From stablecoin issuer to payment rail master, Circle launches ARC to intercept public chain transaction fees

- 核心观点:Circle推出ARC公链以捕获稳定币底层价值。

- 关键要素:

- ARC提供隐私保护与固定手续费。

- Circle收入90%依赖USDC储备利息。

- ARC将稳定币交易费收入内部化。

- 市场影响:重塑稳定币价值链与支付格局。

- 时效性标注:中期影响。

Original article | @bullish_bunt

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

Editor's Note: As stablecoins gradually become mainstream globally, Circle is attempting a deeper transformation. Following the Genius Act, which legalized government-backed stablecoins for payments, Circle, the world's second-largest stablecoin issuer, launched ARC, a public blockchain specifically designed for stablecoins. This initiative aims to reclaim value previously siphoned off to underlying infrastructure and become a "track builder" controlling the stablecoin supply chain.

Once confined to the crypto industry, applications are now taking a crucial step toward mainstream adoption. The recently passed Genius Act paves the way for stablecoins backed by U.S. Treasury bonds to gain official recognition as payment methods. This significant policy shift is expected to further accelerate the adoption of stablecoins globally.

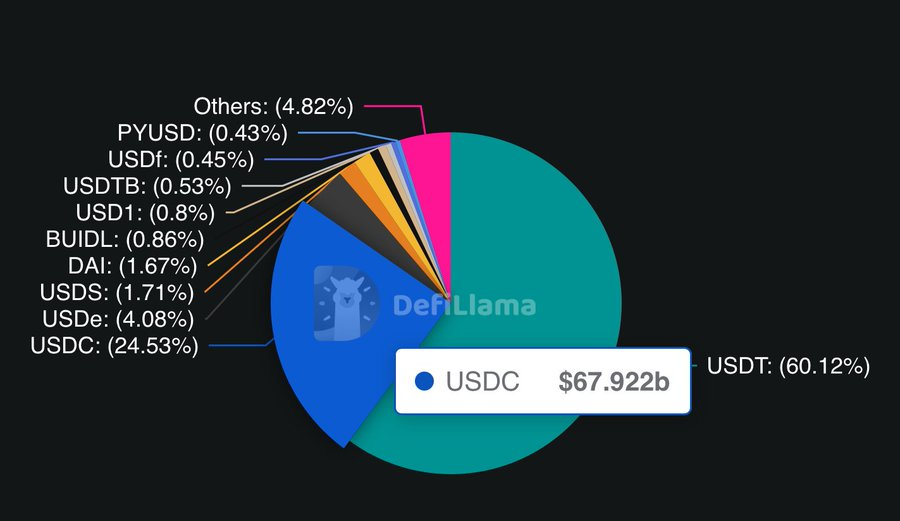

Among the beneficiaries, one of the biggest winners is undoubtedly Circle, the world's second-largest stablecoin issuer. Its core asset, USDC, currently has a market capitalization of $67.9 billion , second only to USDT, according to DeFiLLama data.

Circle's latest move: the launch of @arc , a Layer-1 public blockchain purpose-built for stablecoins. This isn't the first attempt at a dedicated stablecoin chain; projects like Plasma and Stable have already explored similar approaches. But the question remains: when there are already numerous efficient Layer-1 and Layer-2 networks on the market, why is Circle building its own dedicated chain?

Industry Perspective

From an industry perspective, the answer is closely tied to the unique needs of traditional finance (TradFi). Unlike the openness and transparency of the crypto ecosystem, traditional finance operates within a closed system , where customer data confidentiality is paramount. Financial institutions cannot tolerate the exposure of sensitive information directly on public ledgers.

ARC addresses this pain point by providing opt-in privacy , allowing transactions and user data to be shielded when needed.

Another long-standing issue plaguing traditional institutions is fee volatility . Transaction fees on most blockchains fluctuate dramatically with network congestion, whereas traditional businesses are accustomed to stable, predictable cost structures. They typically charge customers fixed fees, rather than minute-to-minute fluctuations. ARC introduces a low-cost, fixed fee structure denominated in US dollars that is unaffected by network congestion.

Combined with instant finality , institutional-grade performance, and deep integration with Circle’s existing infrastructure—including its payment network, programmable wallets, CCTP (Cross-Chain Transfer Protocol), and fiat on- and off-ramps—ARC is no longer just a new blockchain, but a complete stablecoin runtime designed to seamlessly combine traditional finance with the speed and programmability of blockchain.

Business Perspective

The more interesting part actually doesn’t appear in the white paper.

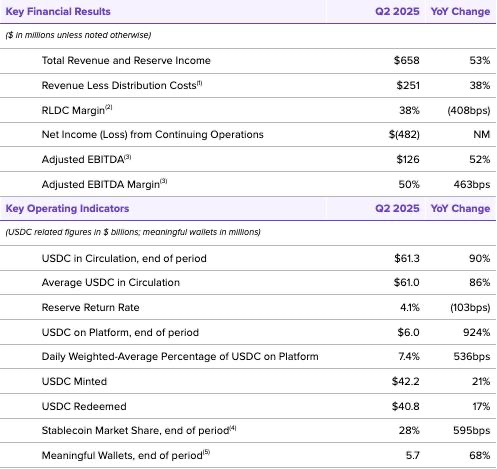

Circle's Q2 2025 financial report shows that its revenue structure remains highly dependent on its USDC reserves. During the reporting period, the company's total revenue and reserve income totaled $658 million , of which approximately 90% came from reserve interest —the income generated from the cash and short-term investments behind its USDC reserves.

By comparison, revenue from subscriptions, services, and other fees was only $24 million , meaning Circle's growth model is almost entirely constrained by its Treasury and cash reserves, as well as the current interest rate environment.

How does ARC help Circle open up new revenue space?

You know, the dominant position of the US dollar in the global financial system is obvious to all: it accounts for 57% of global foreign exchange reserves, 54% of export valuation, and 88% of foreign exchange transactions.

If Circle can integrate ARC into the global payment system with the help of payment giants such as Visa and Mastercard, even if it only captures 1-2% of global payment volume, the demand for USDC will be in the billions of dollars.

Who is the one who truly captures the value?

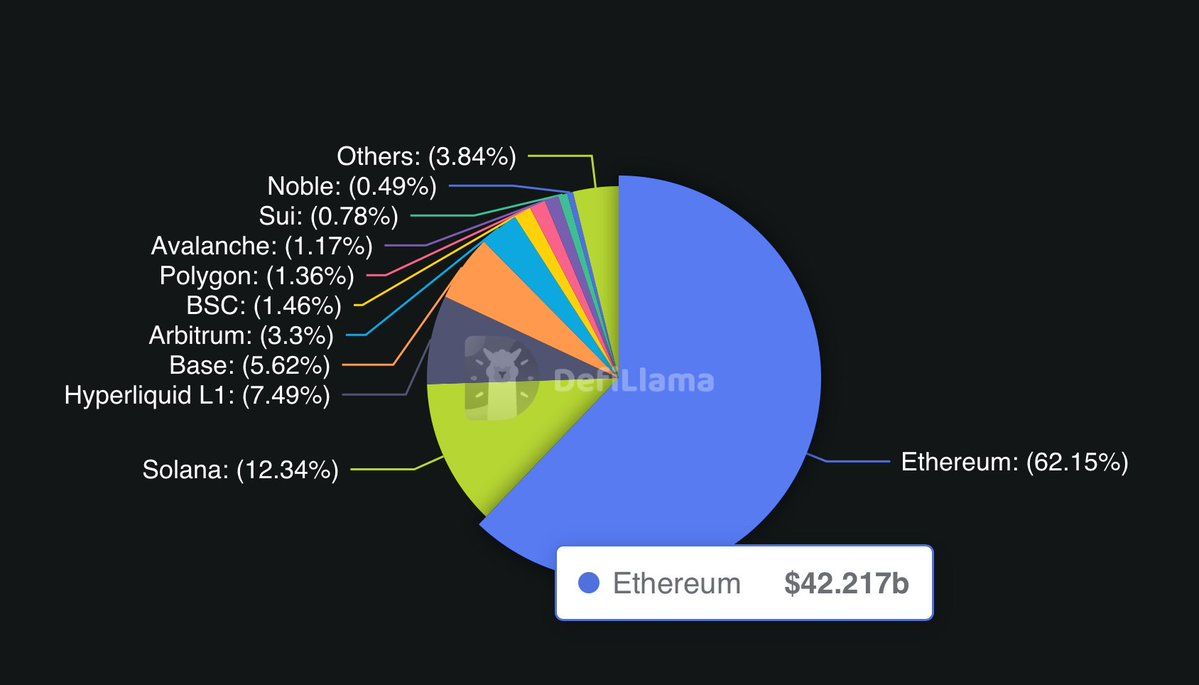

Stablecoin issuers often hog the spotlight, but the true value lies in the underlying infrastructure . Take USDC, for example: Ethereum currently hosts approximately $42.2 billion in USDC, Solana accounts for 12.3%, and emerging platforms Hyperliquid and Base account for 7.4% and 5.6%, respectively.

The problem is that while USDC is issued by Circle, transaction fees are accrued to the underlying blockchain. This means that billions of dollars in value are actually captured by the underlying public blockchain, not the stablecoin issuer itself.

From a business perspective, this is undoubtedly a significant value spillover. If Circle continues to rely on public blockchains, it will be forced to "rent" external infrastructure and forgo fee revenue. ARC, however, aims to recapture this value and transform infrastructure into Circle's own revenue stream.

This strategy is familiar. Amazon wasn't content with simply being an e-commerce platform; it built its own logistics and cloud services (AWS), controlling its own operational infrastructure and thereby capturing a larger portion of the value chain. ARC represents a similar strategic move for Circle: controlling the underlying infrastructure, reducing external reliance, and building a more defensible, multi-layered business model.

Conclusion

ARC is more than just "another new chain." From an industry perspective, it addresses key barriers that have long hindered TradFi's entry into the crypto market: privacy, stable fees, and institutional-grade finality . From a business perspective, it allows Circle to truly control the stablecoin supply chain, locking in value that would otherwise flow to public chains within its own system. And from a global perspective, it makes USDC a programmable expression of the US dollar.

If Circle succeeds in deeply embedding ARC into the global payment infrastructure—from Visa and Mastercard to corporate payment networks—even capturing a small fraction of global payment volume could be enough to translate into billions of dollars in stablecoin demand.

In this sense, ARC is not just an attempt to capture value, but also a layout to shape the future flow of money.

In the digital economy, real power lies not only in issuing currency but also in controlling the trajectory of the currency.