The GENIUS Act is expected to pass the Senate, and stablecoin regulation will usher in a historic breakthrough

Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

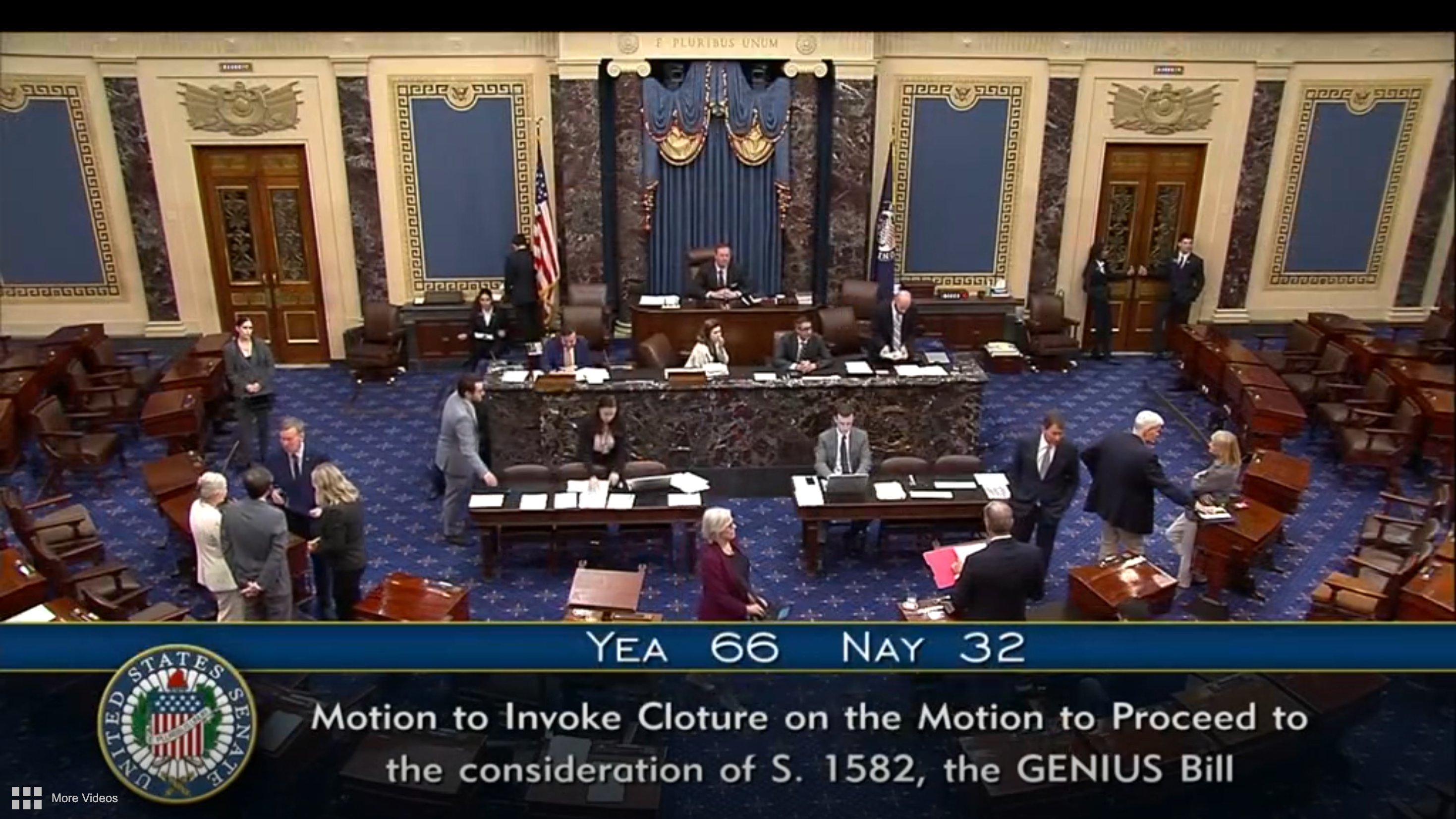

In the early morning of May 20th, Beijing time, the highly anticipated stablecoin regulation bill (GENIUS Act) had a key breakthrough in a vote in the U.S. Senate - the Senate passed the cloture vote on the GENIUS Act with 66 votes in favor and 32 votes against. This means that the Senate has agreed to stop the debate on the bill and will hold a final vote in 30 hours at the latest.

Has the final vote been completed?

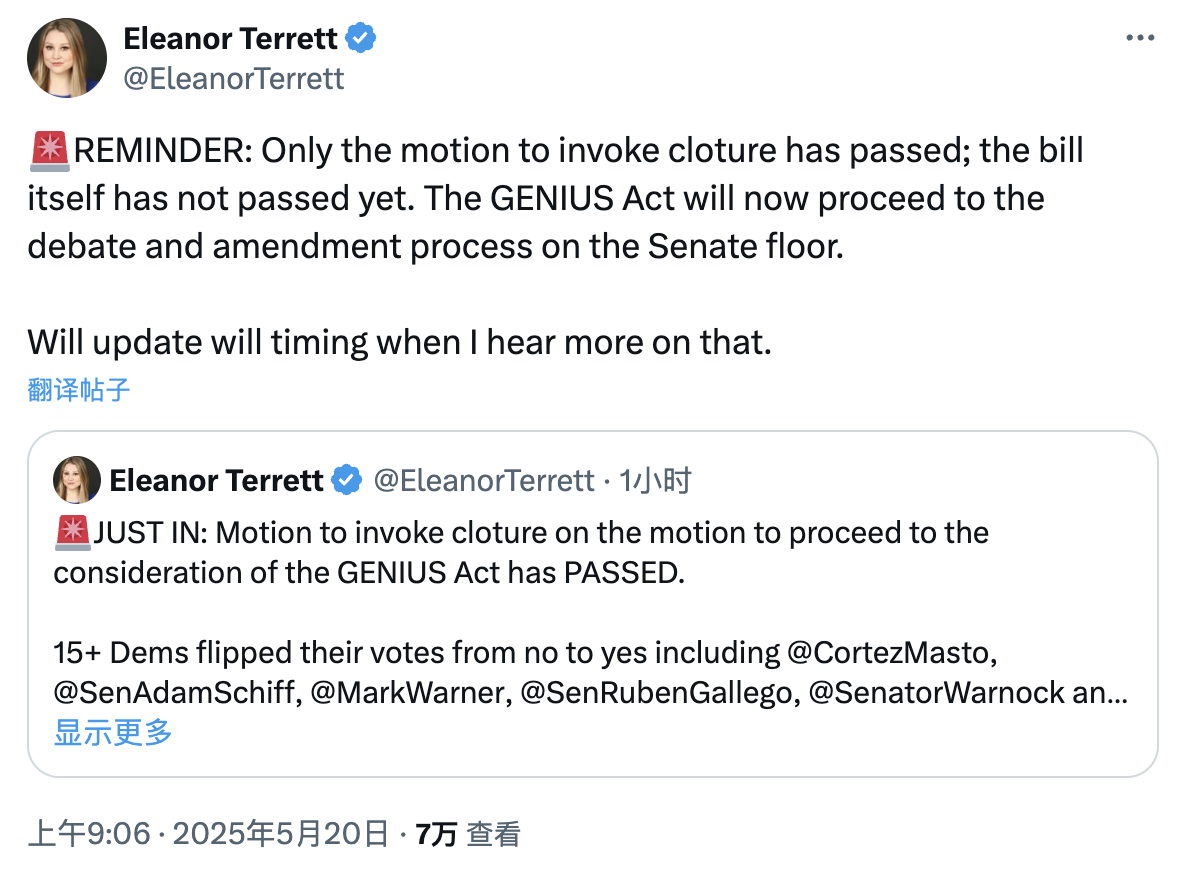

It needs to be clearly emphasized that this morning many media outlets and KOLs misreported the latest progress of the GENIUS Act. In fact, the Senate only voted to end the debate, and the bill itself has not yet passed the final vote.

However, this can still be seen as a key breakthrough for the GENIUS Act in getting through Congress, as the vote to end debate is a key mechanism in the U.S. Congressional legislative process, specifically designed to break the deadlock in which the minority party with opposing views hopes to hinder the vote on bills through "endless debate."

In the case of the GENIUS Act, Democratic senators represented by Elizabeth Warren have always been the main force hindering the progress of the GENIUS Act. It was precisely because of the collective opposition of Democratic senators that the GENIUS Act failed to advance further in the Senate vote on May 8 because it only received 49 votes (which did not meet the minimum requirement of 60 votes). However, in the vote to end the debate this morning , 15 Democratic senators including Adam Schiff and Mark Warner changed their votes from no to yes - this means that in the upcoming final vote, these Democratic senators are likely to become the key force for the GENIUS Act to pass the Senate.

Odaily Note: NBC reported that the reason why several Democratic senators changed their votes was that representatives of the two parties reached an agreement through negotiations last week. In exchange, the bill added some amendments , including changes to consumer protection measures and restrictions on the issuance of stablecoins by technology companies, and expanded ethical standards to special government employees - this will temporarily apply to Musk and David Sacks.

GENIUS Act

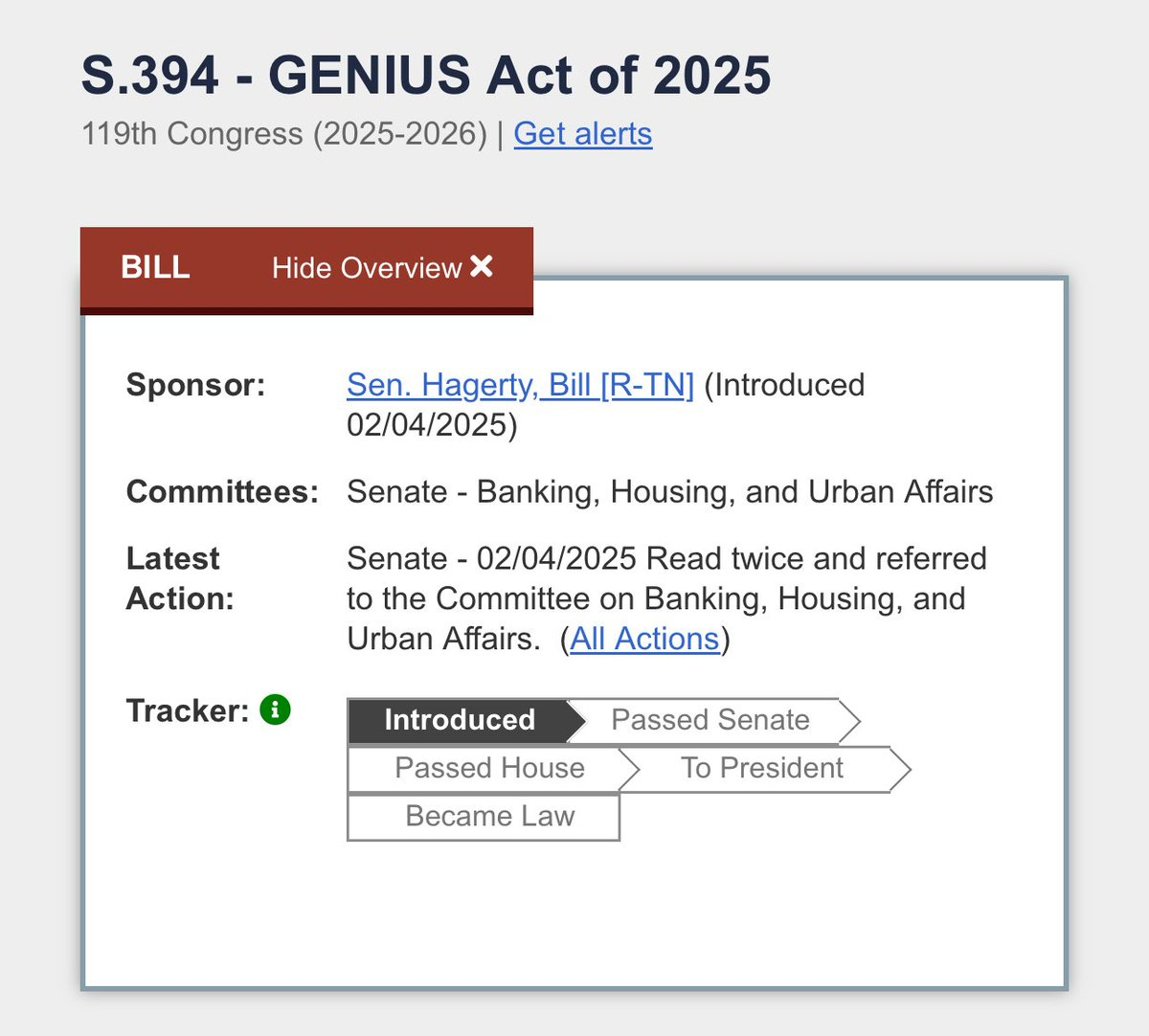

On February 4, 2025, U.S. Senators Bill Hagerty, Tim Scott, Kirsten Gillibrand, and Cynthia Lummis jointly proposed the Guiding and Establishing National Innovation for US Stablecoins (GENIUS Act), which aims to establish a legal framework for the legal use of stablecoin payments in the United States.

The core provisions of the Act are as follows.

Definition of payment stablecoin : A digital asset anchored to a fixed currency value, fully backed by the U.S. dollar or other highly liquid assets at a 1:1 ratio, and specifically used for payment settlement scenarios.

Dual licensing regulation : federal regulation, issuers with a market value of more than US$10 billion must be subject to federal regulation; state regulation, small issuers can choose state registration (must meet federal equivalent standards).

100% reserve requirement : Reserve assets are limited to cash, short-term US Treasury bonds or central bank deposits, and must be isolated from operating funds. Proof of sufficient reserves must be submitted monthly to ensure that users can redeem at face value.

Transparency and mandatory disclosure : Reserve fund composition and redemption policy are disclosed regularly and audited for compliance by a registered accounting firm.

Anti-Money Laundering Compliance : Bringing issuers under the Bank Secrecy Act and meeting financial institution-level AML obligations.

Priority protection for users : When the issuer goes bankrupt, the claims of stablecoin holders take precedence over other claimants.

Clear regulatory authority : It is clearly stipulated that payment stablecoins do not fall into the category of securities, commodities or investment companies, thus clearly defining the regulatory boundaries.

In short, as the first federal-level stablecoin bill, the GENIUS Act has been widely regarded by the industry as an important progress for stablecoins to move out of the wild growth stage, officially enter the compliance scope, and is expected to move towards broader markets such as payments.

Precisely because of the importance of the GENIUS Act, many parties in the industry have invested heavily in lobbying in the hope that the bill can go through the legislative process as soon as possible and be implemented smoothly.

After the Senate, what's next?

According to the U.S. legislative process, if the GENIUS Act can pass the Senate smoothly, it will still have to go through a vote in the House of Representatives before being submitted to President Trump for signature. It will finally become law.

Barron's reported that the bill is expected to be reviewed more smoothly in the House of Representatives because the House does not need an absolute majority vote to approve it.

How has the market reacted?

Perhaps due to the positive impact of the GENIUS Act having achieved a key breakthrough in the Senate, the cryptocurrency market, which suffered a large correction yesterday, rebounded strongly today - BTC re-entered the $106,000 mark, and a new high seems to be just around the corner.

Looking ahead to market changes after the implementation of the GENIUS Act, as the first step for stablecoins to move towards compliance and a broader market, the bill is undoubtedly a huge boon to the entire industry, and some projects whose business content is highly related to stablecoins will benefit greatly - for example, Aave (AAVE), Pendle (PENDLE), and Frax (FRAX) have all seen larger increases that are better than the overall market performance; in addition, Ethereum (ETH), as the main battlefield for the issuance of compliant stablecoins, may also be able to capture greater capital inflows.

In the stablecoin market, the GENIUS Act, which explicitly requires dual federal and state licensing supervision, may also become an opportunity for a major reshuffle at the track level . Circle (USDC), which has long followed the compliance route and is registered in the United States, and the Trump family project WLFI (USD 1) may receive stronger compliance endorsements. However, Tether (USDT), the current king of the stablecoin track, may face greater regulatory challenges due to overseas registration, transparency issues, etc. - As a response, Tether has officially announced plans to launch a new stablecoin in the United States. In addition, Tether has also been actively lobbying in Washington recently to try to promote more friendly policies.

However, these are all matters that will remain after the GENIUS Act is finally implemented. For now, the top priority facing the bill will be the final vote in the Senate, which will take place within 30 hours at most. Odaily Planet Daily will then follow up on the voting results as soon as possible.