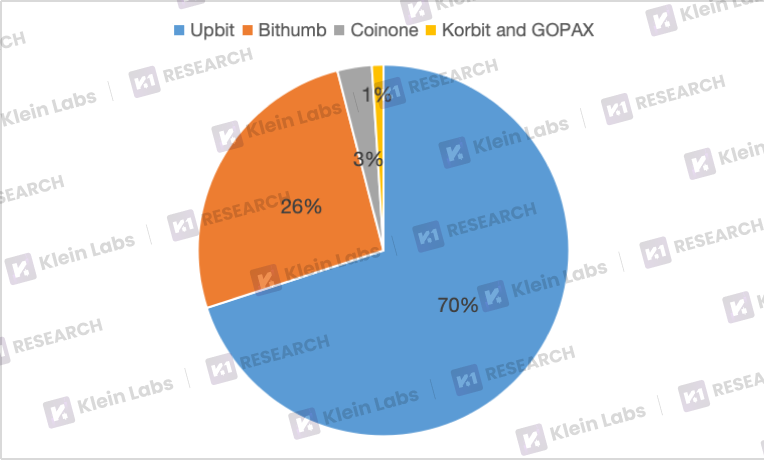

- UPbit: Affected by the competition from other exchanges launching transaction fee reduction activities, UPbit's market share has gradually declined from its highest point of 86% in 2021, and stabilized at about 70% in February 2025.

- Bithumb: With an active marketing strategy, especially a substantial increase in marketing investment and the launch of zero-fee promotions since 2024, its market share has recovered significantly, with trading volume remaining stable at approximately 26%.

- Coinone: Since the first launch of the "Fee-Free Early Bird Ticket" in October 2024 to attract new users, and at the same time combined with community operation strategies such as trading rankings and event questionnaire participation codes, it has not only accelerated market share growth but also consolidated the old user base. Its current market share is about 3%.

Among all Korean local exchanges, the top three exchanges, UPbit, Bithumb and Coinone, have a combined market share of up to 99%, while Korbit and GOPAX have a combined market share of about 1%.

These major exchanges all participate in the DAXA Alliance. Through information sharing and market collaboration, they enhance overall industry stability and coin listing efficiency, while also coordinating the pace of new coin launches and market reactions. In 2023, South Korea's five largest cryptocurrency exchanges established DAXA (Digital Asset Exchange Alliance), an industry self-regulatory alliance dedicated to enhancing transparency, compliance, and investor protection in the crypto asset market. The alliance ensures that projects meet security and compliance requirements by standardizing listing standards and collaborating with regulators to promote policy improvements, thereby improving compliance and transparency across the industry.

Since the Virtual Asset Committee meeting in June 2025 finally confirmed that the "zero fee policy" applies to South Korea's three major fiat-to-cryptocurrency exchanges - UPbit, Bithumb and Coinone, it has further consolidated and promoted the dominant position of these three companies in the market.

3.2 Supported Trading Pairs

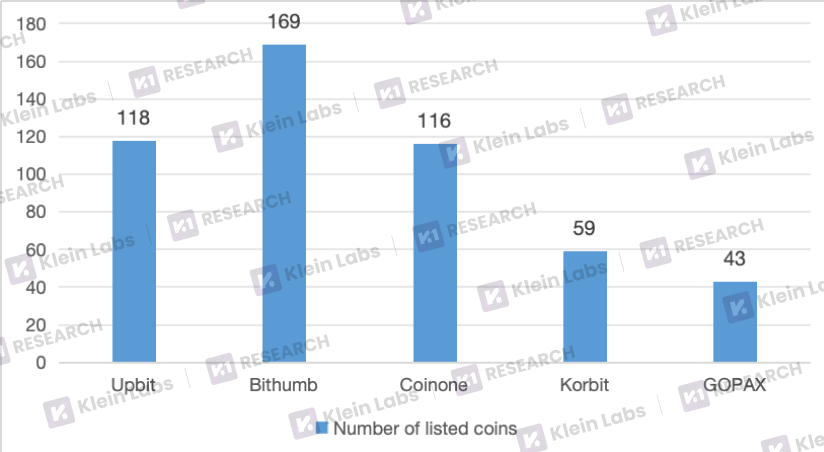

3.3 Number of listed coins

To analyze coin listings, we selected the period from January 2024 to July 2025. This period not only covers the complete bull and bear market cycle, but also encompasses key political milestones in the South Korean cryptocurrency market. This statistical period provides a comprehensive reflection of the changes in the number of coin listings on South Korean exchanges and the market environment, providing a reliable reference for researching project listing patterns and marketing strategies.

Overall, the number of coin listings in the South Korean market showed a significant growth trend during the statistical period, with particularly active activity in the second quarter of 2024 and the first half of 2025. During this period, almost all major exchanges accelerated the pace of new coin listings, and market activity climbed to a relatively high level. This phenomenon is closely related to the policy environment.

- Q2 2024: The Virtual Asset User Protection Law will take effect on July 19th. In the two months leading up to the new regulations' official implementation, leading exchanges like UPbit and Bithumb significantly accelerated their coin listing and token review processes, attempting to seize the brief "window" to launch more projects before stricter listing and inventory review mechanisms were implemented. This phased concentration of coin listings directly increased the overall number of coin listings.

- First half of 2025: Political factors also played a significant role. During the South Korean presidential election, Lee Jae-myung explicitly stated his commitment to fully supporting the local cryptocurrency industry, promoting its legalization and loosening regulations. This policy expectation, along with the subsequent introduction of the Digital Asset Basic Act, further strengthened market confidence. For the world's largest altcoin trading market, renowned for its high activity and speculation, the implementation of this law was widely viewed as a significant boon, prompting exchanges and project developers to accelerate their investment in the short term.

Specifically, against the backdrop of the overall market craze for cryptocurrencies, the strategic differences among different exchanges also reflect their different considerations in resource allocation, risk tolerance, and competitive positioning.

- Bithumb leads the market in terms of the number of listed coins, surpassing other exchanges. Bithumb not only boasts advantages in user base and liquidity, but also maintains a relatively aggressive coin listing schedule to seize market opportunities.

- UPbit and Coinone, two of the top three exchanges, have maintained roughly the same number of listed coins, demonstrating a more robust and prudent listing strategy, focusing on maintaining ecosystem stability and complying with regulatory requirements.

- In contrast, Gopax and Korbit have listed relatively few coins, indicating that these two exchanges are relatively small in terms of introducing new coins. This is closely related to their relatively limited market size, financial strength, and risk control capabilities.

4. Coin Listing Path Analysis

After gaining a preliminary understanding of the listing characteristics and overall performance of several major Korean exchanges, the next step is to conduct an in-depth analysis based on specific listing price data. By comparing the specific data on the types of listed coins and their performance across different exchanges, we can more clearly identify the similarities and differences in project selection, pricing strategies, and market feedback, providing a more intuitive and data-driven perspective on each exchange's operational logic and competitive strategies.

In order to more accurately grasp the overall rules and trend characteristics of cryptocurrency listings in South Korea, this study will focus on analyzing the three exchanges with the largest market share.

4.1 Analysis of the Number of Listed Coins and Influencing Factors

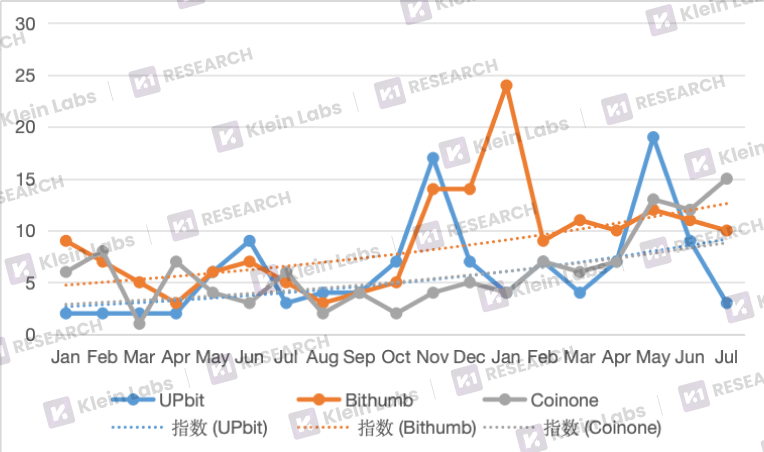

4.1.1 Overview of Monthly Token Listings on the Three Major Exchanges

Overall Trend: Since November 2024, the number of coin listings on all three major exchanges has been on an upward trend. This increase in listings reflects the buoyant market sentiment. In November 2024, the results of the US presidential election were announced, with Trump's victory, bringing renewed confidence to the market. Simultaneously, Bitcoin prices continued to hit new highs, and popular sectors such as Layer 1, memecoins, AI, and DeSci performed strongly, contributing to positive market sentiment. During this period, exchanges saw a significant increase in coin listings, reflecting the trend of rising coin listings during bull markets.

Specific analysis:

- UPbit: The overall peak characteristics are quite obvious, with significant differences between the periods of intensive listing and the periods of slow listing. There are three peaks in total, in June 2024, November 2024, and May 2025. The latter two periods of concentrated listing coincided with the bull market:

In November 2024, Bitcoin rose by nearly 40%, driving the overall market boom;

In May 2025, Bitcoin broke through the $100,000 mark, and Ethereum also rebounded strongly. Most of the listed coins were concentrated in the Layer 1 track, and it was also superimposed on the regulatory window period before the "Digital Asset Basic Law" was officially released.

Although BTC and ETH showed signs of weakness in June 2024, the overall market capitalization of South Korea's crypto market remained high. At the same time, the exchange launched a public official crypto asset information disclosure system, which brought benefits due to increased transparency. Therefore, Upbit also saw a peak in coin listings that month.

- Bithumb: Coin listings peaked in January 2025. Starting in November 2024, its coin listings rapidly climbed to 24 new coins per month, then stabilized at around 10 new coins per month, nearly double the average level for the first half of 2024. Since its strategic adjustments in 2023, Bithumb's market share has steadily increased. With the inauguration of a new president and favorable conditions for cryptocurrency in South Korea, the company has adopted a more aggressive coin listing strategy to accelerate its market share acquisition.

In early 2025, Bithumb accelerated its coin listings to capitalize on user growth and attract more participants. This move correlates closely with the fact that by December 2024, the proportion of new users among South Korean crypto investors had reached 33%. This growth was primarily driven by market sentiment surrounding the Bitcoin halving and Trump's election victory, indicating a continued expansion of its user base.

- Coinone: Coinone maintains a relatively balanced coin listing cadence, maintaining a consistently high number of listings in the first quarter of both 2024 and 2025. In May of this year, Coinone saw a significant spike in coin listings, surpassing the peaks of the previous few months. This growth was driven by the previously introduced fee reductions and marketing investments, which successfully secured a loyal user base. Furthermore, multiple positive cryptocurrency news and the introduction of the Digital Asset Basic Law have provided Coinone with stronger policy support. Based on these factors, Coinone has expanded its listings and supported a wider range of trading pairs to attract more users and further expand its market share.

Similar to UPbit, Coinone also reached a peak in May of this year; however, UPbit's coin listings plummeted in July, while Coinone hit a new high that same month. This suggests that the two platforms employ different strategies in responding to market conditions. Overall, the coin listing cadence is closely tied to BTC price trends and market sentiment. Coinone prefers to actively launch new products during periods of market upturn to attract users and maintain its growth momentum.

Judging from the exponential curves for the number of listed coins, UPbit and Coinone generally follow similar trends, but with different performance styles. UPbit's curve has more pronounced peaks and troughs, forming a cyclical adjustment to a certain extent, helping to maintain overall balance. Coinone's curve, on the other hand, maintains a high degree of synchronization with BTC price trends, remaining relatively stable and continuously upward, indicating that its coin listing strategy more directly follows market trends and pursues stable expansion.

4.1.2 Quantitative Analysis of Factors Affecting the Number of Listed Coins

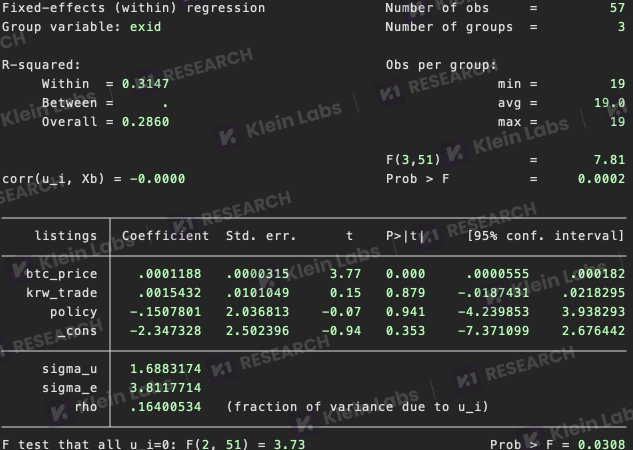

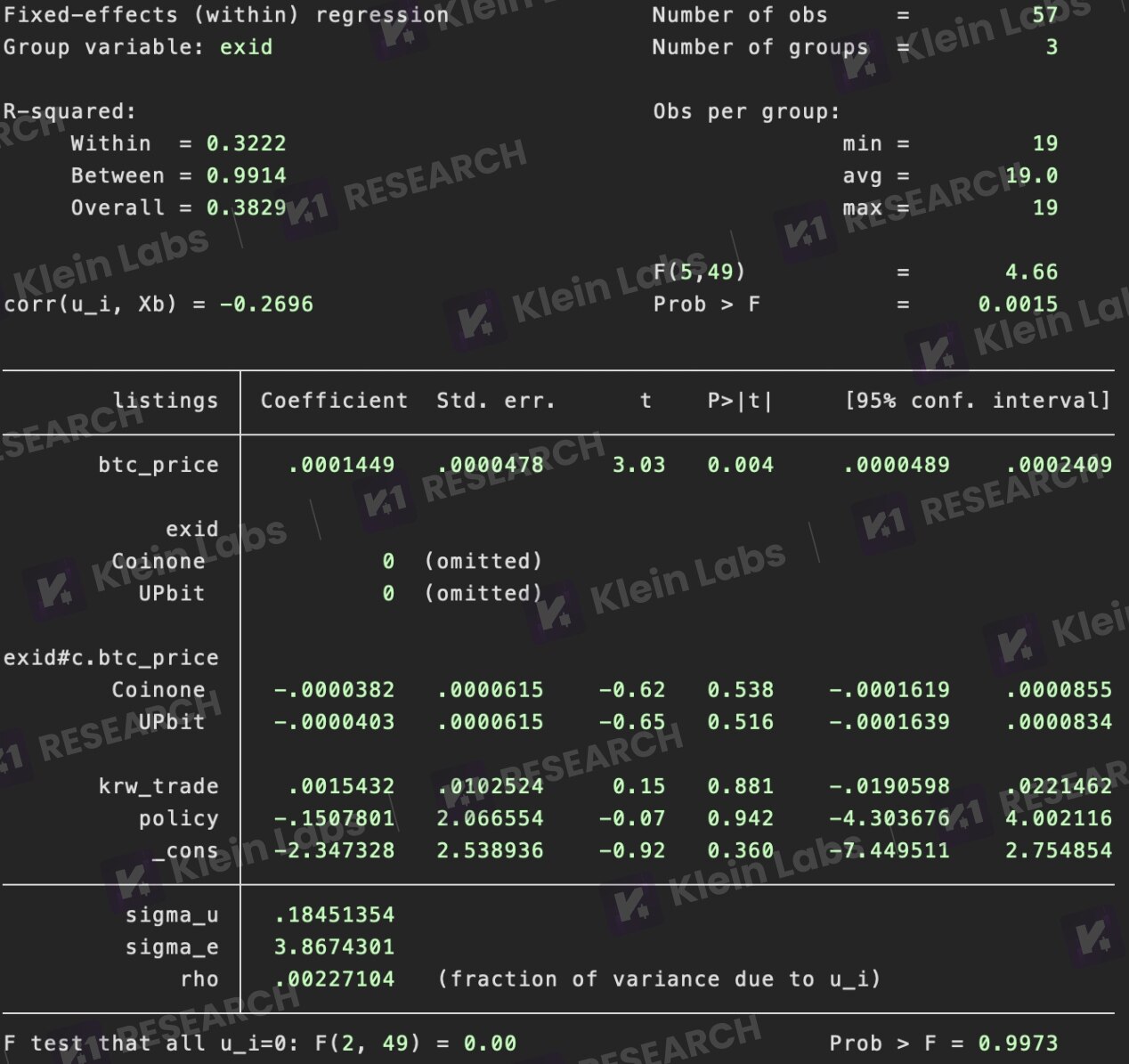

This section uses a panel data fixed-effect regression model to systematically evaluate the impact of BTC prices, Korean won-denominated trading volume, and policy factors on the number of coins listed on major Korean exchanges.

- Panel data have the advantage of encompassing both time series and cross-sectional dimensions, allowing them to capture the dynamic effects of variables over time while controlling for individual differences. Compared to single cross-sectional or time series analysis, panel methods can effectively improve estimation accuracy and reduce omitted variable bias.

- The introduction of a fixed-effects model primarily controls for time-invariant exchange-level characteristics, preventing these long-term structural differences from interfering with coefficient estimates. By incorporating the exchange fixed effect αᵢ, the model focuses on temporal variations, more accurately identifying the marginal impact of factors such as BTC price fluctuations, trading volume changes, and policy windows on coin listing decisions.

- In interpreting our results, this study uses the p-value as a core measure of statistical significance. When a variable's p-value is greater than 0.05, it means that at the 5% significance level, we cannot reject the null hypothesis of "the coefficient is equal to zero," meaning that the model does not provide sufficient evidence to demonstrate a stable statistical correlation between the variable and the number of coin listings over the sample period. However, statistical insignificance does not necessarily equate to economic inefficiency. In the highly volatile crypto market, short-term sample noise, variable measurement error, and individual heterogeneity can obscure their true effects. Therefore, for variables with p-values greater than 0.05, we will exercise caution in interpreting our conclusions, providing additional discussion from the perspective of economic implications and underlying mechanisms, rather than relying solely on statistical significance.

We set the following model:

in:

listings: the number of listed coins on exchange i in month t

btc_price: average BTC price for the month (USD)

krw_trade: Total trading volume in the month denominated in Korean won (unit: Billion)

policy: policy dummy variable (1 = policy window period, 0 = no)

αᵢ: Exchange fixed effect, used to control for long-term strategy differences across exchanges.

Explanation of panel regression results:

- The correlation is significant and positive. For every $1 increase in BTC, the average number of listed tokens increases by approximately 0.00012. If the average monthly price of BTC rises by $10,000, the average number of listed tokens increases by approximately 1.19. The p-value is extremely small, indicating that the relationship is statistically robust.

- Changes in Korean won-denominated trading volume are not significantly correlated with the number of listed coins. This may be due to the significant impact of short-term trading fluctuations and project heterogeneity, and does not directly drive exchanges' coin listing strategies.

- The policy window period has no significant impact on the number of listed coins, suggesting that different exchanges respond differently to policies.

- The fixed effect αᵢ helps control for differences in long-term strategies across exchanges, allowing the model to focus on the impact of time-dependent factors.

When further analyzing the differences among exchanges, the regression results show that:

- In contrast, UPbit and Bithumb have slightly lower marginal responses to BTC prices, but the difference from Coinone is not statistically significant, indicating that the three major exchanges generally exhibit similar positive response patterns when facing BTC price fluctuations.

- Specifically, Coinone is particularly sensitive to changes in BTC prices. For example, when the average BTC price rises by $10,000, Coinone's number of listed tokens is expected to increase by approximately 1.45, indicating that price increases incentivize the listing of new tokens to capture market interest and investor attention.

- Overall, BTC’s price signals have a significant impact on Korean exchanges’ coin listing decisions in the short term and serve as an important reference for project developers in selecting a listing window.

Combining the two analyses, the conclusions show that:

- When the market is favorable, the three major exchanges generally adopt a synchronized expansion strategy, but Coinone is more sensitive to market conditions.

- BTC price is the main factor driving the number of coin listings, rather than strategic differentiation among exchanges.

- The Korean crypto market as a whole is driven by macroeconomic trends, and differences within exchanges only have a limited impact on long-term strategies.

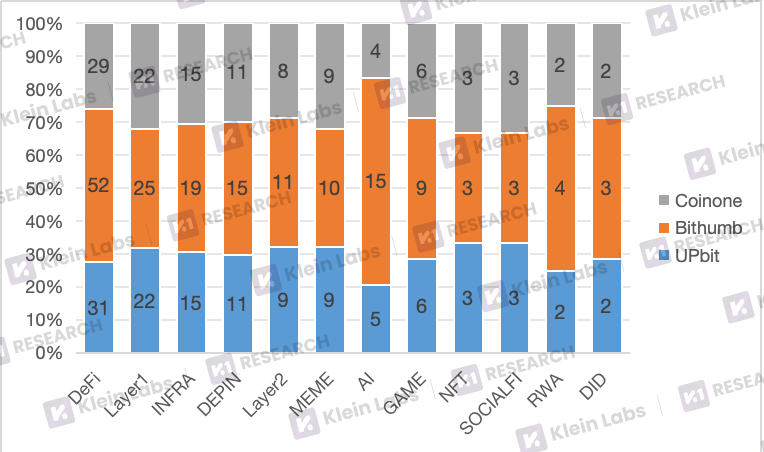

4.2 Analysis of Coin Listing Track

To delve deeper into the new listing preferences of the three major Korean token exchanges, we conducted a systematic review and analysis of their recent listings. This analysis not only provides project developers with references to listing strategies, but also helps investors identify potential investment targets and grasp the hot spots and trends in the Korean local market.

Commonalities

- DeFi, Layer 1, and Infra projects are at the forefront of the listing structure of the three major exchanges. This demonstrates that these platforms maintain a strong focus on listing sectors with practical application value, with a particular emphasis on the DeFi ecosystem and underlying Web 3 infrastructure. DeFi projects account for approximately one-third of the total number of listed tokens.

- In the DeFi sector, the three exchanges have jointly launched 12 large-scale overseas high-quality projects, including BABY, COW, DEEP, DRIFT, ENA, HAEDAL, JTO, JUP, KERNEL, PUFFER, W, and ZRO. These are all representative projects with high visibility and user base worldwide, demonstrating the convergence of exchanges in selecting high-quality DeFi assets.

- In contrast, the number of listings in emerging sectors like NFT and SocialFi is significantly lower across all three platforms. From the explosive growth in 2020 to the roller-coaster market fluctuations, and then to the prolonged downturn in the NFT market, market sentiment and liquidity have continued to be under pressure. The NFT market has recently experienced a strong rebound, and the three major exchanges have selectively listed three leading NFT projects: PENGU, ME, and ANIME, as they replenish their top assets. Overall, however, the three major exchanges remain relatively cautious and cautious in their approach to the NFT market.

Differences

- Bithumb ranked first in the number of tokens listed during the statistical period, and compared with UPbit and Coinone, the proportion of its newly added tokens in the DeFi and AI tracks was higher, which fully demonstrated Bithumb's keen grasp of market opportunities and hot spots in the AI boom in 2024, as well as its rapid response in token listing strategy.

Coinone and UPbit have a high degree of overlap in terms of overall coin quantity and time rhythm, but there are obvious differences in the style of specific token selection. Take the DeFi track as an example:

- During this period, UPbit separately listed COMP, BNT and other established projects with long-term ecological support and market verification, demonstrating its emphasis on stability and historical performance.

- Coinone has independently listed relatively new but highly promising innovative DeFi projects such as NAVX and YALA, demonstrating an open attitude and forward-looking layout towards emerging high-quality projects. It is more inclusive in its selection criteria and tends to support early-stage innovative projects with long-term growth potential.

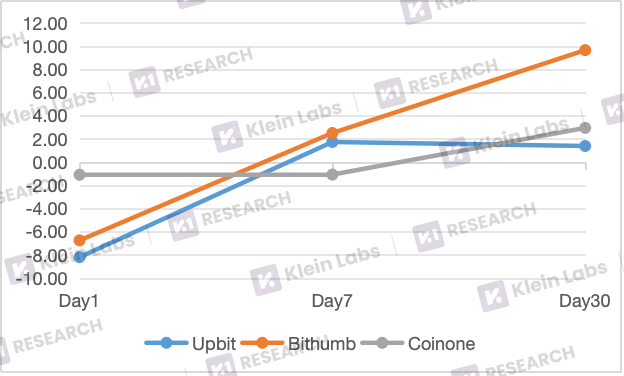

4.3 Token Price Performance Analysis

This study focuses on the price performance of newly listed tokens on the three major exchanges. We examine price changes on days 1, 7, and 30 relative to the initial coin offering price set by the exchanges to analyze trends, volatility patterns, and market reactions.

- The first-day price reflects the market's immediate acceptance of new assets and is influenced by a rush to buy and FOMO sentiment. It is a critical stage in the market's initial pricing.

- Price changes from day 1 to day 7 can capture short-term market sentiment and initial recognition of project fundamentals, measure the sustainability of market enthusiasm, and help assess reasonable initial pricing;

- The price trend from the 1st to the 30th day reflects the long-term support of the token. As short-term speculation cools down and speculators exit, changes in price and trading volume become an important reference for market recognition.

When calculating price-to-return rates, to avoid the impact of extreme values on the overall trend, we removed the upper and lower 25% of outliers and used the truncated mean method for analysis to more accurately reflect the typical price fluctuations of the token.

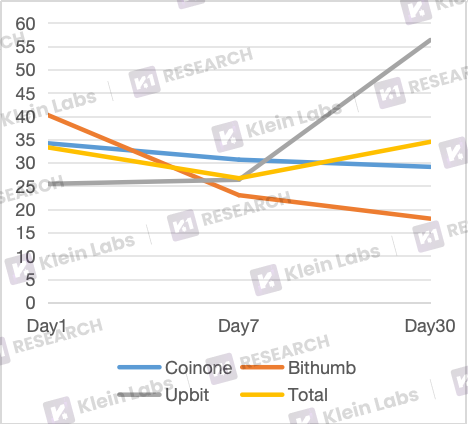

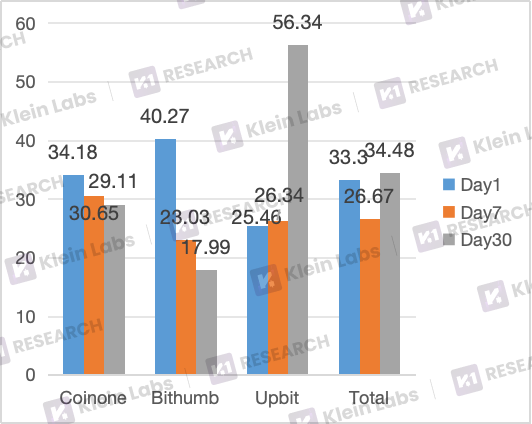

- UPbit: The average closing price on the first day was the lowest, likely due to a large user base and concentrated selling by speculators, which put pressure on prices on the first day. On average, UPbit's price rebounded rapidly on the seventh day, then gradually decreased in magnitude, demonstrating a steady upward trend after a short-term correction.

- Bithumb: Its price performance exhibits the largest average volatility, with both strong ups and downs. This may be due to its wide variety of listed coins and high market activity. While the curve indicates an upward trend for Bithumb, its excessively steep slope and amplitude may increase investor risk.

- Coinone: Its price fluctuations were minimal, demonstrating high stability and predictability. Its price trend remained stable throughout the observation period, with its 30th-day increase even exceeding that of UPbit, demonstrating the token's potential for continued growth despite limited short-term volatility. This stable yield rate means investors face relatively low risk from price fluctuations, making it more suitable for investment strategies seeking stable returns and long-term investment value.

4.4 Yield Analysis: The Bridge Effect of Listing on Exchanges

4.4.1 Research Methods

In this study, we analyze the secondary metric, token yield, to examine the impact of the first Korean exchange on the price performance of newly listed tokens. Compared to absolute price, yield has significant advantages:

- Ignoring unit effects: Compared to absolute price, yield is a relative indicator that is not affected by differences in token face value or trading units, making it easier to compare across currencies and exchanges.

- Reduce scale bias: Different token prices vary greatly, and direct comparison of prices can be misleading. However, yield can unify the scale and highlight the magnitude of changes rather than the absolute value.

- Capturing market reaction sensitivity: Yields reflect investors’ immediate sentiment and behavioral reactions to newly listed coins, helping to measure the impact of the initial exchange listing on price fluctuations.

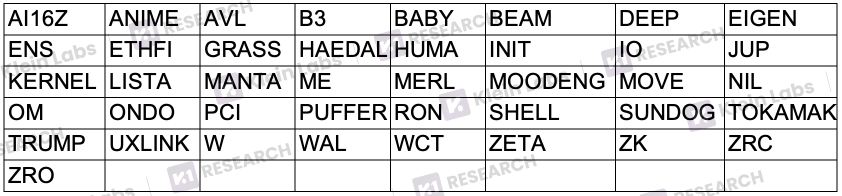

4.4.2 Token Screening and Sample Determination

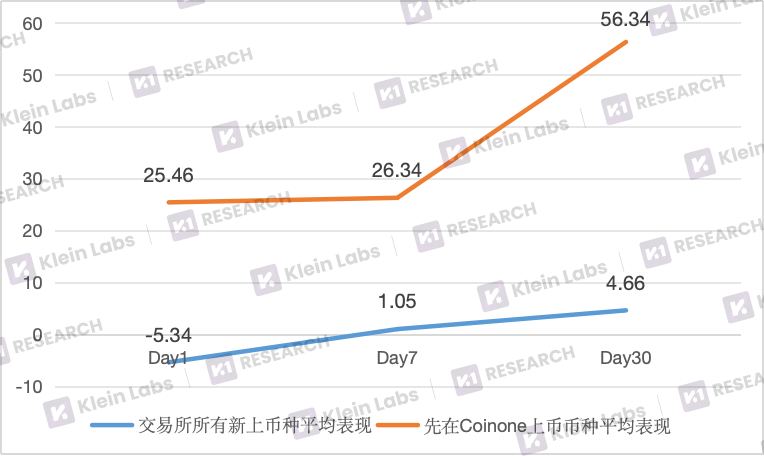

Data shows that both Bithumb and Coinone exhibit a certain "bridge effect." Bithumb saw 57 tokens listed first on its platform before subsequently listing on UPbit. Coinone also exhibited a significant performance, with 41 tokens listed first on Coinone and subsequently subsequently on UPbit and Bithumb, with an average listing interval of 93.6 days. This section will use Coinone as an example to analyze the characteristics of its listing rhythm and market interaction.

For some representative projects, such as EIGEN, ENS, and ETHFI, Coinone even began its deployment more than a year in advance. Overall, the average returns of these tokens have outperformed the overall market, further validating Coinone's role as a "bridge" within the ecosystem—introducing promising assets early and channeling them to platforms with higher trading volume and broader reach.

This bridge effect is reflected not only in the timing difference but also in returns: tokens listed early on Coinone offer significant excess returns for early adopters, while subsequent listings on other major exchanges create a cross-platform price and liquidity transmission mechanism. Coinone thus plays a dual role in the Korean exchange ecosystem, serving as both a project incubator and an asset circulation hub.

4.4.3 Yield Time Window Analysis

Analyzing the temporal distribution of price performance, Coinone-listed tokens exhibited the best overall returns. Across the three observation windows (days 1, 7, and 30), Coinone's returns were above the overall token average at two of these timeframes, while slightly below average at the remaining timeframe. In contrast, UPbit and Bithumb only outperformed the average at one timeframe, lagging behind the overall market level in the remaining timeframes.

From the overall performance point of view, in the short and medium term of tokens, projects listed on Coinone and Bithumb first tend to perform best; while in the long term, UPbit shows a more stable and excellent average level.

- UPbit: A relatively conservative strategy is adopted in the early stages of new token launches, often listing projects only after they have proven market interest. While its price performance was weakest on the first day of listing, it leveraged its liquidity and large user base to surpass the leading performer on day 30, demonstrating that its token is more likely to attract investment and experience a secondary rally in the later stages.

- Bithumb: The strategy relies more on market enthusiasm. The price performance was the best on the first day of listing, with obvious short-term effects. However, the overall yield rate subsequently declined significantly and lacked sustainability. This shows that in the absence of subsequent maintenance and market operation support, short-term surges are difficult to transform into medium- and long-term advantages.

- Coinone: Leveraging the premium effect of its first-mover advantage, it invests in popular assets early, allowing early adopters to capitalize on arbitrage opportunities when tokens are listed across platforms, while also increasing its appeal to early investors. Coinone tends to assume the risk of early listing in exchange for the opportunity to screen for potentially high-yield tokens, and has consistently outperformed the overall token market over most timeframes.

By clearly understanding the performance differences of tokens on various exchanges, investors can develop more targeted strategies based on their own risk appetite and operating cycles:

- Short-term speculative funds: Focus on the performance of Bithumb's new tokens on the first day of listing and capitalize on short-term market enthusiasm to capture price differences.

- Medium- to long-term trend investors: It is more suitable to track the performance of UPbit's new coins 30 days after listing, capturing their subsequent capital attention and secondary pull-up potential.

- Early-stage dividend collectors: Pay close attention to Coinone's early listing trends and leverage its first-mover advantage and bridge effect to obtain premium returns during the cross-platform listing process.

4.4.4 Global Performance of Yield

Statistics show that the average price performance of tokens listed on Coinone far outperforms the overall average for all newly listed tokens, showing a generally upward trend. This phenomenon demonstrates not only the high quality and market competitiveness of these tokens listed on Coinone, but also reflects Coinone's foresight and precision in its listing selection. Its ability to identify and introduce high-quality assets at an early stage is a key manifestation of its role as a bridge within the Korean exchange ecosystem.

The analysis results also provide a reference for a potential coin listing strategy: by selecting a platform with relative screening advantages for the initial launch in the early stage, not only can there be a chance to gain initial market attention and price performance, but it will also facilitate the expansion of liquidity and user coverage on larger exchanges in the future, thus forming a complete market development path from initial exposure to mid- to long-term value accumulation.

5. Excellent examples of coin listing marketing

South Korean exchanges generally have a high barrier to listing: They not only have strict requirements for project technical strength, regulatory compliance, and team background, but also high expectations for market potential, community foundation, and early user activity. This limits the number of projects that can actually be listed. This means that when seeking listing on a South Korean exchange, projects must prioritize both project strength and marketing strategies.

Below, we've selected five projects that demonstrated impressive early marketing and post-launch token price performance. We've analyzed their marketing strategies to provide valuable insights for other projects. By drawing on these successful examples, projects can prioritize promotional initiatives, community building, media partnerships, and early user incentives, thereby increasing their chances of approval and successful listing.

5.1 UXLink

- Media Cooperation and Special Reports

UXLink has partnered with numerous blockchain media outlets and industry research institutions to publish feature reports and technical analysis, raising market awareness of the project. CoinDesk Korea provided an in-depth analysis of UXLink's cross-chain technology, enhancing its credibility. CryptoSlate published an interview detailing UXLink's ecosystem and token economics. TokenPost and BlockBeats shared the report in Korean and Asian communities, expanding market exposure and community attention.

- Ecological expansion and cooperation layout

UXLink has built a community on Telegram, with partners including the TON ecosystem, UOB, Arbitrum, and Animoca Brands. Through cross-chain interoperability, AMAs, and technical workshops, UXLink has seen a 150% increase in active users and a 200% increase in daily trading volume within three months, significantly enhancing liquidity and market influence while also promoting the development of the decentralized finance ecosystem. UXLink also sponsored the Consensus Hong Kong conference and partnered with BNB Chain and Meet 48 to host the "AI Agent Rising" event in Hong Kong, further enhancing its industry influence and community awareness.

- Incentive Mechanism and User Participation

Participate in AIRDROP 2049 and issue SBT points through social network on-chain, which will encourage user interaction and community participation, while improving the reputation and activity on the chain.

5.2 Mantle Network

- Media Cooperation and Special Reports

Mantle Network has systematically deployed media outreach, partnering with numerous prominent media outlets and research institutions to publish feature reports and technical analysis, significantly enhancing the project's influence within the industry. Klein Labs provides a comprehensive ecosystem overview, offering investors a reference. Binance Square published an interview about Mantle Network, highlighting its modular architecture and Eigen-DA data availability support, enhancing the technology's credibility. Messari conducted in-depth analysis of the project and published a research report, raising investor attention. TokenPost and CoinNess reposted reports on the project's progress in the Korean market, expanding awareness within the Asian community.

- Community operation and social media promotion

Mantle Network actively operates social media and community platforms, building a highly engaged user base. X has over 800,000 followers, regularly updating project updates and engaging with the community. Its official Telegram and Discord communities have over 200,000 members, regularly hosting AMAs and community discussions to enhance user engagement and a sense of belonging. This refined community operation not only promotes information dissemination but also provides strong support for user engagement and loyalty.

- Incentive Mechanism and User Participation

Mantle Network uses incentives to increase user activity and engagement. The Mantle Journey user engagement program, launched in August 2025, distributes a 20 million MNT reward pool to participating users and applications through Soulbound Token minting, encouraging community building and ecosystem activity. These incentives not only enhance user loyalty but also validate the economic appeal of the project ecosystem, effectively forming a self-reinforcing community closed loop.

5.3 Flock.io

- Media Cooperation and Special Reports

Flock.io systematically deployed media communications, collaborating with well-known media such as Messari and Cointelegraph Korea to publish special reports and market analysis to enhance its industry influence; Klein Labs provided a comprehensive interpretation of the project ecosystem and provided investment references; TokenPost reported on its progress in the Korean market, enhancing local market awareness.

- Ecosystem expansion and cooperation layout

Flock.io has partnered with Alibaba Cloud's Qwen and Base platforms to integrate centralized AI models into decentralized platforms, enabling decentralized on-chain transactions and wallet management. Leveraging the Web 3 Agent model, locally running AI assistants safeguards user privacy. Furthermore, through community AMAs and technical workshops, Flock.io significantly increases user engagement and market influence, strengthening the decentralized ecosystem.

- Incentive Mechanism and User Participation

FLock.io supported the Qwen × FLock × Base AI Hackathon. The event attracted participation from SKY University and the KAIST Developer Club in South Korea. The event leveraged federated learning technology to promote innovation and practical application of decentralized AI models, strengthening FLock.io's technological leadership and industry influence in the decentralized AI ecosystem.

5.4 BigTime

- Media Cooperation and Special Reports

BigTime has systematically deployed media communications, collaborating with well-known media outlets such as CoinDesk Korea, CryptoSlate, and TokenPost to publish special reports and project ecosystem analysis to enhance its industry influence; Messari has provided an in-depth interpretation of its game economic model and token incentive mechanism, providing reference for investors; BlockBeats has reported on BigTime's community activities in the Asian market, enhancing local market awareness.

- Community Forum Viral Marketing

BigTime leverages social channels like community forums, Twitter, and Discord to implement viral marketing strategies, stimulating player interaction and information dissemination. Through in-game team formation and an invite code system, players are encouraged to actively invite new users, rapidly expanding the community while also enhancing user stickiness and brand influence.

- Incentive Mechanism and User Participation

BigTime players must submit an invitation code to participate, creating a short-term frenzy of "hard-to-get" codes and significantly boosting community activity. This reflects market demand. The project also offers multiple incentives, including free OTC games, voice channel support, daily NFT drop rate sharing, and premium dungeon sharing, effectively enhancing user engagement and community activity.

5.5 Sign

- Media Cooperation and Special Reports

Sign systematically arranges media communications, cooperates with well-known media and research institutions such as Tiger Research, CoinDesk Korea, and CryptoSlate, publishes special reports and technical analysis, and enhances industry awareness and capital attention; TokenPost and BlockBeats forward reports to expand the project's exposure and influence in the Korean and Asian communities.

- Community Forums and Viral Marketing

Sign leverages cultural symbols to foster a strong sense of identity and belonging, successfully cultivating a self-sustaining community of over 50,000 members. Community loyalty is high, with some core members even getting tattoos of the Sign logo, demonstrating the project's profound cultural influence and social impact.

- Incentive Mechanism and User Participation

Sign encourages user interaction and content sharing through on-chain tasks, airdrop rewards, and a fair incentive system based on Soul Binding Tokens (SBT). A high proportion of community incentives combined with a diversified product matrix effectively penetrates the on-chain trust and distribution infrastructure market, promoting the vigorous development of the "Orange Dynasty" community and the self-reinforcement of the ecosystem.

The above case study fully demonstrates that through a systematic, multi-dimensional marketing strategy, the project not only attracted investment attention and user recognition, but also successfully landed on the strict and limited Korean exchange market. This demonstrates that the project's strength and market recognition have reached a high standard, providing a successful experience and reference for other projects.

6. Conclusion

Within the global cryptocurrency landscape, the uniqueness and activity of the Korean market provide a valuable reference for project developers. Data indicates that the interaction between policy and market sentiment significantly influences the pace of coin listings. Bitcoin price fluctuations not only influence investor confidence but also subtly alter exchanges' listing strategies. This dual market-policy driven mechanism reminds project developers to incorporate macro trends and regulatory dynamics into their decision-making frameworks when formulating global launch plans.

More notably, Coinone embodies a prominent "bridge listing effect"—its early listings often serve as a signal for other mainstream exchanges to follow suit, generating secondary liquidity and amplifying the project's market presence. This suggests that, given limited resources, carefully selecting an entry platform may be more effective in leveraging the market than blindly pursuing large platforms.

However, the Korean market's experience can't be simply replicated. Different exchanges' user profiles, community culture, listing review mechanisms, and localized promotional resources all determine a project's success or failure in this market. For projects seeking an international presence, true competitiveness lies in the ability to deeply integrate data analysis, market judgment, and localized execution, resulting in a presence on the right platform at the right time and with the most appropriate strategy.

The crypto market is ever-changing, but its patterns persist. The Korean example shows that project success depends not only on technology and concepts, but also on a precise grasp of market microstructure and sentiment. In the face of this future landscape, can project developers seize short-term profits while laying the groundwork for long-term value? The answer lies in every strategic choice they make before taking the first step.

7. References

- Kaiko: Korean Crypto Market Report

- Simplicity: Token Launch Dynamics: The Science Behind Price Performance

- 나무위키: 대한민국의암호화폐규제논란

- [영상] 민주당, 디지털자산청신설검토..암호화폐도주식처럼관리?

- DeSpread Research: 2024 대한민국가상자산개인투자자트렌드리포트

- 업비트•빗썸, 2025년상장전략엇갈렸다...보수vS 공격