How does Cap build a self-sustaining stablecoin? (Interactive tutorial included)

- 核心观点:Cap推出机制驱动型收益稳定币。

- 关键要素:

- 结合无抵押借贷与EigenLayer再质押。

- 风险由再质押者承担,用户优先受偿。

- TVL达1544万美元,APY约23%。

- 市场影响:推动稳定币向收益化与结构化演进。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web 3)

On August 19th, the stablecoin protocol Cap announced its launch on the Ethereum mainnet . Users can deposit USDC into a reserve pool, mint cUSD, and begin accumulating protocol points (CAPs). This also marks a key step in the project's transition from concept to implementation, following its $11 million funding round in April.

Cap's funding round is also quite impressive. Franklin Templeton, a globally renowned asset management firm, has been actively investing in on-chain assets and traditional finance in recent years. This investment is seen as a recognition of the "mechanism-driven" stablecoin model. The participation of investment institutions such as Triton Capital adds further capital backing to Cap's credibility.

On the day of the launch, Bankless co-founder David Hoffman posted on the X platform , noting that Cap's uniqueness lies in its combination of unsecured lending and EigenLayer re-hypothecation. He wrote, "Borrowers receive a line of credit, while the risk is borne by the re-hypothecator, providing unprecedented protection for cUSD holders."

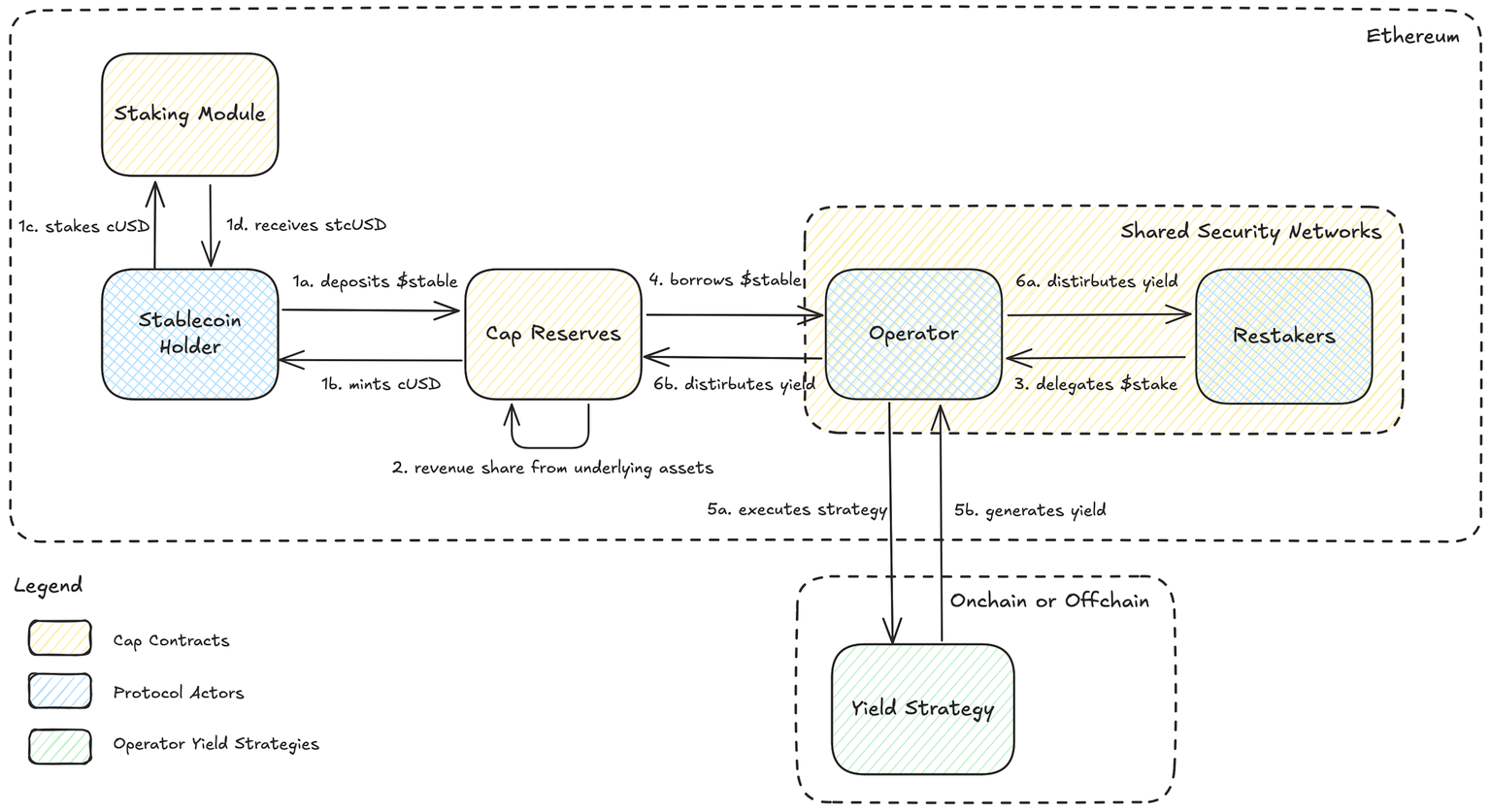

Mechanism: Dual Currency and Five Roles

Cap's overall design resembles a structured financial system. Its core lies not only in the issuance of stablecoins but also in the restructuring and redistribution of returns and risks through institutional rules. The protocol comprises five core participants: cUSD holders, stcUSD holders, operators, restakers, and liquidators. Funds flow out of the reserve pool, are executed by operators, and are then recycled back to users through a profit distribution and liquidation mechanism.

Cap adopts a dual-currency structure: cUSD is the reserve-backed basic stablecoin, which supports USDC deposits, minting and proportional redemption. It serves as a unified settlement layer in the system, helping users switch freely between multiple reserve assets; stcUSD is an income-generating stablecoin. Users must first hold cUSD and then pledge it in exchange for stcUSD, thereby obtaining the automatic compounding profit distribution of the protocol.

Operators are key revenue generators. To lend funds, operators must first secure collateral from re-stakeholders, who provide credit support with locked assets and charge a fixed risk premium. If the operator successfully repays the loan and pays interest, the protocol distributes the revenue proportionally: the base interest rate goes to stcUSD holders, the premium is paid to the re-stakeholders, and the remaining profit belongs to the operator. This logic ensures consistent incentives among different participants.

On the risk side, Cap establishes clear boundaries through its liquidation mechanism. If the operator defaults or the health of the loan position falls below a threshold, the liquidator will purchase the re-pledging collateral at a discount through a Dutch auction and exchange it for reserve stablecoins to compensate stcUSD holders. This means that users' principal has a clear on-chain recourse mechanism , and the risk is borne by the re-pledging party, achieving structurally equal responsibility.

Mechanism case study (source quoted from official documentation )

To more intuitively understand how this mechanism achieves the distribution of benefits and risks, let us imagine a minimal scenario:

Alice deposits $100 USDC on the Ethereum mainnet, and the system automatically mints 100 cUSD. She then stakes these cUSD for stcUSD, becoming a participant and beginning to earn automatic compound interest according to the protocol rules.

Meanwhile, an operator identifies a strategic opportunity with a potential annualized return exceeding 8%. To secure the loan, they first need to find a re-stakeholder willing to guarantee their risk. After due diligence, the re-stakeholder provides the guarantee in exchange for a pre-determined risk premium. Once secured, the operator can borrow funds from the reserve pool to execute their strategy.

If the strategy is successful, the protocol distributes the profits according to a fixed rule: for example, if the operator earns 15% in profits, 8% will be automatically distributed to stcUSD users, 2% will be paid to re-stakers, and the remaining 5% will be the operator's net profit. No manual action is required by the user; profits accumulate automatically through the contract's compounding mechanism.

This is the “Happy Path” designed by Cap—funds flow in from users, generate income through on-chain strategies, and are then automatically distributed among different roles. Users, as the upstream coin holders, obtain priority income rights.

But reality isn't always a happy path. If an operator defaults or positions fall below a risk threshold, the protocol triggers a liquidation mechanism. Liquidators auction off the re-pledgers' collateral at a discount, recovering the stablecoin reserves and compensating stcUSD users' principal. This mechanism ensures that user risk remains a top priority within the protocol's protections , avoiding the structural risk of "strategy failure, user footing the bill."

Benefits and risks: the other side of the mechanism

As the examples above demonstrate, the "automatic compounding" income path provided by Cap's stcUSD is driven by a comprehensive set of on-chain mechanisms, allowing users to receive income distributions with virtually no user interaction. Compared to the traditional DeFi model of manual migration and desperate pursuit of APY, this model is clearly more user-friendly.

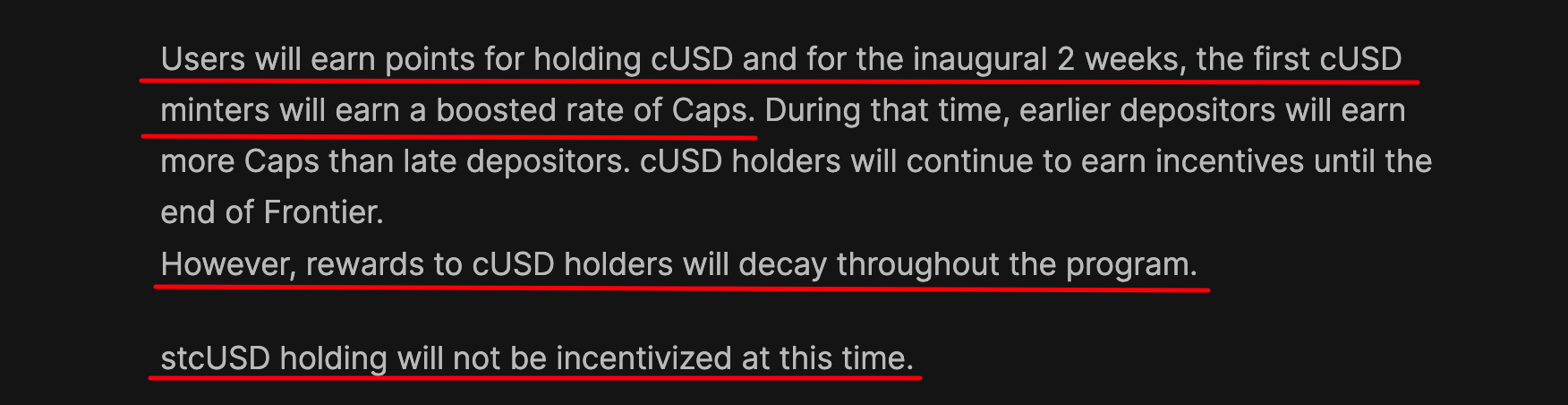

However, Cap's current revenue narrative isn't the most compelling. Under the current rules, cUSD holders receive points rewards, which can then be converted into on-chain returns by staking cUSD into stcUSD. However, you can't have it both ways: you must choose between points and returns. (See "Cap Frontier Plan" for details .)

As of press time, official website data shows that Cap TVL has reached $15.44 million, and the stcUSD APY is approximately 23.07% (having previously reached a high of 130%). With continued influx of funds, yields are fluctuating upward, but whether this trend can be sustained ultimately depends on the efficiency of strategy execution and the robustness of the overall system.

A key feature of Cap is that it doesn't rely on centralized team decision-making, but rather uses a mechanism to dynamically flow returns and risks among different participants. For users, this design not only provides a more sustainable return path but also strengthens the verifiability of risk protection—a practice that remains rare among current DeFi yield products.

Risk Logic

Cap's logic in risk management is significantly different from that of traditional income-generating stablecoins.

In a typical model, if a strategy goes awry, the losses are often borne directly by users, potentially even hidden by the project's undisclosed financial structure. Cap's design shifts this risk to re-stakeholders: if the operator defaults or their position falls below a safety threshold, the re-stakeholder's collateral will be liquidated, with stcUSD holders receiving priority compensation. Structurally, stcUSD acts more like a "preferred creditor," meaning even if returns are automated, risks are not easily passed on to users.

Of course, this doesn't mean Cap is completely free of hidden dangers. Smart contracts themselves remain a core risk point, and any undiscovered vulnerabilities could potentially lead to systemic problems. External components the protocol relies on, such as EigenLayer, oracles, and cross-chain bridges, also become potential transmission channels. Price fluctuations or compliance issues in reserve assets and re-pledged assets could also trigger chain reactions.

Cap has designed multiple mitigation mechanisms such as whitelist asset restrictions, dynamic interest rate adjustments, and off-chain guarantee agreements, but the effectiveness of these measures still needs time and actual testing.

summary

In summary, Cap's revenue model can be described as "more transparent and structured": the source of revenue is verifiable on-chain, and risk exposure is embedded in the contract logic, eliminating the need for users to rely on verbal promises from the team. However, from another perspective, the more complex the protocol, the more potential vulnerabilities it presents, a fact that no participant can ignore.

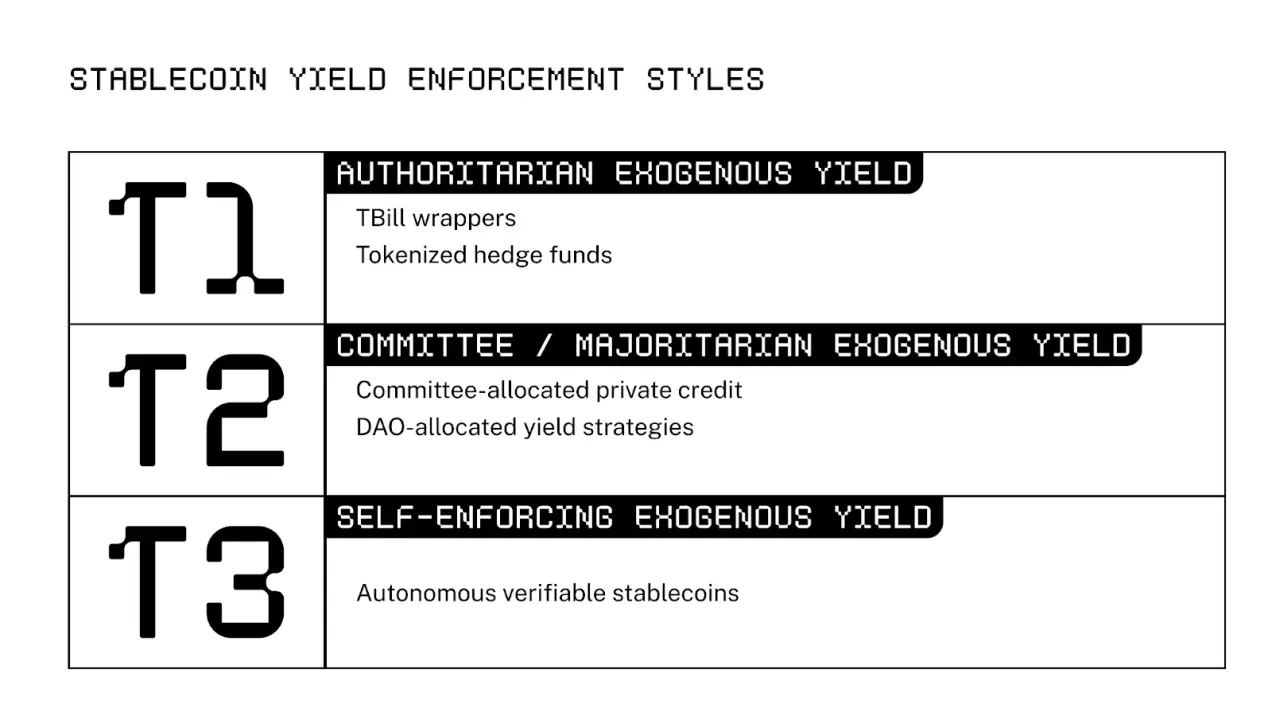

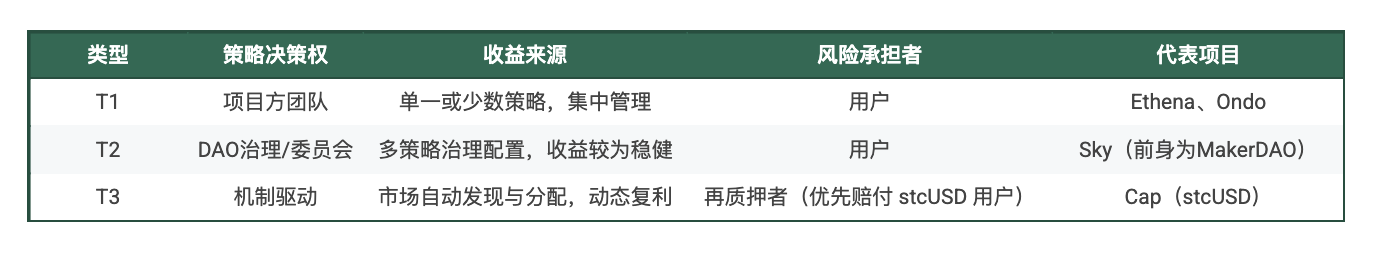

Comparison of Yield-Based Stablecoin Architectures: Three Design Paths

Referring to the classification method of the Stanford Blockchain Club , income-generating stablecoins can be divided into three paths according to the income distribution mechanism: centralized strategy management (T1), DAO governance configuration (T2), and on-chain self-coordination model (T3).

The core differences between the three paths lie in two dimensions: how the strategy is determined and who bears the risk.

The first type : centralized strategy, which has both efficiency and risks.

Representative projects: Ethena (USDe), Ondo, Agora, Resolv.

These stablecoins are centrally managed by the project owner, who centrally decides and executes profit strategies. User funds are funneled into a unified pool, where they are allocated and used by the team. For example, USDe exploits the interest rate differential by shorting ETH perpetual contracts and building a hedging model.

For users, this model lacks transparency, and the revenue mechanism is highly dependent on the team's capabilities. If the strategy fails or the team fails to fulfill its responsibilities, users have little recourse. In some ways, it's more like investing in an "unsecured debt" with the project, where trust is a prerequisite and the risks are uncontrollable.

Category 2 : Governance coordination, stable but slow.

Representative projects: MakerDAO (DSR), Sky, Maple Finance.

These stablecoins delegate policy configuration to a governance organization. Funds can be dynamically shifted between multiple external strategies, with decisions made by governance token holders or their authorized representatives.

While the advantages lie in its stable structure and dispersed risk, governance games often slow down strategy updates, and issues such as vote bribery and mismatched agent incentives persist. Furthermore, since users are at the very end of the protocol, they still face the dilemma of no recourse if their strategies fail.

The third category : mechanism-driven, automatically coordinating risks and returns.

Representative project: Cap (stcUSD).

Cap solidifies the risk and reward distribution logic through smart contracts and enables automatic operation with the help of on-chain incentive mechanisms. The team no longer determines the flow of funds, but instead forms a self-consistent closed loop through the "re-staking + lending + liquidation" triangle structure:

- The operator identifies strategic opportunities and can borrow funds after being guaranteed by re-pledgers ;

- When the operation is successful, the profits are automatically distributed proportionally to the stcUSD user, the re-stakeholder, and the operator;

- In the event of a default, the liquidation mechanism is triggered, and the re-pledged assets will be used to compensate stcUSD users first.

Compared to the first two categories, Cap's stcUSD is more like a "preferred creditor" design at the protocol level. Fund flows are verifiable, risk accountability is quantifiable, and governance participation is minimized. This model emphasizes that while returns can be competitive, risks must be clearly defined .

Summary: Different return paths and different risk allocations

In summary, the core differences among the three models can be summarized into three points: profit distribution method, strategic decision-making power and risk allocation.

Interactive Tutorial: How to Participate in Cap Protocol?

Now that we understand the mechanism and risk structure built by Cap, let’s take a look at its actual user experience - minting cUSD, staking it for stcUSD, and obtaining on-chain income. The interaction threshold of the entire process is not high.

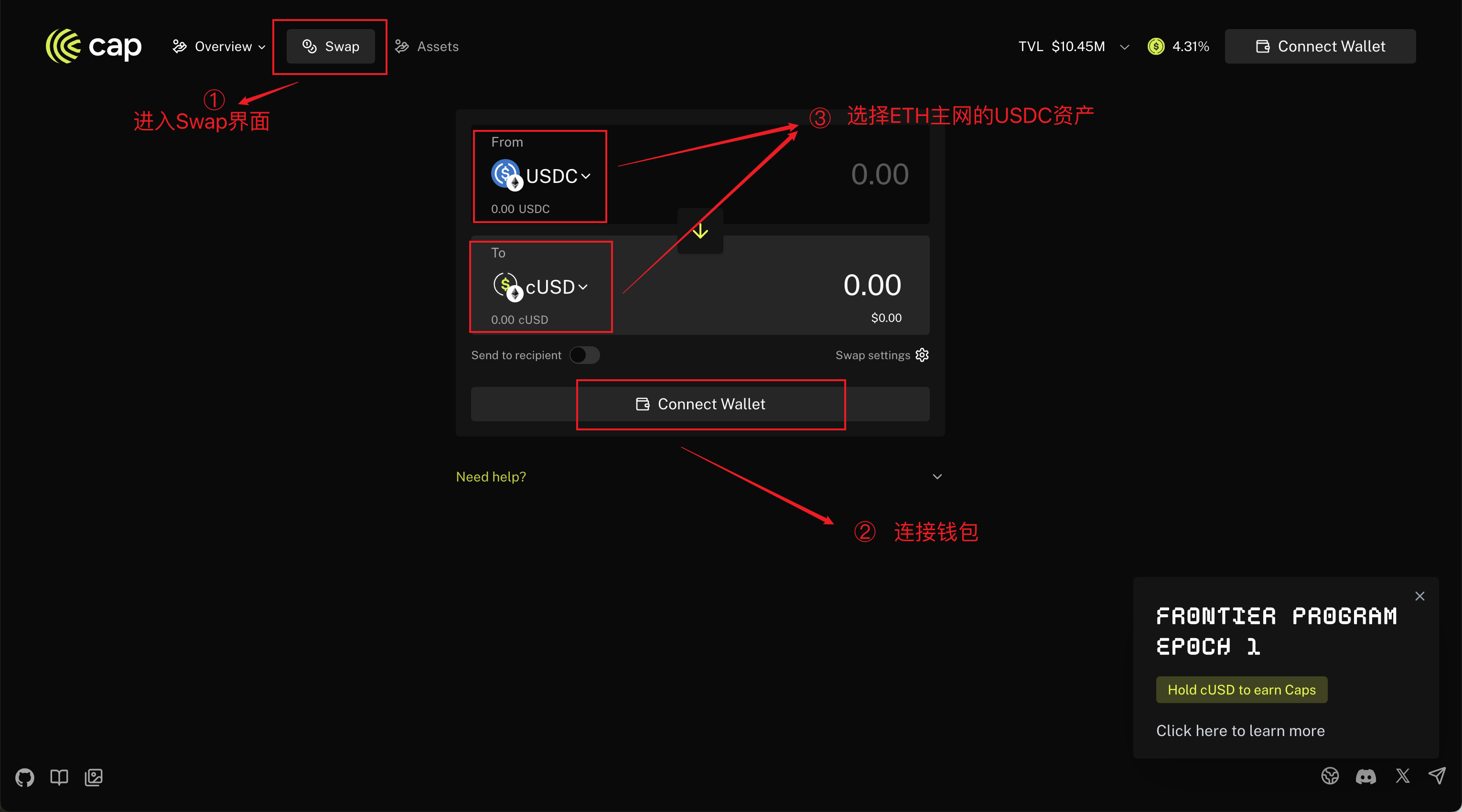

The following is an example of a minimal path operation: using the cUSD swap process as an example, the stcUSD method is also applicable. (Note: Currently supports the ETH mainnet, be sure to confirm that the wallet network has been switched)

STEP 1: Open Cap official website ;

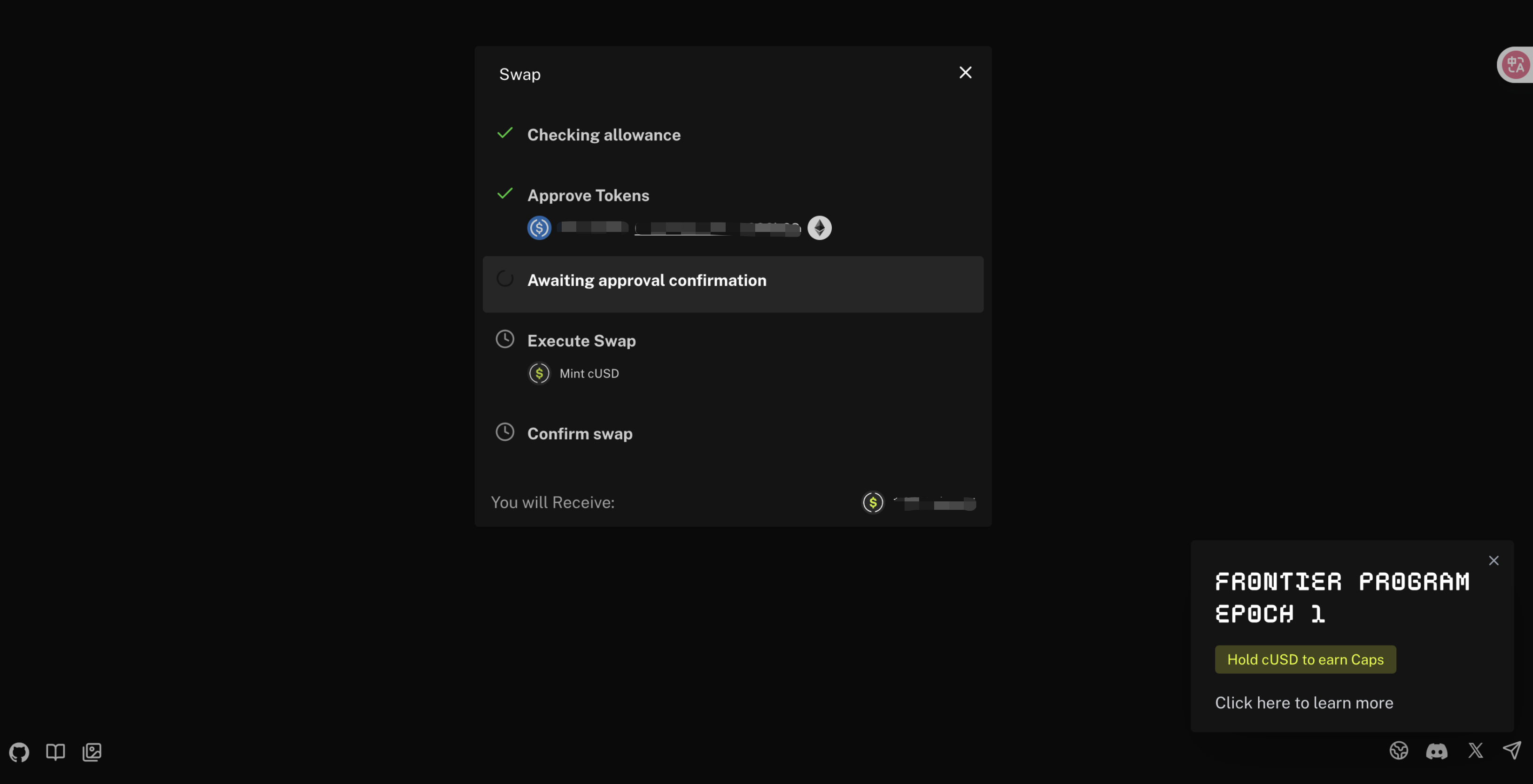

STEP 2: Click "LAUNCH APP" to enter the "SWAP" interface and connect your wallet; select USDC on the ETH mainnet to exchange for cUSD; then click "Swap" and wait for the wallet plug-in to sign;

STEP 3: Wait for the exchange to be completed (a pop-up window will appear on this page asking you to approve the contract interaction or transfer the exchange amount).

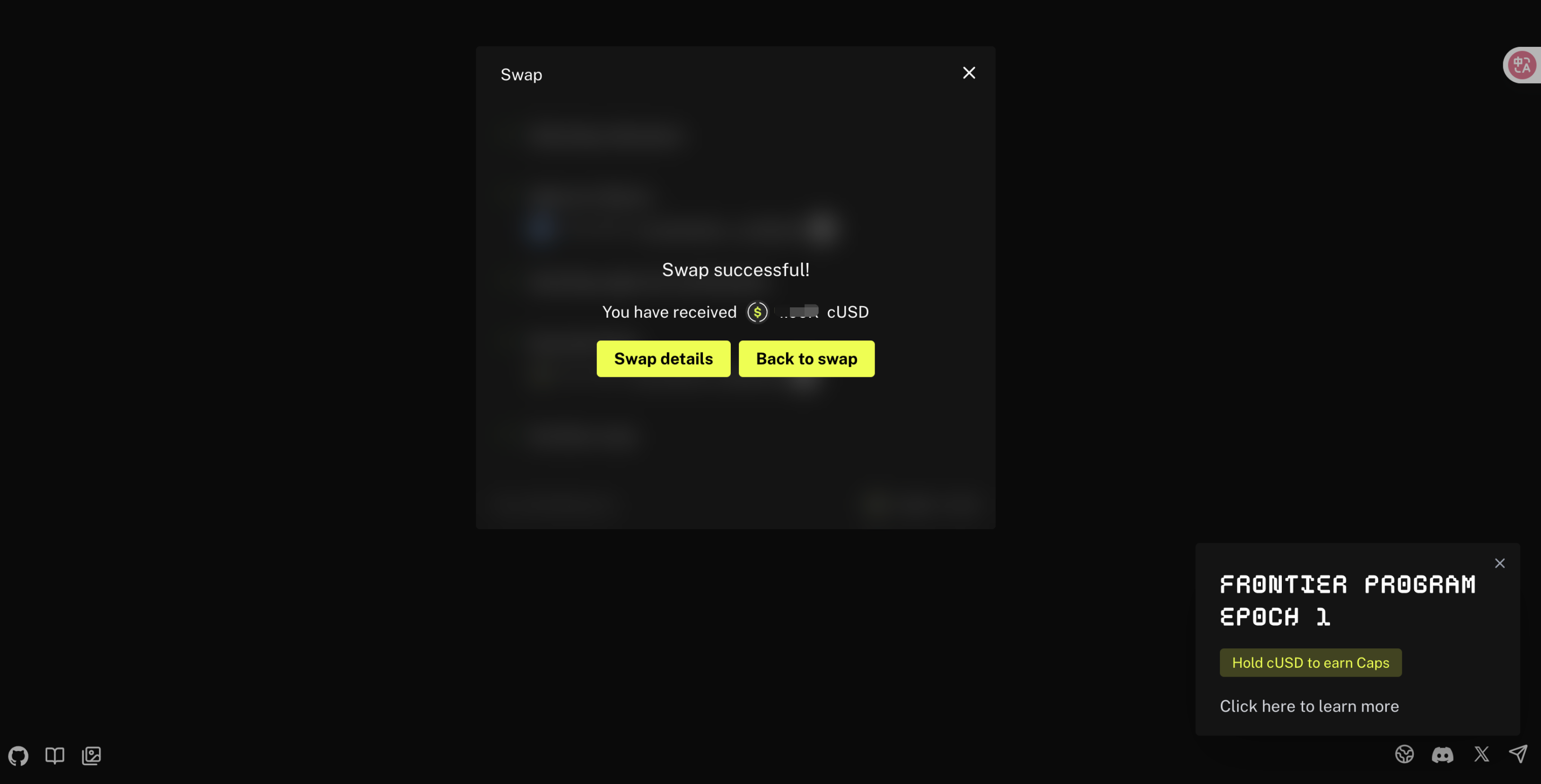

STEP 4: Complete the cUSD exchange.

Conclusion

The launch of Cap isn't just about adding a new stablecoin; it's a structural experiment in how to distribute returns and risks. Over the past few years, the stablecoin market has evolved from pegging to the US dollar, to emphasizing compliance and transparency, and finally to exploring profitability. Most attempts have either limited returns to reserve interest or relied excessively on team decisions, consistently struggling to strike an effective balance between scale expansion and risk control.

Cap's solution is to delegate the distribution of revenue and risk to a mechanism. Revenue is generated through a game of negotiation between operators and re-stakeholders, while risk is hedged through on-chain rules and a liquidation system, placing users in a logically secure zone. This design gives stcUSD a degree of self-sustaining power while also removing some degree of subjective judgment.

However, this mechanism doesn't guarantee risk-free operation; it simply redistributes risk. The complexity of Cap means it still requires long-term market validation. Contract security, external dependencies, and the credit quality of re-stakeholders are all key factors in determining the sustainability of this structure.

From this perspective, Cap is more like the experimental starting point for Stablecoin 3.0. It's neither a simple payment medium nor a mere redistribution of reserve interest; rather, it's building a mechanism-driven stablecoin income system. If this model takes hold in practice, the very definition of a stablecoin may be rewritten: not just "stable," but also "interest-bearing."

After all, what users ultimately care about may not be whether the mechanism is elegant, but rather: Can this system bring me real and sustainable on-chain benefits?

Cap has left this question to the market.