Original author: Artemis

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Ethan ( @ethanzhang_web3 )

Editor's Note: The crypto world has long been plagued by a chaotic valuation system—the same token presents vastly different supply figures on different platforms, leading to distorted market capitalization and inaccurate investment judgments. While traditional stock markets have long adopted standardized metrics such as shares outstanding, on-chain valuations are still largely unsophisticated. Recently, Artemis and Pantera Capital proposed the "circulating supply" framework, introducing the well-established concept of shares outstanding in the stock market to the crypto world. By excluding non-circulating tokens such as protocol holdings, this framework provides the industry with a value benchmark comparable to traditional finance. This transformation may become a key infrastructure for institutional investment and has the potential to reshape the entire cryptoasset valuation paradigm.

Editor's Note: The crypto world has long been plagued by a chaotic valuation system—the same token presents vastly different supply figures on different platforms, leading to distorted market capitalization and inaccurate investment judgments. While traditional stock markets have long adopted standardized metrics such as shares outstanding, on-chain valuations are still largely unsophisticated. Recently, Artemis and Pantera Capital proposed the "circulating supply" framework, introducing the well-established concept of shares outstanding in the stock market to the crypto world. By excluding non-circulating tokens such as protocol holdings, this framework provides the industry with a value benchmark comparable to traditional finance. This transformation may become a key infrastructure for institutional investment and has the potential to reshape the entire cryptoasset valuation paradigm.

The following is the full text, compiled by Odaily Planet Daily:

summary

Currently, crypto data providers display significant discrepancies in supply metrics for the same token, significantly impacting the calculation of market capitalization or valuation multiples (e.g., market cap/revenue ratios). Artemis, in collaboration with Pantera Capital, has proposed a simplified framework called "circulating supply," calculated as total supply minus total protocol holdings. This model is similar to the concept of "shares outstanding" in the stock market (total issued shares minus treasury shares). Our goal is to provide investors with a clearer apples-to-apples comparison of tokens and stocks when conducting valuation comparisons.

introduction

When buying stocks, investors typically look at several key figures to understand the share count :

- Authorized Shares – the maximum number of shares a company can legally issue;

- Issued shares – the total number of shares actually issued by the company;

- Outstanding shares – the total number of shares held by all investors (excluding treasury shares held by the company);

- Floating Shares – The number of shares actually available for public trading.

Why is this data important?

Because these indicators can help investors clarify:

- Ownership – the size of the company’s economic interest in the shares purchased by the investor;

- Supply risk – the number of additional shares that may flood the market in the future;

- Liquidity – the degree to which a stock can be traded smoothly without easily influencing its price.

Source: Artemis

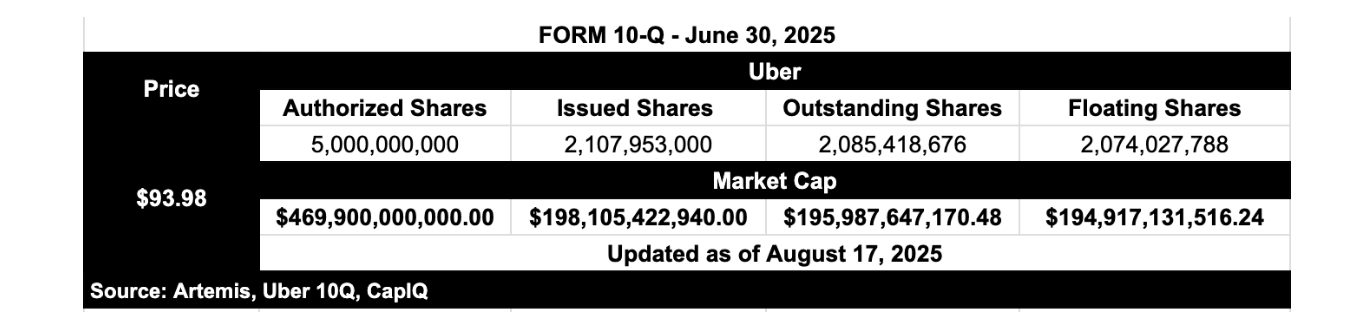

Let’s take Uber as an example to analyze in depth:

- Authorized Shares : 5 billion → The maximum number of shares Uber can legally issue. Public market investors almost never refer to authorized share counts.

- Shares issued : ~2.1 billion → Uber's total number of shares outstanding

- Shares outstanding : ~2.09 billion → The number of shares currently held by Uber investors. This is the number of shares that public market investors actually care about.

- Floating shares : Approximately 2.07 billion shares → The number of shares that can actually be traded in the market.

Consider this: If Uber were valued based on its authorized share count, its market capitalization would reach $469 billion, with a forward price-to-earnings ratio of 70—a striking counterintuitive outcome. Authorized share count has never been used by investors to value a company because "authorized share count x share price" doesn't reflect true economic value.

In reality, investors value Uber based on its outstanding shares (approximately 2.09 billion). As of August 17, 2025, its market capitalization is approximately $195.9 billion, with a forward price-to-earnings ratio of 30. The number of outstanding shares truly reflects the economic ownership distribution of a company's value.

The Problem with Current Token Supply Metrics

Crypto investors currently primarily use the "circulating supply" metric, which measures the number of tokens available for trading on the public market. However, this metric has serious flaws:

- Some statistics include locked tokens, while others exclude them;

- Some are included in the Treasury wallet holdings, and some are removed;

- The standards for whether to deduct tokens after destroying them vary;

- The project party quietly released tokens without clear disclosure.

At the same time, the FDV (fully diluted valuation) commonly used by investors also presents problems: FDV = token price × total supply. This is like calculating Uber's market capitalization using the number of authorized shares—assuming all shares are immediately tradable, the resulting market capitalization of $469 billion is clearly inflated and inconsistent with economic reality.

Investors are therefore faced with a dilemma: either choose a distorted FDV (which includes the entire potential supply) or use the confusingly defined and inconsistently defined "circulating supply" (which, critically, often excludes tokens that have been issued but not unlocked).

Why is "Circulating Supply" the best compromise?

"Outstanding Supply" counts all generated tokens while excluding any balances held by protocols (such as non-circulating assets like foundations, treasuries, or laboratories). It can be considered the "number of outstanding shares" in the crypto space.

- Compared with FDV: it more accurately reflects economic reality;

- Compared with traditional circulating supply: the definition is clearer and the standards are more unified;

- This indicator is rooted in economic substance and provides investors with a reliable intermediate benchmark.

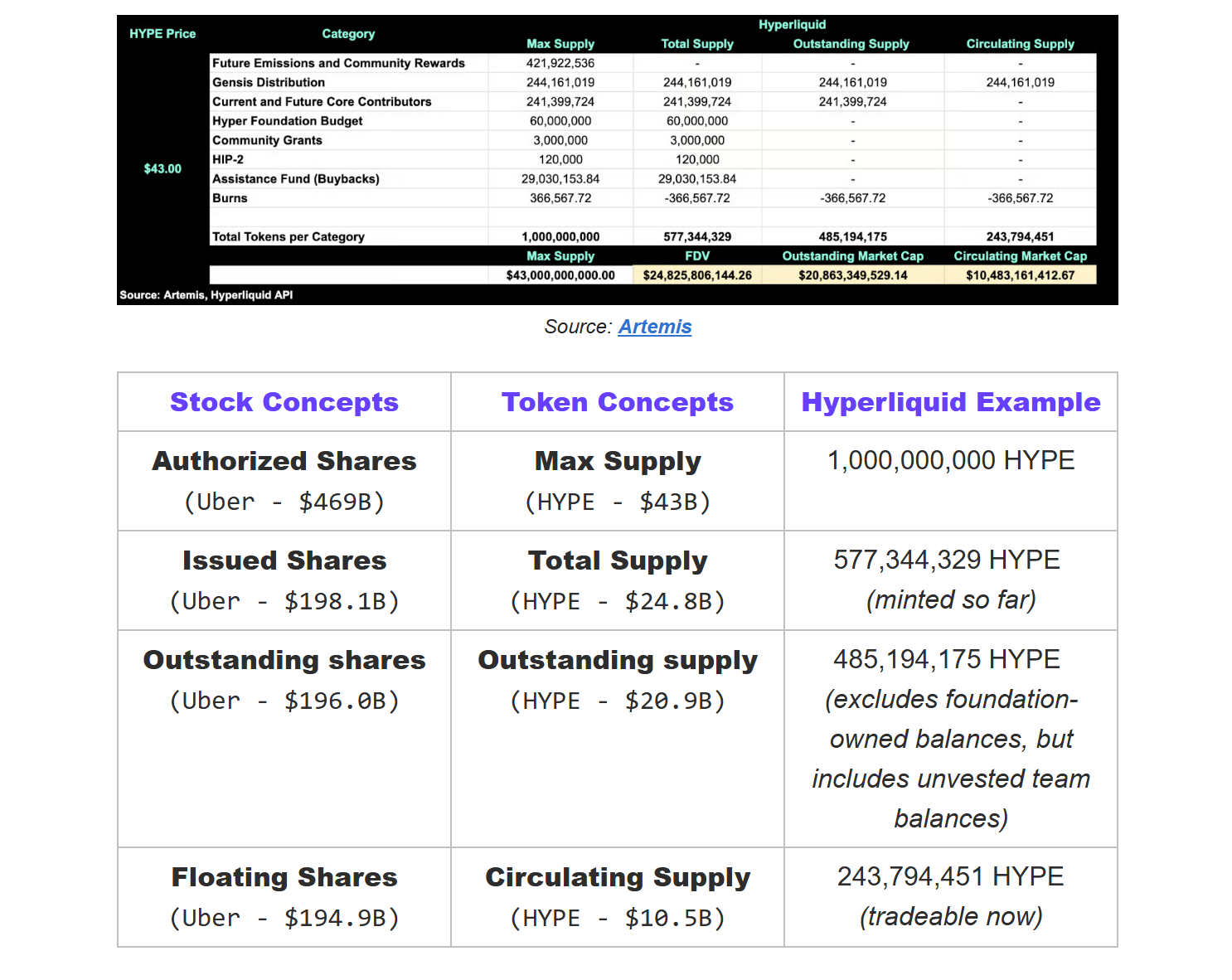

Real Token Example - Hyperliquid

Why is the circulating supply metric important?

For a long time, the crypto space has defaulted to using FDV (fully diluted value) = maximum supply × price. For example, using Uber's 5 billion authorized shares to calculate its market capitalization would result in a valuation of approximately $469 billion, rather than the approximately $196 billion market capitalization typically displayed by Google Finance.

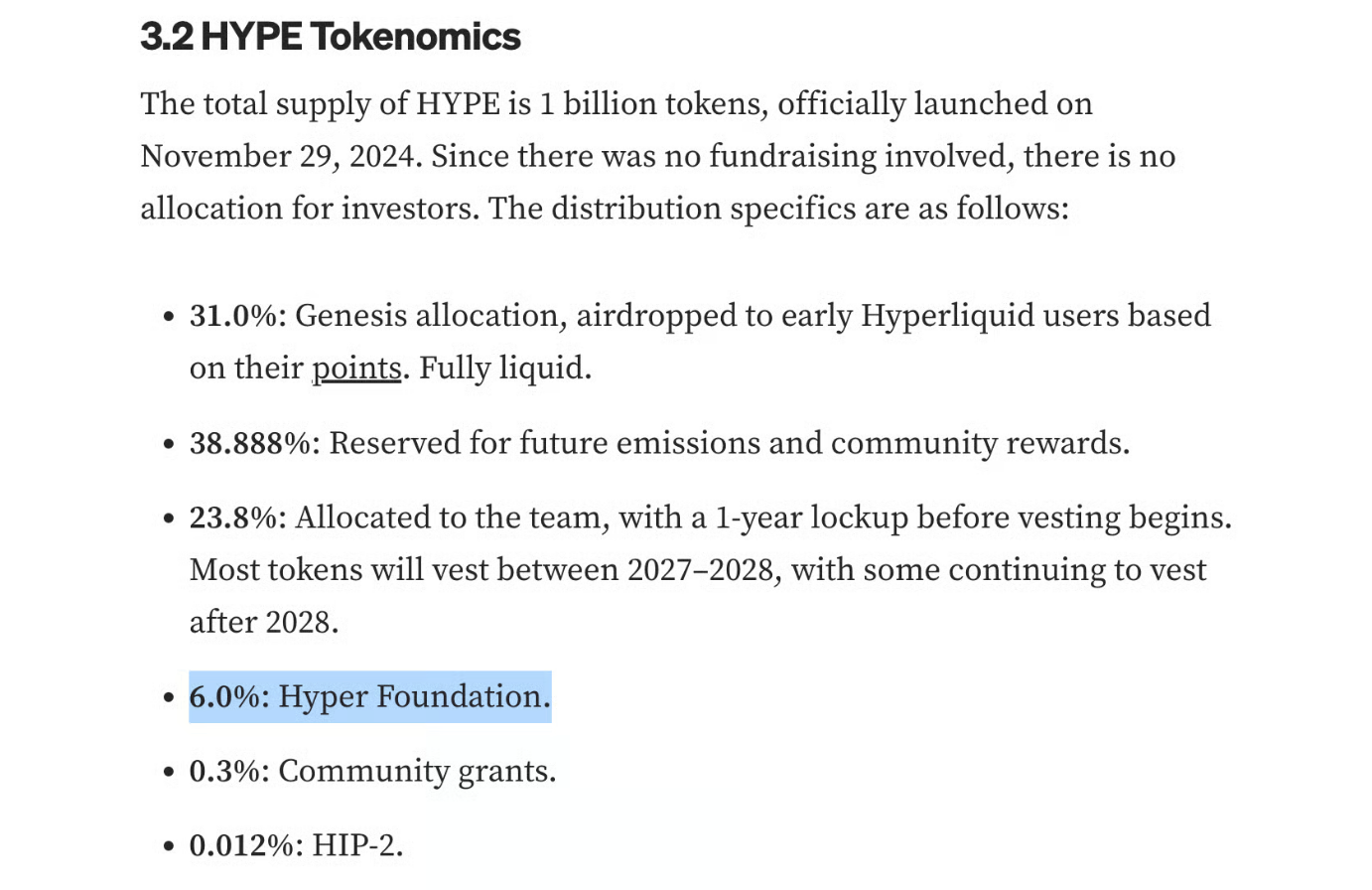

The industry subsequently shifted to using total supply valuation, but this still overestimates actual value because total supply includes all tokens held by the protocol. Take Hyperliquid, for example: 60 million (6% of its 1 billion HYPE tokens) are held by the Hyper Foundation. These are protocol-controlled assets that can be used for operational investment, ecosystem funding, or team incentives. Their economic properties are fundamentally different from those of tokens held by investors.

Source: Mint Ventures

Therefore, Hyperliquid's circulating supply estimate (approximately $20.8 billion) is the closest to its true market capitalization. This is similar to the concept of outstanding shares in the stock market—the total number of tokens actually held by all investors after excluding treasury shares.

In contrast, its circulating supply valuation (approximately $10.5 billion) is closer to the size of tokens that can actually be circulated and traded, similar to the number of floating shares in a stock.

These supply metrics are critical because valuation multiples like price-to-earnings or price-to-sales ratios calculated based on FDV are artificially inflated — effectively penalizing projects like Hyperliquid that hold a large number of unreleased tokens, putting them at a disadvantage compared to their peers.

Note: Our definition of total supply differs from Coingecko. While Coingecko counts all tokens (regardless of ownership), we exclude permanently destroyed and ungenerated tokens to ensure that total supply truly reflects the number of tokens in existence, which influences valuation.

Why are the existing data contradictory?

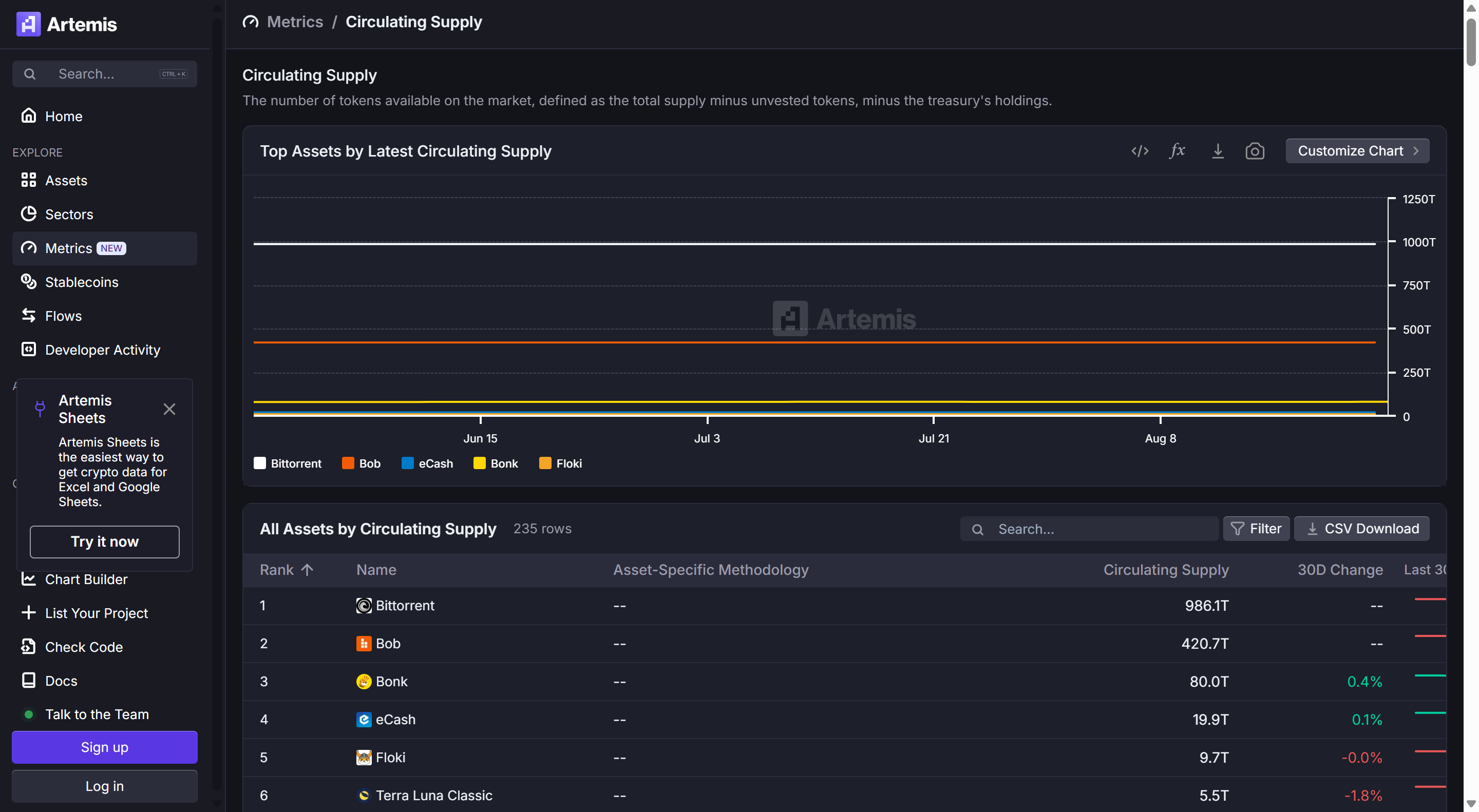

When investors look at HYPE tokens, they will find that different data platforms present completely different values:

DefiLlama shows a circulating FDV of $27.8 billion. Based on a token price of $43, this assumes a circulating supply of approximately 647 million tokens – which even exceeds the current minted supply of 577 million.

CoinGecko's circulating supply valuation is $14.5 billion, suggesting that its circulating supply is approximately 337 million.

However, this number is likely an overestimate, as Coingecko does not exclude wallets held by all protocols (such as the Hyper Foundation, community funding funds, and aid funds). In fact, a large number of tokens have not yet entered the market, and the actual circulation supply is likely lower.

The problem is that these discrepancies can lead to valuations that are worth billions of dollars. Without a consistent standard, different investors can have vastly different perceptions of the size of the same token.

This is why we need to promote "circulating supply" and "smarter circulating supply." A token circulating supply standard not only improves transparency but also enables horizontal comparability with stock valuation systems.

Artemis Solutions: Introducing New Standards for Circulating Supply and Smart Circulating Supply

Total Supply

Definition: The total number of tokens generated (minted) (excluding any burned). This is analogous to "issued shares" in the stock market.

Calculation formula: Total supply = Maximum supply - Ungenerated tokens - Destroyed tokens

Circulating Supply (New Indicator)

Definition: The portion of all existing tokens excluding those held by the protocol itself (including by foundations, DAOs, labs, or lock-up distribution contracts). Excluding protocol-held tokens is similar to how the stock market excludes treasury shares—these tokens exist but are not owned by external investors. Only externally held tokens reflect true ownership, liquidity, and market value. This can be compared to the "number of shares outstanding" in the stock market.

Source: Artemis

Calculation formula: Circulating supply = Total supply - Total protocol holdings

The total holdings of the agreement include:

- DAO/Foundation Holdings — Tokens held by entities responsible for governance or ecosystem development;

- Lab holdings - tokens held by the lab entity that actually assumes the protocol management function (such as the ecological fund, distribution manager) when there is no independent foundation;

- Programmatic distribution contracts — smart contracts that automatically release tokens to the ecosystem according to preset rules;

- Idle funds — tokens that are not yet deployed in an on-chain fund managed by validator governance (requires decentralized voting to release);

- Buyback Reserve (Not Burned) — Tokens that have been bought back by the protocol but not yet burned.

Smart Circulating Supply (Optimization Indicator)

Definition: The number of tokens currently available for immediate trading. This excludes locked tokens, un-unlocked internal/team holdings, and illiquid treasury wallets. This is analogous to the "floating shares" in the stock market.

Source: Artemis

Calculation formula: Circulating Supply = Circulating Supply - Locked Tokens

Why are dual indicators needed?

- Transparency — clearly distinguishing between generated tokens and actual tradable tokens;

- Risk assessment – predicting the potential supply that may enter circulation in the future;

- Standardization – eliminating statistical ambiguity between different items;

- True Market Cap — Accurate circulating supply means more accurate valuation;

- Comparability - enabling standardized horizontal comparisons across projects.

Summary and inspiration:

The stock market eliminates the need to guess at share counts or potential supply, and this clarity builds trust in the market.

The same should apply to the crypto space. If the industry wants to earn institutional trust, it must provide institutional-level transparency. Through the Circulating Supply and Smart Circulating Supply standards, investors will finally have the same transparency they enjoy in traditional financial markets.

- 核心观点:加密估值需引入流通供应量标准。

- 关键要素:

- 排除协议持仓,对标股市流通股。

- 解决FDV高估与流通量混乱问题。

- 提升估值准确性与跨市场可比性。

- 市场影响:增强机构信心,推动资金入场。

- 时效性标注:中期影响。