Ethereum unstaking scale hits new high, what is the risk of selling pressure?

- 核心观点:以太坊质押解除规模创新高,市场担忧抛压风险。

- 关键要素:

- 8.7万枚ETH排队退出,创历史新高。

- 借贷利率飙升打破套利逻辑,加剧退出需求。

- 机构资金转向合规质押协议,Lido市占率下滑。

- 市场影响:短期抛压受限,机构增持或支撑市场。

- 时效性标注:短期影响。

Original author: Nancy, PANews

Currently, the divergence between Ethereum's bulls and bears is becoming increasingly pronounced. As ETH prices hit new highs, demand for staking withdrawals has increased significantly, fueling market concerns about potential downside risks. Will the anticipated massive sell-off in Ethereum materialize?

Driven by multiple factors, the scale of Ethereum staking unstaking has reached a new high

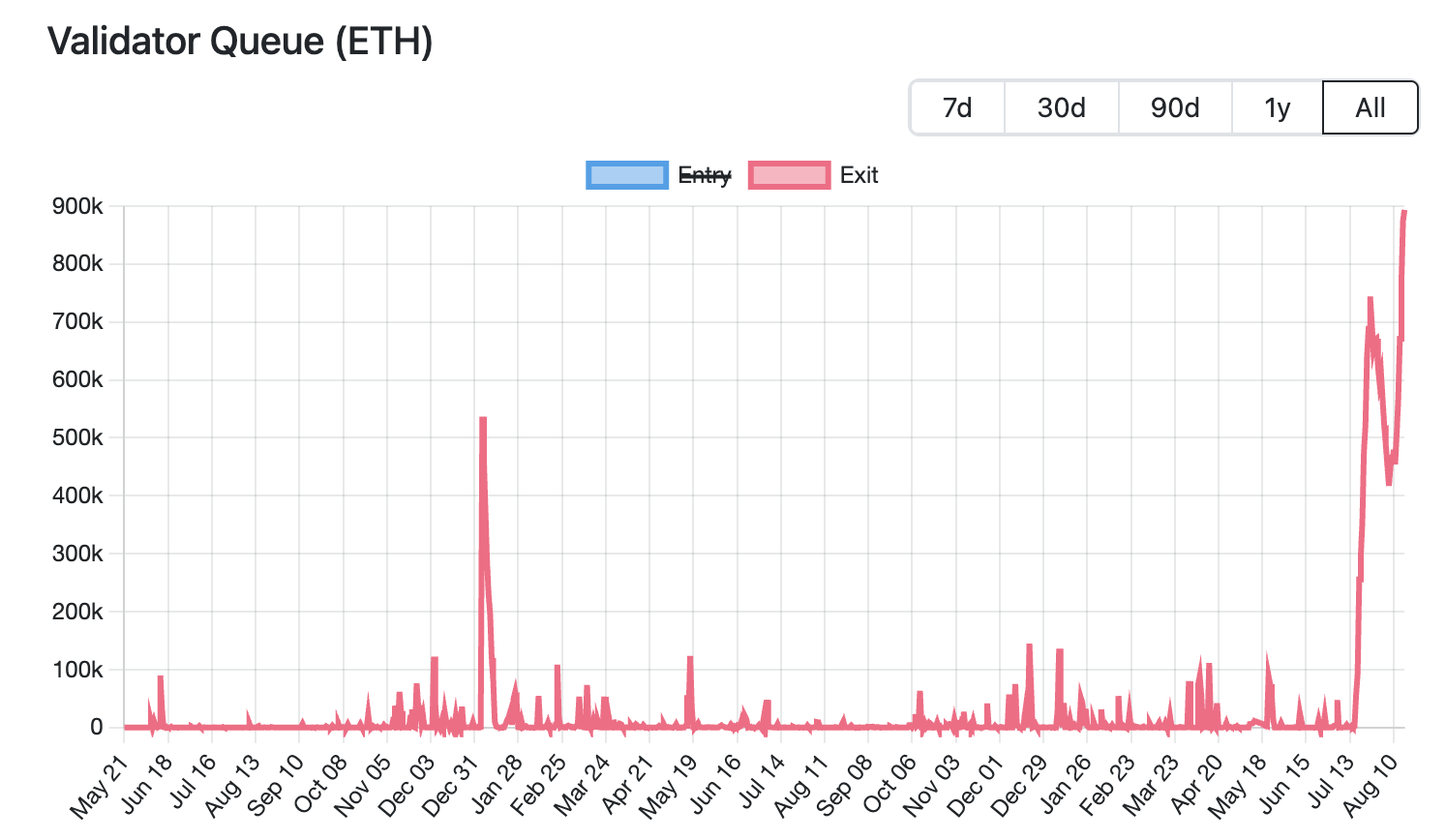

Currently, the scale of Ethereum unstaking has reached a historical peak. According to Validator Queue data, as of August 18th, over 87,000 ETH (worth approximately $3.76 billion) were waiting to be de-staking the Ethereum network, a record high and increasing for six consecutive days. The estimated waiting time is 15 days and 4 hours. In contrast, only approximately 26,000 new ETH (worth approximately $1.12 billion) are waiting to be staked, with an estimated activation delay of approximately 4 days and 12 hours.

Currently, the scale of Ethereum unstaking has reached a historical peak. According to Validator Queue data, as of August 18th, over 87,000 ETH (worth approximately $3.76 billion) were waiting to be de-staking the Ethereum network, a record high and increasing for six consecutive days. The estimated waiting time is 15 days and 4 hours. In contrast, only approximately 26,000 new ETH (worth approximately $1.12 billion) are waiting to be staked, with an estimated activation delay of approximately 4 days and 12 hours.

This round of large-scale withdrawal of pledged assets was driven by multiple factors, including market strategy adjustments, institutional capital flows, and the demand for profit-taking caused by price fluctuations.

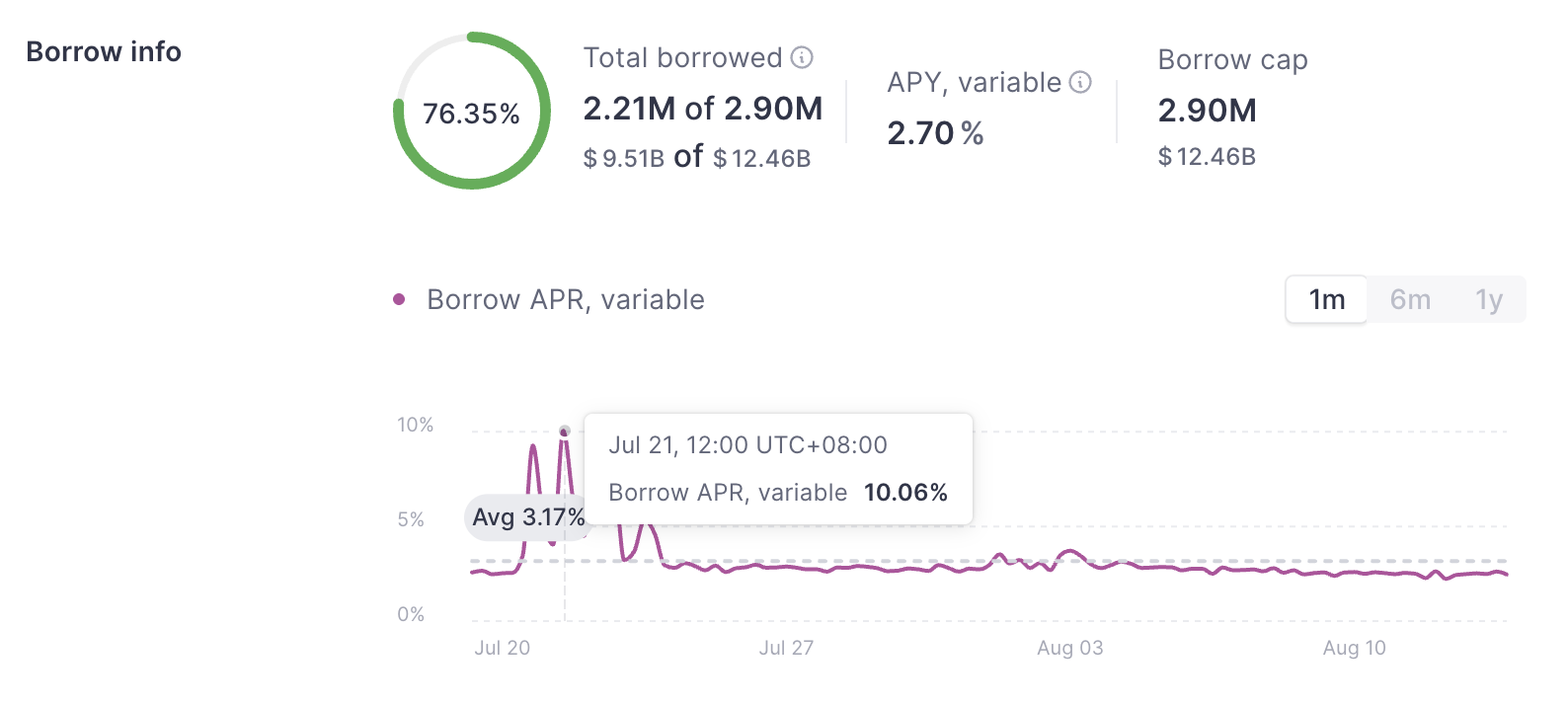

A sharp rise in ETH lending rates has impacted leveraged strategies, prompting a wave of validators to withdraw from the pool. Last month, a large amount of ETH was withdrawn from Aave's lending pool, tightening the platform's ETH supply and driving a sharp surge in lending rates. Official website data shows that in July, Aave's ETH lending annual interest rate climbed from approximately 2.5% to 10.6%, far exceeding Ethereum's staking yield of approximately 3% at the time.

This interest rate increase disrupted the trading logic of circular arbitrage. Investors could previously use their staked ETH as collateral to borrow more ETH for leveraged trading. However, this leverage model lost its appeal after the sudden interest rate increase, forcing traders to liquidate their positions and release their collateral to repay loans or reduce leverage, thereby exacerbating the need for exits.

Rising lending rates have also exacerbated the decoupling of LST/LRT (such as stETH and weETH) from ETH. For example, Dune data shows that the discount between stETH and ETH reached 0.4% in July. This has led arbitrageurs to buy liquid staking tokens at low prices in the secondary market and profit from the price difference by unstaking and redeeming them for the full ETH value, further congesting the Ethereum staking queue.

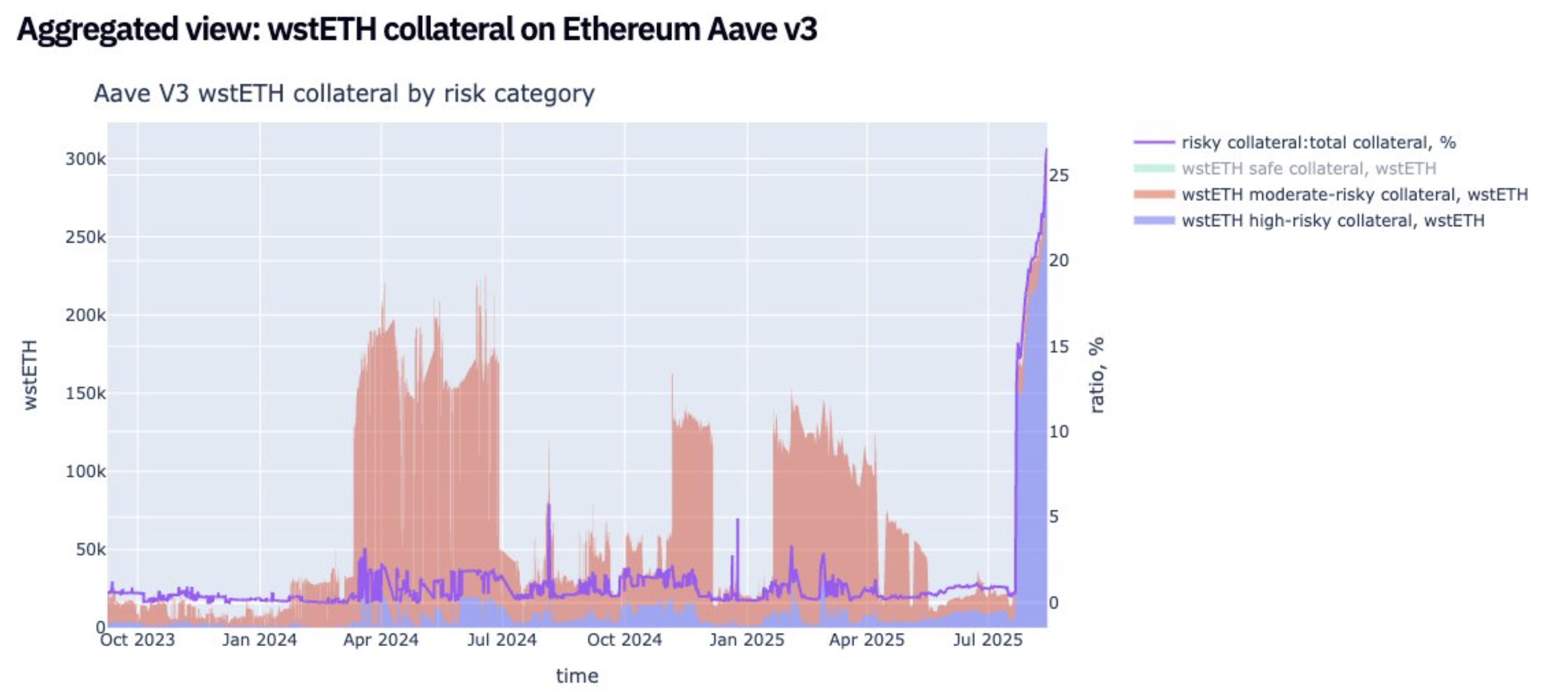

Meanwhile, while the market hasn't yet seen systemic liquidations due to price decoupling, potential pressure is further driving investors to exit the market early. According to a recent analysis by Jlabs Digital analyst Ben Lilly, stETH is currently being withdrawn from Lido, with 32% of stETH (wstETH) used as collateral in lending protocols. Decoupling could mean large-scale liquidations of lending protocols. Furthermore, 278,000 wstETH are considered "high risk" (defined as a health factor between 1 and 1.1).

Juan Leon, senior investment strategist at Bitwise, also said that staked tokens like stETH can be traded at a discount, and the discount will reduce the value of the collateral, thereby triggering risk reduction, hedging and even liquidation, and ultimately leading to a sell-off of ETH spot. Leveraged stETH circular trading through the DeFi protocol liquidity pool will no longer be profitable, and traders will also create simultaneous selling pressure by closing positions and selling ETH to repay loans.

As a result, many investors have opted to exit the market, with some whales even opting to quickly cash out. For example, Lookonchain recently monitored a whale who abandoned the queue to exit their stake and directly converted 4,242.4 stETH into 4,231 ETH (worth $18.74 million) and deposited it on Kraken for sale, resulting in a direct loss of 11.4 ETH (approximately $50,500).

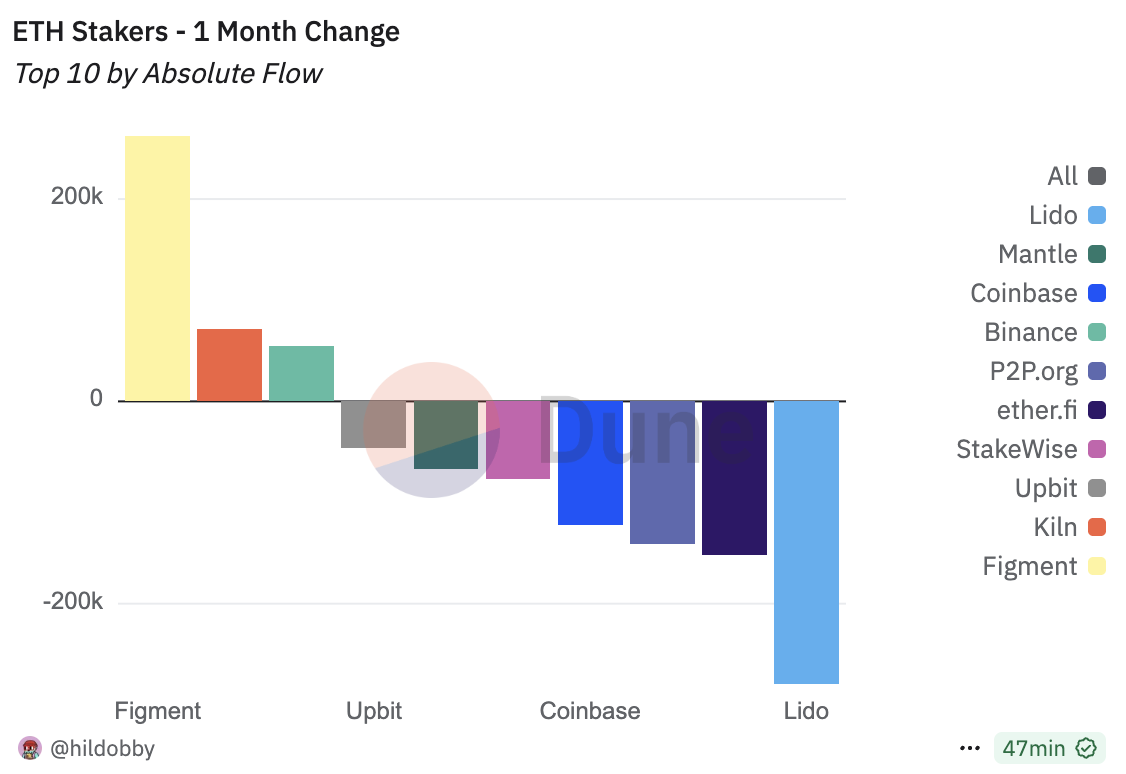

The massive withdrawal of ETH from staking is also related to a shift in funds to new staking protocols. As Ethereum's primary investor base shifts from retail investors to institutions, its staking market landscape is undergoing significant changes. Dune data shows that as of August 18th, three of the top five staking protocols were centralized institutions: Binance, Coinbase, and Figment. Over the past month, Lido, ether.fi, and P2P.og have seen the largest ETH outflows. Lido saw a monthly outflow of over 279,000 ETH, bringing its market share down to 24.4%, a record low. In contrast, Figment saw an inflow of over 262,000 ETH, making it the biggest winner.

This migration trend is driven by institutions' multiple needs for compliance and stability. For example, institutions require clear legal entities and compliance processes, while decentralized protocols struggle to meet regulatory requirements. The fragmented nature of decentralized network nodes makes comprehensive audits difficult, making global Know Your Customer (KYC) nearly impossible. Centralized institutions can clearly assume responsibility for node failures, while decentralized protocols have fragmented responsibilities, which aligns with risk management expectations. The uncertainty inherent in DAO voting mechanisms makes decision-making less stable for institutions. In short, institutional funds prioritize compliance, responsibility, and stability over decentralization. This also means that in the ETH staking market, decentralized protocols are gradually taking a defensive stance, while centralized staking institutions are expanding their market share by leveraging compliance and stability.

The increasing number of ETH unstaked is also driven by profit-taking driven by rising prices. Coingecko data shows that since April of this year, the price of ETH has rebounded approximately 223.7% from its low. This rapid rise has provided significant unrealized profits for early stakers, prompting some investors to unstake and lock in profits, thereby increasing pressure on the liquidity of ETH in the short term.

Large-scale selling pressure is difficult to release directly in the short term, and the market still has some room for support

Although the scale of Ethereum pledge release has reached a record high, triggering market concerns about selling pressure, due to the limited release rhythm and continued increase in institutional holdings, it may provide a certain support space for ETH.

On the one hand, as mentioned above, this wave of unstaked ETH is driven by multiple factors, including liquidation of rotational strategies, arbitrage demand, and transfers to other stakers. This means that not all unstaked ETH will be directly sold on the market.

Furthermore, Ethereum's PoS mechanism imposes strict restrictions on validator exits. Each validator must stake 32 ETH to participate in network consensus. To ensure network stability, only 8–10 validators are allowed to exit per epoch (approximately 6.4 minutes). As the demand for validator exits increases, the waiting queue will significantly lengthen. Currently, it is estimated that this unstaked ETH will take approximately 15 days and 4 hours to be fully released to the market, so it will not have a short-term impact on liquidity supply.

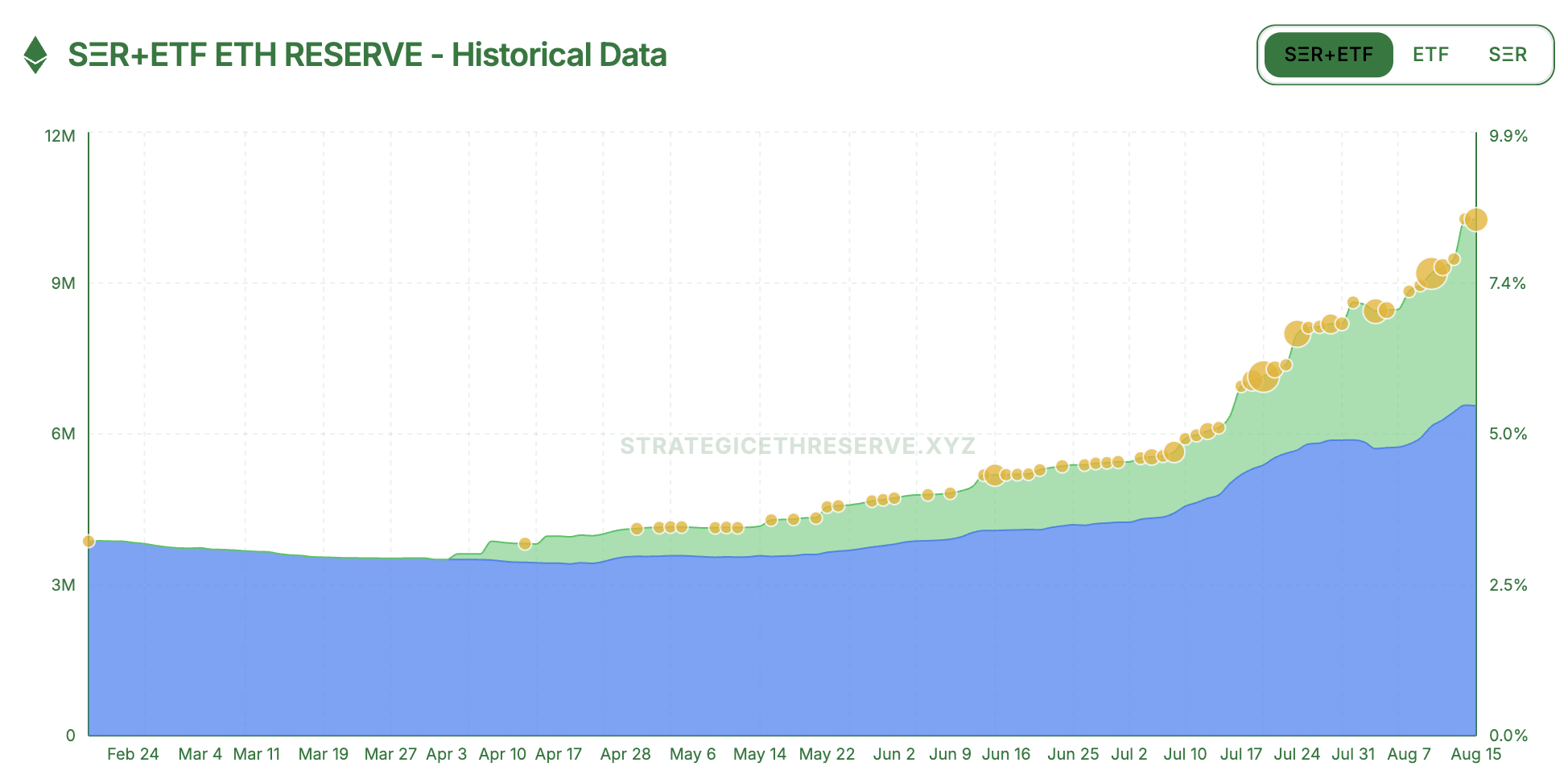

Furthermore, market data indicates that Ethereum currently faces over 61,000 ETH in demand for unstaking, but the surge in institutional investors' holdings could offset potential selling pressure. According to data from strategythreserve.xyz , as of August 18th, the Ethereum Reserve Company and various ETH spot ETFs held a cumulative total of 10.26 million ETH, representing over 8.4% of Ethereum's total supply. In the past two weeks, institutions have increased their holdings by over 1.83 million ETH, far exceeding the current round of unstaking. If this upward trend continues, it could effectively absorb potential selling pressure.

Overall, the recent high volatility in ETH prices may be a natural reaction to profit-taking and fluctuating market sentiment. Despite market uncertainty and short-term volatility, overall confidence in Ethereum remains unshaken, and the continued flow of institutional funding, in particular, further strengthens market resilience.