Aave Umbrella officially passed: stkGHO APY 13% stablecoin mine falls?

Original author: @Web3 Mario (https://x.com/web3_mario)

This week, the AAVE ecosystem passed a key proposal. The AAVE Umbrella module, which has been brewing for a long time, has been recognized by the community and will be implemented on June 5, 2025. So far, the AAVE Umbrella module will officially replace the original Safety Module and carry the bad debt guarantee function of the AAVE ecosystem. I personally like the stkGHO yield scenario of the original Safety Module very much before. It can get an annualized yield of 13% of the stablecoin standard under controllable risks, which is not bad. However, the passage of this proposal will bring a significant change to the yield paradigm of the original AAVE ecosystem. Therefore, this article is specially summarized to introduce the specific impact of the passage of Aave Umbrella and share it with you. In general, through the launch of Aave Umbrella, the pressure on the supply side of AAVE tokenomics is optimized, and the capital efficiency is improved from the perspective of the project party, but it is necessary to observe the impact of the original incentive scenario participants on the protocol during the transition process, and stkGHO participants alone may need to find other yield scenarios.

What Problems Does the Aave Umbrella Module Solve?

First of all, we need to introduce the significance of the Aave Umbrella module. As we know, AAVE is a decentralized lending protocol with an over-collateralization mechanism. The core risk comes from the bad debt problem caused by untimely liquidation when the market fluctuates violently, resulting in a sharp drop in the value and liquidity of the collateral. Before Aave Umbrella, AAVE mainly used the Safety module to mitigate this risk. Simply put, it is a fund pool. When the protocol has bad debts, the funds in the pool can be used to make up for the protocol losses. Of course, in order to subsidize the fund providers who bear the risk of bad debts in the protocol, AAVE has allocated relatively generous incentives to them.

In the Safety module, three types of funds are supported, AAVE, BPT, a liquidity certificate in the Balancer AAVE/wstETH Pool, and GHO. Users holding these three tokens can stake their tokens in the Safety module and earn AAVE token rewards released by the official. The pledged funds will be used to compensate when AAVE has bad debt problems, a process also known as "slashing". The maximum slashing ratio for the first two assets is 30%, while the maximum slashing ratio for GHO is 99%. In addition, the pledged funds need to go through a 20-day cooling-off period and a 2-day redemption period when redeemed, and they will be re-pledged if the time limit expires.

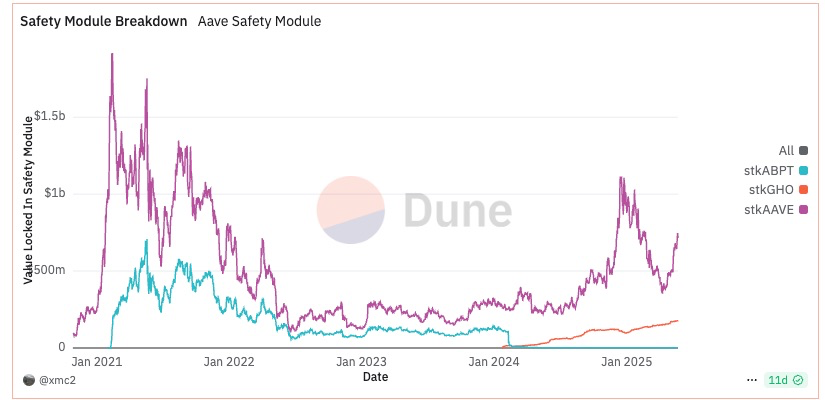

This mechanism design has two benefits. In addition to alleviating the bad debt risk of the protocol, the yield capability also brings usage scenarios for related tokens, thereby creating demand for AAVE tokens and GHO. As of now, the total amount of funds in the Safety Module has reached $1.14 B. Among them, the AAVE pledge value has reached $744 M, the ABPT pledge value has reached $222 M, and the GHO pledge value has reached $170 M.

However, this mechanism has two main problems:

The maintenance cost is too high;

Capital efficiency is too low;

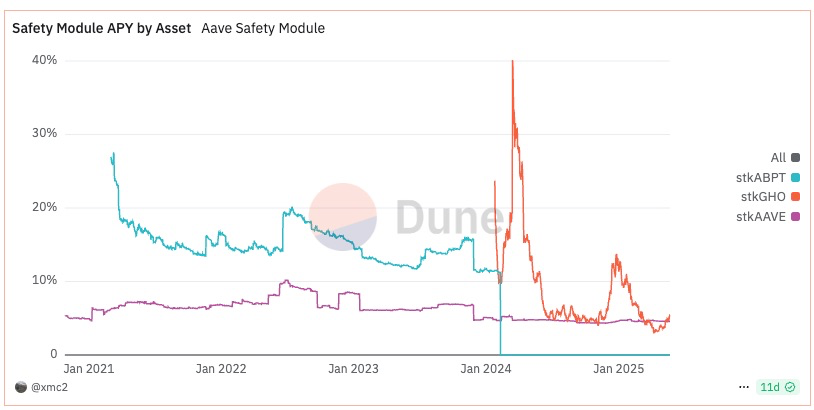

First of all, the cost that AAVE has paid to attract this part of funds is also amazing. According to the current interest rate level, the staking APR of stkAAVE is 4.57%, the staking APR of stkGHO is 5.55%, and the staking APR of stkABPT is 10.18%. We roughly estimate the annual incentive expenditure based on TVL to be around $66M, and this part of the incentive comes from the additional issuance of AAVE, which has put a lot of pressure on the maintenance of AAVE's market value.

Secondly, since the funding category only involves AAVE tokens and GHO related assets, considering that AAVE is a blue-chip asset lending protocol, the core category of bad debts should be blue-chip assets, such as USDT, ETH, etc. When bad debts occur, relying on the current Safety module, AAVE related tokens or GHO have to be sold in exchange for bad debt assets to make up for the deficit, which also brings additional challenges to the liquidity of AAVE and GHO. Therefore, it can be said that the funding pool built with high rewards is not very efficient in terms of bad debt risk mitigation.

In order to optimize these two problems, the AAVE team proposed Aave Umbrella to replace the original Safety module. In short, Aave Umbrella has three main optimizations:

1. In terms of funding categories, aTokens that are more relevant to protocol loans are used to absorb funds, and each aToken is only responsible for the guarantee of the corresponding underlying tokens, replacing the original reliance of all loans on AAVE tokens and GHO-related tokens. In this upgrade, three new assets are mainly introduced: stkwaUSDC (staked wrapped aUSDC), stkwaUSDT, and stkwaETH.

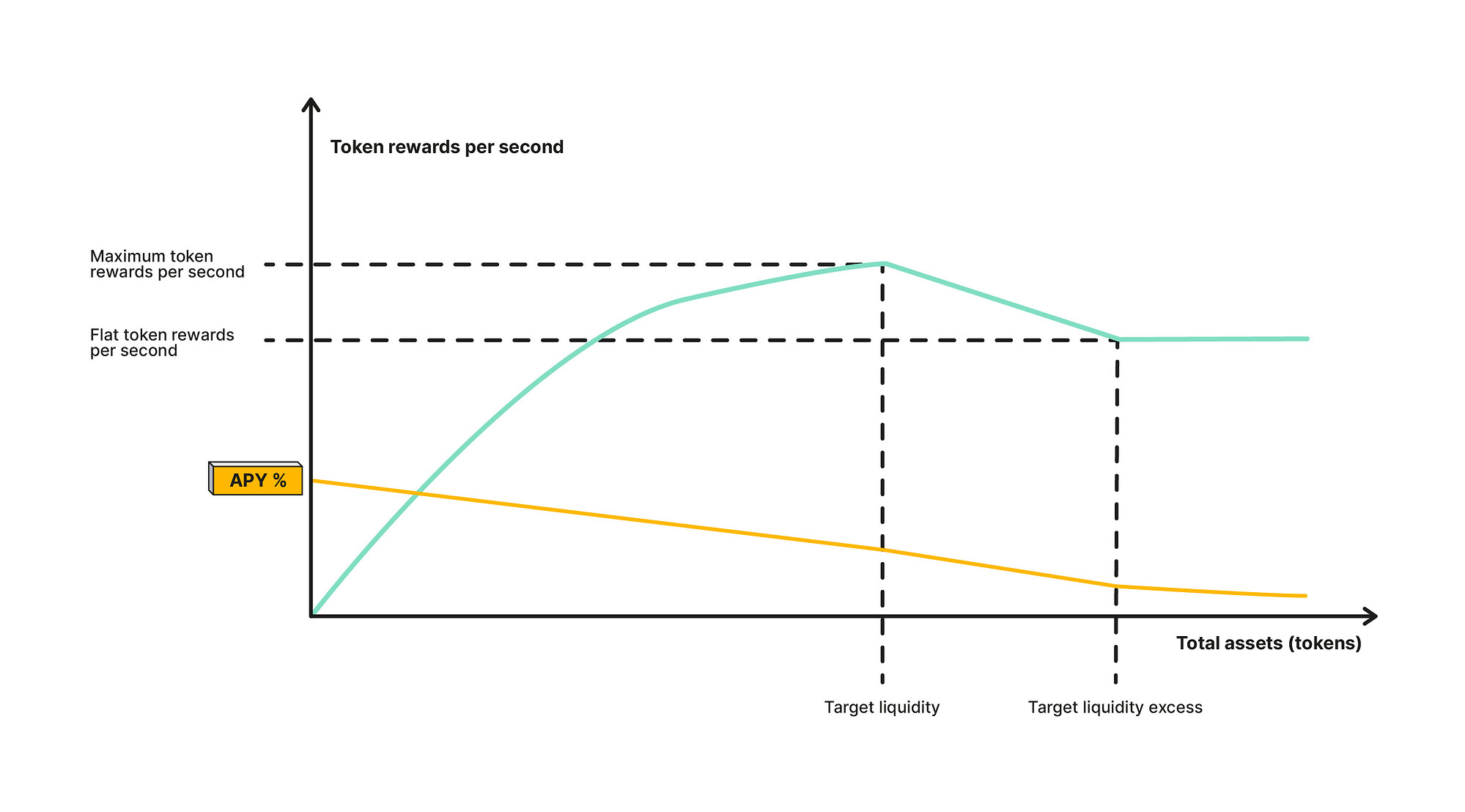

2. In terms of incentive distribution, the release curve model is used to determine the final staking yield of each asset. The interest rate will be affected by three parameters: target liquidity, current staking amount, and maxEmission. Simply put, the release curve is a three-segment function:

(1) When the amount of staked tokens is less than the preset target liquidity, the AAVE reward distributed by the protocol for each unit value of staked tokens will increase, but the growth rate will slow down as the target liquidity is approached until maxEmission is reached;

(2) When the staked amount reaches Target Liquidity and an excess threshold (perhaps 20%), the AAVE rewards distributed by the protocol for each unit value of staked tokens will decrease linearly;

(3) When the pledge amount exceeds the threshold, the unit reward amount remains unchanged;

The total APY change follows the yellow line shape, which is a piecewise function. Of course, the main benefit of doing this is capital efficiency. By adjusting the interest rate, the amount of safe funds can be controlled within a reasonable range to avoid protocol transition subsidies. In this adjustment, the system parameters are shown in the figure. Note that the unit is priced in the basic token.

The AAVE release adjustments for the original three tokens are as follows:

3. In the Slashing mechanism, automatic execution at the smart contract level replaces the original proactive trigger that relies on DAO governance.

The first two points are more important for DeFi users because the medium of return and the rate of return have changed. Considering that the incentive adjustment of AAVE and ABPT adopts gradual adjustment, we will mainly use the rate of return change of stkGHO to illustrate the impact of AAVE Umbrella.

From 13% to 7.7%, the risk-return model of GHO stakers has undergone a structural shift

After this upgrade, AAVE provides a transition period for the reward adjustment of stkAAVE and stkABPT. The reward change is not particularly large, which is naturally a consideration for maintaining the demand and liquidity of AAVE. However, in the new Umbrella module of stkGHO, the risk compensation rate of GHO has dropped significantly: First, we calculate according to the latest interest rate model, combined with the current preset parameters:

(1) Target Liquidity: $12M

(2) maxEmissionPerYear: $1.2M

(3) The current total stkGHO stake is $170M

Assuming that the current stkGHO pledgers completely switch to the Umbrella module, the user's holding rate is only 0.56%, which is much lower than the current 5.55%. Of course, considering the 7.14% income allocated to GHO users in the Merit module, the final income may drop from the current 13% to about 7.7%. Of course, the premise is that all stkGHO pledgers completely switch to the Umbrella module. Considering the loss of funds, the actual yield will be greater than the changed value. For specific calculations, please refer to the Desmos link to calculate it yourself. Of course, the reduction in yield is also accompanied by a reduction in risk. In the future, stkGHO pledgers only need to bear the bad debt risk of GHO loans.

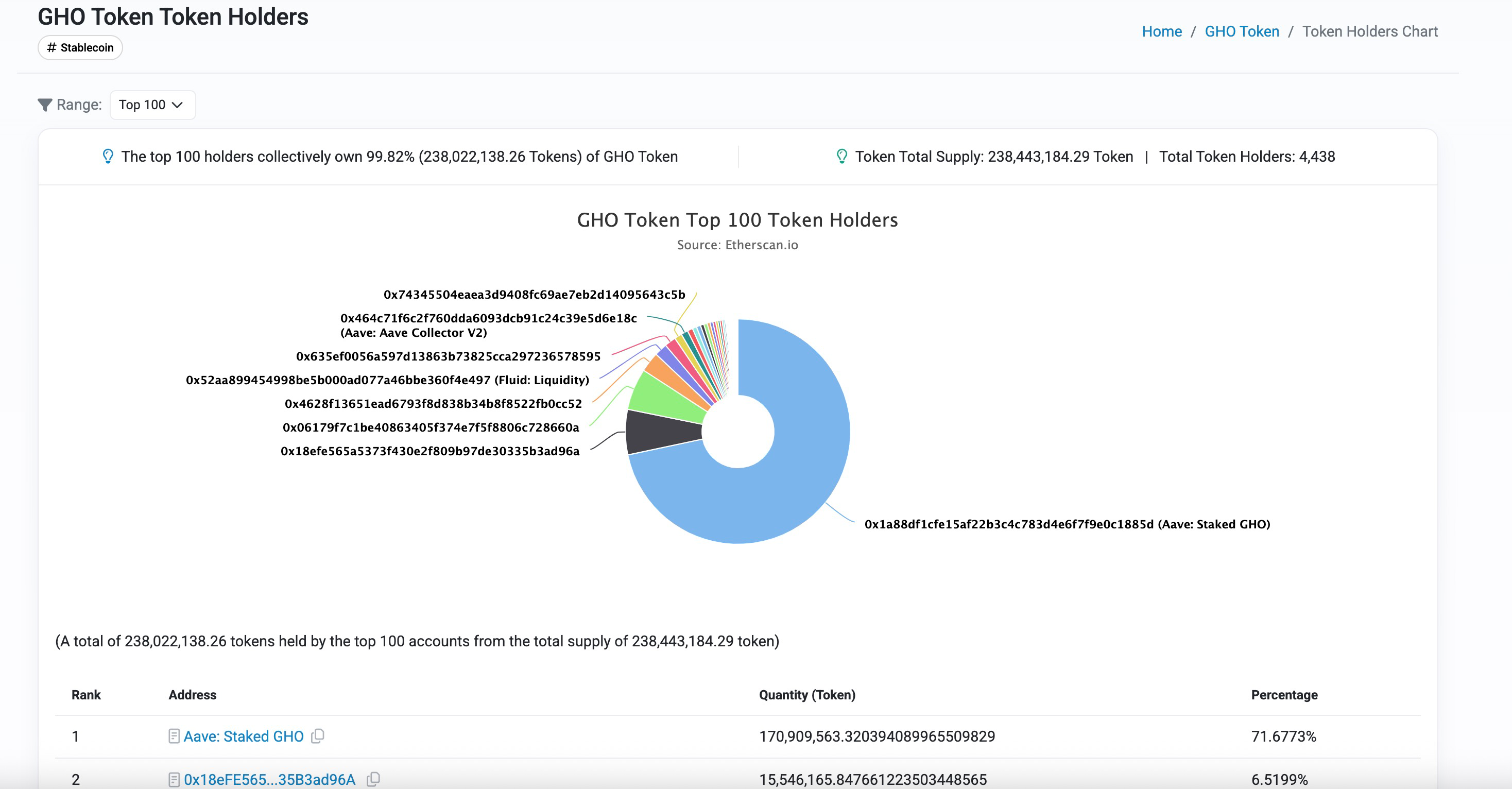

Then let's discuss what impact it will have. It is foreseeable that the issuance of GHO will shrink significantly. The current GHO is 238M, of which 170M is used to participate in stkGHO, accounting for about 71% of the total. This is a high pledge amount, which means that most of the current user demand for GHO still comes from the pledge income of stkGHO in the Safety module. A sharp drop in yields will inevitably mean a loss of GHO demand until the supply and demand relationship is rebalanced. However, there is no need to worry about the risk of a run in the process, because after all, the total collateral of GHO currently exceeds 245%, which is at a very healthy level.

From the perspective of the AAVE protocol, this is a re-examination and adjustment of the unhealthy development model of GHO in the past stage, because before this, the demand for GHO was more based on governance token subsidies, but there was no actual sustainable demand support. After this update, perhaps the AAVE team will rebuild the competitiveness of GHO from the actual demand scenarios such as decentralized stablecoins in payment media, anti-censorship, and improving the capital efficiency of lending agreements. But it is a pity that the first generation of God Mine may disappear.