An article analyzing the breakthrough point of the contract track in CZ’s eyes - dark pool

This article comes from: Four Pillars; original author: @SiwonHuh

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

On June 1, CZ posted a tweet about dark pools on X, proposing the establishment of a "dark pool-type perpetual contract DEX" and pointing out that the transparency of DEX's real-time public orders may harm the interests of traders.

CZ's topic quickly sparked market discussions on the privacy and efficiency of cryptocurrency transactions, especially the concept of dark pools, which aroused great interest in the market.

In this article, we will systematically analyze the definition of dark pools and the significance of dark pools in the Web3 field.

What is a dark pool?

Dark pools in traditional finance

Although CZ’s statement may cause the misunderstanding that “dark pools are a product unique to Web3,” dark pools are actually private trading platforms that have existed in the financial market for a long time.

The history of dark pools can be traced back to 1979, when the U.S. Securities and Exchange Commission (SEC) passed Regulation 19 c-3, allowing securities listed on specific exchanges to be traded on other platforms. Subsequently, the rise of high-frequency trading (HFT) based on electronic trading in the 1980s exposed order book information more widely than before, which gave rise to institutional investors' demand for private trading venues that do not disclose large transactions.

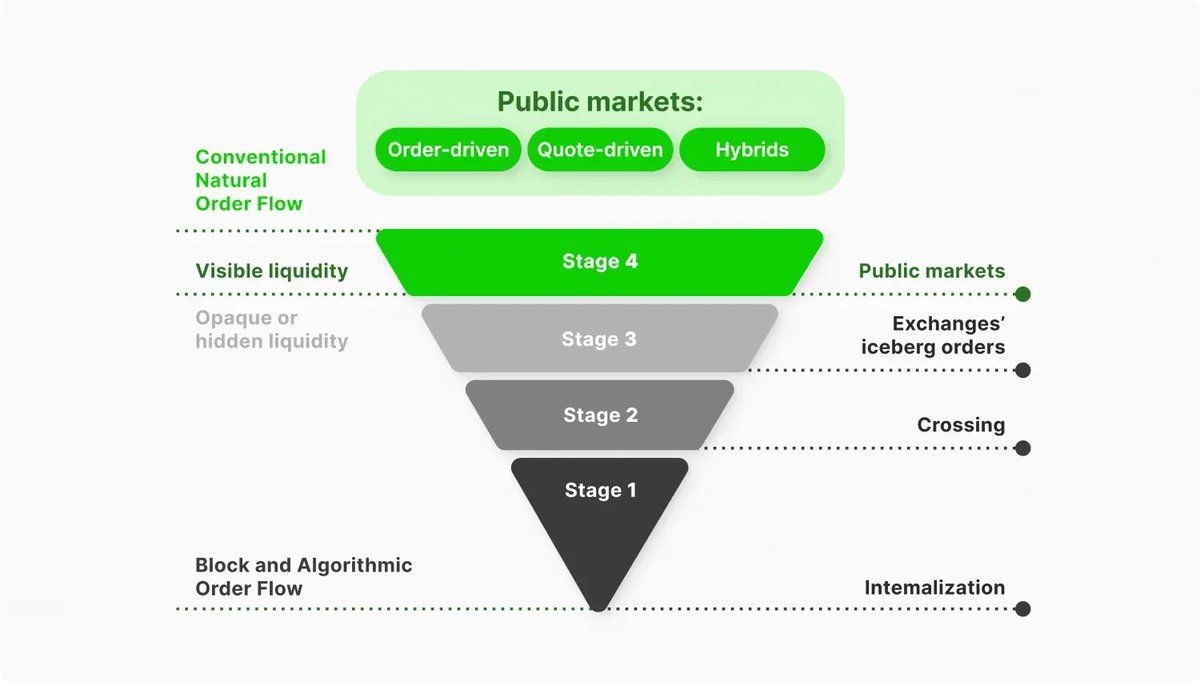

Usually we deal with public exchanges such as the New York Stock Exchange (NYSE) and Nasdaq, but when large buy and sell positions are established in these public markets, it will significantly impact market prices and may cause unexpected losses to ordinary traders. Dark pools refer to independent trading systems that allow institutions or large investment banks that conduct such large transactions to execute privately.

All buy and sell orders in traditional exchanges are publicly displayed on the order book, while dark pools do not disclose order prices or quantities before they are executed. With this feature, large institutional investors can hide their trading intentions while minimizing market impact. By 2025, 51.8% of US stock trading volume will be completed through dark pools, indicating that it has evolved from a supplementary trading method to a mainstream trading method.

This kind of dark pool trading is different from cryptocurrency over-the-counter (OTC) trading. Dark pool operators accumulate stocks through short selling and deliver purchase volume to buyers. Since they need to disclose short selling transaction details to financial regulators such as FINRA, the details and scale of dark pool transactions are actually disclosed. The difference is that the identity of the institution that directly initiates the transaction is not disclosed. The current dark pool trading volume is disclosed in the form of the DIX index, and traders usually speculate on the flow of institutional funds based on this.

Controversy of Traditional Dark Pools

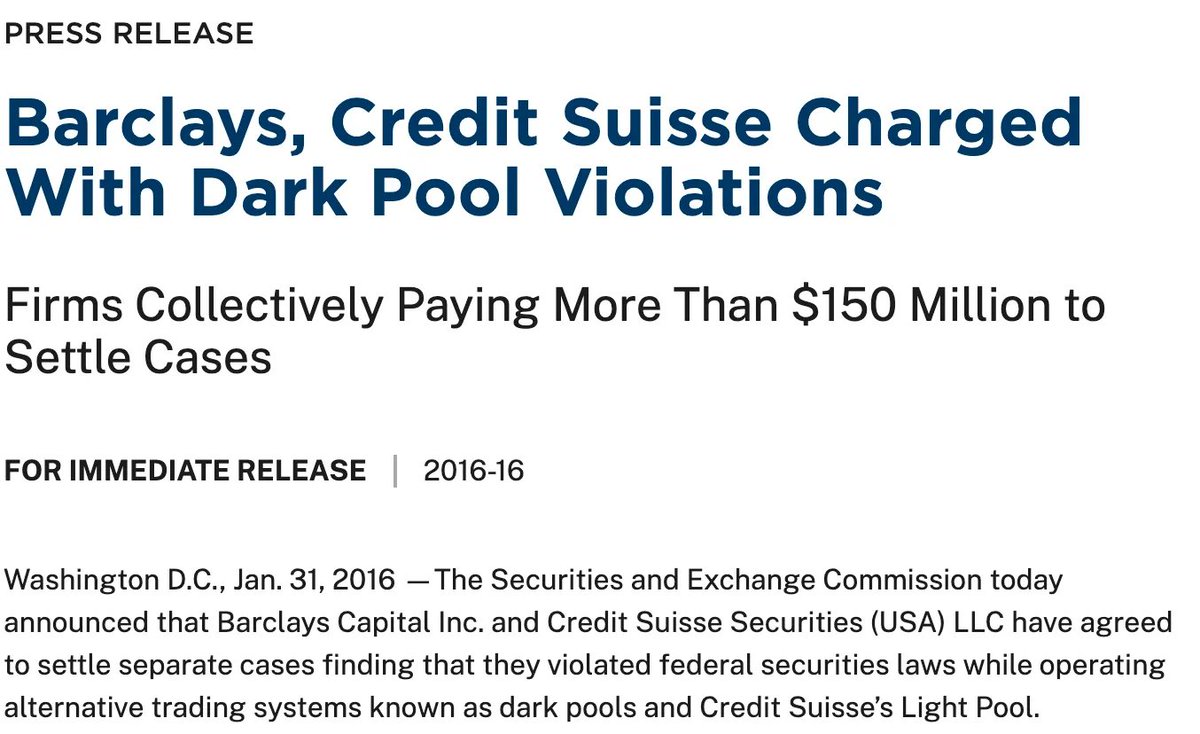

However, dark pools in traditional financial markets have long been criticized - since traditional dark pools are managed by centralized operators, they are easily abused when the proceeds of corruption far exceed the cost of fines, and many dark pool crime cases have occurred in reality.

In 2016, several financial institutions were fined more than $150 million for violating federal laws in their dark pool businesses, with Barclays and Credit Suisse being sued by the SEC for violating dark pool regulations. The charges included misrepresenting to clients the composition of dark pool participants or offering preferential terms to high-frequency trading firms without transparent disclosure.

In 2018, Citigroup was fined $12 million by the SEC for misleading investors about its dark pool operations. The group leaked confidential order information to high-frequency trading firms, allowing these firms to execute more than $9 billion in trades against Citigroup clients and profit from it.

The root of these problems lies in the trust and conflict of interest in centralized operators, which is also the core pain point that the Web3 decentralized dark pool solution can solve.

Dark Pool Innovation in Web3

The concept of dark pools has also received attention in the Web3 field, and has been implemented in a more sophisticated and transparent form than dark pools in traditional financial markets. Based on the full disclosure of blockchain transaction data, Web3 dark pools can use cryptographic technologies such as zero-knowledge proof (ZKP) and secure multi-party computing (MPC) to ensure transaction privacy.

The core advantage of Web3 dark pools is that they can avoid operational risks compared to traditional Web2 dark pools. Since transactions are automatically executed through smart contracts, no intermediaries are required and traders always have full control over their assets. At the same time, there is no risk of traditional dark pool operators abusing customer information, and all transaction processes can be cryptographically verified.

Web3 dark pools also introduce a new paradigm of programmable privacy. Developers can decide which parts of the application should remain private and which should be made public. For example, while keeping transaction orders private, the final transaction results are only disclosed to specific regulators. Although this technology cannot be implemented by traditional software, Web3 technology has a relatively significant advantage in the flexibility and verifiability of programmable privacy protocol implementation.

The necessity of “Dark Pool Perpetual Contract DEX”

When CZ proposed the need for a “dark pool perpetual contract DEX”, he highlighted several issues caused by the transparency of existing DEXs. The core arguments and background support are as follows.

Preventing MEV attacks

The transparency of DEX is one of the main causes of MEV attacks. When DEX orders are made public in the blockchain memory pool, MEV robots will detect and implement frontrunning, backrunning, or sandwich attacks. This causes traders to end up with prices that deviate from their expectations, and the slippage of large orders will increase significantly.

CZ also gave an example, saying "If you want to execute an order of $1 billion, you must want to complete the transaction before the market notices it", and advocated that dark pools are a necessary solution to such problems.

Growth Potential

CZ pointed out that dark pools have been widely used in traditional financial markets, and emphasized that their liquidity scale can reach more than 10 times that of public exchanges. He believes that the cryptocurrency market also needs similar solutions, especially in high-leverage products such as perpetual contracts, where trader privacy protection is more critical.

In addition to CZ's remarks, the demand for dark pools in the Web3 market has also increased significantly recently. Blocknative research shows that Ethereum private memory pool transactions accounted for only 4.5% of the total in 2022, but currently account for more than 50% of gas fee consumption. Although the Solana network does not have a memory pool mechanism, various trading robots and wallet solutions have listed MEV protection functions as standard , indicating that users' awareness of MEV has increased significantly. This clearly confirms that the Web3 community has realized the impact of transaction transparency on results and has generated a need to actively avoid it.

Potential harms of DEX transparency

CZ particularly emphasized that the feature of "DEX's real-time disclosure of all orders" will cause serious problems in perpetual contract transactions. In perpetual contract DEX, traders' positions and liquidation prices are exposed on the chain, making it possible for malicious participants to use this information to manipulate the market. For example, when other traders identify the liquidation price of a whale, they may deliberately push the market price to trigger a forced liquidation. CZ associated this phenomenon with "recent events", which may point to Hyperliquid's HLP liquidation event or James Wynn's large position liquidation case.

For a more specific explanation than CZ’s tweet, please refer to a recent article written by Simon Kim, the founder of Hashed. The article points out that although Web3 promises decentralization and privacy protection, it actually builds the most transparent monitoring system in history - all transactions are permanently recorded, open to everyone, and subject to AI analysis.

The article specifically uses the case of MicroStrategy (now Strategy) to illustrate that even companies cannot escape tracking. Despite Michael Saylor’s repeated warnings about the risks of public wallet addresses, blockchain analysis platform Arkham Intelligence has gradually managed to track down 87.5% of the company’s Bitcoin holdings.

The article also focused on James Wynn's multi-million dollar liquidation in Hyperliquid, pointing directly to the huge demand for dark pools. Wynn once built a $1.25 billion long position in Bitcoin with 40x leverage, but because its liquidation price was publicly visible, it attracted targeted sniping by market participants. In fact, a trader continued to reverse Wynn's position and made a profit of $17 million in a week. This incident not only proves the backlash effect of the transparency of perpetual contract DEX, but also shows that there is sufficient market demand for a trading environment that does not expose position information.

Different ways to implement on-chain dark pools

Although many people may have first come into contact with the concept of dark pools through CZ's tweets, there are already multiple projects promoting the construction of dark pools. Since there are multiple technical paths to achieve the core goal of dark pools, namely "transaction privacy", different projects have adopted different encryption schemes. The following are the main implementation methods and representative projects.

Renegade

Renegade is one of the most popular on-chain dark pool projects. The project is deployed on the Arbitrum mainnet and aims to build a privacy solution by combining secure multi-party computation (MPC) and zero-knowledge proof (ZKP).

In Renegade, all states (balances, order books, etc.) are managed locally by traders, without relying on centralized or distributed servers. Transaction execution requires knowing both the old and new wallet states, and submitting three pieces of information to the smart contract: commitment, nullifier, and validity proof. This structure is similar to ZK projects such as Zcash.

The core feature of Renegade is to ensure complete privacy before and after the transaction: the order details (price, quantity, direction, etc.) are hidden before the transaction, and only the counterparty knows the asset exchange after the transaction. All transactions are anchored to the real-time mid-price of Binance, without slippage or price impact. This Web2-like experience is very attractive.

In Renegade's architecture, multiple independent relayers continuously execute MPC through a P2P network. During the MPC process, Renegade will prove a special NP proposition called "VALID MATCH MPC" to verify that both parties to the transaction do have valid input orders. Through this collaborative zero-knowledge proof structure, users are provided with complete anonymity, privacy, and security.

Arcium

Arcium is a privacy project in the Solana ecosystem that uses MPC technology based on additive secret sharing to implement "encrypted shared state". Developers can use this to store encrypted states and perform calculations on the chain without exposing the original data. The solution supports non-interactive local addition operations and single-round communication multiplication operations while maintaining strong security.

Arcium also introduces programmable privacy, allowing developers to specify in Solana programs which states need to be encrypted and stored, and which functions should perform calculations on encrypted states. Arcium's MPC tasks are managed by a virtual execution environment called MXE, which is responsible for setting parameters such as data, programs, and computing nodes. This architecture supports large-scale parallel transaction processing similar to Solana.

Recently, Arcium has successfully deployed a dark pool demo on the Solana testnet, becoming the first confidential trading venue on the chain. Any Solana DeFi team can build a dark pool based on Arcium to provide users with privacy trading services.

Aztec

Aztec is an Ethereum privacy ZK-Rollup solution. In 2022, it completed a $100 million Series B financing round led by a16z crypto, becoming one of the projects with the largest single investment in the field of privacy technology.

Similar to Arcium, Aztec allows developers to annotate private functions - the annotated functions are executed locally on the user's device and generate proofs, and only public functions are executed on the Aztec network. The state value of the private function is stored in the form of UTXO, which can only be decrypted by the owner, ensuring that no one except the user can read it.

Aztec has worked with Ren Protocol to develop a privacy exchange protocol based on dark pools. Its system uses ZK tokens called Aztec Notes for transactions, and the order book does not disclose any transaction information. After the user recharges, Aztec creates a cash-like encrypted certificate through the off-chain UTXO system. When the transaction is executed, the state tree updates the encrypted message. Only the owner can view the certificate content, fully protecting the user's identity and balance.

Challenges and opportunities of dark pools

The biggest technical challenge facing Web3 dark pools is scalability and performance. Current MPC and ZKP technologies are computationally intensive and still have limitations in processing large-scale transactions. Taking Renegade as an example, its P2P network structure will increase exponentially in complexity as the number of participants increases.

In addition, there is a certain trade-off between the privacy and scalability of dark pools. Aztec co-founder Zac Williamson once pointed out: "Completely private transactions contain more data because everything needs to be encrypted. This consumes more resources and reduces scalability." To break through these fundamental limitations, a more efficient cryptographic algorithm library needs to be developed.

Network stability is also an important challenge. When Arcium recently tested a dark pool demo application based on its test network on Solana Devnet, some nodes crashed due to high traffic, resulting in a backlog of order queues. The test was originally intended to verify the stability of the infrastructure and solve the problem before the main network goes online, and the failure was quickly fixed. This shows that dark pool implementations require sophisticated technology and sufficient testing to cope with high load demands.

In the long run, dark pools are expected to become an important part of the cryptocurrency trading ecosystem. Considering that CZ mentioned that dark pools account for more than 50% of trading volume in traditional finance, it is likely that they will reach a similar proportion in the crypto market. As institutional investors enter the market faster, this trend will become more obvious.

This does not mean that existing DEXs will be completely replaced. The two are more likely to form a relationship of complementary demand - small transactions where price discovery is important will be conducted on existing DEXs, while large transactions with strong privacy requirements will be completed in dark pools.

The development of dark pools will also expand beyond the privacy field. As Arcium explores, the demand for privacy-preserving technologies in areas such as AI, DePIN, and supply chain management is growing. As the starting point of the privacy revolution, dark pools are expected to develop into a core component of the privacy ecosystem.