SignalPlus Macro Analysis Special Edition: Happy New Year

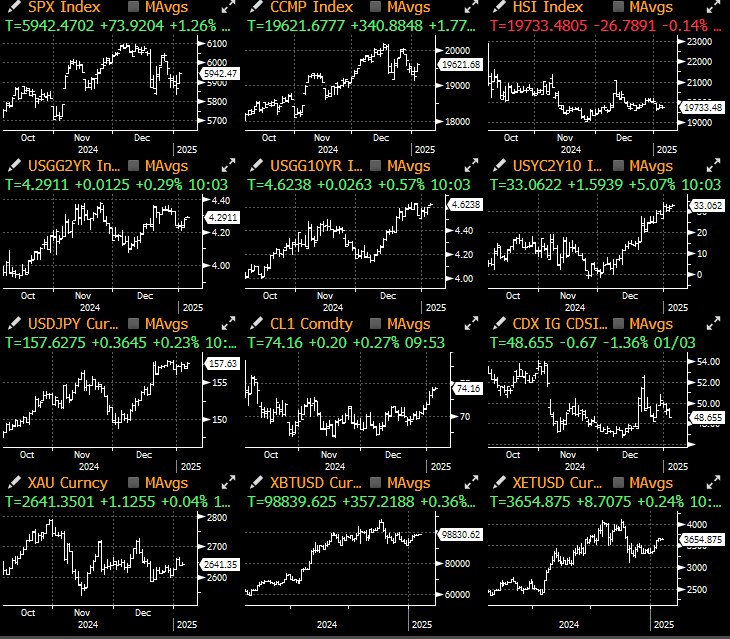

Looking back at 2024, markets are once again on an all-around uptrend, with almost all major macro asset classes delivering positive returns. Stocks have outperformed in both absolute and risk-adjusted returns, gold has risen steadily throughout the year with minimal volatility, and has performed extremely well, while the yen and Japanese government bonds have lagged behind, with the Bank of Japan refusing to tighten monetary policy even in the face of rapidly rising domestic inflation.

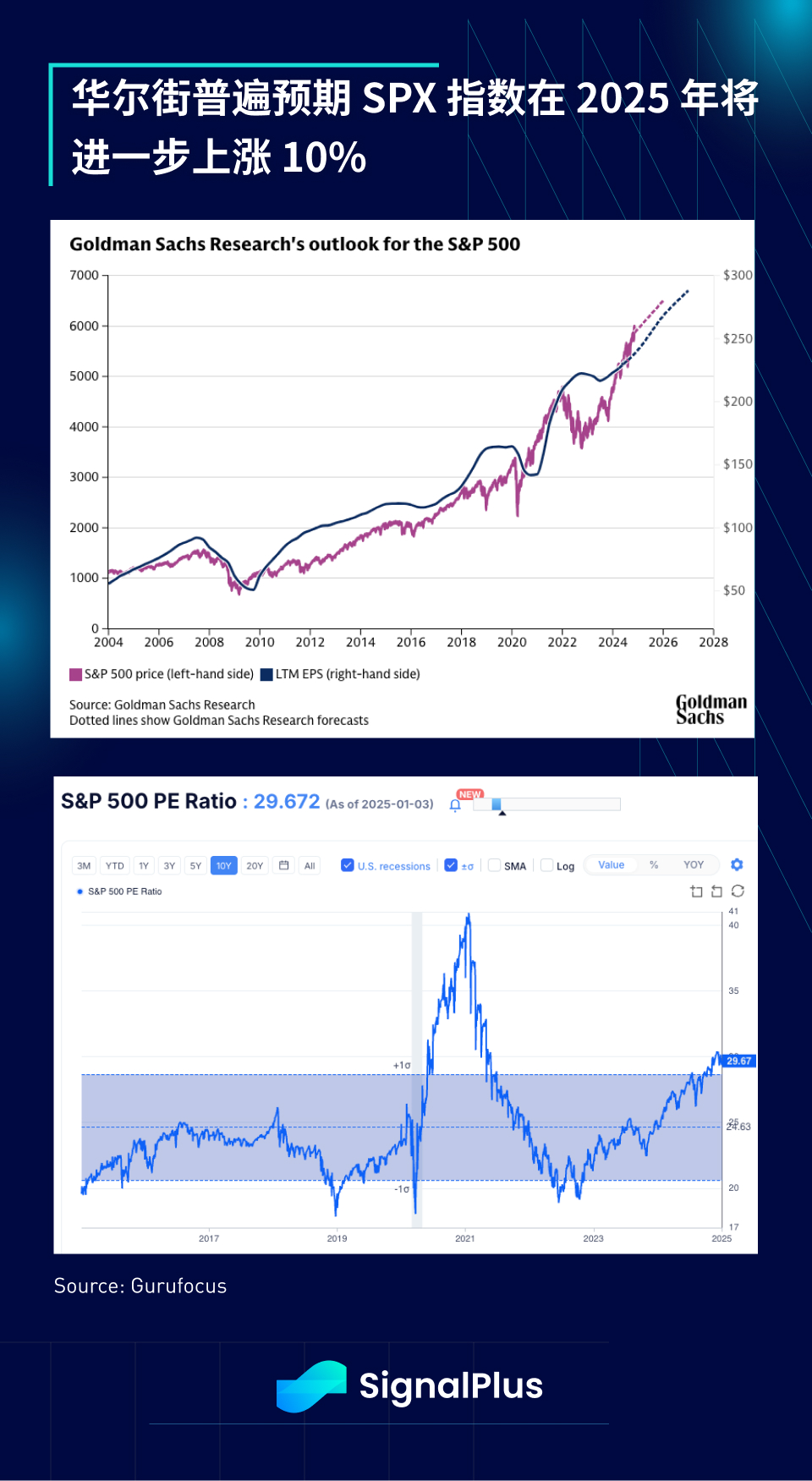

As we head into 2025, market sentiment remains unanimously bullish, with most Wall Street banks predicting that the SPX will rise a further 10% this year, with a forward P/E ratio of around 24-25 times and EPS reaching around $270 by the end of the year.

In fixed income, bond investors expect fewer than two rate cuts in 2025 as inflation remains high and the Federal Reserve showed a clear hawkish bias in December.

"I think the risks to the upside outweigh the risks to the downside," Richmond Fed's Barkin said in a talk in Maryland on Friday. "So I think it's appropriate to keep rates restrictive for a while longer."

In addition, Trump 2.0 policies are expected to exert upward pressure on prices, although the extent of transmission will depend on how well these policies are implemented. We expect the new administration to face greater headwinds than the current market anticipates.

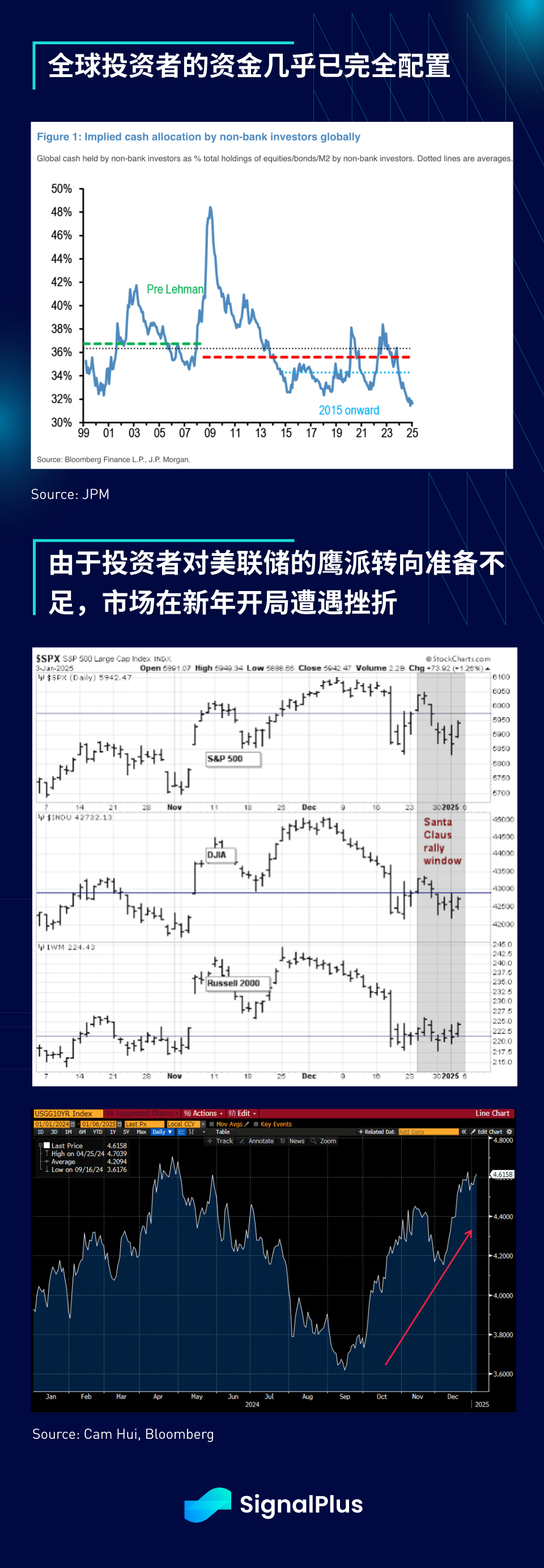

At the same time, most of the funds of global investors have been fully allocated, and the proportion of cash held is at a low point, which has led to a somewhat difficult start in 2025. The market is still somewhat affected by the Federal Reserve’s unexpected hawkish turn, and the 10-year U.S. Treasury yield is rapidly approaching the high point before the Fed’s rate cut in 2024.

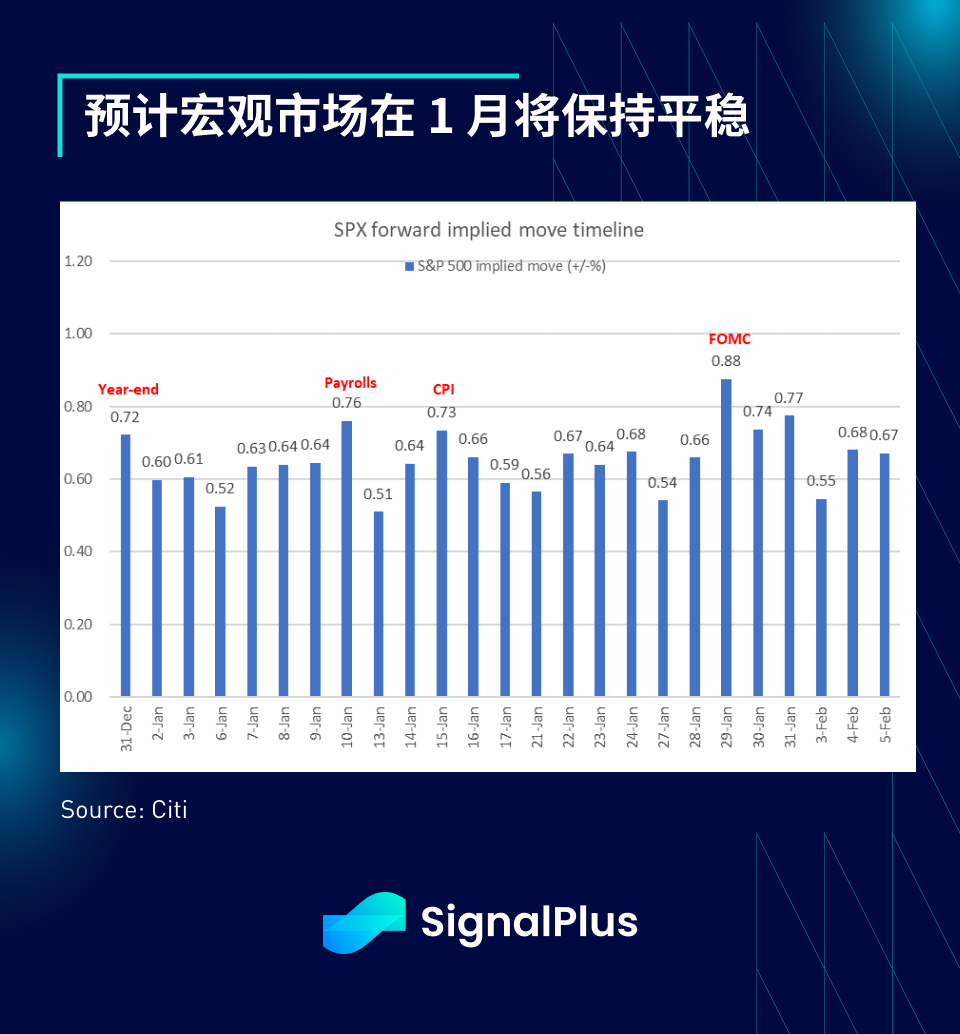

Nevertheless, market volatility is expected to remain low ahead of Friday's non-farm payrolls report, which will officially kick off the new year's trading activities. In the short term, economic data is expected to show signs of a "soft landing", and the most volatile event this month is expected to be the FOMC meeting at the end of the month.

One potential source of volatility could come from China, where 30-year bond yields fell below those in Japan for the first time. As deflation concerns grow, the People's Bank of China is expected to adopt more aggressive easing policies. The interest rate gap between China and the United States and developed markets continues to widen, which will have a significant impact on the RMB exchange rate. The market has high hopes for the success of the People's Bank of China's policies this year.

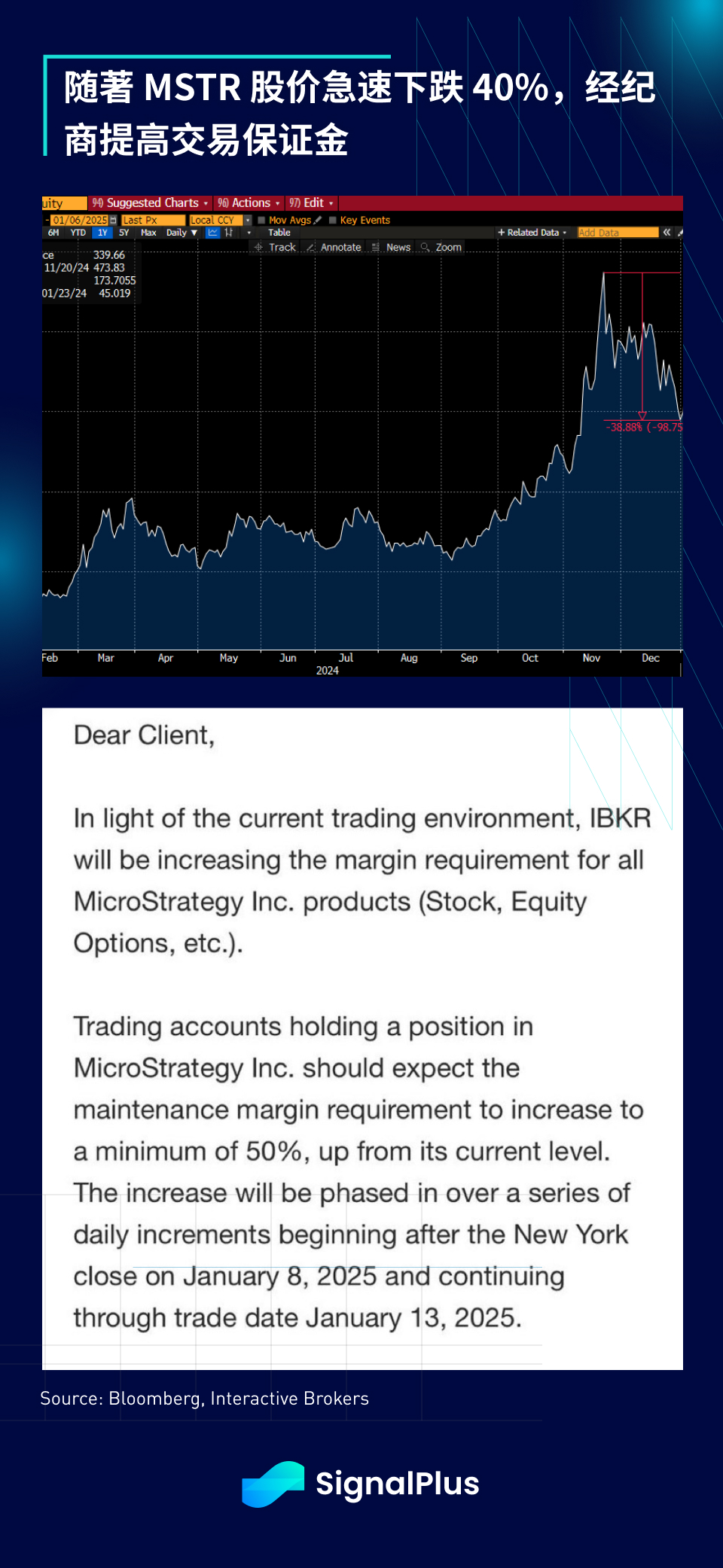

In terms of cryptocurrencies, Microstrategy's significant stock price correction has led brokers to increase trading margins, and ETFs have seen large outflows, with IBIT recording a single-day net outflow of $333 million, the largest single-day outflow since its launch, and the third consecutive day of net outflows, the longest streak of outflows. In contrast, futures liquidations were much milder, showing that this adjustment was more driven by TradFi and in response to the sharp drop in MSTR's stock price, with the company's net asset value premium now falling back to "only" 1.8 times.

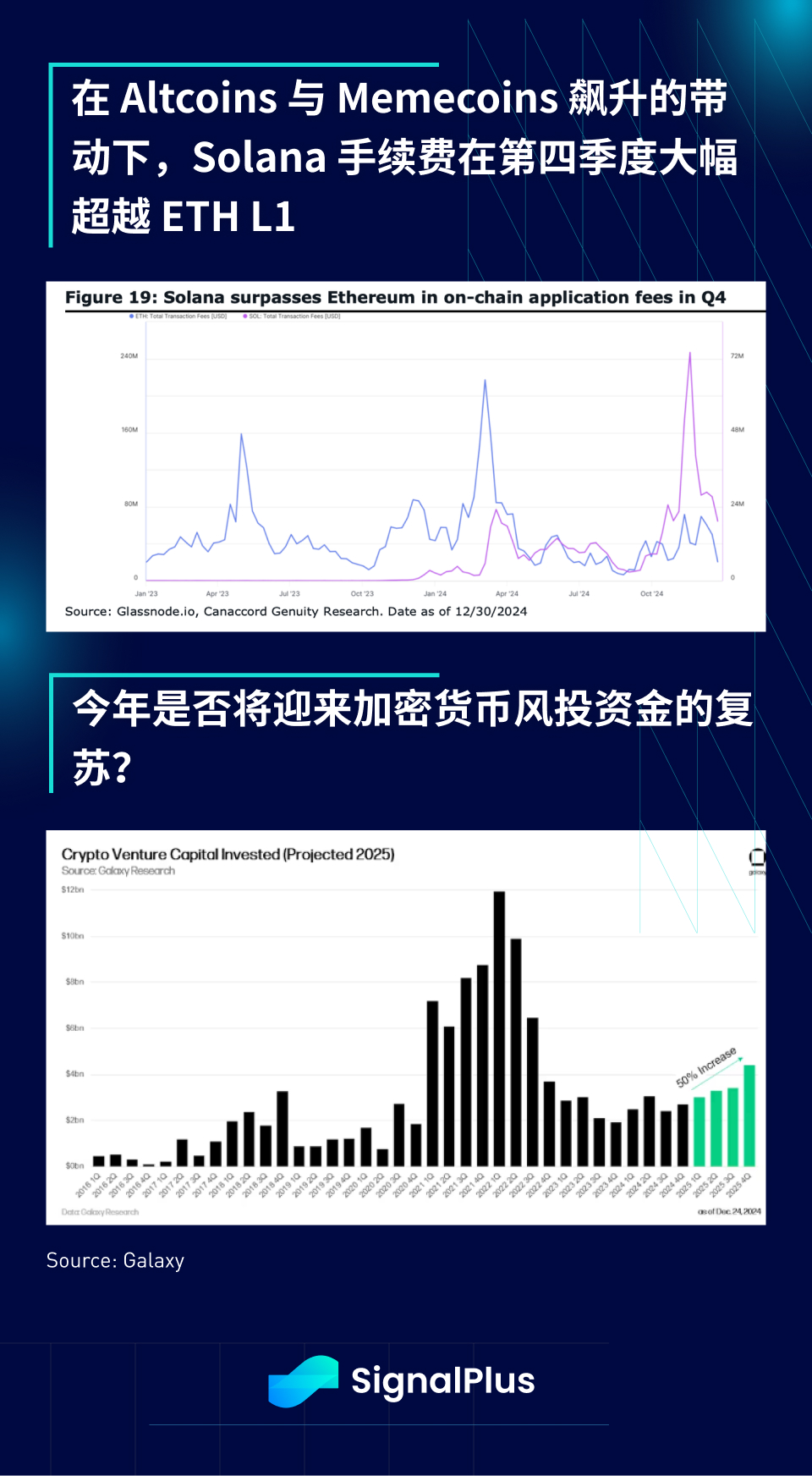

Finally, judging from the on-chain activity data, thanks to the altcoin boom, the transaction volume of decentralized exchanges (DEX) has broken through a record high, but the dominance of DeFi has declined, and the locked volume (TVL) is still a long way from the high point in 2021. With Trump's policies expected to bring new hope for the mainstream adoption of cryptocurrencies, will this year be the year when cryptocurrency venture capital funds return?

Happy New Year! I wish you all smooth trading and fruitful harvest in the new year!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com