YZi Labs takes action, making two bets in seven years. Is hardware wallet still a good business?

On June 5, YZi Labs tweeted that it had invested in open source hardware wallet company OneKey.

This is the first time that Binance resources have supported a hardware wallet project again in 7 years after investing in SafePal in 2018 (Note: In 2022, Binance Labs announced a strategic investment in Belgian hardware wallet manufacturer NGRAVE. The amount was not disclosed. The attention in the Chinese-speaking region is relatively low, so this article does not cover it for the time being). It can be called "restrained", so it is particularly worthy of attention, and it has once again heated up the industry's discussion on whether hardware wallets are a good business.

From a timeline perspective, after the FTX incident in 2022, the importance of self-custody has been repeatedly verified. Binance’s two (publicly disclosed) investments in seven years also fully demonstrate that it is not a random but a selective betting logic.

So the question is: Is hardware wallet still a good business? Or, after going through bull and bear cycles, regulatory storms and security incidents, has it already surpassed a simple profit-making business and become a trust-level Web3 infrastructure?

Are hardware wallets a good business?

Hardware wallets have always been a business where "it's difficult for newcomers to enter and difficult for old brands to grow."

High barriers to entry, high education costs, thin hardware profits, and long user conversion cycles are inherent structural challenges in this field. Therefore, even in the more than ten years of development of Web3, hardware wallets have always been regarded as the "ultimate solution" for asset security, but there is always a psychological and usage threshold between them and large-scale popularization.

If we look back at the development history of these mainstream hardware wallet products on the market, we will find that the starting point of the industry can be traced back to 2014, which is a very long span:

2014: Trezor launched the world's first hardware wallet. Ledger also launched the classic Nano series in the same year, marking the starting point of cold wallet security technology.

2018: SafePal became the first hardware wallet project selected for the Binance Labs incubator, and received strategic investment from Binance at the end of the same year. The following year, the S 1 Classic product was launched.

2019: OneKey was officially established, with the positioning of "open source × minimalism" and became one of the most representative hardware wallet brands in the minds of Chinese-speaking users due to the hot sales of OneKey Classic during the Summer on Chain period;

But it is worth noting that although almost all of them had been established or launched mature hardware wallet products before 2020, the key nodes of these product dimensions did not directly contribute to the transformation of hardware wallets from "geek tools" to "mainstream user portals."

What really pushed hardware wallets back to the core of users’ vision were two unexpected industry events:

First, the outbreak of the on-chain Summer in 2020 catalyzed a group of on-chain Degen users to start using hardware wallets for secure signatures and contract interactions, completing a critical step in educating many users from 0 to 1;

The second is the FTX collapse in 2022. The trust crisis brought about by the collapse of CEX has caused a large number of users to re-examine private key management. "Not your keys, not your coins" has changed from an idealistic slogan to a real pain point, and the attention to hardware wallets has surged;

Since then, hardware wallets, which were originally in a corner, have officially entered the center of the Web3 security narrative.

But to be realistic, Trezor and Ledger hardware wallets in the 1.0 era were indeed not suitable for ordinary users - the initial setup and backup process was complicated, the operating threshold was high, the supporting software was difficult to use, and the price of thousands of RMB discouraged most people before they experienced its value.

The emergence of brands such as SafePal and OneKey has, to a certain extent, greatly lowered the entry threshold by lowering prices and reconstructing the experience, making hardware wallets move from geeks to the masses. It can be said that this strategy of "tearing down the price wall and focusing on user experience" is precisely an important catalyst for pushing hardware wallets from the geek circle to the mass market.

In fact, as long as it is cheap enough and the user experience is friendly, users will be more willing to take the first step in self-custody even if they just want to "try it first". Once the experience is good and the sense of asset security is improved, they may transform from "experimenters" to long-term users.

The market demand for security has always been rigid, especially with the continuous expansion of Web3 user base. Security should not be an advanced configuration but a basic public service.

This is why we say that security is not an accessory to Web3, but the foundation of Web3 - again, behind every successful scam, there may be a user who stops using Web3, and the Web3 ecosystem will have nowhere to go without any new users.

From this perspective, regardless of whether hardware wallets are a "good business" or not, at least they are becoming an indispensable business.

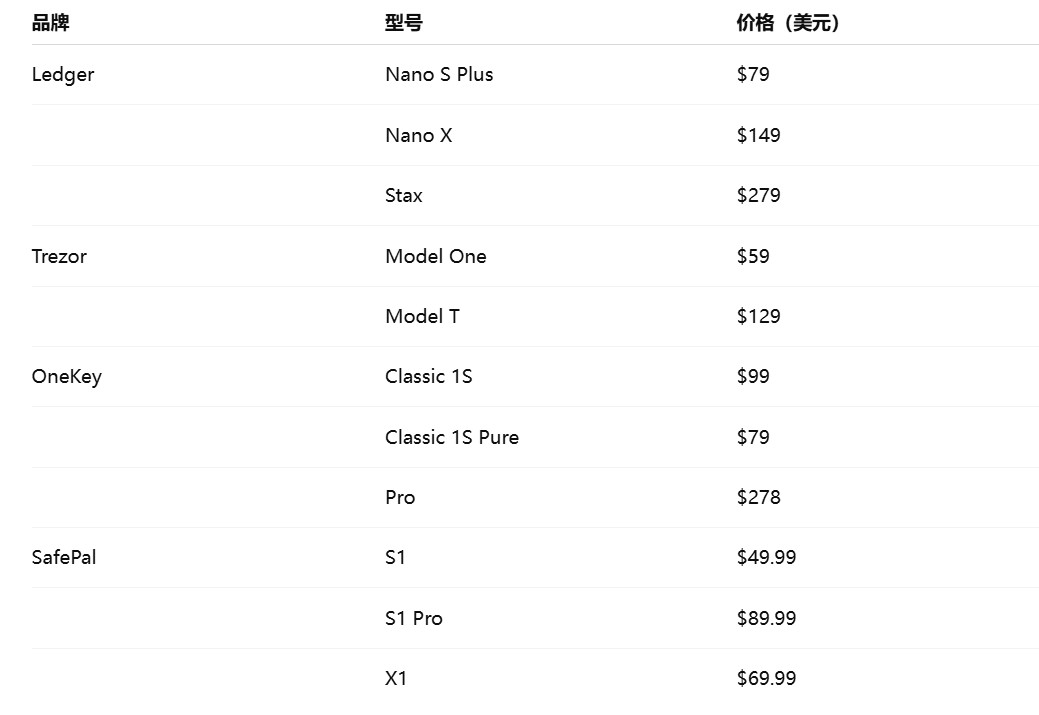

List of mainstream hardware wallets on the market

If hardware wallets were still exclusive equipment for geek players a few years ago, they are now gradually evolving into encryption infrastructure for a wider user group.

The author has used a number of hardware wallets including Cobo, imKey, OneKey and SafePal. In addition to the differences in experience, he has also clearly felt the rapid evolution of the industry - especially among the Chinese-speaking user group. In addition to the two overseas veteran manufacturers Trezor and Ledger, OneKey and SafePal are the most recognized and have the most active product iterations.

1.OneKey: Open source philosophy + rapid construction of user mind

Among all the mainstream hardware wallet manufacturers, OneKey, which was independent from Bixin, did not start early, but with the narrative dividend of Summer on the chain, it has quickly established strong user awareness (in the Chinese-speaking area) and formed a clear brand label - minimalist, secure, and open source.

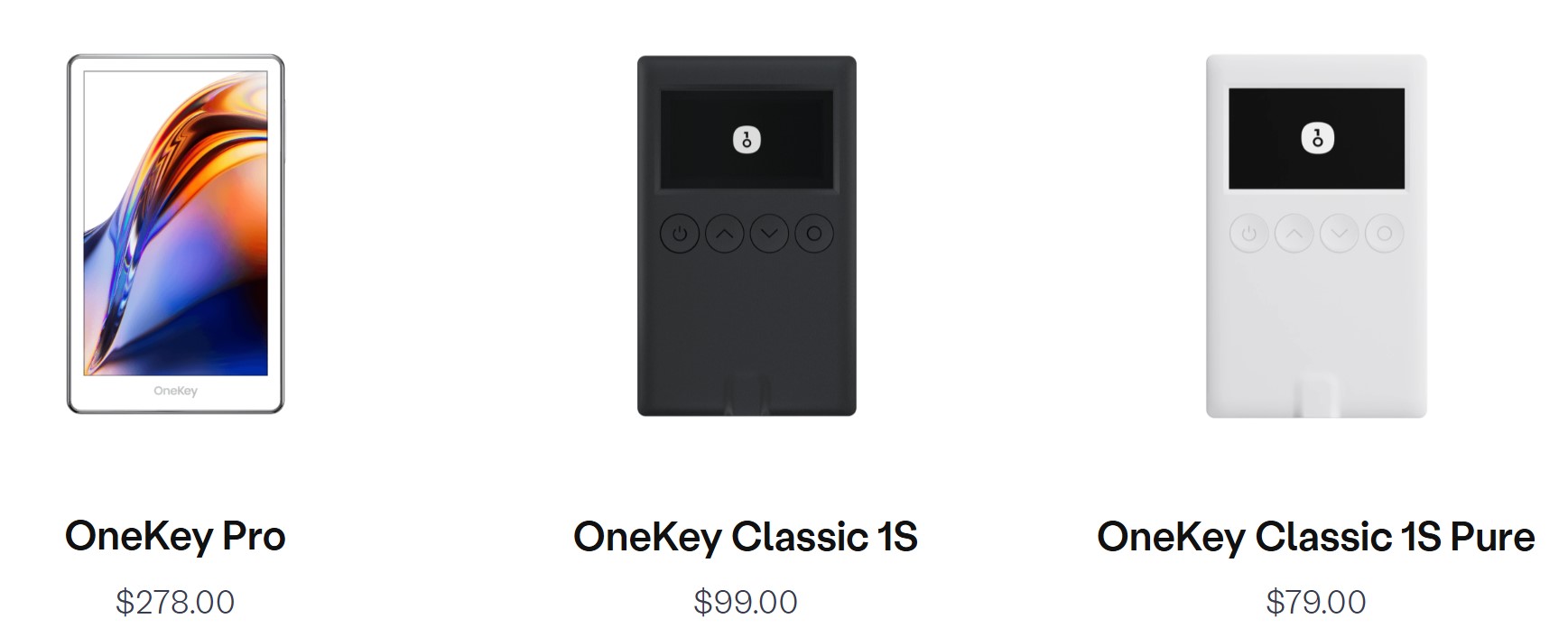

In recent years, OneKey's products have gained a lot of favor among users in the Chinese-speaking market. Its representative products include:

OneKey Classic 1 S / 1 S Pure: A thin, credit card-style hardware wallet for first-time cold wallet users;

OneKey Pro: supports Air-gapped signature, fingerprint encryption verification and wireless charging, taking into account both security and convenience, and is aimed at advanced users;

In particular, its classic product OneKey Classic released in 2020, riding on the momentum of Chain Summer, became a favorite of Chain Degen users for a time, but the model is currently sold out.

In recent years, OneKey has also begun to try to "break the circle" with its products. For example, the recently launched USDC income module attracted more than US$62 million in subscriptions, which indirectly reflects its active user base and community stickiness.

2. SafePal: From hardware to full stack, Binance’s “Wallet OG”

Compared to OneKey, which has just received investment from YZi Labs, SafePal is actually the earliest hardware wallet project supported by Binance, and its growth path is more inclined to the development project of Binance:

In September 2018, SafePal was selected as the only wallet brand for Binance Labs' first incubator program and went to San Francisco for a 10-week incubation. At the end of the same year, it received investment from Binance and officially launched its first hardware wallet product, S 1, in the first half of 2019.

SafePal then adopted a product strategy of "small steps and fast progress", gradually expanding its models to cover different market segments and building a product matrix for different user levels:

The entry-level hardware S 1 (2019), the Bluetooth model X 1 (2023), and the advanced version S 1 Pro (2024), all of which are open source;

Supporting software wallet app (2020) and browser plug-in wallet (2022);

Telegram mini-app wallet (2024), on-chain bank account/Mastercard (2024), and other services;

Although SafePal has mass-produced a number of hardware wallets, it still takes a people-friendly approach overall. For example, among its current products on sale, the S 1 Pro is the most expensive, but it is only $89.99, the X 1 Bluetooth model is $69.9, and the S 1 is as low as $49.99.

It is worth noting that SafePal is one of the few hardware wallet projects with tokens. In 2021, SFP was released through Binance IEO Launchpad, and it has become more well-known to many Chinese-speaking users. For this reason, SafePal’s characteristics have always been reflected in its deep linkage with the Binance system:

SafePal is currently the only wallet product that is deeply integrated with Binance - the APP directly accesses Binance's spot trading, leveraged trading, contract trading and financial management functions (in the form of sub-accounts). It also lightly integrates Binance's fiat currency deposit and withdrawal channels, which means that you can share Binance's trading liquidity and deposit and withdrawal channels in a one-stop manner in the SafePal wallet, which can basically meet your daily trading needs.

In addition, SafePal also has a first-mover advantage in supporting BNB Chain on-chain activities and ecological collaboration. For example, it currently supports gas-free transfers of stablecoins on BNB Chain (currently, the author uses the SafePal App to transfer stablecoins such as USDT/USDC on a daily basis to save gas fees).

It is worth noting that in April, SafePal co-founder Veronica became a mentor for the new incubator of YZi Labs, which to some extent reflects its long-term relationship with Binance VC and its influence in the industry.

3. Ledger and Trezor

As mentioned above, Ledger and Trezor are the oldest overseas manufacturers in the hardware wallet market, but they have always been criticized for being "difficult to use" and "too expensive."

Among them, Ledger is currently the hardware wallet manufacturer with the highest cumulative sales in the world. The cumulative shipments of Nano S/Nano X series have exceeded 6 million units. It has a very high brand reputation and compliance endorsement in the European and American markets, and is suitable for institutions and high-net-worth users with high requirements for private key hardware isolation and security authentication.

Trezor is recognized by the industry as the "pioneer of hardware wallets". It released the world's first hardware wallet in 2014. Its two products, Trezor One and Trezor Model T, have a strong reputation in the BTC community, geek users and liberal circles, and its operating logic tends to be geek-type users.

4.Keystone: The ultimate secure QR offline solution

Keystone is a fully open source Air-Gap security product that uses an embedded system (no Bluetooth, USB, Wi-Fi). It completes address generation, transaction signing and other operations by scanning QR codes with a camera to ensure that private keys never touch the Internet. It is also an official MetaMask cooperative hardware wallet and supports linking with MetaMask.

The current flagship model Keystone Pro is equipped with a 4-inch touch screen, fingerprint recognition and multiple security chips (3 independent CC EAL 5+ certified chips), supports up to 3 sets of mnemonics management, and can be linked with mainstream wallets such as MetaMask and Solflare via QR code.

In general, different hardware wallet players currently have different focuses on product positioning, but they are all committed to building the next stage of "security × usage × linkage" encryption entry products.

More than just "cold storage", from single hardware to full-stack services

The starting point of a hardware wallet is security, but the real end point is far more than that.

This is also the common trend of almost all mainstream wallet manufacturers today: cold storage is certainly a core competitiveness, but relying solely on one or more hardware devices is no longer enough to form a differentiated barrier.

From a business perspective, the user groups of hardware wallets are generally labeled as "on-chain Degen", "diamond hand holder", "Crypto high net worth users" and other market segments with extreme demands for security. Therefore, for "hardware wallets", their core value lies in the offline storage and isolated protection of private keys.

However, as the crypto user group migrates from geeks to everyday users, asset sinking with "secure storage" as the core is only the first step. More and more users are beginning to expect that wallets are not just warehouses for cold storage of coins, but operating platforms that can smoothly use assets: covering a wider range of experiences such as transactions, interactions, financial management and even off-chain payments.

In other words, the competitive dimension of hardware wallets is extending from "security capabilities" to "service capabilities."

This is also the reason why hardware wallet manufacturers are turning to "full stack". SafePal, OneKey, etc. have already extended their functions to DeFi and TradFi scenarios, rather than just being limited to "coin storage":

Upgraded on-chain operation experience: support one-click swap, multi-chain asset synchronous display, contract authorization analysis and other functions, lowering the threshold for on-chain interaction;

On-chain payment scenario access: Integrate lightning network, cross-chain bridge, and stablecoin protocol to achieve fast on-chain payment and inter-chain asset flow;

Ecological tools are connected: contract authorization analysis/authorization removal tools, gas stations, built-in DApp browsers, plug-in wallets, Telegram applets and other interactive modules are provided to cover the "last mile" of user chain activities;

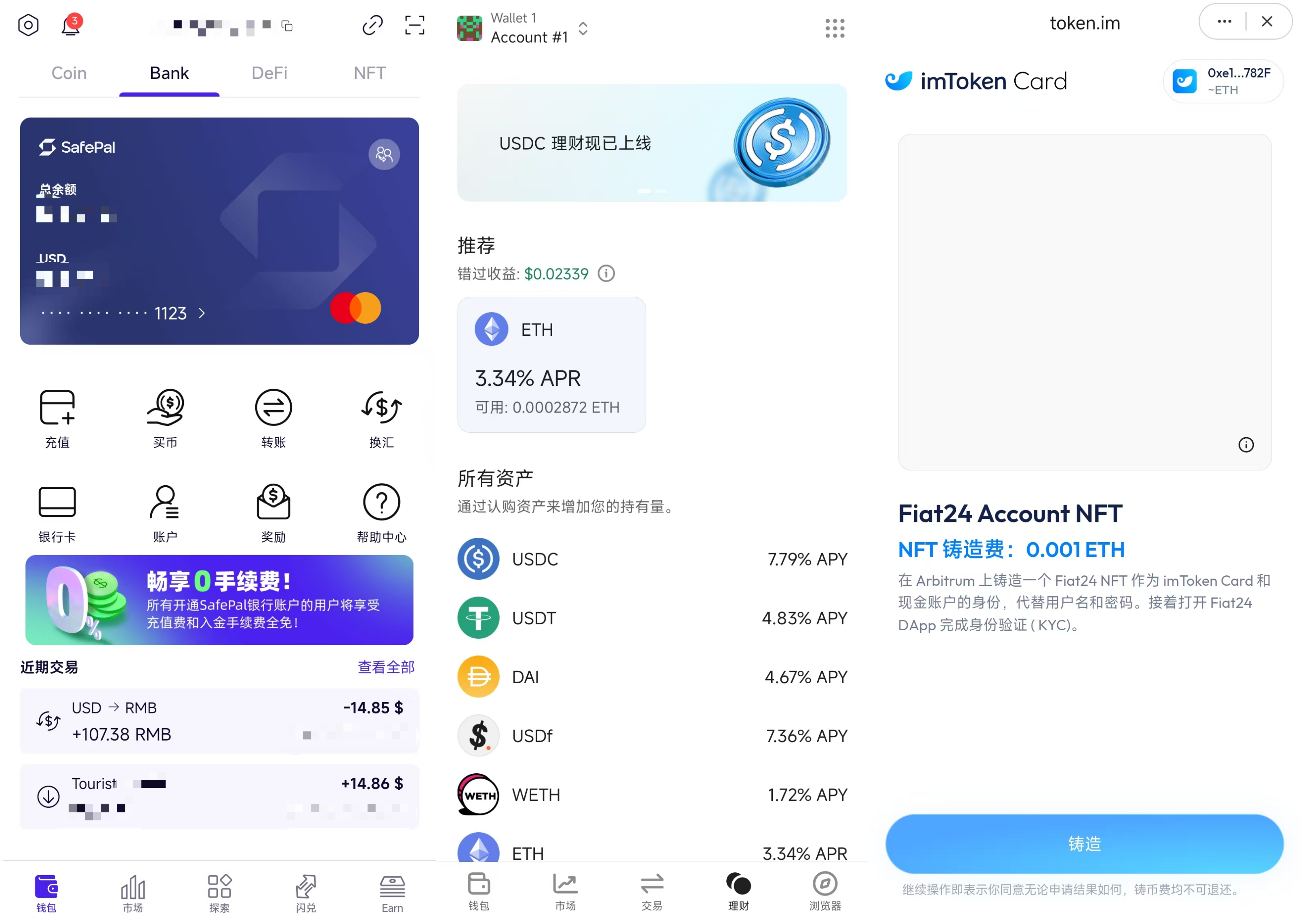

There are even companies like SafePal that try to "move" exchanges (Binance, Bitget) into wallets, and imToken, SafePal, and TokenPocket that integrate banks such as Fiat 24 to achieve consumer-level innovation in bank account/Mastercard payments, in order to further open up fiat currency channels and off-chain consumption.

From left to right: SafePal "Bank" page, OneKey financial management page, imToken Card page

This "full-stack path" is quite representative of SafePal, the hardware wallet project that Binance invested in the earliest: from the early hardware wallet to the construction of App wallets, plug-in wallets, off-chain payment accounts and bank card services, it has now formed a complete asset management closed loop covering "cold storage - on-chain interaction - off-chain use".

This also means that hardware wallets are no longer isolated devices here, but the physical security base of the entire multi-terminal product matrix, taking into account "hardware coin storage + APP/plug-in interaction + off-chain consumer payment", which is a microcosm of this major trend.

Looking at the entire industry, this is a signal that a consensus is forming. Objectively speaking, when we discuss the competitiveness of hardware wallets today, their role boundaries are constantly being expanded from "being able to keep" to "being able to afford" and then to "being enjoyable to use" - from cold storage to multi-chain interaction, from on-chain asset management to off-chain deposits and withdrawals, the role boundaries of hardware wallets are being continuously expanded.

This may also be one of the reasons why Binance re-entered the hardware wallet track after 7 years. No matter which path wins in the end, the second half of the hardware wallet has obviously just begun.

Last words

Wallets have always been regarded as the entry point to Web3, and are the intersection of the on-chain identity system and the off-chain payment channel.

Because of this, although this track seems to be divided, the players are actually heading towards the same destination: whether it is the international veteran manufacturers Ledger and Trezor, or the up-and-coming companies SafePal, OneKey, and Keystone, they are ultimately heading in the same direction, that is, to build a comprehensive encrypted wallet system that integrates private key security, on-chain interaction, and off-chain payment.

So, is hardware wallet still a good business?

Judging from the current signs, especially the renewed efforts of YZi Labs, the answer tends to be affirmative - however, it is no longer a "cold wallet" business that simply sells equipment and targets niche geeks, but is evolving into a foundation that undertakes the role of self-custody, secure interaction and off-chain landing of encrypted assets.

A truly "good business" is often not just about making money, but about penetrating into the underlying logic of the industry and becoming an indispensable part.

The next stop for hardware wallets may be this location.