The Dark Side of Prediction Markets: Who’s Rigging Your Bets?

- 核心观点:预言机误判导致用户巨额亏损。

- 关键要素:

- 乌克兰矿产交易误判致数百万亏损。

- TikTok封禁误判涉1.2亿美元资金。

- 泽连斯基西装事件误判涉2.1亿美元。

- 市场影响:削弱预测市场公信力与参与度。

- 时效性标注:长期影响。

Original author: Splin Teron

Original translation: Luffy, Foresight News

I have fallen into all the pitfalls I am going to talk about below and lost a lot of money because of them.

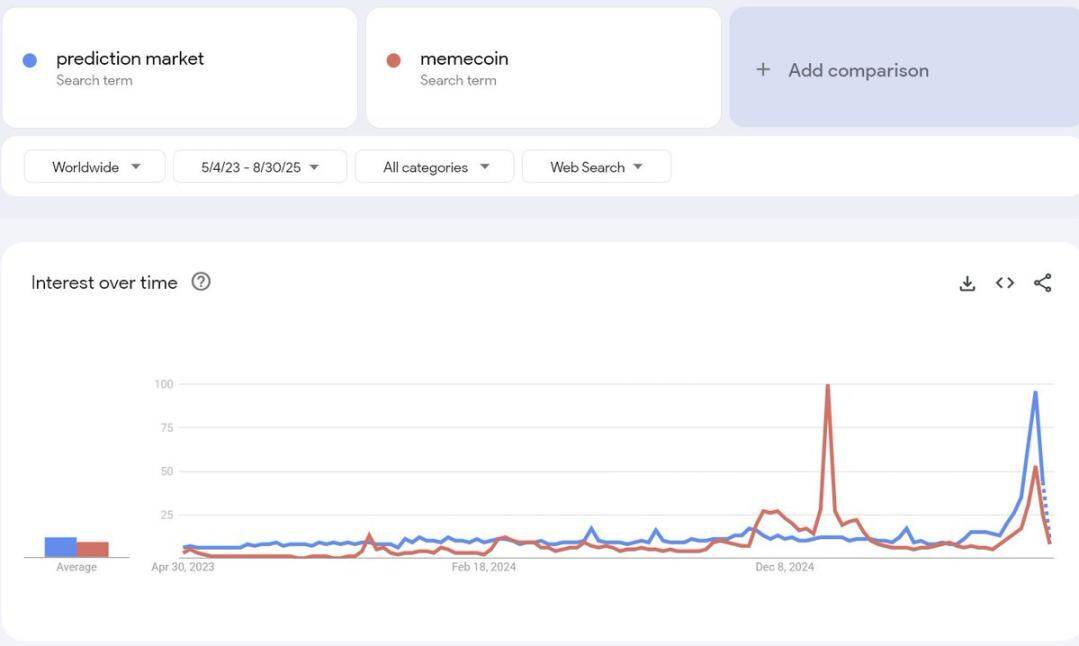

There’s no need to deny the current trend. Google Trends shows that searches for “prediction market” are now on par with searches for “memecoin” at the beginning of the year.

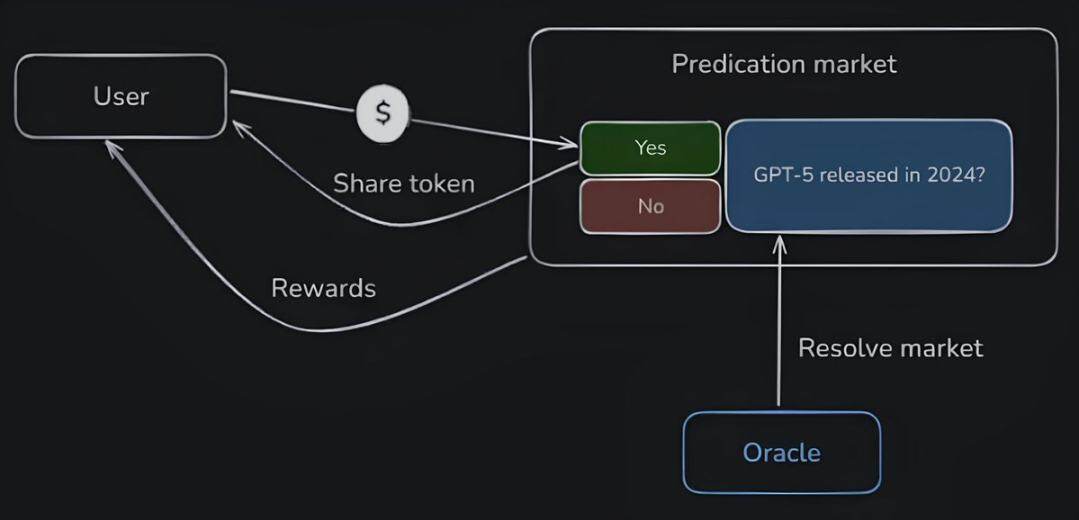

But first, let’s quickly review the basics of how prediction markets work:

- Deposit USDC;

- Buy an outcome token, either "bullish" (Yes) or "put" (No);

- Tokens are locked in the smart contract until the event is over;

- After the event is settled, the oracle will lock the result;

- If your bet turns out to be correct, you can redeem the tokens and get a profit; if your bet is wrong, you will lose the principal you invested.

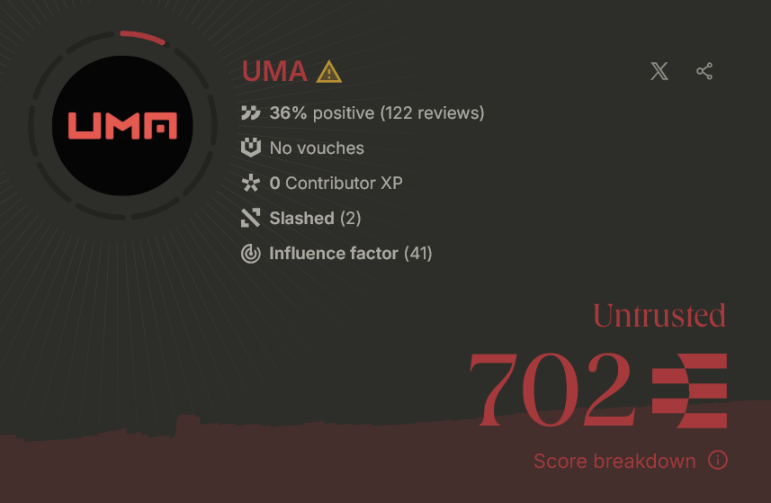

So… an oracle is an external source of truth. On the Polymarket platform, this role is played by UMA.

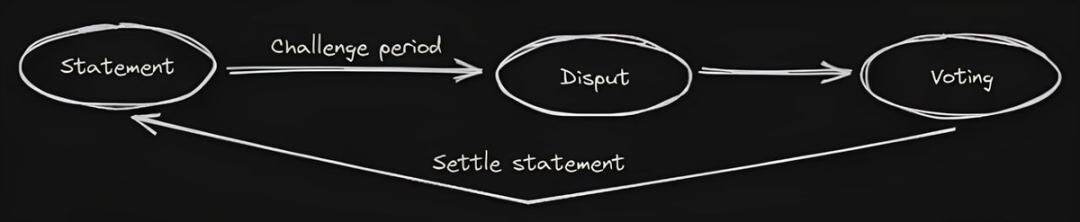

After the event is over, the oracle sends a signal to the contract: "Yes" or "No". It is at this time that the funds are redistributed among the participants.

The entire market’s trust depends on oracles. If an oracle misjudges or determines an outcome in a questionable way—even when the truth is obvious—someone will gain and some will lose.

The problem is that… the oracle’s “misjudgments” are actually quite frequent. Or, as the community says, the oracle is “favoring the whales”!

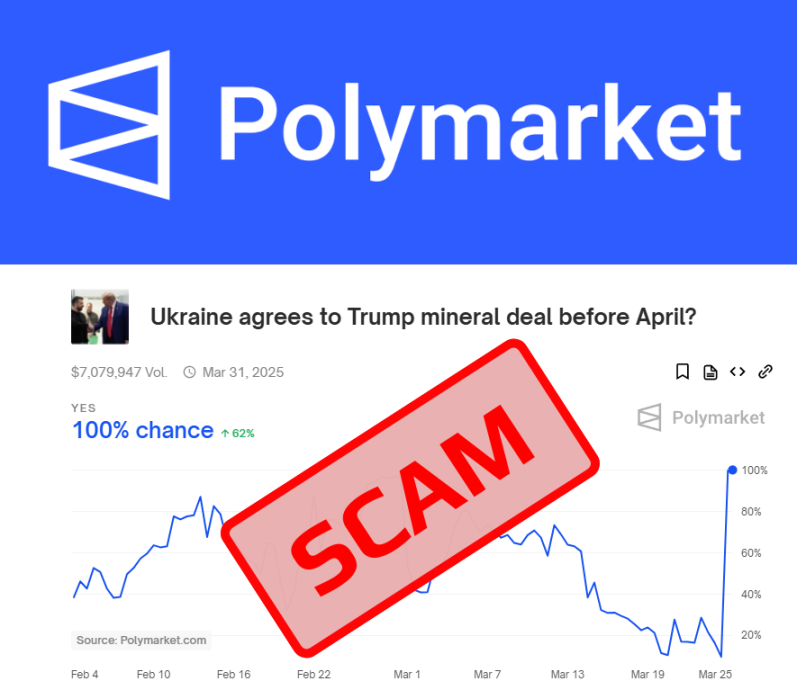

Case 1: Ukraine and Trump Minerals Agreement

March 2025: A prediction market on the Polymarket platform, "Ukraine and Trump reach a mineral deal," ultimately concluded with a "yes" outcome. However, no deal actually took place; the decision was forced by UMA's whales. Users lost millions of dollars, and Polymarket announced it would not provide any refunds.

Case 2: Will TikTok be banned before May 2025?

January 2025: A prediction market on the Polymarket platform, "Will TikTok be banned before May 2025?", ultimately concluded in a "yes" outcome. Despite the US Supreme Court's approval of the bill, TikTok remained operational and not banned. The UMA oracle locked in this outcome, bypassing the standard dispute resolution process. Approximately $120 million was involved in the market at the time. Users accused the market of manipulation, but the platform still offered no refunds.

Case 3: Will Zelensky appear in a traditional suit?

July 2025: A prediction market on the Polymarket platform, "Will Zelensky appear in a traditional suit?", attracted over $210 million in bets. Despite multiple media outlets and even the suit's manufacturer confirming that Zelensky was wearing a suit, the UMA oracle declared the market negative. They defended this result with a vague explanation, claiming that "the core intent of the market is 'a suit with a tie,'" a claim that effectively served as a safeguard for whales, helping them maintain their positions.

Case 4: Will the Houthis attack Israel before August 31?

August 2025: A prediction market on the Polymarket platform, "Will the Houthis attack Israel before August 31st?", saw $13 million in trading volume, ultimately resulting in a "yes" prediction. However, official sources confirmed that the missile was intercepted mid-air. According to the rules, this should have been a "no."

I don’t want to list all the cases to fill up the word count... If you want to know more, you can search on Reddit, or use Grok or ChatGPT to check.

Why do markets, where the results are obvious, ultimately judge things contrary to reality? Who has the final say in voting?

I don’t know the answer, but the key point is simple: this is happening, and people are losing money because of it!

What screening methods can help you avoid risks before trading?

- Manage your funds well: bet no more than 1%-3% of your deposit on a single market.

- Choose events with clear information sources, such as court decisions, official statements, and on-chain data;

- View market liquidity and the list of top holders;

- Take profit in advance, for example, exit the market when the profit reaches about 95%, and do not wait until the final result is determined.

And I hope you understand that prediction markets are more like gambling than investing. If you can't control the urge to bet, it's best to stay away from this field...

But if you decide to dig deeper, I’ve included a diagram of the distribution of different protocols to help you get started in the world of prediction markets.