The acceleration of U.S. encryption policy: 9 actions in 20 days, which areas will benefit?

- 核心观点:美国加密监管政策转向,全面利好行业。

- 关键要素:

- 稳定币、DeFi、ETF等获明确监管框架。

- 银行、养老金等传统资金加速入场。

- RWA、链上信贷等赛道迎爆发式增长。

- 市场影响:推动加密市场机构化与合规化。

- 时效性标注:中期影响。

Original title: "4 statements, 3 bills, and 2 executive orders issued in 20 days: Which crypto fields are favored by US policies?"

"The White House is preparing to issue an executive order to punish banks that discriminate against crypto companies." This news has been flooding the WeChat Moments recently. People who have been in the cryptocurrency industry for more than two years have to rub their eyes to confirm it after seeing this news, and exclaimed, "It feels like a lifetime ago."

However, just over a year later, Operation Choke Point 2.0 was fully implemented in March 2023. During the Biden administration, the Federal Reserve, the FDIC, the OCC, and other institutions issued a joint statement designating cryptocurrency businesses as "high-risk" and requiring banks to rigorously assess their exposure to crypto clients. Regulators, through informal pressure, forced crypto-friendly banks like Signature Bank and Silvergate Bank to close core businesses and restrict new client access. Payment and trading platform builders were particularly affected by this. Publicly listed crypto companies like Coinbase were caught in the middle, forced to invest hundreds of millions of dollars to establish independent banking networks. Small and medium-sized crypto startups, unable to meet KYC/AML requirements, registered offshore in large numbers.

Over the past month, policy trends have dramatically reshaped nearly every type of crypto asset, including stablecoins, DeFi, ETFs, and LSTs. The accelerated entry of traditional financial institutions and the prevalence of cryptocurrency-to-equity companies have created a strong sense of disconnect. But beyond signaling a start for institutions, what opportunities can we find within these bills?

Four statements, three bills, and two executive orders

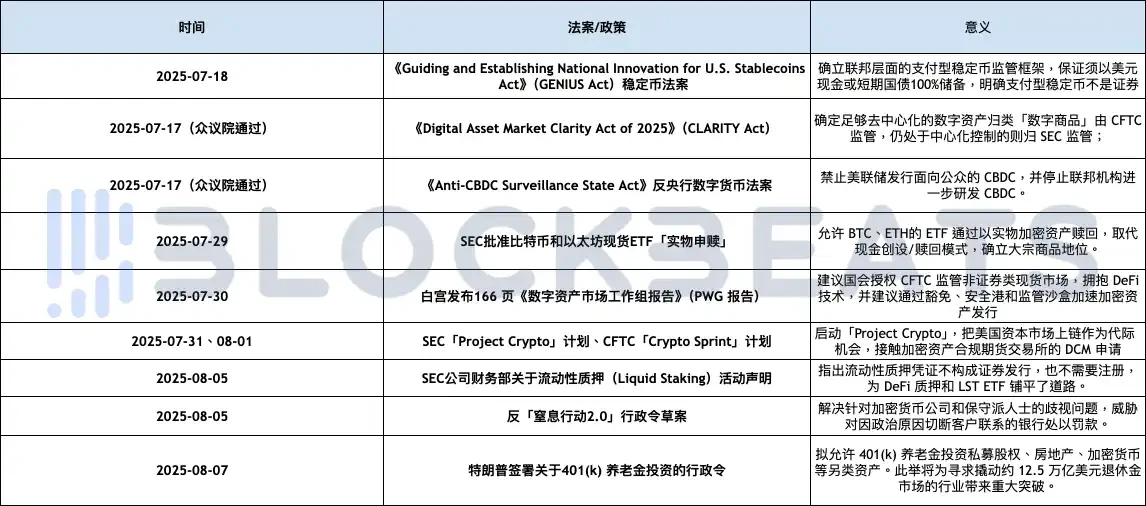

Before we begin, let’s take a complete look at some of the announcements from the US government and regulators between July and August. These announcements were dense and fragmented, but they pieced together the current US crypto regulatory landscape like a puzzle:

July 18 Trump signed the GENIUS Act

The bill establishes the first federal-level stablecoin regulatory framework in the United States, specifically including:

Payment stablecoins are required to be 100% backed by liquid assets such as US dollars or short-term government bonds and to make monthly disclosures.

Stablecoin issuers must obtain a "federal qualified issuer" or "state qualified issuer" license.

The bill prohibits issuers from paying interest to holders and requires that stablecoin holders be given priority protection in the event of bankruptcy.

The bill clearly defines that payment stablecoins are not securities or commodities.

July 17: The House of Representatives passed the CLARITY Act

The bill intends to establish the crypto asset market structure, including:

Clearly assigns jurisdiction to the CFTC (to regulate digital commodities) and the SEC (to regulate restricted digital assets).

The CLARITY Act allows projects to convert from securities to digital commodities through temporary registration after the network matures, providing a safe harbor for decentralized participants such as developers and validators. The CLARITY Act creates a Section 4(a)(8) exemption from the Securities Act for the issuance of digital commodities, with a financing limit of US$50 million per 12 months, and uses a "mature blockchain system" test to determine whether the network is out of control of any person or team.

On July 17, the House of Representatives passed the Anti-CBDC Surveillance State Act

The House of Representatives passed a bill prohibiting the Federal Reserve from issuing a central bank digital currency (CBDC) to the public and prohibiting federal agencies from researching and developing CBDCs. Representative Tom Emmer explained the bill's potential use as a "government surveillance tool." The bill codifies the President's executive order prohibiting the development of CBDCs to protect citizens' privacy and freedoms.

On July 29, the SEC approved the "physical subscription and redemption" of Bitcoin and Ethereum spot ETFs.

The committee approved crypto asset trading products such as Bitcoin and Ethereum, allowing the creation and redemption of shares in physical crypto assets rather than cash, which means that Bitcoin and Ethereum will receive similar treatment to commodities such as gold.

On July 30, the White House released the 166-page Digital Asset Markets Working Group Report (PWG Report).

The White House Digital Asset Task Force released a 166-page report proposing a comprehensive encryption policy blueprint, including:

Emphasis is placed on establishing a digital asset classification system to distinguish between security tokens, commodity tokens, and commercial/consumer tokens.

Request Congress to give the CFTC the power to regulate the spot market of non-securities digital assets based on the CLARITY Act and embrace DeFi technology.

It is recommended that the SEC/CFTC quickly approve the issuance and trading of crypto assets through exemptions, safe harbors and regulatory sandboxes.

Recommendations include reigniting crypto innovation in the banking sector, allowing banks to custody stablecoins, and clarifying the process for obtaining a Federal Reserve account.

SEC "Project Crypto" plan on July 31 and CFTC "Crypto Sprint" plan on August 1

In his speech at the U.S. Securities and Exchange Commission, Atkins launched the "Project Crypto" plan, which aims to modernize securities rules and bring the U.S. capital market to the blockchain. The SEC will formulate clear rules for the issuance, custody, and trading of crypto assets, and use interpretation and exemptions before the rules are perfected to ensure that traditional rules do not hinder innovation. Specific contents include:

Guide the issuance of crypto assets back to the United States and establish clear standards for distinguishing categories such as digital commodities, stablecoins, and collectibles.

Revise custody regulations to emphasize citizens’ right to self-host digital wallets and allow registered intermediaries to provide crypto custody services.

Promote "super applications" to enable broker-dealers to trade securities and non-securities crypto assets on a single platform and provide staking, lending and other services.

The updated rules create space for decentralized finance (DeFi) and on-chain software systems, clarify the distinction between pure software publishers and intermediary services, and explore innovative exemptions to allow new business models to quickly enter the market with "weak compliance".

Then on August 1, the U.S. Commodity Futures Trading Commission (CFTC) officially launched the "Crypto Sprint" regulatory plan in conjunction with Project Crypto. Four days later, on August 5, it further proposed to include spot crypto assets in CFTC-registered futures exchanges (DCMs) for compliant trading. This means that Coinbase or on-chain derivatives protocols can obtain compliant operating licenses by registering with DCMs.

August 5th SEC Division of Corporation Finance Statement on Liquid Staking

The SEC's Division of Corporation Finance issued a statement analyzing the liquidity staking landscape and concluded that liquidity staking itself does not involve securities trading. Staking receipts (Staking Receipt Tokens) are not securities, and their value represents ownership of the staked crypto assets, not the entrepreneurial or managerial efforts of a third party. This statement clarifies that liquidity staking does not constitute an investment contract, providing greater regulatory compliance for DeFi staking services.

Draft executive order against Operation Suffocation 2.0 on August 5

The order aims to address discrimination against cryptocurrency companies and conservative figures, threatening banks with fines, consent decrees, or other disciplinary measures if they cut off customers for political reasons. The order also reportedly directs regulators to investigate whether any financial institutions have violated the Equal Credit Opportunity Act, antitrust laws, or consumer financial protection laws.

August 7 Trump signs executive order on 401(k) pension investments

The plan to allow 401(k) pension plans to invest in alternative assets such as private equity, real estate, and cryptocurrencies would be a major breakthrough for an industry seeking to tap into the roughly $12.5 trillion retirement fund market.

In the Super App era where everything is on the blockchain, which cryptocurrencies can benefit from the policy dividends?

The US has established a comprehensive compliance framework for the crypto sector. The Trump administration, through its stablecoin bill and anti-central bank digital currency bill, has established the fundamental role of stablecoins, firstly by tying them to US Treasury bonds and secondly by linking them to global liquidity. This foundation allows stablecoins to be extended across various crypto sectors without concern. The CLARITY Act, a brilliant piece of legislation, established the jurisdiction of the SEC and CFTC. Four announcements, made in just one week between July 29th and August 5th, were more on-chain related. From opening up physical redemptions for BTC and ETH ETFs to liquidity-backed certificates, these announcements were intended to first connect "old money" channels to the blockchain and then use "DeFi returns" to expand the financial system onto the blockchain. The two executive orders issued in the past two days have effectively injected funds from banks and pension funds into the crypto sector. This combined force has ushered in the first true "policy bull market" in crypto history.

When Atkins launched Project Crypto, he mentioned the key concept of "Super-App," referring to the horizontal integration of product and service offerings. He envisioned a future where a single application could offer clients a full range of financial services. Atkins stated, "Brokers and dealers with alternative trading systems should be able to offer trading in non-security crypto assets, crypto-asset securities, traditional securities, as well as crypto staking and lending services, without having to obtain licenses in more than 50 states or multiple federal licenses."

When it comes to this year's hottest Super App candidates, the obvious choices are traditional brokerage Robinhood and Coinbase, the earliest "compliant" trading platform. While Robinhood acquired Bitstamp, launched tokenized equity, and partnered with Aave to bring it online (transactions within the platform and on the chain are conducted simultaneously), Coinbase further integrated its Base Chain ecosystem and access to the Coinbase exchange, upgrading the Base Wallet to integrate it into an app that integrates social and off-chain application services. However, the real explosion of RWAs in various fields within the context of Super Apps is taking place.

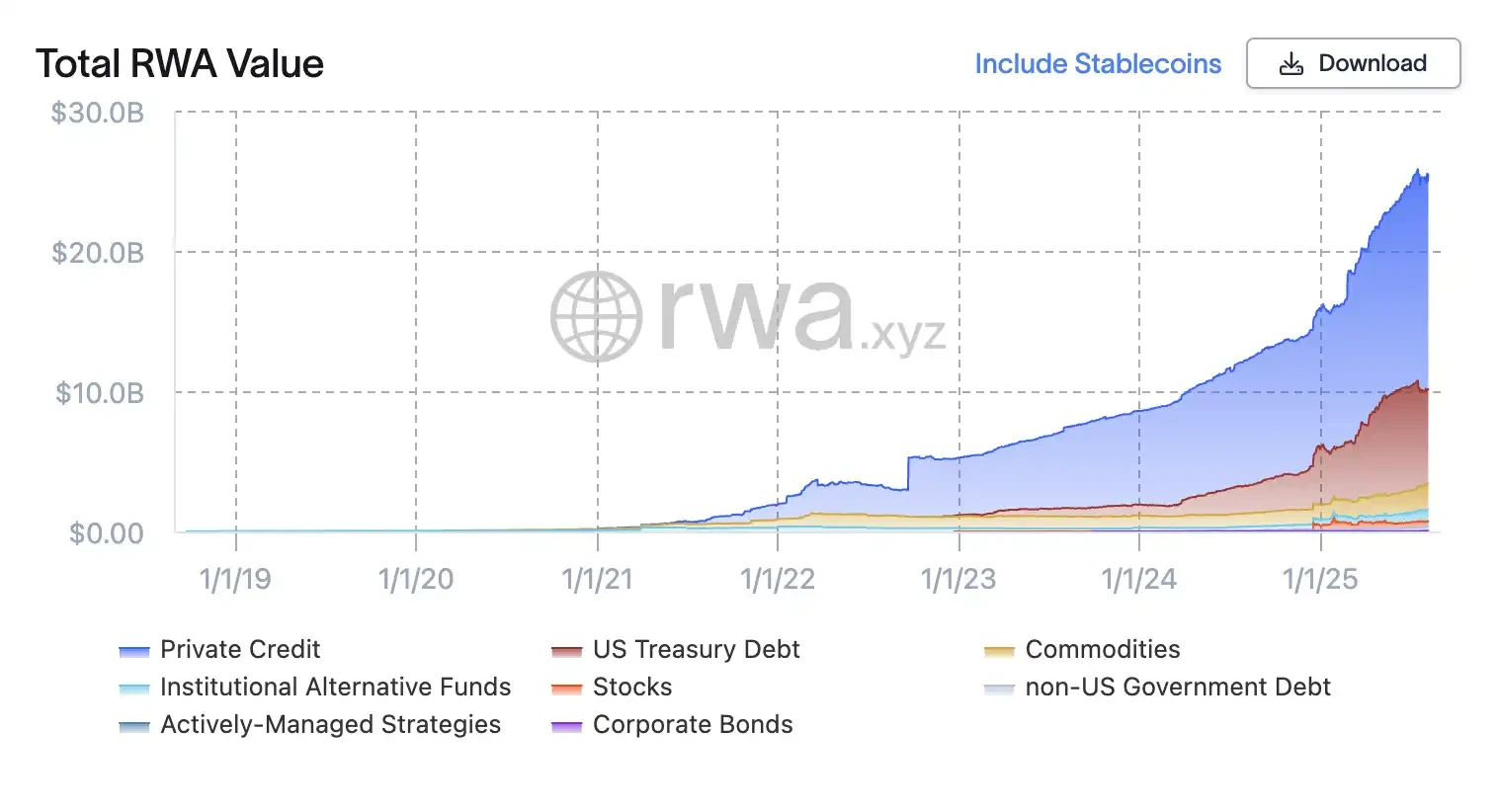

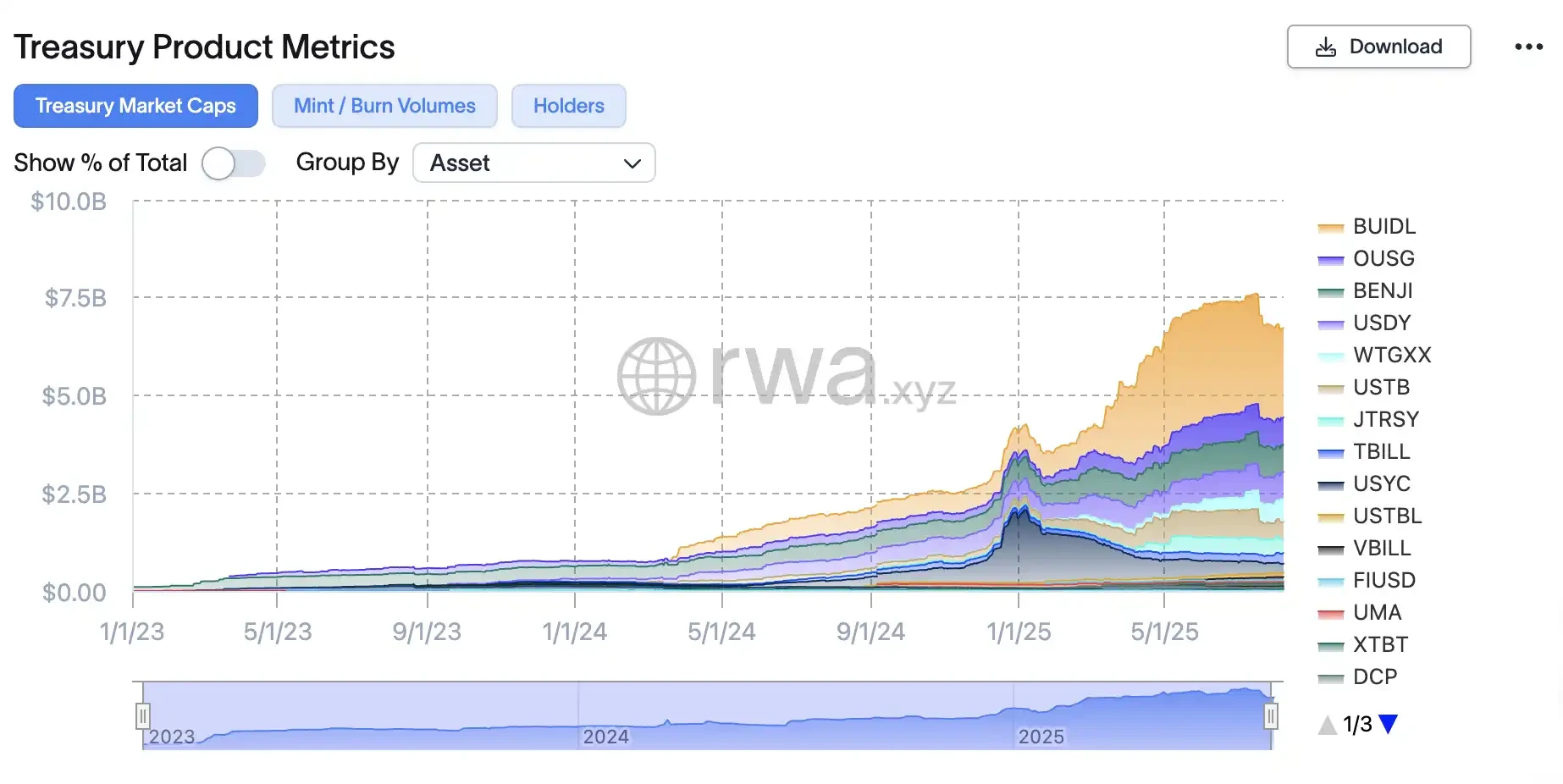

With policies encouraging the on-chain integration of traditional assets, the tokenization of Ethereum bonds, stocks, and short-term government bonds will gradually become compliant. According to data from RWA.xyz, the global RWA market will grow from approximately $5 billion in 2022 to approximately $24 billion by June 2025. Rather than calling it RWA, it's better to call it Fintech, as its goal is to make financial services more efficient through institutional and technological means. From the emergence of real estate investment trusts (REITs) and E-gold in the 1960s to the subsequent emergence of ETFs, RWAs emerged only after countless experiments, both failed and successful, with decentralized ledgers, colored Bitcoin, and algorithmic stablecoins.

Now that it has been recognized by policy systems, it has become the most reliable endorsement, and its market is expected to be enormous. Boston Consulting Group believes that by 2030, 10% of global GDP (approximately $16 trillion) could be tokenized, while Standard Chartered Bank estimates that tokenized assets will reach $30 trillion by 2034. Tokenization opens exciting new doors for institutional firms by reducing costs, streamlining underwriting, and improving liquidity. It also helps improve returns for investors prepared to take on more risk.

The Essence of Stablecoins: On-chain Treasury Bonds

When discussing RWAs in cryptocurrencies, US dollar assets, particularly the US dollar and US Treasury bonds, always take center stage. This is the result of nearly 80 years of economic history, with the development of the Bretton Woods system in 1944, which has made the US dollar the backbone of global finance. Global central banks hold the majority of their reserves in US dollar-denominated assets. Approximately 58% of global official foreign exchange reserves are held in US dollars, with the majority invested in US Treasury bonds. The US Treasury market is the world's largest bond market, with approximately $28.8 trillion in outstanding bonds and unparalleled liquidity. Foreign governments and investors alone hold approximately $9 trillion of this debt.

Historically, few assets have matched the depth, stability, and credit quality of U.S. Treasuries. High-quality government bonds are the cornerstone of institutional portfolios, serving as a safe haven for capital and collateral for other investments. The crypto world capitalizes on these same fundamentals, and with stablecoins becoming the largest on-ramp and off-ramp for crypto, the relationship between the two is deeper than ever.

While cryptocurrencies haven't fulfilled Satoshi Nakamoto's goal of "establishing an alternative to the US dollar system," they've instead become a more efficient infrastructure for the dollar-based financial system. This, in turn, has become a necessary condition for the US government to "fully accept its existence." In fact, the US government may need it more than ever.

With the recent addition of Saudi Arabia, the UAE, Egypt, Iran, and Ethiopia, the BRICS group's combined GDP in 2024 will reach $29.8 trillion, surpassing the US GDP of $29.2 trillion. The US will no longer be the world's largest economic group in terms of GDP. Over the past two decades, the BRICS economies have grown significantly faster than the G7.

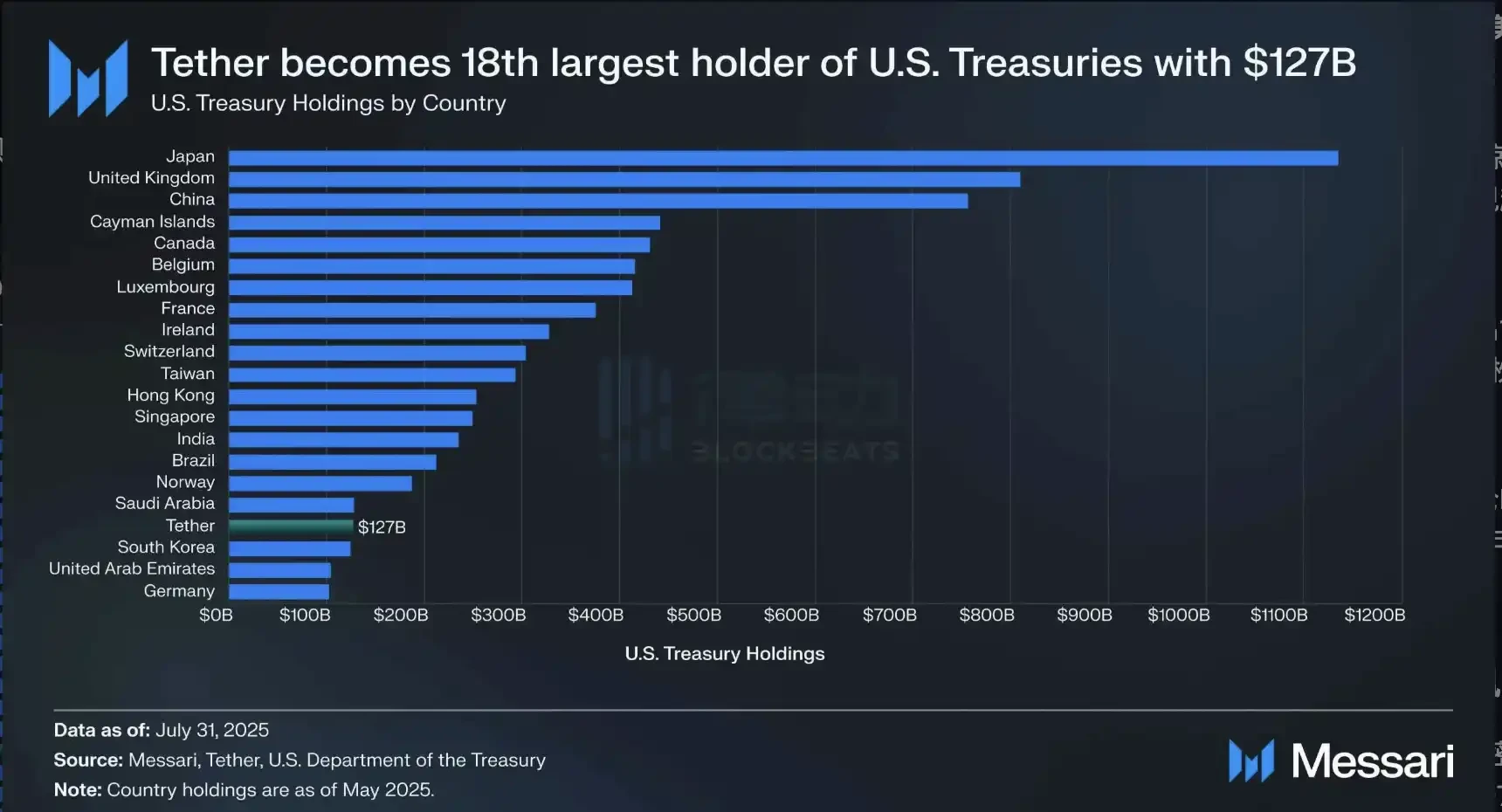

Tether's holdings of US Treasury bonds surpass South Korea's as of May 15, 2025, according to US Treasury data. Source: Messari

Tether's holdings of US Treasury bonds surpass South Korea's as of May 15, 2025, according to US Treasury data. Source: Messari

Stablecoins, which are strongly correlated with them, have a unique position in the global financial landscape. They are the most liquid, efficient, and user-friendly wrappers for short-term U.S. Treasury bonds, effectively solving two obstacles associated with de-dollarization: maintaining the dollar's dominance in global transactions while ensuring continued demand for U.S. Treasuries.

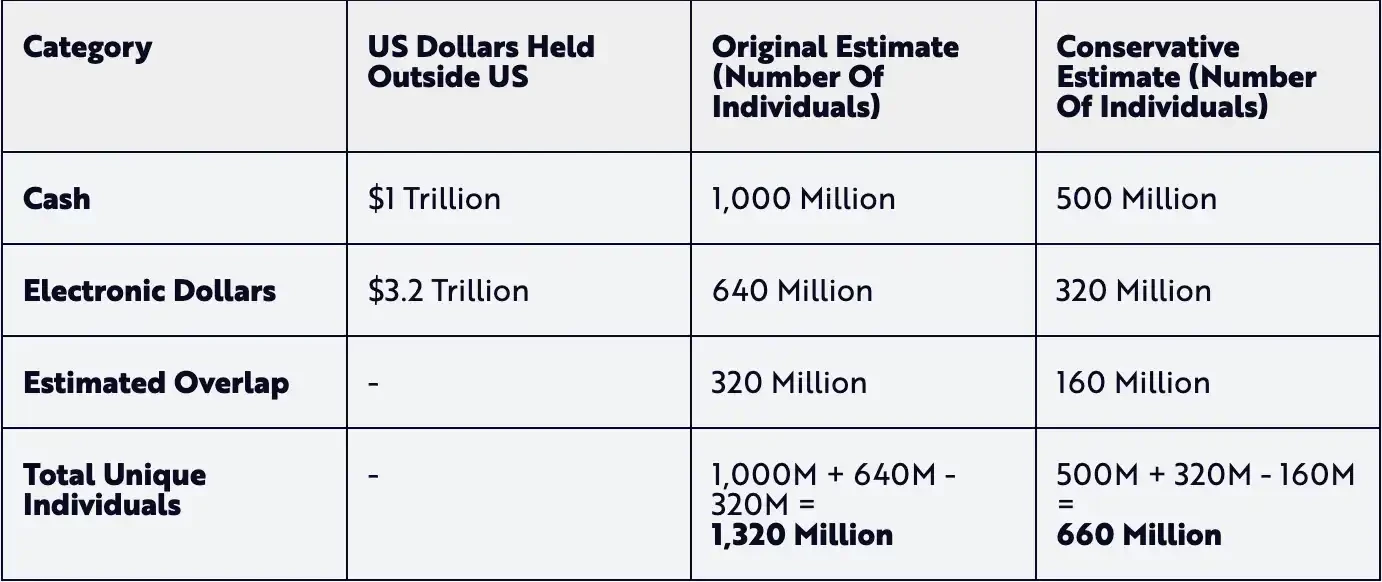

As of December 31, 2024, the number of US dollar holders has reached 15% to 30% of the total number of traditional US dollar holders in 5 years of development. Source: Ark Investment

As of December 31, 2024, the number of US dollar holders has reached 15% to 30% of the total number of traditional US dollar holders in 5 years of development. Source: Ark Investment

USD stablecoins like USDC and USDT not only provide traders with a stable currency, but are also backed by the same bank deposits and short-term Treasury bonds that traditional institutions rely on. While the income from these Treasury bond stablecoins is not shared by holders, there are more on-chain wealth management products that incorporate the concept of US Treasury bonds. Currently, there are two main approaches to tokenizing Treasury bonds on-chain: yield generation mechanisms and rebasing mechanisms.

Yield tokens like Ondo's USDY and Circle's USYC accumulate underlying returns by increasing asset pricing through various mechanisms. In this model, the price of USDY will be higher six months from now than it is today due to the accumulated returns. In contrast, rebasing tokens like BlackRock's BUIDL, Franklin Templeton's BENJI, or Ondo's OUSG maintain USD parity by distributing returns through newly issued tokens at predefined intervals.

Whether it is "yield-generating stablecoins" or "tokenized U.S. Treasury bonds," just like the use of fund portfolios in TradeFi, on-chain wealth management products use on-chain U.S. Treasury bonds as a part of stable income. It has become an alternative to high-risk DeFi, allowing crypto investors to obtain a stable annual yield of 4-5% with minimal risk.

Further reading: The Stablecoin Bill and the Restless Wall Street Bankers

The easiest area to make money: on-chain credit

The traditional lending industry is one of the most profitable core sectors of the financial system. According to Magistral Consulting , the global credit market will reach $11.3 trillion in 2024 and is projected to reach $12.2 trillion in 2025. In comparison, the entire crypto lending market is less than $30 billion, yet yields generally range from 9% to 10%, significantly higher than traditional finance. If regulatory restrictions are lifted, this will unlock enormous potential for growth.

In March 2023, a research team led by Giulio Cornelli of the University of Zurich published a paper in the Journal of Banking and Finance on the importance of lending to large technology companies . The study showed that clear fintech regulatory frameworks can double the growth of new lending activities (one study showed that fintech lending volume increased by 103% when clear regulations were in place). The same principle holds true for crypto lending: where policies are clear, capital will flow.

Lending market size, source: Magistral Consulting

Lending market size, source: Magistral Consulting

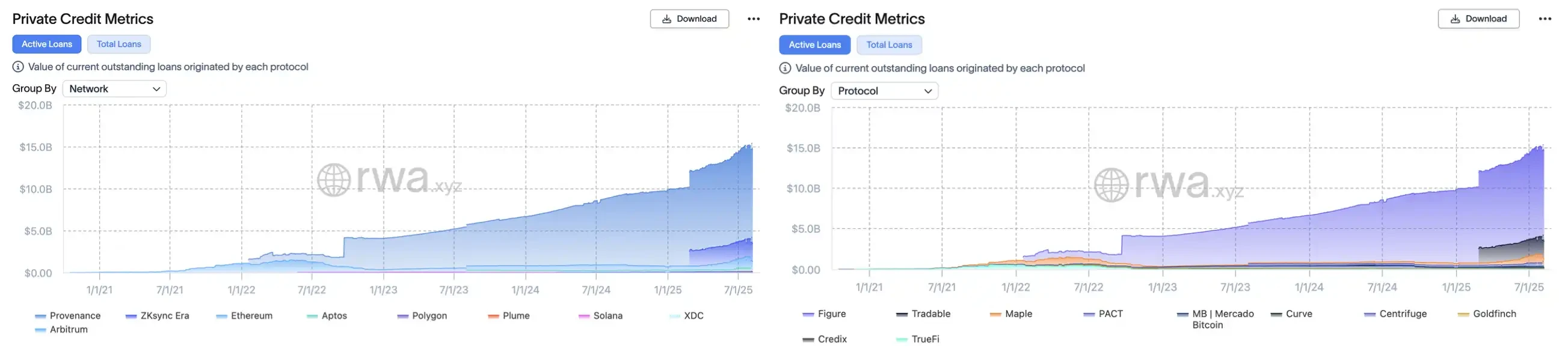

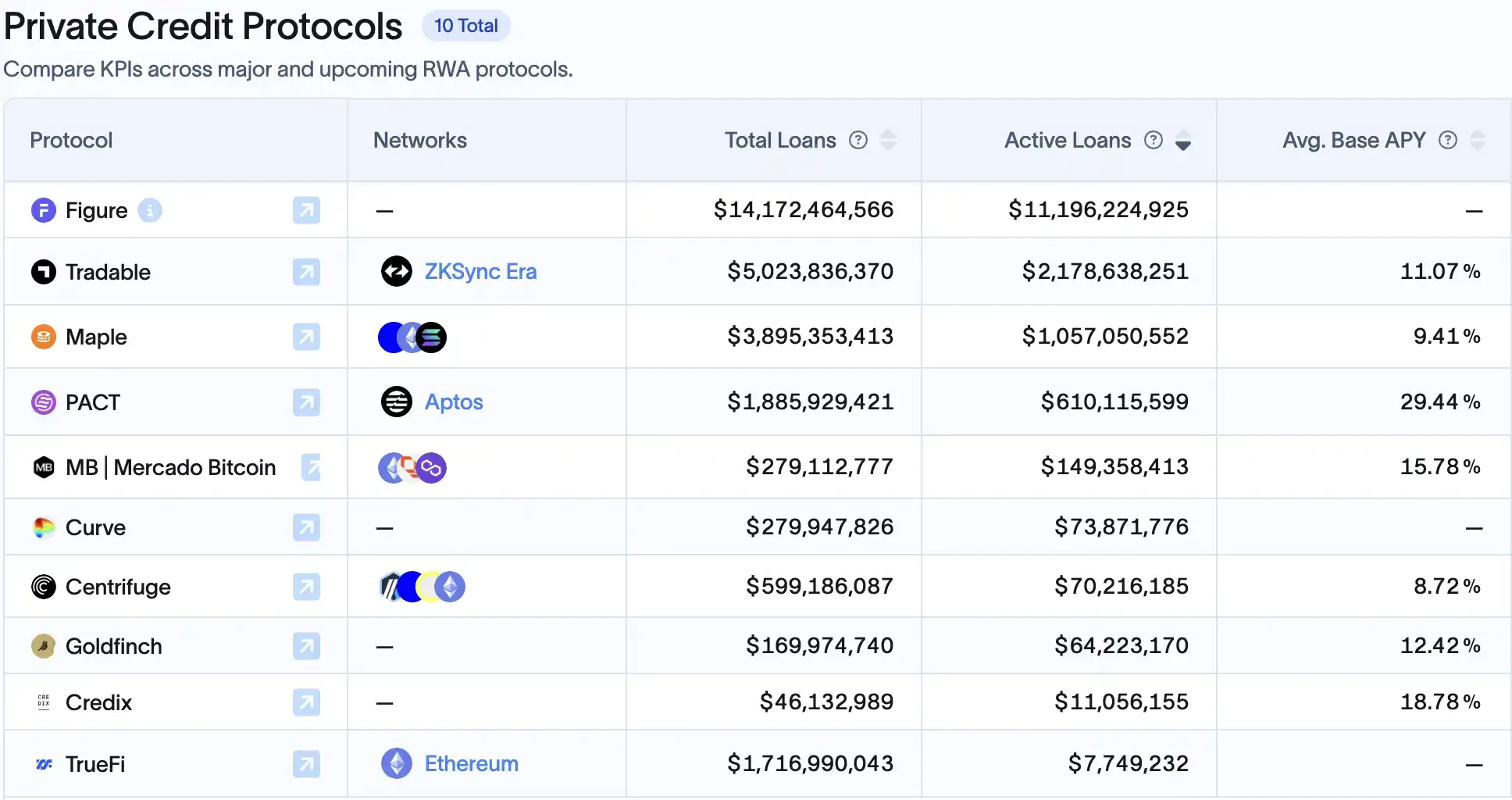

As more and more RWA assets are brought on-chain, one of the biggest beneficiaries of regulatory compliance is likely to be the on-chain lending industry. Currently, the crypto sector lacks the big data support of traditional finance, such as the "government credit score" system, and is limited to focusing on "collateralized assets." DeFi is being used to enter the secondary debt market and diversify risk. Therefore, private credit assets currently account for approximately 60% of on-chain RWAs, or approximately $14 billion.

Behind this wave of growth is the deep involvement of traditional institutions, led by Figure, which is currently in discussions for an IPO. Its Provenance, a Cosmos-based ecosystem designed specifically for asset securitization and loan finance, already holds custody of approximately $11 billion in private credit assets as of August 10, 2025, representing 75% of the sector. Its founder is Mike Cagney, the former founder of SoFi. His experience as a serial entrepreneur in the lending sector has made him adept at blockchain lending. The platform connects the entire chain from loan origination to tokenization and secondary trading.

The second place is Tradable, which tokenized $1.7 billion in private credit on Zksync at the beginning of the year thanks to its partnership with Janus Henderson, a $330 billion asset management company (making Zksync the second largest "lending chain"). The third place is the "world computer" Ethereum, but its market share in this field is only 1/10 of Provenance.

Left: Market capitalization of the "credit public chain"; Right: Market capitalization of credit projects. Source: RWAxyz

Left: Market capitalization of the "credit public chain"; Right: Market capitalization of credit projects. Source: RWAxyz

Further reading: From Sex Scandal to the First RWA Stock, Figure's "American Scam"

Bitcoin Mortgages: A $6.6 Trillion New Blue Ocean

DeFi-native platforms are also entering the RWA lending market. For example, Maple Finance has facilitated over $3.3 billion in loans, with approximately $777 million in active loans currently, some of which are for real-world accounts receivable. MakerDAO has also begun allocating real-world assets like government bonds and commercial loans, and platforms like Goldfinch and TrueFi have also made early moves.

All of this was once suppressed under regulatory hostility, but now the "policy warming" may completely activate this sector.

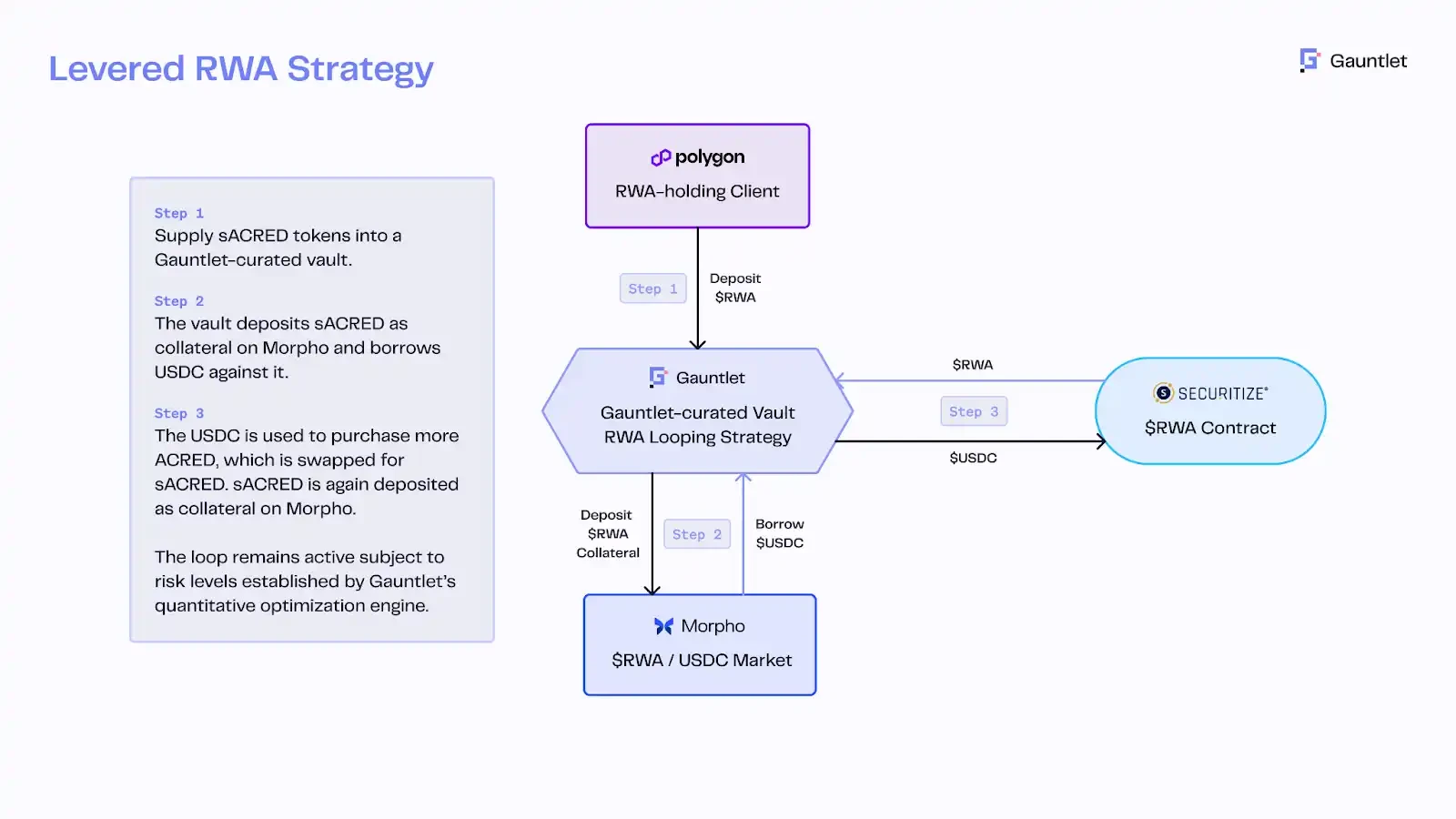

For example, Apollo launched a tokenized version of its flagship credit fund, ACRED. This allows investors to mint sACRED tokens through Securitize to represent their shares, which can then be used for lending and arbitrage on DeFi platforms such as Morpho on Polygon. Using the RedStone price oracle and the Gauntlet risk control engine, sACRED is collateralized to borrow stablecoins, which are then leveraged to repurchase ACRED, leveraging a base yield of 5–11% to 16% annualized. This innovative approach combines institutional credit funds with DeFi leverage.

sACRED revolving loan structure, source: Redstone

sACRED revolving loan structure, source: Redstone

Longer-term, 401(k) reforms will indirectly benefit on-chain credit. Jake Ostrovskis, an over-the-counter trader at Wintermute, stated that the impact of this move cannot be underestimated. "A 2% allocation to Bitcoin and Ethereum alone is equivalent to 1.5 times the cumulative ETF inflows to date, while a 3% allocation would more than double the total market inflows. The key is that most of these buyers are price-insensitive; they focus on meeting allocation benchmarks rather than engaging in tactical trading." The demand for returns in traditional retirement funds is expected to drive investment interest in stable, high-yield DeFi products. For example, tokenized assets based on real estate debt, small business loans, and private credit pools, if properly packaged and compliant, could become new options for pensions.

The top 10 on-chain lending projects by market share. Source: RWAxyz

The top 10 on-chain lending projects by market share. Source: RWAxyz

Given clear regulations, these institutional-grade "DeFi credit funds" are likely to replicate rapidly. After all, most large institutions (Apollo, BlackRock, and JPMorgan) already view tokenization as a key tool for increasing market liquidity and yield. After 2025, as more assets (such as real estate, trade finance, and even mortgages) are tokenized and put on-chain, on-chain credit is expected to become a trillion-dollar market.

Turning 5*6.5 hours of "American Value" into "On-chain US Stocks" for people around the world to play 24/7

The US stock market is one of the world's largest capital markets. By mid-2025, its total market capitalization will be approximately $50-55 trillion (USD), accounting for 40%-45% of the global total. However, this enormous "American value" has long been traded only within a 6.5-hour window, five days a week, with significant regional and time constraints. This situation is now changing, with on-chain US stocks enabling global investors to participate in the US stock market 24/7.

On-chain US stocks refer to the digitization of US-listed company shares into blockchain-based tokens, whose prices are pegged to the actual stock and backed by the actual stock or derivatives. The biggest advantage of tokenized stocks is that trading hours are no longer restricted: traditional US stock exchanges are only open for approximately 6.5 hours per weekday, while blockchain-based stock tokens can be traded continuously around the clock. Currently, US stock tokenization is being implemented primarily through three approaches: third-party compliant issuance with multi-platform access, proprietary issuance by licensed brokerages with closed-loop on-chain trading, and contracts for difference (CFDs).

Further reading: From Robinhood to xStocks, how is US stock tokenization achieved?

At this stage, a variety of US stock tokenization-related projects have appeared in the market, from Republic's "Pre IPO" mirror coin, to Hyperliquid's Ventures that can short and long "Pre IPO", to Robinhood, which has caused a double earthquake in the TradeFi circle and the crypto circle, xStocks, which cooperates with multiple institutions, MyStonk, which can receive stock dividends, and StableStock, which will soon launch a dual-track gameplay of brokerage + on-chain tokens that integrates DeFi.

Behind this trend is the rapidly clarifying regulatory environment and the entry of traditional giants. Nasdaq has proposed creating a digital asset version of an ATS (Alternative Trading System), allowing tokenized securities to be listed and traded alongside commodity tokens to improve market liquidity and efficiency. SEC Commissioner Paul Atkins even compared the blockchainization of traditional securities to the digital transformation of music: Just as digital music revolutionized the music industry, the blockchainization of securities has the potential to enable entirely new issuance, custody, and trading models, reshaping every aspect of the capital market. However, the field is still in its early stages. Compared to other RWA sectors, which often generate billions of dollars, the US stock tokenization sector appears to have greater room for growth. The current market capitalization of on-chain stocks is less than $400 million, with monthly trading volume only around $300 million.

The underlying issues facing this area include incomplete compliance pathways, complex institutional entry regulations, and lengthy deposit processes. However, for most users, the primary challenge is insufficient liquidity. Tech investor Zheng Di explains that high OTC costs create a divide between those who invest in US stocks and those who invest in blockchain. "Depositing via OTC involves fees exceeding a thousand yuan, and if you deposit through a Singapore-licensed exchange like Coinbase, you'll also incur a roughly 1% handling fee and a 9% sales tax. Therefore, funds in the cryptocurrency market and funds held in traditional brokerage accounts are inherently separate entities, rarely interoperable. It's like fighting on two fronts."

Because of this, on-chain US stocks are currently more like teachers who are "educating" Degen players to receive "training" on the basics of US stocks, while at the same time shouting "24/7" to those who are used to using traditional brokerages. In an interview with Zhiwubuyan , ZiXI, the founder of StableStock, divided users of on-chain US stocks into three categories and analyzed why on-chain US stocks are "needed" in these users' use cases:

Novice users are primarily found in countries with strict foreign exchange controls, such as China, Indonesia, Vietnam, the Philippines, and Nigeria. They hold stablecoins, but due to various restrictions, they are unable to open overseas bank accounts and thus cannot successfully invest in traditional US stocks.

Professional users have both stablecoins and overseas bank accounts, but traditional brokerages offer very low leverage ratios. For example, Tiger's leverage ratio is only 2.5x. On-chain, by setting a higher LTV (Loan-to-Value) ratio, high leverage can be achieved. For example, if the LTV is 90%, 9x leverage can be achieved.

High-net-worth individuals hold US stocks for a long time and may earn interest, dividends, or share gains from stock price increases through margin trading in traditional brokerage accounts. Once their stocks are tokenized, they can become LPs, engage in lending, and even conduct cross-chain operations.

From Robinhood's launch event to Coinbase's pilot application to the SEC, becoming one of the first licensed institutions in the US to offer "on-chain US stocks" services, coupled with the SEC's Division of Corporation Finance's favorable statement regarding liquidity staking, it's foreseeable that as the policy bull market progresses, on-chain US stocks will gradually be integrated into the DeFi ecosystem, thereby building a relatively deep liquidity pool. US value, once limited to 5/7 trading, is rapidly transforming into an on-chain equity market accessible to global investors at any time, regardless of time or region. This not only significantly broadens the asset base for crypto investors but also introduces 24/7 liquidity to the traditional stock market, signaling Wall Street's march toward the on-chain capital market of the "Super-App Era."

The Rectification of Staking Assets and the Rise of DeFi

One of the biggest winners from this regulatory overhaul is undoubtedly DeFi derivative protocols. The SEC has paved the way for the legalization of liquidity staking, a significant benefit for crypto native developers. Previously, the SEC was hostile to centralized staking services, forcing exchanges to delist them and raising concerns about whether Lido's stETH and Rocket Pool's rETH were unregistered securities. However, in August 2025, the SEC's Division of Corporation Finance clarified that "as long as the underlying asset is not a security, LST is also not a security." This clear policy signal was hailed by the industry as a watershed moment in the legalization of staking.

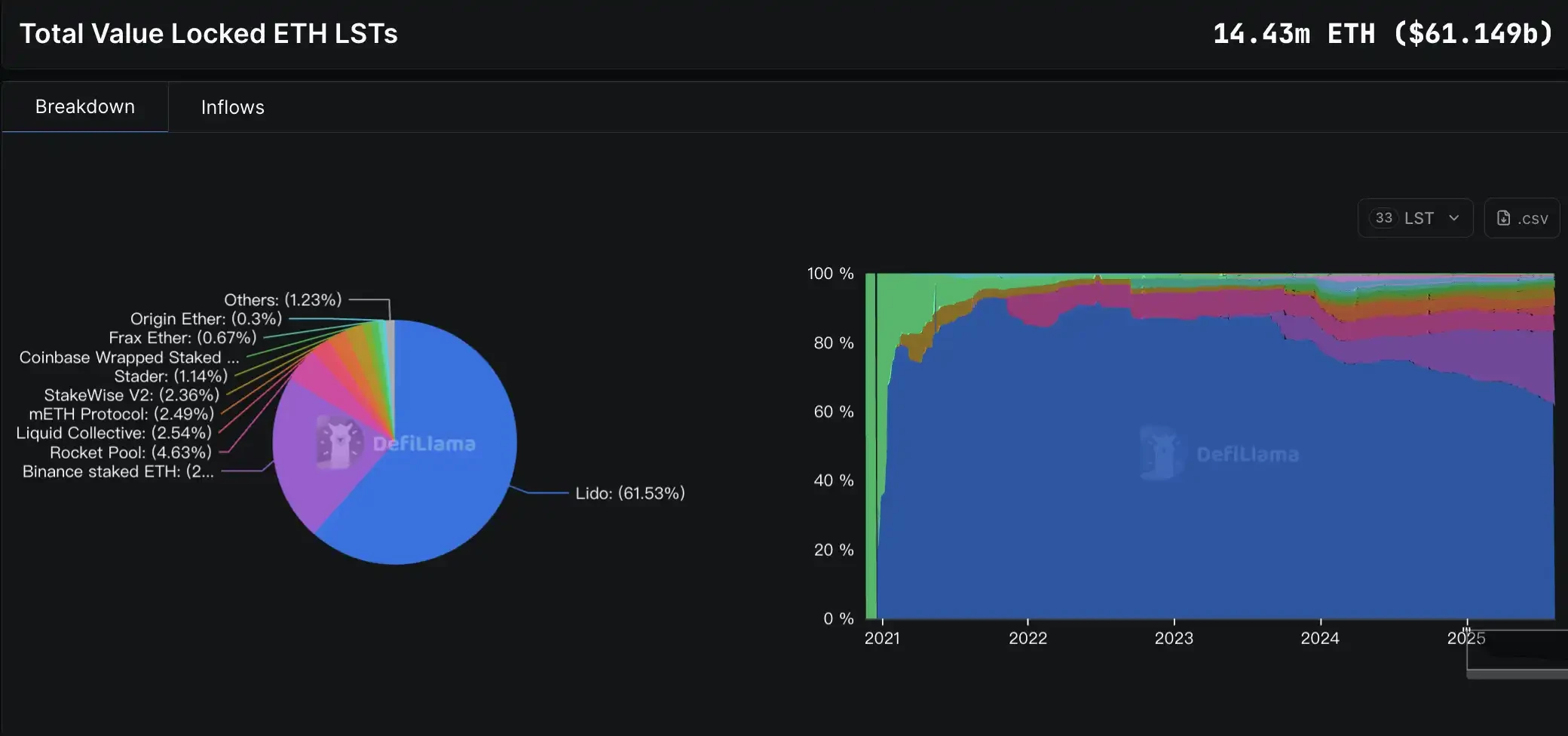

This not only benefits staking itself but also activates an entire staking-based DeFi ecosystem: from LST collateralized lending, yield aggregation, and re-staking mechanisms to yield-based derivatives built on staking. More importantly, US regulations clearly indicate that institutions can legally participate in staking and related product configurations. The current amount of ETH locked in liquid staking is approximately 14.4 million, and growth is accelerating. According to Deflama data, between April and August 2025, the TVL of LST locked in staking soared from $20 billion to $61 billion, returning to a historical high.

The SosoValue DeFi Index has outperformed the recently strong ETH over the past month. Source: SosoValue

The SosoValue DeFi Index has outperformed the recently strong ETH over the past month. Source: SosoValue

At some point, these DeFi protocols seemed to reach a consensus and began to collaborate deeply. Not only did they connect with each other's institutional resources, but they also collaborated on revenue structures, gradually forming a systematic "revenue flywheel."

For example, the newly launched integration between Ethena and Aave allows users to gain leveraged exposure to sUSDe interest rates while maintaining greater liquidity for their overall positions by holding USDe (without a cool-down period). A week after its launch, the Liquid Leverage product has already attracted over $1.5 billion in inflows. Pendle, on the other hand, splits yield assets into principal (PT) and yield (YT), creating a "yield trading market." Users can purchase YT with a relatively small amount of capital, hoping for high returns, while PT locks in fixed returns, making it suitable for conservative investors. PT is used as collateral on platforms like Aave and Morpho, forming the infrastructure for the yield capital market. Furthermore, Pendle's new initiative, "Project Boros," which recently partnered with Ethena, expands its trading market to include perpetual contract funding rates, allowing institutions to hedge Binance contract fee risk on-chain.

DeFi expert JaceHoiX stated, "Ethena, Pendle, and Aave are forming the iron triangle of inflated TVL." Currently, users can use 1 USDT to recycle 10x by minting USDT, then minting PT, then depositing PT, then borrowing USDT, then minting USDT, turning it into a $10 deposit. This $10 deposit is then held in the TVL of all three protocols, ultimately turning $1 into a $30 deposit across them.

Many institutions have already entered this field through various channels in recent years, such as JP Morgan 's Kinexys lending platform, as well as BlackRock, Cantor Fitzgerald, and Franklin Templeton. Clarifying policies will accelerate the integration of DeFi protocols with TradFi, ultimately extending the narrative of "selling apples in the village" like $1 for $30 into a more sustainable form.

American public chain and world computer

Public blockchain projects in the United States are experiencing a surge in policy support. The CLARITY Act, passed in July, establishes a "mature blockchain system" standard, allowing crypto projects to transition from securities to digital commodity assets once their networks achieve mature decentralization. This means that public blockchains and their tokens with high levels of decentralization and adherence to regulatory compliance procedures are expected to acquire commodity status, subjecting them to regulation by the Commodity Futures Trading Commission (CFTC) rather than the SEC.

KOL @Rocky_Bitcoin believes that the advantages of the US financial center are beginning to shift to the crypto sector. "The CFTC and SEC have clear divisions of labor. The US wants to achieve not only high trading volume in the next bull market, but also become a project incubator." This is a big boon for US-based public chains like Solana, Base, Sui, and Sei. If these chains can natively adapt to regulatory compliance logic, they may become the next major carrier networks for USDC and ETFs."

For example, asset management giant VanEck has applied for a Solana spot ETF, stating that Solana functions similarly to Bitcoin and Ethereum and should therefore be considered a commodity. Coinbase also launched CFTC-regulated Solana futures contracts in February 2025, accelerating institutional participation in Solana and paving the way for the future launch of a Solana spot ETF. This series of moves demonstrates that under new regulatory approaches, certain "US public blockchains" are gaining commodity-like status and legitimacy, becoming a crucial bridge for traditional capital on-chain and allowing established institutions to confidently migrate value onto public blockchains.

Meanwhile, Ethereum, the crypto world's "world computer," has also benefited significantly from the policy shift. New regulations restrict insider trading and rapid token issuance for cash-out, favoring mainstream cryptocurrencies with proven infrastructure and robust liquidity. As the world's most decentralized public blockchain, with the largest developer base, and one of the few to have never experienced a downtime, Ethereum already handles the vast majority of stablecoin and DeFi application throughput.

US regulators now generally recognize Ethereum's non-security status. In August 2025, the SEC issued a statement clarifying that as long as the underlying asset, such as ETH, is not a security, the liquid pledge certificates anchored to it are also not securities. Furthermore, the SEC's previous approval of spot ETFs for Bitcoin and Ether further reinforces Ethereum's status as a commodity.

With regulatory backing, institutional investors can more boldly participate in the Ethereum ecosystem. Whether issuing on-chain RWA assets like government bonds and stocks, or using Ethereum as a clearing and settlement layer for TradFi services, these opportunities have become a reality. It's foreseeable that while "US public blockchains" compete for regulatory compliance and expansion, Ethereum, the "world computer," will remain the mainstay of global on-chain finance. This is not only due to its first-mover advantage and network effects, but also because this round of policy dividends has opened the door to deeper integration with traditional finance.

Did the policy really bring about a bull market?

Whether it's the "Stablecoin Act" establishing the regulatory compliance status of dollar-pegged assets or "Project Crypto" outlining a blueprint for an on-chain capital market, this round of top-down policy shifts has indeed created unprecedented institutional space for the crypto industry. However, historical experience shows that friendly regulation does not mean unlimited openness. The standards, thresholds, and implementation details during the policy trial period will still directly determine the survival of various sectors.

From RWAs and on-chain credit to collateralized derivatives and on-chain US equities, nearly every sector has found its place within the new framework. However, their true test may be whether they can maintain crypto-native efficiency and innovation while adhering to regulatory compliance. Whether the global influence of the US capital market and the decentralized nature of blockchain can truly merge will depend on the long-term game between regulators, traditional finance, and the crypto industry. The policy winds have shifted, and how to manage the pace and control risks will determine the longevity of this "policy bull market."