Exclusive interview with AnchorX founder Hill Wang: The 100 billion ambition of offshore RMB stablecoin

Original author: Lesley, MetaEra

The global monetary system is at a historical turning point. A new payment revolution centered on sovereignty, compliance, and efficiency is quietly unfolding.

On July 19, at the Shanghai-Hong Kong Web3 Complementary Collaborative Development Conference, Hill Wang, founder of AnchorX, gave a detailed introduction to the practice and development trend of offshore RMB stablecoins. With the increasing demand for cross-border payments and the gradual clarification of regulatory frameworks in various countries, offshore RMB stablecoins are ushering in an important development window.

From Hong Kong to Kazakhstan, from the five Central Asian countries to the Belt and Road Initiative, AnchorX is laying a new digital Silk Road. This is not only a business innovation, but also a strategic bet on the diversification of the global monetary system.

Hill Wang, founder of AnchorX

1. Thinking about encryption in the context of traditional finance: The origin of AnchorX

"I first came into contact with cryptocurrency when I was a VC at Hony Capital. At that time, I often studied some cutting-edge technology projects, so I had a certain understanding of the crypto industry," said Hill Wang, founder of AnchorX, in an interview. Previously, he worked as a senior analyst at Morgan Stanley and a managing partner at Hony Capital, with nearly 20 years of experience in finance and investment.

"By the end of 2022 and the beginning of 2023, we believe that exchanges are the most profitable track in the current crypto industry, and the next opportunity is likely to be stablecoins." As the "infrastructure" connecting traditional finance and the crypto world, stablecoins can improve cross-border payment efficiency and reduce settlement costs. But before they are truly implemented, "compliance" will determine whether stablecoins can go further.

It is in this context that Hong Kong's policy trends have become a key factor. As an international financial center, Hong Kong has a regulatory environment that is highly recognized by the industry, while leaving more room for financial innovation. "Hong Kong's support in this regard is very critical. We have seen that Hong Kong has carried out public consultations on stablecoins very early, and is at the forefront globally," said Hill Wang.

Hong Kong Monetary Authority

At the end of 2023, the Hong Kong Financial Services and the Treasury Bureau and the Hong Kong Monetary Authority (HKMA) jointly issued a consultation document on stablecoin regulation, soliciting opinions on the issuance mechanism, reserve management and licensing requirements, laying the foundation for the next step of the policy. Facing this opportunity, Hill Wang established AnchorX in Hong Kong in 2023 to lay out the stablecoin track.

AnchorX's rapid development also benefits from the "double support" of traditional finance and the blockchain industry. As two major strategic partners, Hony Capital provides resources and business collaboration for AnchorX, while Conflux Network provides technical support for AnchorX's stablecoin practice with its high-performance, low-cost underlying architecture.

In the interview, Hill Wang specifically mentioned Conflux Network, the organizer of this conference: "Conflux is one of the few Chinese infrastructure projects that has both public chain capabilities and government endorsement, which is highly consistent with our direction. It is also very mature in technology, with fast transaction speed and low cost. It is a typical representative of many characteristics of Chinese companies such as "more, faster, better and cheaper", and the government's recognition is also very high."

AnchorX is actively exploring offshore RMB stablecoin solutions

2. Kazakhstan landed and Hong Kong took off: the realistic path of stablecoins

Against the backdrop of a rapidly changing global regulatory environment, AnchorX has chosen a pragmatic compliance path. "We have seen rapid progress in the regulation of stablecoins in various countries, and the entire virtual asset industry is moving in a more compliant and healthy direction," said Hill Wang. "It is precisely because of these regulatory frameworks that we have the opportunity to make this more standardized and achieve scale."

Started in Kazakhstan and obtained the first stablecoin license

In early 2025, facing the imperfect regulatory framework in Hong Kong, AnchorX took the lead in overseas layout. In May, Kazakhstan's financial regulator, the Astana Financial Services Authority (AFSA), officially approved AnchorX's license to develop stablecoins linked to offshore RMB. This is the first time the country has issued an official license related to stablecoins.

AnchorX receives first stablecoin license from ASFA

AnchorX's layout is highly consistent with China's "Belt and Road" initiative. Kazakhstan is one of China's most important economic and trade partners in Central Asia. Last June, the second China-Central Asia Summit was held in Astana, the capital of Kazakhstan, showing the importance of Kazakhstan to China's trade in the Belt and Road. AnchorX's layout also subsequently covered the five Central Asian countries, providing stablecoin solutions for cross-border settlement scenarios in related regions.

"In the past two or three years, the annual growth rate of bilateral trade between China and Kazakhstan has been around 20%-30%, which provides a real and sustainable application scenario for the AxCNH stablecoin," said Hill Wang.

Taking root in Hong Kong, exploring offshore RMB stablecoins

As the world's largest offshore RMB trading center, Hong Kong will be the focus of AnchorX's long-term strategy.

“We have been communicating with the Hong Kong Monetary Authority for some time and plan to submit a formal application for a stablecoin license,” said Hill Wang.

In Hill Wang's view, Hong Kong is a global financial regulatory highland with strict regulatory policies. But at the same time, as an international financial center, Hong Kong has shown a relatively open attitude towards Web 3.0 and has been at the forefront of the world. "For entrepreneurs, such an environment itself is a benefit."

However, he also admitted that the development of the industry still depends on the continuous evolution of supervision: "As entrepreneurs, we certainly hope that the regulatory attitude can be more open, and the implementation of regulatory details can give companies a certain amount of room at the execution level. Only in this way can companies release more market-oriented exploration possibilities under the compliance framework."

3. Farewell to the T+3 era: How offshore RMB stablecoins reconstruct cross-border payments

AnchorX hopes to provide compliant and efficient cross-border payment options for companies going overseas through a stablecoin payment system, challenging the long-term dominance of the traditional financial system and the US dollar stablecoin.

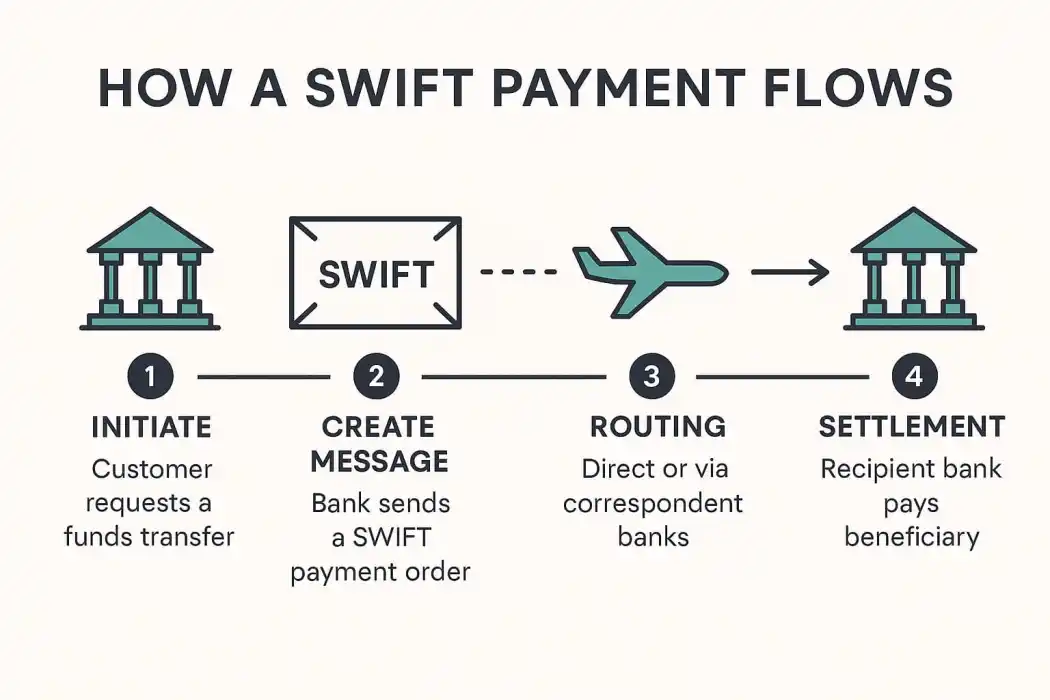

Receipt of funds in seconds, solving the SWIFT dilemma

Compared with the traditional SWIFT system, stablecoins have an overwhelming advantage in cross-border settlement efficiency. "As we all know, SWIFT is actually a messaging system, and the information flow is separated from the capital flow," Hill Wang explained, "that is, it is not what you see is what you get. It often takes T+ 3 days for a fund to arrive. We have a company in Kazakhstan, and we have personally experienced that a cross-border transfer often takes five to six days, and it may take longer on weekends."

SWIFT system principle, source: Cambridge Currencies

Based on the technical architecture of blockchain, AxCNH directly connects the information flow and capital flow, realizing near-instant arrival of funds. "Our solution can achieve near-real-time settlement on the cross-border chain," he said. "The settlement speed is in seconds, and generally confirmation can be completed within one minute, which significantly improves efficiency."

He further concluded: “Blockchain technology is expected to replace the traditional structure of SWIFT and truly achieve the synchronization of transactions and settlements.”

Less exchange loss, more suitable for enterprises to "go global"

Compared with the US dollar stablecoin, AxCNH will be more in line with the actual usage scenarios of Chinese companies in their global layout.

“When many Chinese companies are promoting overseas business, their cost centers are still in China. Using U.S. dollars means that they still need to convert back to offshore RMB in the end,” Hill Wang pointed out. “This is equivalent to an additional exchange.”

AxCNH is exploring a way to simplify the path by directly anchoring to offshore RMB. This process reduces one round of exchange rate losses and brings substantial savings to enterprises.

4. The era of multipolar stablecoins: the next stop in the global landscape

Hill Wang has a clear understanding of the global stablecoin landscape: "The stablecoin market is closely related to the traditional monetary system. At present, the US dollar stablecoin occupies an absolute dominant position." However, Hill Wang firmly believes that this single pattern will not last long.

"In the future, if sovereign currencies are mapped to stablecoins in some form, the international monetary system will likely move towards a multipolar balance of power structure centered on several important sovereign currencies." He pointed out that the share of the euro, the renminbi, and especially the offshore renminbi in the stablecoin market will gradually increase.

This trend has already been reflected at the regulatory level. On August 1, Hong Kong's "Stablecoin Ordinance" will be officially implemented; US President Trump has also signed the "GENIUS Act"; the European Union, the United Kingdom, Singapore and other economies have also included digital currencies in the regulatory framework. "The improvement of the regulatory framework has cleared the way for the growth of non-US dollar stablecoins," said Hill Wang.

He further cited data to illustrate: "Take offshore RMB as an example. It currently accounts for about 5% of the SWIFT payment system. If the stablecoin market size reaches US$2 trillion in the future, the potential space for offshore RMB stablecoins may be as high as hundreds of billions of dollars."

AnchorX's goal is not only to become a stablecoin issuer, but also to build an international payment network based on offshore RMB. "We hope to use Hong Kong, the world's largest offshore RMB settlement center, as a base to support overseas companies to connect more efficiently with countries along the Belt and Road."

Conclusion: The Eastern Narrative of the New Order of Digital Currency

The power map of digital currency is being reconstructed. The seemingly scattered regulatory actions around the world actually outline the underlying logic of the reshuffle of the global monetary system. Hill Wang's judgment is also very firm: it is not subversion, but diversity. The "hundred-billion-dollar level" market space is enough to accommodate multiple independent ecosystems that are not dependent on the US dollar system.

In this global competition centered on technology, regulation, and currency, companies facing the international market are transforming from rule adaptors to practitioners, participants, and co-builders with innovative technology solutions such as AxCNH as the fulcrum. The prelude to the era of multipolar stablecoins may be quietly opening in the morning mist of Victoria Harbor in Hong Kong.