Foresight Ventures: Crypto Thought의 연대기(1997 - 2022)

사람들은 기술에 돈을 지불하지 않고 기술과 혁신을 담고 있는 이야기에 돈을 지불할 것입니다 크립토의 번영의 열쇠는 그것이 얼마나 참신한가가 아니라 그 뒤에 있는 전통적인 혁신, 중앙집권적 질서의 전복, 경제 예술의 정치적 물결입니다. 재검토.

첫 번째 레벨 제목

보조 제목

The Sovereign Individual —— James Dale Davidson / William Rees-Mogg

한 줄로: 주권자가 일어날 것입니다.

"Avalanche"가 메타버스의 개념에 영감을 주었다면 "The Sovereign Individual"은 비트코인에 영감을 주었습니다.

이 책은 세상의 미래를 보는 책이다 책은 미래가 무질서하다고 말한다 디지털 기술은 세상의 경쟁력과 불평등과 불안정성을 크게 높이고 사회를 더욱 분열시키고 정부를 점차 축소시킬 것이다.

이 책은 인간 사회 구조의 근본적인 논리를 정리하고 디지털 기술의 발달과 함께 전통적 조직에 의한 폭력, 지식, 부의 독점이 점차 해체되고 분권화되고 주권을 가진 개인이 부상할 것이라고 지적한다.

이 책은 크립토, 전자전, 스마트폰에 대한 몇 가지 정확한 예측을 합니다.그들은 고유하고 익명이며 검증 가능하고 국경 없는 글로벌 시장에서 거래될 수 있는 암호화된 디지털 통화를 구상합니다.이것은 Satoshi Nakamoto에게 Bitcoin에 대한 영감 약세장에서는 모든 사람이 읽을 것을 권장합니다.

첫 번째 레벨 제목

2008년: 비트코인의 탄생

보조 제목

원라이너: Bitcoin은 P2P 전자 현금 시스템으로 Crypto의 기원입니다.

이 백서에 대해서는 일반화할 것이 없으며, 모든 사람이 비트코인 백서를 수시로 검토하고 집중적으로 읽어야 합니다.

나카모토 사토시(Satoshi Nakamoto)라는 가명을 사용하는 수수께끼의 남자는 P2P 전자 현금 시스템을 만들어 2008년에 블록체인을 탄생시켰습니다. 주권, 금융, 자유 사이에서 수천 가지의 변화와 혁신을 불러일으킨 13년이 넘는 세월이 흘렀지만, 우리는 여전히 간결한 언어와 이해하기 쉬운 개념, 그리고 빛나는 디자인에서 영양분을 추출합니다.

2008년 비트코인의 백서는 크립토의 바이블이라고 할 수 있으며 비트코인은 종교적 의미를 부여받은 듯 수없이 되살아나 불사조가 죽었다.

아무도 Satoshi Nakamoto가 누구인지 말할 수 없고, 우리가 "도"가 무엇인지 이해할 수 없는 것처럼. 그리고 Bitcoin이 탄생했고, Bitcoin은 Crypto의 초기 상태인 "하나"입니다. 과학과 기술의 본질 그런 다음 "둘이 셋을 낳고, 셋이 모든 것을 낳는다"를 계속해서 만물을 창조하고 각각의 조화로운 상태를 찾으십시오.

첫 번째 레벨 제목

2011년: 왓 비트코인

보조 제목

한 줄 요약: 비트코인은 매우 흥미로운 투자 기회입니다.

텍스트

텍스트

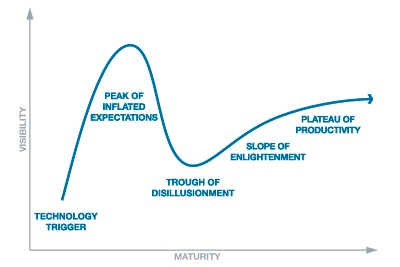

당시 비트코인 가격에 대해서는 비트코인이 망했다고 할 수 있고(29달러에서 13달러로 되돌림), 부풀려진 기대의 시기를 막 지나서 가격이 돌아왔다고도 할 수 있다. Bitcoin의 진정한 가치 흥미롭게도 Bitcoin의 현재 가격은 $ 30,000 이상입니다.

이 기사의 댓글 섹션도 매우 흥미롭습니다. 2011년 사람들이 비트코인에 대해 어떻게 생각하고 질문하고 토론했는지 볼 수 있습니다.

첫 번째 레벨 제목

2013년: 비트코인은 재미있다

보조 제목

한 줄 요약: Coinbase는 Bitcoin의 중요한 인프라가 될 것입니다.

이 기사에서 Chris Dixon은 Bitcoin에 대한 미디어의 이해와 Bitcoin에 대한 기술자의 이해 사이의 대조를 보여줍니다.미디어는 대부분 Bitcoin이 사기라고 생각하는 반면 실리콘 밸리에서 Bitcoin은 괴짜 기술 혁신의 주요 프로젝트로 간주됩니다.

그는 인터넷이 크립토 시스템을 위한 공간을 제공하지만 전자 현금의 전송을 성공적으로 완료하지 못했다고 지적했다.비트코인은 전자 현금 서비스에서 높은 거래 수수료와 만연한 사기 문제를 해결한다. 새로운 기술이 개발될 수 있는 플랫폼에서 그는 구독 및 광고 수수료에 대한 소액 결제, 기계 간 거래(완전히 스마트한 계약처럼 들림), 모두를 위한 금융 서비스(완전히 DeFi처럼 들림)와 같은 몇 가지 잠재적인 응용 프로그램을 예측합니다.

보조 제목

Why I‘m interested in Bitcoin—— Chris Dixon

한 줄 요약: 비트코인은 금융 인프라를 혁신할 수 있습니다.

마지막 기사가 게시된 지 10일 후 Chris Dixon은 비트코인에 관심을 갖게 된 이유를 밝혔습니다. 어떤 사람들은 비트코인이 단순히 자유주의자들의 지원 때문에 뜨겁다고 생각합니다. Chris Dixon은 많은 초기 비트코인 지지자들이 자유주의자이며 많은 중요한 컴퓨팅의 움직임은 이데올로기에 의해 뒷받침됩니다.

그는 비트코인의 궁극적인 목표가 연방 준비 제도 이사회를 대체하는 것이라고 생각하지 않습니다. 그는 기술을 사용하여 금융을 변화시키려면 기존 기반 위에 새로운 서비스를 구축할 뿐만 아니라 완전히 재건해야 한다고 생각합니다. 새로운 시스템과 새로운 질서.

그는 처음에 비트코인이 투기 거품이자 인터넷 금이라고 생각했지만 갑자기 비트코인이 전체 결제 산업을 재건하고 있음을 깨달았고 그는 소액 결제의 적용에 대해 매우 낙관적입니다.

그는 마지막으로 기술이 금융을 개선할 수 있는 유일한 방법은 기존의 다른 시설에 의존하지 않는 새로운 서비스를 재구축하는 것이라고 강조했습니다.

첫 번째 레벨 제목

2014년: 비트코인 문제

보조 제목

한 줄 요약: 비트코인은 파괴적입니다.

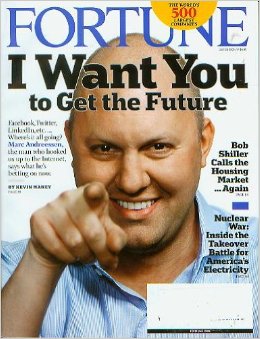

갑자기 나타난 것처럼 보이지만 실제로는 거의 익명의 연구원들이 20년 동안 집중적으로 연구 개발한 결과인 신비한 신기술이 등장했습니다. 다른 한편으로, 기술자, 괴짜들은 그것에 의해 석화됩니다. 그들은 그것의 엄청난 잠재력을 보고 밤과 주말 내내 그것을 만지작거립니다. 결국 주류 제품, 회사 및 산업이 그것을 상용화하기 위해 등장하고 그 영향은 광범위해졌습니다. ; 그리고 나중에 많은 사람들이 처음부터 그 강력한 약속이 그렇게 분명하지 않은 이유를 의아해했습니다.” Marc Andreessen은 어떤 기술에 대해 이야기했습니까?

1975년 개인용 컴퓨터, 1993년 인터넷, 2014년 비트코인.

Marc Andreessen,웹을 진정으로 이해하는 사람(a16z 창립 외에도 그는 Mosaic을 작성하고 Netscape를 시작했습니다)은 비트코인 기술에서 혼란, 탈중앙화, 네트워크 효과 및 기존 질서의 재구성을 보았습니다.

첫 번째 레벨 제목

2016년: 이더리움 등장

보조 제목

한 줄 요약: 이더리움은 투자하기에 더 가치 있는 암호화폐가 될 것입니다.

Fred Ehrsam은 비트코인에서 이더리움으로 관심을 집중시켰습니다.비트코인의 디자인은 너무 완벽하고 어떤 변경도 불필요한 것 같으며 지갑과 교환을 제외한 진정한 완전한 응용 프로그램은 비트코인에서 태어날 수 없습니다.Ethereum Fang은 완전한 컴퓨팅 환경을 제공할 수 있습니다. 블록체인에서 수많은 애플리케이션을 지원합니다.Fred는 이더리움에 설립된 DAO 조직이 기사가 게시된 지 한 달 만에 공격을 받아 이더리움 포크로 이어진 것을 언급했습니다.

Crypto의 선구자 인 Bitcoin은 Ethereum의 탄생을 이끌었습니다.Bitcoin의 "스마트 계약"에 비해 Ethereum의 스마트 계약은 사용하기 쉽고 개발하기 쉽고 커뮤니티가 더 번영합니다.동시에 Fred는 또한 Ethereum 개발자의 핵심은 Bitcoin보다 건강하고 커뮤니티 정신은 더 겸손하며 방향은 더 일관성이 있다고 지적했습니다.

이러한 장점 외에도 Fred는 이더리움의 몇 가지 잠재적 위험도 언급했습니다. 자금 규모가 비트코인만큼 높지 않고 아직 거버넌스 위기(기사가 게시된 지 한 달 후 경험)를 경험하지 않았기 때문입니다. 기능이 더 복잡하고 위험이 더 크며 합의가 PoS로 변경될 수 있으며(비록 5년 후에도 변경되지 않음) 네트워크 확장이 매우 어렵습니다(이 문제는 다양한 Layer2에서 천천히 해결됨).

Fred는 이더리움과 비트코인이 경쟁적이거나 보완적인지에 대해 결론을 내리지 않았습니다. 그는 이더리움이 큰 잠재력을 가지고 있다고 믿으며 특정 체인에 "충실"하지 않으며 세상에 가장 큰 이익을 가져다주는 모든 것을 원합니다.

Fred는 마침내 Crypto의 변화 속도가 가속화되고 있다고 결론을 내렸습니다. Crypto의 비전은 전 세계를 위한 더 나은 거래 네트워크를 만들기 위해 매우 큽니다. Crypto는 인터넷 자체와 마찬가지로 제품을 판매하는 회사가 아니라 일련의 회사입니다. 언젠가는 모든 사람을 연결하게 될 것입니다 개인적인 동의 인터넷처럼 발전하는 데 시간이 더 걸리겠지만 그 영향은 엄청날 것입니다.

또한 그는 1년 후인 2017년에 기사를 썼는데 주요 내용은 다음과 같습니다.블록체인은 메타버스의 기본 레이어입니다.

보조 제목

원라이너: 프로토콜 > 애플리케이션.

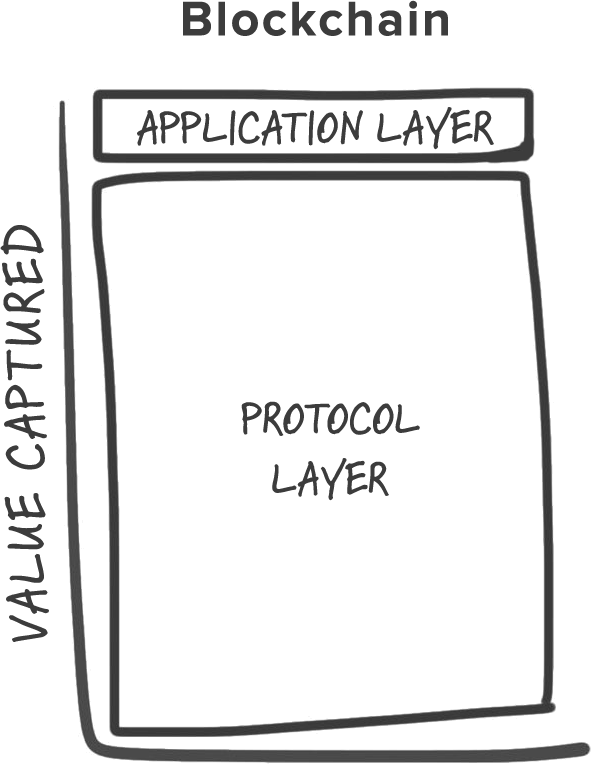

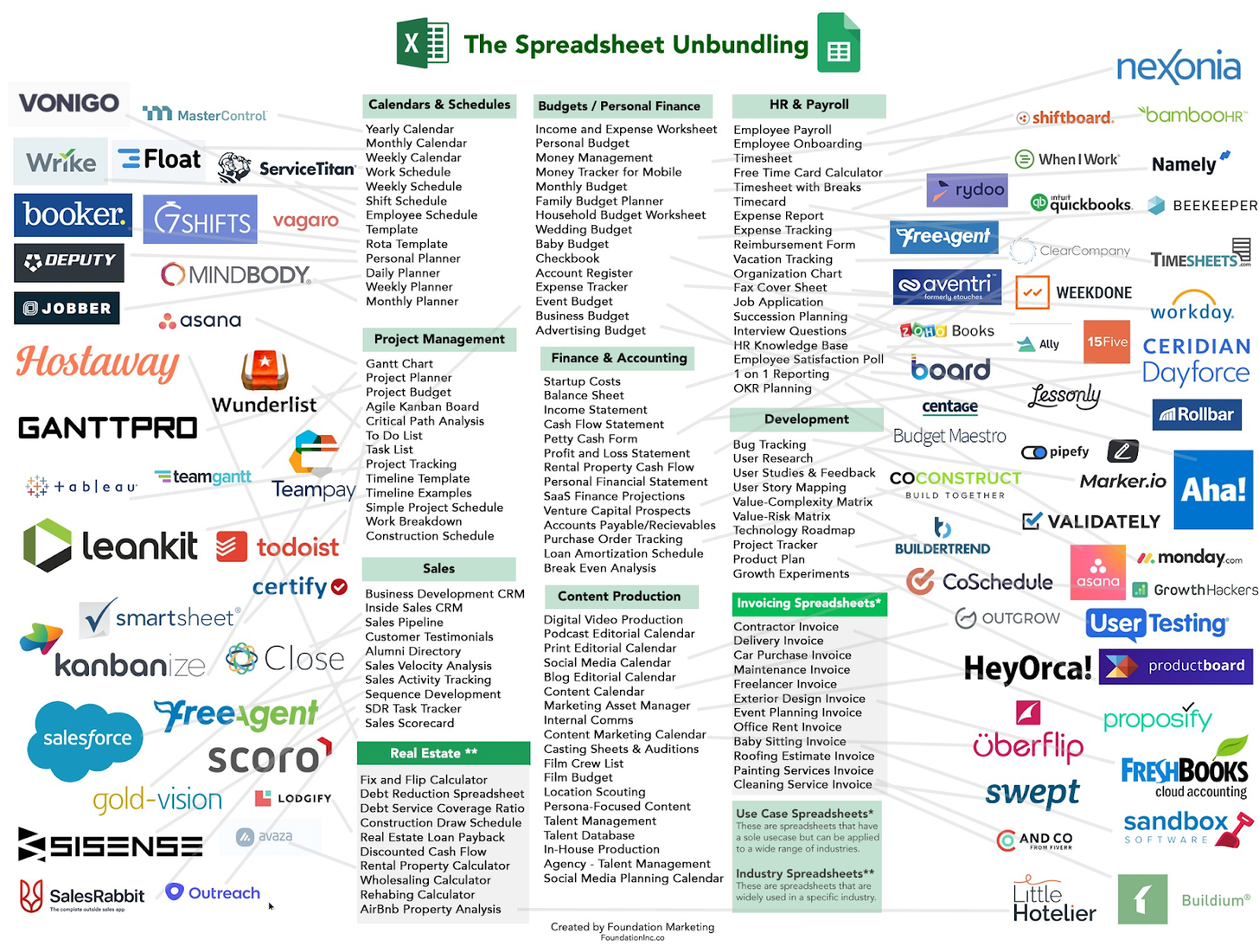

Joel Monegro는 Fat Protocols 기사에서 관점, 즉 Web2 구조에서 프로토콜 기반 응용 프로그램의 가치는 매우 큰 반면 프로토콜의 가치는 작으며 이러한 상황은 블록체인에서 역전될 것이라고 논의했습니다.

블록체인의 프로토콜 계층의 가치는 더 큰 비율을 차지하며 프로토콜 간의 개방성, 데이터 공유 및 상호 운용성을 크게 향상시킵니다.예를 들어 비트코인 및 이더리움과 같은 프로토콜(물론 1~2년 후에 Uniswap 및 AAVE 등)이 온체인 응용 프로그램보다 더 가치가 있고 응용 프로그램이 더 성공적이며 사람들은 이 계약의 잠재력이 아직 발견되지 않았다고 느낄 것입니다.토큰 경제는 그것에 매우 긍정적인 역할을 했습니다.투자자들은 프로토콜의 투기적 행동은 프로토콜의 애플리케이션 생태계를 더욱 번영하게 만들 것입니다.

첫 번째 레벨 제목

2017: 암호화 및 토큰

올해의 사고 경향은 특히 강렬합니다.이 기사에서는 각 기사를 간략하게 요약 할 것입니다.시간이 있으면 집중적으로 읽고 지식을 얻을 수 있습니다.

추가 기사:

보조 제목

Value of the Token Model—— Fred Ehrsam

한 줄 요약: 토큰 가치는 거버넌스, 통화 정책 및 인센티브 조정에 반영됩니다.

Fred Ehrsam은 이 게시물에서 토큰 모델의 가치를 탐구합니다.

그는 토큰의 가치가 주로 거버넌스, 통화 정책 및 조정 인센티브에 반영된다고 믿습니다.

동시에 그는 초기 인터넷 스타트업처럼 일부 토큰은 의미가 없으며 1개의 큰 성공마다 3개의 작은 성공과 100개의 실패가 있을 것이라고 지적했습니다.

첫 번째 레벨 제목

보조 제목

One-liner: Token > Equity.

Balaji Srinivasan은 기사 시작 부분에서 처음으로 지적했습니다: 토큰은 자산이 아니지만 유료 API 키와 유사합니다.전통적인 자금 조달 방법과 비교할 때 토큰은 더 높은 유동성, 더 많은 청중을 나타내며 일부 새로운 유형의 프로젝트 자금 조달에도 사용됩니다. 공간을 엽니다.

그런 다음 그는 2017년부터 토큰이 점점 더 성공할 이유를 설명했습니다.

4년간의 인프라 구축으로 견고한 기반 마련

토큰은 블록체인 기본 통화보다 더 다양하고 유연합니다.

토큰 구매자는 실제로 개인 키를 구매하고 있습니다(전통적인 방법보다 더 개인적이고 안전함).

토큰은 유료 API와 유사합니다(특정 서비스에 대한 액세스를 나타냄).

토큰은 신생 기업뿐만 아니라 모든 신기술(오픈 소스 조직, 소규모 프로젝트, DAO)을 위한 자금 조달 모델입니다.

기존 금융과 비교할 때 토큰은 희석할 수 없습니다.

모든 미국인은 토큰을 살 수 있습니다

웹 서핑을 하는 사람은 누구나 토큰을 살 수 있습니다.

토큰 유동성이 특히 좋습니다

토큰은 자금 조달을 분산시킬 것입니다

토큰 모델은 무료보다 더 나은 비즈니스 모델이므로 초기 사용자가 혜택을 얻을 수 있습니다.

인터넷의 블로거가 실제로 새로운 시대의 저널리스트인 것처럼 토큰 구매자는 실제로 투자자입니다.

토큰은 기술을 비즈니스보다 앞서게 합니다.

토큰은 보유자 자신이 직접 규제합니다.

토큰은 지불 또는 일부 VIP 서비스에 사용될 수 있습니다.

보조 제목

Crypto Tokens: A Breakthrough in Open Network Design —— Chris Dixon

원라이너: 토큰은 공용 네트워크에 필요한 디자인이 될 것입니다.

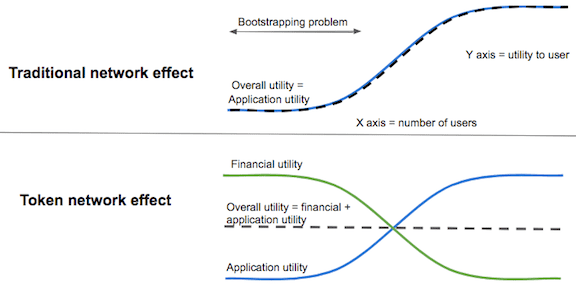

Chris Dixon은 비트코인과 이더리움의 토큰에서 이 기사의 토큰의 역할에 대해 이야기합니다. 토큰은 공개 서비스를 관리하고 자금을 지원할 수 있으며, 네트워크 참여자 간에 인센티브를 조정하고, 토큰의 네트워크 효과는 전체 시스템이 긍정적인 순환을 가져옵니다.

보조 제목

보조 제목

Analyzing Token Sale Models—— Vitalik Buterin

원라이너: 좋은 토큰 모델이 중요합니다.

Vitalik Buterin은 기사에서 여러 프로젝트의 토큰 모델을 분석했는데, Vitalik은 Maidsafe, Ethereum(제가 직접 분석했습니다), BAT 및 Gnosis를 예로 들어 몇 가지 좋은 토큰 판매 모델을 요약했습니다. 3. 모금액 제한 4. 중앙 은행 없음 5. 판매 효율성

보조 제목

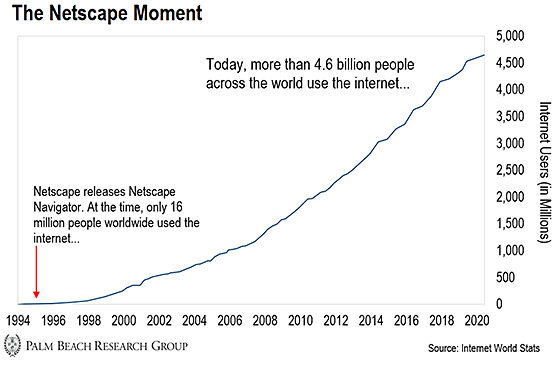

Cryptocurrency’s Netscape Moment —— Elad Gil (Solo Capitalist)

한 줄 요약: 2017년은 Crypto의 Netscape 순간이었습니다.

기사 Crypto's Netscape moment에서 Elad Gil은 2017년 ICO 붐을 Netscape의 IPO와 인터넷 시대 및 암호화 시대의 진정한 시작으로 비교합니다.

보조 제목

Permissionless —— Alok Vasudev

원라이너: Permissionless는 매우 중요합니다.

Alok Vasudev의 이 글은 매우 짧습니다.그의 요점은 블록체인과 크립토의 Permissionless가 그들 중 가장 흥미로운 기능이라고 느끼게 만든다는 것입니다.

Linux는 Permissionless, Web은 Permissionless, PC는 Permissionless 반대로 모바일 애플리케이션은 Apple, Google의 Permission이 필요하고 VR은 Facebook, HTC, Sony의 Permission이 필요 AI는 알고리즘 수준에서 Permissionless이지만 학습 데이터는 독점에 의해 통제됩니다.

첫 번째 레벨 제목

보조 제목

One-liner: DAO > Firm.

Nick Tomaino는 이 기사에서 관점을 설명했는데, 즉 비트코인이 이끄는 일부 프로젝트는 실제로 오픈 소스 분산 조직(DAO 및 오픈 소스 개발 조직 등)의 개념을 도입했습니다.금융 시스템을 전복하는 것 외에도 Satoshi Nakamoto는 생성된 비트코인은 또한 기업 형태를 혼란에 빠뜨릴 것입니다.

경제학자들은 일반적으로 기업이 거래 비용을 최소화하고 자본과 인력을 모으는 두 가지 주요 이유로 존재한다는 데 동의합니다. 지원하지만 코드(조직 규칙)와 인센티브(토큰)를 통해 채굴자, 개발자, 사용자를 포함한 참여자가 모여 함께 가치를 창출합니다.

비트코인은 기업의 장점(거래 비용 최소화, 풀링 및 공유 자본, 기여자의 직업 안정)을 가진 조직 구조의 첫 번째 예이며, 분산된 소유권, 통제되지 않은 데이터 및 의사 결정의 견제와 균형의 장점- 비트코인은 사람들에게 세계적인 규모로 돈을 벌 수 있는 기회를 제공하고 명확한 인센티브 메커니즘을 확립하여 기업이 달성할 수 없는 새로운 분산 제품(검열할 수 없는 디지털 통화)을 만듭니다.

그러나 이 분산된 조직 구조의 단점도 분명합니다. 분산된 의사 결정이 어렵고 느리고 참가자의 실제 기여도를 측정하기 어렵고 분산은 많은 남용으로 이어집니다...

보조 제목

Big Banks And Blockchain —— Elad Gil

한 줄 요약: 대형 은행은 블록체인을 이해하지 못합니다.

Elad Gil은 이 짧은 기사에서 많은 실제 문제를 폭로했습니다.Crypto가 2013년에 업계의 시야에 들어왔기 때문에 이것이 대형 은행이 블록체인을 다루는 방식입니다(내가 아는 한 2021년까지 여전히 많은 중국 은행과 금융 회사는 여전히 이와 같이):

1. 블록체인 팀을 구성합니다.

2. 블록체인 팀이 프라이빗 체인을 만들도록 하세요. 항상 데모 단계에 있습니다.

3. CEO가 블록체인 팀에 대해 “저희도 저런 블록체인이 있고 전담팀이 있다”고 자랑할 수 있게 해주세요.

Elad는 또한 고객의 요구를 충족시키기 위해 대형 은행들이 Crypto를 사용하여 ETF, 토큰 보관, 헤지 펀드 및 파생 상품 거래소와 같은 제품을 개발하기 시작했으며 은행 및 기타 중개 기관이 Crypto를 점점 더 빨리 채택할 것이라고 결론지었습니다. 빠른.

보조 제목

The Meaning of Decentralization —— Vitalik Buterin

원라이너: 탈중앙화는 내결함성, 공격 방지 및 담합 방지를 의미합니다.

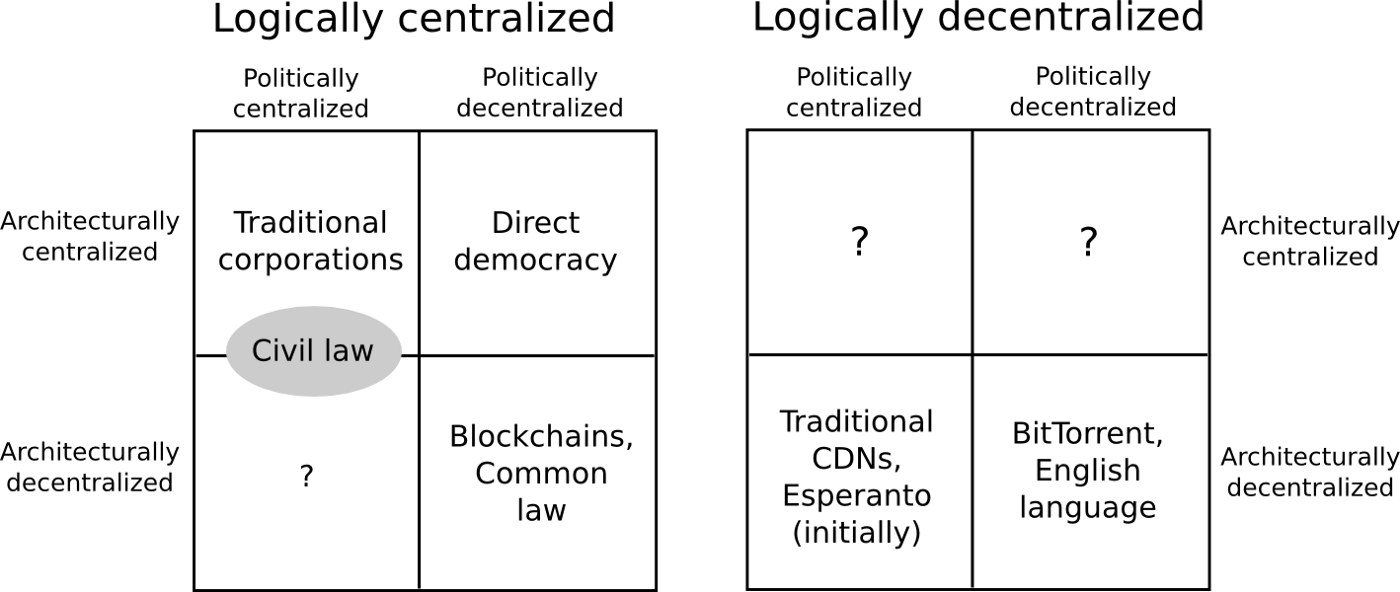

Vitalik은 탈중앙화의 의미에 대해 논의했습니다.소프트웨어의 탈중앙화의 의미를 말할 때 아키텍처, 관리 및 논리 측면에서 고려할 수 있습니다. , 논리적으로 변명과 데이터 구조가 합리적인지 여부를 나타냅니다.

본질적으로 탈중앙화를 위한 중요한 조건은 내결함성, 공격 방지, 담합 방지입니다.

내결함성과 관련하여 블록체인 시스템은 실제로 그것을 진정으로 달성하기 위해 여러 가지 방법으로 분산되어야 합니다.우리는 다중 클라이언트 구현, 민주화된 기술 토론 포럼, 가능한 한 관련 없는 이해 관계를 가진 개발자와 연구원, 마이닝이 필요합니다.알고리즘은 위험을 줄여야 합니다. 중앙화의 위험을 제거하고 하드웨어 중앙화(PoS 사용)의 위험을 제거합니다.

공격 저항의 경우 매우 직관적인 예를 들면 한 사람에게 총을 겨누고 돈을 달라고 하면 돈 없이 죽을 수 있지만 탈중앙화의 경우 10명에게 총을 겨누어야 위협이 된다. 비용은 10배 더 높음 탈중앙화 정도가 높을수록 방어 비용에 대한 공격 비용의 비율이 높아짐 따라서 PoS는 PoW보다 공격 저항이 높음 하드웨어는 탐지 및 공격이 쉽고 토큰은 숨다.

마지막으로 가장 복잡한 것은 담합 방지입니다. 담합 방지의 간단한 예는 독점 금지법입니다. 블록체인에서 담합의 예는 대규모 채굴자가 모여서 대량의 컴퓨팅 성능을 사용하여 무언가를 홍보하는 것입니다. 그러나 블록체인의 장점 중 하나는 개발자가 같은 회사에 있지 않고 같은 방에서 작업하지 않기 때문에 기존 소프트웨어 회사처럼 마음대로 규칙을 수정할 수 없다는 것입니다. .

보조 제목

A beginner’s guide to Ethereum—— Linda Xie

원라이너: 이더리움 소개.

Linda Xie는 이더리움을 시작하는 방법을 가르칩니다. Linda는 비트코인과 이더리움의 유사점과 차이점, 이더리움의 ID와 스토리지, 소셜 미디어, 권한 관리, 회사 관리 및 자금 조달 애플리케이션에 대해 이야기했습니다. 반복하겠습니다.

첫 번째 레벨 제목

보조 제목

Why decentralization matters —— Chris Dixon

원라이너: 탈중앙화가 중요합니다.

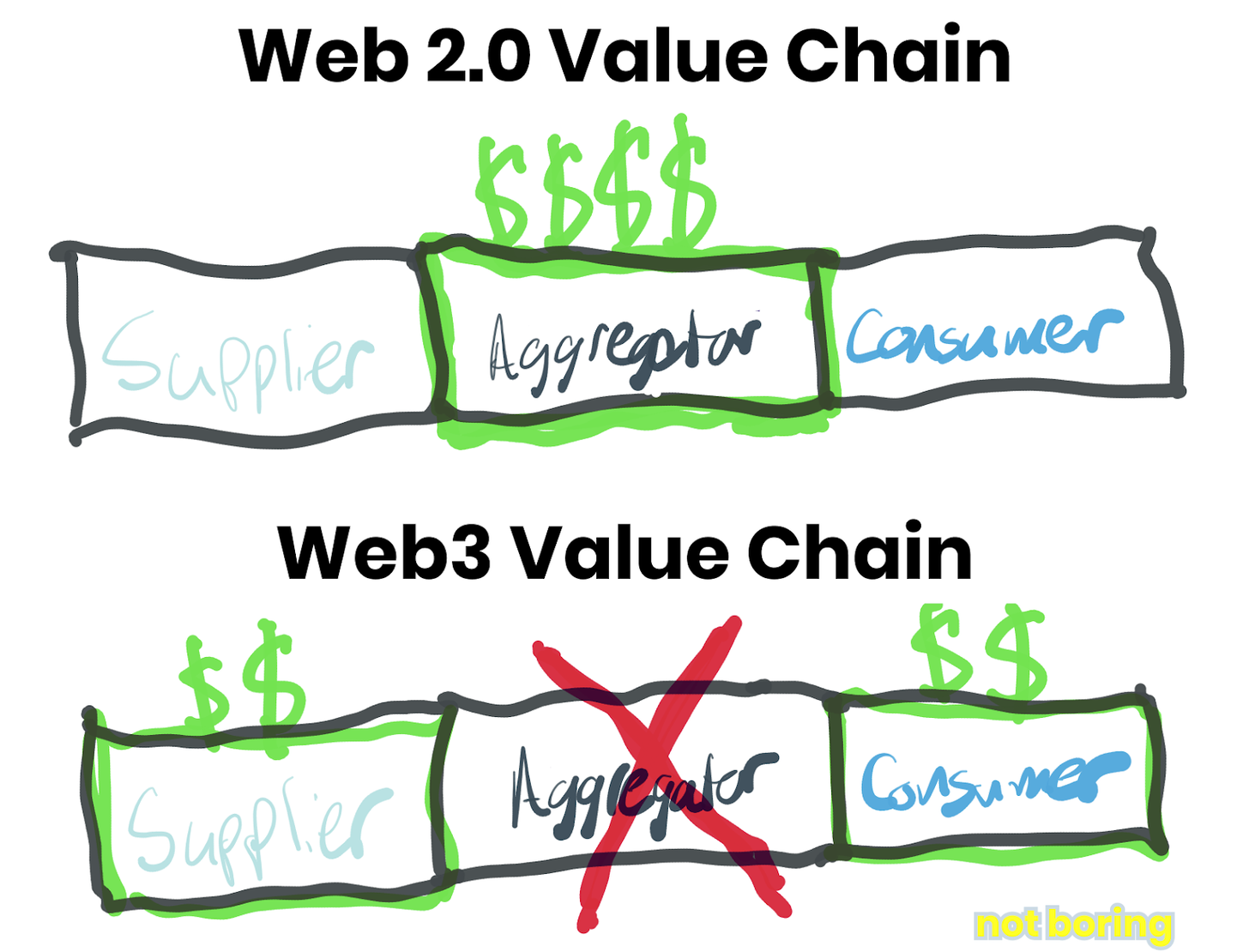

이 글에서 Chris Dixon은 제목이 탈중앙화의 중요성에 관한 것이지만 실제로는 2018년 Web3의 개념에 대해 주로 이야기하고 있습니다.

Web1,1980 - 2000년, 이 서비스는 인터넷 커뮤니티에서 구축한 개방형 프로토콜을 기반으로 구축되었습니다.

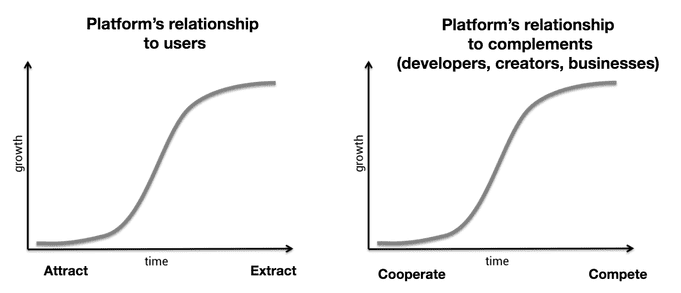

Web2,21세기 초부터 현재까지 영리 목적의 인터넷 회사는 개방형 프로토콜을 훨씬 능가하는 소프트웨어와 서비스를 구축해 왔습니다. 중앙 집중화 서비스 기술은 매우 훌륭하지만 혁신을 억제하고 인터넷의 재미와 활력을 감소시키며 데이터 도용 및 알고리즘 편향을 통해 더 긴장된 사회적 상황을 만듭니다.

“Web3”,완벽한 인센티브 조치를 통해 기술 창의성과 인센티브 설계가 교차하도록 하고 향후 수십 년 동안 기존 Web2 패턴을 다시 파괴하고 대체할 수 있습니다.Crypto 네트워크는 Web1과 Web2의 장점을 결합하여 커뮤니티 거버넌스를 위한 방법을 제공합니다. 중앙 집중식 네트워크 및 중앙 집중식 서비스보다 강력한 서비스 Crypto 네트워크는 블록체인 컨센서스를 사용하여 상태를 업데이트하고 유지하고 Crypto를 사용하여 참여자, 개발자 및 응용 프로그램 사용자에게 인센티브를 제공합니다 Crypto 네트워크는 오픈 소스 코드와 커뮤니티 거버넌스를 사용하여 성장의 분산을 유지하는 방법입니다. 참가자가 퇴장을 원하면 모든 토큰을 직접 판매하거나 포크 프로토콜을 통해 퇴장할 수 있습니다.Crypto 네트워크는 네트워크 참여자가 단결하여 공동으로 네트워크 성장과 토큰 평가를 달성할 수 있도록 합니다.그러나 Crypto 네트워크의 성능 문제는 여전히 병목 현상입니다( 물론 L2 22는 이미 이 문제를 해결할 수 있습니다.)

분산형 네트워크가 승리해야 하고 승리할 것이라고 말하는 것은 서로 다른 것입니다.Chris가 그들이 승리할 것이라고 말하는 진짜 이유는 Web3 개발자가 진정으로 혁신적인 애플리케이션을 구축하기 때문입니다.Crypto 네트워크는 기업가와 개발자의 마음을 사로잡을 것입니다(즉, 실제 커뮤니티가 있을 것입니다. 그리고 사랑의 힘을 생성하는 사람들) 프로토콜이 새로운 기여자를 유치함에 따라 프로토콜의 생태와 성숙도는 기하급수적으로 성장할 것입니다 Crypto 네트워크에 존재하는 여러 긍정적인 주기는 네트워크의 각 역할에 동기를 부여하여 개발 속도를 높입니다 마침내 Crypto 네트워크가 Web2 대기업보다 개발자와 기업에 더 매력적일 때 더 많은 리소스를 동원할 수 있습니다(22년 동안 총 Web3 개발자 수는 Amazon 직원 수보다 훨씬 적음). 대기업의 발전 속도.

보조 제목

And What Has the Blockchain Ever Done for Us? —— Balaji Srinivasan

한 줄 요약: 블록체인은 전복적이었습니다.

Balaji Srinivasan은 당시 블록체인이 수많은 문제를 해결하고 수십억 달러 규모의 시장을 만들었지만 일부 매우 똑똑한 사람들은 여전히 블록체인이 좋지 않거나 전혀 쓸모가 없다고 주장했으며 블록체인이 거품이라고 믿었다고 지적했습니다. , 수명이 짧습니다.

Balaji는 가치가 높은 기술이 정상에 오르는 과정에서 끊임없는 부정성을 경험하는 경우가 많다고 주장합니다. 높은 성장은 높은 변동성과 높은 기대치를 동반하며, 과대 광고 주기와 명백한 과대 평가 기간이 결국 기술이 글로벌 Everywhere가 될 때까지 이어집니다. 그런 다음 새로운 비판 더 이상 유행이나 유용성 부족에 관한 것이 아니라 다음 파괴가 지평선에 나타나고 주기가 완전히 다시 시작될 때까지 불가피한 독점에 관한 것입니다.

당시 블록체인은 이미 디지털 금, 국제 전신 송금 및 크라우드 펀딩 분야에서 최소 30억 달러 부문에서 10배 개선을 제공했습니다.

보조 제목

Stablecoins: designing a price-stable cryptocurrency—— Haseeb Qureshi (Dragonfly Capital GP)

원라이너: 이상적인 스테이블 코인은 없습니다.

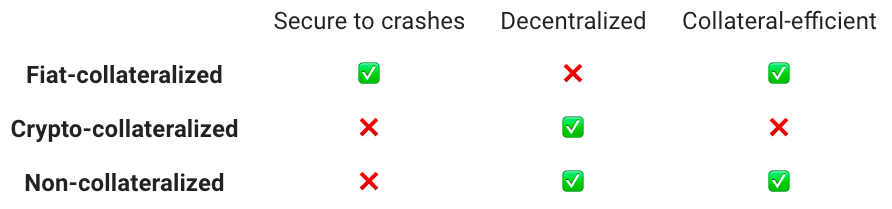

Haseeb Qureshi는 유용한 돈이 교환의 매개체, 계정 단위 및 가치 저장소인 통화여야 한다고 말했습니다. 미국 달러와 같은 안정적인 자산에.

스테이블 코인은 항상 안정적일 수는 없지만 일정 범위의 시장 행동 내에서 안정적으로 유지될 수 있습니다. 스테이블 코인은 20년만 있어도 안정적이라고 할 수 있습니다. 스테이블 코인은 주로 네 가지 측면에 따라 달라집니다: 얼마나 변동성을 견딜 수 있습니까? 시스템을 유지하는 데 얼마나 많은 어려움이 있습니까? ?변동폭 분석이 쉬운가? ?죽음의 나선으로 이어질지 여부를 판단하기 위해서는 후자의 두 가지가 매우 중요하다 이상적인 스테이블코인은 엄청난 시장변동을 견딜 수 있어야 하고, 유지비용이 지나치게 높지 않아야 하며, 안정성이 높아야 한다. 매개변수는 분석하기 쉽고 트레이더와 차익 거래자에게 투명해야 합니다.

스테이블 코인을 설계하는 방법 스테이블 코인의 분류에는 명목 담보 코인, 토큰 담보 코인 및 비담보 코인의 세 가지 범주가 있습니다.

피아트 담보 통화: 100% 안정적이고 가장 단순하며 체인은 공격을 받지 않지만 중앙화되고 청산이 번거롭고 규제가 심하며 투명성을 유지하기 위해 정기적인 감사가 필요합니다.

Oken 모기지 통화: 더 분산되고 저렴한 청산, 매우 투명하고 레버리지를 사용할 수 있지만 급락 시 자동으로 청산되며 가격이 가장 안정적이지 않고 토큰과 높은 상관 관계가 있으며 자본 효율성이 낮고 가장 복잡합니다.

Non-mortgage 통화: 담보가 필요하지 않고 대부분이 탈중앙화되어 있으며 다른 자산과 관련이 없지만 지속적으로 성장해야 하고 거시적 영향을 받기 쉽고 안정성을 분석하기 어렵고 어느 정도의 복잡성이 있습니다. .

Hasseb은 이상적인 스테이블 코인은 다음과 같아야 한다고 믿습니다. 이상적인 스테이블 코인은 없습니다. 승자를 조기에 선택하려고 하는 대신 더 많은 스테이블 코인 실험을 장려해야 합니다. 크립토는 미래를 예측하기 어렵다는 것을 가르쳐 주었습니다.

첫 번째 레벨 제목

보조 제목

Yes, You May Need a Blockchain —— Balaji Srinivasan

원라이너: 블록체인은 웹을 위한 더 나은 데이터베이스입니다.

Balaji는 데이터베이스 관점에서 블록체인의 중요성을 설명했습니다. 일부 개발자는 블록체인이 단지 나쁜 데이터베이스일 뿐이라고 말합니다. 고성능의 성숙한 PostgreSQL을 사용하지 않는 이유는 무엇입니까? 회의론자들은 블록체인이 느리고 느리다고 생각합니다. 멍청하고 비쌉니다. 데이터베이스.

Balaji는 퍼블릭 체인이 대규모 다중 클라이언트 데이터베이스이며 각 사용자는 루트 사용자이며 이러한 데이터베이스는 특히 이 데이터가 돈과 같이 가치가 있을 때 사용자 간에 공유 상태를 저장하는 데 유용하다고 반박했습니다.

보조 제목

The future of decentralized finance—— Linda Xie

한 줄 요약: DeFi는 금융의 미래입니다.

Linda Xie가 DeFi의 미래에 대해 이야기합니다. DeFi는 기존의 많은 금융 시스템(예: 대출, 대출, 파생 상품)을 재창조하는 것을 목표로 하지만 종종 자동화되는 방식으로 중개인을 제거합니다. DeFi가 다루게 될 방향 중 일부 기사뿐만 아니라 몇 가지 가능한 가능성.

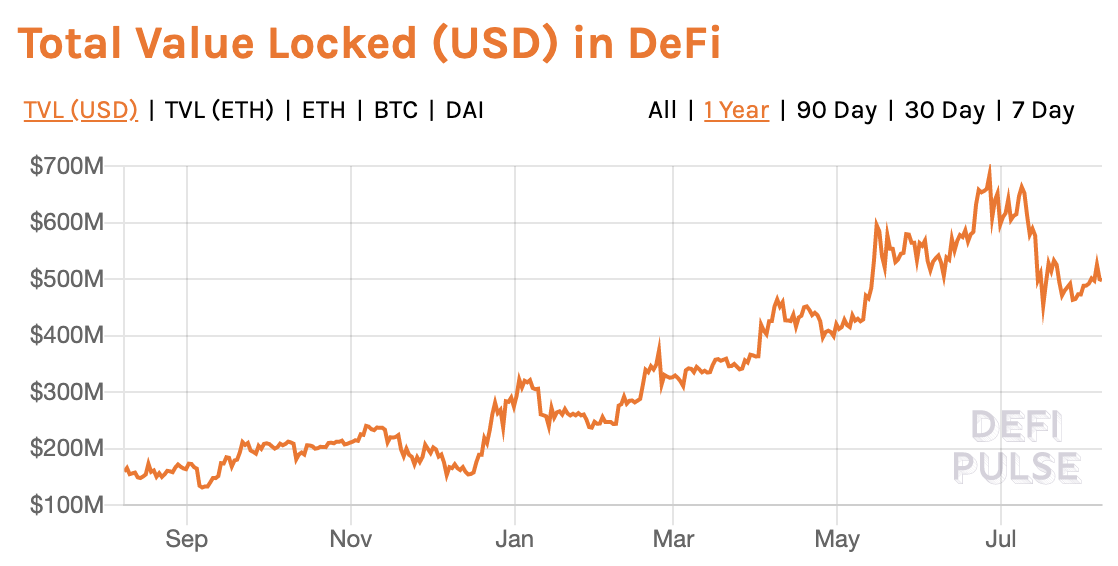

담보: DeFi에 대한 주요 불만 중 하나는 대출을 받기 위해 과도한 담보가 필요하다는 것입니다. 누가 그렇게 많은 자본을 잠그고 싶겠습니까? 5억 달러가 [잠겼습니다](https://defipulse.com/ ) (오늘 링크 클릭하시면 750억이라고 보실 수 있습니다) 활용이 필요하다는 것을 알 수 있습니다. DeFi와 관련된 DID 및 평판 시스템이 없었습니다.더 나은 신원 및 평판 시스템이 있으면 담보 요구 사항이 떨어집니다(Lens Protocol?).

구성 가능성: DeFi의 가장 독특한 측면 중 하나는 레고 조각을 서로 연결하여 완전히 새로운 콘텐츠를 생성할 수 있는 구성 가능성입니다.

자산: Linda는 비트코인과 같은 자산의 토큰화된 버전을 DeFi에 도입하는 것을 좋아합니다.그녀는 전통적인 투자자가 토큰화된 형태로 다양한 자산을 대표하고 DeFi 작업을 수행할 것이라고 상상합니다.

위험: Linda는 DeFi가 계약의 구성 가능성과 다양한 새로운 계약으로 인한 복잡성을 수반하기 때문에 DeFi가 매우 위험하다고 생각합니다.또한 담보 가격이 하락할 위험과 향후 감독의 위험이 있습니다.그녀는 어느 정도의 탈중앙화가 가능하다고 생각합니다. 일부 위험을 헤지하기 위해 특화된 보험 상품을 사용하십시오.

보조 제목

The Pseudonymous Economy—— Balaji Srinivasan

한 줄 요약: 가명 경제가 중요합니다.

이 강연에서 Balaji는 가명 경제(익명 경제가 아님)에 대해 이야기합니다.가명은 Discord 및 Reddit에서 귀하의 정체성과 같습니다.

그는 현실 세계에서 사람에게 가명의 중요성을 탐구합니다. 은행 계좌는 자산을 저장하고, 실제 신원은 신용과 평판을 저장하며, 은행 계좌는 본인만 변경할 수 있지만 신원 평판은 귀하를 제외한 모든 사람에게 있습니다. 결정하다.

Balaji는 사람의 자산, 발언, 신원이 독립적으로 분리되어야 한다고 생각합니다 그는 Twitter를 예로 들어 사람들의 평판(팬 등)이 자산과 마찬가지로 영지식 증명을 통해 가명 신원으로 이식될 수 있음을 설명했습니다. 전송만큼 쉬움 이것은 프라이버시와 평판의 균형을 달성하여 신원과 평판을 성공적으로 분리할 수 있습니다.

첫 번째 레벨 제목

보조 제목

Credible Neutrality As A Guiding Principle —— Vitalik Buterin

단언: 신뢰할 수 있는 중립성은 매우 중요합니다.

Vitalik Buterin은 신뢰할 수 있는 중립성의 중요성에 대해 논의합니다. 사람들은 정부 조치, 프로젝트 토큰 배포, 검열 및 이데올로기에 대해 불안해합니다. 이것은 실제로 신뢰할 수 있는 중립성의 부족으로 인한 불안감입니다. 새로운 메커니즘이 필요합니다(알고리즘과 인센티브 ) 신뢰할 수 있는 중립성을 보장합니다.

중립은 실제로 단순히 공정으로 이해할 수 있지만 중립과 공정은 결코 완전하지 않으며 신뢰할 수 있는 중립은 물론 신뢰할 수 있어야 합니다.

신뢰할 수 있는 중립 건설은 다음 속성을 충족해야 합니다.

1. 특정 사람이나 특정 결과를 메커니즘에 작성하지 마십시오(입력은 하드 코딩된 규칙이 아닌 참가자의 입력이어야 함)

2. 오픈 소스 및 공개 검증 가능(영지식 증명은 이를 잘 이해하고 프라이버시를 잘 보호함)

3. 단순하게 유지(이것이 가장 복잡함)

4. 자주 바꾸지 않는다

신뢰할 수 있는 중립성의 효과도 매우 중요합니다. 우리의 모든 창작물은 신뢰할 수 있는 중립성뿐만 아니라 효과적이어야 합니다. 우리의 물건은 실제로 사용 가능하고 문제를 해결해야 합니다.

보조 제목

A Beginner’s Guide to Decentralized Finance (DeFi)—— Sid Coelho-Prabhu

원라이너: DeFi 소개.

이 기사는 DeFi에 대한 기본 지식에 대한 매우 상세하고 명확한 소개이자 입문 매뉴얼입니다.

보조 제목

한 줄 요약: 소유권 경제는 웹의 차세대 큰 내러티브입니다.

Jesse Walden은 이 기사에서 소유권 경제에 대해 이야기했습니다.Variant Fund의 투자 논리도 소유권 경제에 초점을 맞추고 있습니다.그는 소유권 경제가 Crypto 및 소비자 소프트웨어의 차세대 프론티어라고 믿습니다.

오늘날 대부분의 플랫폼은 사용자가 소유하지 않습니다.가치 창출에서 개인의 역할이 더욱 보편화됨에 따라 인터넷의 다음 진화 방향은 사용자가 만들고 운영하고 자금을 조달할 뿐만 아니라 사용자가 소유하는 소프트웨어로 향할 것입니다. .

소유권은 사용자가 제품에 더 깊이 기여할 수 있는 강력한 인센티브이며, 시간이 지남에 따라 제품이 사용자와 더 잘 일치하도록 돕고 플랫폼이 성장하고 창의성을 더욱 유지하여 네트워크 효과를 구축할 수 있도록 합니다.

IP, HTTP, HTML, RSS에 이르기까지 BitTorrent(데이터 유통의 혁신) 프로토콜의 혁신은 파괴로 가득 차 있다. BitTorrent가 데이터 패킷을 배포하는 것과 동일한 방식으로 소유합니다.

비트코인과 이더리움의 성공의 핵심은 사용자 소유권입니다.채굴자, 사용자 및 개발자는 플랫폼을 진정으로 소유하고 가치를 얻을 수 있습니다.토큰의 경제적 인센티브는 프로토콜의 개발을 빠르게 합니다.소유 경제의 대표적인 대표자는 Celo입니다. , 바이낸스, 컴파운드, 유니스왑, 레딧 등

보조 제목

Bitcoin for the Open-Minded Skeptic —— Matt Huang

한 줄 요약: 비트코인은 완벽하지 않습니다.

Matt Huang은 비트코인에 대한 대중의 의문점을 설명했습니다.우선 변증법적 사고를 지속해야 하며 막다른 골목으로 파고들지 않고 사물의 반대편을 볼 수 없습니다.비트코인은 10년 이상 개발되었지만 투자자들은 돈 많이 벌었네 그릇이 꽉 찼는데 아직도 논란이네.

이 시대에 비트코인이 필요한 이유는 새로운 금융 시스템이 필요하기 때문입니다. 돈의 개념은 인간 마음의 가장 위대한 발명품입니다(다른 하나는 쓰기입니다). 돈의 주요 기능은 가치를 저장하는 것이므로 구매력을 제공합니다. 시간과 지리적 위치에 걸쳐 금은 오랫동안 가치 저장 수단으로 여겨져 왔습니다 지폐와 미국 달러의 지배력은 주로 정부에 대한 신뢰에 달려 있습니다.

분산된 자산으로서 비트코인은 금의 희소성, 통화의 특성 및 디지털 전송 가능성을 결합하고 큰 가치 저장 잠재력을 가지고 있습니다. 아직 강조 표시됨) 게다가 비트코인은 디지털이고 프로그래밍이 가능하며 검열에 강합니다.

금융 거품으로서의 비트코인도 말이 됩니다. 거품 자산은 내재가치가 과대 평가된 자산이므로 모든 통화 자산은 거품 자산이며 금도 거품 자산입니다. 통화는 결코 터지지 않는 거품, 법정 통화로 상상할 수 있습니다. , 금이나 비트코인의 가치는 집단적 믿음에 달려 있습니다.

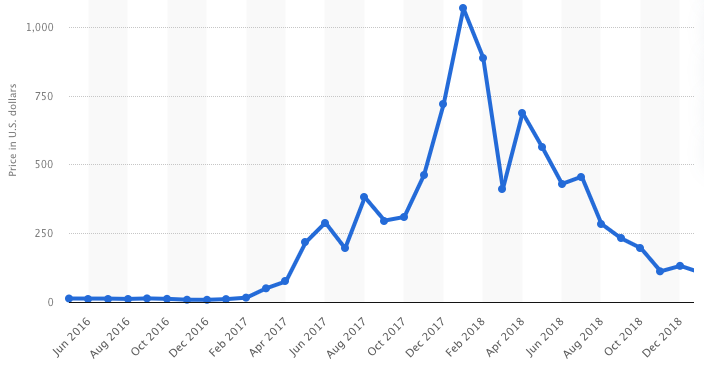

비트코인의 11년 역사에는 네 가지 거품이 있었습니다.

- 2011년: 1 → 31 → $2

- 2013년: 13 → 266 → $65

- 2013~2015년: 65 → 1242 → $200

- 2017~2018: 1000 → 19500 → 3500 USD

거품이 터질 때마다 믿음이 넓어지고 미래의 가치 저장 수단으로서 비트코인의 잠재력이 확장됩니다.그러나 비트코인에는 광범위한 수용, 변동성, 규제, 기술적 위험, 경쟁적 위험, 알려지지 않은 많은 위험이 있습니다.

보조 제목

Creators, Communities, and Crypto—— Fred Ehrsam

한줄: 제목이 잘 요약되어 있습니다.

Fred Ehrsam, Blake Robbins,Jesse Walden은 제작자 및 커뮤니티와 함께 Crypto에 대해 논의합니다.

그들의 좋은 점 중 일부는 다음과 같습니다.

- 사람들은 실제 제품을 제공하는 대신 아이디어를 추측하고 있습니다.

- 팬 사회 활동과 경제적 인센티브는 차세대 인터넷의 중요한 부분입니다.

- 비트코인은 본질적으로 금융이지만 무엇보다도 사회적 커뮤니티입니다.

- 크리에이터 경제를 금융화하는 것은 탐구할 가치가 충분히 있습니다.

- 명성은 특히 알고리즘 세계에서 자체 강화 현상입니다.

- 크리에이터들은 크라우드 펀딩이 아닌 유통으로 시작할 가능성이 높습니다.

- 불완전한 원형을 갖는 것은 사람들이 새로운 패러다임에 적응하도록 돕는 정신적 버팀목입니다.

보조 제목

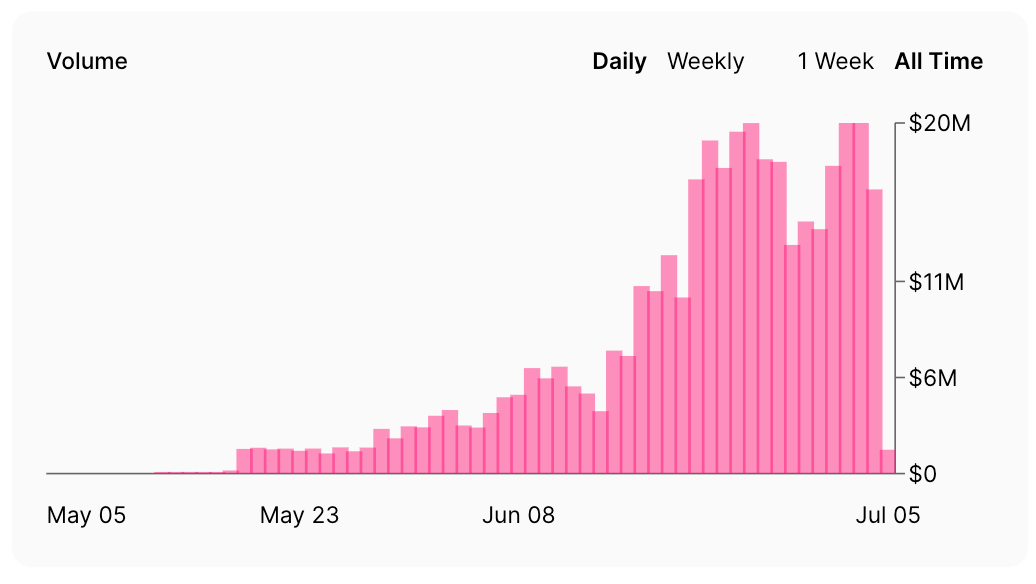

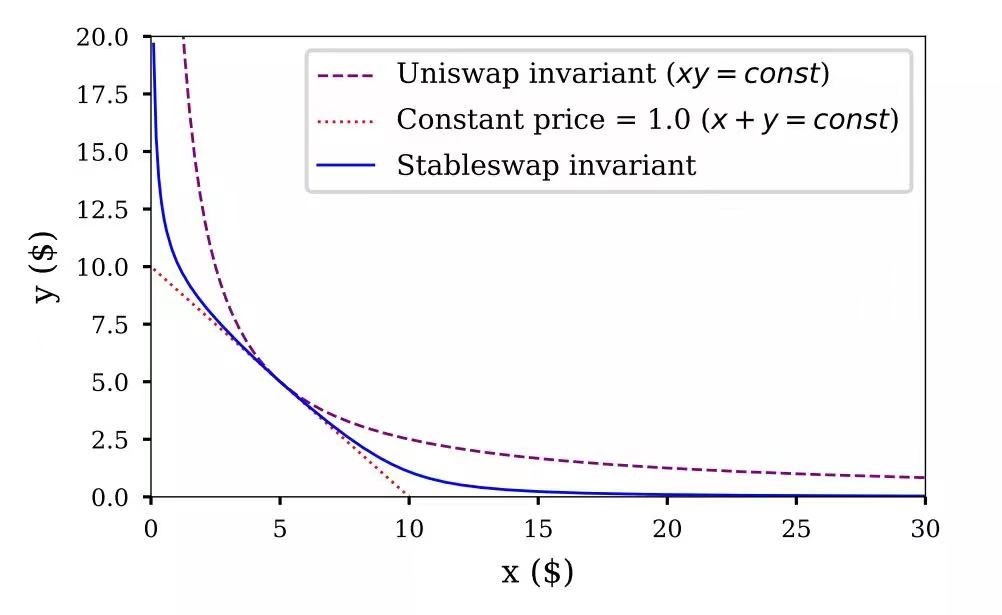

What explains the rise of AMMs?—— Haseeb Qureshi

한 줄 요약: AMM은 좋은 임시 디딤돌입니다.

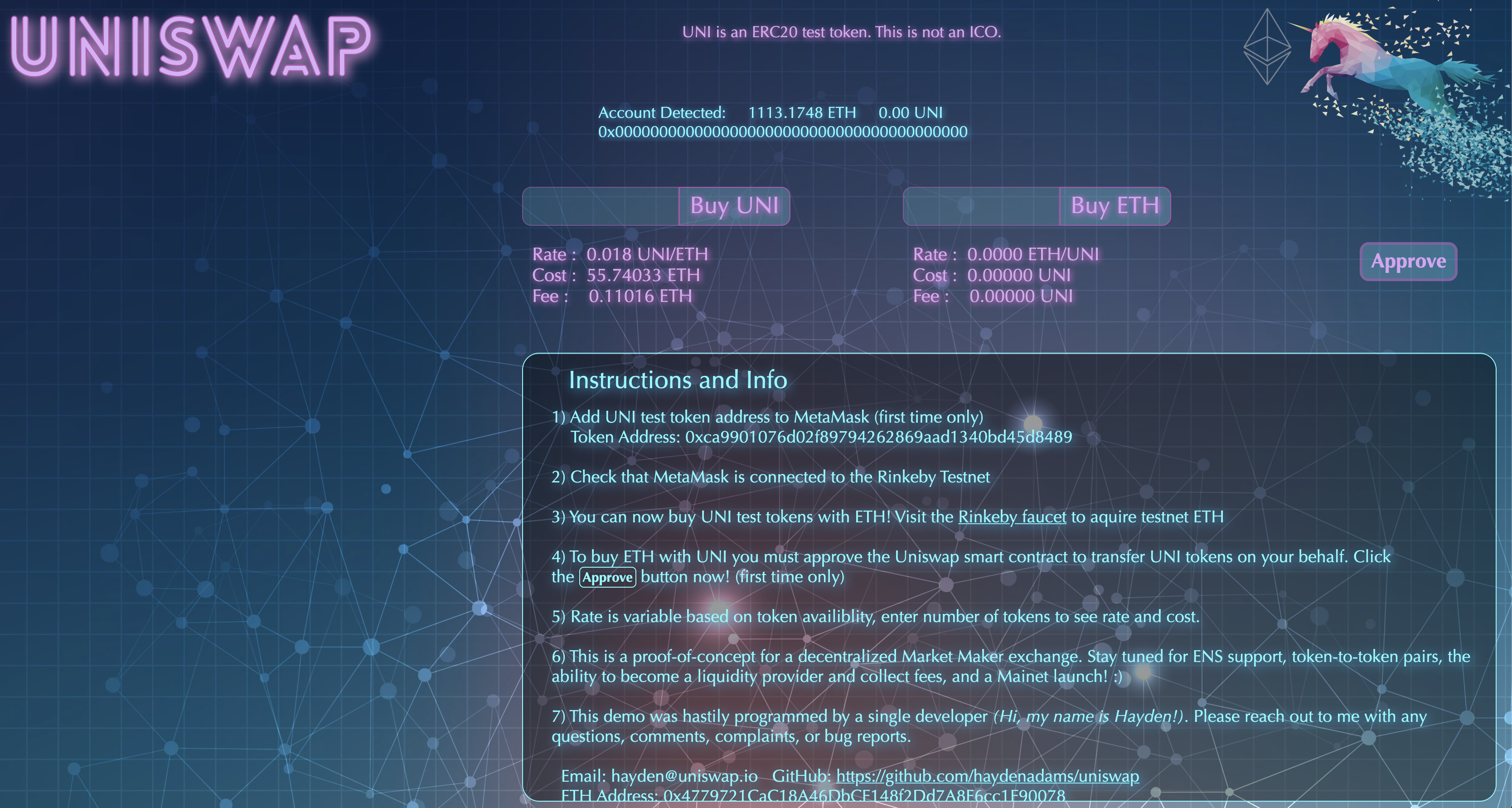

본질적으로 Uniswap은 x * y = k인 어리석은 시장 조성 로봇이지만 이미 세계에서 가장 큰 DEX입니다.

유니스왑의 원리는 실제 환율에서 조금이라도 벗어나면 차익거래자들이 환율을 정상으로 되돌린다는 것입니다 유니스왑의 또 다른 어리석은 점은 비영구적 손실입니다 풀은 수수료를 통해 돈을 벌지만 비영구적 손실, 수요는 당신을 위해 일하지만 당신에게 불리하게 일을 퍼뜨립니다.

간단한 300줄의 코드로 Uniswap은 DeFi에서 인기를 얻었습니다. 무허가 방식을 사용하여 누구에게나 서비스를 제공하고 오라클이 필요하지 않습니다. Uniswap 이후에는 고유한 장점을 가진 고유한 후손들이 많이 있습니다. .

Uniswap은 소매와 차익 거래를 구분할 수 없습니다.어떤 시장 상황에서도 x * y = k를 준수합니다.예를 들어 Uniswap과 같은 가장 간단한 CFMM은 운영, 통합 및 인건비 .컨트랙트를 전개하면 자동으로 실행되며 계산비용과 가스비도 사용자가 부담한다.(점프트레이딩보다 훨씬 낫다.) 그런 상황이라면 점프트레이딩 80%면 충분하다. .

보조 제목

Ethereum is a Dark Forest —— Dan Robinson and Georgios Konstantopoulos

한 줄 요약: 이더리움의 MEV는 만만치 않은 포식자입니다.

이더리움은 모든 종류의 정점 포식자가 있는 무서운 어두운 숲입니다. 이러한 포식자는 차익 거래 봇을 사용하여 이익을 얻습니다. 그래서 MEV라는 용어가 탄생했습니다.

누군가 의도치 않게 컨트랙트 주소로 유니스왑 유동성을 보냈다. 계약했지만 구조에 실패했습니다.

결국 그들은 교훈을 얻었습니다: 어두운 숲의 괴물은 진짜이고, 체인의 작동은 손실될 수 없으며, 정상적인 인프라는 신뢰할 수 없습니다.Ethereum의 미래는 더욱 두려울 것입니다.그러나 이 미래는 VDF 및 MEV를 통해 수정하여 개선합니다.

첫 번째 레벨 제목

2021년: 암호화폐를 믿으세요

보조 제목

Surviving Crypto Cycles—— Fred Ehrsam

원라이너: Bull-bear 전환에서 살아남는 방법.

Fred Ehrsam은 황소 곰 전환에서 살아남는 방법을 가르칩니다. 우리는 모범을 보여야 하고, 작업에 집중하고, 주요 작업을 잘 수행하고, 스트레스 테스트를 수행하고, 자금 조달을 고려하고, 조심스럽게 팀을 확장하고, 여러 채널을 통해 뉴스를 확인하고, 그리고 마라톤을 준비합니다.

첫 번째 레벨 제목

보조 제목

원라이너: 열린 메타버스의 가치는 무한합니다.

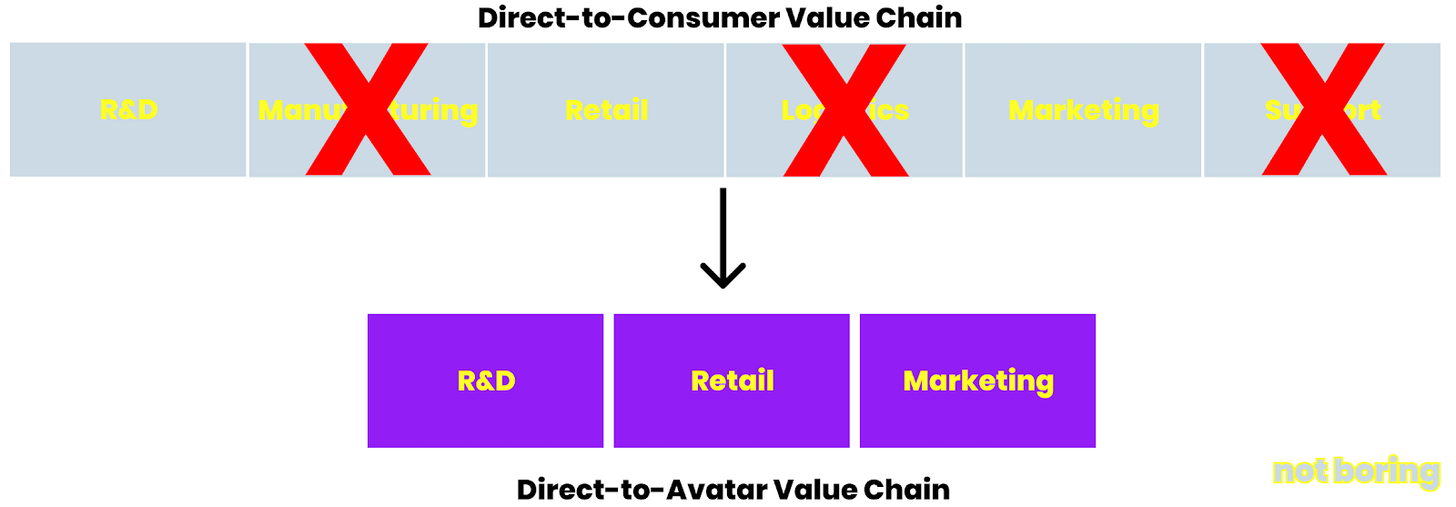

Packy McCormick이 Web3에서 Open Metaverse의 가치 사슬에 대해 이야기합니다.

Web3는 차세대 인터넷 형태로, Crypto를 사용하여 합의 및 표준에 도달하고, 커뮤니티 거버넌스를 통해 분산된 상호 운용 가능한 네트워크를 구축하고, 사용자에게 자주적 신원을 부여합니다.

현재의 메타버스는 닫혀있는 닫힌 Web2 모델에 가깝습니다.개방형 메타버스에서 가장 중요한 것은 디지털화와 개인 데이터의 이식성 및 상호 운용성입니다.NFT의 가치가 중앙 집중식 플랫폼에 의해 매개되는 것이 아니라 사용자가 결정합니다.

보조 제목

MEV and Me—— Charlie Noyes

원라이너: MEV의 원리와 의미.

Charlie Noyes는 MEV의 개념에 대해 자세히 설명했습니다. 다른 로봇도 입찰을 시작할 수 있습니다.

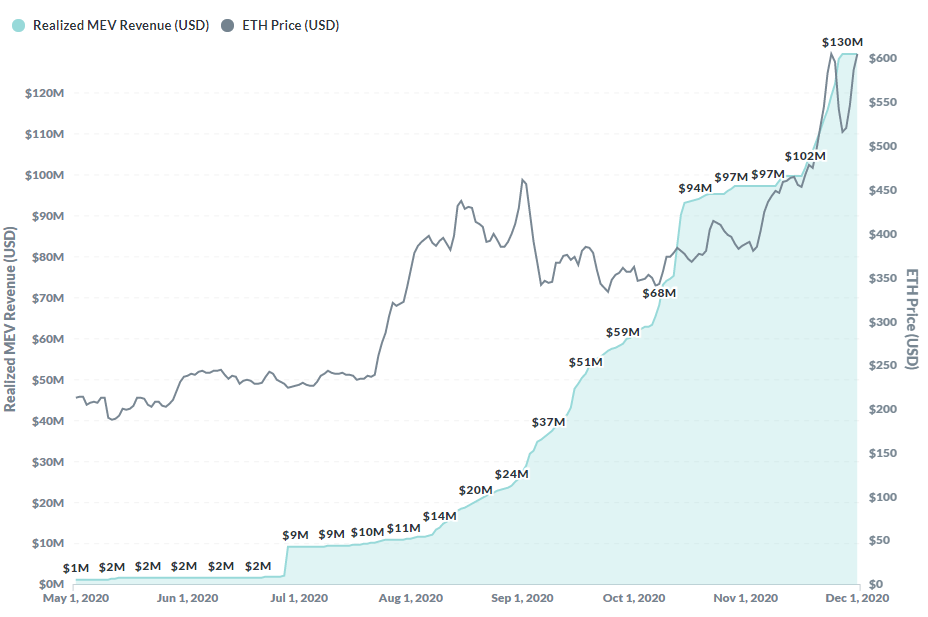

MEV는 이더리움과 일반 사용자에게 해롭습니다 아래 그림은 실현된 MEV 이점을 나타내며 실제 MEV 동작은 실제로 더 높습니다.

현재 MEV는 주로 마이너를 사용하여 Uniswap 차익 거래를 하고 일부 스마트 계약에서 자금을 훔칩니다.미래에 MEV는 점점 더 위험해질 수 있으며 마이너는 위험 영역에 진입하기 위해 더 많은 위험을 감수하여 다양한 MEV 및 담합을 일으킬 것입니다. 이것은 사용자에게 보이지 않는 세금, 악랄한 운영이며 동시에 본질적으로 합의에 불안정을 초래합니다.

보조 제목

NFTs make the internet ownable —— Jesse Walden

원라이너: NFT는 블록체인에서 복제할 수 없는 파일 시스템입니다.

Jesse Walden에 따르면 NFT를 쉽게 생각할 수 있는 방법은 블록체인의 복제할 수 없는 파일입니다.

NFT를 사용하면 비트코인과 같은 디지털 통화 자산을 소유하는 것처럼 디지털 미디어 자산을 소유할 수 있습니다 NFT를 통해 제작자, 청중 및 개발자는 디지털 소유권 시장에서 더 많은 수익을 올릴 수 있습니다.

NFT에 대한 일반적인 비판은 NFT 작품을 복사할 수 있다는 것입니다.하지만 실제로 더 많은 파일을 복사하고 볼수록 문화적 가치가 커집니다.

보조 제목

NFTs and A Thousand True Fans —— Chris Dixon

한 줄 요약: NFT는 엄청난 팬 경제 잠재력을 가지고 있습니다.

보조 제목

A beginner’s guide to DAOs—— Linda Xie

원라이너: DAO 시작하기.

보조 제목

The Most Important Scarce Resource is Legitimacy —— Vitalik Buterin

한 줄짜리: 수용의 위험과 가능성.

비탈릭 부테린(Vitalik Buterin)은 블록체인과 합법성의 관계, 합법성을 어떻게 활용할 것인지에 대해 논의했습니다.

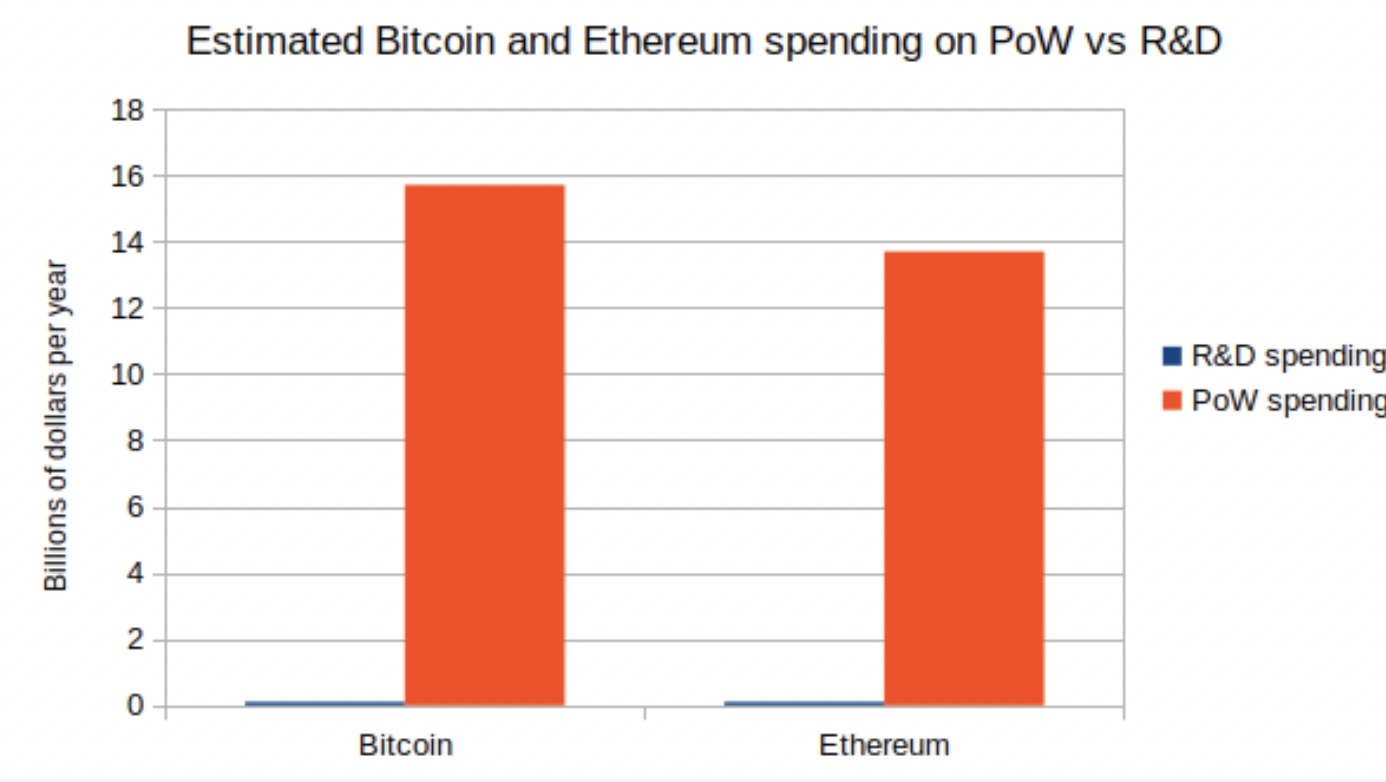

비트코인 및 이더리움 네트워크의 지출 모델은 심각한 자원 할당 오류입니다.광부에게 제공되는 혜택은 R&D 비용을 훨씬 초과합니다.비트코인 및 이더리움 생태계는 수십억 달러를 모을 수 있지만 자금 사용은 매우 이상하고 이해할 수 없습니다.

많은 경우에 토큰은 궁극적으로 키가 소유하는 것이 아니라 일종의 사회적 계약(예: VC)에 의해 소유됩니다. 이러한 사회적 계약은 사회적 지위의 게임을 지배하는 합법성입니다. 이 개념은 실제로 일반 대중에 의해 받아들여지고 한 사람은 다른 사람이 그렇게 하길 기대합니다. 수용은 힘, 연속성, 공정성 또는 프로세스, 성과, 참여에 의해 이루어질 수 있습니다.

보조 제목

The Great Online Game —— Packy McCormick

한 줄 요약: Crypto는 정말 재미있는 게임입니다.

Packy McCormick은 이 기사에서 블록체인 게임에 대해 설명합니다.Crypto는 수십억 명의 사람들이 온라인에서 플레이하는 훌륭한 게임입니다.소셜 미디어는 이 게임을 분명히 반영합니다.

성공적인 비디오 게임 디자인에는 빈번한 피드백 루프, 가변적인 결과, 제어 감각, 연결 및 메타게임(가장 중요한 사항)이 필요합니다. 인터넷은 무한한 게임입니다. Twitter, YouTube, Discord, 작업, 상태 축적 등에서 자신을 플레이하세요. 머스크는 아주 좋은 선수입니다.

인터넷 게임에서 크립토는 돈입니다.자신의 정체성에 관심을 가질수록 새로운 가능성이 열리고 NFT에 더욱 끌리게 될 것입니다.

보조 제목

India & Crypto series —— Balaji Srinivasan

한 줄 요약: 인도와 크립토 모두 매우 잠재적인 시장입니다.

보조 제목

Own the Internet — by Packy McCormick

원라이너: 이더리움의 가치에 대한 완전한 솔루션.

Not Boring은 Ethereum의 가치에 대한 심층 분석을 제공합니다.

Ethereum은 분산형 세계 컴퓨터, Web3의 백본 및 인터넷 통화, Ethereum 네트워크의 소유권, Crypto, 훌륭한 온라인 게임에서 일반적으로 사용되는 통화, Yield-generating, store of value, bet on Web3 .

보조 제목

Why web3 matters —— Chris Dixon

원라이너: Web3의 정의

Chris Dixon은 Web3를 완전히 정의합니다.Web3는 개발자와 사용자가 토큰 형태로 소유할 수 있는 인터넷입니다.

Web3가 중요한 이유는 탈중앙화가 중요하기 때문입니다.(2018년 그가 쓴 글을 다시 보면 알 수 있습니다.) Web3에서는 소유권과 제어가 탈중앙화되어 있으며 사람들은 토큰(NFT 및 FT)을 소유하여 서비스를 소유할 수 있습니다.

보조 제목

Composability is Innovation—— Linda Xie

한줄: 제목이 잘 요약되어 있습니다.

Linda Xie가 가장 큰 혁신인 구성 가능성에 대해 설명합니다.

DeFi의 예는 통화 LEGO의 구성 가능성을 보여줍니다 스마트 계약을 사용하여 토큰은 대출에서 파생 상품에 이르기까지 다양한 응용 프로그램에서 사용할 수 있습니다 개발자의 경우 구성 가능성을 통해 다른 프로젝트를 기반으로 할 수 있습니다 추가와 같은 제품 구축 DeFi 요소는 게임으로, 게임은 DeFi로 NFT의 금융화는 또한 무제한 구성 가능성과 자본 활용을 제공합니다.Mirror와 Zora의 협력을 통해 서로의 생태계가 고유한 이점을 가질 수 있습니다.

보조 제목

The Strongest Crypto Gaming Thesis—— gubsheep

원라이너: 크립토 네이티브 게임.

암호화는 점진적인 혁신이 아니라 새로운 세계로의 문을 열어줍니다.게이밍은 신흥 기술의 선행 지표이며 상대적으로 위험이 낮고 더 빠른 반복 루프를 허용하는 탐색 가능한 미래 영역입니다.

보조 제목

Endgame —— Vitalik Buterin

원라이너: 이더리움 스케일링의 끝판왕.

Vitalik은 이더리움 스케일링의 끝판왕을 해석합니다.

BSC, 솔라나와 같은 블록체인의 경우 더 많은 롤업이 필요합니다 TPS와 더 나은 사용자 경험을 위해 이러한 블록체인은 블록 생성에서 탈중앙화 정도를 줄여야 하므로 더 많을 때 롤업 솔루션이 여러 개 있을 때 관점에서 탈중앙화할 수 있습니다. 블록 생성 단계의 중앙 집중식 노드가 신뢰할 수 있는지 여부를 검증하기 위한 검증(라이트 노드 실행 등).

이더리움의 경우 Rollup은 필연적인 추세이지만 블록 생성에서도 점진적으로 중앙 집중화 될 것입니다 하나의 가능성은 롤업이 Layer 2 생태계를 지배할 수 있다는 것이고 이는 방금 언급한 BSC와 같은 블록체인의 경우와 동일합니다 또 하나의 가능성은 수백 송이의 꽃이 피고, 롤업이 모두 경쟁하고 협력하여 MEV로 이어지고, 채굴자들은 여러 롤업 노드를 잘 처리하고, 기술적으로 강한 노드는 점차 롤업 노드가 되는 작업을 독점하게 될 것입니다.

보조 제목

Trading the metagame —— Cobie

원라이너: 암호화폐 투자 로직.

Cobie는 Packy와 비슷한 점을 지적했습니다. Bull Market Crypto에 투자하는 것은 비디오 게임을 하는 것과 비슷합니다.

크립토가 투자한 게임은 주로 이더리움과 이더리움 킬러 게임과 NFT 프로젝트 게임이라는 두 가지 흥미로운 메타 게임을 포함합니다.실제로 2021년 두 가지 주요 투자 트렌드입니다.가장 큰 승자는 이 두 가지 메타 게임을 이해하는 것입니다.게임과 그 뒤에 있는 사람들.

2020년의 메타 게임은 DeFi Summer로, 연말에 BTC로 바뀌었다가 DeFi 부활, Shit Coin, Alt L1, Retro NFT로 바뀌었습니다. A 메타 게임은 장기 투자로 시작하여 인기를 얻고, 마침내 모방자가 속속 등장하면서 끝납니다.

메타 게임의 원리를 이해하는 것도 매우 중요합니다. 예를 들어 LOL에서 녹턴은 일정 기간 동안 매우 강했지만 더 이상 강하지 않을 때까지 이 영웅을 계속 사용할 수 있습니다. Avax와 Sol의 DeFi, Sol과 Sol의 차이점 이해 Avax에는 큰 차이가 없지만 Avax의 생태계는 보다 커뮤니티 지향적이므로 보유자가 실제로 혜택을 얻을 수 있습니다.

승자에게서 배우는 것은 게임에서 승리하는 데 매우 중요합니다.동시에 커뮤니티를 관찰합니다.그리고 Crypto 분야 밖의 일부 기술: 새로운 온라인 자산은 상승할 가능성이 높습니다. 체인 분석, 고래 지갑 관찰...

Cobie는 또한 게임에서 승리하기 위한 몇 가지 팁을 권장합니다.

메타 게임을 조기에 식별하고 시간이 지남에 따라 보유량을 늘립니다.

일시적인 실패 후에는 휴식을 취하고 마음을 새로운 것으로 바꾸십시오.

트레이더는 메타 게임을 사용하여 장기 포지션을 종료하거나 재조정할 수 있습니다.

메타 게임은 파생 상품 거래에 적합한 자산을 결정하는 데 도움이 될 수 있습니다.

우리는 생각의 편견을 식별하기 위해 스스로 생각해야 하며, 이는 오랜 시간이 걸릴 것입니다.

mdnice 편집기

The Mirrortable —— Balaji Srinivasan

원라이너: 암호화 기반 벤처 캐피탈.

Mirrortable의 개념은 주로 Crypto의 Cap Table이다.

엔젤 투자는 많은 Web2 도구(Docusign 등)를 포함하며 Web3에는 더 성숙하고 강력한 도구가 있습니다. 이상적인 투자 프로세스는 다양한 투자의 링크를 열고 온체인 및 오프체인 구성 요소를 통합할 수 있습니다.

이것은 거대한 트랙이 될 것입니다(EthSign은 최근 1,200만 달러를 모금했습니다).

mdnice 편집기

2022년: 예측할 수 없는 세상

mdnice 편집기

2021 NFT Year in Review —— 1confirmation

한줄: 제목이 잘 요약되어 있습니다.

mdnice 편집기

Soulbound —— Vitalik Buterin

원라이너: 소울 바운드 NFT.

World of Warcraft의 오래된 플레이어인 Vitalik은 소울 바인딩 개념을 통해 탈중앙화된 신원 인증과 관련된 콘텐츠에 대해 논의합니다.

NFT에 소울 바인딩 개념이 사용되면 NFT는 양도할 수 없습니다.(실제로 일부 NFT는 이미 일부 NFT가 소울 바인딩 개체입니다. , 이것은 이미 그의 정체성의 일부입니다. 자세한 내용은 이 스레드를 읽을 수 있습니다.)

mdnice 편집기

Hyperstructures - Jacob Horne(Zora 설립자)

한줄: 제목이 잘 요약되어 있습니다.

Jacob Horne은 Crypto의 새로운 정신 모델이 될 Hyperstructure라는 새로운 개념을 제안했습니다.

블록체인은 하이퍼스트럭처 아키텍처를 생성하고 블록체인의 프로토콜은 하이퍼스트럭처입니다. 종료할 수 없고, 자유롭게 사용할 수 있으며(가스 계산되지 않음), 가치 축적이 있고, 동기가 부여되며, 허가가 필요하지 않으며, 여러 당사자로부터 이익을 얻습니다. , 신뢰할 수 있고 중립적입니다.

하이퍼스트럭처는 수백만 개의 인터페이스에 서비스를 제공하고, 가치는 생태계를 피드백할 수 있으며, 건설 프로토콜이 우선시되고, 유동성이 높으며, 참여자에게 소유권과 거버넌스 권한이 부여되고, 건설 주기가 길다.

mdnice 편집기

Sufficient Decentralization for Social Networks —— Varun Srinivasan

원라이너: 차세대 소셜 네트워크.

Varun은 차세대 소셜 네트워크의 적절한 분산화, 네트워크의 분산화, 이름 등록의 분산화 및 프로젝트 초기 구성원을 위한 효과적인 인센티브를 탐색합니다.

요약하다

요약하다

1997년부터 2022년까지 크립토는 점점 더 다양한 커뮤니티를 가지게 되었고 다양한 관점이 시시각각 퍼지기 시작했고 관련된 분야는 비트코인 분야에서 시작하여 인문학, 경제, 정치학으로 확장되면서 점점 더 넓어졌습니다. .. 크립토는 붕괴, 융합, 재탄생의 순환에 나선다.

크립토 게임 승자들의 관찰을 통해 우리는 이러한 장기 예측에 실제로 무수한 부 코드가 있다는 것을 발견했습니다. 그들의 기사와 트윗이 게시된 지 2~3년 후 갑자기 깨달았습니다. ” 우리가 생각해낸 멋진 아이디어는 3~4년 전에 많이 제안되고 논의되었습니다.

하지만 그건 중요하지 않아 우리가 해야 할 일은 배우고 생각하는 것 뿐이야 더 많이 배울수록 더 많이 벌고 더 많이 알수록 더 성장해.

Crypto Readings를 만든 Dan Romero에게 감사드립니다.