"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days, and bring new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, come and read with us:

Investment and Entrepreneurship

Biological traps in trading: Why small wins are more reliable than 100 times?

Take profits early and stop thinking about diamond hands. The market doesn't care about your beliefs, it cares about supply and demand. When you make a profit, you must stop profiting, at least a little at a time.

Keep track of your wins. Take screenshots of every win and create a folder to look at when you're having a bad day. Your brain needs proof that you're a winner, not just an abstract recollection of the moment you made money.

Control your leverage and set realistic daily goals. Small wins mean you have to control your losses as well.

Trading is a marathon, not a sprint. Most traders trade to be right, while winners trade to make money, and there is a huge difference between the two. Getting rich slowly is boring and not cool.

Don’t try to prove that you are smart, prove that you are self-disciplined.

Portrait of crypto gamblers: bait of luck, prisoner of K-line

In the highly leveraged contract market, so-called investment often quickly degenerates into behavioral addiction. The principal is no longer capital for appreciation, but chips to keep the game running. The random fluctuations of the market, the high-speed UI/UX of the exchange, and the emotional amplification of social media together build a closed system.

How does war affect Bitcoin? A deep analysis of the five-year price trajectory

The persistence of the war has instead provided new narrative support for Bitcoin, strengthening its position as an alternative financial tool.

The war value of digital assets has not disappeared, but is being reconstructed in a scenario-based manner. The real turning point lies in monetary policy. When the Fed opens the channel for interest rate cuts, the signing of a ceasefire agreement will become an accelerator for capital inflows. Bitcoin's relative stability in geopolitical crises may enhance its status in the minds of institutional investors.

The moment a ceasefire agreement is signed is often the best window to observe the logic of capital

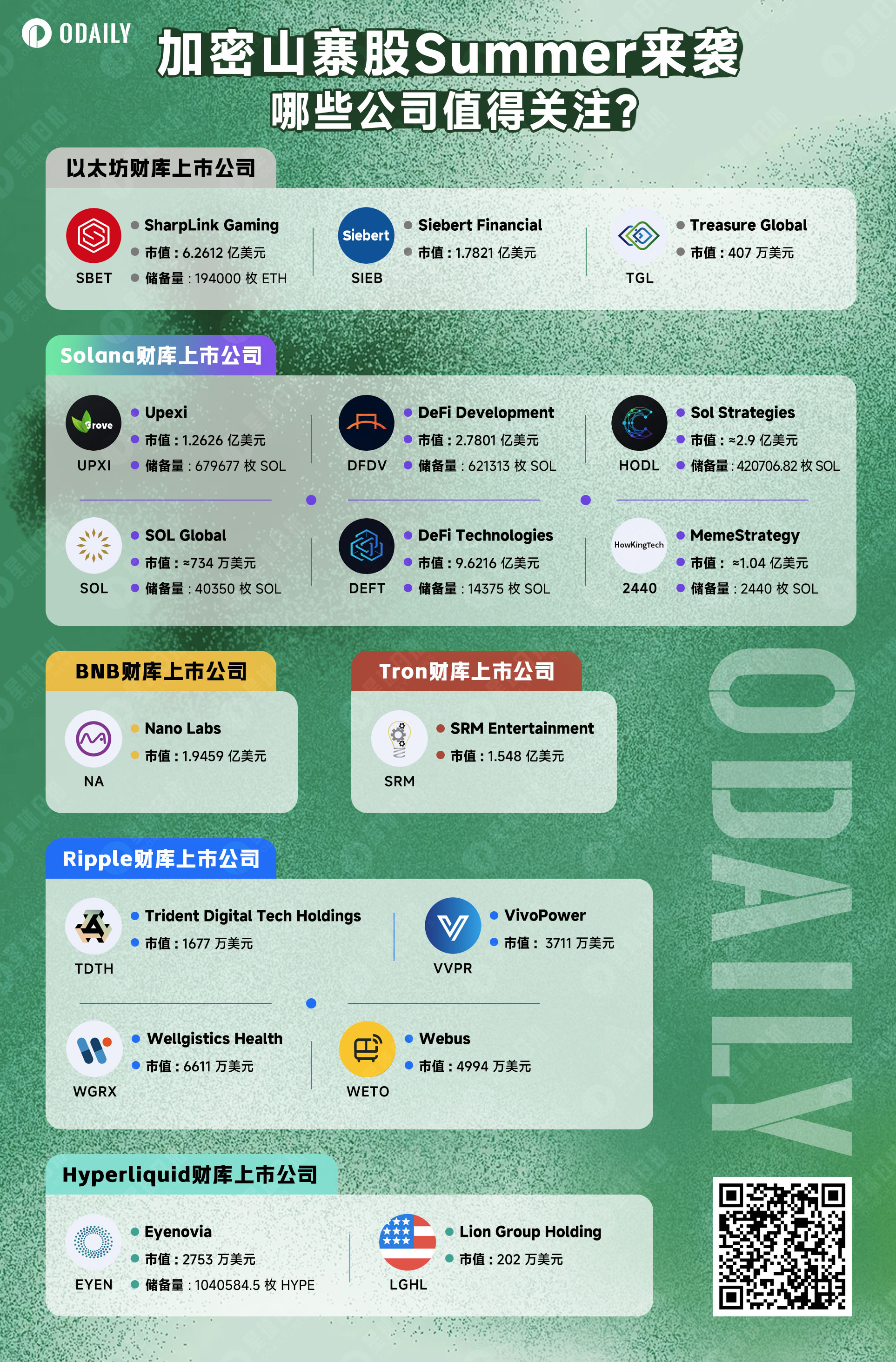

Hyperliquid, a new player in the cryptocurrency stock market

Eyelid digital technology company Eyenovia (stock code: EYEN) announced that it has signed a securities purchase agreement to conduct a PIPE "Private Placement of Public Equity" to institutional qualified investors for US$50 million, which will be used to establish its first cryptocurrency reserve program, targeting Hyperliquid's native token HYPE. The investment amount of US$50 million even exceeds the company's market value of US$20 million.

Eyenovia is facing delisting due to the exhaustion of cash flow and the failure of new product trials. However, the HYPE reserve strategy has given Eyenovia a chance to "extend its life". After the relevant news leaked, Eyenovia's stock price soared 134% in a single day.

Eyenovia said that this transaction is only open to institutional investors. The company will issue 15.4 million convertible preferred shares and 30.8 million common stock warrants, both of which have a conversion price and exercise price of $3.25 per share. If all warrants are eventually fully exercised, Eyenovia is expected to further raise up to $150 million in funds. Although there is no guarantee that all warrants will be exercised, if the transaction is successfully completed, Eyenovia will be able to obtain and pledge more than 1 million HYPE.

The HyperStrategy concept is to treat the native token $HYPE on Hyperliquid as a highly volatile digital asset similar to BTC. The difference is that HYPE does not exist in the narrative of digital gold, but participates in the entire protocol ecosystem as an on-chain economic engine with endogenous cash flow. This structure makes the behavior of holding coins no longer just "static holding", but a configurable, manageable, and dividend-paying on-chain asset operation model.

Circle surged 7 times but I dare not follow it. Can I go long on Coinbase?

Don't go long on Coinbase just because you are bullish on Circle, because USDC-related revenue only accounts for a small share of Coinbase's total revenue. Although Coinbase is a huge ecosystem covering compliant exchanges, USDC, on-chain products and other businesses, its various businesses are currently under competitive pressure. The situation is not optimistic, and investors still need to be cautious in pricing it.

How long can the “mouth-stirring” economy last? Where is the next stop for crypto marketing?

The "mouth-pushing" economy is at the forefront and has become a hotbed for retail investors and project owners to compete with each other. However, this "mouth-pushing" craze is currently facing severe challenges: the proliferation of low-quality content, rampant brushing behavior, and users' growing fatigue with the "reward-driven" routine have led to a continuous decline in conversion rates.

Whoever can provide the largest reward pool, the most sophisticated incentive alignment mechanism, and achieve real user conversion will stand out in this round of InfoFi cycle.

Also recommended: " What are the crypto stocks speculating about? Sorting out the hottest cryptocurrency concept targets in the US stock market " " How to use Grok to capture crypto market sentiment and trading signals in real time ."

Policy and Stablecoins

Those who make rules are not necessarily innovators, but they are often the ones who force things to mature.

For stablecoin issuers, compliance giants are welcoming spring, while offshore players are facing challenges. Traditional financial institutions are actively embracing stablecoins and laying out a new digital landscape. Technology and Internet giants are entering the payment and RWA track to expand the boundaries of application.

Which Web2 businesses are more suitable for the rapid introduction of stablecoins?

What we are really pursuing is the large-scale application of stablecoins - to enable the large-scale use of stablecoins in real business scenarios.

The article provides a detailed guide for To C fintech banks, payroll service providers, and card issuers - how to use stablecoins instead of just telling stories.

The established stablecoin issuer announced the establishment of Paxos Labs, which aims to help institutions issue branded stablecoins, deploy tokenized yield strategies, and manage tokenized assets.

With the launch of Paxos Labs, the "Hundred Coin War" is ready to begin. Whether it is traditional institutions, crypto projects or financial banks, they will all join the stablecoin battlefield. On the one hand, they will earn "coin issuance profits" and seek to pocket real money; on the other hand, they will "expand the business territory" and increase the "market dream rate", just like Strategy, Metaplanet and other listed companies that hoard coins.

The risks and challenges of SaaS services include distribution, revenue and application scenarios.

Airdrop Opportunities and Interaction Guide

Seven Early Airdrop Opportunities for the Solana Ecosystem

Titan, Hylo, Pyra, Exponent, Ranger Finance, Loopscale, Ping Network.

7 new projects worth watching recently

Pengu Clash, VIBES, Upside, Yieldoor, Pango, Ultraviolet, Solid.xyz.

Also recommended: " Treasure List: Inventory of 60+ potential airdrop projects in the second half of 2025 ", " OpenLedger lands on two major "Zuilu" platforms, unlocking new interactive opportunities ", " This week's featured interactive projects: Recall and Anoma landed on the "Zuilu" platform; Kite AI test network ", " Hand in hand to guide you to participate in the latest TG game Pengu Clash of Fat Penguin ", " Interactive Tutorial | Seize the last test network mining opportunity before the Nexus main network ".

Bitcoin Ecosystem

A brief history of mining in Iran: We sat in the dark, just to keep the Bitcoin miners running

On the day when the United States bombed Iran's nuclear facilities, the Bitcoin computing power of the entire network seemed to have dropped off a cliff. Alex Thorn, head of Galaxy research, said that Iran may be mining and the mining website may have been attacked.

The article uses the voice of the Iranian opposition organization NCRI to expose and denounce the corruption in Iran's Bitcoin mining history.

CeFi

Metaplanet, Tax-Free Bitcoin for Japanese

Metaplanet is known as the "Japanese version of MicroStrategy", but public data shows that its bitcoin reserves are only 11,111, far lower than MicroStrategy's 590,000.

mNAV is a measure of a company's valuation relative to the value of its Bitcoin holdings. The higher the value, the more investors are willing to pay for the company's Bitcoin exposure. For every $1 in Bitcoin held by Metaplanet, the stock market pays an additional premium of about $9.35, while MicroStrategy only pays $1.10. In other words, participants in the Japanese stock market are more willing to buy Metaplanet shares than MicroStrategy in the US stock market.

Buying Metaplanet is equivalent to buying tax-free BTC. Metaplanet's Bitcoin reserves are seen as a hedging tool that can not only hedge the risk of yen depreciation, but also provide value preservation in a domestic inflationary environment. This macro hedging demand further increases its market premium. In addition, the investor structure of the Japanese capital market is dominated by retail investors.

Also recommended: " The Lazy Man's Financial Management Guide | Deposit USDC and earn 17%+ interest; don't miss the SyrupUSDC limited incentive pool (June 24) ".

Web3 & AI

Safety

$50 million OTC crypto scam: Well-known tokens involved, VCs and whales can’t escape

There are huge risks in conducting unregulated over-the-counter (OTC) transactions in informal channels such as Telegram, Discord, etc.

Hot Topics of the Week

In the past week, Trump: has successfully completed the attack on three Iranian nuclear facilities ; U.S. Congressman AOC: Trump's unauthorized bombing of Iran may constitute impeachment ; Trump called for "Make Iran Great Again", and BTC lost the 100,000 mark under geopolitical conflicts ; Iran hopes that the United States will pay a "direct" price, and the war is estimated to last for two years ; Trump mediated, Iran and Israel ceasefire, the Federal Reserve hinted at a rate cut, and the crypto market reversed overnight ; Crypto Reporter: OKX may consider an IPO in the United States , and has returned to the U.S. market in April; The United States intends to allow cryptocurrencies to be used as mortgage assets for "two houses" and the market is worried about the subprime mortgage crisis again;

In addition, in terms of policy and macro market, Fed Governor Bowman hinted that he might support a rate cut in July ; Trump called on Powell again : the rate should be cut by at least 2 to 3 percentage points; Fed Hammack: As the Fed seeks clear guidance, interest rate policy may remain unchanged for quite a long time ; Powell dismissed the possibility of a rate cut in July ; White House digital asset policy adviser: The United States is working on building a strategic BTC reserve infrastructure ; Hong Kong Financial Secretary: Embracing the development of digital assets, eight virtual asset trading platform license applications are being reviewed ; Caixin: Hong Kong tokenized ETFs will be exempt from stamp duty ; Hong Kong Cyberport launched a blockchain and digital asset pilot funding program, focusing on payment and stablecoins ; Yu Weiwen: Hong Kong has set relatively strict standards for stablecoin issuers , and it is expected that only a few licenses will be issued in the first phase; Japan's Financial Services Agency is considering incorporating crypto assets into the Financial Instruments and Exchange Act, or promoting separate taxation and Bitcoin ETFs ;

In terms of opinions and voices, Morgan Stanley: Offshore RMB stablecoins will verify the actual use cases of cross-border settlement; Arthur Hayes: The weakness of the crypto market will eventually pass , and Bitcoin's safe-haven properties will be recognized; Analysis: With the recovery of global liquidity and the increase in expectations of the Fed's interest rate cut, BTC may usher in a breakthrough in Q4 ; Coinbase CEO: Buying more Bitcoin every week; Yi Lihua: I believe ETH can outperform BTC , and the success or failure of the investment is the responsibility of myself and the team; Matrixport: Ethereum prices are mainly driven by futures market positions and lack fundamental support ; CZ: There are several other companies preparing to reserve BNB vaults , and they have nothing to do with Binance; Polygon Labs CEO Marc Boiron and Aave community core member Marc Zeller bet on the market value performance of POL and KAT after 6 months ;

In terms of institutions, large companies and top projects, Anthony Pompliano announced a $1 billion merger to create ProCap Financial, a Bitcoin-native financial company ; Nasdaq-listed company Eyenovia announced the completion of a $50 million private placement and the purchase of more than 1 million HYPE tokens ; WLFI said that there will be major news releases soon, and hinted that it is related to the start of token transfers ( interpretation ); Ledger announced that it will gradually phase out its former flagship product Ledger Nano S , which caused controversy; Across was involved in a governance scandal ; OneKey founder questioned Resupply's blame-shifting behavior and called on Curve to return user losses caused by the vulnerability;

According to data, the amount of ETH pledged exceeded 35 million, setting a record high; market news: Polymarket raised nearly $200 million in financing, with a valuation of over $1 billion ;

In terms of security, Coin responded to the SparkKitty virus infection : a risky SDK was implanted, but the relevant functions have never taken effect and user data is always safe; ZachXBT: New York scammers impersonated Coinbase customer service and stole more than 4 million US dollars , most of which was squandered on gambling... Well, it's another week of ups and downs.

Attached is a portal to the “Weekly Editor’s Picks” series.

See you next time~