BTC and ETH devour liquidity, while altcoins use buybacks to build an anti-siphoning turret

- 核心观点:代币回购成为山寨币项目争夺资本的关键策略。

- 关键要素:

- Chainlink将协议收入反哺代币生态。

- Ethena启动2.6亿美元代币回购计划。

- BounceBit回购20%流通代币。

- 市场影响:提升项目信心但需透明执行。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

The crypto market in 2025 is experiencing a new wave of prosperity. Bitcoin has broken through the $120,000 mark, and Ethereum is just shy of its all-time high. This surge is driven not simply by the enthusiasm of crypto natives but by the orderly entry of increasing amounts of traditional financial capital. This massive influx of liquidity has made Bitcoin and Ethereum a natural reservoir, where funds settle but are unlikely to overflow.

For projects lacking direct access to traditional capital, this presents both a feast and a sifting through. Winning the attention of capital amidst the siphoning effect of Bitcoin and Ethereum has become a survival challenge they must confront. Over the past month, a growing consensus has emerged among altcoin projects: garner market confidence through token buybacks and treasury reserves .

The logic behind token buybacks is simple: reducing circulating supply and increasing scarcity, thereby driving prices upward or maintaining stability. It directly leverages supply and demand, while also signaling to the market that the project is bullish. Funding sources for buybacks include protocol revenue, financing, or existing reserves. Execution methods include direct purchases on the open market, buybacks from on-chain liquidity pools, and even token burns.

However, buybacks are never a panacea. Transparency, enforcement, and funding sources all determine the temperature of the market reaction. Some projects may spark controversy or even price drops due to opaque buyback plans or failure to deliver on promises.

A month ago, Odaily Planet Daily published an article titled " From Growth Illusion to Cash Flow Reality: When Buybacks Become the Collective Narrative of Altcoins ." It argued that projects with cash flow are more likely to survive under the narrative of survival. Today, while market sentiment appears to have shifted from sluggish to euphoric, the narrative dilemma facing altcoins remains. How to break through the hype through buybacks is a testament to the strategic foresight of project developers.

Typical Case: The Multifaceted Picture of the Buyback Boom

The following are several recent eye-catching buyback cases, showing the strategies and results of different projects in token buybacks.

Chainlink (LINK): Protocol Revenue Feeds Back into the Token Ecosystem

On August 7, Chainlink announced the launch of the Chainlink Reserve, which converts revenue from enterprise integrations and on-chain service fees directly into a reserve of LINK tokens to support the long-term development of the network. Co-founder Sergey Nazarov stated that the project has already generated hundreds of millions of dollars in revenue, primarily from large enterprises. The reserve account has accumulated over one million dollars in LINK since its launch.

The core of this model is to channel real external revenue into the token ecosystem, forming a closed loop. This approach is similar to traditional corporate "profit-based share repurchases," except that the underlying assets are on-chain assets. As a decentralized oracle network, Chainlink is critical infrastructure for DeFi. Protocols like Aave, Compound, and Uniswap rely on its price data to trigger liquidations and calculate collateralized value. Collaborations with traditional financial giants like JPMorgan, SWIFT, and Fidelity further strengthen its role as a bridge between TradFi and blockchain. The 2025 White House Digital Asset Report even highlighted its strategic value in the stablecoin and tokenized asset sectors.

The greatest significance of this buyback lies not in short-term price fluctuations but in the fact that, for the first time, LINK tokens are directly tied to protocol revenue—token holders finally have a quantifiable path to value creation. Previously, LINK's market value relied primarily on the narrative of "infrastructure scarcity," but now it has an additional logical chain of "cash flow feedback."

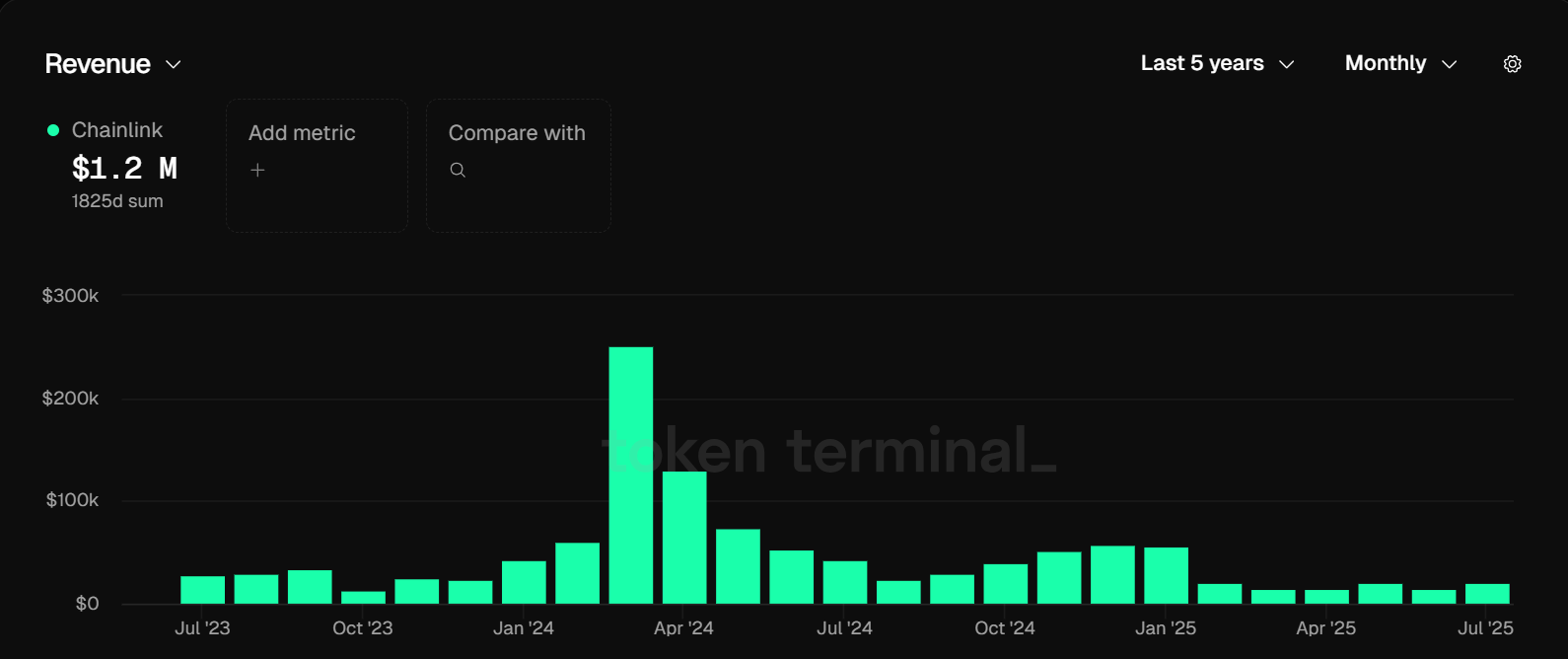

However, the effectiveness of the buyback still depends on network usage. If Chainlink's network usage is insufficient, revenue may not be able to support large-scale buybacks, thus hindering effectiveness. According to data from tokenterminal.com , Chainlink's monthly revenue currently remains around $20,000. Even if all of this were used for token buybacks, annual revenue would only be $2.4 million. Judging solely by this data, the actual impact on the protocol is likely to be minimal.

However, on August 14th, Chainlink added 44,109.76 LINK to its strategic reserve, valued at $1.03 million, bringing the total to 109,661.68 LINK, valued at $2.55 million. The on-chain revenue figures may differ from actual operations, and the percentage of this transaction used in Chainlink's protocol revenue remains unknown. Therefore, it's impossible to definitively assess the impact of the LINK reserve on the project itself.

Psychologically, however, investors will view this "long-term" repurchase as a safety margin . However, whether LINK can ultimately break the long-standing "value transmission gap" depends on whether the actual call volume of the oracle network can continue to increase.

Ethena (ENA): The buyback shockwave behind the huge wave of financing

On July 21, Ethena Labs announced a $360 million PIPE (Private Investment in Equity) transaction with stablecoin issuer StablecoinX. StablecoinX plans to list on the Nasdaq under the ticker symbol "USDE" (the same as Ethena's stablecoin, USDe). Simultaneously, the Ethena Foundation announced the launch of a $260 million buyback program for ENA tokens , stating that it would invest approximately $5 million per day over the next six weeks to build up its ENA reserve. If the entire $260 million is used to buy back ENA, at the current price of $0.73, the token repurchase would reach 356 million, representing approximately 5% of the circulating supply. The Ethena Foundation stated in a statement that between July 22 and 25, its subsidiaries, through a buyback program initiated by third-party market makers, had repurchased 83 million ENA tokens on the open market.

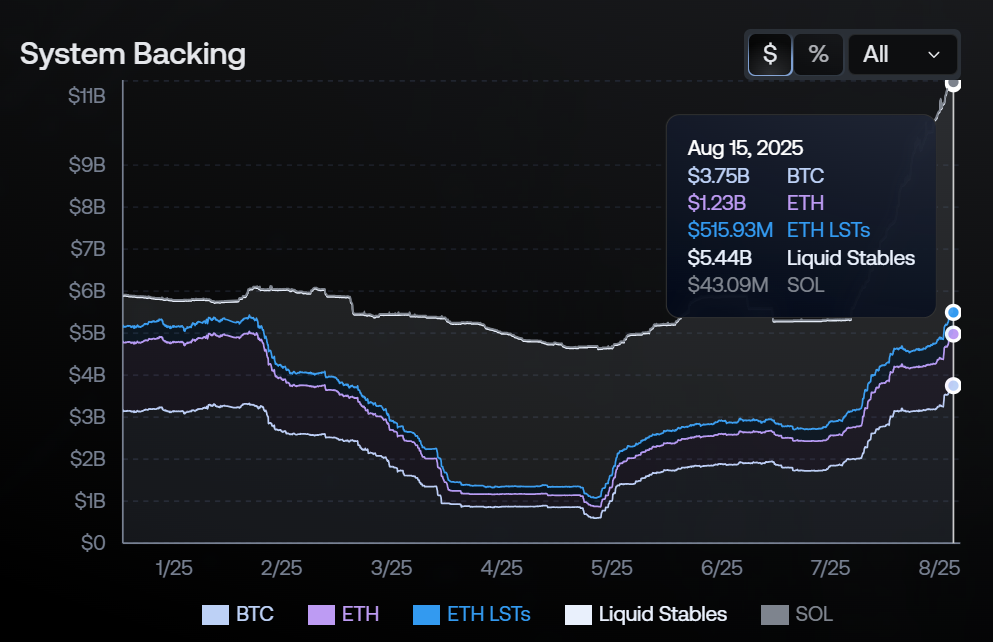

Ethena's core product, USDe, is a synthetic dollar created through a delta-neutral strategy, designed to maintain a 1:1 peg to the US dollar without relying on traditional banks or centralized reserves. Its operational logic requires the use of on-chain crypto assets (such as ETH and BTC) as collateral, while simultaneously establishing an equivalent short position in the derivatives market to hedge against price volatility. This design not only requires extensive connections and strong execution capabilities, but also demonstrates the project's inherent strategic value , as evidenced by its rapid growth since launch.

The scale of assets locked in the current protocol is growing rapidly, and the supply of Ethena's stablecoin USDe has exceeded the 10 billion mark, reaching 10.98 billion US dollars, second only to centralized stablecoins USDT and USDC, becoming a dark horse that is shaking up the stablecoin market.

This round of ENA buybacks was funded by financing proceeds. While the $260 million figure isn't enough to fully support market prices, the short-term positive signals it sends shouldn't be underestimated. Furthermore, StablecoinX's listing on the Nasdaq under the ticker symbol "USDE" will establish a direct brand association with Ethena's synthetic USDe, potentially providing Ethena with unexpected brand endorsement and institutional traffic. For a stablecoin issuer, this represents a ticket to Wall Street, and token buybacks are a strategic tool to capitalize on market confidence.

BounceBit (BB): A high-ratio buyback platform in the CeDeFi experiment

On August 5th, BounceBit announced a partnership with Wall Street asset management giant Franklin Templeton to launch a new product, BB Prime. The product integrates its tokenized money market fund and combines basis arbitrage with Treasury bond yields, creating a quintessential CeDeFi structured product. For BounceBit, this represents not only a product iteration but also a strengthening of its traditional financial pedigree. Simultaneously, the team launched a token buyback program, backed by over $10 million in protocol revenue, to strengthen the long-term value of the BB token.

BounceBit's core business is Bitcoin restaking (BTC Restaking). Based on the compliance and profit structure of CeFi, combined with the transparency and composability of DeFi, it allows BTC holders to obtain more diversified profit scenarios, occupying a unique position in the crypto industry.

A week later, BounceBit disclosed on the X platform that it had repurchased 8.87 million BBs from the open market, valued at approximately $1.16 million, and planned to continue repurchasing them using the protocol's annualized revenue of approximately $16 million. If fully repurchased, at the current price of $0.118, the repurchase would total 135 million BBs, representing approximately 20% of the total circulating supply .

While the absolute size of the buyback isn't significant, the percentage (20% of the circulating supply) is quite aggressive. However, the ultimate impact of the buyback will depend on whether the overall crypto market excitement can continue and whether it can be transmitted to the BounceBit project.

Story (IP): Misalignment between favorable financing and price reversal

On August 11th, Nasdaq-listed Heritage Distilling announced the completion of a $220 million funding round, led by renowned crypto investment firms including a16z crypto, Amber Group, and Arrington Capital. The company also launched a $360 million IP token reserve program in partnership with the Story Foundation. Heritage will acquire 52.4 million IP tokens for a long-term lock-up, while the Story Foundation will repurchase the equivalent amount within 90 days for $82 million.

From a capital structure perspective, this marks a16z's first involvement in a listed company's strategic digital asset allocation, and a rare example of a Nasdaq-listed company with the lowest market capitalization introducing a crypto token reserve. For Story, an AI-driven decentralized content ecosystem, this should have been a narrative leap forward—with a large financing scale, a strong institutional team, and clear reserve commitments.

However, the market reaction was unexpected. Following the announcement, the price of IP tokens plummeted from $7.1 to around $5.5. Rumors circulated that the financing cost had been leaked and significantly lower than the secondary market price, triggering a collapse in confidence, though this information has not been officially confirmed. This also highlights a core contradiction: if the positive news of the buyback program is interpreted by the market as "institutional investors entering the market at a low price," it could actually become a catalyst for selling pressure .

pump.fun (PUMP): Revenue-driven buybacks and the transparency crisis

Pump.fun, once a leading meme coin launch platform, launched its PUMP token on July 12th after being overtaken by LetsBONK.fun. The platform attempted to rebuild its moat through fee discounts, staking rewards, and community incentives. However, the lack of clear governance rights, staking income, or fee sharing mechanisms for PUMP, coupled with the rapid sell-off by whale wallets after the ICO, put downward pressure on its price.

Faced with significant selling pressure, pump.fun launched a buyback program totaling $30.53 million . The buyback funds came from platform transaction fees (1% buy and sell fees), of which 35% was used to repurchase PUMP tokens.

The first round of repurchase on July 16 was worth approximately US$2.1 million. As of now, the PUMP repurchase address has accumulated PUMP tokens worth US$6.68 million, of which approximately US$5.72 million of tokens have been transferred to the Squads Vault.

The problem lies in transparency. Market rumors previously circulated that pump.fun would increase its PUMP token buyback ratio, allocating 100% of daily revenue to repurchases. Dumpster DAO, following this, cautioned the community to carefully monitor on-chain data, as pump.fun has only used 100% of its revenue for one day of token repurchases. While pump.fun previously allocated 100% of its revenue for token repurchases, this was not fully executed, raising concerns that they were misleading on-chain observers. Furthermore, these tokens were never destroyed or transferred anywhere, and without any official communication or reliable repurchase system, there's no reason to believe this will continue.

Despite a significant revenue decline, pump.fun's monthly revenue still reaches approximately $20 million. If the aforementioned 35% repurchase ratio is met, the monthly repurchase amount could reach $7 million. For a repurchase model that relies on platform revenue, the key challenge isn't the amount, but rather the stability and verifiability of execution. Without transparency, even ample revenue won't truly boost investor confidence.

Lista DAO (LISTA): Hard Burn and Economic Structure Optimization

On August 14th, Lista DAO announced the approval of the LIP-021 proposal, which will destroy 20% (200 million) of LISTA tokens at once and adjust the protocol's revenue distribution mechanism. This reduces the maximum supply of LISTA from 1 billion to 800 million, creating a direct benefit to the scarcity logic.

Lista DAO is centered around its over-collateralized stablecoin lisUSD and native governance token LISTA, and is committed to providing users with decentralized financial services such as lending, staking, and liquidity mining.

Compared to other examples of "revenue-driven buybacks" or "financing buybacks," Lista's approach involves a rigid supply reduction. Furthermore, the proposal eliminates the previous mechanism of freezing 40% of protocol revenue for token buybacks. Instead, it allocates this revenue flexibly between veLISTA holders (users who gain voting rights by locking up LISTA) and the DAO's operations and ecosystem development. This means that LISTA holders will have a more direct right to revenue, while also providing the DAO with greater flexibility in its use of funds.

This mechanism makes it easier to form positive price expectations in the short term, but its long-term effect still depends on whether lisUSD's market penetration rate and protocol revenue can continue to grow.

Bonk (BONK): Dual-track strategy and a test of trust

On July 24th, LetsBONK announced that it would allocate 1% of its total revenue to repurchase top tokens within the BONK ecosystem. Funds will come from the team's marketing fund, and repurchases will be conducted weekly. According to data from that day, LetsBONK generated approximately $1.5 million in transaction fees over the previous 24 hours, of which $15,000 will be allocated for this repurchase round. Based on this data, the monthly repurchase amount could reach $450,000.

LetsBONK.fun is a Solana-based meme token launch and trading platform, developed in partnership between the BONK community and the decentralized exchange (DEX) Raydium. It officially launched on April 25, 2025. Following its launch, the platform rapidly gained popularity, surpassing then-industry leader Pump.fun in July 2025 to become the largest meme token issuance platform on Solana. On August 5, BONK announced on the X platform that it had destroyed 300 billion BONK tokens, equivalent to approximately $8 million , through protocol fees generated by LetsBONK.fun.

However, the implementation process was also controversial. On July 25th, the Bonk project announced on Twitter that it had repurchased and destroyed 500 billion BONK (worth approximately $18.47 million). However, half an hour later, 510 billion BONK were transferred from Galaxy Digital to Binance and Coinbase. Following the announcement, BONK's price plummeted by 10%.

On August 11th, Nasdaq-listed Safety Shot announced a strategic alliance with the founding contributors of Bonk, launching the BONK Treasury Strategy. The company will reportedly receive $25 million worth of BONK tokens in exchange for the issuance of $35 million worth of preferred stock convertible into common stock.

For BONK, the protocol is currently experiencing rapid development, and its substantial revenue provides it with a certain degree of competitiveness. However, while the dual-track model of destruction and buyback can certainly create an expectation of scarcity at the narrative level, in an era where on-chain transactions can be monitored in real time, any lack of transparency in the flow of funds quickly translates into trust risks.

Summary: Buyback is a tool, not a talisman

Whether driven by financing, revenue rebates, or a one-time burn, the market effectiveness of buybacks hinges on execution, transparency, and funding sustainability . For investors, the key lies not in the word "buyback," but in asking three questions: Where does the funding come from? How long will it last? And does it truly reduce circulating supply? The answers to these three questions determine whether the buyback program serves as a foundation for price support or a short-term narrative. Only when funding sources are secure, execution is transparent, and supply is truly shrinking can buybacks become a long-term tool for navigating sentiment cycles.