Original | Odaily Planet Daily ( @OdailyChina )

By Wenser ( @wenser 2010 )

On July 30, 2025, Ethereum celebrated its tenth anniversary. For a blockchain network to continue operating for 10 years, this is already a miracle. As Ethereum founder Vitalik mentioned in a previous post : "Ethereum has been online for ten consecutive years with zero downtime and zero maintenance. Meanwhile, Facebook was down for 14 hours, Cloudflare lost 19 data centers, and other Layer 1 networks have encountered multiple problems, but Ethereum will never stop. Every centralized giant will go down because they rely on on-call staff and planned downtime. And whether it is forks, crashes, bubbles, lawsuits, hacker attacks, wars, or any other dramatic events that the internet can trigger. Despite bank failures and server repairs, Ethereum continues to run. Developers, stakers, researchers, users, people from all over the world, active on the blockchain year after year, we have created this magnificent scene together." Like the protagonist in an inspirational novel who perseveres despite all difficulties, Ethereum, after its tenth anniversary, now deserves the saying: "What doesn't kill me makes me stronger."

Looking back over the past decade, Ethereum truly resembles a penniless startup that has ascended to become a fixture on Wall Street and even the global economy. From a white paper promising to surpass Bitcoin, to the acclaimed ICO; from the vibrant DeFi summer to the shift to POS; from the crypto winter to spot ETFs, Ethereum's decade has not always been one of glory and honor, but rather one of crisis and humiliation. Fortunately, with the "ETH reserve treasury" narrative reignited, Ethereum has once again returned to the center of the crypto scene.

Perhaps you're tired of the clichéd retrospectives on major historical events, or perhaps not many people care about the intricacies of Ethereum's development. Perhaps the most important question to discuss right now is: How many times have Ethereum's "bankers" changed hands in the past 10 years? Who are the remaining players? What is the ceiling for ETH's price?

Odaily Planet Daily will give its own answer in this article and sincerely invites readers to share.

Ethereum Never Sleeps: From an ICO with a Public Offering Price of Less Than $0.3 to a Spot ETF Coveted by Wall Street

There's no doubt that Ethereum's initial triumph was a resounding success for the entire industry. Although the industry was still in its infancy, the crypto market was already witnessing the rise of numerous major players: BTC dominated, LTC was gaining momentum, DOGE was emerging, and new currencies were constantly emerging, only to disappear into the sands of history like rapidly decaying sand. It was against this backdrop of crises that Ethereum emerged.

ETH's First Makers: IC0 Participants and Early Contributors

From July 22 to September 2, 2014, it took about 42 days for the Ethereum ICO to be successfully completed. In the first two weeks, the ratio was 1 ETH: 0.0005 BTC (that is, 2000 ETH = 1 BTC, and the BTC price range at that time was 572-632 US dollars), and then it linearly decreased to 1 ETH: 0.0007479 BTC (that is, 1337 ETH = 1 BTC, and the BTC price range at that time was 471-592 US dollars), raising a total of approximately US$18 million.

Based on the varying BTC prices at the time, the lowest IC0 price per ETH was around $0.286. The current market consensus for an IC0 price of $0.30-$0.31 is calculated using $18.3 million USD and a total supply of 60 million ETH. This incident also highlights the shortcomings of the industry's early lack of a unified standard. Although BTC prices were volatile at the time, it remained an undisputed hard currency.

Ethereum Team, Toronto, 2014 by Duncan Rawlinson/Flickr Creative Commons

On July 30, 2015, approximately a year later, Ethereum officially launched. According to official records , 72 million ETH were initially pre-mined, of which 60 million were allocated to ICO participants and over 12 million were distributed to early Ethereum contributors and the Ethereum Foundation. For example, Vitalik reportedly received 553,000 ETH for his personal contributions. Other known early Ethereum contributors include: Cardano founder Charles Hoskinson; Bitcoin Magazine founder Mihai Alisie; Decentral founders Anthony Di Iorio and Amir Chetrit; Polkadot founder Gavin Wood; Grit Games founder Jeffrey Wilcke; and Consensys founder Joseph Lubin, each reportedly receiving 300,000 ETH. Furthermore, the Ethereum Foundation retained 3 million ETH for staff operations and conducted two large-scale sales at market peaks in 2018 and 2021.

Currently, the Ethereum Foundation's main wallet address still holds 185,000 ETH, worth approximately US$720 million; Vitalik's related addresses still hold 240,000 ETH, worth approximately US$928 million.

It is worth mentioning that there are many whales in IC0 who hold hundreds of thousands or even 1 million ETH, which is also the focus of controversy that Ethereum suffered a lot of criticism in the early days - the excessive centralization of early token distribution.

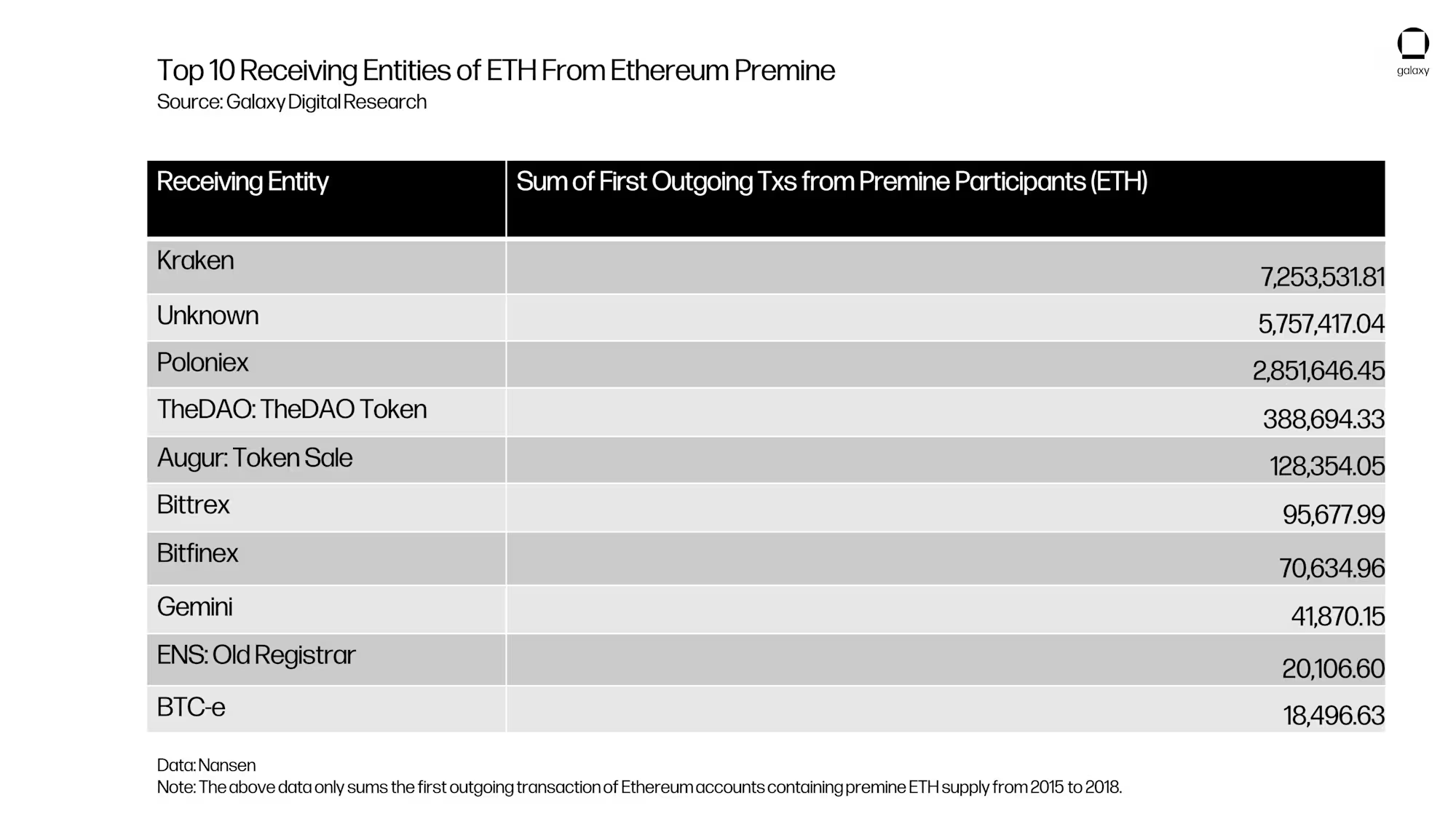

According to a Galaxy report , of the 8,800 participating addresses in the Ethereum ICO, approximately 100 addresses received 40% of the ETH ICO's total. Furthermore, on-chain data shows that the cluster of addresses that received 1 million ETH ultimately points to an address with the ENS domain name virternity.eth; two other major ICO whales received 935,900 ETH and 933,580 ETH, respectively. Data shows that between 2015 and 2018, approximately 10.3 million ETH (41.7% of the pre-mined supply) was transferred to CEXs. In contrast, only 1.6 million ETH (approximately 2.3% of the pre-mined supply) remained unchanged during the same period. In other words, many Ethereum ICO participants took profits within the first three years.

Nansen data, source: Galaxy Research Report

The second group of ETH dealers: Ethereum miners and crypto institutions

After IC0 came to an end and early ETH holders divided up the spoils, the second group of dealers to appear on the scene were Ethereum miners and a large number of crypto capitals.

After launching in 2015, the Ethereum network adopted a Proof-of-Work (PoW) mechanism modeled after Bitcoin. Miners earn newly issued ETH tokens by validating transactions and securing the network. From 2015 to 2022, before the PoW upgrade, approximately 49.1 million ETH were mined, gradually diluting the initial pre-mined holdings.

According to YCharts data , the cumulative number of independent addresses holding ETH has gradually increased from a few thousand in 2015 to 170 million in September 2022; at the same time, the mining rewards of the Ethereum network have gradually decreased from 5 ETH per block in 2015; at the end of 2017, the block reward dropped to 3 ETH; at the beginning of 2019, the block reward dropped to 2 ETH, which further affected the distribution pattern of ETH holdings.

It's worth noting that throughout the history of Ethereum mining, community consensus has always been tested , most dramatically by the hard fork triggered by "The DAO hack" in 2016. The hack resulted in a loss of 3.6 million ETH, valued at approximately $60 million. After weeks of deliberation and debate, ETC was finally launched on July 20 of that year, giving ETH a new lease on life.

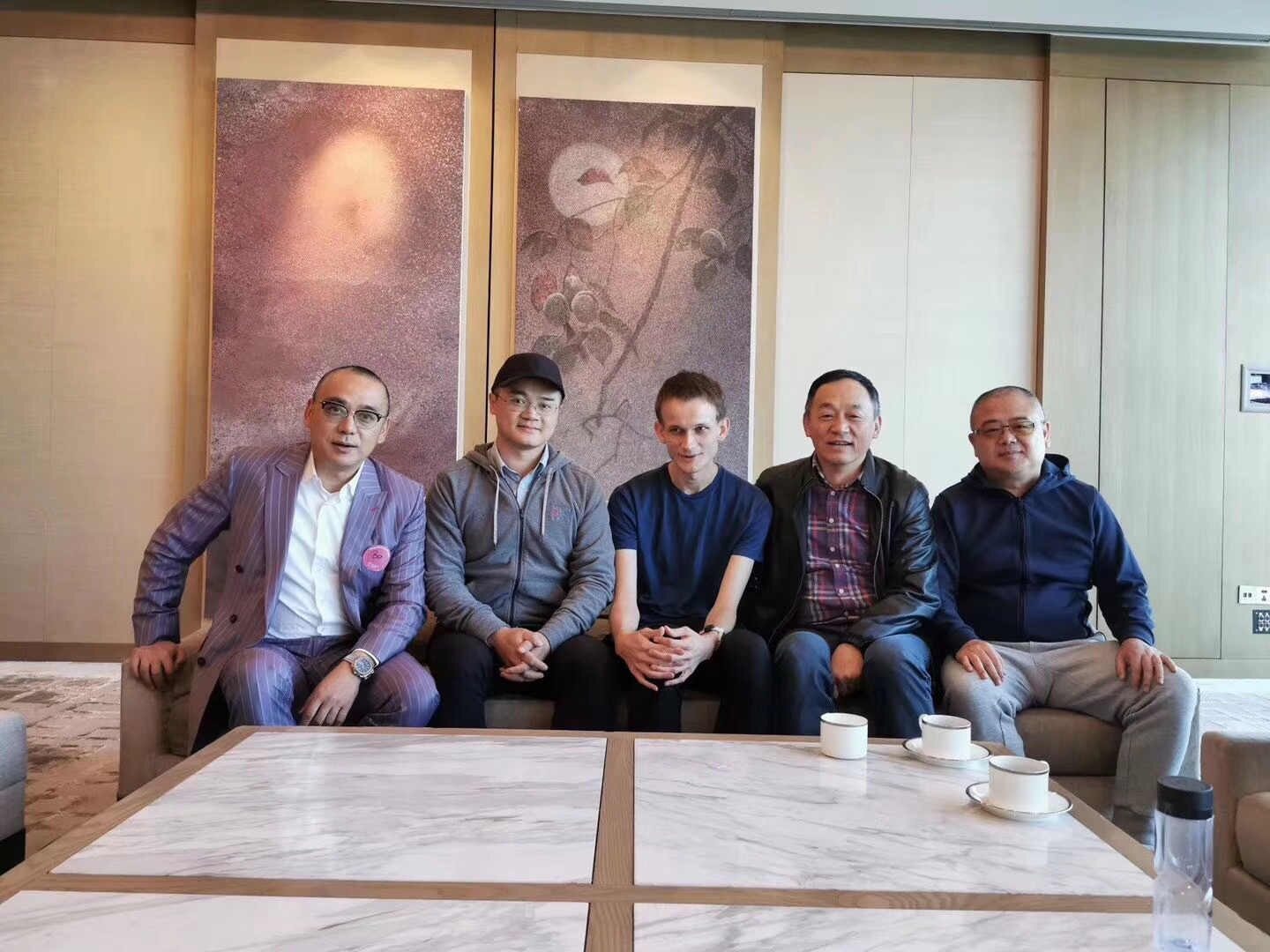

Despite the initial hurdles, the relatively low mining difficulty inspired many to participate in the booming Ethereum mining boom. Some internet cafe owners even amassed tens of thousands of ETH using idle mining equipment. This rare opportunity to make a fortune naturally gave rise to a new generation of elites. F2 Pool, Cobo founder Shenyu, and Xiao Feng, chairman of Wanxiang Group and founder of Hashkey, who are still active in the market, were all participants in this era and can even be called true trendsetters. The former started out mining Bitcoin and also participated in the early days of Ethereum mining, becoming known in the industry as the "ETH 10,000 Coin Candidate." The latter, during Ethereum founder Vitalik's early visit to China, generously donated $500,000 to rescue Ethereum from its predicament, laying the foundation for its early development in the Chinese-speaking world.

In October 2019, Dragonfly hosted the Crypto Summit, with Dragonfly founder Feng Bo, Meituan CEO Wang Xing, Vitalik and Wanxiang Xiaofeng attending.

As time goes by, the Ethereum ecosystem has ushered in the expansion of another new force - the DeFi protocol .

Since 2020, DeFi protocols, primarily focused on the concept of "liquidity mining," have experienced explosive growth, with large amounts of ETH beginning to be locked up as liquidity in various smart contracts. According to Coindesk , as of July 29, 2020, $3.68 billion worth of crypto assets were locked up in various DeFi protocols. By May 2021, according to Galaxy analysis , this figure had rapidly increased to over 31.2 million ETH (approximately 26% of the total ETH supply at the time), valued at approximately $57.4 billion.

Of course, this transformation also marked a milestone: the POS upgrade. In September 2022, Ethereum completed the Merge upgrade, successfully transitioning the network from a Proof-of-Work (PoW) to a PoS (PoS) mechanism. Since then, Ethereum miners have become a thing of the past, replaced by "large ETH stakers"—including exchanges, crypto institutions, whales, and individuals.

As early participants in the Ethereum ecosystem, crypto capital including Galaxy, Paradigm, Dragonfly, Hashkey and other institutions are also the undisputed dealers at this stage . They can only be replaced by larger-scale capital.

ETH's third wave of market makers: Wall Street Capital and spot ETFs

In July 2024, following the approval of the Bitcoin spot ETF in January of that year, the US SEC approved multiple Ethereum spot ETFs (including BlackRock, Fidelity, Grayscale, 21 Shares, Franklin Templeton, Bitwise, etc.). Since then, ETH has begun its third wave of "changing dealers". This time, the "takers" are no longer limited to the cryptocurrency circle, but come from Wall Street financial institutions and professional investors active in the global capital market.

There are two main reasons why Wall Street financial institutions have become the "ETH dealers" in today's market:

First, the Ethereum spot ETF market has seen impressive performance . According to Sosovalue data , as of July 28th, the total net asset value of Ethereum spot ETFs reached $21.534 billion, with a net asset value ratio (market capitalization relative to Ethereum's total market capitalization) of 4.71%, and cumulative net inflows reaching $9.400 billion. Among these, the iShares Ethereum ETF (ETHA) launched by BlackRock has performed remarkably well: just 251 days after its listing, its assets surpassed $10 billion, making it the third fastest ETF to reach this level. Meanwhile, over the past month, global exchange-custodied ETH holdings have decreased by over 1 million (approximately $3.8 billion), with a significant amount of ETH flowing out of exchanges and into ETF issuers' custodians, cold wallets, or other institutions to support institutional investment needs.

ETH spot ETF data, as of July 28

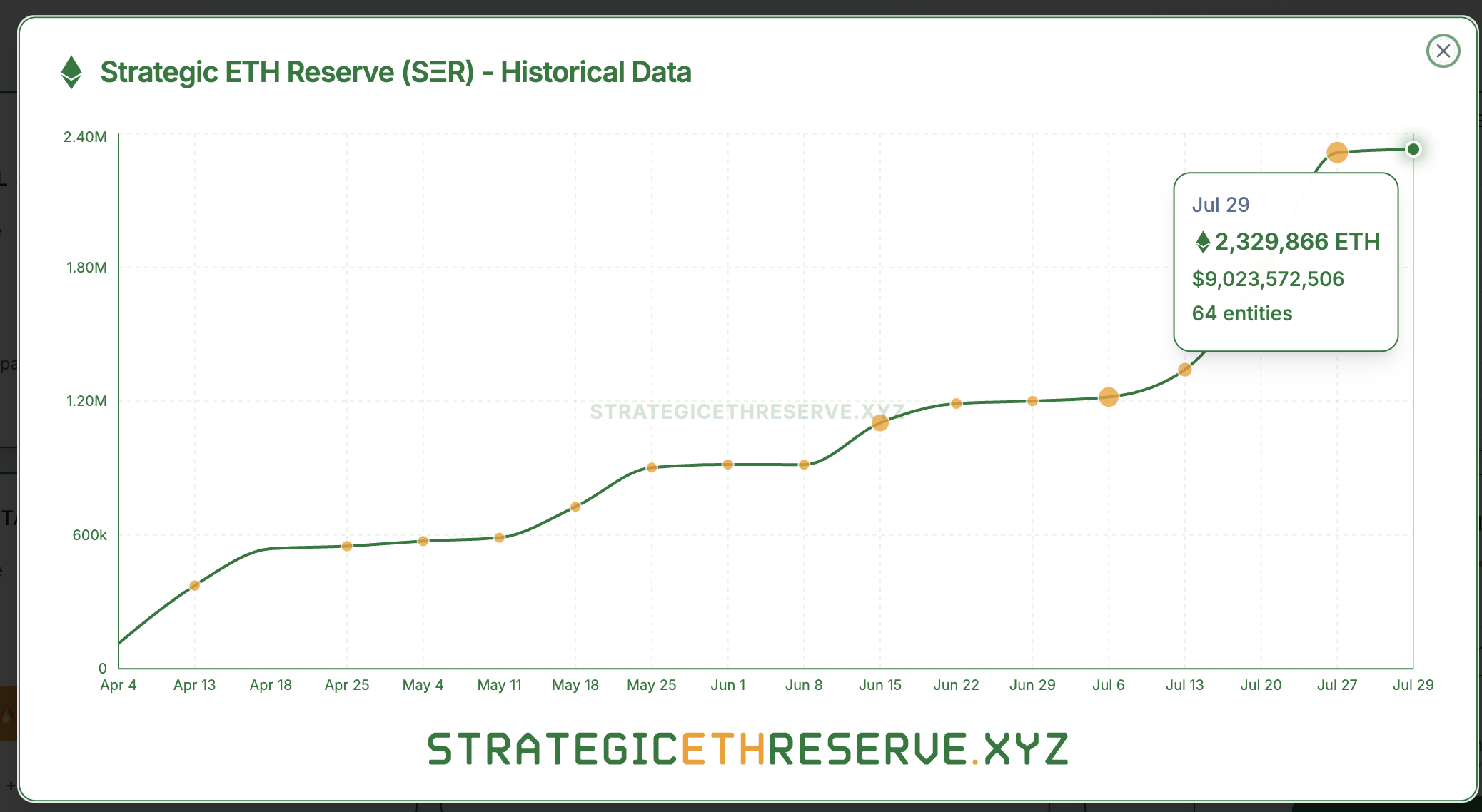

Secondly, the "ETH reserve treasury" narrative has been widely embraced by the US stock market . According to data from the StrategyEstheServe website , the total holdings of publicly listed companies that have established ETH reserve treasuries have exceeded 2.329 million, valued at $9.02 billion. Among these, Bitmine, Sharplink, The Ether Machine, and The Bit Digital are among those continuing to increase their ETH holdings. The former two's ETH holdings even far exceed the Ethereum Foundation's current holdings. As a result, this new influx of capital has fueled a gradual recovery in ETH prices, rebounding from around $2,400 to above $3,800 today, having previously approached $4,000.

ETH Reserve Treasury Company Holdings

As for the aforementioned crypto institutions, they have been gradually withdrawing from the ranks of ETH market manipulation, either actively or passively. Galaxy transferred 65,600 ETH (worth approximately $105 million) to Binance within two weeks in April 2024. Just this past July 28th, a wallet associated with HashKey Capital transferred 12,000 ETH (worth approximately $47.18 million) to OKX. Arkham data shows that the ETH holdings of Paradigm's institutional address have plummeted from 83,500 in April of this year to just over 2,800 today. The ETH holdings of Dragonfly's institutional address are even more limited, at only around 155. While it's highly likely that major institutions still hold some ETH assets on exchanges, DeFi protocols, or in cold wallets, the apparent withdrawal is a foregone conclusion.

Now that things have come to this, perhaps we can only sigh: Talented people emerge in every generation, and the old are replaced by the new.

Ethereum's narrative shift: from world computer to world ledger to digital oil

After talking about the change of dealers, the narrative changes of Ethereum may seem a little barren.

Technology, Applications, and Resources: From One Person’s Idea to Ecosystem Growth

In Ethereum founder Vitalik's vision, Ethereum would serve as a "world computer," building a rich on-chain ecosystem and, thereby, creating a more transparent and decentralized on-chain world based on the internet's digital space. This was evident in the Ethereum Foundation's YouTube video , "Ethereum: The World Computer," released on July 30, 2015. At the time, Ethereum's core advantage and market selling point was that developers could use smart contracts to build decentralized applications, ranging from games to social networking and financial products.

But over time, despite the phenomenal crypto craze sparked by games like CryptoKitties, AxieInfinity, and STEPN, and the bull market driven by NFTs like Cryptopunk, BAYC, and Azuki, DeFi remains the only enduring sector in the crypto market, and to some extent, the only surviving sector. It's no wonder that Arthur, founder of DeFinance Capital, once argued that Ethereum's market capitalization didn't match its industry status due to Vitalik's willingness to speculate in DeFi. Since then, Ethereum's narrative has effectively shifted to that of a "world ledger."

Subsequently, although the market and even the Ethereum community once regarded "ultrasonic currency" as Ethereum's new value narrative, this narrative has not been widely recognized in terms of its dissemination, recognition, or "market dream rate".

It was not until the emergence of EIP-1599 that the deflationary properties of ETH gradually became prominent. As a result, in the process of cryptocurrencies gradually transforming into digital assets that are more acceptable and recognized by mainstream society, ETH has gradually become a "fuel" similar to oil-driven digital economic development.

In the Bankless podcast "Ethereum is Digital Oil" , an important communication platform for the Ethereum ecosystem, ETH is regarded as "digital oil", emphasizing its value as network fuel and reserve asset; ICBC (Industrial and Commercial Bank of China) also compared ETH with BTC, known as "digital gold", in a previous report, calling it "digital oil".

In the future, if ETH wants to stimulate the sensitive and fragile investment nerves of more people, perhaps it needs to strengthen its narrative positioning as "digital oil". At that time, Ethereum will transform itself and become as indestructible as the current US dollar system.

Where is the price ceiling for Ethereum? The highest may be $706,000

Regarding the price ceiling of Ethereum, market views are more diverse.

In June 2024, on the eve of the approval of an Ethereum spot ETF, asset management firm VanEck predicted a target price of $22,000 for Ethereum by 2030. This move was influenced by news about the Ethereum ETF, scaling progress, and on-chain data. VanEck noted that Ethereum is reshaping multiple industries, including finance, banking, payments, marketing, advertising, social networking, gaming, infrastructure, and artificial intelligence. Furthermore, VanEck predicted that the Ethereum (spot) ETF could surpass the size of a Bitcoin ETF and anticipated its approval and listing, providing financial advisors and institutional investors with a convenient way to hold Ethereum. The report also highlighted the low cost, high efficiency, and transparency of Ethereum technology as key factors driving the price increase.

VanEck further predicts that this shift will force traditional financial and technology institutions to shift significant market share to blockchain-based solutions, which currently hold a total available market of up to $15 trillion. By 2030, free cash flow from holding Ethereum is expected to reach $66 billion, which will also help drive Ethereum's valuation towards the expected target.

By this year, the price of just $22,000 was considered significantly undervalued in the eyes of public companies implementing Ethereum reserve treasury strategies.

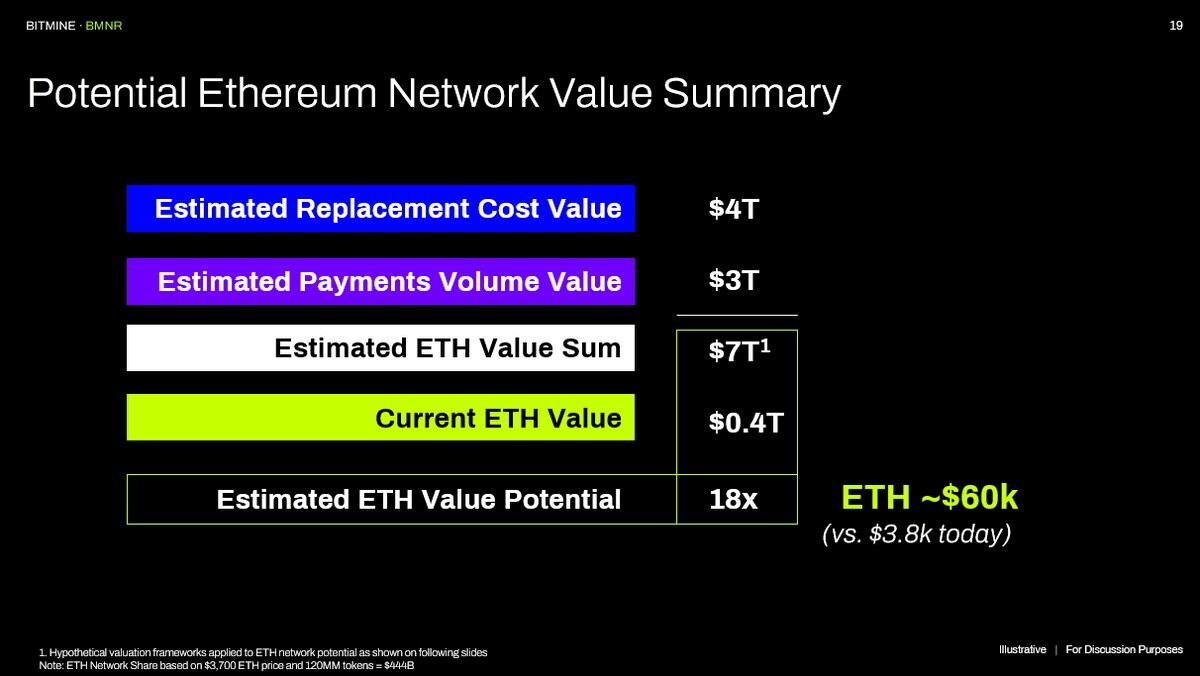

Bitmine, the Ethereum treasury and crypto mining company,announced in an official statement that it has commissioned several research institutions to assess Ethereum's "replacement value" (Wall Street valuation), which is estimated at $60,000. This argument is supported by U.S. Treasury Secretary Bessen's previous statement that the market capitalization of stablecoins will reach $4 trillion, a more than tenfold increase. Currently, over 60% of stablecoins are on the Ethereum network.

ETH per coin: $60,000

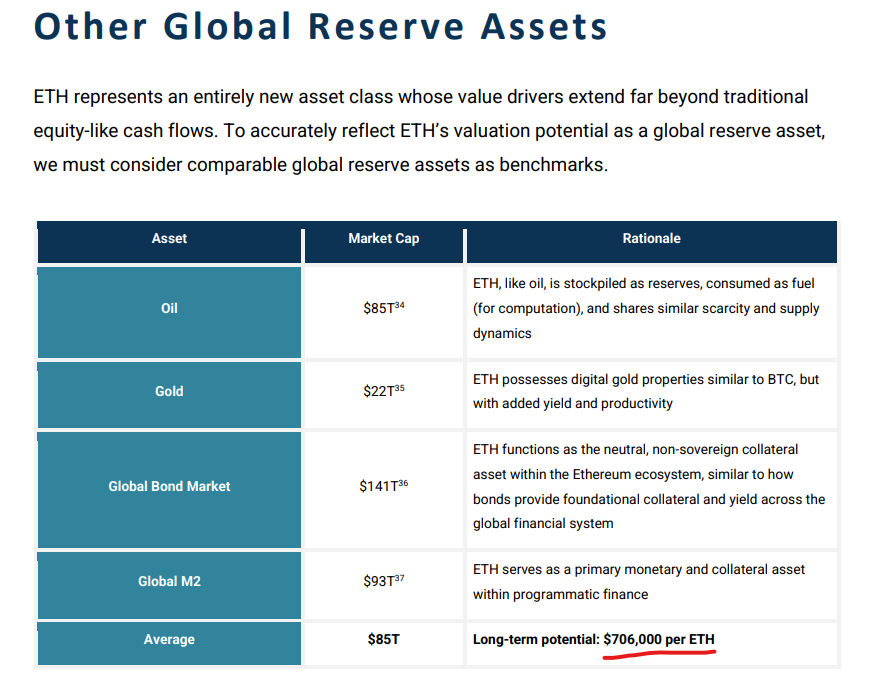

ethdigitaloil.com is even bolder. Taking into account oil, gold, and global currency market capitalization, it predicts that the market value of ETH may reach 85 trillion US dollars, and the future price of a single ETH will reach 706,000 US dollars.

ETH ceiling

Of course, if such a price can really be reached, we may have to wait for Ethereum’s “centennial moment”.

Now, Ethereum has only gone through one-tenth of its journey, and it still has 90 years to go before it can be labeled as a "century-old store."

By then, Vitalik, who is now over 30 years old, will have already become a centenarian. In the future with advanced biotechnology, perhaps he will still be a witness to the history of Ethereum, just like you and me.

Recommended Reading

Five charts looking back at Ethereum's history

ETH staking data and corresponding platform Dune chart

The Last Miner: A 10,000-Word Review of Ethereum's 8-Year Mining History

Galaxy: ETH Supply Distribution Analysis Report Since Genesis

Unveiling the two key figures behind ETH's recent surge: Tom Lee vs. Joseph Rubin

- 核心观点:以太坊十年发展成就区块链奇迹。

- 关键要素:

- 10年零宕机,超越中心化巨头。

- 从ICO到ETF,市值增长万倍。

- 三次换庄,机构资金主导市场。

- 市场影响:推动ETH成为主流金融资产。

- 时效性标注:长期影响。