AI+DeFi is ready to take off, but is there any AI+stablecoin?

Original author: 0x Jeff

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator: CryptoLeo ( @LeoAndCrypto )

Editor's note: 2025 is the year when the stablecoin track rises. The United States has launched the GENIUS Act, and South Korea's new president Lee Jae-myung is also fulfilling his campaign promise to allow local companies to issue stablecoins. In addition to the national level, there are Standard Chartered Bank, Citibank, JD.com, and Ant Group. Domestic and foreign corporate giants are exploring the issuance of various types of stablecoins.

Crypto AI researcher Jeff published an article analyzing the existing problems of existing crypto + AI projects. These projects are too "AI-friendly and crypto-shy", which makes them unable to gain a foothold in DeFi. In addition, Jeff also listed the existing AI + stablecoin projects worthy of attention. Odaily Planet Daily compiled them as follows.

Stablecoins are one of the most important pieces of infrastructure ever created for crypto. Without stablecoins, we wouldn’t have stable units of currency for investors to put their money into (which would make building CEXs, DEXs, Perps, money markets, and any other vertical very difficult).

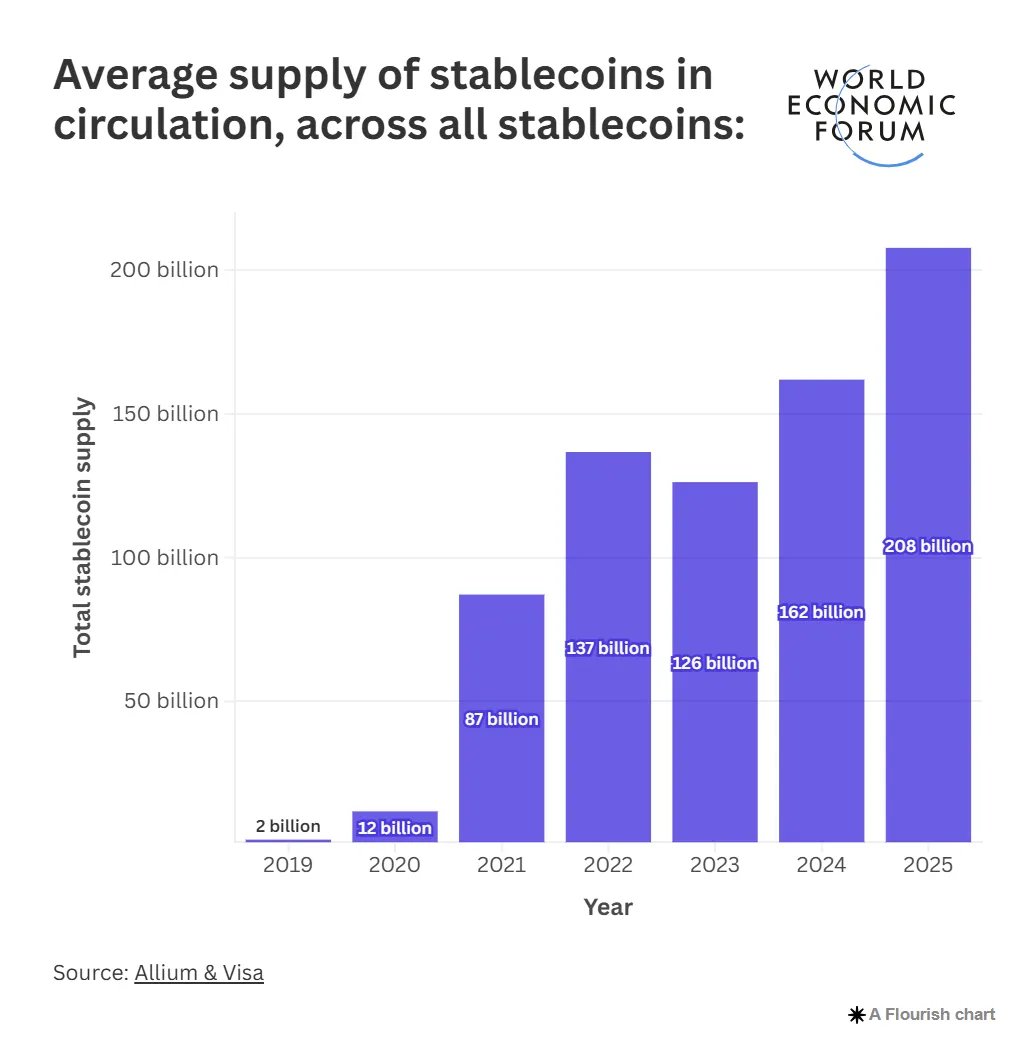

Stablecoins are rapidly gaining popularity - between 2023 and 2025, the total supply of stablecoins, transaction volume, and circulation velocity (the frequency of stablecoin transactions) increased sharply, especially in payments and cross-border transactions.

In addition, we have also seen clearer regulations and further institutional stablecoin adoption, such as Stripe launching stablecoin financial accounts in 101 countries, Societe Generale will launch a dollar-backed stablecoin, major banks (Bank of America, JPMorgan Chase, Citibank, Wells Fargo) are exploring the joint issuance of stablecoins, and large companies are exploring stablecoin payment options to reduce Visa and Mastercard transaction fees.

The recent IPO of CRCL (Circle) has also set off a stablecoin craze, attracting more stakeholders. While we see further adoption of TradFi, we are also seeing some stablecoin innovations emerging in the field of artificial intelligence, aiming to solve the challenges faced by service providers and users in Web3 artificial intelligence.

The first challenge

While AI teams often design AI tokens as a key part of the AI ecosystem (payments, governance, utility), they often invest fewer resources into DeFi and more into AI products.

example:

Virtuals Protocol uses their VIRTUAL/AGENT LP, which brings good value to VIRTUAL, but at the same time makes it difficult for agent teams and liquidity providers to provide liquidity (due to impermanent loss);

Aethir uses ATH tokens as payment for computing power, which has a boosting effect on the token, but also increases its volatility;

Bittensor uses dTAO (alpha subnet token) to pay miners, validators, and subnet owners. Participants must sell alpha tokens in exchange for stablecoins to maintain their operations.

While both examples can be considered flywheels for AI tokens, they also prevent some key players from participating due to the volatility introduced by their design. (BTW, these 3 examples are excellent, but there are also many AI teams that do a pretty bad job in token design, especially some fair launch teams).

The increase in the number of tokens on the market, coupled with suboptimal designs, has led to low liquidity and difficulty in building the Lego blocks of DeFi.

Projects to address the problem of “unequal resource allocation”

MAITRIX —AI Stablecoin Layer

Maitrix launches an over-collateralized AI native stablecoin (AI USD) tailored for each independent ecosystem, essentially transforming unstable (but productive) AI economies into predictable, composable, and vibrant economies with AI native stablecoins.

Key components of Maitrix:

CDP: Users deposit AI tokens and their derivative assets (liquidity staked or staked AI tokens) through CDP to mint and destroy AI USD;

Stablecoin Launchpad: AI projects can create their own AI stablecoins using their native tokens and their derivatives;

Curve War ve(3, 3) incentives: ve governance of MAITRIX tokens, emission redirection, and a ve(3, 3)-like bribery mechanism

StableSwap DEX: Enables trading between various AI USD tokens.

AI USD Assets Supported (To Date)

Aethir USD (AUSD) — A stable payment method for computing power

Vana USD (VanaUSD) — A data-based stablecoin

Virtual USD (vUSD)

ai16z USD (ai16z USD)

0G USD (0 USD)

Nillion USD

More partners are under negotiation.

There is not much detailed documentation on the use cases for each AI stablecoin yet, I will go into more detail on the technical aspects once their whitepaper comes out, but for now, Maitrix is the only team building this layer for AI projects and has established partnerships with top AI ecosystems.

Maitrix is currently on the testnet and is attracting a lot of attention. The public mainnet will be launched soon.

The second challenge

As AI continues to accelerate and expand its application scope, the demand for computing resources is also growing. Data center and cloud operators need to plan their expansion in advance to meet future needs.

Enterprise-class GPUs, such as NVIDIA's H100 and H200, are typically expensive and require a lot of capital.

Traditional financing methods, such as bank loans or equity investments, are often slow and complicated processes, resulting in data centers being unable to scale quickly to meet demand, which is where the next two AI projects, Gaib and USDAI, focus.

Responding to “demand issues” projects

The first project is Gaib.

GAIB AiFi - The first economic layer for AI and computing power, Gaib tokenizes the future cash flow of GPUs to help data centers raise funds efficiently while providing investors with income assets backed by real assets (GPUs).

Basically, it works like this:

Cloud/data centers package future GPU cash flows into financial products;

These cash flows are tokenized on a 6-12 month basis;

Investors buy these tokens and start receiving regular rewards;

They call this AI-synthetic dollar “AID.”

Each AID token is backed by a portfolio of GPU financing transactions and treasury bonds or other liquid asset reserves

The floating return is expected to be around 40% APY, which depends largely on the portfolio of GPU transactions, whether it is debt financing or equity transactions (equity accounts for 60-80%+, while debt has an annual yield of 10-20%).

So far, they have accumulated about $22 million in TVL in incentive deposits, which are in the form of “Spice” points that will entitle investors to future airdrop rewards.

Additionally, Gaib has partnered with Aethir to conduct its first GPU tokenization pilot earlier this year. The pilot was just GPU tokenization/franchising as part of its roadmap to expand to a GPU-backed stablecoin called “AID.”

The second project is USD.AI

USDAI is an interest-bearing synthetic stablecoin backed by RWA launched by Permian Labs. It is very similar to Gaib in some ways, but also different. USDAI is a stablecoin collateralized by hardware assets (such as GPUs, telecommunications equipment, solar panels), and its operation is a debt financing transaction. Borrowers (asset owners) obtain loans from USDAI and pay interest, and these interest incomes belong to USDAI token holders.

Behind Permian Labs is metastreet , a top structured credit marketplace that offers products such as NFT-secured loans, structured credit for illiquid assets/risk-weighted assets (watches, artworks), and Pendle-like NFT income rights transfer (PT YT).

USDAI is not yet live, but its target yield is 15-25% APY, and the asset portfolio is divided into three stages, from 100% treasury bonds to 100% hardware assets. USDAI uses CALIBER, a system that simplifies the loan/issuance process and meets the legal standards for putting GPUs on the chain.

Odaily Note: CALIBER: Collateralized Asset Ledger: Insurance, Bailment, Evaluation, Redemption. This system is based on Article 7 of the Uniform Commercial Code (UCC) of the United States, and through asset tokenization and legal framework, it converts real-world assets (such as infrastructure) into legal collateral that can be used for on-chain financing.

To make a clear distinction, USDAI is focused on debt and has a wider range of assets. With their CALIBER model, they can cover a variety of use cases (wherever the need is), while Gaib is more focused on equity, offering a higher expected rate of return.

You can fill out the form to apply to become an early user, and USDAI will provide additional rewards to early participants.

Other AI-related stablecoin products

Almanak recently launched alUSD, an ERC-7540 version of the token (an extension of ERC-4626), a tokenized AI yield optimization strategy designed to maximize the risk-adjusted returns of stablecoin investments such as Aave, Compound, Curve, Yearn, etc.

The Almanak team will soon launch a points campaign to bootstrap liquidity and continue to expand the composability of DeFi so that people can use alUSD as collateral or recycle it to maximize returns.

The AIxFI project is a vault that automatically deploys USDC in DeFi protocols. It will initially be rule-based, and will gradually introduce AI for decision making. It will be launched on Virtuals Protocol this month.

Future Trends

We will likely see the rise of another project focused on leveraging GPUs to generate high yields for stablecoins, Ethena. More importantly, how they manage their 1:1 USD peg and ensure the price returns to $1 in times of crisis.

In the future, we will also see the emergence of more tokenized AI strategies. We have already seen AI optimize returns better by taking into account gas fees, rebalancing fees, slippage, and other dynamic variables. Imagine tokenizing these strategies into highly composable "vaults" that can be used as collateral and can be recycled to achieve 5-10x leveraged returns.

As players like Maitrix build stablecoin infrastructure for the top AI ecosystem, we will begin to see an increase in Web3 AI liquidity. More AI value will begin to become more composable and flow to DeFi, thereby increasing the value added of the entire Web3 ecosystem.

While these teams are very interesting, when it comes to stablecoins, risk/peg management/redemption/liquidation mechanisms are critical. Do a good risk assessment before deciding to invest.