Coinbase Monthly Report: $7 Trillion in Cash Ready to Go, Altcoin Season May Begin in September

- 核心观点:山寨季即将来临,资金轮动至山寨币。

- 关键要素:

- 比特币主导地位下降至59%。

- 山寨币总市值增长50%。

- 机构对ETH兴趣增加。

- 市场影响:山寨币或迎来全面上涨。

- 时效性标注:中期影响。

This article comes from: Coinbase; Original author: David Duong

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

Core Summary

- Our outlook for Q3 2025 remains positive, but our view on alt season has evolved. We believe current market conditions suggest the market could shift to a full-blown alt season as September approaches – a term we typically define as at least 75% of the top 50 altcoins outperforming Bitcoin over the last 90 days.

- Many have debated whether the Federal Reserve's September rate cuts triggered a localized peak in the cryptocurrency market. We disagree. With a significant amount of retail capital currently sitting idle in money market funds (over $7 trillion) and other channels, we believe the Fed's easing policy could unleash even more retail capital into the market over the medium term.

- Focusing on Ethereum (ETH), the divergence between the generally sluggish CoinMarketCap Altseason Index and the 50% growth in total altcoin market capitalization since early July largely reflects increased institutional interest in ETH, driven by demand from digital asset treasuries (DATs) and the growing narrative surrounding stablecoins and real-world assets.

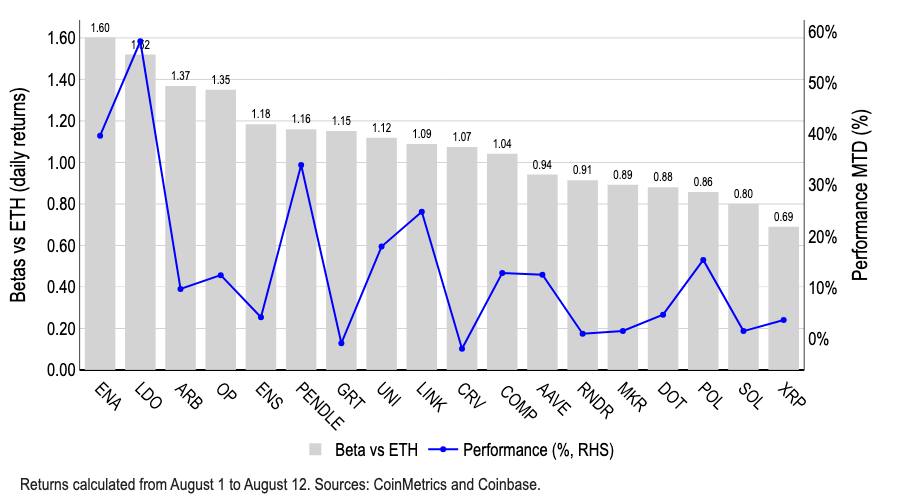

- While tokens like ARB, ENA, LDO, and OP exhibit higher beta to ETH in terms of daily returns, only LDO appears to have significantly benefited from ETH's recent rally (up 58% so far this month) . Historically, Lido has provided relatively direct ETH exposure due to its liquid staking nature. Furthermore, we believe LDO's rally was fueled by the US SEC's ruling that liquid staking tokens do not constitute securities under certain conditions.

The copycat season is coming

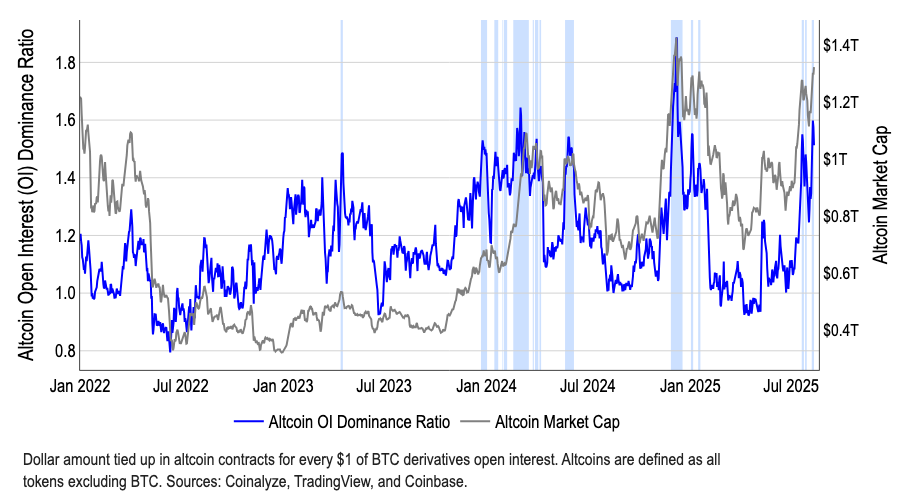

Bitcoin's market dominance has declined from 65% in May 2025 to approximately 59% in August 2025, indicating a rotation into altcoins. Despite altcoin market capitalization increasing by over 50% since early July (reaching $1.4 trillion as of August 12), CoinMarketCap's "Alt Season Index" remains low at around 40, well below the 75 threshold that historically defines an alt season. We believe current market conditions are beginning to signal a potential shift toward a full-blown alt season as September approaches.

Odaily Note: The proportion of open interest in altcoins has surged.

Our optimistic outlook is based on a macro perspective and anticipation of significant regulatory developments. We have previously noted that changes in the global M2 money supply index tend to lead Bitcoin prices by 110 days, pointing to a potential wave of liquidity in late Q3/early Q4 2025. This is crucial, as the narrative for institutional funds appears to remain centered around large-cap coins, while altcoins are primarily supported by retail investors.

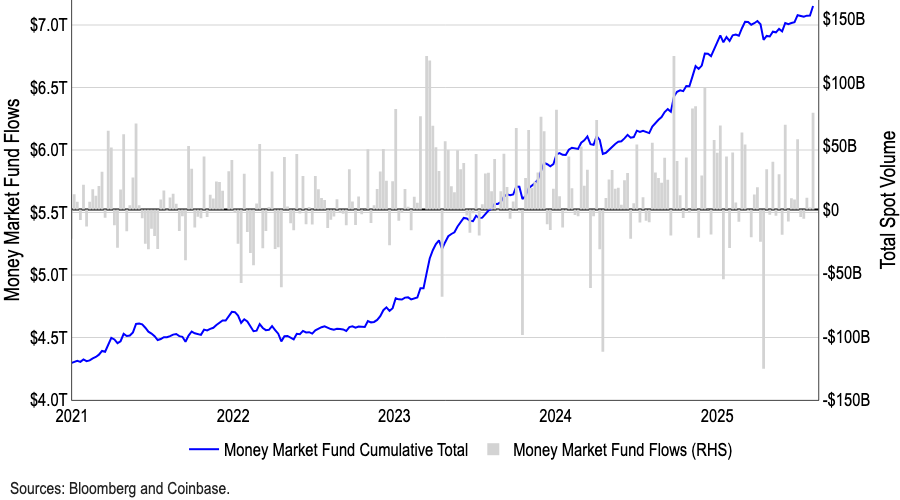

Notably, while US money market funds currently hold a record $7.2 trillion, cash balances declined by $150 billion in April, which we believe contributed to the strong performance of crypto and risk assets in the following months. Interestingly, however, cash balances have rebounded by over $200 billion since June, contrasting with the rise in cryptocurrencies over the same period. Typically, cryptocurrency price increases and cash balances tend to show a negative correlation.

Odaily Note: The asset size of money market funds has exceeded 7 trillion US dollars.

We believe this unprecedented level of cash reserves reflects missed opportunity costs, primarily due to:

- Increased uncertainty in traditional markets (caused by issues such as trade conflicts);

- Market valuations are high;

- Persistent concerns about economic growth.

However, with the Federal Reserve set to implement rate cuts in September and October, we believe the appeal of money market funds will begin to wane, with more funds flowing into cryptocurrencies and other riskier asset classes.

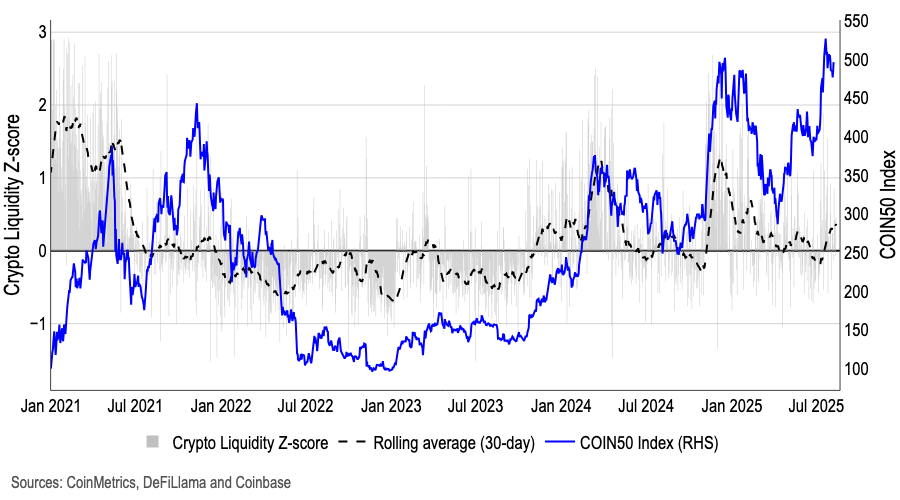

In fact, our cryptocurrency liquidity-weighted Z-score metric (based on factors such as stablecoin net issuance, spot and perpetual swaps trading volume, order book depth, and free float) shows that liquidity has begun to recover in recent weeks after a six-month decline. Stablecoin growth is partly due to increasing clarity in the regulatory environment.

Odaily Note: There are initial signs of recovery in cryptocurrency liquidity.

Beta Options for ETH

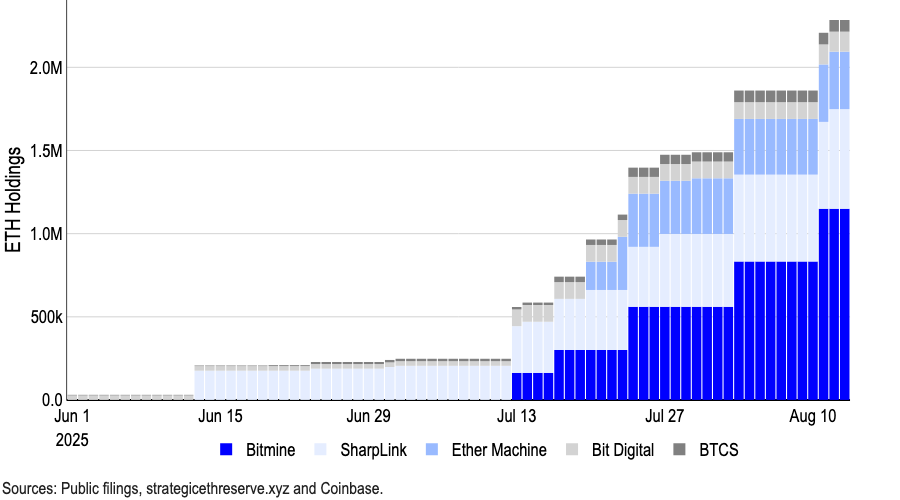

Meanwhile, the divergence between the Altseason Index and the Total Altcoin Market Capitalization primarily reflects growing institutional interest in Ethereum (ETH)—a trend bolstered by demand for digital asset treasuries (DATs) and the narrative surrounding stablecoins and real-world assets (RWAs). Bitmine Immersion Technologies alone has acquired 1.15 million ETH and plans to continue increasing its holdings through a capital raise of up to $20 billion. Sharplink Gaming, another leading ETH DAT, currently holds approximately 598,800 ETH.

Odaily Note: The amount of ETH held by some digital asset treasury companies.

The latest data as of August 13 shows that the top ETH treasury companies hold a total of approximately 2.95 million ETH, accounting for more than 2% of the total supply of ETH (120.7 million).

Among the highest-yielding beta options relative to ETH, ARB, ENA, LDO, and OP rank at the top, but only LDO appears to have significantly benefited from ETH's recent rally (up 58% so far this month). Due to its liquid staking nature, Lido has historically provided relatively direct ETH exposure. Currently, LDO's beta relative to ETH is 1.5—a beta greater than 1.0 means the asset is theoretically more volatile than the benchmark, potentially amplifying gains and losses.

Odaily Note: Beta values of some altcoins compared to ETH.

We believe the price increase for LDO was also supported by the US SEC's August 5th statement regarding liquid staking. SEC Division of Corporation Finance staff noted that when the services provided by a liquid staking entity are ministerial in nature and staking rewards are distributed 1:1 according to the agreement, the related activities do not constitute an offering or sale of securities. However, it is important to note that yield guarantees, voluntary re-staking, or additional return mechanisms may still trigger a securities designation. Furthermore, the current guidance represents only the staff's opinion—future shifts in the Commission's position or litigation could alter this interpretation.

in conclusion

We maintain a constructive outlook for Q3 2025, but our assessment of an altcoin season has evolved. The recent decline in Bitcoin's dominance suggests a preliminary rotation into altcoins, but a full-blown altcoin season has not yet formed. However, with the total altcoin market capitalization climbing and the "Altcoin Season Index" showing early positive signals, we believe the market is creating conditions for a more mature altcoin season, potentially arriving in September. This optimistic assessment is based on both macro factors and expectations for regulatory progress.