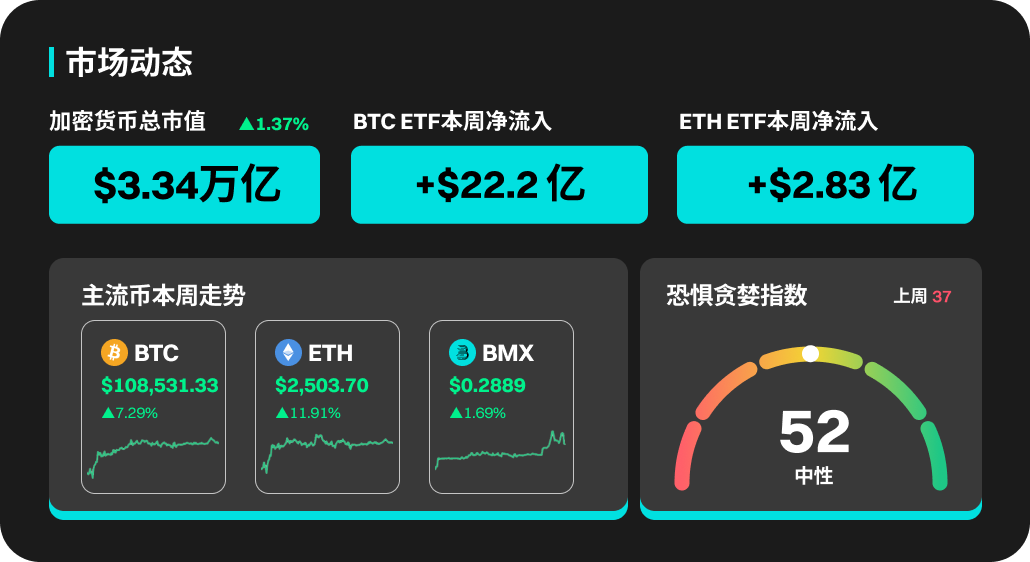

According to BitMart's market report on June 30, the total market value of cryptocurrencies in the past week was 3.34 trillion, up 7.4% from the previous week.

Crypto market dynamics this week

Last week (2025.06.23-2025.06.29), BTC ETF had a net inflow of 2.214 billion US dollars, achieving large net inflows for three consecutive weeks, and a total of 4.5 billion US dollars in the past three weeks. In the past week, BTC briefly plunged to around 99,000 US dollars and then rebounded sharply. It is currently consolidating in a narrow range around 108,500 US dollars. BTC's market share exceeded 64.6%, continuing to be at a nearly 4-year high.

Last week, ETH ETF had a net inflow of $283 million, achieving net inflows for four consecutive weeks. Although ETH funds continue to flow in, ETH has been constrained by the $2,500 mark in the past week. The ETH/BTC exchange rate is currently reported at 0.023, and ETH's market share is currently reported at 9.1%.

This week's popular coins

In terms of popular currencies, PENGU, BSW, W, ZRC and DBR all performed well. PENGU's price rose 71.89% this week, and its current market value is $92 M. BSW's price rose 12.13%, with the highest price being 0.03481 USDT. W and DBR rose 32.34% and 5.97% respectively.

US market and hot news

The Middle East war may end prematurely due to inflation fears triggered by a surge in crude oil prices. Stocks hit record highs, further supported by the U.S. government's continued calls for sharp interest rate cuts and the new Federal Reserve chairman's promise to cut rates to 1% and keep them there indefinitely.

After two weeks of sideways trading, the S&P 500 surged 3.4%. The Dow 30 long-short strategy made a strong comeback this week, with sector rotation strategies performing best, up 3.4%.

Singapore requires crypto companies that have entities in the country but provide offshore services to cease operations by June 30

Argentina finalizes rules for virtual asset service providers; individuals registered with PSAV must comply with new regulations by July 1

Thursday 20:30, U.S. initial jobless claims for the week ending June 21, June unemployment rate, June seasonally adjusted non-farm payrolls, May trade balance

Popular sections and projects unlocked

Optimism (OP) will unlock approximately 31.34 million tokens at 8:00 am Beijing time on June 30, accounting for 0.67% of the current circulation and worth approximately US$17.4 million.

Sui (SUI) will unlock about 44 million tokens at 8:00 am Beijing time on July 1, accounting for 1.3% of the current circulation and worth about $122.8 million.

Ethena (ENA) will unlock approximately 40.6 million tokens at 3:00 pm Beijing time on July 2, accounting for 0.67% of the current circulation and worth approximately US$10.7 million.

ZK

The ZK (zero-knowledge proof) sector refers to crypto assets that use zero-knowledge proof technology, focusing on privacy protection, scalability, and efficient data verification. It is usually represented by ZK-rollups and privacy public chains, and has both technological innovation and application potential. With the growth of blockchain's demand for privacy and performance, ZK projects have risen rapidly and attracted much attention from the market. On the one hand, they attract investment from developers and institutions with high technical barriers and Layer 2 optimization; on the other hand, they have also become the focus of speculation in capital rotation due to the craze for technical narratives. - The sector has risen 5.2% in the past 7 days, with MOVE and ZKML rising 39.1% and 16.7% respectively.

Oracle

Oracle is a key mechanism in the blockchain ecosystem that connects smart contracts with the outside world. It is used to safely and reliably introduce real-world data into the blockchain to support the execution of smart contracts. Since the blockchain itself cannot directly access off-chain data, oracles, as intermediary bridges, play a core role in decentralized finance (DeFi), supply chain management, and insurance, such as providing real-time asset prices or verifying transaction conditions. However, the data reliability and security of oracles remain technical challenges, and decentralized solutions such as Chainlink enhance credibility through multi-source data aggregation and encryption technology. ——The sector rose 4.7% in the past 7 days, with BIRD and SEDA rising 28.9% and 13.3% respectively.

Risk Warning:

Use of BitMart services is entirely at your own risk. All cryptocurrency investments (including earnings) are highly speculative in nature and involve substantial risk of loss. Past, hypothetical or simulated performance is not necessarily indicative of future results.

The value of digital currencies may go up or down, and there may be substantial risk in buying, selling, holding or trading digital currencies. You should carefully consider whether trading or holding digital currencies is appropriate for you based on your personal investment objectives, financial situation and risk tolerance. BitMart does not provide any investment, legal or tax advice.