1 BTC>1Kg Golden Era Arrives: Looking Back at BTC's Unique "Digital Gold History"

- 核心观点:比特币超越黄金成为新价值存储标杆。

- 关键要素:

- BTC价格突破12.2万美元,市值全球第六。

- 现货ETF年度净流入为黄金ETF的81倍。

- 萨尔瓦多国家持仓浮盈4亿美元。

- 市场影响:加速传统资本向加密资产迁移。

- 时效性标注:长期影响。

Original | Odaily Planet Daily ( @OdailyChina )

By Wenser ( @wenser 2010 )

This morning, the price of Bitcoin briefly surpassed $122,000 , making it the world's sixth-largest asset . Meanwhile, its relative value to gold has once again become a focus of market attention. Perhaps it's time to relinquish the reputation of Bitcoin as "digital gold," often associated with it, to a certain extent.

Looking back at the growth of BTC over the past decade, from being ignored to being widely known, from being a niche asset to being a mainstream asset, what has changed is the price of BTC and the degree of mainstreaming of cryptocurrencies. What remains unchanged is its transcendent status as "the only one comparable to gold" and its increasingly strengthened strategic reserve value.

In 2018, former Coinbase CTO Balaji Srinivasan stated at the Coindesk Conference: "Three types of investors are entering the market: the first wave focuses on digital gold, the second on smart contracts, and I believe the third will be micropayments." Looking back now, the investments he mentioned correspond to BTC, ETH, and stablecoins, demonstrating his foresight. Today, we're discussing how BTC has become "digital gold."

The History of BTC as Digital Gold: From Obscurity to Fame

Before discussing how BTC can truly grow into “digital gold” with the same value as physical gold, the background of its birth not only involves the subprime mortgage crisis that swept the world in 2008, but can even be traced back to 1997.

"Internet Currency" under "Sovereign Individual": The Prototype of BTC Emerges

In 1997, The Sovereign Individual: Managing the Transformation of the Information Age, co-authored by William Mogg, former editor of the British newspaper The Times and father of the famous Eurosceptic Jacob, and James Davidson, an American investment guru and conservative propagandist, was officially published. The book boldly predicted: "Digital technology will greatly increase the competitiveness, inequality and instability of the world, society will become more divided, and government will gradually shrink. In the future society, there will be two kinds of countries: one controlled by government employees, and the other controlled by 'customers'. The former is restricted by the interests of government departments themselves, deviating from the original intention of democracy, with high operating costs and low efficiency. Under the pretext of providing 'protection services', it continues to exploit the wealth of the people like a monopoly group to maintain its violent capabilities; only a country truly dominated by 'customers' can solve the problem of 'inefficiency of democracy'." At the time when capitalism was at its peak, such remarks were quite unorthodox.

The book also systematically expounds on the fundamental logic of human social structure, pointing out that with the development of digital technology, traditional organizations' monopolies over violence, knowledge, and wealth will gradually disintegrate, and decentralized, sovereign individuals will rise. Furthermore, the book specifically mentions a type of "cybermoney," the characteristics of which include:

- It consists of an encrypted multi-digit prime number sequence, which is unique, anonymous and verifiable.

- Able to accommodate the largest transaction and can be divided into the smallest unit.

- Trade at the touch of a button in a borderless, multi-trillion dollar wholesale market.

- Denationalized, holders free themselves from state power through inflation.

Initially, the book received scant attention. However, with the 2008 subprime mortgage crisis and the emergence of Bitcoin (BTC), it has become increasingly revered as gospel. This includes Silicon Valley investment magnate and leader of the "PayPal Mafia," Peter Thiel. In a 2014 interview with Forbes, Thiel stated that The Sovereign Individual had influenced him more than any other book. In a 2020 reprint, the book excitedly stated in its preface, "The development of information technology has given elites the ability, for the first time, to use their intelligence to control the direction of the 'mob' and, ultimately, everything. Artificial intelligence has made 'centralized control of the entire economy possible.' The most important tool in the hands of the sovereign individual is 'strong encryption,' the embodiment of liberalism, which promises a 'decentralized and personalized world.'" Following Trump's presidency, this trend has further underscored Thiel's ambitious ambitions, and cryptocurrencies, such as Bitcoin, have become the perfect tool for elite individuals to challenge authoritarian states and, in some cases, even slowly infiltrate them.

As the opening line of The Sovereign Individual quotes Tom Stoppard's play Acharya: The future is disordered. The future world is dominated by nonlinearity and asymmetry, which is also the world background for the birth of Bitcoin.

From peer-to-peer electronic cash systems to digital gold: the transformation from currency to speculation

In 2008, with the collapse of Lehman Brothers, the subprime mortgage crisis that swept the world was like a bomb that caused immeasurable losses to the US economy, the most important link in the global economic system. The authoritarian government's wanton issuance of paper currency and the fragile real estate revolving loan economy became a nightmare for countless people.

It was also on October 31 of that year that a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” appeared on the cryptography mailing list of Metzdowd (some say the white paper was published on a P2P website forum), attracting the attention of many technology geeks; on January 3, 2009, the Bitcoin network was officially launched, and the inventor Satoshi Nakamoto inscribed the front-page headline of the Times on its genesis block: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”.

A Glimpse into the Bitcoin White Paper Email

Whether it was the Times' description of the plight of modern banking, or the fact that William Mogg, the author of "The Sovereign Individual," was a former editor of The Times, many speculated that Satoshi Nakamoto might have been inspired by "The Sovereign Individual" when inventing Bitcoin. Furthermore, Nakamoto is British. Bitcoin's characteristics do share many similarities with online currencies, particularly in terms of denationalization and inflation resistance. Specifically, Bitcoin's characteristics include:

- Decentralization: No central authority required, based on blockchain technology.

- Fixed supply: 21 million in total, with issuance controlled by a halving mechanism every four years.

- Anonymity and privacy: Transaction addresses are not directly linked to real identities, but can be tracked through analysis.

- Global Transactions: Transfers can be made instantly around the world via the internet without cross-border fees.

Furthermore, the book mentions that online currencies will "reduce the ability of nation-states around the world to determine who becomes a sovereign individual," which aligns with Bitcoin's view as a tool against traditional financial systems and state control. It was precisely because of these characteristics that early Bitcoin community members began comparing it to gold.

Despite this, in the geek circle at the time, Bitcoin was more like a "computing power game" than a "wealth code". Even Hal Finney, Satoshi Nakamoto's "network neighbor", an early developer of Bitcoin, and the recipient of the first BTC transfer, probably did not expect that one day Bitcoin would grow to a coin worth hundreds of thousands of dollars.

As a cryptocurrency designed to resist inflation and oppose government minting, Bitcoin's first physical transaction can be traced back to May 22, 2010, when Florida programmer Laszlo Hanyecz used 10,000 BTC on a forum to purchase two Papa John's pizzas, valued at approximately $40. Another British resident then paid $25 for the pizzas. In other words, BTC's currency journey began with a unique "over-the-counter" transaction. This also marked the first time BTC was exchanged with fiat currency, with the BTC:USD exchange rate reaching approximately 1:0.0025. This also gave rise to the "Pizza Day" celebrated by crypto enthusiasts worldwide. This event signified that BTC was no longer just a cold number, but possessed real purchasing power.

Subsequently, the first Bitcoin trading platform, Mt. Gox, was established in July 2010, giving BTC its own secondary trading market. Subsequently, BTC's censorship resistance gained attention during the WikiLeaks incident, and soon after, many charities began accepting BTC donations. Furthermore, the emergence of Silk Road, the "American dark web," also significantly contributed to the popularization of BTC.

Since then, it has embarked on its own path of soaring prices:

- In early 2011, graphics card-based Bitcoin mining equipment began to appear on the market; by the end of the year, the price of Bitcoin was approximately $2.

- In September 2012, the Bitcoin Fund was established, when the price of BTC was $12.46;

- In April 2013, BTC hit a record high, with the price soaring to $266;

- In June 2013, a German conference decided that Bitcoin held for more than one year would be exempt from tax. The industry interpreted this as a disguised recognition of Bitcoin's legal status. At this time, the price of BTC fell to $102.24.

- In November 2013, the BTC trading price hit a record high of $1,242. During the same period, the price of gold was $1,241.98 per ounce. The standard unit price of Bitcoin exceeded that of gold for the first time.

Since then, BTC has been closely linked to the term “digital gold,” and its role has evolved from electronic cash to a speculative asset with high returns and high-risk volatility.

The "digital gold" evangelists of those years: from journalists to investors

It is worth noting that although many people discuss and compare BTC with gold, the term "digital gold" was first used in the book "Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money" published by Nathaniel Popper, a reporter for the New York Times in 2015.

The book details the origin, development, and early adopters of Bitcoin, including "Bitcoin Jesus" Roger Ver, Erik Voorhees, founder of the cryptocurrency exchange ShapeShift, and the Winklevoss brothers (founders of the cryptocurrency exchange Gemini, who had previously sued Zuckerberg over the dispute over the founding of Facebook).

"Digital Gold" book cover

Furthermore, Xapo founder Wences Casares is considered an early proponent of the "digital gold" narrative. He publicly referred to Bitcoin as "digital gold" numerous times between 2014 and 2016. At the 2016 Consensus conference, he boasted, "Bitcoin may be the best store of value in human history. It is easier to store and transfer than gold." As an early BTC evangelist, he raised $20 million from LinkedIn founder Reid Hoffman and Palpay founder Max Levchin, and also garnered attention for successfully persuading Bill Gates to use digital currency in his work.

In his book “Mastering Bitcoin,” Bitcoin evangelist Andreas Antonopoulos compared Bitcoin’s decentralized nature to the scarcity of gold. In a 2017 speech, he said, “Bitcoin is not a substitute for gold, but an evolved version of gold in the digital world.”

In addition to individuals, many investors are also loyal supporters of the "digital gold theory", including Paul Tudor Jones, founder of Tudor Investment Corporation and hedge fund manager, and Cathie Wood, founder of Ark Invest. The former compared Bitcoin to "gold in the 1970s", calling it a tool to fight inflation. He once said, "If I have to choose an asset to hedge against future uncertainties, Bitcoin will be one of my choices"; the latter has always been a BTC bull, and has previously stated that the price of BTC will rise to US$2 million per coin. He has also repeatedly emphasized the scarcity of Bitcoin and its potential as a store of value, calling it "gold in the digital age."

In a 2018 interview, 1confirmation founder Nick Tomaino expressed optimism about Bitcoin's future value. While he still didn't expect the price to reach $10,000 again that year, he believed Bitcoin's value would exceed $100,000 within the next five years. He also emphasized, "Over the next decade, Bitcoin will play the role of 'digital gold,' while Ethereum will be considered 'digital oil.'"

Tyler Winklevoss, founder of the US cryptocurrency trading platform Gemini (one of the Winklevoss brothers mentioned above), stated in 2019 that Bitcoin's market capitalization is approximately $140 billion, while gold's is approximately $7 trillion. Due to the difference in market capitalization, Bitcoin is undervalued. Bitcoin is gold 2.0, capable of rivaling or even surpassing gold. These differences have also helped propel Bitcoin to higher levels than gold. For example, gold offers low risk and low returns, while Bitcoin offers high risk and high returns. Furthermore, gold is controlled by the futures market, while digital gold is not controlled by any government.

Max Keiser, a Wall Street financial analyst and Bitcoin supporter, also stated in 2019 that to truly fulfill Satoshi Nakamoto's vision, Bitcoin must be peer-to-peer gold, a feat Bitcoin has already achieved. Keiser strongly disagreed with the World Gold Council's report's claim that Bitcoin is not a gold substitute. He also stated that Bitcoin may be "insignificant" as digital cash, but as digital gold, it is changing the world.

Based on previous industry insiders' perspectives, it's clear that by around 2019, the view that "BTC is digital gold" had largely gained acceptance within the cryptocurrency industry and some in traditional finance. This can be seen in the statements of industry leaders. For example, MakerDAO founder Rune Christensen stated in a December 2019 podcast that Bitcoin's current use case had shifted to digital gold, which was a positive development. Of course, he later admitted, "Although this wasn't the original vision for digital cash," a view later echoed by Ethereum co-founder Vitalik .

In 2020, BTC's "digital gold" supporters camp welcomed new fans.

Strategy and El Salvador's "BTC Hoarding Wave": When BTC Becomes a Corporate and National Reserve Asset

In 2020, MicroStrategy (later renamed Strategy) and Square (later renamed Block), the payment company owned by Twitter founder Jack Dorsey, began to include Bitcoin in their corporate balance sheets, strengthening its status as "corporate gold"; on the other hand, in 2021, El Salvador also launched its own "1 BTC a day plan", and BTC thus became "national gold."

Strategy and Block join the BTC hoarding battle

On August 11, 2020, MicroStrategy, a US-listed company, purchased over $250 million worth of Bitcoin as part of its asset allocation. In response, MicroStrategy CEO Michael Saylor stated , "Bitcoin is digital gold, stronger, faster, and smarter than any currency before it. We expect its value to continue to grow with technological advancements, expanded adoption, and the network effects that have fueled the rise of category-killers in this era."

Michael Saylor also said at the time: "Bitcoin is a better store of value asset than gold. It is the corporate reserve asset of the digital age."

Thus, a massive "US-listed companies' cryptocurrency hoarding plan" kicked off, and five years later it has become a wave sweeping the world.

In October 2020, Square, an online payment company and US-listed company that has supported Bitcoin purchases since 2017, initially invested $50 million to purchase 4,709 BTC. In February 2021, the company purchased approximately 3,318 BTC for $170 million, at an average purchase price of $51,200. Notably, BTC soon plummeted to around $46,000, yet Jack Dorsey remained confident in the currency. In contrast, then-US Treasury Secretary Janet Yellen harshly criticized BTC, calling it "highly speculative" and "inefficient." She stated, "Bitcoin is a highly inefficient method of transaction, consumes staggering amounts of energy to process these transactions, and is frequently used for illicit financing." Yellen also stated that it was time for the US Treasury to research the merits of a digital dollar. A blockchain-based digital dollar launched by the Federal Reserve could potentially enable faster, safer, and cheaper payments, but many issues, including consumer protection and money laundering, require further study.

Looking at it today as the Anti-CBDC National Surveillance Act has been passed, the dramatic effect is at its maximum.

El Salvador's tortuous journey to hoarding cryptocurrency: from tens of millions of dollars in losses to a $400 million profit

In June 2021, with the strong support of Salvadoran President Nayib Bukele, Bitcoin was recognized as legal tender by the country , and the event was recorded on Bitcoin block 686604 , becoming another milestone event in the cryptocurrency industry - this means that BTC has become one of the legal currencies of a sovereign state for the first time, and the cash system once envisioned by Satoshi Nakamoto has become one of the national legal tender.

In September of that year, Salvadoran President Nayib Bukele announced that his country had purchased its first batch of 200 Bitcoins, stating that "our brokers will purchase more as the deadline approaches." Thus, with the price of BTC fluctuating, El Salvador embarked on a path of BTC reserves that was misunderstood and controversial. At the time, both the International Monetary Fund and the people of Salvador were negative about the initiative, strongly disapproving of it.

But time will tell the answer behind people's choices:

In 2022, according to media reports , El Salvador’s GDP grew by 10.3% in the first year after adopting Bitcoin;

In 2023, the President of El Salvador stated : “We have seen the benefits of Bitcoin adoption. Tourism has grown by 95% and we have received a lot of private investment.”

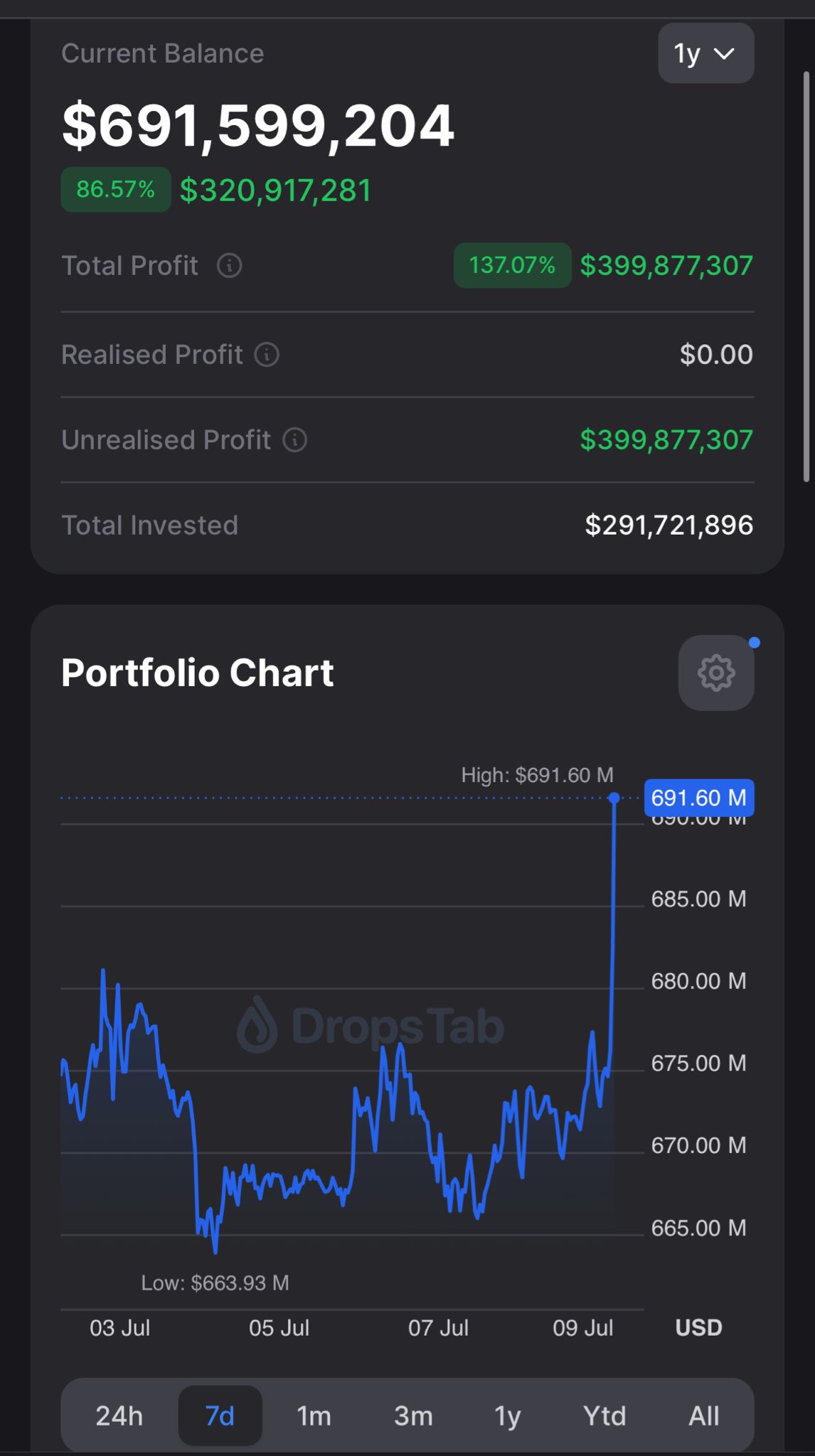

That same year, El Salvador officially announced it would begin purchasing one BTC daily. On July 10th of this year, Salvadoran President Nayib Bukele published a post showcasing the government's profits from Bitcoin accumulation. A screenshot showed that after Bitcoin reached a new high, the Salvadoran government's holdings had generated a net profit of approximately $400 million. Its current total holdings are valued at $691 million.

What once seemed like a willful decision now appears to be a farsighted choice.

El Salvador's floating profit data

Bitcoin Spot ETF Approved: Sounding the Cry for "1 BTC > 1 KG Gold"

As time enters 2024, after more than a decade of accumulation and about 4 crypto cycles of sedimentation, the Bitcoin spot ETF was finally approved by the US SEC, and the price of BTC finally broke through the new high of US$70,000. As a result, a BTC value attack on gold has once again begun on the financial stage.

BlackRock CEO: BTC represents priceless freedom

In a July 2024 interview with CNBC, BlackRock CEO Larry Fink admitted that he had previously misunderstood Bitcoin, but that learning had changed his mind. He reiterated that Bitcoin is digital gold and that he is now a Bitcoin believer. It's worth noting that in a previous interview, when a reporter asked him what BTC is worth, he responded with a brilliant rhetorical response: "What is freedom worth?"

Data Interpretation: BTC ETF's annual net inflow is 81 times that of gold ETF

In fact, after the BTC ETF was passed, many people compared it with the gold ETF in many aspects.

In March 2024, Eric Balchunas, senior ETF analyst at Bloomberg, stated that Bitcoin ETFs will eventually surpass gold ETFs, barring a black swan event. ETFs had $28.9 billion in assets under management when they were first launched, while the 11 spot Bitcoin ETFs currently hold a combined $61 billion in assets under management. Amidst significant inflows and rising Bitcoin prices, the size of Bitcoin ETFs is approaching that of gold ETFs, which have approximately $97 billion in total assets under management.

In August 2024, Lin Chen, head of Asia-Pacific business at Deribit, wrote : "The overall inflow performance of ETFs this year is very good. IBIT (Blackrock's Bitcoin spot ETF) ranks third with a net inflow of US$20 billion this year; the most popular gold ETF is GLD, and its current asset management volume is US$68.88 billion; that is, compared with the most popular gold ETF, BTC's ETF asset management can triple again." This fully demonstrates the confidence of industry insiders in the inflow of funds into BTC ETFs.

According to a Radar post on the X platform, as of November 10, 2024, the asset value of BlackRock's Bitcoin ETF officially surpassed that of its gold ETF, accumulating approximately $33.2 billion in assets in just 10 months. By comparison, the asset value of BlackRock's gold ETF, IAU, was approximately $32.9 billion at the time.

At the end of December 2024, statistics showed that Bitcoin ETFs saw a net inflow of $36.8 billion, while gold ETFs saw a net inflow of $454 million. The former was approximately 81 times the latter.

Representative figures of the "digital gold theory" in 2024: Trump, Michael Saylor, trader Cobie

At this time, people inside and outside the circle not only regard gold as a "competitor" of BTC, but also express strong confidence that BTC will outperform gold in a highly optimistic manner.

At the Bitcoin Conference held in Nashville, Tennessee, at the end of July 2024, Trump, who had not yet taken office as US President, boldly stated : "Based on the current trend, Bitcoin will have the opportunity to surpass the market value of gold in the future."

In November 2024, MicroStrategy founder Michael Saylor said : "Bitcoin will eat up gold. It has all the advantages of gold but none of its disadvantages."

That same month, cryptocurrency trader Jordan Fish (alias Cobie) also wrote , "Bitcoin's overtaking of gold is simply a reminder to return to rational reality. The multiple it overtakes is the more interesting question. Perhaps 5-10 times is the fair valuation we're approaching in this process." Steven, a researcher at TheBlock, asked in the comments, "(You mean) a single BTC price of $4 million to $9 million???" He then responded, "That sounds like a good price for BTC." He added, "Honestly, while gold will face significant competition from competing assets, Bitcoin is essentially interstellar digital gold. Therefore, as the writing on the wall predicts, as humans become a multi-planetary species, investors in Earth's minerals, rocks, and gold may choose more superior assets. There are many other gold examples: perhaps some future intelligence can refine gold, or perhaps future humans who have conquered the stars will be able to enter space and mine infinite gold. In contrast, it seems unlikely that we will find any Bitcoin in space."

This view was supplemented by information from Paradigm co-founder Matt Huang, who reported that a giant asteroid in space holds $700 trillion worth of gold.

The Final Chapter of BTC’s Digital Gold History: 1 BTC > 1 KG Gold Is a Foregone Conclusion

In January 2025, Trump, who held high the banner of crypto-friendliness, was officially sworn in as the 47th President of the United States. As a result, another wave of enthusiasm for BTC and the entire cryptocurrency industry hit again. After the BTC price broke through US$110,000 and US$12 in succession, 1 BTC > 1 KG of gold became almost the norm in the market.

BTC can maintain more than 1 kg of gold if it stands above $110,000

According to the latest information from the Kinesis website , one kilogram of gold is currently worth $107,757.50; in comparison, one BTC is currently worth $118,017.7.

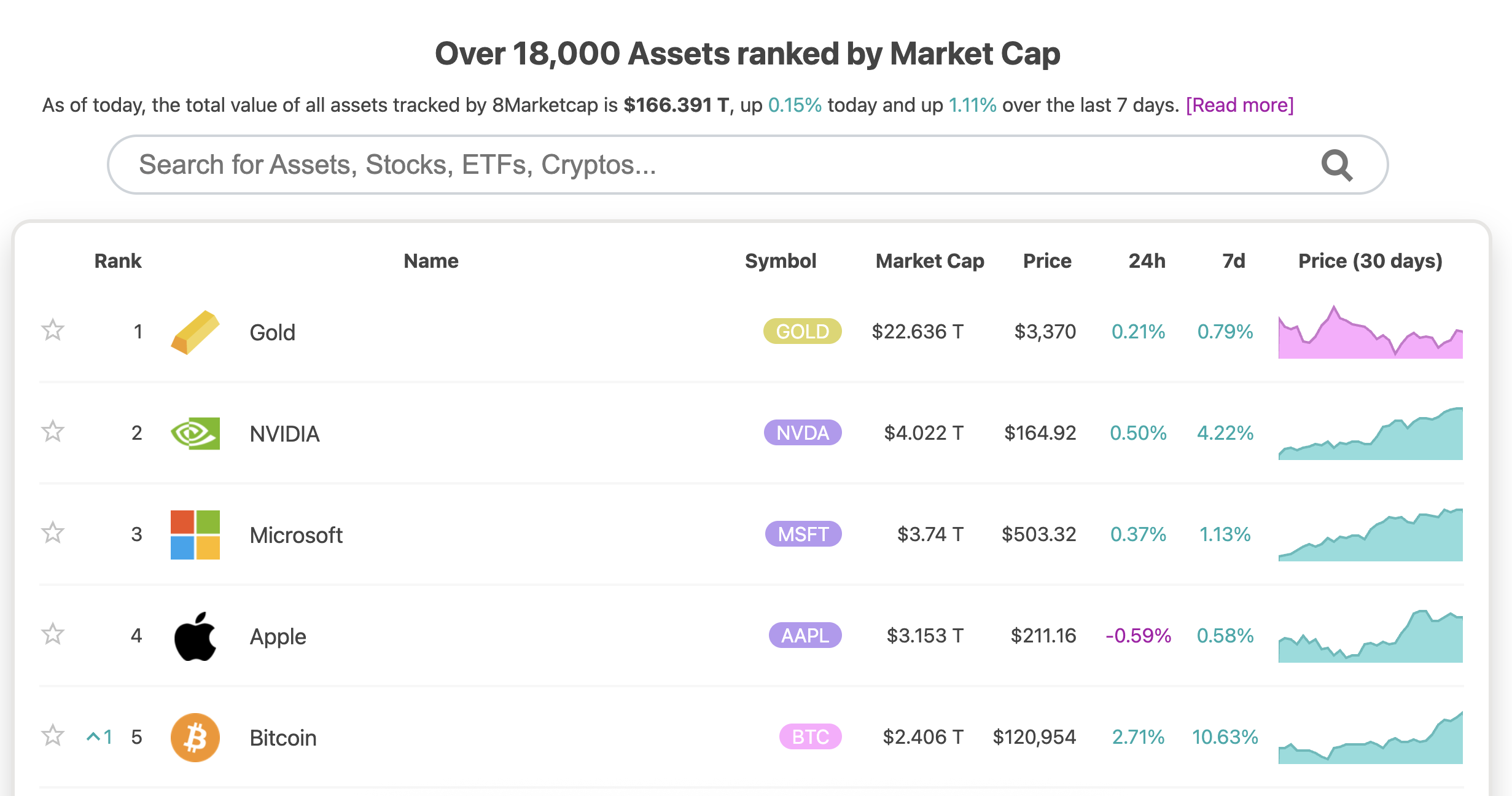

In addition, according to 8 Marketcap data , the current total market value of gold is approximately US$22.6 trillion, ranking first among global assets; the total market value of BTC is approximately US$2.4 billion, ranking fifth among global assets. The overall market value gap between the two has also narrowed from about 12 times to about 9 times.

Top five global asset market capitalization

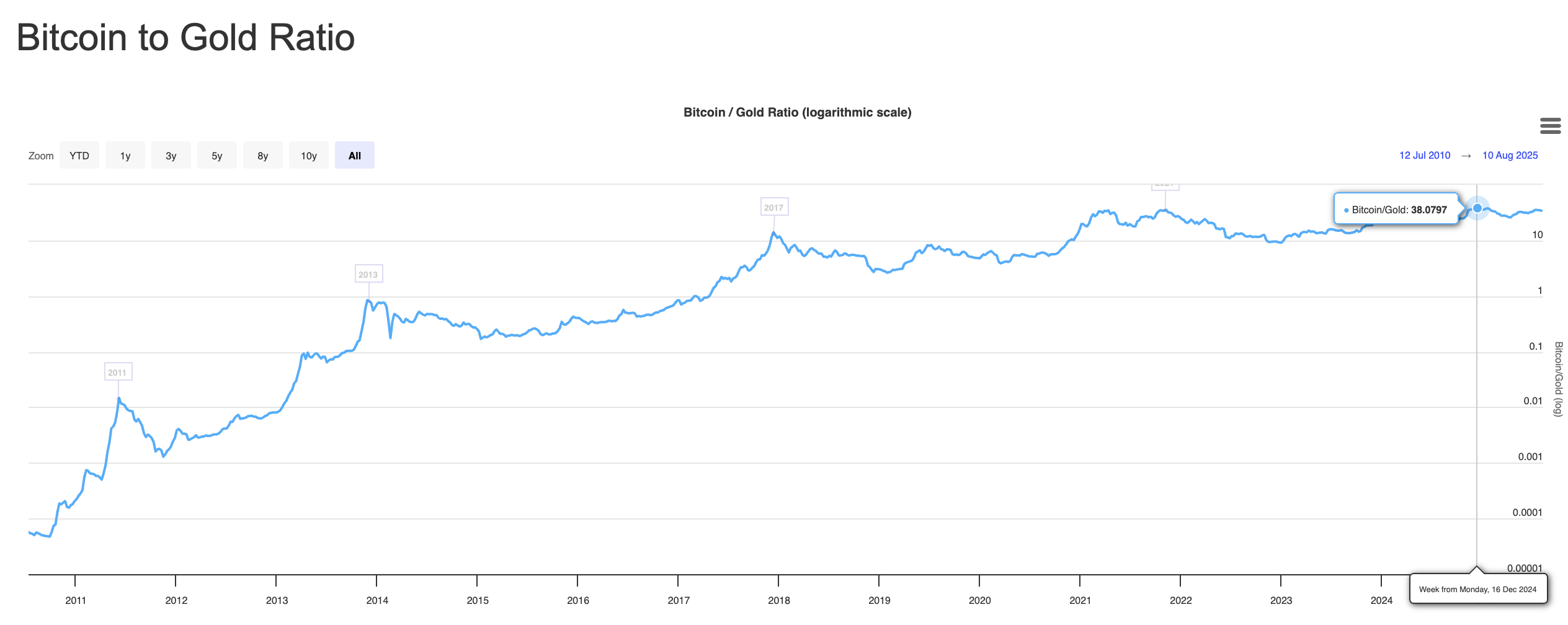

In addition, for comparison, on December 16 last year,the BTC:gold exchange rate rose to a record high, with 1 BTC being exchangeable for 38.0797 ounces of gold, and currently remains above 34 ounces of gold.

BTC:Gold exchange rate chart

Of course, such historical achievements are not always accompanied by support and praise, but also denial and criticism.

As early as the beginning of 2020, as gold prices hit a seven-year high of $1,670 per ounce this week, marking a 10% increase for the year, Bitcoin fell below its key support level of $9,300. At the time, economist and gold proponent Peter Schiff wrote, "Bitcoin's decline demonstrates that it is a digital risk, not digital gold."

Coincidentally, Wang Yongli, former Vice President of the Bank of China , published an article in his Sina column at the time, arguing that while Bitcoin closely mimics the mechanics of gold, it is not real gold at all, but rather digital "virtual gold" or "virtual assets." The impact of the novel coronavirus pandemic has caused prices for Bitcoin and other "digital currencies" to plummet, dropping by two-thirds within a week. People should fully understand that these currencies cannot become "digital gold," nor can they become strong currencies or safe-haven assets. They should completely shed their illusions about various "digital currencies" and develop a clear and accurate understanding of currency.

But looking back at it today, five years later, I can only sigh: "The long road ahead is as hard as iron, but now I start over again. As I start over, the mountains are like the sea, and the setting sun is like blood."

Recommended reading:

- Bitcoin Project Introduction

- The 15 real bigwigs in the cryptocurrency world

- The "Sovereign Individual" Elite's War on All Nations

- A Conversation with Nathaniel Popper, Author of Digital Gold

- Foresight Ventures: A Chronicle of Crypto Thought (1997-2022)

- " CRYPTOCURRENCY: How Digital Money Could Transform Finance "

- The Sovereign Individual: A Little-Known Book That Inspired Satoshi Nakamoto to Invent Bitcoin