On the other side of the world, a “tokenized apartment” sold out in one day

Original | Odaily Planet Daily ( @OdailyChina )

Author: jk

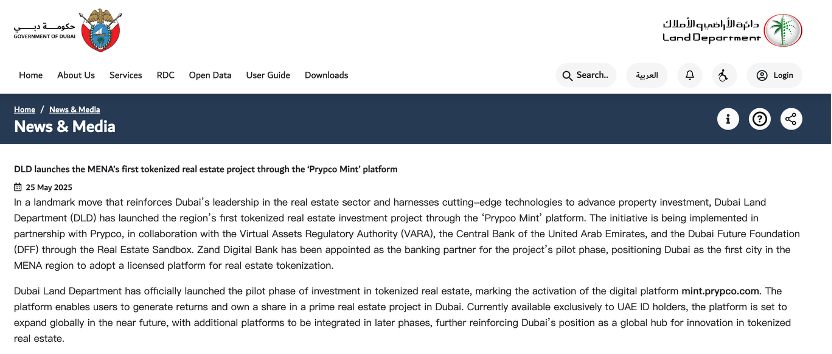

On May 26, 2025, the Dubai Land Department (DLD), together with real estate fintech company Prypco and blockchain infrastructure provider Ctrl Alt, officially launched the Middle East's first real estate tokenization platform "Prypco Mint" , and successfully completed the full financing of the first real world asset (RWA) apartment on the XRP Ledger chain in just one day. The platform is an important part of the UAE government's blockchain strategy, aiming to put about 7% of transactions in Dubai's real estate market on the chain by 2033. By then, the total asset size is expected to reach US$16 billion.

On May 26, 2025, the Dubai Land Department (DLD), together with real estate fintech company Prypco and blockchain infrastructure provider Ctrl Alt, officially launched the Middle East's first real estate tokenization platform "Prypco Mint" , and successfully completed the full financing of the first real world asset (RWA) apartment on the XRP Ledger chain in just one day. The platform is an important part of the UAE government's blockchain strategy, aiming to put about 7% of transactions in Dubai's real estate market on the chain by 2033. By then, the total asset size is expected to reach US$16 billion.

Previously, most RWA real estate projects either remained at the level of independent projects without official endorsement, and basically relied entirely on the credit of a single company. However, due to the lack of time for the Web3 industry to settle down and the lack of user trust in the projects, there were no so-called "well-known" RWA real estate projects. This time, Dubai's operation may be able to fill this gap.

Why Dubai?

Another reason why many RWA projects have not been popular before is that the tokenized real estate is not in any real estate hotspot . In the global real estate industry, Dubai is a well-deserved hot city ; the hot real estate investment here has attracted a lot of foreign investment. If you search for "Dubai" on social media, you will most likely see the word "real estate" automatically completed.

Why is Dubai so famous? It’s simple, because of its potential for appreciation and extremely high rental-to-sale ratio.

In recent years, Dubai's real estate market has continued to heat up. According to a report by CBRE, Dubai's residential prices rose by an average of 18% in 2024, and the increase in the first quarter of 2025 has reached 20%. During the same period, the volume of real estate transactions also hit a new high, reaching 45,474 in the first quarter of 2025, a year-on-year increase of 22%. This growth trend is due to the "Golden Visa" policy launched by the Dubai government, which is equivalent to buying a house and getting a five-year or ten-year residence permit, attracting a large number of high-net-worth people to invest in real estate. In addition, Dubai's geographical advantages, stable political environment and diversified economic structure also provide a solid foundation for the continued growth of the real estate market.

In terms of investment returns, Dubai's real estate market has performed well. Data shows that Dubai's rental-to-sale ratio is about 1:132, and the 90% foreign population makes the rental return rate as high as 8% to 9% , which is much higher than the 2% to 3% in cities such as Shanghai. This high rental return rate allows investors to recover their costs in a relatively short period of time, usually within 10 to 12 years. In addition, the UAE government exempts all personal income tax and capital gains tax , a policy that further enhances investment attractiveness.

This is not an advertisement, but the reality of the Middle East real estate market over the past decade.

Of course, Dubai's market has achieved very high growth in the past decade, so there have been many arguments this year that this year may be the peak of Dubai's real estate market , citing various data such as high construction area and slowing population inflow. However, judging from past data alone, real estate investment in Dubai is indeed very hot.

So what assets were sold out in one day?

The business model of RWA Real Estate is very simple: tokenize the ownership of a property, and the token holder holds part of the property ownership, and the appreciation income and rental income generated by the property will be distributed to all property holders according to the token rights. In this way, even if the holder does not have the ability to directly purchase the entire property, he can still include the real estate in his investment portfolio, and the liquidity of exit is significantly better.

Perhaps for hunger marketing, PrypcoMint only put out one apartment for tokenization on the first day of its opening.

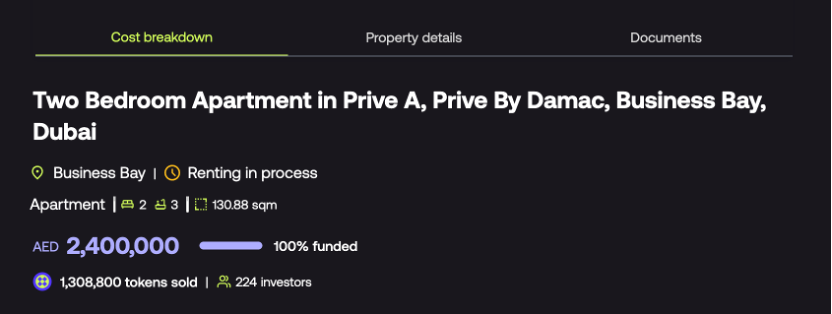

This real estate tokenization project, which has completed financing, is located in the core area of Business Bay in Dubai. It is a two-bedroom unit in Prive by Damac, a residential complex built by the well-known developer Damac. The building area is about 130.88 square meters, with two bedrooms and three bathrooms. The project features a full lake view and is equipped with hotel-style service facilities.

The first tokenized property, source: Prypco official website

Within one day, the property was 100% financed on Prypco Mint, with a total price of 2.4 million dirhams (about 5.8 million yuan) , a total of 1,308,800 tokens issued, and a total of 224 investors participated. Perhaps it was a benefit given by the official to early investors, and this price was significantly lower than the official market valuation: according to the valuation of the Dubai Land Department, the market value of the unit was 2.89 million dirhams, and the actual purchase price of the platform was about 16.96% lower, bringing investors an unrealized floating profit space equivalent to 20.42%.

In terms of returns, the unit is expected to have an annual rental income of AED 175,000, corresponding to a net rental yield of 5.17% in the first year . Combined with the expected capital appreciation, the annualized total return of the apartment is estimated to be up to 14.77%. To date, the net return achieved is 5.31% and the property has entered the leasing process.

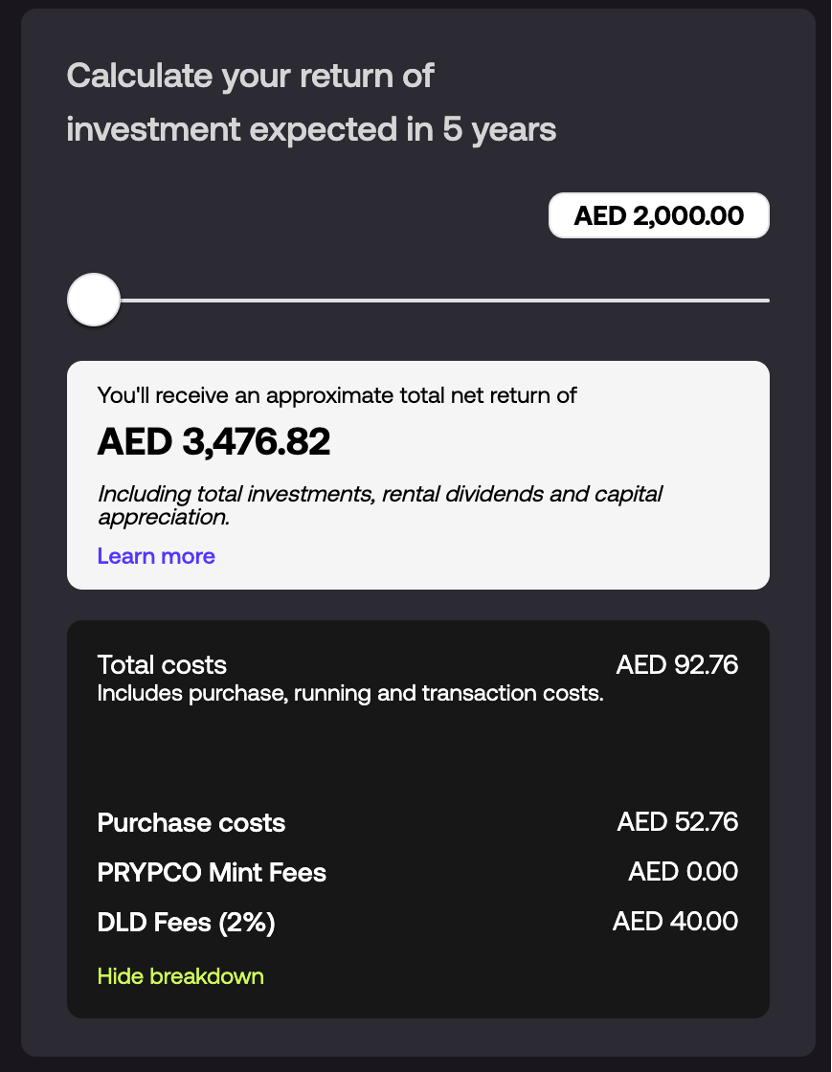

On the official website, you can see that the minimum entry threshold for investors can be as low as 2,000 dirhams (about 4,000 RMB) , and the estimated value after 5 years is about 3,476.82 dirhams, with a 5-year comprehensive return of 73.84%. It should be noted that this is an estimate provided by the official website and does not represent the actual return.

Five-year revenue forecast, source: Prypco official website

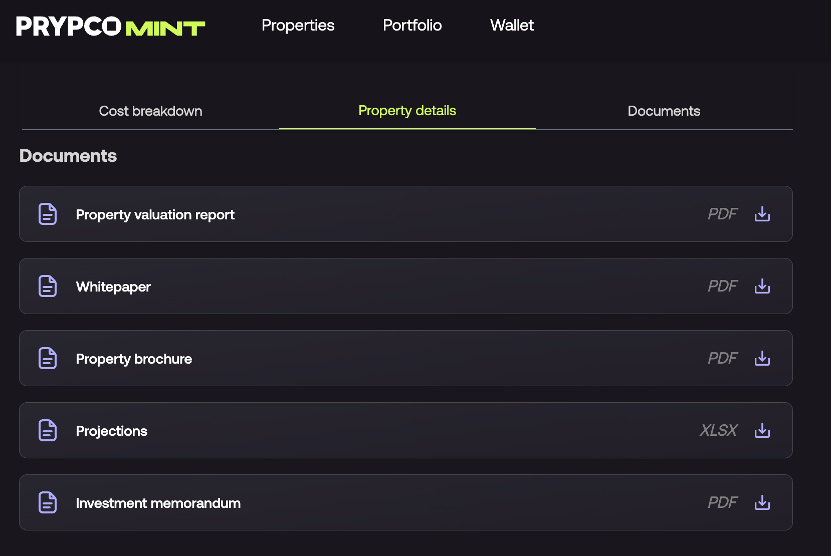

In terms of transaction fees, the platform itself does not charge any tokenization fees, and investors only need to pay official fees. However, this should only be a benefit for early investors and will most likely not continue in the future. The entire property rights of the unit have been uploaded to the XRP Ledger through Ctrl Alt's technical architecture, and the property rights information is synchronized in real time with the government database of the Dubai Land Department.

The official website has all kinds of reports. Source: Prypco official website

Is it a buy? Is it good for XRP?

Unfortunately, if you are not a resident of the UAE, you cannot purchase it , and the sale of this one unit has ended, but it does not mean that it will not be open in the future .

From a compliance perspective, the tokenization project is currently only open to Emirates ID holders . In other words, you need to be a Golden Visa holder working/studying in Dubai/or buying a house in the UAE to qualify, and only accepts dirhams for payment, which means you need a local bank account . The regulatory system is composed of the Central Bank of the UAE, the Dubai Virtual Asset Regulatory Authority (VARA) and the Dubai Future Foundation. The financial partner of the project is Zand Digital Bank.

Dubai Municipality official news release, source: Dubai Municipality official website

Strictly speaking, this is not your dream RWA project . An ideal RWA project should meet the following requirements:

Different investors can invest in a property and clarify ownership by the amount of tokens;

Payment can be made directly through on-chain assets;

Tracking house price gains or losses by token prices;

Get rental dividends regularly based on the amount of tokens held;

And can be sold in whole or in part at any time.

At present, PrypcoMint’s attempt has only accomplished points 1, 3, and 4 of “a property is clearly defined through tokens, and distribution and dividends are realized to different investors”. However, payment must be made through legal currency , and the exit mechanism is unclear. This is very similar to holding real estate through a company or trust, and trading the company’s shares or trust ownership on a stock exchange.

Even so, it’s a pretty big step for RWA. The apartment is one of the first real estate projects in the Dubai government’s plan to put assets on the blockchain, and is part of the city’s $16 billion tokenization strategy, which is valued at about 7% of Dubai’s total real estate transactions by 2033.

Therefore, it is expected that XRP will not benefit much in the short term, because only the property ownership information and tokens are on the chain, and the on-chain public sale has not been opened. But if it is opened in the future, the gas demand generated by the estimated $16 billion worth of tokenized real estate will undoubtedly be very high, and now may be the low point of value capture. But all this still depends on waiting for the continuous output of the RWA platform, which may truly create a new boom in Dubai real estate held by "more scattered retail investors."

PS Think about it from another perspective. This operation... all real estate information is on the chain, the purchase price is real and transparent, and in the future, the public sale of on-chain assets and the sale of ownership tokens at any time may be launched ... Isn't this the vision of decentralized finance back then, a dimensionality reduction attack on financial middlemen? Will this mean the complete decline of Dubai's real estate agency industry in the future? Let's wait and see.