Byron Gilliam, Blockworks

Compiled and compiled by: BitpushNews

There was a pleasant time when Federal Reserve chairmen had the freedom to lecture politicians about their irresponsible spending habits.

For example, in 1990, Alan Greenspan told Congress that he would lower interest rates, but only if Congress reduced the deficit.

In 1985, Paul Volcker even put a number on it, telling Congress that the Fed’s “stable” monetary policy depended on Congress cutting about $50 billion from the federal budget deficit. (Ah, that’s $50 billion in federal debt, not in the days of rounding errors.)

In both cases, the Fed chairmen were implicitly threatening Congress and the White House with recession risks: You have a good economy now, and it would be a shame if something went wrong.

However, now the situation is reversed, and US President Trump is "lecturing" the Federal Reserve about interest rates.

Just in recent weeks, Trump has commented that the federal funds rate is "at least 3 percentage points higher," insisted there is "no inflation," and mocked Federal Reserve Chairman Jerome Powell as "Too Late Powell."

This is also a form of pressure: you have a good central bank independence...

Trump also lobbied for lower interest rates during his first term. Like nearly all modern American presidents, he wants the Federal Reserve to stimulate the economy.

This time, however, it's much more than that: Trump wants the Fed to finance the deficit.

The Trump-Powell showdown was ostensibly about the current level of interest rates (the Federal Open Market Committee (FOMC) kept rates unchanged today, which presumably displeased the president).

But what the president has been threatening is “fiscal dominance” — a state in which monetary policy is subordinated to the government’s spending needs.

“Our interest rates should be three percentage points lower than they are now, saving the country $1 trillion a year,” the president recently wrote on Truth Social in his signature casual capitalization style.

By repeatedly making such statements, Mr. Trump made history as the first American president to explicitly call for fiscal dominance.

But he is by no means the first to acknowledge this possibility.

When Volcker and Greenspan threatened Congress with rate hikes, it brought to the surface the normally hidden link between monetary and fiscal policy.

It worked for them: Both Fed chairmen successfully used the threat of recession to get Congress to address deficit spending, setting a hopeful precedent.

But that strategy seems unlikely to work this time.

Chairman Powell has frequently warned of the risks of growing deficits, even explaining that higher deficits could mean higher long-term interest rates.

But it is hard to imagine him issuing the explicit threats that Volcker and Greenspan did—perhaps because he knows he is in a significantly weak bargaining position.

In the 1980s, the most feared effect of raising interest rates was a recession, a risk the Fed was willing to take to get Congress to change its free-spending habits.

Back then, lawmakers faced a ballooning defense budget and a stagnant economy, both of which seemed manageable.

Federal debt, at just 35% of GDP, also looks manageable.

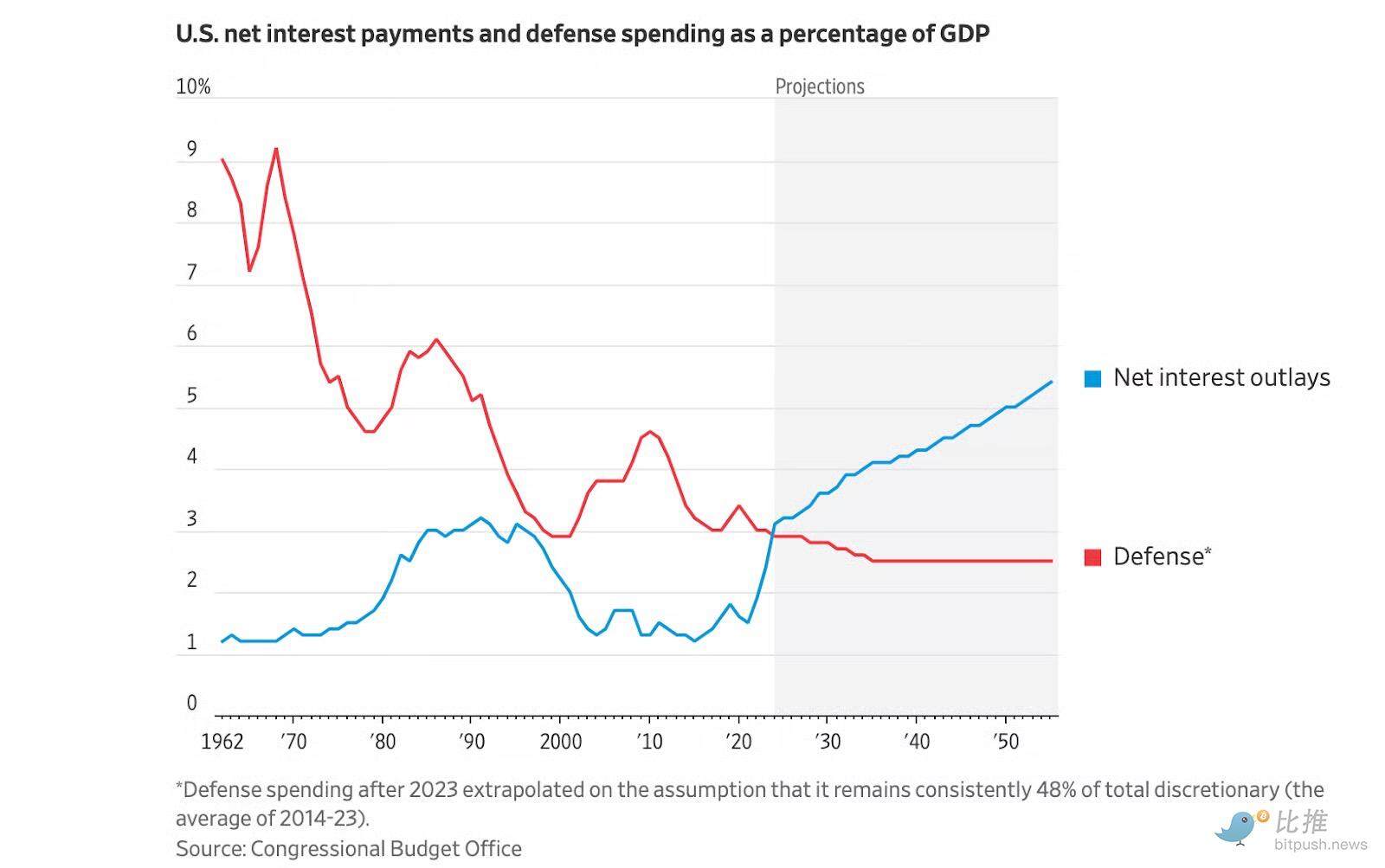

Federal debt is now 120% of GDP, and the US spends more on interest payments than on defense:

Chart: The rapidly rising blue line represents federal debt interest payments as a percentage of GDP, far exceeding defense spending.

The rapidly rising blue line in the chart above is probably the biggest budget issue right now.

This puts the Federal Reserve in a dilemma: it wants to use interest rate hikes as a tool to "cure" the government's fiscal problems, but the government's debt is so large that raising interest rates will become "poison" and make the fiscal problems worse.

Of course, the Fed could take a chance.

But if raising rates causes the deficit to rise further, who will blink first: the Fed or the White House?

Before you answer, consider that 73% of federal spending is now non-discretionary, compared to just 45% in the 1980s.

Believing that the Fed can win a showdown over the deficit is tantamount to believing that Congress is willing to make deep cuts in non-discretionary spending like Social Security and Medicare.

This seems, well, unbelievable.

Especially now, with a president who seems completely unfazed by the country's growing debt.

This may stem from his experience as an over-indebted property developer in the 1990s.

“I guess it was the banks’ problem, not mine,” Trump later wrote of being unable to repay his debts. “What the hell do I care? I even told one bank, I told you you shouldn’t lend me money, I told you that damn deal ain’t gonna work.”

Now, as president, when Trump tells Powell that interest rates should be lower, what he is really saying is that the national debt is the Fed’s problem, not his.

He is not wrong.

“When interest payments on the debt rise and fiscal surpluses become politically unfeasible,” wrote David Beckworth, a former U.S. Treasury economist, “something has to sacrifice. That sacrifice is more debt, more money creation, or both.”

Yes, the Fed could resort to the Volcker/Greenspan maneuver and threaten Congress with higher interest rates.

But Powell presumably knows that if he does so, it will only exacerbate a problem that the Fed may eventually need to fix — and accelerate the point at which it will be forced to do so.

“If debt levels are too high and continue to grow,” Beckworth explained, “the Fed’s job becomes to accommodate them—either by lowering interest rates or by monetizing the debt.”

That, he warned, is the Fed’s real existential threat, not Trump: “When a central bank is forced to cater to fiscal demands, it loses its economic independence.”

Beckworth remains hopeful that it might not come to that.

We've seen how unpopular inflation is, so if there's another bout of it, voters might force lawmakers to address the deficit.

But he despairs that focusing on Trump’s demands for lower interest rates is a red herring: “What we are witnessing is less about Trump himself than about the growing and inevitable fiscal demands being placed on the Fed.”

Trump was the first to make these demands explicitly, probably because he knew that the current fiscal policy of the US government was unsustainable.

But everyone knows this, even the government itself.

The only question now is: who will handle it?

- 核心观点:特朗普施压美联储为赤字融资。

- 关键要素:

- 特朗普要求降息以节省1万亿美元。

- 联邦债务占GDP比例已达120%。

- 73%联邦支出为非自由裁量支出。

- 市场影响:美联储独立性面临威胁。

- 时效性标注:长期影响。