Hyperliquid KOL Influence Report 2025

- 核心观点:Hyperliquid KOL交易表现与社媒影响力显著分化。

- 关键要素:

- The White Whale累计盈利超3000万美元。

- 超半数KOL交易胜率不足50%。

- James Wynn社媒粉丝年增14倍。

- 市场影响:推动跟单交易与KOL评估标准化。

- 时效性标注:中期影响。

Original author: Mark Lee, former senior researcher at Gate.

Preface

Hyperliquid, a decentralized contract trading protocol emerging in 2024, leverages its own high-performance public blockchain to significantly improve transaction execution efficiency and user experience. Beyond its performance advantages, its core innovation lies in its deep integration of media and financial trading capabilities. Through on-chain tools, it provides transparency into the real-time trading behavior of top traders like James Wynn, providing a convenient copy trading mechanism for the market.

This report constructs a KOL influence assessment system based on a systematic analysis of Hyperliquid on-chain contract transaction data and associated social media interaction data. The research sample covers 10 leading KOLs and their associated 100 highly active "smart money" addresses (Note: The focus is on the KOL's primary public address; in the case of multiple addresses, the representative address is used as the main analysis subject). Data collection ends at 12:00 UTC on August 10, 2025.

1. KOL on-chain transaction influence

This report begins by focusing on quantifying the on-chain trading influence of Hyperliquid KOLs. For traders, the effectiveness of their strategies can be objectively measured through key performance indicators, including trade win rate, cumulative returns, trading frequency, and capital size. This section systematically collects and analyzes on-chain data across these core dimensions, aiming to provide a comprehensive picture of each target KOL's trading behavior patterns and strategic characteristics, laying the foundation for subsequent comprehensive influence analysis.

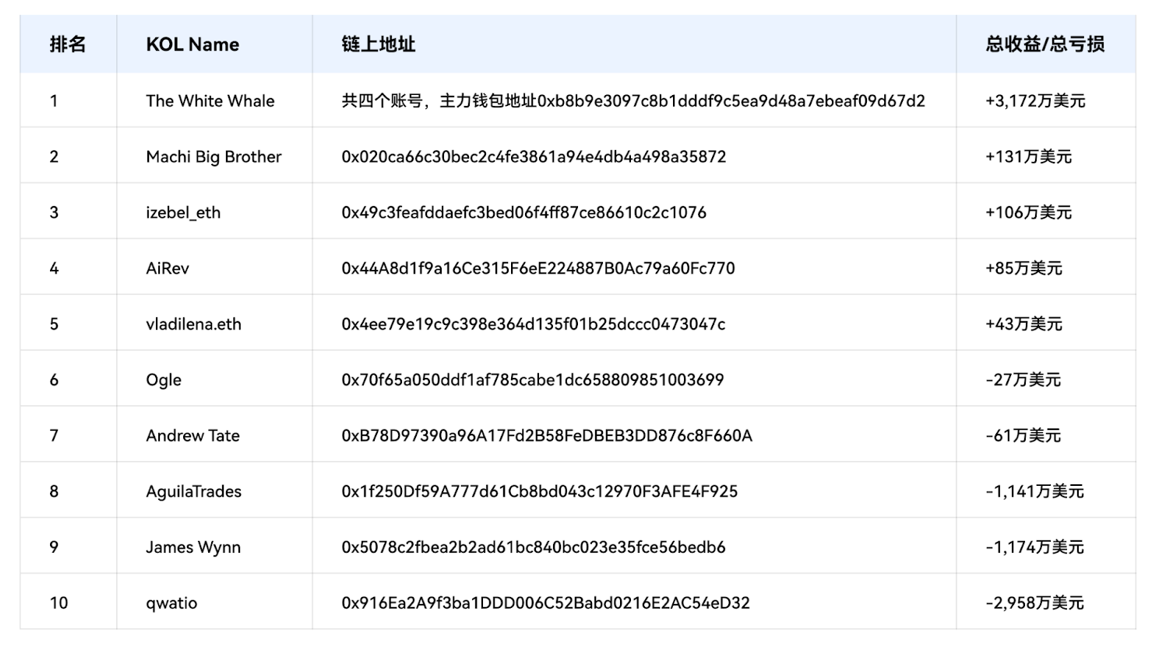

1.1 KOL Transaction Revenue Ranking

Hyperliquid KOL Total Transaction Revenue Ranking

Due to the fluctuations in traders' input costs, calculating their profit margins is difficult. However, when looking at total trading profits, The White Whale significantly outperforms other prominent KOLs. Hyperdash data shows that its four associated addresses have generated cumulative profits exceeding $30 million. Meanwhile, the profits of other profitable KOLs have all fallen below $2 million. Notably, some prominent KOLs (such as James Wynn, qwatio, and Aguila Trades) have accumulated losses exceeding $10 million. This demonstrates that high-leverage contract trading carries a high risk of margin calls and makes actual profits more difficult to achieve, so traders should exercise caution.

1.2 KOL Trading Win Rate Ranking

Hyperliquid KOL Trading Win Rate Ranking

Looking at the win rate, over half of KOLs have a win rate of less than 50% for on-chain contract trading, confirming the high difficulty of contract trading. While Machi Big Brother and vladilena.eth achieved a 100% win rate, their low trading frequency limited their statistical significance. For investors, The White Whale is a valuable target for continued tracking. Data shows that its four associated addresses completed over 1,000 transactions in 2025, with a 72.8% win rate, a significant performance among similar traders. In contrast, some high-profile KOLs, such as James Wynn and qwatio, have relatively poor win rates. This demonstrates that high-leverage contract trading carries a high risk of margin calls and makes actual profits more difficult, so traders should exercise caution.

1.3 KOL’s Best Trading Assets

Hyperliquid KOL's best trading assets

The price trends of different tokens are driven by multiple factors, including fundamentals, funding, and news, resulting in significant variations. Consequently, influencers (KOLs) often have specific trading interests they specialize in. A prime example is James Wynn: his breakthrough was building a PEPE position with a $7,000 investment, ultimately generating over $25 million in profits through swing trading. PEPE is also his core profitable asset in futures trading, generating cumulative profits exceeding $20 million through high leverage. It's important to note that his account losses were primarily due to the extremely low win rate of BTC and ETH futures trading. Conversely, The White Whale, focusing primarily on ETH, has generated over $20 million in profits through strategic holdings.

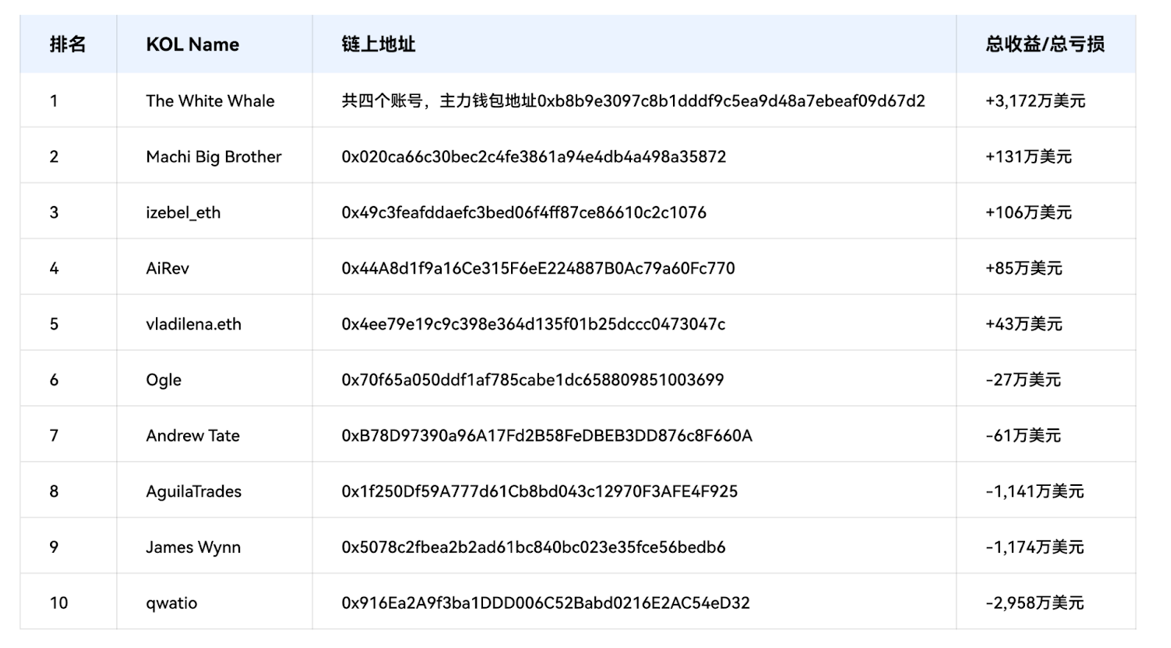

1.4 KOL Contract Holding Period

Hyperliquid KOL Contract Holding Time

Funding rates are a core cost component for cryptocurrency futures traders. For example, Hyperliquid settles its funding rate every eight hours, paid by the trader holding the dominant position. Therefore, the longer a position is held, the higher the cumulative funding cost, reflecting a trader's confidence in the asset's medium-term performance.

Data shows that James Wynn had the longest average holding period of any trade in the statistical sample, at 77 hours. His representative trade involved highly leveraged PEPE contracts, which he held for over 1,455 hours (approximately 60 days), ultimately generating a profit of approximately $25 million. In comparison, AiRev had the shortest average holding period, at just 6.5 hours.

For contract traders, the time dimension often outweighs the underlying asset itself. With high leverage, holding a position for an extended period not only increases capital costs but also significantly amplifies the risk of margin calls. Given the 24/7 nature of the crypto market, short-term price fluctuations can easily lead to margin calls if positions are not closed promptly. Therefore, ultra-short-term traders can consider the strategies of AiRev and The White Whale; those who prefer to capture medium-term trends can consider the long-term holding strategies of James Wynn.

1.5 Cumulative Profits of KOL Long-Short Trading

Hyperliquid KOL long-short trading income

In the volatile bull market of 2025, high-leverage short-selling strategies proved significantly more difficult to profit from. Statistics show that among the KOLs sampled, only izebel achieved positive returns from shorting ETH, while the majority of the others incurred losses from their short contracts. Notably, even The White Whale, a major investor with cumulative profits exceeding $30 million, failed to generate positive returns from its short-selling activities. In contrast, qwatio, known as "50x Brother," suffered heavy losses from short-selling contracts, with cumulative losses exceeding $30 million in 2025, making his long-term gains seem like a drop in the bucket.

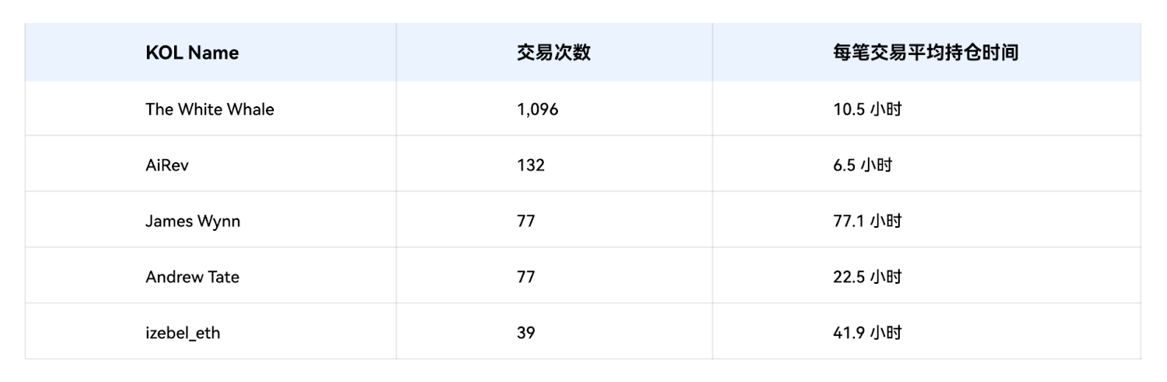

1.6 KOL Asset Size Ranking

Hyperliquid KOL Current Asset Size

Data shows that some KOLs in the statistical sample have transferred their primary assets out of their current wallet addresses, resulting in on-chain asset balances of less than $1,000. It is expected that these KOLs may use new addresses for future operations. In terms of asset size, only The White Whale and Machi Big Brother currently meet the "whale" criteria; the remaining KOLs have relatively limited assets on Hyperliquid. It is worth noting that, similar to traditional fund managers, managing larger funds generally means higher strategy execution and risk management costs.

Hyperliquid KOL asset size peak

Historical data reveals that the primary addresses of several KOLs once managed assets exceeding tens of millions of US dollars. Typical examples include James Wynn, AguilaTrades, and qwatio, whose addresses peaked at $84.2 million, $33.67 million, and $13.68 million, respectively. Notably, the current on-chain assets of all three have fallen below $1,000. Interestingly, these three KOLs are also the top three traders with the highest cumulative losses as reported in the statistics previously mentioned (Section 1.1). These significant losses may have prompted these KOLs to start over with a new wallet address or to leave the Hyperliquid contract trading market entirely.

1.7 Hyperliquid Anonymous Smart Money and Anonymous Whale Addresses

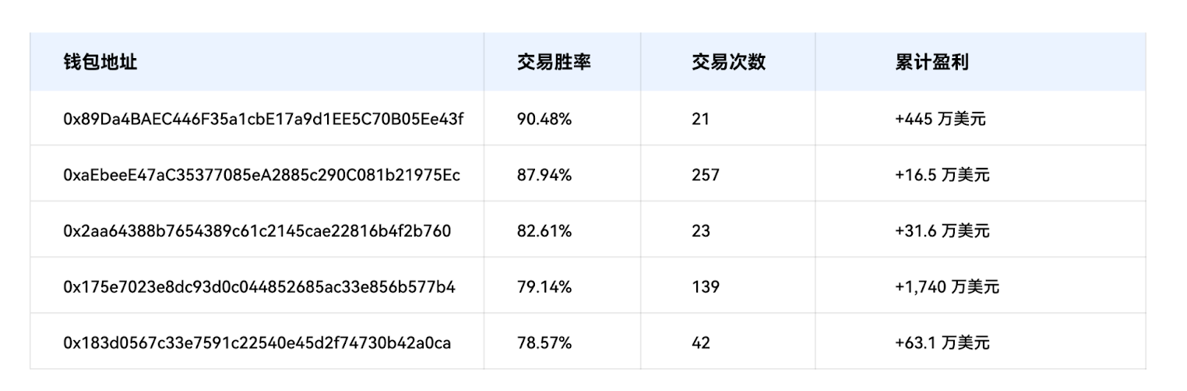

Hyperliquid anonymous smart money transaction addresses and transaction data

Table 9: Hyperliquid anonymous whale transaction addresses and transaction data

Anonymous smart money addresses and whale addresses have the potential to become influential KOLs on social media. In fact, the on-chain address 0x175e7023e8dc93d0c044852685ac33e856b577b4 has become a highly-followed on-chain address by social media accounts including Lookonchain, Onchain Lens, and Aunt Ai. Due to its high win rate and large amount of funds, even without being linked to a personal IP, this address's every move effectively acts as a KOL, influencing retail investors' trading behavior.

Anonymous smart money addresses and whale addresses have the potential to become influential KOLs on social media. In fact, the on-chain address 0x175e7023e8dc93d0c044852685ac33e856b577b4 has become a highly-followed on-chain address by social media accounts including Lookonchain, Onchain Lens, and Aunt Ai. Due to its high win rate and large amount of funds, even without being linked to a personal IP, this address's every move effectively acts as a KOL, influencing retail investors' trading behavior.

Focusing on KOLs who have attached their personal IPs, we observe two typical persona strategies: the "loss-making whale" and the "high-win-rate smart money." The former capitalizes on dramatic events by creating narratives of "massive wealth fluctuations" (e.g., the "fall from grace" of a wealthy individual), attracting market attention. The latter, however, relies on verifiable high win rates to attract investors to copy their trades in the hope of replicating their outsized returns. It's worth noting that The White Whale has successfully broken through the "scale curse" commonly associated with asset management, achieving both top-tier asset size and a high win rate, making it a benchmark IP in the Hyperliquid ecosystem, both influential and profitable.

2. Social media influence

2.1 Hyperliquid KOL Social Media Data

Hyperliquid KOL social media data as of January 1, 2025

Note: The White Whale created its account in July 2025, and its follower data was included in the LunarCrush website statistics on July 28, 2025. qwatio and vladilena.eth were not included in the LunarCrush website statistics due to their small number of followers on their personal social media accounts.

Hyperliquid KOL social media data as of August 10, 2025

2025 YTD KOL data growth

2025 YTD growth rate of major KOLs

Data shows that James Wynn will undoubtedly be the fastest-growing KOL in terms of followers by 2025, with his follower base increasing over 14-fold and his exposure and engagement on the X platform also rising significantly. The White Whale, despite registering its X account in July, attracted over 5,300 followers in its first month, demonstrating its continued expansion in social media influence. Furthermore, KOLs such as AguilaTrades and izebel_eth also saw significant growth in their followings.

A noteworthy example of cross-sector influence is Andrew Tate, a former professional kickboxer who has amassed over 10 million followers through his fitness content. While his account has widespread influence, cryptocurrency-related content accounts for a very small percentage, with his core audience focused on non-crypto fields. This stands in stark contrast to niche influencers who primarily specialize in cryptocurrency.

2.2 Hyperliquid KOL Social Media Personality

To become an influential trader on social media platforms, not only do you have advantages in terms of capital or winning rate, but a well-rounded persona will increase fan engagement and boost exposure for your legendary story. Many KOLs on the Hyperliquid chain have their own distinct personas, ranging from ambitious and talented traders to grassroots trading prodigies and technical experts deeply immersed in code. The following sections introduce some representative KOL personas.

2.2.1 James Wynn, a talented trader from a small town

James Wynn is currently the most legendary trader on the blockchain. Hailing from a forgotten town in England, cryptocurrency trading changed his life. James Wynn first encountered cryptocurrency in 2022. Being relatively modest, he became one of the "10 U Warriors" (investing $10 per trade). In 2023, James Wynn established a personal Twitter account, where he constantly promoted content related to PEPE. In April 2023, James Wynn predicted that PEPE's market capitalization would rise from $4.2 million to $4.2 billion. As everyone knows, James Wynn became the biggest beneficiary of PEPE's rise, and his social media popularity soared.

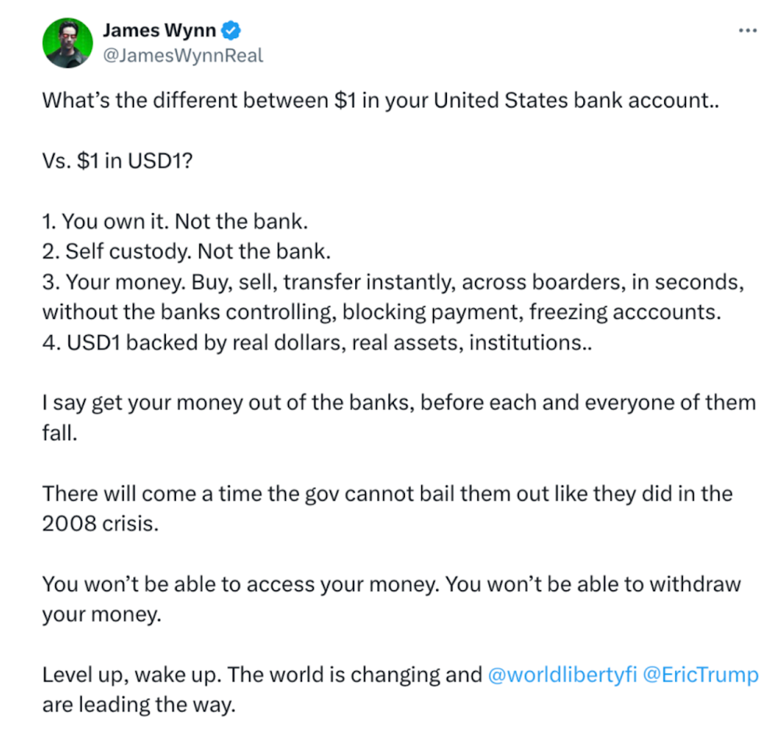

Even after achieving success as a small-town teen, James Wynn maintained his anti-capitalist persona. In a July 17th tweet, he questioned the US banking system, suggesting that everyone choose USD 1 over banks. Furthermore, James Wynn has posted numerous tweets criticizing the old order and institutions.

James Wynn tweets about banks

2.2.2 The White Whale, the Evangelist of Rational Investment

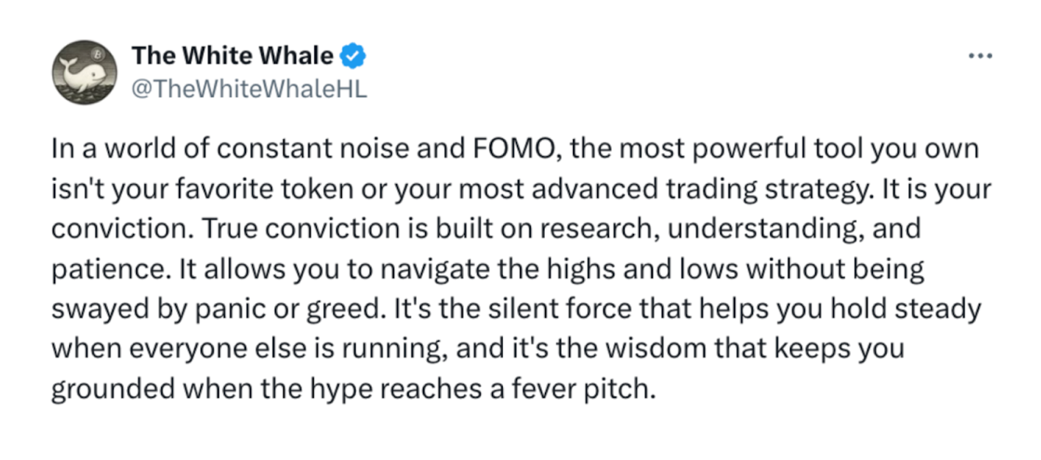

As mentioned above, The White Whale is one of the few on-chain KOLs who has overcome the "scale curse." He only created his personal account, X, in July 2025. As a successful trader, his X account showcases his understanding of cryptocurrency trading, not its techniques. While he occasionally expresses himself irrationally, compared to other KOLs, he presents himself more like a kind and respectful elder. He is eager to share his insights on investment and his views on the future trends of ETH and SOL. He has repeatedly tweeted that traders should reduce irrational trading and analyze data rationally to make sound trading decisions.

Figure 2: The White Whale’s tweet about rational trading

2.2.3 izebel_eth, a crypto pioneer specializing in technical analysis

izebel_eth is a distinctive KOL on the Hyperliquid chain. He excels at technical analysis when making trading decisions, using indicators such as trading volume, moving averages, resistance levels, and support levels to determine whether to go long or short contracts. Furthermore, izebel_eth frequently uses anime and memes on his social media accounts to express his feelings about missed trading opportunities and successful trades. Compared to other KOLs, his X-account content alone resembles that of an anime blogger. Furthermore, izebel_eth is highly skilled at reviewing past failures, formulating new trading plans based on their insights. Many of izebel_eth's high-quality content has been shared by mainstream blockchain media outlets.

izebel_eth's tweets about technical analysis

2.2.4 AiRev, a heavy GameFi player who is not good at speaking

Among cryptocurrency influencers, izebel_eth and AiRev are the most active online influencers. However, unlike many other influencers who are highly expressive, AiRev tends to repost content from other influencers, only actively speaking out when others mention him. AiRev is also one of the few influencers who proactively responded to the on-chain monitoring account Lookonchain after it revealed his transactions. Besides trading, AiRev has also reposted a large amount of GameFi-related content, with content related to the card game Parallel being reposted numerous times. Perhaps for him, trading is merely a means to make money, while gaming is his greatest passion.

AiRev responds to Lookonchain's tweet

2.2.5 Machi Big Brother, a former hip-hop singer and crypto veteran

Machi Big Brother, the social media handle for Taiwanese-American singer Huang Licheng, is one of the few publicly recognized opinion leaders (KOLs) in the current on-chain trading space, and a rare Chinese KOL on the Hyperliquid platform. He entered the cryptocurrency space in 2017 and is a veteran compared to other traders. Before joining Hyperliquiquid, Machi Big Brother dubbed himself "Chairman of the Bored Ape," frequently gifting NFTs to friends in the entertainment industry and actively promoting the Bored Ape Yacht Club (BAYC). However, after the NFT bubble burst in 2022, NFT-related content on his account declined. Machi Big Brother is a staunch supporter of Ethereum (ETH), frequently mentioning ETH on his social media accounts.

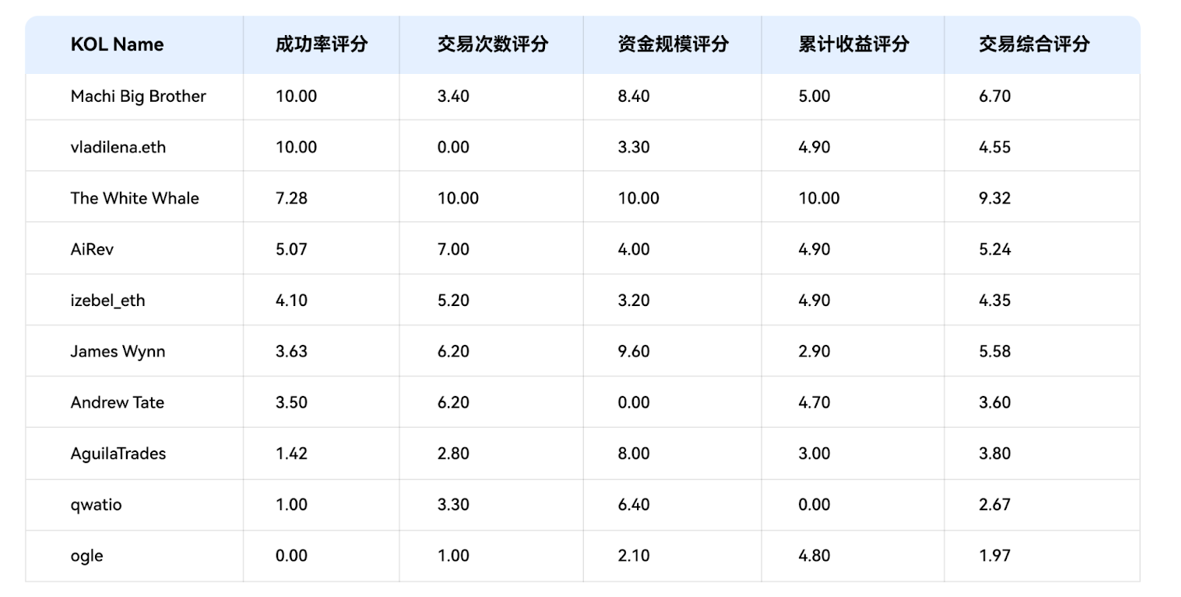

3. Summary of KOL influence

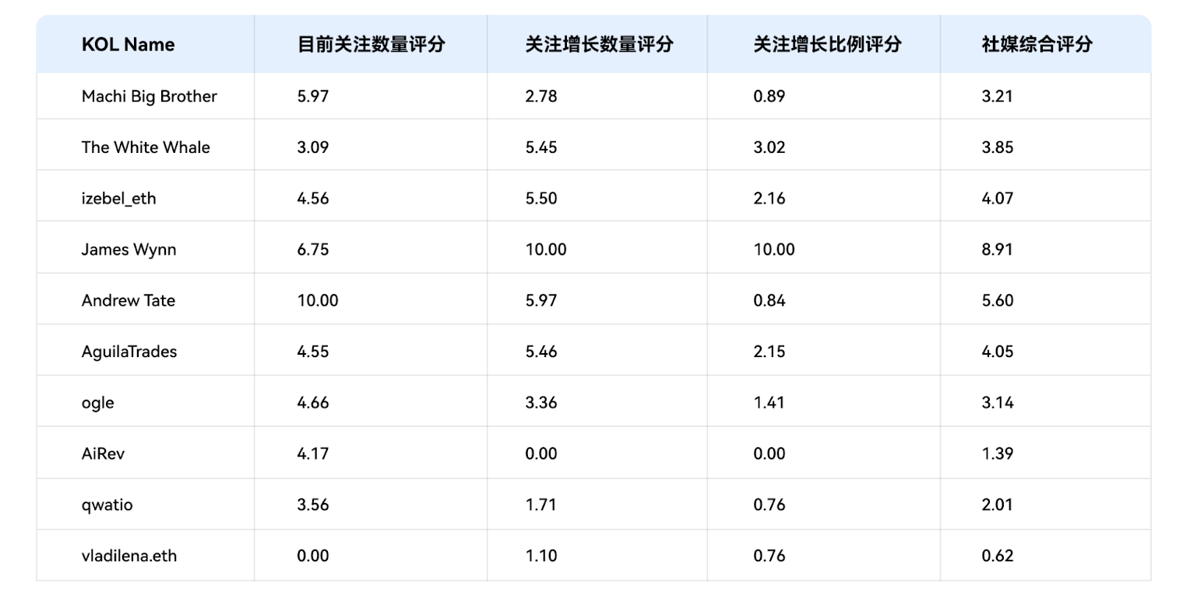

This article divides KOL influence into two dimensions. The first is the transaction dimension, which includes four indicators: transaction success rate, number of transactions, funding scale, and cumulative revenue. The second is the social media dimension, which considers the absolute number of followers and the month-over-month growth rate of followers.

KOL's comprehensive influence on on-chain transactions

KOL social media comprehensive influence

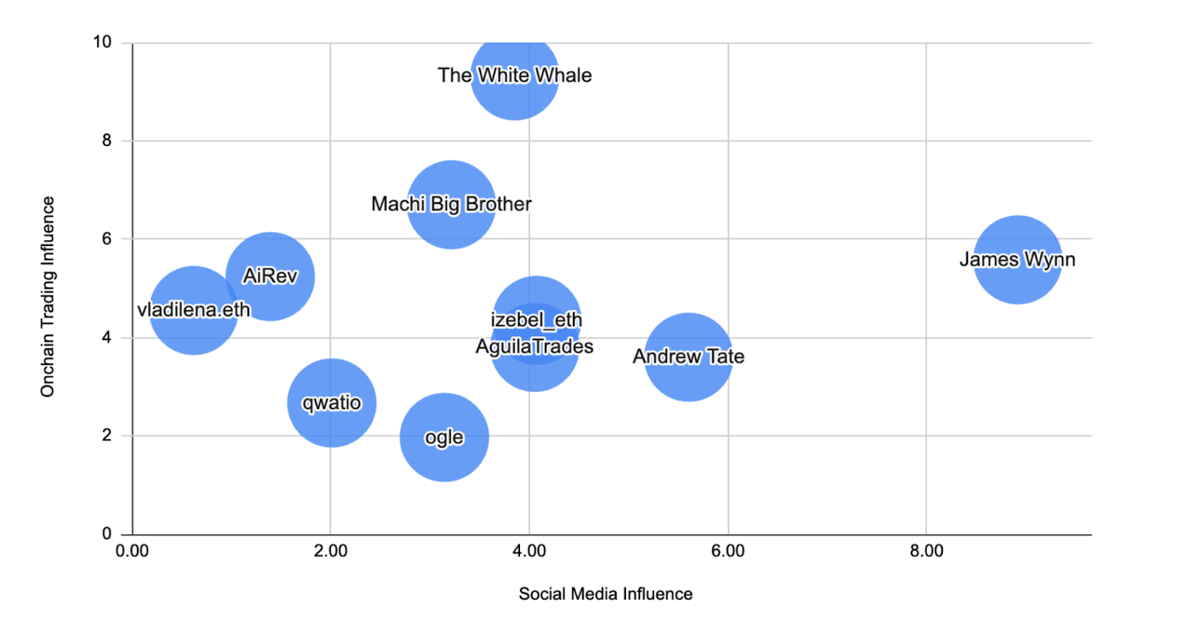

In summary, this study, based on an analysis of KOLs on the Hyperliquid platform, constructed a comprehensive influence evaluation matrix based on two dimensions: social media influence and on-chain transaction performance. As shown in the figure, The White Whale significantly leads in on-chain transactions, demonstrating strong capital scale and transaction win rate. Meanwhile, James Wynn holds a relative advantage in social media, demonstrating higher community engagement and content dissemination effectiveness.

Table 16: Hyperliquid KOL influence coordinate chart

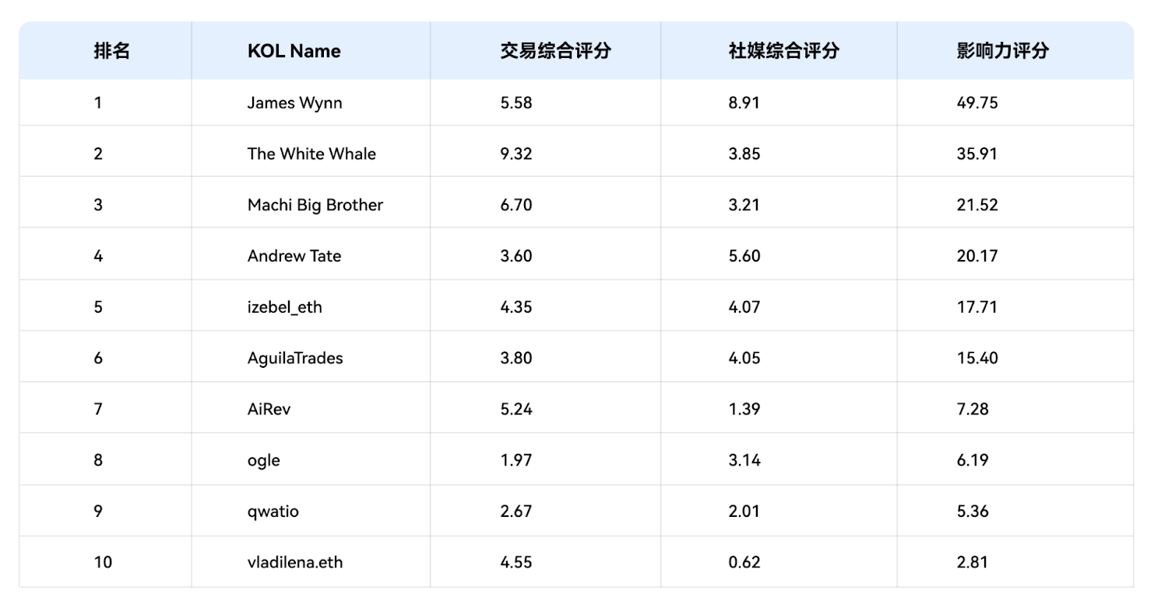

Hyperliquid KOL Comprehensive Influence Ranking

Through a comprehensive assessment of two core indicators, on-chain transaction influence and social media influence (influence index = transaction influence × social media influence), the top three are James Wynn, The White Whale, and Machi Big Brother. It is worth noting that The White Whale, due to its relatively recent account registration and relatively limited social media presence, is slightly disadvantaged in this score, which affects its overall ranking.

Hyperliquid has become a vital platform for top cryptocurrency traders to expand their voices and enhance their industry influence. However, even if they successfully build on-chain traction, establishing true influence in the crypto world requires long-term dedication in two key areas: sustained and in-depth community engagement, and maintaining a high win rate in on-chain trading. Only by cultivating trading prowess and building community trust can they navigate cycles and truly establish themselves at the center of industry discourse.

4. Source:

1. https://hyperdash.info/trader/0 x 5078 c 2 fbea 2 b 2 ad 61 bc 840 bc 023 e 35 fce 56 bedb 6

2. https://hyperdash.info/trader/0 x 1 f 250 Df 59 A 777 d 61 Cb 8 bd 043 c 12970 F 3 AFE 4 F 925

3. https://hyperdash.info/trader/0 x 916 Ea 2 A 9 f 3 ba 1 DDD 006 C 52 Babd 0216 E 2 AC 54 eD 32

4. https://hyperdash.info/trader/0 x 44 A 8 d 1 f 9 a 16 Ce 315 F 6 eE 224887 B 0 Ac 79 a 60 Fc 770

5. https://x.com/lookonchain/status/1953130827484938597

6. https://hyperdash.info/trader/0 x 020 ca 66 c 30 bec 2 c 4 fe 3861 a 94 e 4 db 4 a 498 a 35872

7. https://x.com/OnchainLens/status/1951820201470873768

8. https://hyperdash.info/trader/0 xd 5 ff 5491 f 6 f 3 c 80438 e 02 c 281726757 baf 4 d 1070

9. https://hyperdash.info/trader/0 xb 8 b 9 e 3097 c 8 b 1 dddf 9 c 5 ea 9 d 48 a 7 ebeaf 09 d 67 d 2

10. https://hyperdash.info/trader/0 xa 04 a 4 b 7 b 7 c 37 dbd 271 fdc 57618 e 9 cb 9836 b 250 bf

11. https://hyperdash.info/trader/0 xfa 6 af 5 f 4 f 7440 ce 389 a 1 e 650991 eea 45 c 161 e 13 e

12. https://x.com/lookonchain/status/1946957494364103135

13. https://hyperdash.info/trader/0 x 4 ee 79 e 19 c 9 c 398 e 364 d 135 f 01 b 25 dccc 0473047 c

14. https://x.com/lookonchain/status/1943144977199947851

15. https://hyperdash.info/trader/0 xB 78 D 97390 a 96 A 17 Fd 2 B 58 FeDBEB 3 DD 876 c 8 F 660 A

16. https://x.com/lookonchain/status/1933045616063676657

17. https://hyperdash.info/trader/0 x 70 f 65 a 050 ddf 1 af 785 cabe 1 dc 658809851003699

18. https://x.com/lookonchain/status/1930805770947637632

19. https://hyperdash.info/trader/0 x 49 c 3 feafddaefc 3 bed 06 f 4 ff 87 ce 86610 c 2 c 1076

20. https://x.com/lookonchain/status/1910274545912787248

21. https://hyperdash.info/trader/0 x 89 Da 4 BAEC 446 F 35 a 1 cbE 17 a 9 d 1 EE 5 C 70 B 05 Ee 43 f

22. https://hyperdash.info/trader/0 xaEbeeE 47 aC 35377085 eA 2885 c 290 C 081 b 21975 Ec

23. https://hyperdash.info/trader/0 x 2 aa 64388 b 7654389 c 61 c 2145 cae 22816 b 4 f 2 b 760

24. https://hyperdash.info/trader/0 x 175 e 7023 e 8 dc 93 d 0 c 044852685 ac 33 e 856 b 577 b 4

25. https://hyperdash.info/trader/0 x 183 d 0567 c 33 e 7591 c 22540 e 45 d 2 f 74730 b 42 a 0 ca

26.https://lunarcrush.com/creators/x/jameswynnreal

27. https://lunarcrush.com/creators/x/machibigbrother

28. https://lunarcrush.com/creators/x/thewhitewhalehl

29. https://lunarcrush.com/creators/x/izebel_eth

30. https://lunarcrush.com/creators/x/aguilatrades

31. https://lunarcrush.com/creators/x/cryptogle

32. https://lunarcrush.com/creators/x/cobratate

33.https://lunarcrush.com/creators/x/parallelairev