Ethereum is undergoing a major blood transfusion: Is it a good opportunity to get on board, or a signal to escape?

Original article from SoSoValue

The market has once again reached a point where it is difficult to understand.

On one hand, the price of ETH is neither going up nor down, which makes people upset; on the other hand, there are shocking headlines in the news - " ETH worth $2.3 billion is queuing up to withdraw from staking, and the biggest selling pressure in history is coming!" Panic spread instantly. It feels like you are sitting in a theater , the lights suddenly flicker, and the audience in the front row starts to stand up and leave. You are worried: Is the show going to fail? Should I run away too?

Don't rush. Before you impulsively press the "sell" button, let's be a calm detective and return to the most basic question: Who is selling? And more importantly, who is buying? When you see the cards of the players on both sides of the table, you will find that this is not a panic stampede, but a "king's change of defense" that is reshaping the future.

The first step of the investigation: Who is the seller?

The recent main selling pressure of ETH comes from three main forces:

Early investors took profits: As the price of ETH reached a new high, many early holders chose to cash in their gains and sold part of their holdings.

Large amount of unlocking by on-chain stakers: Since the Shapella upgrade, ETH stakers have been allowed to withdraw locked principal and rewards more flexibly. A large amount of long-term locked ETH has entered circulation, some of which have been liquidated.

Institutions and large investors adjust their positions at high levels: Some institutions and large capital accounts choose to switch to other assets or conduct speculative arbitrage operations at high points.

Large selling events and main addresses:

In July 2025, one of the largest sales occurred at the well-known institution Trend Research: 69,946 ETH were sold in batches within 24 hours, equivalent to $218 million, of which the largest single transaction was 21,000 ETH (about $67 million). After the sale, the Trend Research account still held 115,187 ETH, indicating that this was a portfolio rebalancing or phased cashing out, rather than a "clearance-style" sell-off.

Another large amount of selling came from whale-level accounts (a single address sold 40,000 ETH, about $127 million, to the Kraken exchange). The total amount of selling by institutions and whales in recent times exceeded $374 million in July.

The Ethereum Foundation has also recently sold some of its related addresses, but the official clarification was that some of them were mistakenly attributed to the Foundation itself. In fact, 1,210 ETH were sold to Argot Collective (a non-profit organization around the Ethereum ecosystem infrastructure) to support development funds.

Selling characteristics and flow:

Large-scale selling orders were concentrated at the institutional and whale levels and were of the nature of "one-time settlement" or "profit taking", and did not lead to an overall structural crash.

Most of the selling funds flowed to centralized exchanges (such as Kraken and Binance), and some were quickly absorbed by new entrants and ETF demand.

Even so, whales and institutions bought and sold at high levels, showing differentiation: there were those who sold to cash out, and there were long-term players who bought at low levels and accumulated positions during the same period.

Key insight: The current wave of unpledging is a normal phenomenon in the mid-term bull market, and its essence is the optimization and consolidation of the investor structure.

Step 2 of the investigation: Uncovering the secret of "buying", Wall Street's new water pipe is constantly receiving water

Since the “old money” is exiting the market in a planned manner, who is the “new money” with a huge appetite that is quietly taking over? The answer lies on Wall Street - Ethereum spot ETF.

If the crypto market in the past was a pond, then the Ethereum spot ETF is a newly built, huge-caliber super water pipe that directly connects to the world's largest capital ocean (traditional finance). Since its launch, the US spot Ethereum ETF has attracted $8.32 billion in net inflows, and its total holdings account for more than 4.4% of the circulating supply. Among them, BlackRock's iShares Ethereum ETF (ETHA) alone holds more than 2.2% of the total ETH.

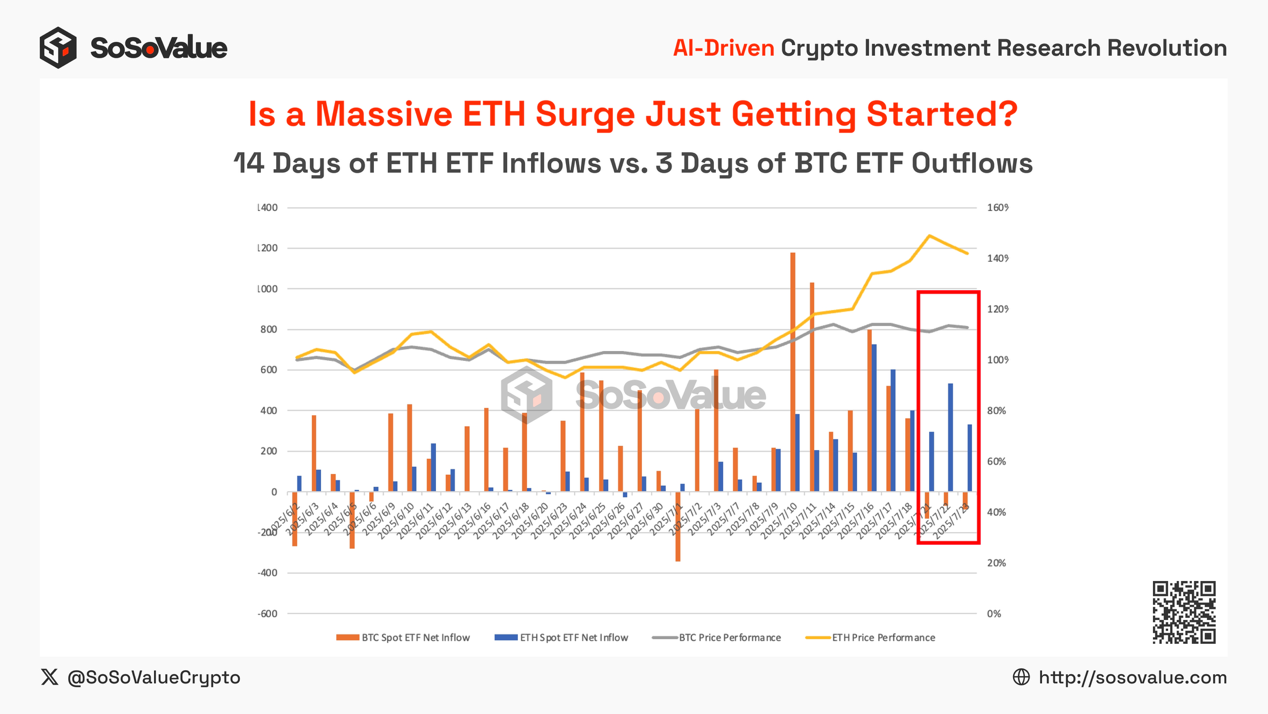

Data shows that this force is highly independent. In the days when Bitcoin ETFs experienced capital outflows due to market fluctuations, Ethereum ETFs were like a magnet, firmly attracting funds. See the figure below:

This differentiation sends a strong signal: the funds invested in Ethereum do not come from passive following of the crypto market, but from active and well-thought-out strategic allocation. This is just like in the stock market, when the leading stock (Bitcoin) fluctuates, keen institutional investors will selectively deploy those "second blue chip stocks" (Ethereum) with stronger fundamentals and greater growth potential. They value the unique value of Ethereum as "digital oil" and a decentralized application platform.

Another strong buying force comes from those listed companies and institutional whales with a keen sense of smell. They no longer regard ETH as a short-term transaction product, but include it in their balance sheets as a productive asset that can "earn interest" just like allocating treasury bonds. In the past, institutions asked: "How much can ETH rise?" Now, they ask: "How much stable annualized return can ETH bring me?" This is a fundamental shift from "price game" to "value investment". When listed companies begin to convert part of their balance sheets into ETH, it also marks that the value of ETH has received the ultimate endorsement of the industry. This is more far-reaching than short-term speculation.

The current ETH holdings of these companies do not account for a high proportion of the total supply, but they have high goals. For example, BMNR plans to buy and pledge 5% of the total supply of ETH as a long-term holding target.

These companies are not financially speculating, but strategically deciding. They view ETH as a productive asset (generating income through staking) and as the core of their long-term value strategy. This demand force from the business community has just begun.

Key insight: Wall Street's "smart money" is building structural long positions through ETFs and treasury companies. This buying force is independent, continuous and firm, building a solid value defense for Ethereum.

The third step of the investigation: On-chain pledge reveals the change of "major shareholders"

The second clue comes from the core of the Ethereum network - the validator ecosystem. Recently, the record number of validators "quitting the queue" has caused panic in the market, and many people interpret it as a "collective exodus" of core participants. But is this really the case?

Let's change our perspective. Imagine the most popular restaurant in the city, which is always full and has a long line of people waiting for a table. At this time, some early diners who have eaten and drunk enough get up to pay the bill and leave, leaving their seats vacant. Do you think this restaurant is going to close? Of course not. You will only feel that it is finally your turn! The current validator dynamics are just such a "hot restaurant table change".

“Leaving” (Exit Queue): About 519,000 ETH are queuing to exit. Most of them are early investors or VCs who have made huge profits and locked in profits for many years. This is a planned “return on investment” rather than a panic sell-off.

“Waiters” (entering the queue): At the same time, 357,000 ETH are queuing up to enter. This is new, more confident long-term capital that is optimistic about the future of Ethereum and comes to “take over”.

Key insight: This is not a one-way "escape", but a healthy "shareholder change". Short-term speculators are transferring their chips to long-term value investors. This not only does not weaken the network, but optimizes the investor structure and lays a solid foundation for the next round of increases.

In-depth analysis - the "three major engines" of ETH value

Engine 1: The magic of value given by the deflation mechanism

After the Ethereum EIP-1559 upgrade is launched, the base fee of each transaction will be automatically destroyed (Burn), which means that the total amount of ETH circulating in the market is constantly decreasing. Driven by the prosperity of DeFi and active on-chain activities, the destruction rate even exceeds the issuance rate of new ETH, making Ethereum "deflationary" - ETH is becoming more and more scarce. Compared with traditional fiat currency (arbitrary issuance) and Bitcoin (fixed upper limit), ETH is not only resistant to depreciation risks, but also builds a stronger value anchor under the supply and demand mechanism. Therefore, it is nicknamed "ultrasound money" by the community: the circulation volume continues to decrease, and each ETH contains stronger purchasing power and storage properties. It is this mechanism that gives ETH unprecedented "sound wave-level" scarcity and value growth potential in the digital economy.

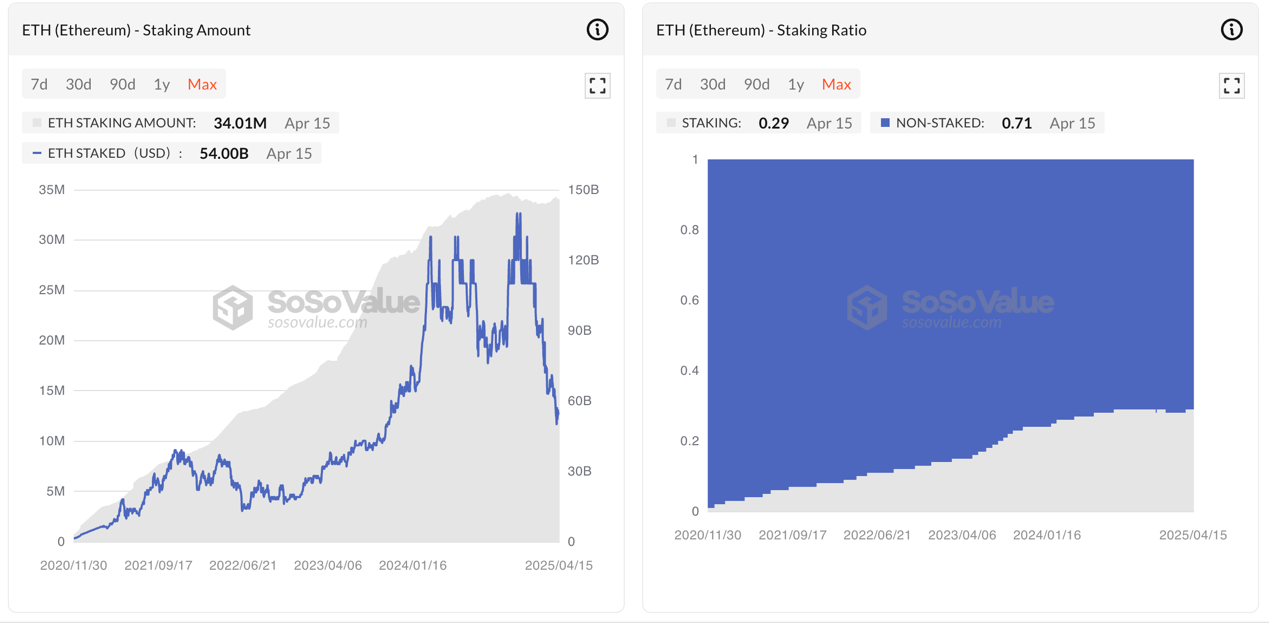

Engine 2: Staking on the chain - the "long-term national debt" of the economy

Each ETH staked is like a long-term treasury bond, solemnly "locked" into the treasury of Ethereum by investors. Holders are willing to temporarily leave the market for ETH in exchange for continued network security and generous "interest" - this is a resonance of trust and foresight. At present, the total amount of ETH staked in the entire network is still more than 34 million, accounting for ~29% of the total supply, which means that almost one out of every three ETH is selected as a "long-term treasury bond" and is locked as the cornerstone of the Ethereum economy.

Since the Shapella upgrade opened flexible withdrawals, the net inflow of pledged ETH has reached about 12 million ETH, which fully confirms the market's trust in the future of Ethereum and "fixed investment". People "deposit ETH in the national treasury", not only to enjoy network rewards, but also to make ETH in circulation in the market more scarce, which supports the price of ETH. It can be said that every "treasury bond" on Ethereum is a triple insurance of market confidence, network security and long-term value.

Engine 3: Regulatory dividends promote the inflow of stablecoins and drive economic activities on the Ethereum chain

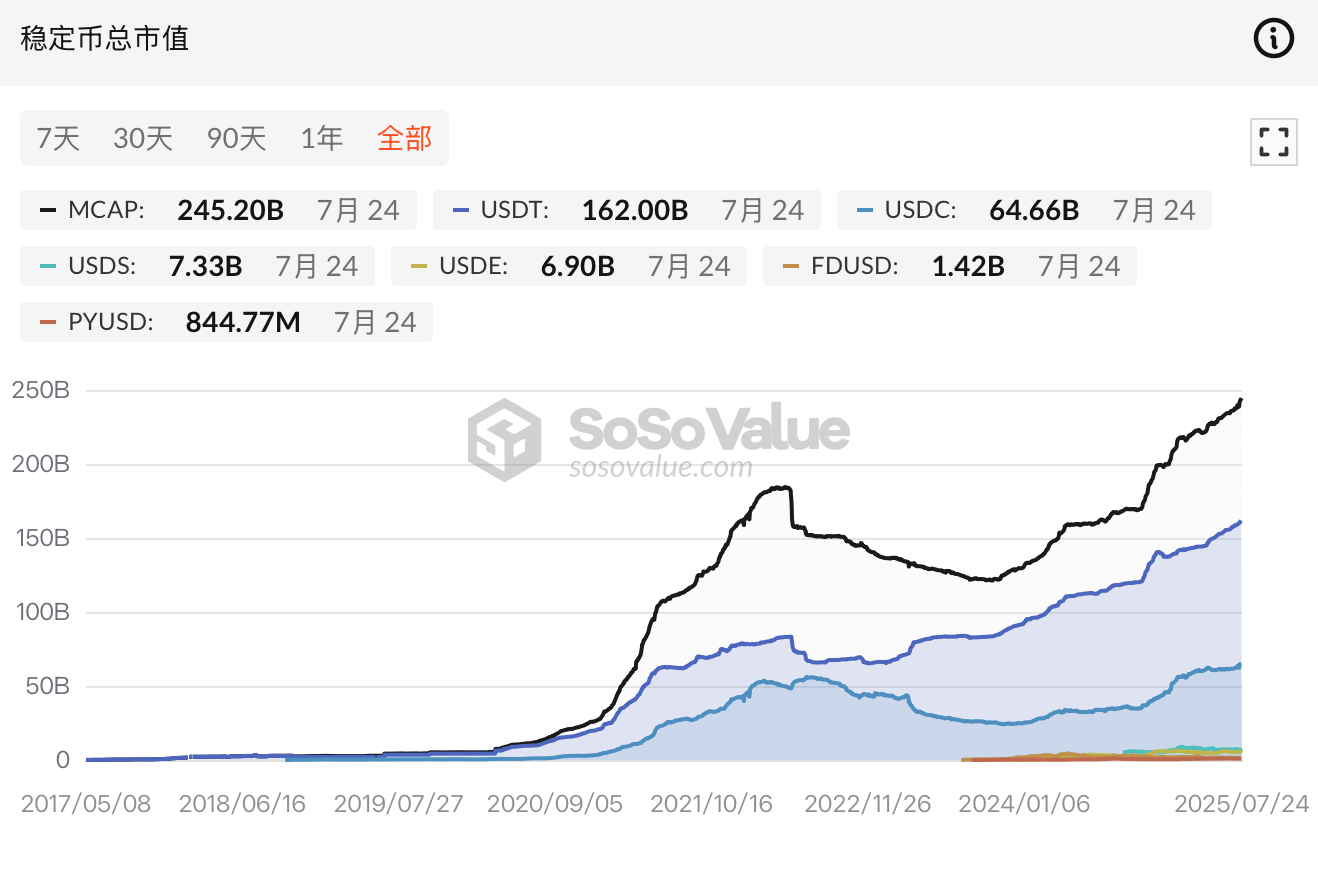

Since the passage of the GENIUS Act (US Stablecoin Regulatory Act), many companies have announced their plans to issue stablecoins or are preparing to issue them, opening a new round of "stablecoin competition". Currently, many leading financial and technology companies have clearly stated that they will invest in this field, and traditional banks and large retail technology companies are particularly active. The total market value of stablecoins has also recently reached US$244 billion, of which the Ethereum ecosystem accounts for about 54%.

When stablecoins pour into Ethereum, it is like a batch of "new cargo ships" entering the port, carrying real-world money into the on-chain world. These "cargo ships" make Ethereum's economic port unprecedentedly busy, and the on-chain DeFi market is also full of spring and bustling. The large influx of stablecoins into the Ethereum ecosystem not only indirectly drives on-chain economic activities and increases gas fees, but also brings continuous demand for ETH (payment of handling fees and staking).

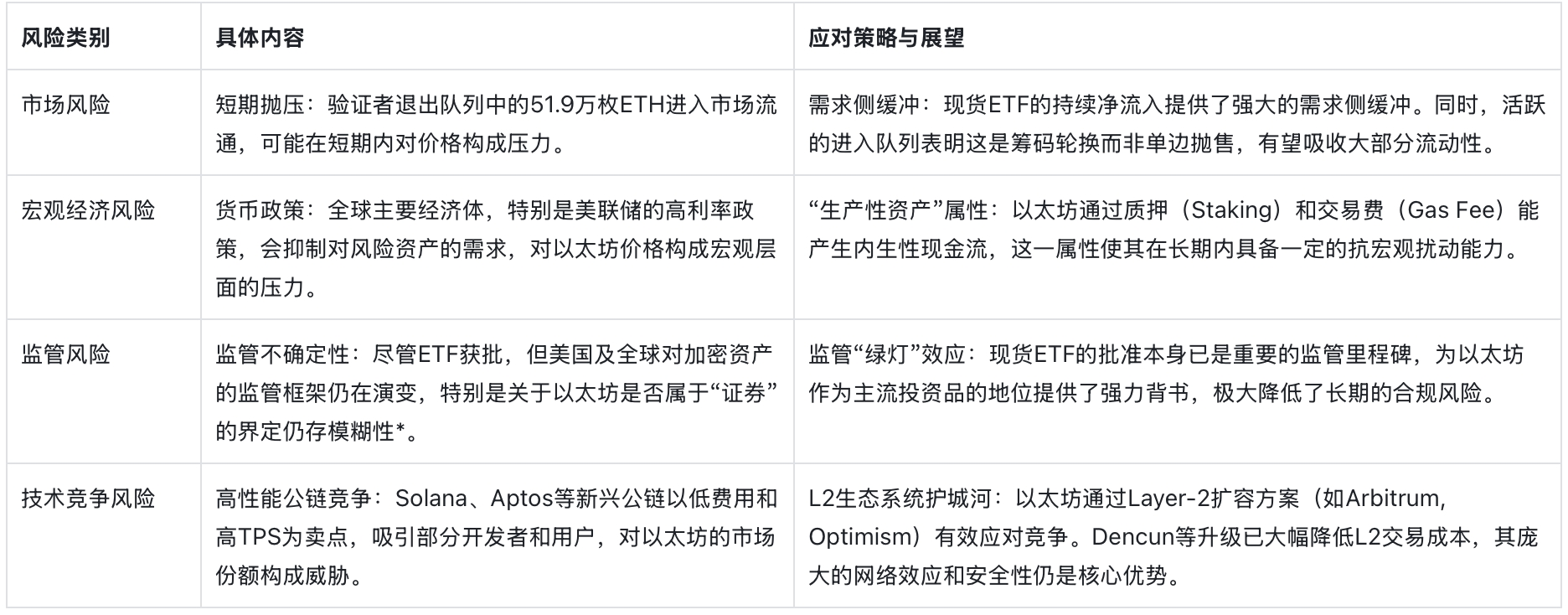

Risk assessment: The road ahead is not all smooth sailing

Despite the promising long-term outlook, in order to provide investors with a balanced perspective, we must identify and assess the potential risks and challenges facing Ethereum. These factors could have an impact on prices and network development in the short to medium term.

ETH itself has been defined as a commodity. There is still controversy over whether Ethereum's staking products and certain innovative derivatives are securities, but the overall framework has become clearer.

Conclusion: The clouds have cleared and the sun has appeared, where does the investment compass point to?

The "ice" on the surface of the Ethereum market (price fluctuations, withdrawal tide) cannot cover up its inner "fire" (ETF structural buying, investor base reshaping). The current "big blood transfusion" is not a sign of physical decline, but a metabolism that makes Ethereum's body healthier and stronger.

The conclusion is very clear: for investors who can see through the fog and identify structural trends, the current market volatility is not a "life-saving signal" but a strategic "good opportunity to get on board". As a long-term bull target in the secondary market, ETH's price and value can only truly converge after sufficient turnover and chip precipitation. For investors, what really needs to be considered is: how long are you willing to spend on this investment, and how much confidence and patience do you have to stick to it.