How can on-chain detectives seize the initiative? 7 tools to see through the "treasure map" of the unissued Alpha protocol

Original author: Ignas , DeFi researcher

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator: CryptoLeo ( @LeoAndCrypto )

Editor's note: DeFi researcher Ignas published a tutorial article on "How to Find Unsold Alpha Protocols", which introduces how crypto users can find Alpha through tools and data websites. As a DeFi OG, Ignas's tools are relatively comprehensive. In addition to the familiar Nansen, DefiLlama, etc., there are also some niche but very useful tools. Odaily Planet Daily compiled the content as follows:

Are you still motivated to look for Alpha projects these days?

I’ve written before that my motivation to find new projects has waned. This is probably the most obvious change since I entered the crypto space in 2018. Even in the previous bear market, I felt less sluggish.

I wonder if it’s just me, maybe I’m just too lazy or bored? While not entirely true, I’m more cautious about putting a larger portion of my portfolio into new protocols than before. In past bull markets, money flowed more freely and it was relatively easy to make profits. But now is different. The bear market has not yet arrived, but there is less money. The risk-reward ratio has also changed: while hacks and exploits are less common now, the airdrop rewards of the vast majority of projects have decreased.

Funds are spread across many protocols, and no protocol has particularly large returns. I feel like too many new projects are just incremental improvements, without real innovation from 0 to 1. This applies not only to DeFi protocols, but also to L1 and L2. So how can we be motivated to explore Kraken's Ink or Soneium L2? If there are no innovative, value-added protocols, only airdrops and liquidity mining rewards. It's hard to know which project is worth your time. Maybe I'm not the only one who feels this way.

But we can’t stop looking for those few outstanding projects that may become the next Aave, Ethena or Pendle. The question is how to know which protocols are worth your time? Where can you find them? Therefore, in this article, I will share some tools, methods and resources to help you find protocols that have already had a certain influence. They are divided into three categories:

Mind Share

On-chain adoption

Smart Account Usage

1. Kaito

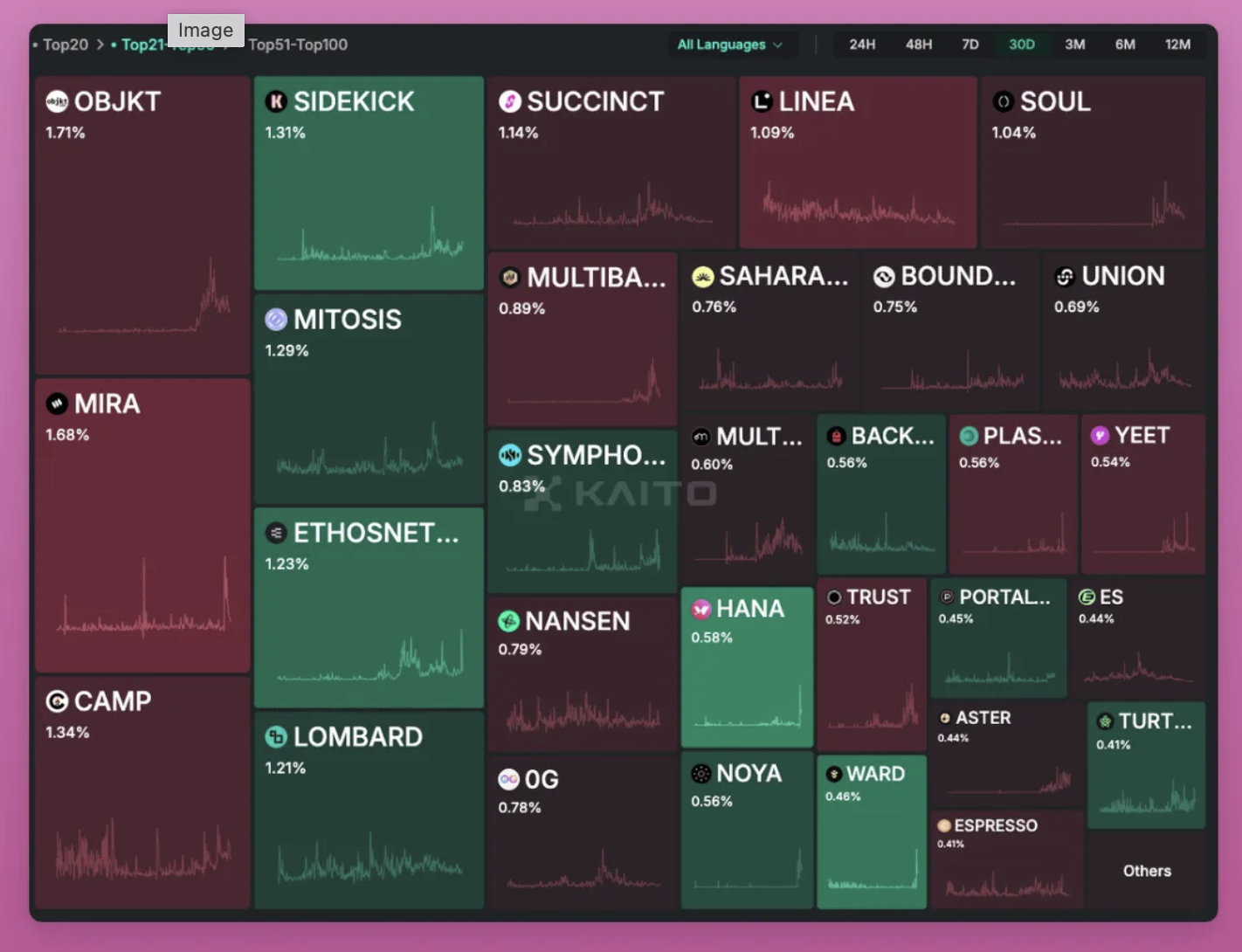

Kaito’s flagship portal costs $1,099 per month (down to $750 for a two-year term), but Kaito offers a free dashboard that lists popular projects by mindshare, most of which do not have tokens. Screenshots of the top 20 projects are often shared, but how many of the top 21-50 projects do you recognize?

You can go to yaps.kaito.ai and research the projects that catch your attention.

For example, Multipli generates income through native assets (BTC), stablecoins, and RWA. I expect it to launch a token with low circulation and high (or slightly higher) FDV because it is backed by VCs such as Pantera, Sequoia, and The Spartan Group. Multipli's current TVL is $70.3 million, which is a balance point. Although it is currently in the second quarter, its implied risk is not too low and the dilution effect is not too strong.

Kaito is great, but critics say it distorts the market because influencers are often incentivized to promote specific projects. If you are one of them, consider using a second tool that uses a different algorithm to broaden your project search.

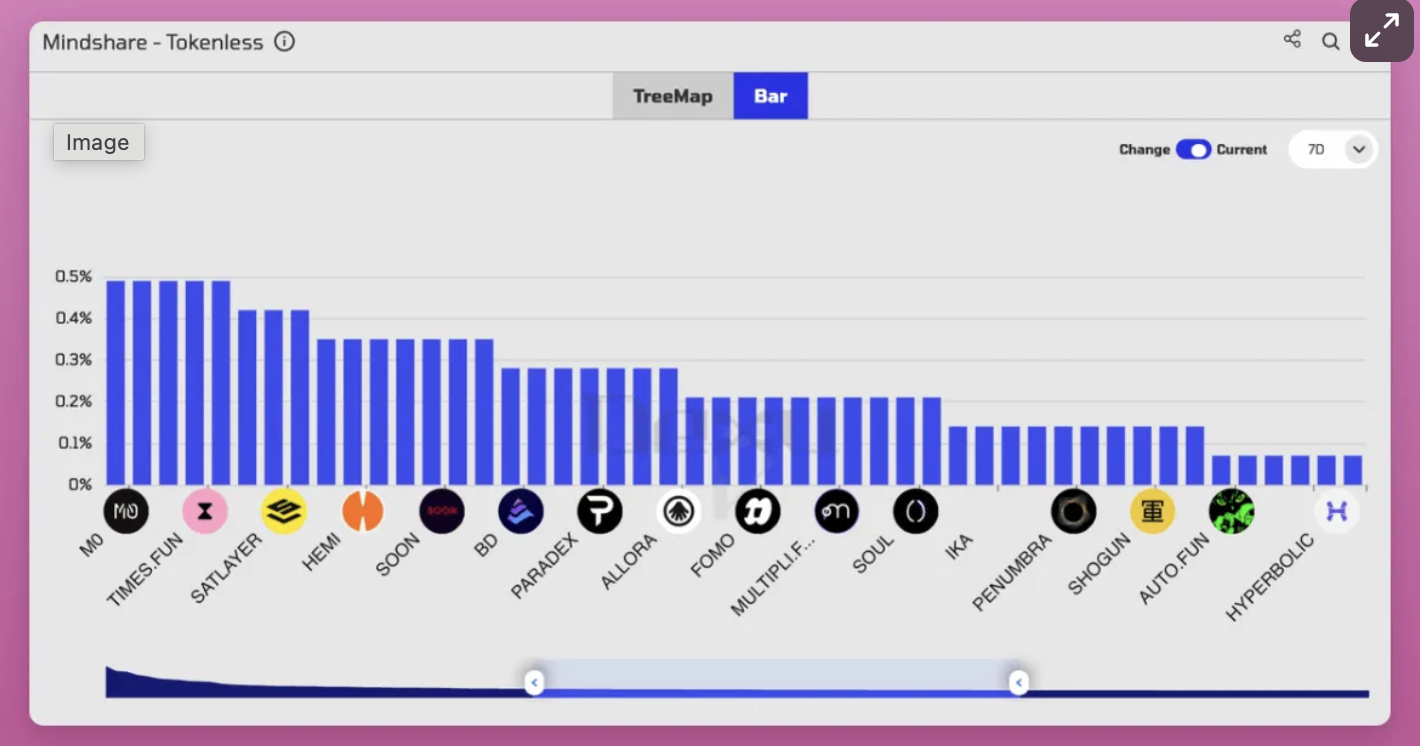

2. Dexu AI

“Get mind share, sentiment, narrative performance, original tweets, CT Smart Account stats, and more.”

Here is a short guide on how to find tokenless projects using Dexu:

First method:

Go to "Dexu AI, Sector analysis, Social";

Try different areas of analysis: mind share, sentiment analysis, X smart fans, etc.

Select a different time period and zoom in/out with the slider.

Second method:

Go to "Projects - Popular Projects"

Scroll down to "Project Ranking - Top 5000";

Adjust the Seniority filter to a lower percentage to find newer projects, and increase the Network participation percentage to filter out projects with lower participation.

Project example: Time.Fun

Two prominent use cases:

Pay to send private messages to cryptocurrency founders and key opinion leaders, with higher response rates

Guess which one will have a higher demand for DMs.

I bet the airdrop value will be good since the Solana team/founders actively use and promote Time.Fun and have the support of investors like Coinbase Ventures, Alliance DAO, etc.

3. 0x PPL

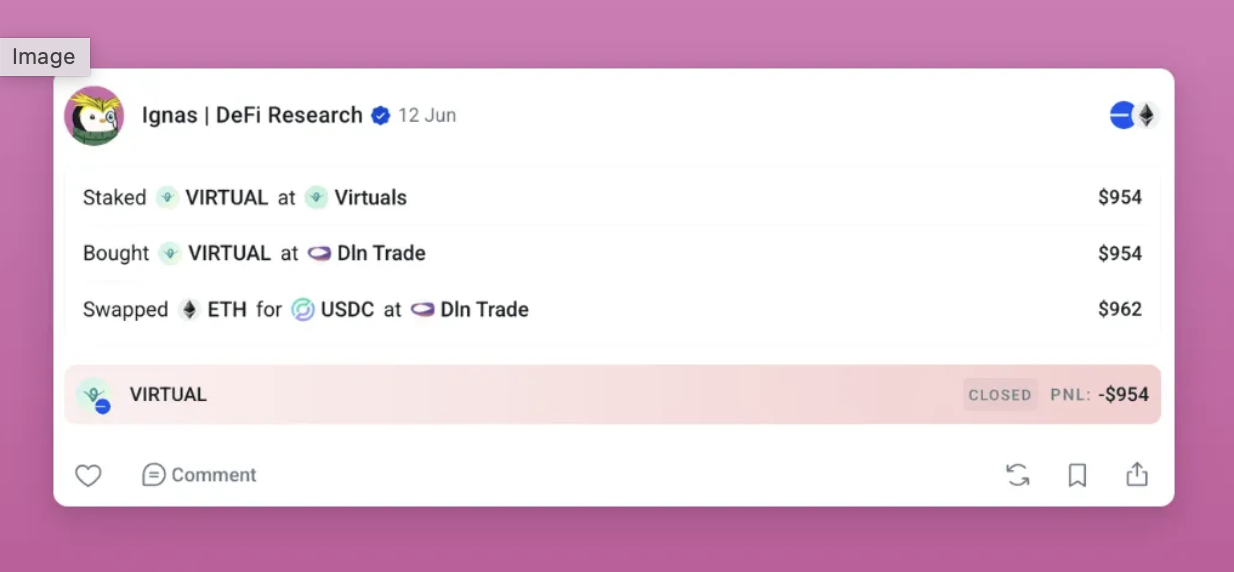

0x PPL is one of my favorite tools in crypto, but few people seem to know about it or use it. 0x PPL is a social media platform, but unlike normal X-style posts, you can see how the people you follow use their wallets. While Kaito and Dexu focus on followers and mindshare, 0x PPL shows how they act with their wallets. The wallet search team at 0x PPL does a great job of connecting wallets to key opinion leaders (KOLs). You can see that most transactions are buys/sells of tokens, and you will also see deposits to the protocol.

How to use: Log in through your X account and link a wallet with transaction records. You can immediately see the transactions of your followers. If you follow many airdrop bloggers, you will have the opportunity to understand the protocols in which they actually invest funds in their linked wallets, rather than just gaining attention through discussions.

One more thing to add, I can clearly see that the team is working hard to optimize the app every day. Every detail is carefully polished, and they focus on small details to improve the user experience.

4. Nansen

Nansen is great for multiple functions, and I’ve shared a guide on how to use Nansen and other tools to get 100x returns. However, there are two other features of Nansen that I really like:

First, Nansen launched a points program. You can earn points by subscribing to Pioneer or Professional, staking on Nansen, and referring friends. InfoFi narratives are hot, and Nansen is already an established player in this space.

In addition, you can understand the flow of funds through the popular contracts function.

I like the ability to remove DEX and liquidity pools (if you are an active LP, you will love this feature), set the minimum TVL to $5 million, and choose the contract term to be 30 days.

Here are the results:

YielFi’s vyUSD stablecoin offers a 16% APY (total TVL is $32M, invest with caution, but they offer points);

Plasma is getting a lot of attention, but deposits are closed;

The new BOLD stablecoin from Liquity is growing (LQTY continues to rise while the overall market is stagnant).

There is also the Steer protocol : automated, multi-position liquidity management for DeFi. It has been launched on 27+ chains and 32 DEXs, such as Quickswap, Camelot, and Sushiswap.

Why it’s worth paying attention to:

No need to manage your own centralized liquidity;

Higher LP returns;

A large number of market-making strategies;

Steer raised $1.5 million in seed funding from Druid Ventures, Republic Capital, and Big Brain Holdings.

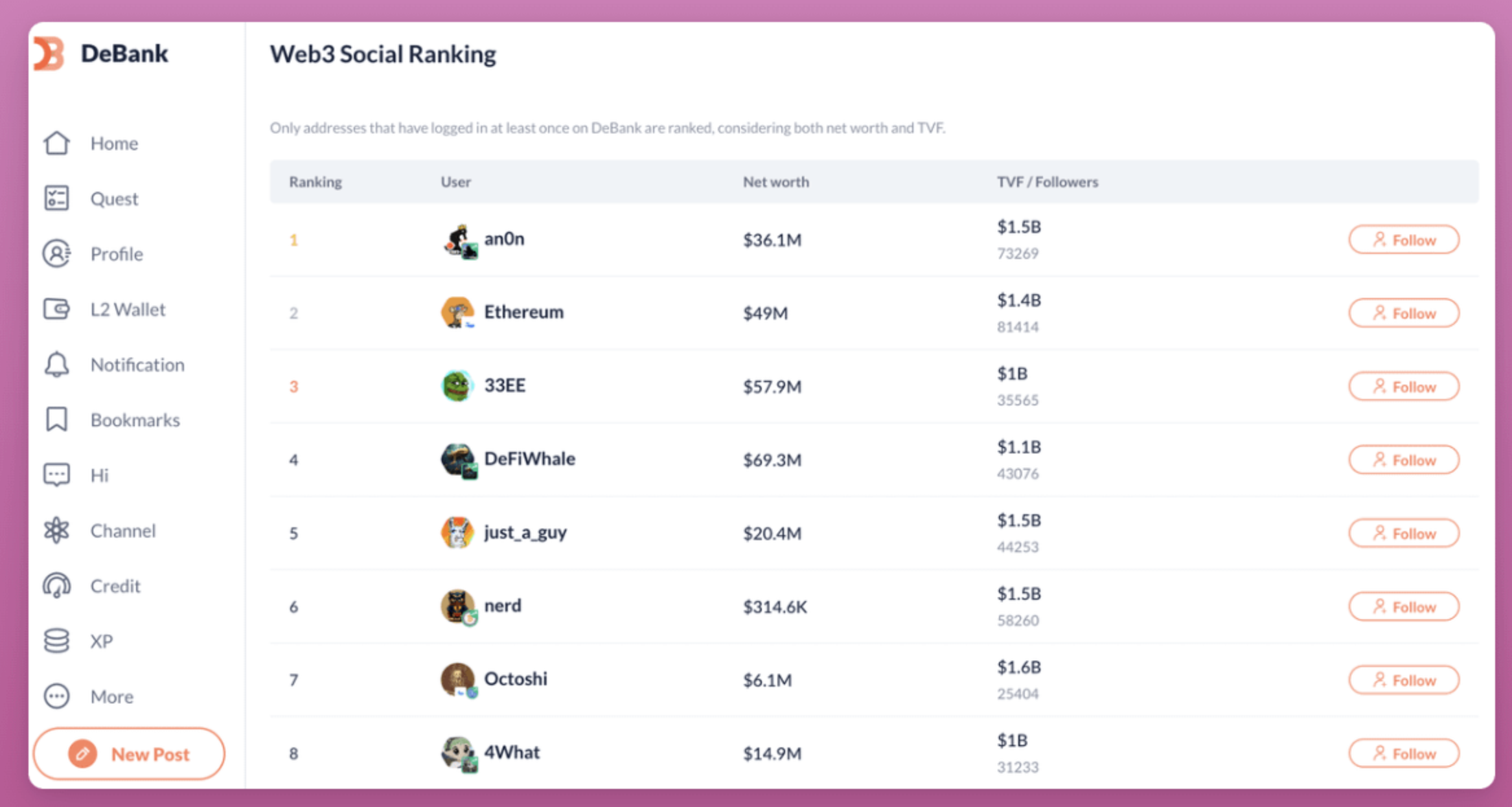

5. DeBank

While it feels like DeBank’s market share on X has decreased as its flagship product has been integrated into the Rabby wallet, there are still plenty of alpha opportunities to be found using the DeBank profile tracking feature alone:

Go to the Debank page;

Web3 social ranking;

Check the accounts to see what they are investing in now.

It’s worth putting in some effort to find accounts and protocols that fit your investing style, and you can learn how investors use their money, which may be a better use of your time than browsing the latest news on X.

While writing this article and looking at DeBank, I discovered LAGOON: A Vault Strategy Provider with $70M TVL. ETH can earn 9% APY, DYOR!

6. DefiLlama

Defillama is familiar to everyone, so this section is brief. When I asked Patrick Scott, the head of growth at DefiLlama, for advice, he shared the following two suggestions:

Go to DefiLlama, Airdrop;

Toggle: Hide forked protocols. (Can add TVL filter)

Go through the agreements one by one to see which ones meet your standards.

Another little tip: Identify popular chains like HyperEVM and look for protocols on that chain by TVL.

7. Focus on financing (Coincarp)

In this cycle, people's antipathy towards VCs has reached an all-time high, but well-funded protocol projects are excellent projects for profiteering. I have always believed that low-circulation, high-FDV tokens are ideal for profiteering because the project party has the funds to provide initial liquidity for the token TGE.

Among the many financing query tools, I like Coincarp, which is free and easy to use.

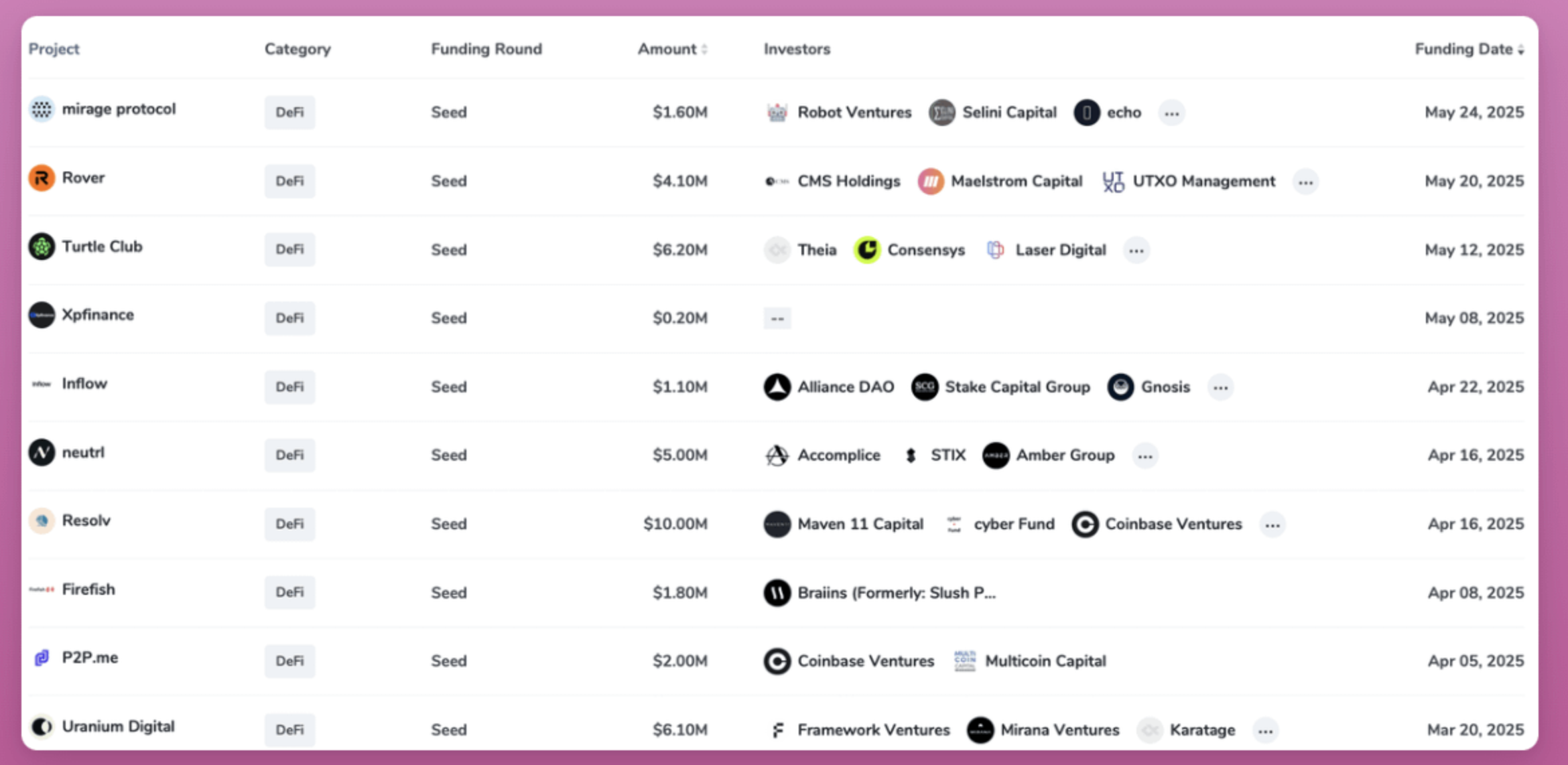

I usually filter for “DeFi” and select “Seed” as the earliest stage protocols.

You can clearly see the major investors and the amount of funds they have raised.

The number of seed rounds announced in the DeFi space recently has been surprisingly low. Only 4 protocols received funding in May, and only 5 in April.

Turtle Club : A rewards platform that provides additional earnings for partnered protocols you use (e.g. cashback in DeFi).

Here’s how it works:

Login via package (no deposit required);

Turtle tracks your liquidity pools/staking on partner platforms;

You will receive additional rewards and TURTLE tokens.

Why it matters:

No additional risk – funds always remain in your wallet;

Additional income on top of existing income;

Early users get more rewards.

Conclusion

The above are the 7 useful tools shared by Ignas. If you want to be an early discoverer and investor of high-quality projects, in addition to the commonly used tools, several other niche tools may also be your necessities in the future. In the field of encryption, it is not only necessary to "Buy The Rumors, Sell The News" in transactions, but also in finding projects. When a project is talked about by most people, it may be difficult to get big results if you participate in it. Only by working hard can you discover early Alpha and get more benefits than others in the future.