100,000 users in 3 days, Bybit's own son Byreal overthrows Hyperliquid's DEX throne?

Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

After Hyperliquid, who can take up the banner of on-chain DEX? Byreal, incubated by Bybit, may bring new variables to this track. Previously, the number of registered addresses of Byreal's public beta version exceeded 100,000 in less than 3 days , and the first Fragmetric Reset Launch was oversubscribed 22.5 times, which shows the market's enthusiasm. Odaily Planet Daily will briefly analyze Byreal's platform-related advantages and potential subsequent development directions in this article.

When CEX sets its sights on DEX: Byreal places its hopes on Bybit’s on-chain ambitions

As the main line of the market becomes increasingly clear, the optional paths left for cryptocurrency platforms and projects are gradually shrinking to two routes:

One is the off-chain mainstream compliance route, including Circle, Kraken and other platforms choosing IPOs, traditional financial institutions promoting the approval of various ETFs, and Robinhood’s tokenization of U.S. stocks;

The other is the on-chain decentralization route, including various token launch platforms such as pump.fun, on-chain DEXs such as Hyperliquid, and various new liquidity platforms and traffic entrances such as Binance Alpha and OKX Wallet.

As a CEX that has grown rapidly in recent years, Bybit is not to be outdone and has launched its own layout. In addition to cooperating with the xStocks platform to open up tokenized trading of US stocks and launching the Bybit payment U card, it has also set its sights on the DEX market. Byreal is its latest attempt to achieve on-chain transformation.

Byreal: A rising star in on-chain DEX

In mid-June, Bybit CEO Ben Zhou posted on the X platform: "Byreal, the first on-chain DEX incubated by Bybit, will be launched at the end of this month. It was born from scratch in the Solana ecosystem. The special thing is:

1/ CEX + DEX synergy. Byreal is not just "another DEX". It combines CEX-level liquidity with DeFi native transparency. This is true hybrid finance. More CEX + Dex projects are coming soon.

2/ Unified liquidity and speed adopt RFQ ( Request for Quote) + CLMM ( Centralized Liquidity Market Making) routing design. Byreal will provide users with low slippage, MEV-protected Swap transactions at extraordinary speeds. "

After Binance opened up the liquidity between the main site and the Alpha platform and OKX bet on OKX Wallet, many CEXs including Bybit also chose the route of "CEX + DEX" collaborative development. Odaily also mentioned this in the article "OKX suspends DEX aggregator trading services, has the CEX vs. DEX war reached a turning point?" published in March.

In short, Byreal's focus is on: 1. Mobilizing the enthusiasm of CEX liquidity fund trading; 2. Providing better trading services based on the Solana ecosystem.

Byreal IDO New Mode: Reset Launch

After the Byreal beta version was launched, the platform quickly launched an IDO model that is different from other DEXs: Reset Launch. The first project is the Solana ecosystem re-staking protocol Fragmetric.

Previously, Fragmetric had received $7 million in seed round investment and $5 million in strategic round financing, with a total financing amount of up to $12 million. It also received participation from Solana founder Anatoly Yakovenko and Solana Foundation Chairman Lily Liu, and was called the "Solana Ecosystem Parent-Child Project". This also greatly increased the market participation enthusiasm for the project. In the end , at the end of Byreal's first Reset Launch project Fragmetric IDO, the actual fundraising was 49587.8 bbSOL, worth more than 8.18 million US dollars, far higher than the target of 2199.0112 bbSOL, with an over-funding of 22.5 times, and the lowest price tier over-funding of 4406.96%.

Golem, the author of Odaily Planet Daily, also participated in this IDO, with an investment of about 0.45 SOL (about 68 US dollars). In the end, the profit earned by FRAG tokens was about 200 US dollars, and the rate of return was about 300%. There is no doubt that this fixed-price tiered fundraising model is more conducive to the participation of small and micro users, and asset types such as Revive Vault and bbSOL also provide users with the possibility of additional income to a certain extent. For the official introduction of this model, see here .

In contrast, the coin listing auction model adopted by Hyperliquid is relatively more open and transparent, but it focuses more on the "supply side" of the project rather than the "demand side" of the user.

User Quantity PK: Hyperliquid has about twice as many users as Byreal

As of the time of writing, Byreal's official website shows that its public beta user number is about 278,000; in contrast, according to Dune data , Hyperliquid has about 527,000 users. It has to be said that with Bybit, which has tens of millions of users, Byreal has a unique advantage in accumulating the number of users.

Byreal official website information

The future of Byreal: IDO wealth creation effect, Bybit listing closed loop, coin issuance expectations

In summary, whether Byreal can successfully break through at the DEX level in the future mainly depends on three aspects:

First, whether the wealth-creating effect of its subsequent IDO projects can continue. Although the previous FRAG token IDO had certain profits, the final token price performance was still lower than market expectations. Fragmetric co-founder Daniel also apologized to the community for untimely communication and other issues. It can be seen that the development of the project after IDO also affects the market's attention and participation in Byreal to a certain extent.

Second, whether Bybit can open up the closed loop of listing coins. Just as Binance Alpha Points opened up the liquidity and ecological closed loop between Binance main site and Alpha section, if Bybit wants to open up the interaction between on-chain ecology and exchange funds through Byreal, it also needs to make efforts in guiding the listing of popular tokens and Byreal high-frequency trading incentives.

Third, Byreal’s coin issuance expectations. Although strictly speaking Byreal is a product under Bybit and still needs to comply with some exchange compliance requirements, the coin issuance expectation is still one of the important reasons why countless users participate in the interaction and use Byreal. This requires further news from Bybit and Byreal.

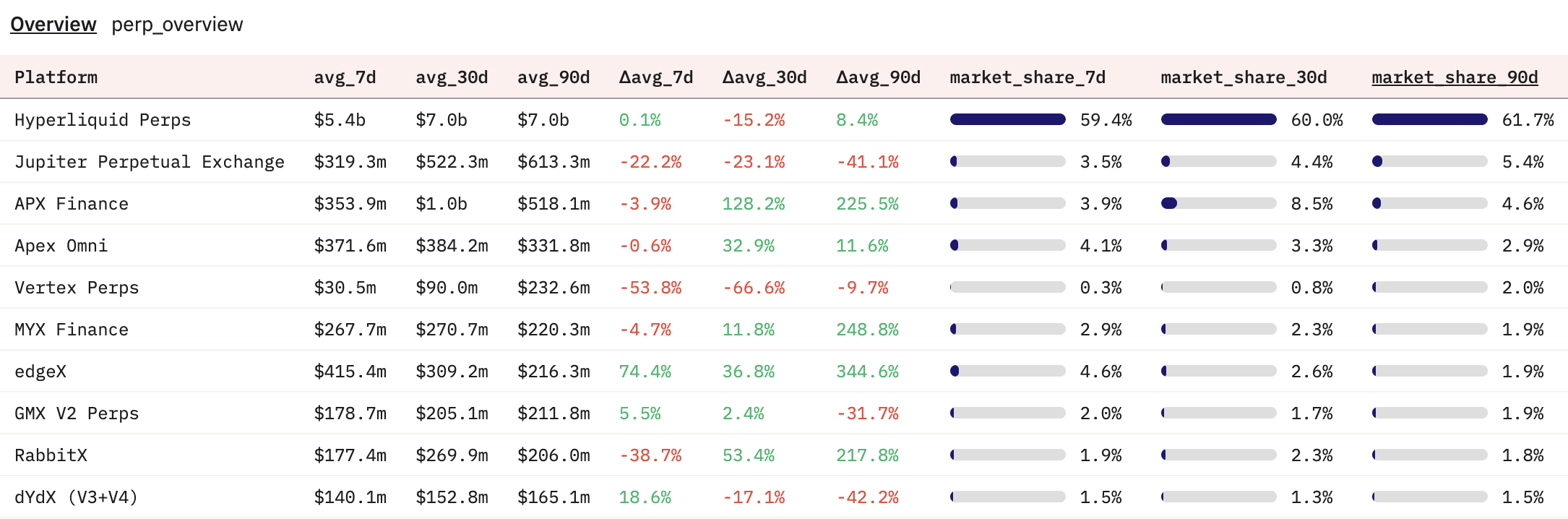

According to Dune data , in the past three months, Hyperliquid's market share in the Perp market has reached about 60%, and it is still the undisputed overlord of the on-chain Perp platform. If latecomers want to threaten its survival position, in addition to the accumulation of time, they also need innovations in platform mechanisms and other aspects.

Perp Market Share at a Glance

It is worth noting that Byreal recently reached a strategic cooperation with the compliant tokenized securities platform xStocks, providing users with trading channels for on-chain U.S. stock assets (such as Tesla, Apple and other tokenized stocks). Compared with Hyperliquid's focus on on-chain native derivatives and DeFi contract ecology, this move significantly broadens the boundaries of user asset allocation - from a single cryptocurrency to traditional financial assets, forming a differentiated competitive barrier.

The Byreal mainnet is scheduled to be officially launched in the third quarter of 2025. Whether it can occupy a place in the fiercely competitive DEX market and pose a substantial challenge to the perpetual contract market share dominated by Hyperliquid will become the focus of the next stage.