Powell hinted at an interest rate cut, and ETH hit a new high. How will it perform in the future?

- 核心观点:鲍威尔鸽派讲话提振加密市场。

- 关键要素:

- 美联储9月降息概率升至91.1%。

- ETH单日暴涨超14%创历史新高。

- 巨鲸大量换仓ETH并加杠杆做多。

- 市场影响:短期流动性预期推动普涨。

- 时效性标注:短期影响。

Original | Odaily Planet Daily ( @OdailyChina )

By Golem ( @web3_golem )

On the evening of August 22nd, Federal Reserve Chairman Powell's final Jackson Hole speech of his term opened the door to a resumption of interest rate cuts. The last rate cut announced by Powell occurred on December 18, 2024. Like a long-awaited rain, the market immediately responded positively. The three major US stock indices closed higher, with the Dow Jones Industrial Average up 1.89%, the S&P 500 up 1.52%, and the Nasdaq Composite up 1.88%. Meanwhile, several US crypto stocks rebounded, including SharpLink (up 15.69%), Bitmine (up 12.07%), Coinbase (up 6.52%), CIrcle (up 2.46%), and Strategy (up 6.09%).

The crypto market also performed strongly, with the total market capitalization returning to $4.1 trillion, primarily driven by Ethereum. On August 22nd, ETH rose by over 14.33%, reaching a high of $4,887.5, a record high in three years and nine months . Simultaneously, influenced by ETH's new high, multiple ETH Layer 2, staking, and infrastructure tokens saw widespread gains. SSV saw a 24-hour increase of over 25.54%, ETHFI saw a 24-hour increase of 20.67%, ENA saw a 24-hour increase of 17.58%, and ARB saw a 24-hour increase of 9.53%.

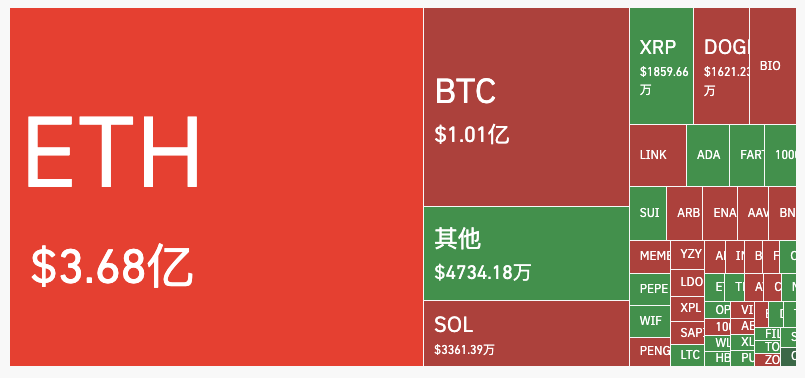

According to Coinglass data, the amount of ETH liquidation in the past 24 hours exceeded that of BTC, with the main liquidation being short positions (US$368 million).

Powell's dovish remarks sparked market frenzy

The market is anticipating a Federal Reserve rate cut to stimulate the economy in 2025, but since January, Powell has failed to signal a rate cut in any of his public statements. Powell's recalcitrance has irritated none other than US President Trump, who has been pressuring Powell to cut rates since taking office earlier this year, culminating in a threat to fire him.

However, the Federal Reserve has been forced into a corner this year. On the one hand, Trump's tariff policies could lead to upward price pressure and increased inflation; on the other, the labor market is showing signs of cooling. If the Fed chooses to raise interest rates to stabilize inflation, it could cause interest rates to soar and trigger a financial panic. However, if the Fed cuts interest rates too early to stimulate the economy, it could cause inflation expectations to spiral out of control.

In this dilemma, more people expect Powell to still lean towards the hawkish side, and BitMEX co-founder Arthur Hayes even expects Powell to become "Volcker 2.0" ( Odaily Note: Volcker was the chairman of the Federal Reserve in the 1970s and 1980s. During his tenure, he used extremely tough monetary policies to reverse the high inflation crisis and thereby rebuilt the prestige and independence of the Federal Reserve ).

However, Powell's speech on the evening of August 22nd surprised the market. The probability of a 25 basis point Fed rate cut in September jumped from 75.5% before Powell's speech to 91.1% . In his speech, Powell stated, "Given the labor market is not particularly tight and faces increasing downside risks, this outcome (of persistently rising inflation) seems unlikely," and directly stated, "If a tight labor market poses risks to price stability, preemptive action may be necessary."

The comments add to Powell's dovish shift, predicting the inflationary effects of tariffs will fade while labor market weakness will push the Fed to cut interest rates to support a weakening job market.

Powell's shift sparked a wave of market enthusiasm, driving ETH's over 10% daily surge. Despite this, the ever-so-proud Trump sarcastically commented after Powell's speech, "Powell should have cut interest rates a year ago. It's too late to signal a rate cut now."

What is the future of ETH?

With the rise of ETH, its market capitalization has surpassed that of payment giant Mastercard, ranking it 26th in the global asset market capitalization rankings. Yesterday, ETH surged over 10% and briefly reached a new high. While this was positively impacted by Powell's dovish comments, some believe the direct cause of ETH's new high was a short squeeze. So, once this temporary sentiment subsides, what's the outlook for ETH going forward?

Many remain optimistic. Tom Lee, in a post following Powell's speech, stated that the speech was interpreted as dovish, which was in line with expectations and positive for cryptocurrencies (BTC and ETH). Yi Lihua, founder of Liquid Capital (formerly LD Capital), also wrote , "ETH has ended its week-long bear market, and the expected consistent rate cut is confirmed, ushering in a new round of growth."

Although Arthur Hayes once believed that there would be no interest rate cut signal before Powell's speech, he still said in the interview that " as long as ETH breaks through the historical high, the upside space is completely open and the price will reach $10,000-20,000."

On-chain whales swap ETH

The whales on the chain have also begun to vote with their feet. After Powell's speech, as the price of ETH broke through a new high, a Bitcoin OG deposited 300 BTC to Hyperliquid in exchange for ETH. It has gained more than 160 million US dollars in floating profits and currently holds 118,277 ETH and a long position of 135,265 ETH.

At the same time, the much-watched "$125,000 Rolling Long ETH" whale bet on interest rate cuts and went long on ETH before Powell's speech. As the market rose overnight, he increased his position by rolling over with floating profits. His ETH holdings increased from 4,000 at the opening of the position on the morning of August 22 to 25,100, with a position value of $120 million and a floating profit of $5.5 million. The current position liquidation price is $4,666.

Huang Licheng, known as his "unlimited ammunition" buddy, has also closed out his long positions in BTC, HYPE, PUMP, and YZY at a loss. He only retained a 25x leveraged long position in ETH, which has generated a profit of over $3 million and a total profit of approximately $37 million, demonstrating his continued optimism about ETH's future.

However, the market is currently overheated, and traders should remain sensible. A FOMO trader sold 2,277 ETH (worth $9.57 million) at $4,203 five days ago, then bought 1,966 ETH (worth $9.57 million) at $4,869 about six hours ago, driven by FOMO. This trader has now lost approximately 311 ETH (worth $1.5 million).

While Powell signaled a positive rate cut, its actual implementation remains uncertain. Following Powell's speech, Fed Chair Hammack cautiously stated, "I've heard that Fed Chairman Powell is 'open-minded' about the policy outlook, but the Fed should maintain a moderately tight monetary policy." Fed Chair Musallem also added this morning, "The decision to cut interest rates should be based on the entire interest rate path, not just the rate decision at a specific meeting. Inflation is already above target, and there are ongoing risks. The next jobs report may or may not be enough to justify a rate cut, depending on its content."

We will have to wait and see how the crypto market and ETH perform in the future.