BTC Conference | Michael Saylor's speech: 21 keys to unlock billions of BTC wealth

Original author: Michael Saylor , founder of Strategy

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator: CryptoLeo ( @LeoAndCrypto )

Michael Saylor delivered a speech titled "21 Ways to Wealth" at the Bitcoin Conference. Although titled "21 Ways to Get Wealth", it actually explained to everyone the importance of buying Bitcoin now. The content also involved the inheritance of Bitcoin, the simple operation of enterprise-level Bitcoin and its wealth effect.

Saylor used 21 words to describe what needs to be done to try to get access to wealth now. The core point is that the compound interest of funds obtained under enterprise-level Bitcoin reserves and corporate valuations is slightly radical, but Bitcoin is also a good way to pass it on to future generations. You can refer to Saylor's previous speech: " Michael Saylor Crypto Summit Speech: Bitcoin Strategic Reserves, Becoming the Source of Permanent Prosperity for Future Generations of the United States ".

The following is the full text of the speech, compiled by Odaily Planet Daily

I am very happy to see you today at Bitcoin 2025, and I am very happy first because this speech is for you. I have traveled around the world to talk about Bitcoin in the past few years, and I have told many countries why they need Bitcoin, and I have also explained the reasons why they need Bitcoin to institutional investors, boards of directors, companies and CEOs.

I've spoken to the spirits about why our children and grandchildren need Bitcoin (a rhetorical device, a sentence with a quasi-religious tone, emphasizing the importance of Bitcoin in a surreal environment). But my speech today is for the 8 billion people on the planet. This is how every person, family, business, and entrepreneur can get rich. Bitcoin is not only suitable for multi-billion dollar public companies, but also for everyone. I have been focusing on Bitcoin for a long time, so today is my speech for you on "Multiple Ways to Wealth". (21 Ways To Wealth)

1. Clarity (refers to the transparency and immutability of Bitcoin, the code is 'transparent' everything

Bitcoin is transparent and immutable. When you realize that Bitcoin is perfect capital, programmable capital, and anti-corruption (cannot be manipulated by humans), your mind will be clear. This means that every smart and thoughtful person, no matter where they are, wants perfect capital. Every one of your enemies will want anti-corruption capital, and all AIs will want programmable capital. The demand for this is huge. How much is Bitcoin worth? It is worth half of the earth's economy.

2. Conviction

Bitcoin will appreciate faster than any other asset because it is designed to outperform other assets, it will grow faster than the S&P, gold. Sorry Peter, it has to grow faster than gold, real estate, collectibles, or anything else you can imagine because it is designed that way.

3. Courage

This brings us to the third way to get rich. If you get rich on Bitcoin, you need courage, which means wealth favors those who accept the risk of cryptocurrencies. Satoshi lit a fire on the Internet (Bitcoin), and the fearful stayed away from it, the fools fiddled around with Bitcoin and never took action, and only the loyal kept the flames burning, dreaming of a better world under its light. This means that many people who pay attention to Bitcoin are afraid of it, and they will never buy it, nor benefit from it. They will be left behind. They create derivatives around the fire, make fireworks, and create trinkets.

But the people who really understand it will light the fire, and how? By buying Bitcoin. By selling fiat money, long-term capital, bonds, low-quality equity, real estate, etc. to buy Bitcoin. Use it to light the fire, and what will happen? Under the explosive and spreading power of the network, you will buy a ticket to prosperity.

4. Cooperation

Collaboration is very important. You are stronger with your family. If you understand Bitcoin, you can act as an individual, but when the whole family understands Bitcoin, you are stronger. Your parents have the credit and capital, you have the ability and conviction, and perhaps the courage. Your children have enough time and potential. Your 80-year-old grandfather can draw money from his retirement account, borrow money from the bank, have an investment portfolio, and the secret is to transfer capital to your children. Your next generation is exposed to wealth earlier than your previous generation. When you transfer capital from the past and turn it into money for the future, it is a generational thing. So think about the family and work together .

5. Capability

I could list a lot of technologies to illustrate this part, but I think about it, the most important thing today is that you need to master artificial intelligence. If you want to be rich in 2025, you want to have access to a group of accountants, lawyers, professors, historians, and have collective wisdom. You want to have all the knowledge that a great entrepreneur needs to know, then go to AI, put it in deep thinking mode, introduce all your situations, hopes, visions, and problems, and then start interacting with it. I tell all my executives, go to AI before asking lawyers, bankers, or any experts, ask AI, let it think, and break the technological barriers through hard work .

This is very important because much of the advice I’m about to give is beyond the capabilities of the average employee, or even beyond the capabilities of mid-level leaders.

You can say, yes, those complex trusts or complex legal structures are great, but I don't have the money. I can't afford to spend hundreds of thousands of dollars on lawyers. I'll tell you a secret, I have dozens of lawyers working for me, and they also spend money to hire other lawyers. When I have a problem, the first thing I ask is the AI. I will argue with it, and it will tell me no, then I will change the way I do it - threaten it, ask it to give me a solution, and I find 95% of the solution, then determine the solution, and then I send the link to my management team and lawyers, "Look, I solved the problem, this is what I want to do." Then I give them 2 to 5 days to determine the execution plan. If they can't solve the problem in the specified time, they will quit my team, change lawyers, and change everything.

The path to wealth is based on ability. This is the case in 2025. Everyone is not a super genius, but also a combination of 100 super geniuses. AI reads everything published by humans. If you humbly ask AI for help, don’t put yourself first, put profit first, your family will thank you in the years to come.

6. Composition

Structuring a legal entity that can scale and protect assets. Meaning you can go to your 401k and borrow money, maybe invest in an IRA, maybe you can structure an effective insurance policy, maybe you want to set up a dynasty trust in Florida that will benefit your children and grandchildren for the next 300 years, you may find that a South Dakota "Perpetual Dynasty Trust" is an ideal choice because it can exist forever and protect family wealth from generation to generation.

Odaily Note: Section 401(k) of the U.S. Internal Revenue Code is a U.S. employer-sponsored retirement savings plan that allows employees to deposit part of their salary into a tax-advantaged account for future retirement.

The normal reaction is that you probably don't know how to do it, go ask the AI, figure out the process. By the way, I'm not going to give you a very clear answer because it's completely different if you live in Dubai or Singapore. It's completely different if you live in North Dakota. You get different answers based on who you are. But what I can tell you is, go online and fire up the AI, and start asking it. It will give you a customized answer so that you can work hard and you can work smart.

It’s much easier than it used to be. 10 years ago, someone would say it’s too hard, it takes a year, and the lawyers are too slow and too expensive. This year, everyone should be as smart as the most sophisticated billionaire family. Maybe you can get the same legal advice as them, and you can have the same efficiency.

7. Citizenship

Citizenship is important, choose a place of economic ties, where sovereignty respects your freedom, what does that mean to you? Everyone's situation is different, but I'll give you a simple hint, go to AI and ask, what are the 10 most friendly states in the United States for Bitcoin holders?

Now go to some AI and ask, "Why not rank every country in the world based on my intention to own Bitcoin or invest in Bitcoin?" Then describe your situation and it will give you the answer. I encourage everyone to think about this because living in Florida is different than living in other states, and we like Wyoming, we have Cynthia, the Bitcoin Senator from Wyoming.

But you have to figure out what the attitude is towards Bitcoin at the state level, the county level, the city level, the national level, and think deeply about it. This is not about this year, this is about the century. What will become of you and your family in the next 100 years? Your children and grandchildren will thank you.

8. Civility

Number 8 is civility, respect the natural power structures of the world, like if you go on a safari, don't fight a lion. Don't try to fight market trends or economic realities. Don't fall off a cliff while taking a selfie on a hike. Respect the forces of nature. I think everyone understands that. Beyond that I would say if you want to create wealth in the Bitcoin universe, think about the way the world is built. Remember, you don't have to overthrow a government you don't like, you don't have to convert someone to a religious belief, you don't have to overthrow any particular system that exists in the world.

You need to pick your battles, right? Respect social norms. Avoid unnecessary arguments, which just drain energy. Every time I look at the world, I can think of 100 things I want to change. And then I think the world only cares about my opinion on one of those things, and the chances of successfully changing the other 99 are not high, right? If you want to create wealth, figure out what you want to do, focus on it, and do it civilly.

Often you will meet people with different religious beliefs, political beliefs, economic beliefs, and cultural beliefs than you do, and these people will work hard to find common ground and move forward, because stimulating conflict and distraction will only slow you down as you move toward the future. So civility is good for you.

9. Corporation

The 9th way to get wealth is through a corporation. A wealth structured corporation is the most powerful wealth creation engine on the planet. And you are an individual, my suggestion is that you ask AI, you will figure out how to create a corporation, whether it is a small company or multiple companies, a company has special access to the banking system, a company has special rights in every business. The company enjoys legal immunity.

Corporations can be sustainable, corporations are tax efficient, corporations have all kinds of efficiencies, they are more reputable. Corporations can sell equity, corporations can finance the future. A company can map out projects 30 years into the future and then bring the economy back to the present and invest. Individuals can't do that. So while it's laudable to be an individual, there's no shame in being a one-person company or a family business.

If you look at the hierarchy of the world and rank them, individuals are at the bottom, family businesses, partnerships are more powerful, small and medium-sized private companies are more powerful. Large private companies are next. Next is the small public companies listed on the OTC market.

Companies listed in the larger capital markets are larger than those listed on NASDAQ or NYSE. Then, you have the experienced issuers in the U.S. capital markets. And at the top of the pyramid are the well-known experienced issuers. There are only a few hundred of these companies in the world. When you climb to the top of the pyramid, file a registration statement and sell a billion dollars of securities in six hours, you can do this. This is what each of you can do, and I hope you can all realize your full potential. And starting a company is the first step towards this goal.

10. Focus

Number 10 is focus. The path to wealth is focus, just because you can do something, doesn't mean you should do it. I've done a lot of things. I'm 60 years old.

One of the reasons I embrace Bitcoin with religious fervor and ideological fervor is that I had the opportunity to do it in my 20s, 30s, 40s, and 50s. You see, changing the world on an operational level is very challenging. I thought a lot of my great ideas were infallible, but they didn't turn out the way I wanted.

In fact, if you invent a new product, service, or thing, there is a 90% chance that it will fail within five years. But if you invest in Bitcoin on your balance sheet, there is a 90% chance of success within five years, and if you look at a 30 or 40 year time frame, the chance of success is as high as 99%. Every operational idea has a 99% chance of failure, and every financial idea based on Bitcoin has a 99% chance of success.

So don't confuse ambition with achievement, remember that companies that own Bitcoin are earning between 30% and 60% return on assets every year. You're growing 30%, 40%, 50% every year. If you don't do anything right now, think of every business that's in operation, your restaurant, your hotel, or whatever store you opened at the beginning of the year, and then grow your business by 30% every year for the next 20 years. There are seven companies that have done it, and we call them the "Magnificent Seven." But there are actually more companies that have tried this. So in this case, when you develop a strategy, make sure you focus and don't be distracted.

11. Equity

Number 11 is through equity. This means sharing your opportunity with investors who are willing to share the risk with you. Companies can do this, individuals can’t. Metaplanet did this, and they grew from a $10 million market cap to $5 billion through partnerships with equity investors, without whom they would be nothing. My company grew from a $1 billion business to a $100 billion business, and that was also done with the help of our equity investors.

If you are a dentist with $200,000 in cash flow per year, you could buy $200,000 in Bitcoin per year for 20 years. That's not a bad idea. You would be the richest dentist on your block, but you could incorporate your dental practice as a corporation, value it at $1 million at five times cash flow, and sell 33% of it for $500,000. Invest that $500,000 in Bitcoin, and a year later, raise another $500,000 to invest at two, three, or four times the market value. Wait another year and raise $3 million to invest. You would be the first dentist on your block to become a billionaire. So what did you do that was special? You partnered with others and gave them a share of the profits. That's what Strategy did, that's what Metaplanet did, and that's what a lot of companies are doing.

12. Credit

Number 12 is through credit. What does that mean? There are a lot of people in the world who are afraid of the future. There are a lot of people who want to protect their money or seek a slim yield. Japanese corporate bonds are yielding 50 basis points, while U.S. investment grade bonds are yielding 400/500 basis points. As a company, by giving creditors certainty, giving them a fixed coupon, a fixed dividend, and giving them a senior position in your capital structure, you turn risk into return. You give them certainty, a safe return, and you get capital in return.

The world is full of people like that. I'm a retiree and I want a guaranteed 8%. I don't want to lose my money. If you make them an offer like that, you get the money and it compounds at 30% to 60%, and in the worst case you get a 22% spread, but all the money is upfront, so credit is sometimes a bad word.

But at the end of the day, as an individual starting a company, you can create credit. If I want to be the billionaire dentist on the block, I start a company and sell some equity. I sell some of the future earnings, let the stock go up, and then I go out and borrow money or sell preferred stock or sell some kind of financial instrument to people who want less risk, less return, more certainty. And so on and so forth, and the goal is not to get $200,000 or $50,000 in cash flow a year and invest it in 20 years, the goal is to get my corporate entity right now with the right financing and get 100 times the money and put it into Bitcoin.

13. Compliance

Thirteen is not always a lucky number, I use the word compliance. You should create the best company you can within the rules of the market you are in. Every market is different. For example, public companies have special rights, they can issue stocks and bonds. Trust companies have other special rights, they are more efficient in terms of taxation. Insurance companies have special rights. They can reinvest annuities, they can take risks, and they can create very efficient tax vehicles. Broker-dealers have special rights. Exchanges have special rights. Banks have special rights. Banks can print $20 million worth of fiat currency with $1 million of capital, and operate with 20 times leverage, and that's the advantage.

Even though compliance sounds like a complicated word, if you create a company and you understand the rules of the market you're in, you can operate it properly and you can create a very efficient, very productive business. And then you can use the power of that business to raise money, invest in Bitcoin, and create wealth. So it's more complicated. But if you have the talent for it, you know it's going to get you farther and faster.

14. Capitalization

Point 14 is capitalization, your goal is to consistently raise money and reinvest it, fast and on a large scale, so that your wealth compounds. So, for example, you set up a small hotel, sell 10% of the equity, and then buy Bitcoin.

The price of Bitcoin goes up, and the value of the hotel goes up. You sell another 20% of your equity to buy more Bitcoin. The value of the business continues to rise, and you borrow a little more money to buy Bitcoin. The value of the business continues to rise, and you keep raising funds, and you have cash flow to buy Bitcoin, and you have government bonds to buy Bitcoin. You have a house without a mortgage, and for you, if you can borrow at 6% to invest in Bitcoin, it has risen 80% in the past year, so even if you see an annualized return of 30% or 20%, you borrow at 6% and invest at a return of 20%, and you can capture the difference, which is compound growth.

It’s a race to utilize Bitcoin, and whoever has the most Bitcoin at the end of the game wins.

15. Communication

Point 15 is about communication. If they don't trust you, no one will give you money, not even creditors. They won't accept or give you loans, they won't buy your bonds, preferred stocks. Equity investors won't buy your stock.

No one will do business with your employees, and suppliers won't trust you. You must be upfront and transparent, and you need to repeat this often using all modern digital channels. In the Bitcoin world, you don't need a complicated strategy to build wealth. You just need a simple, clear strategy, and once others understand what you're trying to do, they'll support you, and you'll succeed.

16. Commitment

Point 16 is to stay focused and don’t let yourself be distracted.

Many people discovered Bitcoin before me. In 2011-2014, people discovered it, and then they went to other coins, and then they went to other concepts, playing with Bitcoin. Then they wrote books bragging about how smart they were to discover Bitcoin.

Then they started a company, a board, and the board told them to sell their bitcoin. So stick with bitcoin, the idea is good. When someone laughs at you being stupid online, ignore the trolls. Don't argue with them. And by the way, don't get distracted by your own good ideas, don't chase your own good ideas, Satoshi gave you something worth half the world's economy.

The most common mistake entrepreneurs make is to fall in love with their idea and then try to make it happen. You have the greatest thing in human history, Bitcoin is out there, and you live in a time when most people on the planet don't understand Bitcoin, all you have to do is figure out how to use it now. There may be countless other ideas in the future, don't get involved in something that is doomed to fail. Choose your battles firmly, don't try to solve problems that are beyond your ability, you may have an opinion on this, that and other things, which may make you angry and you think it's too bad, this is also reality, I agree with you, but the fact is that the world may not care what you think. Unless you can stop the "war", if you can stop the "war", then do it. But if you can't, don't take your success for granted, avoid distractions.

17. Competence

Execute consistently, accurately, reliably. Don't take your customers for granted, don't take your safety for granted, don't take your success for granted. Be laser-focused. The world expects you to be perfect. When I first came to DuPont (Saylor was an in-house counsel at DuPont ), they said, "You can only make one mistake, but you can't make a second one."

You may think you can multitask, but your competition can focus like a laser, and the market will eventually shift to those who focus like a laser.

18. Adaptation

On a long enough timeline, every counterparty will fail, including you. In 100 years, everyone, including every bank, every company, everything, every structure that works well now, will fail. You need to adapt, and wise people will be ready to let go many times in their lives, so be ready. Make a plan. Start executing now, and monitor quarterly, annually.

Don’t be shy about changing paths if at some point that path is no longer the right one, have a succession plan, and put things in order.

19. Evolution

Play to your core strengths and leverage your strongest assets. Your goal is to grow gracefully, not radically. If you happen to have expertise in a certain culture, capital market, or field, then the business you want should be based on this expertise. When you lose balance or decide to venture into a completely new field, the execution risk increases a hundredfold.

20. Advocacy

Advocacy is also important, calling on others to engage with Bitcoin and become an evangelist for economic freedom. The more individuals, businesses, governments, institutions, cities and leaders accept Bitcoin, the more likely you are to succeed, the more likely they are to succeed, the more likely Bitcoin is to succeed, and the more likely humanity is to succeed.

21. Generosity

The last point is generosity. When you are successful, get up every morning and spread happiness and spread hope. For those who are not as fortunate as you, you have been on this path first. You should spread good karma. Make sure you pass this on to your employees, family, friends, customers, investors, and community. They will see your light and respect and support you. They will be inspired by you and follow you, which is good for you, good for business, good for Bitcoin, and good for the world.

Conclusion

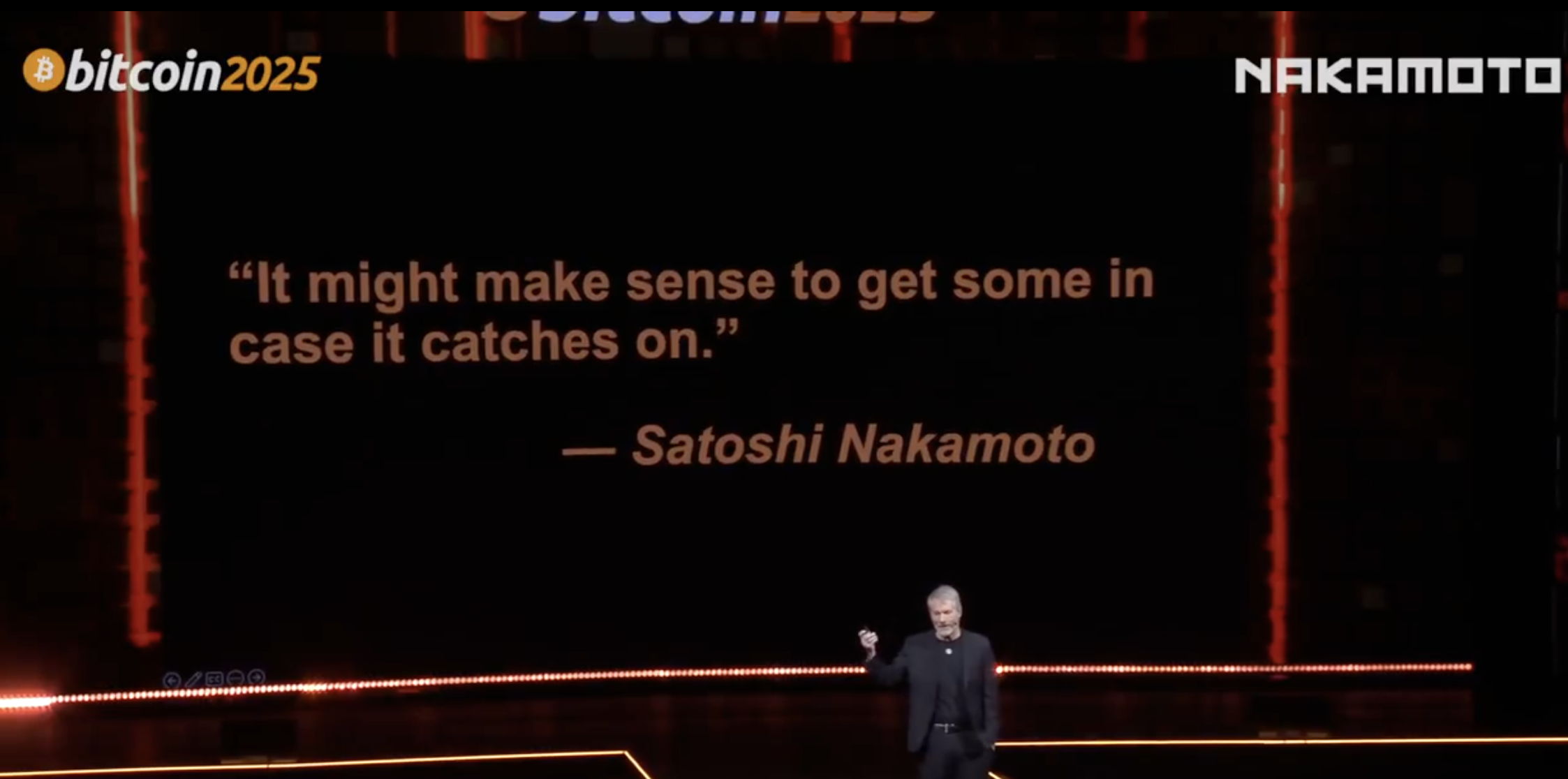

I would like to end my speech with this sentence:

“It’s been 16 years since Bitcoin was created in 2009, two trillion dollars has proven its value, and who knows how much wisdom has been passed on to the world. I can give you this speech here, but Satoshi Nakamoto, who is much greater than me, said these 12 most important words in the English language many years ago without any of this information, proof, and so much time: It might make sense to get some in case it catches on.”